About Bayesian Efficiency

Bayesian efficiency addresses an appropriate economic definition of Pareto efficiency where there is incomplete information. Under Pareto efficiency, an allocation of a resource is Pareto efficient if there is no other allocation of that resource that makes no one worse off while making some agents strictly better off.

A limitation with the concept of Pareto efficiency is that it assumes that knowledge about other market participants is available to all participants, in that every player knows the payoffs and strategies available to other players so as to have complete information. Often, the players have types that are hidden from the other player.

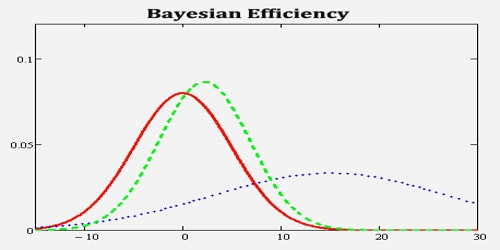

A Bayesian approach is used to investigate a sample’s information about a portfolio’s degree of inefficiency. With standard diffuse priors, posterior distributions for measures of portfolio inefficiency can concentrate well away from values consistent with efficiency, even when the portfolio is exactly efficient in the sample.

The lack of complete information raises a question of when the efficiency calculation should be made. Should the efficiency check be made at the ex-ante stage before the agent sees their types, at the interim stage after the agent sees their types, or at the ex-post stage where the agent will have complete information about their types? Another issue is an incentive.

If a resource allocation rule is efficient but there is no incentive to abide by that rule or accept that rule, then the revelation principle asserts that there is no mechanism by which this allocation rule can be realized.

The data indicate that the NYSE–AMEX market portfolio is rather inefficient in the presence of a riskless asset, although this conclusion is justified only after an analysis using informative priors. Including a riskless asset significantly reduces any sample’s ability to produce posterior distributions supporting small degrees of inefficiency.

Bayesian efficiency overcomes problems of the Pareto efficiency by accounting for incomplete information, by addressing the timing of the evaluation (ex-ante efficient, interim efficient, or ex-post efficient), and by adding an incentive qualifier so that the allocation rule is incentive compatible.

Bayesian efficiency separately defines three types of efficiency: ex-ante, interim, and ex-post.

Information Source: