I was one of the first investors in Lyft, Refinery 29 and Xamarin. I have been on the Midas list for the past three years and recently had a name on The New York Times list of the top 20 venture capitalists. In 2008, I co-founded Floodgate, one of Silicon Valley’s first seed-level VC funds. Unlike most funds, we invest exclusively in seeds, find experts to fit our product-market and create a minimally sustainable company. The seed is fundamentally different in the next stage, so we made it more than a specialty: it is just what we do. Each of our partners looks at thousands of companies each year before deciding to invest in only the top three or four.

Over the past 11 years, I have invested in startups. We have startups going wildly right (Lyft, Refinery 29, Twitch, Xamarin) and wildly wrong the main reason when I reflect on failures inevitably stems from misconceptions around the nature of the product-market fit.

The magic of product-market fit

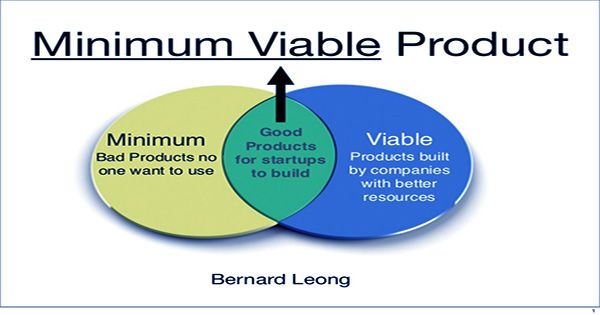

Most successful entrepreneurs and VCs agree that product-market fits are a defined quality of an early-stage startup. If you fit into the product market, you will succeed even if you not optimized on other fronts. Most entrepreneurs convert product-market value to the point where some subset customers prefer the features of their product. At Floodgate, we have forensically analyzed the companies that died and decided that this hypothesis was wrong. Many failed companies had features that customers liked. Some of these companies also had multiple favorite features! We have discovered that consumers like the product just because its part of the product-market fit, not the whole thing. This raises the question: what did they lack?

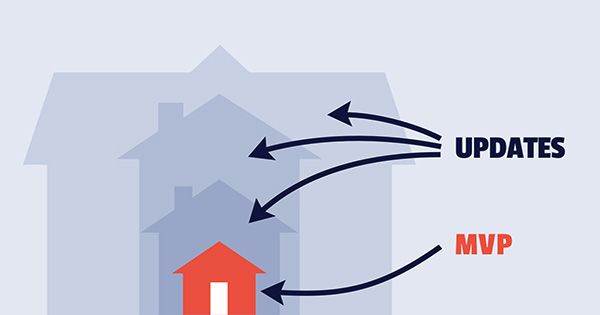

Moving into “growth mode” while missing any of these elements is building your company on an unsound foundation.

The founders who tuned in to the latest tweet cycle “The Privacy of Raising a Series” and instead focused on the complexity of their own business will find that product-market fits are a predictable, achievable phenomenon. On the other hand, founders who focus on premature growth without knowing the basic elements of their minimally sustainable organization often ignite an addictive and destructive cycle around the fake growth of their business, gaining anti-favorable users that contribute to the destruction of their company.