Why Invest in Land?

Land is real

Unlike shares, land for sale is tangible, – it can be visited, seen, and walked on.

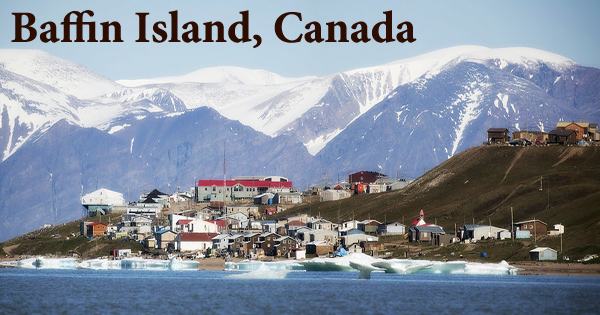

Land is a finite resource

Bangladesh is a small country with the majority of the population wanting to live in the CapitalCity, Dhaka.

Land is a solid and easy to understand investment

Land is not open to accounting scandals and it is clear when property prices are going up (or down) and the reason for this movement. For example, everyone in Bangladesh is presently aware of the housing crisis in the country. Other traditionally ‘solid’ investments such as precious metals are not as simple as they appear.

Land increases in value

This is due to demand outstripping supply and also from land gaining planning permission to have houses built on it.

Investment land has a wide range of uses

Investment land can be used for grazing animals, starting a business or building a home on, or it can simply be left as it is – whatever is done with it, the price is likely to rise considerably, even with the slowdown in house price inflation

Land investment – The alternative investment opportunity

“The population is growing, the economy is growing, the demand for new workers is growing, and household formation is changing with an aging society and family break up. The demand for housing is increasing.”

The result is a massive pent-up demand for new housing. What shape and form that housing takes is irrelevant to land owners. Whether executive houses, or affordable flats for key workers, land is needed for new homes.

Decision process

One should decide where to buy land by applying in exactly the same two key criteria as for any other investment, reward and risk. What is the potential reward? How great is the potential risk.

How great is the potential return?

Get it right and the rewards can be exceptional. Typically, when land is redesigned for development purposes its value dramatically increases. The exact percentage increase varies between plots and locations, but it should be reasonable to expect a substantial return on investment if your land is rezoned for development purposes.

And what’s the risk factor?

The risk is that one’s land will not be re-zoned for development purposes, in which case, he still owns the land, and it should still have its initial value. After all, land never goes out of business!