Accounting Treatment of Goods in Transit

Goods in transit refer to inventory items and other products that have been shipped by a seller but have not yet reached the purchaser. In accounting for goods in transit, the main question is whether a sale has taken place, resulting in the passage of title to the buyer. Normally, the head office sends goods to the branch and it is immediately recorded by the head office in its books. It becomes part of your inventory when title transfers to you. But, the branch will record it when the goods are physically received by the branch. Similarly, sometimes the branch returns goods to the head office and is immediately recorded by branch. But the return of goods will be recorded by the head office when the returned goods are duly received by them. The concept is used to indicate whether the buyer or seller of goods has taken possession, and who is paying for transport. Therefore, the goods which are on the way to the branch/head office are called ‘goods in transit’.

Goods in transit concept are used to indicate whether the buyer or seller of goods has taken possession, and who is paying for transport. Adjustment entry will have to be passed to incorporate the goods in transit in the books of the head office. It is because all in-transit items are normally detected by the head office after receiving the trial balance or a copy of the final account. Goods in transit will appear on the assets side of the head office balance sheet. Point to be noted that in practice the buyer may not record inventory until it arrives at the receiving deck.

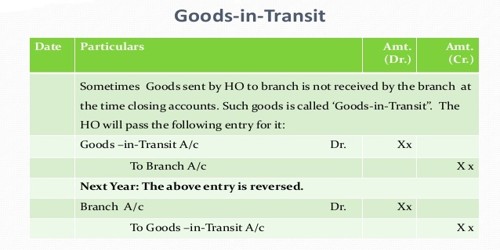

The entry for goods in transit is –

Goods in transit A/C………Dr.

To Branch A/C

Accounting Treatment of Cash in Transit

All the branches send cash at regular intervals to head office. But, at the end of the accounting period, some cash sent by the branch is still in transit. Therefore, to record such transit is cash in the books of head office, the entry will be:

Cash in transit A/C…………Dr.

To branch A/C

Information Source: