About Throughput Accounting

Throughput Accounting (TA) is a management accounting approach that focuses on the throughput of cash from sales and the truly variable costs of producing an additional unit of a product or service. It is designed to support management decision making. TA was proposed by Eliyahu M. Goldratt as an alternative to traditional cost accounting. TA is particularly useful for identifying products that are generating the most cash flow for each incremental unit of production.

Management accounting is an organization’s internal set of techniques and methods used to maximize shareholder wealth. Throughput Accounting is thus part of the management accountants’ toolkit, ensuring efficiency where it matters as well as the overall effectiveness of the organization. It is an internal reporting tool.

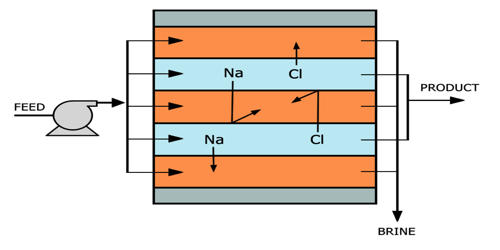

Throughput is the number of units that pass through a process during a period of time. This general definition can be refined into the following two variations, which are:

Operational perspective. Throughput is the number of units that can be produced by a production process within a certain period of time. For example, if 800 units can be produced during an eight-hour shift, then the production process generates a throughput of 100 units per hour.

Financial perspective. Throughput is the revenues generated by a production process, minus all completely variable expenses incurred by that process. In most cases, the only completely variable expenses are direct materials and sales commissions. Given the small number of expenses, throughput tends to be quite high, except for those situations in which prices are set only slightly higher than variable expenses.

Concepts – Goldratt’s alternative begins with the idea that each organization has a goal and that better decisions increase its value. The goal of a profit-maximizing firm is stated as, increasing net profit now and in the future. Profit maximization seen from a TA viewpoint is about maximizing a system’s profit mix without Cost Accounting’s traditional allocation of total costs. TA actions include obtaining the maximum net profit in the minimum time period, given limited resource capacities and capabilities. These resources include machines, capital (own or borrowed), people, processes, technology, time, materials, markets, etc. Throughput Accounting applies to not-for-profit organizations too, where they develop their goal that makes sense in their individual cases, and these goals are commonly measured in goal units.

Throughput Accounting also pays particular attention to the concept of ‘bottleneck’ (referred to as constraint in the Theory of Constraints) in the manufacturing or servicing processes

Simplifying accounting –

Throughput Accounting will probably not replace GAAP in short nor medium term but provides a limited set of simple KPIs, sufficient to:

- Manage and make decisions in a growth-oriented and TOC way

- Allow faster reporting and near to real-time figure-based management

- Help people in operations to understand the basics of accounting

- Set a common base for controllers and operations to discuss decisions, investments, etc.

For operations, throughput can be increased by enhancing the productivity of the bottleneck operation that is constraining production.

For financial analysis, throughput can be increased by altering the mix of products being produced, to increase the priority on those products that have the highest throughput per minute of time required at the constrained resource. As long as some positive throughput is gained by outsourcing, the result is an increased overall level of the throughput for the company as a whole.

Information Source: