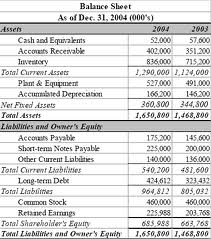

What is Meant by Balance Sheet?

A balance sheet is an accounting statement prepared from accounting balances at a given date. It shows the financial position of a business by detailing the sources of funds and the utilization of these funds. A balance sheet shows the assets and liabilities grouped, properly classified and arranged in a specific manner.

A financial statement listing a company’s assets (what it owns) and liabilities (what it owes) as of a specific date, usually the last day of a company’s fiscal quarter. The difference between a company’s assets and liabilities is termed its net worth or shareholder’s equity.

It has already been stated that after the preparation of trial balance, some accounts are closed by transferring them to the Trading account and some accounts are closed by transferring to Profit & Loss Account. These accounts are in the nature of expenses and revenues.

What are the limitations of the balance sheet?

Similarly, the immensely talented designers and content writers employed by an internet business cannot be reported as assets on the company’s balance sheet since they were not acquired (and accountants are not able to compute a precise amount for these human resources). This is also the case for a company’s reputation, its brand names that were developed through years of effective marketing, its customers’ future demand for its unique services, etc.

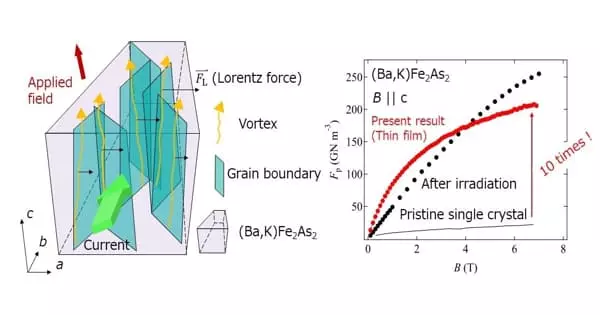

Another limitation of the balance sheet pertains to a company’s long-term (or noncurrent) assets which have increased in value since the time they were purchased in a transaction. For instance, a company’s land will be reported at an amount no greater than its cost (due to the accountant’s cost principle). Its buildings will be reported at their cost minus their accumulated depreciation (due to the cost principle and the matching principle). Hence, the amounts reported on the balance sheet for a company’s land and buildings could be much lower than their market value.