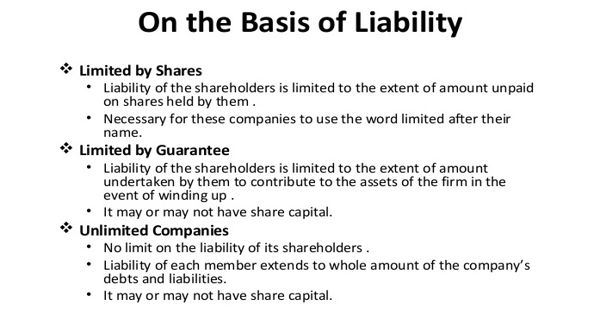

Company forms of business have become immensely popular over the years. Their development has led to the creation of so many new types of companies. Companies are to be classified on the basis of liabilities, members, and the basis of control.

Registered companies are divided into two types, namely, companies having limited liability and companies having unlimited liability.

(a) Companies Having Limited Liability

This liability can be limited in two ways:

- Liability Limited By Shares

A company in which the liability of the members is limited to the unpaid amount of shares held by them is called a company limited by shares. These are those companies in which the capital is divided into shares and the liability of members (shareholders) is limited to the extent of the face value of shares held by them. In the event of the winding-up of the company, a shareholder will be asked to pay only the unpaid amount on the shares held by him. This is the most popular class of company. But in the case of partly paid shares, the liability of members is limited to the unpaid amount on the shares held by them.

- Liability Limited By Guarantee

A company limited by guarantee is a company in which the liability of each member is limited to such amount which the members undertake to contribute to the assets of the company in the event of its winding up. These are such companies where shareholders promise to pay a fixed amount to meet the liabilities of the company in the case of liquidation.

In this case, the shareholders shall be liable to pay the amount which remains unpaid on their shares plus the amount payable under the guarantee. The amount guaranteed is laid down in the Memorandum of Association of the company. This type of company is formed for the promotion of art, culture, religion, sports, trade etc., and not for the purpose of earning profit.

(b) Companies Having Unlimited Liability

A company not having any limit on the liability of its members as in the case of a partnership or sole trading concern is an unlimited company. In such companies, the liability of a shareholder is unlimited like sole proprietor and partnership form of business. If such a company goes into liquidation, the members can be called upon to pay an unlimited amount even from their private properties to meet the claim of the creditors of the company. Members are held liable for the debts of the company in proportion to their interest in the company. Liability in such a case shall extend to the private property of the shareholders. There is rare existence of such companies these days. This form is not beneficial for entrepreneurs.

Information Source: