Methodological Assumptions

The methodology followed in this research for the preparation of this project is questionnaire method. This method is more suitable. Comparatively this approach enables the determination of the cause and effect and relationship more precisely and clearly. Because this study is primarily and mainly dependent on primary data.

Research Design for the Study

The research is descriptive in nature. For the purpose of the study both secondary and primary data have been used.

Descriptive Research:

This research design applicable for this study is descriptive research design causes are outlined below:

• Descriptive research studies are those studies which concerned with describing the characteristic of li particular individual or a group,

• This study concerned with specific predictions with narration’s of facts and characteristics concerning individual group of situation.

* Descriptive research minimization of bias and maximization of reliability of evidence; collected.

* This study makes specific predictions.

” This study provides valuable facts.

So this is a descriptive type of research study in the sense that this study aimed at describing the existing fact, the features of the current channel networks of Dano powder milk.

This study is conducted mainly on the Questionnaire method. The questionnaires comprise with:

* Questionnaire for the Consumers

• Questionnaire for the Retailers

The necessary facts and figure will be coming out for the study through the analysis and observation of the answers of the questions from the above two groups.

Sources of Data

Data is gathered from information which is the foundation of research. The .search for answers to research questions call for collection of data. The data collection begins after a research problem has been identified and research / plan chalked our white deciding about the method of data collection to be used for The study. Data are fact, figures and other relevant materials pas! and present serving as bases for study and analysis. Two types of data should be kept in mind in cases of collection. They are as follows:

a. Primary Data

b. Secondary Data

Primary Data:

Primary data’s are generated when a particular problem at hand is investigated by the researchers employing mail questionnaires, telephone surveys, personal interviews, observations and experiment.

Secondary Data:

Secondary data’s are those which are already prepared or collected for some purpose other than the current investigations.

Process of Collecting Data

For this research project, I have used personal interview method for collecting primary data and as the research instrument I have used questionnaire.

The main reasons of using questionnaire are:

1. Less expensive even when the universe is large and widely spread geographically.

2. It is free from bias of the interview answers are in respondents own words.

3. Respondents have adequate time to give well thought out answers,

4. Respondents who are not easily approachable can also be reached conveniently,

5. Large sample can be made use of and the results can be made more dependable and reliable.

6. Time saving.

I have carefully developed distinguished questionnaire as research instrument for this project. The form of questionnaire is combination of dichotomous, reasoning and multiple choice. The method has been selected as personal interview.

Sampling Procedures

Most of marketing studies involve a sample or subgroup of the total population relevant to the problem, rather than a census of the entire group. The population is generally specified as a part of the problem definition process. In this phase of this study, the researcher starts by identifying the appropriate population which includes all the people who can provide the required information. To define the populations the researcher need to know not only who or what to study but also where and when. When a researcher thinks about the sampling procedure it must have clear idea about the following terms:

• Population:

Determination of who (or what objects) can provide the required information.

• Sample Frame:

Developing a list of population members.

• Sampling Unit:

Determination of the basis for drawing the sample (individuals, household, city blocks, etc.)

• Sampling Method:

Determination of haw sample will be selected (probability and non probability)

• Sample Size:

Determination of how many population members are to be included in the sample.

* Sampling Plan:

Developing a method for selecting and contracting the sample members.

• Execution:

Carry out the sample plan.

From the above terminology the following will be concluded for this study: Name and location out of about 10000 retail shops that sell Dano milk powder product is existing in the marketing department. But there is no up to dale data available as. to determine the exact number of consumers that consume Dano milk powder product.

Sample Unit for this Study

Sample /Unit Place

Customer (Consumer) DhakaCity

Retailer DhakaCity

Determination of Sample Size

Since the distribution of shops those sell Dano milk powder product arc not homogeneous, stratified probability sampling was undertaken. On the basis of shops number in different Zones following strata were identified. The percentages of each stratum along with respective sample size are shown below. Assumption is 10% error is a] lowed to calculate sample size.

Sampling Plan

Total 10000 (approx.) retail shops of DhakaCity are divided into 10 zones.

l. Mirpur Zone

2. Mohammadpur Zone

3. Dhanmondi Zone

4. Gulshan Zone

5. Tejgaon Zone

6. Uttra Zone

7. Shahjahanpur Zone

S. Azimpur Zone

9. Motijheel Zone

10. Zattrabari Zone

Selection of Sample Size for the Retailer

It is decided for this study to select 50 Retail shops from the above zones. For this purposes 05 Retailer shops are selected by random sampling from the list of the retailers shop from every zones. The necessary data was collected by interview through structures questionnaires.

Selection of Sample Size for the Consumer

Fr-m the above zone it is decided to select 10 numbers of consumers from each zone for the purpose of the study. So sample size for [he consumer will be 100 from the iii i number of zones as listed.

Research Instruments

The research instruments based on which data were collected for this study were questionnaire method. Personal interview with retailers were conducted using this questionnaire. The method of data collection was through structured questionnaire. I questionnaire consists of both open and close-ended questions. Which include multiple choices as means of collecting data. For the research purpose some questionnaires were used to interview the retailers and consumers.

Analytical Procedure

Collected data edited on the basis of different statistical figures Statistical Methods were used along qualitative analysis procedure to implement the study in line with the determined objectives. Tabulation, frequency distribution, weighted average and percentage and charts were used.

Recommendation

On the basis of the findings some recommendations have made which will be helpful in applying different new marketing strategies and rectifying the previous strategy.

Preparation of Report

At the time of preparing the report at first a draft report has been prepared which sets the topic of final report. Then the final report is prepared. Final report is detailed findings &. analysis of collected data.

Limitation of the Study

The researcher faced a number of impediments in the way of data collection, the following limitation of this research work as given below.

Financial Limitation:

The completion of this report is researcher own cost, so researcher finance is limitation Financial limitation is vital point of researcher point of view.

Lack of Cooperation:

To conduct tin is survey many retailers and consumers are non-cooperative and reluctant in providing necessity information.

Non-availability of Retailers:

When researcher approached to retailers there has non-availability. So, non- availability of retailers was the limitation of the researcher study.

Limitation of Data:

Some information is not available to organizational employees or retailers. Due to this reason they could not provide the necessary information which would be helpful to prepare a report. Moreover secondary data were not available as a result, of which the present situation could not be compared with the previous situation. For this reasons the whole research have been done on the basis of primary data available at the time.

Limitation of Communication:

When researcher approached to collect data from retailers and consumers on that time most of the retailers and consumers were involved in inventory but it had been ultimately managed at cost time &. courtesy. So the fruitful communication was the limitation to conduct this survey.

Limitation for the Sample Size:

The sample size has been selected because of time and cost factor, Ii is not possible to draw appropriate picture from this most sample size because Jack of appropriate responds arid co-operation from the retailers and consumers.

Limitation of Time:

Time limitation was a factor in this survey which was really insufficient time to conduct a study on vast subject. DANO milk powder produces are markets all over, the Bangladesh. So, it is difficult to survey all the districts of Bangladesh, within a short period of lime due to this reason only Dhaka city has been selected to conduct this research survey.

FINDINGS

Analysis of the Answer of the Questionnaires for the Consumers

Analysis on Q. 01: Number of respondents according to Occupation.

Table 01: Number of respondents according to occupation:

| Sl No | Occupation | Respondents | Percentage | Majority |

1 | Student | 4 | 4% |

|

2 | Service | 60 | 60% | Service |

3 | Business | 16 | 16% |

|

4 | Housewife | 20 | 20% |

|

5 | Others | 0 | 0% |

|

In the occupation category of respondents, the percentages of occupation are: Service-60%; Housewife-20%; Business-16%; and Student-4%. The graph is as presented below:

Analysis on Q.02: Number of respondents according to Age.

It is found that the number of respondents according to age in the class interval are below 14=0%, 15-24 =6%, 25-34=34%, 35-44=38%, 45-54=22%, and above 54=0%. The graphical presentation is depicted below:

Table 02: Number of respondents according to age

Sl No | Age | Frequency | Percentage | Majority |

1 | Below 14 | 0 | 0% |

|

2 | 15-24 | 6 | 6% |

|

3 | 25-34 | 34 | 34% |

|

4 | 25-44 | 38 | 38% | 35-44 years of age |

5 | 45-54 | 22 | 22% |

|

6 | Above 54 | 0 | 0% |

|

Analysis on Q.03: Number of respondents according to Income Group.

Table 03: Number of respondents according to Income Group

SL No | Income Group | Frequency | Percentage | Majority |

1 | 4000-5999 | 0 | 0% |

|

2 | 6000-9999 | 10 | 10% |

|

3 | 10000-15999 | 26 | 26% |

|

4 | 16000-20999 | 28 | 28% | 16000-20999 income Group |

5 | 21000-25999 | 26 | 26% |

|

6 | Above 26000 | 10 | 10% |

|

It is observed that the numbers of respondents according to income group in the class interval are: 4000-5999=0%, 6000-9999= 10%, 1000-15999=26%, 16000-20999=28%, 21000-25999=26%, and above 26000=10%. The graphical presentation is depicted below.

Analysis on Q. 04: Buying habits of milk powder.

Table 04: Buying habits of milk powder

SL No | Buying Habits | Respondents | Percentage | Majority |

1 | Regularly | 90 | 90% | Regularly |

2 | Occasionally | 10 | 10% |

|

3 | No | 0 | 0% |

|

Buying habits of consumers for milk powder are found that 90% consumers are buying milk powder on regularly and 10% are buying mile powder on occasionally. Majority of the consumer are used milk powder on regularly basis for their daily purposes.

Analysis on Q.05: Brands preferences of milk powder according to choice

Table 05: Brand Preferences of milk powder according to choice

SL No | Brand Name | Rank Frequency | |||||

1 | 2 | 3 | 4 | 5 | 6 | ||

1 | Nido | 36 | 38 | 20 | 6 | 0 | 0 |

2 | Diploma | 14 | 10 | 42 | 20 | 10 | 4 |

3 | Kwality | 6 | 6 | 10 | 34 | 30 | 14 |

4 | Dano | 44 | 32 | 14 | 8 | 2 | 0 |

5 | Fresh | 0 | 14 | 10 | 20 | 40 | 16 |

6 | Marks | 0 | 0 | 4 | 12 | 18 | 66 |

The present study revealed that brand preferences of milk powder according to consumer’s choice followed by highest preference to lowest preference are-

Dano>Nido>Diploma>Marks>Fresh>Marks.

Analysis on Q.06: Intention to purchase high priced brand of milk powder.

Table 06: Intention to purchase high price brand of milk powder.

SL No | Condition | Respondents | Percentage | Majority |

1 | Yes | 80 | 80% | Yes |

2 | No | 6 | 6% |

|

3 | Others | 14 | 14% |

|

It is found that most of the 80% respondents answer yes about intention of purchase high priced brand of milk powder where comparatively low prices products are available and 6% respondents don’t purchase high priced brand. Rest of the 14% respondent’s opinion about product quality should be maintained and price will be the less than that of high price brand.

Analysis on Q.07: The Favorite type of milk powder pack

Table 07: The Favorite type of milk powder pack

SL NO | Type of Pack | Respondents | Percentage | Majority |

1 | Tin Pack | 22 | 22% |

|

2 | Soft Pack | 78 | 78% | Soft Pack |

The data and information received by the research it is observed that 78% of the respondents are mentioned their favorite type of milk powder pack is the soft pack (pouch) and rest of the 38% respondents are mentioned Tin pack.

Analysis on Q. 08: Preference of pack size for milk powder.

Table 08: Preference of Pack size for milk powder

SL No | Size of the Pack | Respondents | Percentage | Majority |

1 | 25gm | 0 | 0% |

|

2 | 100gm | 14 | 14% |

|

3 | 400gm | 59 | 59% | 400gm Packet |

4 | 500gm | 45 | 45% |

|

5 | 1kg Packet | 15 | 15% |

|

6 | 1 kg Tin | 28 | 28% |

|

7 | 2 kg Super Instant | 19 | 19% |

|

8 | 2kg | 12 | 12% |

|

It is observed from the analysis of the following data the preference of pack size for milk powder accordingly followed by highest preference to lowest preference are-400gm (59%.), 500gm (45%.), 1kg Tin (28%), 2Kg Super Instant (19%), 1kg pack (15%), 100gm (14%), 2 Kg Tin (12%) and 25gm (0%).

Analysis on Q. 09: Purchasing place of milk powder.

Table 09: Purchasing place of milk powder.

SL No | Purchasing Place | Respondents | Percentage | Majority |

1 | Nearest Convenience Shop | 84 | 84% | Nearest Convenience Shop |

2 | Shop where other items were purchase | 16 | 16% |

|

Among the respondents 84% of the consumers prefer to purchase milk powder at the nearest convenience shop and only 16% said that they are purchasing their milk powder from the shop where the other items are normally purchases. In this analysis it is understood that the majority of the consumers like to prefer their nearest convenience shop.

Analysis on Q. 10: Brand awareness of milk powder

Table 10: Brand awareness of milk powder

SL No | Brand awareness | Respondents | Percentage | Majority |

1 | Yes | 100 | 100% | Yes |

2 | No | 0 | 0% |

|

It is observed from analysis of the following data that 100% of the consumers have the awareness of the brand while they purchase milk powder for daily purpose. The graphical presentation is depicted below:

Analysis on Q. 11: Immediate previous brand for milk powder.

Table 11: Immediate previous brand for milk powder.

SL No | Previous Brand | Respondents | Percentage | Majority |

1 | Nido | 22 | 22% |

|

2 | Diploma | 16 | 16% |

|

3 | Dano | 45 | 45% | Dano |

4 | Marks | 10 | 10% |

|

5 | Fresh | 7 | 7% |

|

From the data it is observed that the immediate previous brand for milk powder are. Dano-45%; Nido-22%; Diploma-16%, Marks-10%; and Fresh 7%. Majority of the consumers mentioned their immediate previous brand for milk powder is Dano and the second highest immediate previous brand for milk powder is Nido.

Analysis on Q. 12: Buying conditions of milk powder.

Table 12: Buying Conditions of milk powder.

SL No | Conditions | Respondents | Percentage | Majority |

1 | When earlier stock almost finished | 88 | 88% | When earlier stock almost finished |

2 | When home stock is finished | 8 | 8% |

|

3 | On date of your daily shopping | 0 | 0% |

|

4 | On date of weekly shopping | 0 | 0% |

|

5 | Others | 4 | 4% |

|

The data and information received by the research it is found that different consumers have different in nature of buying milk powder product. In this connection the majority of the 88% consumers are buying their milk powder when earlier stock is almost finished and 8% of the consumers are like to buy milk powder when home stock is finished, it means that consumers are not interested to pile up the stock of milk powder. All other conditions are tabulated as well as graphical presentation is depicted below.

Analysis on Q. 13: Analysis on how the consumers are buying milk powder with respect to different places.

Table 13: Analysis on how the consumers are buying milk powder with respect to different places.

SL No | Condition | Respondents | Percentage | Majority |

1 | Always from the same shop | 20 | 20% |

|

2 | Most of the time from same shop | 48 | 48% | Most of the time from same shop |

3 | Different time in different shop | 32 | 32% |

|

The majority of the consumers’ i.e. 48% said that they are buying milk powder most of the time at same shop and 32% mentioned that they are buying milk powder of different time in different shop and on the other hand only 20% said that they are buying milk powder always from the same shop.

Analysis on Q. 14: Buying attitude when preferred brand is not available.

Table 14: Buying attitude when preferred brand is not available

SL No | Condition | Respondents | Percentage | Majority |

1 | Depend on sales and ask to supply available | 4 | 4% |

|

2 | Wait to till the brand available | 14 | 14% |

|

3 | Request to sales to bring | 2 | 2% |

|

4 | Find another shop | 80 | 80% | Find another shop |

From the analysis it is found that the majority 80% of the respondents find other shop when they fail to find their preferred brand at their convenient shop and 14% of the respondents informed that they will wait to buy until their preferred brand is available. It is also observed that 4% of the consumers are buying by asking the salesman what they are available i.e they do not bother about the brand.

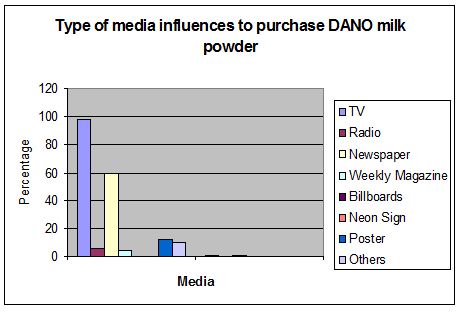

Analysis on Q. 15: Type of media influences to purchase DANO milk powder.

Table15: Type of media influences to purchase DANO milk powder

SL NO | Name of the media | Frequency | Percentage | Majority |

1 | TV | 98 | 98% | TV |

2 | Radio | 6 | 6% |

|

3 | Newspaper | 60 | 60% |

|

4 | Weekly Magazine | 4 | 4% |

|

5 | Billboards | 0 | 0% |

|

6 | Neon Sign | 0 | 0% |

|

7 | Poster | 12 | 12% |

|

8 | Others | 10 | 10% |

|

In this questionnaire the consumers are requested to answer for the multiple choices listed with different type of media influences to purchase DANO milk powder to tick more than one. The respondents mentioned that the type of media which is influence to purchase DANO milk powder and the percentages of that media which influence to purchase DANO milk powder are. TV-98%; Newspaper-60%; Poster-12%; Others-10%; Radio-6%; Weekly magazine-4%; Billboards-0%; and Neon sign 0%. Majority of the consumers express their opinion that the media influences to purchase Dano milk powder is the TV.

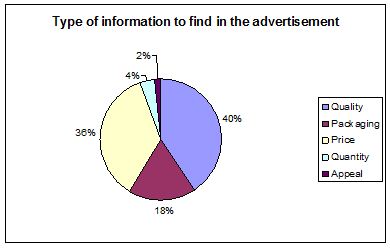

Analysis on Q. 16: Type of information to find in the advertisement.

Table 16: Type of information to find in the advertisement.

SL No | Particular | Frequency | Percentage | Majority |

1 | Quality | 100 | 100% | Quality |

2 | Packaging | 45 | 45% |

|

3 | Price | 88 | 885 |

|

4 | Quantity | 10 | 10% |

|

5 | Appeal | 4 | 4% |

|

In this questionnaire the respondents are requested to answer for the multiple choice listed with different type of information to find in advertisement to tick more than one. It is observed from the analysis of the following data the type of information that has found in advertisement are. Quality-100%; Price-88%; Packaging-46%; Quantity-10%; and Appeal-4%.

Analysis on Q. 17: Consumer’s Comments to improve DANO milk powder marketing in Bangladesh.

1. Products display on wholesale and retail outlets to attract the customer intention to grow purchase this product.

2. Regular milk powder particle is separated during highly boiled water. It would be controlled in production process.

3. Product design should be change after a certain period for new innovation which would be attracting the customer.

4. Price should be settled compare to competitions.

5. Required more distributors up to upazilla level.

6. All pack sizes of Dano milk powder should be available in retail outlets.

7. It should be improved when instant milk powder is mixed up with hot or normal water milk particle create clod or not clearly diluted.

8. Doctor’s prescription may create the image of the product for health improvement & nutritious value for certain customer.

Analysis on the Answer of the Questionnaires for the Retailers

Analysis on Q.01: Selling of milk powder of different brand by retailer.

Table 01. Selling of milk powder of different brand by retailer

SL No | Type of Response | Respondents | Percentage | Majority |

1 | Yes | 50 | 100% | Yes |

2 | No | 0 | 0% |

|

The data and information received by the research it is found that 100% of the respondents informed that they are selling of milk powder of different brands to satisfy the consumer’s demand as well as to increase their sales revenue.

Analysis on Q. 02: Most profitable brand of milk powder.

Table 02: Most profitable brand of milk powder

SL No | Profitable Brand | Respondents | Percentage | Majority |

1 | Nido | 10 | 20% |

|

2 | Dano | 4 | 8% |

|

3 | Diploma | 11 | 22% |

|

4 | Marks | 13 | 26% | Marks |

5 | Fresh | 12 | 24% |

|

The data and information received by the research from the retailers of different areas it is found that the most profitable brand of milk powder the percentages are. Marks-26%; Fresh-24%; Diploma-22% Nido-20%; and Dano-8%. Majority of the retailers are mentioned that Marks is the most profitable brand of milk powder and Fresh is the second highest profitable brand of milk powder.

Analysis on Q. 03: Sources of Dano milk powder for the Retailers.

Table 03: Sources of Dano milk powder for the Retailers

SL No | Sources of milk powder | Frequency | Percentage | Majority |

1 | Directly from company | 50 | 100% | Directly from company |

2 | Distributors | 0 | 0% |

|

3 | Both the above | 0 | 0% |

|

4 | Others | 0 | 0% |

|

The present study revealed that 100% of the retailers said that they are getting DANO brand of milk powder directly from the company. It is understood that the authority of the company properly controls the retailers. The graphical presentation is as below.

Analysis on Q. 04: Frequently supplied with milk powder of DANO brand.

Table 04: Frequently supplied with milk powder of DANO brand

SL No | Frequently supplied | Frequency | Percentage | Majority |

1 | Everyday | 0 | 0% |

|

2 | Twice a week | 20 | 40% |

|

3 | Weekly | 30 | 60% | Weekly |

4 | Fortnightly | 0 | 0% |

|

5 | others | 0 | 0% |

|

The information received by the research it is found that 60% of the retailers said that they are weekly and 40% of the retailers said that they are twice a week supplied milk powder of Dano brand. From the analysis it is observed that the company distribution system is so strong and they are getting frequently supplied milk powder of Dano brand as per schedule of the company.

Analysis on Q. 05: Frequently the company personnel visit to Retailers outlets

Table 05: Frequently the company personnel visit to Retailers outlets.

SL No | Frequently Visit | Respondents | Percentage | Majority |

1 | 2 day/week | 0 | 0% |

|

2 | 1 day/ week | 50 | 100% | 1 day/ week |

3 | 1 day/monthly | 0 | 0% |

|

4 | Never | 0 | 0% |

|

In this questionnaire information received from the retailers of different areas it is found that 100% of the respondent’s opinions are frequently the company personnel visit to retailers’ outlets on one day per week. It is observed that strictly monitored by the company personnel visit to retailer’s outlets on weekly schedule date.

Analysis on Q. 06: Duration of problems resolved of Dano milk powder.

Table 06: Duration of problems resolved of Dano milk powder

SL No | Duration | Frequency | Percentage | Majority |

1 | Within 1 month | 0 | 0% |

|

2 | Within 2 weeks | 0 | 0% |

|

3 | Within 1 week | 50 | 100% | Within 1 week |

4 | Less frequency | 0 | 0% |

|

It is found that 100% of the respondent’s opinion about the problem resolved within one week. From the data analysis it is clearly understood that when retailers faces problem about Dano milk powder it is resolved within one week that means it is resolved within schedule time which is selected by the company.

Analysis on Q. 07: Satisfied with current procedure of distribution.

Table 07: Satisfied with current procedure of distribution.

SL No | Condition | Respondents | Percentage | Majority |

1 | Yes | 50 | 100% | Yes |

2 | No | 0 | 0% |

|

The data and information received by the research it is observed that 100% of the respondents answer is yes about satisfied with the current procedure of distribution of the company. From the analysis it is found that at the retailers are adopted with the current procedure of distribution of Dano Milk Powder Company and retailers opinion it is the convenient procedure of distribution system which is in favor of retailers. So they are satisfied with the current procedure of distribution system of the company.

Analysis on Q.08: Expectation on current procedure of distribution.

It is found that 100% of the respondents places their opinion about satisfied with the current procedure of distribution system of the company. So they have no expectation with the current procedure of distribution.

Analysis on Q. 09: The price of DANO milk powder in comparison to competitors.

Table 09: The price of DANO milk powder in comparison to competitors.

SL No | Criteria of Price | Respondents | Percentage | Majority |

1 | Appropriate | 17 | 34% |

|

2 | Lower | 0 | 0% |

|

3 | Higher | 33 | 66% | Higher |

Most of the respondents’ i.e. 66% said that the price of Dano milk powder is higher compare to competitors’ price and 34% of the respondents said that the price of Dano milk powder is appropriate in comparison with competitors’ price.

Analysis on Q. 10: Opinion about promotional activity of DANO milk powder.

Table 10: Opinion about promotional activity of DANO milk powder

SL No | Promotional activities | Respondents | Percentage | Majority |

1 | Good | 15 | 30% |

|

2 | Not sufficient | 35 | 70% | Not sufficient |

From the filled up questionnaires of different areas of retailers it is found that most of the 70 % respondents answer is not sufficient about promotional activity of DANO milk powder and rest of the 30 % respondents answer is good about promotional activity of DANO milk powder. From the analysis it is observed that majority of the respondents opinion about promotional activity of DANO milk powder is not sufficient.

Analysis on Q, 11: Determination of Problems Faced by the retailers.

1. Small retailers don’t purchase sufficient products of Dano milk powder due to their low financial involvement in their business.

2. Product sometimes not sufficient supplied during trade promotion.

3. Less promotional activity of Dano milk powder.

4. Sales representative don’t give enough time to the retailer’s outlets.

5. Price are same both Instant- 400 gm & Normal- 400 gm but Tin pack of Instant-2000 gm & Normal- 2000 gm are same price.

6. Less incentive for retailers.

Analysis on Q, 12: Valuable suggestions to overcome the existing problems of DANO milk powder.

1. To provide the product twice a week or credit system may overcome this problem for small retailers.

2. To ensure sufficient supply of product during trade promotion to retailers outlets.

3. Promotional activity of Dano milk powder should be increased.

4. To ensure Sales Representative would give sufficient time to the retailer’s outlets for fruitful communication.

5. Product price should be considered among Instant and Normal milk powder to overcome this existing problem.

6. To provide right incentive to the retailers.

The overall results obtained from this study have facilitated to draw the following analysis of findings:

The present study carried out a market survey among retailers and consumers of milk powder as well as the primary sources of marketing problems and prospects of Dano milk powder. For secrecy of the company secondary data are not available as a result of which the present situation could not be compare with the previous situation. Through collection of primary data, analysis of data collected against questionnaire sources, setting assumptions and testing those assumptions, the findings were attained for the study Marketing problems and prospects of Dano milk powder in Bangladesh. It is worth to be mentioned here that since all data were finally analyzed through testing of hypothesis, the outcome of these have governed the findings as indicated below:

From Consumer Point of View:

1. In the occupation category of consumers the percentages of occupation are: Service 60 %, Housewife 20 %, Business 16 % and Student 4 %. It is also found that the number of respondents according to age and income group in the class interval are: Age – below 14-0 %, 15-24 = 6 %, 25-34 = 34 %, 35-44 = 38 %, 45-54 = 22 %, and above 54-0 % ;and Income group – 2000-5999 = 0 %, 6000-9999 = 10 %, 10000-15999 = 26 %, 16000-20999 = 28 %, 21000-25999 – 26 %,and above 26000 = 10 %.

2. Buying habits of consumer for milk powder that 90 %consumers are buying regularly and 10% are buying occasionally

3. Brand preferences of milk powder according to consumer’s choice accordingly followed by highest preference to lowest preference are Dano>Nido>Diploma> Kwality>Fresh>Starship.

4. Majority of the 80 % consumer express their positive altitude about intention to purchase high priced brand of milk powder where comparatively low prices products are available in the market. And 6 % respondents don’t purchase high priced brand. Rest of the 14 % respondents’ opinion about product quality should be maintained and price will be the less than that of high price brand.

5. Most of the 62 % consumers are mentioned their favorite type of milk powder pack like soft pack (pouch) and rest of the 38 % respondents are mentioned Tin pack.

6. The preference of pack size for milk powder accordingly followed by highest preference to lowest preference are: 1,00 kg (72 %), 400gm (52 %), 500gm (40 %), 2.00kg (38 %), 1.8 kg (16 %), 125gm (14 %), 900gm (10 %), and 28gm (0 %).

7. Among the respondents 84 % of the consumer prefers to purchase milk powder at the nearest convenience shop and only 16 % said that they are purchasing their milk powder from the shop where the other items are normally purchases. In this analysis it is understood that the majority of the consumer like to purchase milk powder to prefer their convenience shop.

8. It is found that all the consumers are brand awareness while they purchase milk powder for their daily purposes.

9. The immediate previous brand for milk powder are: Dano- 50 %; Nido- 30 %; Diploma- 10 %; Fresh- 6 %; and Kwality- 4 %. Majority consumer mentioned their immediate previous brand for milk powder is Dano and the second highest immediate previous brand for milk powder is Nido.

10. Different consumers have different in nature of buying milk powder. In this connection the majority of the 88 % consumers are buying their milk powder when earlier stock is almost finished and 8 % of the consumers are like to buy milk powder when home stock is finished, it means that consumers are not interested to pile up the stock of milk powder.

11. The majority of the 48 % consumer said that they are buying milk powder most of the time at same shop and 32 % mentioned that they are buying milk powder of different time in different shop. On the other hand only 20 % said that they are buying milk powder always from the same shop.

12. Majority of the 80 % consumers express their opinion when preferred brand is not available then they finds other shop and 14 % of the respondents informed that they would wait to buy until their preferred brand is available. It is also observed that 4 % of the consumers are buying by asking the salesman what they are available i.e. they do not bother about the brand.

13. The consumers mention that the type of media which is influence to purchase DANO milk powder the percentages are: TV- 98 %; Newspaper- 60 %; Poster- 12 %; Others- 10 %; Radio- 6 %; Weekly magazine- 4 %; Billboards- 0 %; and Neon sign- 0 %.

14. The Consumers are requested to answer for the multiple choices listed with different type of information to find in advertisement to tick more than one. It is observed about the type of information that they found in advertisement are: Quality- 100 %; Price- 88 %; Packaging- 46 %; Quantity- 10 %; and Appeal 4 %.

15. The consumer’s opinions about DANO milk powder in relation to various features are mentioned about Quality- 96 % is ‘good’ and the rest 4 % express their opinion is ‘moderate’. About Taste, 78 % said ‘good’ and 22 % mentioned ‘moderate’. About Availability, 96 % of the consumer’s opinion is ‘good’ and 4 % are mentioned ‘moderate’. Also the feature of Price, 48 % respondents opinion is ‘good’ and the rest 52 % of respondent’s opinion is ‘moderate’. From the data analysis, it is found that features of Quality, Taste, and Availability are ‘good’ and only the feature of Price is ‘moderate’ received by the respondent’s opinion about DANO milk powder. It is also observed that opinion of the consumers about DANO milk powder in relation to various features, the consumers are satisfied with DANO milk powder because they have no opinion about Bad of all the features.

16. All of the consumers express their positive attitude about sufficient supply of DANO milk powder on demand while they are purchasing milk powder at different shop.

17. Some comments of Consumers to improve DANO milk powder marketing in Bangladesh these are as follows:

• Products display on wholesale and retail outlets to attract the customer intention to grow purchase this product.

• Regular milk powder particle is separated during highly boiled water. It would be controlled in production process.

• Product design should be change after a certain period for new innovation which would attract the customer.

• Price should be settled compare to competitors.

• Required more distributors up to upazilla level.

• All pack sizes of Dano milk powder should be available in retail outlets.

• It should be improved when instant milk powder is mixed up with hot or normal water milk powder particle create clod or not clearly diluted.

• Doctor’s prescription may create the image of the product for health improvement & nutritious value for certain customer.

From Retailers’ Point of View

1. All the retailers’ express their opinion that they are selling of milk powder of different brands to satisfy the consumer demand as well as to increase their sales revenue.

2. Besides DANO brand, majority of the retailers are stock for sale Nido, Diploma, Red cow, Kwality, Fresh, and Anchor brands of milk powder for their businesses. The highest selling brands of milk powder are- Dano, Diploma, and Nido. And also indicates the most profitable brands of milk powder are- Diploma, Dano, Nido and Fresh.

3. Retailers are getting Dano brand of milk powder directly from the company and the authority of the company properly controls them. The company distribution system is so strong, So they are getting frequently supplied milk powder of Dano brand as per weekly schedule of the company.

4. The company properly provides the product to the retailers according to their daily requirement to fulfill through Direct Sales Distribution (DSD) system.

5. The company personnel visit to retailer’s outlets one day per week while they are received product by the authority of the company.

6. All the retailers said that they place complain to Sales Representative (SR) of the company. Sales Representatives are closely monitored the retailers outlets of their market area and received retailers complain about Dano milk powder. So, they have no need to place complains the higher authority of the company. On the other hand duration of problem resolved within one week by the Sales Representative of the company or by the higher authority of the company.

7. Majority of the 88 % retailers places their negative attitude about quality complaint stocks replace regularly which means that quality complaint stocks replace occasionally but not regularly.

8. All the retailers express their positive attitude about satisfied with current procedure of distribution system of the company. They also express their opinion that they are receiving Dano milk powder in time; also receiving increased supply from distributors of Dano milk powder during the period of high sales; and reasons for satisfaction of existing distribution channel is the Quality Product.

9. Most of the 66 % retailers said that the price of DANO milk powder is higher compare to the competitor’s price and rest 34 % of the respondents said that the price of DANO milk powder is appropriate in comparison with competitor’s price.

10. It is found that most of the 86 % retailers express their negative attitude about increases sales by increasing number of distributors and rest of the 14 %respondents places their positive attitude about increases sales by increasing number of distributors. Those who are express their positive attitude, their opinion it might be possible through close monitoring and expansion of outlets where the present distributors are not associated with that outlets who may have a retailers of the company.

11. The present study revealed from the retailers that the rank of different brands for milk powder in relation to various aspects accordingly followed by highest rank to lowest rank is:

Availability :Nido>Dano>Diploma>Marks>Fresh>Red Cow

Price :Fresh>Marks> Diploma > Red Cow >Dano>Nido

Quality :Nido>Dan o>Diploma>Red Cow>Fresh>Marks

Packaging Hygienic :Nido>Dano>Diploma>Fresh>Kwality> Marks

Sales Promotion :Nido>Dano>Diploma>Kwality>Fresh> Marks

Advertisement :Nido>Fresh> Marks >Kwality>Diploma>Dano

Distribution System :Nido>Fresh>Red Cow>Diploma>Dano> Marks

Steady Delivery :Nido>Dano>Diploma>Fresh>Kwality>S Marks

Salesman Pushes :Marks>Fresh>Kwality>Diploma>Dano>Nido

Above all features consideration Nido brand is the highest preference and Dano is the second highest rank position. But price is the key factor for the consumer which might be helpful to increase sale for revenue. In this regard, retailer’s opinion Diploma is the best price for the consumer of milk powder.

12. Majority of the 70 % retailer’s opinions is not sufficient about promotional activity of DANO milk powder for selling their product.

13. Some retailer expresses their existing problems & solutions of Dano milk powder these are as follows:

Problems

• Small retailers don’t purchase sufficient products of Dano milk powder due to their low financial involvement in business.

• Product sometimes not sufficient supplied during trade promotion.

• Less promotional activity of Dano milk powder.

• Sales representative don’t give enough time to the retailer’s outlets.

• Less incentive for retailers.

Solutions

• To provide the product twice a week or credit system may overcome this problem for small retailers.

• To ensure sufficient supply of product during trade promotion to retailers outlets.

• Promotional activity of Dano milk powder should be increased.

• To ensure Sales Representative would give sufficient time to the retailer’s outlets for fruitful communication.

• Product price should be considered among Instant and Normal milk powder to overcome this existing problem.

• To provide right incentive to the retailers.

These findings finally interprets in the situation of milk powder market for marketing problem and prospect of DANO milk powder in Bangladesh which would be helpful for company’s decision making through preventive correction measure for smooth business operation in the long run. Because consumer preferences is changing and becoming highly diversified. However, the organization is needed to undertake some of the development as suggested in the recommendations chapter.

CONCLUSION

Before conclusion and solicit recommendations it is worth mentioning here that the study has be?” made completely for an academic requirement with minimum numbers of samples from the total population As such, these can not be over-enthusiastically concluded that whatever outcome and finding have come out is fully dependable for the whole process Since it is based on very small size and therefore there exist definitely some limitations However the effort that was made, will definitely point out some of the major issues of the milk powder sector. Therefore, in case of wider commercial practice, further detail is expected with larger and representative sample size.

The research work was carried out a market survey through questionnaires among retailers and consumers of milk powder as well as the primary sources for collecting data or information about marketing problem and prospect of DANO milk powder in Bangladesh. For secrecy of the company secondary data are not available as a result of which the present situation could not be compare with the previous situation. For this reason the whole research has been done on the basis of primary data. The research should be done ail over the Bangladesh. So. it is difficult to survey all the districts of Bangladesh within a short period of time. In this regard Dhaka city has been selected for this reason and survey.

Since the distribution of shops those sell DANO milk powder product are not homogeneous, stratified probability sampling was undertaken. Total 10000 approx.) retail shops of Dhaka city are divided into 10 zones these are: Mirpur, Mohammadpur. Dhanmondi, Gulshan. Tejgaon. Uttara. Shahjahanpur. Azimpur. Motijheel and Zattrabari. It is decided for this study to select 50 Retail shops from these zones. For this purpose 05 Retailers shops are selected by random sampling from the list of the retailers shop from every zone. From the above zones it is decided to select 10 numbers of consumers from each zone for the purpose of the study. So sample size for the consumer will be 100 from the total number of zones as listed. The necessary data was collected by interview through structures questionnaires. Statistical methods were used along qualitative analysis procedure to implement the study in line with the determined objectives. It is definitely a tedious job to conduct the overall study, make analysis and resolve findings for conclusion. These were done with honest approach under the guideline of the Faculty Guide.

The findings of the research work have been summarized as follows:

- The result of research work found that all the retailers express their positive attitude about selling of milk powder of different brand by the retailer; daily requirement of Dano milk powder fulfilled through Direct Sales Distribution (DSD); satisfied with current procedure of distribution system of the company; receiving Dano milk powder in time; receiving increased supply from distributor of Dano milk powder during the period of high sales. On the other hand most of the retailers express their negative attitude about Quality complain, and increases sales by increasing number of distributors. All the retailers said that they are getting Dano brand of milk powder directly from the company; weekly frequently supplied with milk powder of Dano brand; frequently the company personnel visit to retailers outlets on one day per week; place complains of Dano milk powder to Sales Representative (SR); duration of problems resolved within one week; reasons for satisfaction of existing distribution channel is the Quality product. From the analysts it is revealed that besides Dano brand, majority of the retailers are stock for sale Nido, Diploma, Red cow, Kwality, Fresh and Anchor brand of milk powder for their business. Majority of the retailers opinion are: Dano is the highest selling brand of milk powder; Diploma is the most profitable brand of milk powder; the price of Dano milk powder is higher compare to the competitors price; promotional activity of Dano milk powder is not sufficient.

- The present study showed that the retailers rank of different brands for milk powder in relation to various aspects these are- Availability, Price, Quality, Hygienic, Packaging, Sales Promotion, Advertisement, Distribution System, Steady Delivery and Salesman Pushes. From all features consideration, Nido brand is the highest preference among the retailers and Dano is the second highest rank position among the respondents opinion. But price is the key factor for consumers which might be helpful to increase sale for revenue. In this regard retailers opinion that Diploma is the best price for the consumer.

- The study was carried out that the majority consumer’s are: occupation category-Service; age- 35-44 years; income group-Tk. 16000-20999. Majority of the consumers express their positive attitude about brand awareness of milk powder while they purchase milk powder for their daily purposes, and mentioned about sufficient supply of Dano milk powder on demand while they are purchasing milk powder at different shop. On the other hand most of the consumers also express their positive attitude about intention to purchase high priced brand of milk powder where comparatively low prices products are available. Majority of the consumers said that they are buying milk powder on regularly basis; their favorite type of milk powder pack is the soft pack (pouch); highest preference of pack size for milk powder is the 1.00 kg peek; purchasing place of milk powder at the nearest convenience shop; the highest immediate previous brand for milk powder is Dano brand; consumers are buying their milk powder when earlier stock is almost finished; consumers are buying milk powder most of the time at same shop; consumer fed another shop when they fail to find their preferred brand at their convenient shop; the media influences to purchase Dano milk powder are the TV (98 %) & Newspaper (60 %); type of information Eon to find in the advertisement are Quality and Price.

- The present study revealed that brand preferences of milk powder according to consumer’s choice accordingly followed by highest preference to lowest preference are – Dano> Nido> Diploma> Kwality> Fresh>Starship.

- It is found that most of the consumer’s opinion about Dano milk powder in relation to the features of ‘Quality’, ‘Taste’ and “Availability” are good, and feature of “Price” is moderate.

- The study carried out only for academic purposes which might be helpful for the organization’s decision making. Yet, further investigation needs to understand the full range of benefits of marketing problem and prospect of Dano milk powder in Bangladesh

Recommendation

The study made a number of investigations and thereby made analysis from the data received. As a result, some of the recommendations are found to be useful for the purpose of marketing problem and prospect of DANO milk powder in Bangladesh. These are formulated in the academic pattern, but will have at least some impact on the part of designing activities of DANO milk powder marketing operation in Bangladesh. Those recommendations are outlined below:

1. Media selection plays a major role to be brand awareness for the consumers of a certain product. Integrated advertisement is a modern tool for aggressive selling of the desired product to develop the advertising plan by setting objective on media planning operations. Increases the frequency and duration of the advertisement in different media opportunities,

2. Promotional activities of Dano milk powder are to be maintained on a regular basis. The main media like Radio, Television, Poster, and Newspaper should be included with the right time, duration and frequency. And may be used hoarding signboard for advertising hi the main viewpoints. Attractive and fruitful campaigning for Dano milk powder would be introduced under the campaign plan strategy.

3. Dano is the market leading brand of milk powder market in Bangladesh so the authority of Dano milk powder must find the ways to expand total market demand. The authority must protect its current market share through good defensive and offensive actions. The company should M try to increase its market share further, even if the market size remains constant

4. The price of Dano milk powder is higher to the retailers and also consumer’s point of view price is moderate to the competitors. So pricing policy may be reviewed with competitors for higher sales of the product.

5. Majority consumers purchase milk powder nearest convenience shop. When preferred brand is not available they find another shop. So, company should ensure the availability of the product to pocket outlets because most of the outlets are under the distributor of the company but they do not cover fully.

6. The authority of Aria Foods should undertake activities such as right incentives, gift for higher sells, sample gifts to the retailers even to the consumers for the increasing sales volume are also would be useful.

7. Most of the time category; C’ and ‘D’ retailers don’t purchase sufficient product from the distributor of the company due to their financial bindings. Company should take necessary steps to ensure the sufficient supply of product through credit system or supply of product twice a week for convenient to the retailers to keep the to keep the product by cash in hand or company personnel should continuous monitor lo wholesale & retail outlets minimum twice a week which would might help 10 know the current situation of market and make facilities to rapid adjustments for unwanted situation by the authority of the company.

8. Product display attract the customer for to grow intention to purchase the product and it would be ensured to display product to wholesale & retail outlets by rented selves on that outlet to provide extra monthly payment by the company to increase sales and might help to grow consumers brand loyalty of the company product.

9. Doctor’s prescription plays a vital role to purchase any products through consumers to build up their health recovery for expanding market share and market area.

10. Aral Foods has to undertake detail marketing survey programs lo ventilate the issues and opportunities for Dano milk powder marketing in Bangladesh during the global open market economy.

11. Dano milk powder products are acknowledged to be better quality and this has to be maintained in ail the way.

12. Aral Foods must undertake integrated marketing promotion approach to aware the consumers of Dano milk powder about the quality, taste, its benefits and thereby motivate them to purchase.

13. Planned activities of Dano milk powder should be materialized within the .speculated time so that the other development activities do not encompass in traffic jam wasting time and money both.

14. The organization should exert relentless effort to increase Dano milk powder production through motivation and persuasion.

15. Finally, integrated and coordinated efforts with the scope of monitoring and feedback analysis should be practiced in the process of materializing the activities relating to the marketing problem and prospect of” Dano milk powder in Bangladesh.

First Part of the Post:

Thesis Paper on The Marketing Problems and Prospects of Dano Milk Powder in Bangladesh (Part-1)