Concept of Internal Rate of Return (IRR)

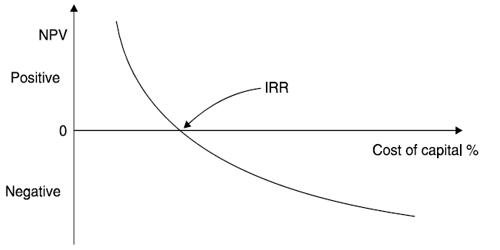

Internal Rate of Return (IRR) is the discount rate that makes the net present value of all cash flows (both positive and negative) equal to zero for a specific project or investment. The IRR is used when the cost of the investment and the annual cash flows are known and the unknown rate of earnings to be determined. It is a metric used in capital budgeting to estimate the profitability of potential investments. The IRR is described as that rate which equates the present value of the future cash flows with the cost of the investment which produce them. IRR method is also called yield on investments, the marginal efficiency of capital, time adjusted rate of return, rate of return, and so on. It is the discount rate that makes the net present value (NPV) of a project zero.

The IRR estimates a project’s breakeven discount rate or rate of return, which indicates the project’s potential for profitability. The IRR is the discounted rate that equals the aggregate present value of CFAT (cash flow after tax) with the aggregate present value of cash outflows required for new investment. Businesses use it to determine which discount rate makes the present value of future after-tax cash flows equal to the initial cost of the capital investment. The project will be accepted only if IRR is higher than the cost of capital.

When calculating IRR, expected cash flows for a project or investment are given and the NPV equals zero. Put another way, the initial cash investment for the beginning period will be equal to the present value of the future cash flows of that investment. To calculate IRR using the formula, one would set NPV equal to zero and solve for the discount rate (r), which is the IRR. Because of the nature of the formula, however, IRR cannot be calculated analytically and must instead be calculated either through trial-and-error or using software programmed to calculate IRR. (Cost paid = present value of future cash flows, and hence, the net present value = 0). In other words, if we computed the present value of future cash flows from a potential project using the internal rate as the discount rate and subtracted out the original investment, our net present value of the project would be zero.

A positive IRR means that a project or investment is expected to return some value to the organization. A negative IRR can happen mathematically if the project’s cash flows are alternately positive and negative over its expected duration.

Calculating the internal rate of return can be done in three ways:

- Using the IRR or XIRR function in Excel or other spreadsheet programs (see example below)

- Using a financial calculator

- Using an iterative process where the analyst tries different discount rates until the NPV equals to zero (Goal Seek in Excel can be used to do this)