Accounting Treatment of Abnormal Loss in Accounting for Branch

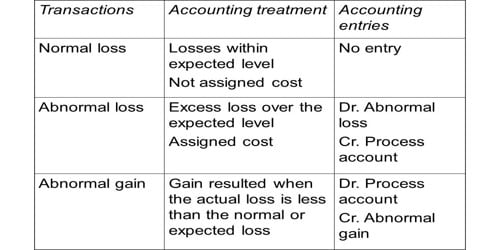

The loss of goods sent by the head office to the branch which is caused by avoidable abnormal conditions or carelessness is called the abnormal loss, for example, loss of goods by theft, fire, riots, accident, etc. So, it is the type of loss that occurs due to some unfortunate incidence which can be avoided such as fire, or some other accidents. If abnormal losses persist in a firm or business, it will threaten the property of the firm or the business. If you use bad quality raw material in production, there is a big risk of wastage in production. So, the use of bad quality raw material is the reason for the abnormal loss.

Abnormal loss is the one that is not realized and arises because of bad working conditions, carelessness, rough handling, lack of knowledge, machine breakdown, accident, etc. These losses are segregated from process costs and investigated to prevent their occurrence in the future.

Value of Abnormal loss: (normal cost of normal output/normal output) x Abnormal loss quantity.

Journal Entries:

(i) Abnormal Loss A/c …Dr.

To Process A/c

(ii) Cost Ledger Control A/c …Dr. (Scrap value)

Costing Profit & Loss A/c …Dr.

To Abnormal Loss.

The abnormal loss should be charged to the profit and loss account. It is calculated as under:

(A) Cost of goods sent……………………………………………………………….XXX

(B) Add Non-recurring expenses up to point of loss……………………….XXX

The total cost of goods sent (A+B) ……………………….XXX

Abnormal Loss = (Total cost of goods sent/Total units of goods sent) X Loss Unit

Journal entries for abnormal loss

(a) If there is no insurance coverage for the goods sent to branch:

Abnormal loss A/C ……………Dr.

To branch A/c

General profit and loss A/C…………Dr.

To Abnormal loss A/C

(b) If there is a policy coverage for the goods sent to branch:

Abnormal loss A/C ………………Dr.

To branch A/C

Bank A/C………………Dr.

General profit and loss A/C……….Dr.

To Abnormal loss A/c.