The main objective of this report is to analysis Foreign Trade Financing of Rupali Bank Limited. Other objectives of this reports are to Get the knowledge about report writings, to make a study (theoretical & practical) and prepare a report that reflects our understandings and knowledge attained during the period, to know about the company and its products / services, to get a good understanding of “Foreign Trade Financing” activities of the bank and to make some findings and put forward some recommendations.

Objectives of the Study

Primary Objective:

- Get the knowledge about report writings.

- To make a study (theoretical & practical) and prepare a report that reflects our understandings and knowledge attained during the period.

Secondary Objective:

- To know about the company and its products / services.

- To get a good understanding of “Foreign Trade Financing” activities of the bank.

- To make some findings and put forward some recommendations.

Methodology of the Study

The needed for conducting the study have been collected from the primary sources as well as secondary sources. In collecting the necessary data, care has been taken so that all the variables that may in some way can’t affect the objectives of the study. The information that I used in this study is collected from the following sources:

Primary data sources:

- Personal interview with the employees

- Practical desk work

- Face to face conversation with the client

Secondary data sources:

- Bulletin published by the bank

- Annual statement of the bank

- Previous research books and journals

- Different books about banking

Introduction of Rupali Bank Limited:

Rupali Bank Ltd. was constituted with the merger of 3 (three) erstwhile commercial banks i.e. Muslim Commercial Bank Ltd., Australasia Bank Ltd. and Standard Bank Ltd. operated in the then Pakistan on March 26, 1972 under the Bangladesh Banks (Nationalization) Order 1972 (P.O. No. 26 of 1972), with all their assets, benefits, rights, powers, authorities, privileges, liabilities, borrowings and obligations. Rupali Bank worked as a nationalized commercial bank till December 13, 1986.

Rupali Bank Ltd. emerged as the largest Public Limited Banking Company of the country on December 14, 1986 under the order No. Ag / Awe / weK- 3 / 33 / 86 / 361 of the Govt. of the Peoples Republic of Bangladesh.

Mission of the Bank:

The bank participates actively in socio-economic development of the country by performing commercially viable and socially desirable banking functions.

Present Capital Structure:

| Authorized Capital | : | Tk. 7000 million (US$ 120.70 million) |

| Paid up Capital | : | Tk. 1250 million (US$ 21.55 million) |

| Reserve Fund | : | Tk. 1130.38 million (US$ 19.49 million) |

Break up of paid up Capital:

| (a)Government shareholding | : | 93.23% |

| (b) Private shareholding | : | 6.77% |

International Banking:

Rupali Bank Ltd. engages itself in providing best international banking service to its valued clients by serving through 28 Authorized Dealer branch.

It has a good number of correspondent banks world-wide and it handles a big volume of export and import business. It is also engaged in collecting home-based remittances of the people and paying the same to the beneficiary promptly.

Products and Services:

- Export Credit (Pre-shipment & Post-shipment)

- Suppliers Credit

- Letter of Credit (Import)

- Guarantees in Foreign Currency

- Bid Bond

- Performance Guarantee

- Advance Payment Guarantee

- Bill purchasing/ discounting

- Remittance, Collection, Purchases & Sales of Foreign Currency & Traveler’s Cheques

- NRTA (Non-Resident Taka A/C )

- NFCD Account (Non-Resident Foreign Currency Deposit)

- RFCD Account (Resident Foreign Currency Deposit)

- Convertible & Non-convertible Taka Account

- Forward contracts

- Correspondent Banking Relations

Correspondent Banking:

- Rupali Bank Ltd’s aim is to increase its foreign exchange business.

- It is doing international banking with major banks of the world.

- It is attending to problems of the correspondent banks.

- It is maintaining agency arrangements and correspondent relationship with about 160 foreign correspondents.

Product & Services

Line of Product & Services of Rupali Bank Limited, Local Office, Dhaka:

Local Office is the main branch of The Rupali Bank Ltd., situated at Ground floor & 1st floor of Rupali Bhavan, 34, Dilkusha C/A, Dhaka.The branch operating its overall business activities under the leadership of a Deputy General Manager, The branch provides above mentioned product & services to its clients through four departments namely:

- General Banking

- Loan & Advance

- Foreign Exchange

- Legal & Recovery

Head of the above departments are four Assistant General Manager the branch, who is directly responsible to the Deputy General Manager for the performances of their respective departments.

The products and services provided by the above departments of the branch to its clients are mentioned below:

Product and services:

RBL has a very broad line products under the various business group, from short term to long term deposits, various types loans and advances, account service, it provides finance for export and import, finance for working capital, project financing, capital investment, remittance service, trade service, foreign exchange service, online banking, cash management service, locker service, Profit & loss sharing and also has other miscellaneous product and services around the nation.

Product of Trade service:

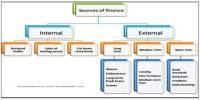

Fund Based:

- Cash Credit (CC Hypo)

- Cash Credit (CC Pledge)

- Overdraft (OD)

- Trust Receipt (TR)

- Foreign Bill Purchase (FBP)

- Loan Against Important Merchandise (LIM)

Non-Fund Based:

- Letter of Credit (LC)

- DA (Deferred)

- DP (Sight)

Letter of Guarantee (LG)

A limit (amount) is set by the bank that can be availed by a particular Customer based on his / her Credit worthiness and record of business transactions with the bank.

General Banking:

It is most important side of the bank. Bank is nothing but a middleman between lenders (surplus unit) and borrowers (deficit unit). To provide loan, a bank needs a huge amount of money from the depositors. General banking is the side where banks offer different alternatives to the clients to deposit and remit their money. To encourage the clients, bank offers different options in front of their clients. Most of these options are very much similar between the banks, but the customer services and facilities may not be the same.

General Banking of RBL is divided into 5 divisions:

- Account opening

- Remittance

- Clearing

- Cash.

- Account’s Department

Account Opening

The relationship between the banker and the customer begins with the opening of an account by the customer. Initially all the accounts are opened with a deposit money by the customer and hence these accounts are called deposit account. Usually a person needs to open an account ton take services form it. Without an opening an account, one can get only a few services from the bank. So the banking begins actually by opening an account with a bank. Generally, there are four types of accounts in our country’s banking system:

- Current account or Demand Deposit(CD Account)

- Savings Deposit(SB Account)

- Fixed or Time Deposit(FDR)

Current Account

Current account is purely demand deposit account because the bank is bound to pay the amount to the account holder on demand at any time. It is running and active account, which may be operated upon any number of times during a working day. There is no restriction on the number and the amount of withdrawals from a current account. The special characteristics of a current account are as follows:

- The primary objective of current is to serve big customers such as businessmen, joint stock companies, private limited companies, public limited companies etc. from the risk of handling cash by themselves.

- The cost of providing current account facilities is considerable to the bank since they undertake to make payments and collects the bills, drafts, cheques for any number of times in a particular day. The bank therefore does not pay any interest on current deposit while on the other hand some banks charge for incidental charges on such account.

- For opening of a current account minimum deposit of taka 1000/= is required. Introductory reference is also required for opening of such account.

Opening a Current Account

The following documentation and formalities are required for opening a current account:

Documentation of Opening a Current Account

- For Proprietorship: Up-to-date copy of trade license, Introducer of a CD account holder, Two copies of passport size photographs of account holder, Seal, TIN, VAT certificate

- For Partnership: up to date copy of trade License, Introducer of a CD account holder, Two copies of passport size photographs of account holder, Photocopy of partnership Deed, notarized by Notary Public, Account agreement (MF-06) and letter of partnership (MF-07), Seal, TIN, VAT certificate

- For Private Limited Company: Up-to-date copy of trade license, Two copies of passport size photographs of account holder, Certified copy of Memorandum and Articles of Association, signed and sealed by the managing Director, Photocopy of the certified of Incorporation, List of directors as per return of joint stock company with signature ,Seal of each operating persons, Particulars of Directors, Resolution for opening account with the bank

- For Public Limited Company: Up-to-date copy of trade license, Two copies of passport size photographs of account holder, Certified copy of Memorandum and Articles of Association, signed and sealed by the managing Director, Photocopy of the certified of Incorporation, Seal of each operating persons, Particulars of Directors, Resolution for opening account with the bank, Certificate of commencement of business, List of directors as per return of joint stock company with signature

- For Societies, Clubs, Associations etc: Up-to-date copy of trade license, Registration from the concerned authority, By laws/ rules and regulations/ constitutions duly signed and sealed by chairman, Resolution for opening account with the bank, Introducer of a CD account holder, Seal of each operating persons.

Formalities of Opening a Current Account

- Application on the Prescribed Form

The person willing to open a current account with the bank has to make application in the prescribed form. This form must be properly filled up and signed by the applicants.

- Introduction to the Applicant

The applicant also required to furnish in the application form the names of the referees from whom the banker may make inquires regarding the character, integrity and respectability of the applicants. In most cases the introduction is done by the customer of the bank or some other person knows to the bank by signing on the application form with his/her account number (if any).

- Specimen signature

Every customer is required to supply to his banker with one or more specimens of his/her signature. These signatures are taken on cards, which are preserved by the banker, and his signature of the account holder on the cheques is compared with the Specimen signatures.

- Opening and operating the account

After the above formalities are over, the banker opens an account in the name of applicant. Generally the minimum amount to be deposited initially is tk. 1000/- for opening a current account. Then the bank provides the customer with:

- A pay in slip/deposit book

With a view of facilitate the receipt of credit items paid in by a customer, the bank will provide him/her pay in slip either loose or in a book forms. The customer has to fill up the pay in slip at the time of depositing the money with the bank. The cashier with his/her initials and stamps will return the counter foil to the customer on the receipt of the money.

- Cheque Book

To facilitate withdrawals and payments to third parties by the customer, the bank will also provide a cheque book to the customer. But it is noted that to get a cheque book, the customer has to dully fill up the cheque requisition slip to the banker.

Savings account (SB)

A savings account is meant for the people of the lower and middle classes who wish to save a part of their incomes to meet their future need and intend to earn an income from their savings. It aims to encouraging savings of non trading persons, institutions, society and clubs etc. by depositing small amount of money in the bank. Both the elements of time and demand deposit are present in this account.

Opening a Saving Account

For opening a savings account following documentation and formalities are required:

Documentation’s

(a) Two copies of passport size photographs of account holder.

- Photograph of the nominee

- Introducer’s reference

- Employer certificate

(b) Two copies of passport size photographs of account holder.

- Photograph of the nominee

- Photocopy of passport ( first four pages)

- Introducer’s reference

- Employer certificate

Formalities of Opening

- Application on the prescribed form: The person willing to open a savings account with the bank has to make application in the prescribed form. This form must be properly filled up and signed by the applicants.

- Introduction to the Applicant: The applicant also required to furnish in the application form the names of the referees from whom the banker may make inquires regarding the character, integrity and respectability of the applicants. In most cases the customer of the bank does the introduction or some other person knows to the bank by signing on the application form with his/her account number (if any).

- Specimen signature: Every customer is required to supply to his banker with one or more specimens of his/her signature. These signatures are taken on cards, which are preserved by the banker, and his signature of the account holder on the cheques is compared with the Specimen signatures.

- Opening and operating the account: After the above formalities are over, the banker opens an account in the name of applicant. Generally the minimum amount to be deposited initially is tk. 1000/- for opening a current account.

Then the bank provides the customer with:

- A pay in slip/deposit book: With a view of facilitate the receipt of credit items paid in by a customer, the bank will provide him/her pay in slip either loose or in a book forms. The customer has to fill up the pay in slip at the time of depositing the money with the bank. The cashier with his/her initials and stamps will return the counter foil to the customer on the receipt of the money.

- Cheque Book: To facilitate withdrawals and payments to third parties by the customer, the bank will also provide a cheque book to the customer. But it is noted that to get a cheque book, the customer has to dully fill up the cheque requisition slip to the bank.

Fixed Deposit Receipts (FDR)

These are the deposits, which are made with the bank for fixed period specified in advance. It is purely a time deposit account. The bank doesn’t maintain cash reserves against these deposits and therefore the bank offers higher rates of interest on such deposits. At present the rate of interest for fixed deposit Receipt (FDR) in the First Security Bank Limited are as follows:

Rate of interest for fixed deposit Receipt (FDR)

| Time period | Interest rate |

| For 3(three month) | 7.5% |

| For 6(six month) | 7.75% |

| For 1(one year) | 8% |

| For 2(two year) | 8.5% |

| For 3(three year) | 8.5% |

Source: Bank Circular

Remittance

Remittance of funds is ancillary services of RBL. It aids to remit fund from one place to another place on behalf of its customers as Ill as non- customers of Bank. RBL has its branches in the major cities of the country and therefore, it serves as one of the best mediums for remittance of funds from one place to another. The main instruments used by RBL:-

- Payment Order Issue/Collection

- Demand Draft Issue/Collection

- T.T. Issue/Collection

Locker Service:

Mail Transfer Advice (MTA)

Payment Order:

The pay order is an instrument issued by bank, instructing itself a certain amount of money mentioned in the instrument taking amount of money and commission when it is presented in bank. Only the branch of the bank that has issued it will make the payment of pay order.

Issuing of Pay Order:

The procedures for issuing a Pay Order are as follows:

- Deposit money by the customer along with application form.

- Give necessary entry in the bills payable (Pay Order) register where payee’s name, date, PO no, etc is mentioned.

- Prepared the instrument.

- After scrutinizing and approval of the instrument by the authority, it is delivered to customer. Signature of customer is taken on the counterpart.

Different modes of PO when a customer can purchase:

By cash:

Cash A/C Debit

Bills payable (PO) A/C Credit.

Income on commission A/C Credit.

By account:

Customer’s A/C Debit

Bills payable (PO) A/C Credit.

Income on commission A/C Credit.

By transfer:

RBL General/ other Dept Clients A/C Debit

Bills payable (PO) A/C Credit.

Income on commission A/C Credit.

PO A/C is the current liabilities of bank, which is acquired to be discharged by beneficiaries against cash or through an account.

Settlement of a PO:

When PO submitted by collecting bank through clearing house, the issuing bank gives payment.

Bills payable (PO) A/C Debit

RBL General A/C Credit.

But before giving payment it is duty for issuing to observe whether endorsement was given by the collecting bank or not, then the instrument is dishonored and marking ‘Endorsement required’.

Bills payable (PO) —————Dr.

Customer A/C———————Cr.

Demand Draft:

The person intending to remit the money through a Demand Draft (DD) has to deposit the money to be remitted with the commission which the banker charges for its services. The amount of commission depends on the amount to be remitted. On issue of the DD, the remitter does not remain a party to the instrument:

- Drawer branch

- Drawn branch

This is treated as the current liability of the bank as the banker on the presentation of the instrument should pay the money. The banker event on receiving instructions from the remitter cannot stop the payment of the instrument. Stop payment can be done in the following cases:

Loss of draft before endorsement: In this case, “Draft reported to be lost, payee’s endorsement requires verification” is marked.

Loss of draft after endorsement: In this case, the branch first satisfies itself about the claimant and the endorsement in his favor.

Accounting treatment:

In case of issuing of the instrument:

Cash/ customer’s A/C———————Dr.

RBL General A/C (Drawn on branch)———-Cr.

Income A/C commission—————————Cr.

After giving these entries an Inter Bank Credit Advice is prepared which contains the controlling number, depicting that the branch is credited to whom it is issued.

An IBCA implies the following entries,

RBL General A/C Issuing Branch ——-Dr.

Drawn on branch————————————Cr.

Telegraphic or Telephonic Transfer (TT)

This Method transfers money to one place to another place by telegraphic message. The sender branch will request another branch to pay required money to the required payee on demand. Generally for such kind of transfer payee should have account with the paying bank. Otherwise it is very difficult for the paying bank to recognize the exact payee.

When sending money is urgent then the bank uses telephone for remittance. This service is only provided for valued customers, who is very reliable and with which banks have long standing relationship.

TT (Issue):

- Customer fills up the TT form and pays the amount along with commission in cash or by cheque.

- The respected officer issues a cost memo after receiving the TT form with payment seal, then signs it and at last give it to the customer.

- Next a TT confirmation slip is issued and its entry is given in the TT issue register.

- A test number is also put on the face of the slip. Two authorized officer signs this slip.

- The respective officer transfers the message to the drawee branch mentioning the amount, name of the payee, name of the issuing branch, date, test number and his her power of attorney (P.A.) number.

- The confirmation slip is send by post.

Payment Process of TT:

- Test confirmation

- Confirm issuing branch

- Confirm payee’s account.

- Confirm amount

- Make payment

- Advice sends to the Head Office for reconciliation.

Test Arrangement of TT & DD

Test is the security code by decoding which any branch can be sure that the TT or DD is not forged one. Only the authorized officers know the test code. Each bank maintains secret code for this. That is the test arrangement is the combination of different secret codes

Locker Service:

RBL, Local Office, Dhaka is providing facility of locker service for the purpose of safeguarding the valuable property of customers. The person or organization that has any account in bank branch can enjoy this service. They keep their valuable assets in banker’s custody. Customers have right to look after with a key of their individual locker provided by bank. FSBL maintains the following types of lockers:

- Large locker.

- Medium locker.

- Small locker.

For enjoying this service, clients have to give charge yearly Tk.2500/-, Tk.2000/- and Tk.1500/- for large, medium and small locker respectively.

Mail Transfer Advice (MTA)

Where the remitter desires the banker to remit the funds to the payee instead of purchasing a draft himself the banker does it through a mail transfer advice. The payee must have an account with the paying office as the amount remitted in such a manner is meant for credit to the payee’s account and not for cash payment. it is the least used technique for transferring fund. Where there is no telex machine or telephone line then this method is used.

Clearing

Clearing house is an assembly of the locally operating scheduled banks for exchange of cheques, drafts, pay orders and other demand instruments drawn on each other and received from their respective customers for collection. The house meets at the appointed hour on all working days under the supervision of two central bank officers or its agent as the case may be, and works within the regulations framed therefore on the basis of prevailing banking practices. in Bangladesh, clearing house sites at Bangladesh bank where there is no office of the Bangladesh bank, sonali bank acts as agent of Bangladesh bank.

There are mainly two types of clearing systems in Bangladesh, such as:

- internal clearing or inter branch clearing or inward clearing

- external clearing or inter banks clearing or outward clearing

What is clearing House?

In Bangladesh Bank, there is a very large room, which contains fifty (50) or more tables for each bank that is called the clearing house.

Nature of clearing house:

1st Clearing House

Return Clearing House

Clearing House Process:

Every bank has an officer of clearinghouse who works with Bangladesh Bank clearing house. Now a day’s most of clients deposit in their account cheques of different banks. Clearing officer check all the cheques and deposit slip very carefully and then he received the cheque. Then the clearing officer posted all the cheques in computer software which is recognized through computer department of Bangladesh Bank. Clearing officer then seal all the cheques in advance date, makes endorsement on all the cheques.

All the cheques are posted in the computer branch wise, then officer print the entire document and staple all the cheques branch wise, which is called schedule of clearing house. It is a very difficult job to staple all the cheques, because some time’s the cheques are huge in quantity, it may be 250 to 400, this is very vital job, Because every cheque must have to staple very carefully, it means cheque amount and the print sheet amount and cheque branch must have to be same.

If the cheques staple in wrong direction, the cheque may be return from another bank, that’s why FSBL not to be able to credited party account.

Then the clearinghouse officer copying the entire document in two floppy dist as per Bangladesh Bank requirement. When the clearing officers enter the clearinghouse, his first job is that the floppy delivered to the Bangladesh Bank computer department.

All of the procedure the clearing in charge goes to the Bangladesh Bank clearing house before 10 am in the morning. The clearing officer check all the bank’s cheque and he put all the cheques in bank wise, like as this another bank’s delivered there cheques in RBL desk. Then the officers of RBL have to calculate all the cheques by using calculator machine, Staple pin remover, and then he divided all the cheques as RBL Branch wise.

Types of Clearing Cheque:

RBL Local Office, Dhaka performs the clearing function through Bangladesh Bank. RBL Local Office, Dhaka acts as the agent of all RBL branches for the clearing house of the Bangladesh Bank. There are two types of cheque which are-

- Inward clearing cheque

- Outward clearing cheque.

Inward clearing Cheques:

Inward clearing cheques are those ones which have drawn on the other branches of RBL, which will be cleared / honored through the internal clearing system of RBL operated by the Local Office of RBL.

Outward clearing Cheques:

Outward clearing cheques are those ones, which have drawn on the other bank branches which are presented on the concerned branch for collection through clearing house of Bangladesh Bank.

Accounts Department

Accounts Department is play most vital role in Banking. Accounts Department is a department with which each and every department is related. It records the profit & loss A/C and statement of assets and liabilities by applying “Golden Rules” of book-keeping. The functions of it are theoretical & computerized based. RBL Local Office records its accounts daily, Weekly and monthly every record.

Functions Provided By Accounts Department:

Like all other Banks, in RBL Accounts Department is regarded as the nerve Center of the bank. In banking business, transactions are done every day and these transactions are to be recorded properly and systematically as the banks deal with the depositors’ money. Any deviation in proper recording may hamper public confidence and the bank has to suffer a lot otherwise. Improper recording of transactions will lead to the mismatch in the debit side and in the credit side. To avoid these mishaps, the bank provides a separate department whose function is to check the mistakes in passing vouchers or wrong entries or fraud or forgery. This department is called as Accounts Department.

Besides the above, the Bank has to prepare some internal statements as Ill as some statutory statements which are to be submitted to the central bank. Accounts Department prepares these statements also. The department has to submit some statements to the Head Office, which is also consolidated by the Head Office late on.

The tasks of the Accounts Department of RBL, Local Office may be seen in two different angles:

(1) Daily Tasks:

The routine daily tasks of the Accounts Departments are as follows——–

- Recording the daily transactions in the cashbook.

- Recording the daily transactions in general and subsidiary ledgers.

- Preparing the daily position of the branch comprising of deposit and cash.

- Preparing the daily Statement of Affairs showing all the assets and liability of the branch as per General Ledger and Subsidiary Ledger separately.

- Making payment of all the expenses of the Branch.

- Recording inter branch fund transfer and providing accounting treatment in this regard.

- Checking whether all the vouchers are correctly passed to ensure the conformity with the ‘Activity Report’; if otherwise making it correct by calling the respective official to rectify the voucher.

- Recording of the vouchers in the Voucher Register.

- Packing of the correct vouchers according to the debit voucher and the credit voucher.

(2) Periodical Tasks:

The routine periodical tasks performed by the department are as follows:

- Preparing the monthly salary statements for the employees.

- Publishing the basic data of the branch.

- Preparing the weekly position for the branch which is sent to the Head Office to maintain Cash Reserve Requirement (C.R.R).

- Preparing the monthly position for the branch which is sent to the Head Office to maintain Statutory Liquidity Requirement (C.R.R).

- Preparing the weekly position for the branch comprising of the break up of sector-wise deposit, credit etc.

- Preparing the weekly position for the branch comprising of the denomination wise statement of cash in tills.

- Preparing the quarterly statements (SBS-2 and SBS-3) where SBS-2 shows “classification of deposits excluding inter bank deposits, deposits under wage earner’s scheme and withdrawals from deposits accounts” and SBS-3 shows “classification of advances (excluding inter bank) and classification of bills purchased and discounted” during the quarter.

- Preparing the budget for the branch by fixing the target regarding profit and deposit so as to take necessary steps to generate and mobilize deposit.

- Preparing an ‘Extract’ which is a summary of all the transactions of the Head Office account with the branch to reconcile all the transaction held among the accounts of all the branches.

Other Activities of Accounts Department:

Transfer

Transfer is not a critical sector in banking but it is very important. Transfers play a vital role in banking sector. So now I have to know what transfer is: basically transfer is a type of register maintaining matter. In this register officer write down every day transactions in Debit and Credit side then the officer calculate both the side of the register if both side shown same amount, it means that the total day’s transaction is completely okay.

Extract:

Extract is a statement of all originating and responding transactions among inter–branches through inter branches debit and credit advice. At the end of the day, all the debit and credit advices of different department come to accounts department. It makes extract in light of all advices.

Actually extract shows the balance of RBL, Local Office general A/C. The objective of preparing it is to know how many transactions have been originated and responded by the respective branch per day. Branch has to send it its Head Office keeping one photocopy.

Statement of affairs:

Accounts section prepares the statement of affairs for finding the profit /loss as Ill as amount of assets and liabilities of concerned branch per day. Theoretically; it is called financial statement and has two parts:

- Income and Expenditure A/C.

- Statement of assets & liabilities.

Foreign Exchange

Definition of Foreign Exchange:

Foreign Exchange is a process which is converted one national currency into another and transferred money from one country to another country.

According to Mr. H. E. Evitt. Foreign Exchange is that section of economic science which deals with the means and method by which right to wealth in one country’s currency are converted into rights to wealth in terms of another country’s currency. It involved the investigation of the method by which the currency of one country is exchanged for that of another, the causes which rented such exchange necessary the forms which exchange may take and the ratio or equivalent values at which such exchanges are effected.

Foreign exchange is the rate of exchange in the both country’s currency.

Foreign Trade and Foreign Exchange:

International trade refers to trade between the residents of two different countries.

Each country functions as a sovereign State with its set of regulations and currency. The difference in the national of the exporter and the importer presents certain peculiar problems in the conduct of international trade and settlement of the transactions arising there from. Important among such problems are:

(a) Different countries have different monetary units;

(b) Restrictions imposed by countries on import and export of goods;

(c) Restrictions imposed by nations on payment from and into their countries;

(d) Differences in legal practices in different countries.

Foreign exchange means foreign currency and includes:

All deposits, credits and balances payable in any foreign Currency and any drafts, traveler’s cheques, letters of credit and bills of exchange, expressed or drawn in local currency but payable in any foreign currency;

Any instrument payable, at the option of the drawee or holder thereof or any other party thereto. Either in local currency or in foreign currency or partly in one and partly in the other. Thus, foreign exchange includes foreign currency; balances kept abroad and instruments payable in foreign currency.

Principles of Foreign Exchange:

The following principles are involved in Foreign exchange:

i) The entire system

ii) The media used

iii) The monetary unit.

Functions of Foreign Exchange:

The Bank actions as a media for the system of foreign exchange policy. For this reason, the employee who is related of the bank to foreign exchange, especially foreign business should have knowledge of these following functions:

(i) Rate of exchange.

(ii) How the rate of exchange works.

(iii) Forward and spot rate.

(iv) Methods of quoting exchange rate.

(v) Premium and discount.

(vi) Risk of exchange rate.

(vii) Causes of exchange rate.

(viii) Exchange control.

(ix) Convertibility.

(x) Exchange position.

(xi) Intervention money.

(xii) Foreign exchange transaction.

(xiii) Foreign exchange trading.

(xiv) Export and import letter of credit.

(xv) Non-commercial letter of trade.

(xvi) Financing of foreign trade.

(xvii) Nature and function of foreign exchange market.

(xviii) Rules and Regulation used in foreign trade.

(xix) Exchange Arithmetic.

Letter of Credit (L/C)

Definition of L/C:

On behalf of the importer if the Bank undertakes to make payment to the foreign bank is known as documentary credit or letter of credit.

A letter of credit is an instrument issued by a bank to a customer placing at the later disposal such agreed sums in foreign currency as stipulated. An importer in a country requests his bank to open a credit in foreign currency in favor of his exporter at a bank in the later country. The letter of credit is issued against payment of amount by the importer or against satisfactory security. The L/C authorizes the exporter to draw a draft under L/Cs terms and sell to a specified bank in his country. He has to hand over to the bank the Bill of exchange, shipping documents and such other papers as may be agreed upon between the exporter and the importer. The exporter is assured of his payment because of the credit while the importer is protected because documents in respect of export of goods have to be delivered by the exporter to the paying bank before the payment is made.

From of Letter of Credit

A letter of credit (L/C) may be two forms. These are as below:

(i) Revocable letter of credit.

(ii) Irrevocable letter of credit.

Revocable L/C:

If any letter of credit can be amended or canceled by the exporter and without prior consent of importer is known as revocable letter of credit.

A revocable letter of credit can be amended or canceled by the issuing bank at any time without prior notice to the beneficiary. It does not constitute a legally binding undertaking by the bank to make payment. Revocation is possible only until the documents have been honored by the issuing bank or its correspondent. Thus a revocable credit does not usually provide adequate security for the beneficiary.

Irrevocable L/C:

If any letter of credit can not be cancelled or amendment without the consent of both the importer and the exporter is known as irrevocable letter of credit.

An irrevocable credit constitution a firm undertaking by the issuing bank to make payment. It therefore, gives the beneficiary a high degree of assurance that he will paid to his goods or services provide he complies with terms of the credit.

Types of Letter of Credit:

Letter of Credit is classified into various types according to the method of settlement employed. All credits must clearly indicate in major categories.

(i) Sight payment credit.

(ii) Deferred payment credit.

(iii) Acceptance credit.

(iv) Negotiation credit.

(v) Red close credit.

(vi) Revolving credit.

(vii) Stand by credit.

(viii) Transferable credit.

Sight payment credit :

The most commonly used credits are sight payment credits. These provide for payment to be made to the beneficiary immodestly after presentation of the stipulated documents on the condition that the terms of the credit have been complied with. The banks are allowed reasonable time to examine the documents.

Deferred payment credit :

Under a deferred payment credit the beneficiary does not receive payment when he presents the documents but at a later date specified in the credit. On presenting the required documents, he received the authorized banks written undertaking to make payment of maturity. In this way the importer gains possession of the documents before being debited for the amount involved.

In terms of its economic effect a deterred payment credit is equivalent to an acceptance credit, except that there is no bill of exchange and therefore no possibility of obtaining money immediately through a descant transaction. In certain circumstances, however, the banks payment undertaking can be used as collateral for an advance, though such advance will normally only be available form the issuing or confirming bank. A discountable bill offers wider scope.

Acceptance Credit:

With an acceptance credit payment is made in the form of a term bill of exchange drawn on the issuing Bank. Once he has fulfilled the credit requirements, the beneficiary can demand that the bill of exchange be accepted and returned to him. Thus the accepted bill takes the place of a cash payment.

The beneficiary can present the accepted bill to his own bank for payment at maturity or for discounting, depending on whether or not he wants cash immediately. For simplicities sake the beneficiary usually gives on instruction that the accepted bill should be left in the safekeeping of one of the banks involved until it matures. Bill of exchange drawn under acceptances credit usually has a term of 60-180 days.

The purpose of an acceptance is to give the importer time to make payment. It he sells the goods before payments fall due, he can use the proceeds to meet the bill of Exchange in this way, he does not have to borrow money to finance the transaction.

Negotiation credit:

Negotiation means the purchase and sale of bill of exchange or other marketable instruments. A negotiation credit is a commercial letter of credit opened by the issuing bank in the currency of its own country and addressed directly to the beneficiary. The letter is usually delivered to the addressee by a correspondent bank. This credit is sometimes also as Hand on credit.

The letter of credit empowers the beneficiary to draw a bill of exchange on the using bank, on any other named drawer or on the applicant for the credit. The beneficiary can they present this bill to a bank for negotiation, together with the original letter of credit and the documents stipulated therein.

Payment of the bill of exchange is guaranteed by the issuing bank on the condition that the documents presented by the beneficiary are in order. The most common form of negotiation credit permits negotiation by any bank. In rare case the choice is limited to specified banks.

Red clause credit:

In the case of a red clauses credit, the seller can obtain an advance for an agreed amount from the correspondent bank, goods that are going to be delivered under the documentary credit. On receiving the advances, the beneficiary must give a receipt and provide a written undertaking to present the required documents before the credit expires.

The advance is paid by the correspondent bank, but it is the using bank that assumes liability. If the sellers does not present the required documents in time and fails to refund the advance, the correspondent bank debits the issuing bank with the amount of the advance plus interest. The issuing bank, in turn, has reveres to the applicant, who therefore bears the risk for the advance and the interest accursed.

The clause permitting the correspondent bank to make an advance used to be written on red in home the name red clause credit.

Revolving Credit:

Revolving credit can be used when goods are to be delivered in installment at specified intervals. The amount available at any one time is equivalent to the value of one partial delivery.

A revolving credit can be cumulative or non-cumulative means that amount from unused or incompletely used portions can be carried forward to subsequent period. If a credit is non-cumulative, portions not used in the prescribing period case to be available.

Stand by credit:

Stand by credit are encountered principally in the US. Under the laws of most US states, banks are prohibited from issuing regular quarantines, so credits are used instead. In Europe, too the use of this type of credit is increasing by virtue of their documentary credit, stand-by credit are governed by the UCP. However, their function is that of a grantee.

The types of payment and performance that can be guaranteed by stand-by credits include the following:

- Payment of thorium bill of exchange

- Repayment of bank advance

- Payment of goods delivered.

- Delivery of goods in accordance wets contract and

- Execution of construction contracts, supply and install contracts.

In order to enforce payment by the bank, the beneficiary merely presents a declaration stating that the applicant for the credit has failed to meet his contractual obligation. This declaration may have to be accompanied by other documents.

Transferable Credit:

Transferable credits are particularly well adapted to the requirements of international trade. A trader who receives payment from a buyer in the form of a transferable documentary credit can use that credit to pay his own supplier. This enables him to carry out the transaction with only a limited and lay of his own funds.

The buyer supplies for an irrecoverable credit issued in the traders favour. The issuing bank must expressly designate the credit as transferable. As soon as the trader receives the confirmation of credit he can request the bank to transfer the credit to his supplier. The bank is under no obligation to affect the transfer except in so far as it has expressly consented to do so. The costs of the transfer are usually charged to the trader and the transferring bank is entitled to delete them in advance.

Parties of Letter of Credit:

A letter of credit is issued by a Bank at the request of an importer in favour of an exporter from whom he has contracted to purchases some commodity or commodities. The importer, the exporter and the issuing bank are parties to the letter of credit. There are however, one or more than one banks that are involved in various capacities and at various stages to play an important role in the total operation of the credit.

- The opening Bank.

- The Advising Bank.

- The Buyer and the Beneficiary.

- The paying Bank.

- The negotiating Bank.

- The confirming Bank.

The opening Bank:

The opening Bank is one that issues the letter of credit at the request of the buyer. By issuing a letter of credit it takes upon itself the liability to pay the bills drawn under the credit. If the drafts are negotiated by the another bank, the opening Bank reimburses that Bank. As soon as the opening Bank, issuing a letter of credit (L/C), it express its undertaking to pay the bill or bills as and when they are drawn by the beneficiary under the credit. When the bills are presented to or when antic is received that bills have been presented to a paying or negotiating Banks its liability matures.

The Advising Bank

The letter of credit is often transmitted to the beneficiary through a bank in the letters country. The bank may be a branch or a correspondent of the opening bank. The credit is some times advised to this bank by cable and is then transmitted by it to the beneficiary on its own special form. On the other occasions, the letter is sent to the bank by mail or telex and forwarded by it to the exporter. The bank providing this services is known as the advising bank. The advising bank undertakes the responsibility of prompt advice of credit to the beneficiary and has to be careful in communicating all its details.

The Buyer and the Beneficiary:

The importer at whose request a letter of credit is issued is known as the buyer. On the strength of the contract that he makes with the exporter for the purchase of some goods that the letter of credit is opened by the opening bank.

The exporter in whose favour the credit is opened and to whom the letter of credit is addressed is known as the beneficiary. As the seller of goods he is entitled to receive payment which he does by drawing bills under the letter of credit (L/C). As soon as he has shipped the goods and has collected the required documents, he draws a set of papers and presents it with the documents to the opening bank or some other bank mentioned in the L/C.

The paying Bank:

The paying bank only pays the drafts drawn under the credit but under takes no opening bank, by debating the latters accounts with it if there is such an account or by any other measured up, between the two bankers. As soon as the beneficiary has received payment for the draft, he is out of the picture and the rest of the operation concerns only the paying bank and the opening bank.

The Negotiating Bank

The negotiating bank has to be careful in scrutinize that the drafts and the documents attached there to are in conformity with the condition laid down in the L/C. Any discrepancy may result in refused on the part of the opening bank to honor the instruments is such an eventuality the negotiating bank has to look back to the beneficiary for refund of the amounts paid to him.

The Confirming Bank:

Sometimes an exporter stipulates that a L/C issued in his favour be confirm by a bank in his own country. The opening this country to add its confirming to the credit the bank confirming the credit is known as the confirming bank and the credit is known as confirmed credit.

Contents of the Letter of Credit:

Banks normally issued letter of credit (L/C) on forms which clearly indicate the banks name and extent of the banks obligation under the credit. The contents of the L/C of different Banks may be different .In general L/C contains the following information:-

Name of the buyer:

Who is also known as the accounted since it is for his account that the credit has been opened.

Name of the seller:

Who is also known as the beneficiary of the credit?

Amount of the credit:

Which should be the value of the merchandise plus any shipping charges intent to be paid under the credit?

Trade terms:

Such as F.O.B and CIF

Tenor

Tenor of the Draft which is normally dependent upon the requirements of the buyer.

Expiration date:

This is specified the latest date documents may be presented. In this manner or by including additionally a latest shipping date, the buyer may exercise control over the time of shipment.

Documents required:

Which will normally include commercial invoice consular or customer’s invoice, insurance policies as certificates, if the source is to be effected by the beneficiary and original bills of lading?

General description of the merchandise:

This briefly and in a general manner duly describes the merchandise covered by a letter of credit.

Advising Letter of Credit

The letter of credit duly signed by two authorized officers, whose specimen signatures already recorded with the correspondent banks, must be addressed to the beneficiary. Issuing bank generally does not enter into direct contact with the beneficiary. Instead, they utilize the services of its own branch office (if any) or correspondent bank at seller’s country for the purpose of advising it to the seller (beneficiary). Thus, the correspondent bank becomes the “Advising Bank”.

The purpose of advising a credit consists of forwarding the original credit to the beneficiary to whom it is addressed. Before forwarding/advising the credit to the seller under appropriate forwarding coverage, the advising and has to verify the signatures of the of the officers of the opening bank and ensure that the terms and conditions of the credit are not in violation of regulations relating to export. While advising, the advising bank does not undertake any liability.

The Article 9 of UCPDC (Publication 600) says,

- A credit may be advised to a beneficiary through an advising bank. An advising bank that is not a confirming bank advises the credit without any undertaking to honor or negotiate.

- By advising the credit, the advising bank signifies that it has satisfied itself as to the apparent authenticity of the credit and that the advice accurately reflects the terms and conditions of the credit received.

Additional confirmation to import Letter of Credit

The beneficiary of L/C may ask for the additional confirmation to a letter of credit by an internationally reputed bank located in beneficiary’s country. In that case after adding confirmation, the negotiation becomes restricted to the bank who has added their confirmation to the credit.

In case there is no branch of the advising bank of the beneficiary’s country, the reimbursing bank may confirm to the advising bank that they are holding reimbursing authority. This may also serve the purpose of adding confirmation.

As per normal practice, the charges of adding confirmation are borne by the beneficiary. In case the charges are to be borne by the importer, the L/C opening bank is to recover charges at the time of issuance of such instructions.

Amendment to Letter of Credit

The letter of credit opened by a bank may need amendment. If the supplier finds that the term of the credit cannot be complied with in full, he would arrange for necessary amendment by the opener before the goods are shipped. These amendments must be advised by the opening bank to the supplier through advising bank.

Sometimes the opener also may like to amend the credit after it has been advised. These amendments may relate to the decrease or increase in amount of credit, change in foreign currency, and change in the dates of shipment or negotiation, change in merchandise and other terms of the credit. These amendments must also be advised by the opening bank to the supplier through the advising or confirmation bank before the shipment is made.

For this kind of amendment, the bank would need a written request from the importer who generally makes this request after obtaining consent of the supplier. Such amendments will, of course, be effective if all the parties to letter of credit namely the L/C opening bank, the advertising bank and the supplies, agree to it.

Amendment is to be typed, like L/C, in the printed format in manifold. The copies of the amendment must be dispatched to all concerned as done in dispatching the L/C. Amendment can be done by SWIFT or Airmail.

Amendment commission and other charges are to be realized form the party by debiting his account. If the amount of L/C is increased, the liability voucher is to be passed including the amount of increase on the date of amendment reserving the old entry passed at the time of opening the L/C.

Shipment

Imports policy sets down the validity period applicable to each type of license on the basis of the goods covered by them. Unless otherwise specified, shipment of goods shall take place within the validity of license/LCAF. Under the present policy, LCAFs remain valid for remittances for one year subsequent to the month of issuance/month of registration (in case of registration with Bangladesh Bank). However, LCAFs issued for import of capital machineries and spare will remain valid for remittance for 18 months subsequent to the month of issuance/registration. The Authorized Dealers should not, under any circumstance, make remittance against any LCAF after the expiry of the above prescribed validity periods without first obtaining revalidation of the LCAF. They may, however allow such remittances without obtaining revalidation only against Foreign Currency funds of Bangladesh nationals working abroad.

Validity of LCAF issued against cash shall not be extended except where shipment cannot be made within the validity of LCAF due to circumstances beyond the control of the importer. In such cases, validity may be extended by the licensing authority for a minimum period considered necessary.

In case of shipment made by sea, the date of shipment will be date on the Bill of Lading.

In case of imports by air, the date of relevant consignment note/ airway bill will normally be taken as the date of dispatch, provided this represents the date on which the goods left the last airport in the country from which the import is affected.

In case of post parcels, the date of stamp of the office of dispatch on the packet or the dispatch note is takes to be the date of dispatch.

In case of imports made from countries connected with land, the date of dispatch of goods by rail, road, or other recognized mode of transport to the consignee in Bangladesh or on consignment basis will be taken to be the date of shipment.

Lodgment of documents

After shipment of contracted goods, the supplier prepares shipping documents and presents these to negotiation bank. On being satisfied that the documents are in order in terms of letter of credit, the negotiation bank makes payment to the supplier by debiting the opening bank’s account, if any, maintained with it or claimed reimbursement from another bank as stipulated in the reimbursement clause of letter of credit and forwards the shipping documents to the opening bank. The importer is to be advised with full particulars of shipment to retire the documents against payment or to dispose the import documents as per pre-arrangement, if any.

On receipt of the shipping documents from the negotiation bank, L/C opening bank should carefully examine these to ensure that they conform to the terms of the credit.

Clearance in absence of shipping documents

Shipping Guarantee:

It is a guarantee-cum-indemnity issued by the bank in favor of the shipping company on the prescribed from provided by the shipping company. When shipping documents against L/C are not received by the bank but goods have arrived at port needing immediate clearance of the consignment to avoid demurrage, this guarantee is issued. The shipping company shall release goods to the importer on production of this guarantee. Shipping guarantee is signed by the importer and counter-signed by the bank.

Procedure for issue of guarantee:

Importer should submit the following documents to the bank for issue of the guarantee

- Counter guarantee signed by the importer on prescribed form of the bank.

- Copy of invoice

- Non-negotiable copy of Bill of Lading/Airway bill etc.

- Deposit of 100% margin on invoice value (foreign currency converted into Taka at BC selling rate)

On receipt of the above documents and margin, the bank will give endorsement on the shipping guarantee at the end in the following way:

“The above indemnity is countersigned on condition that the bank’s liability hereunder shall not exceed Taka…………… and the bank will be finally discharge and released from its liability of a claim hereunder s not lodged with the bank by…………”

Liability Voucher:

Liability vouchers of L/C are to be reserved, fresh voucher on liability against guarantee is to be passed in the following way:

Dr. – Customer’s liability on L/G

Cr. – Banker’s liability on L/G

On receipt of documents from foreign bank, the Bill of Lading is detached and surrendered to the shipping company for release of guarantee.

As soon as guarantee is received back, the liability voucher against guarantee is to be reversed.

Retirement Procedure for Deferred Payment Of Usance Bill (D.A.)

When the draft is returned by the drawee (importer) having been duly accepted by him, the following retirement procedure is followed:

- The maturity date of the bill is to be worked out and noted in the PAD/BE register and also in due date diary.

- The Foreign correspondent should be advised the due date of maturity and be authorized to debit the nostro account to Authorized Dealer or to claim reimbursement on due date as per terms of L/C from the reimbursing bank.

- In case of D.A. Bill, all documents except the accepted draft are delivered to the importer against a simple receipt.

- The invoice is marker “Documents delivered against acceptance and remittance of ………………will be effected on due date”.

Bills negotiated under reserve of indemnity

Negotiation of bills under reserve or on indemnity is prevalent in international trade. When there is discrepancy in the documents the Foreign correspondents or the banks negotiate document under reserve or on indemnity at the risk and responsibility of the paying bank (negotiating bank). If the remitting bank draws the attention of the issuing bank to any irregularities in the documents or advice such bank that it has paid, accepted or negotiated under reserve or against a guarantee in respect of such irregularities, the issuing bank shall not thereby be relived from any of its obligations. Such guarantee or reserve concerns only the relations the remitting bank had with the beneficiary.

On receipt of such documents the bill will be lodged and retired after acceptance from the importer and such case must be deposited of written maximum period of 7 days.

Loan Against Imported Merchandise- LIM (Post Import Finance

Definition of LIM:

Import Finance plays vital role in a country’s foreign trade business. Import of goods and service are needed not only for export production but also to supply domestic industry with the necessary inputs which are not locally available or available at uneconomic cost and are needed for expansion and development.

Loan against Imported Merchandise (LIM) is a facility provided by the Bank to the importers who are in shortage of fund to retire the import bills and thus to clear the goods from the post authority. In other works it may be referred as an advance against merchandise.

Cases of LIM account :

LIM Accounts may be created in the following two cases:-

a) LIM Account on importer’s request.

b) Forced LIM Account.

LIM Account in importer’s request

After lodgment of documents, the importers concerned to be intimated for early retirement of the documents by paying outstanding bill amount including other charge. If the importer is not in a position to retire the bill out of his own sources, at that moment they may request the bank to clear the goods by creating LIM Account. On receipt of the importers request the official of the import bills section will calculate the total landed cost of the consignment. To ascertain the landed cost the following points are to be considered.

Efforts should be taken so that at least 20% to 30% margin of the landed cost may be realized from the importer. Realization of margin will depend on the banker customer relationship and also on the marketability of the goods.

The following charge documents have to be executed by the importer:-

i) DP Note (Demand Promissory note).

ii) Letter of Arrangement.

iii) Letter of Disbursement.

iv) Letter of pledge.

v) Any other document of necessary.

The branch Managers are not empowered to sanction the LIM A/Cs in favor of the importers for clearance the goods without obtaining the approval from Head Office.

On getting approval from Head Office the branch will send the documents to the port city branch by endorsing the bill of lading in favor of them with certification of invoice value for clearance the goods through importers nominated as well as Bank’s approved C&F agent. In the forwarding letter clear instructions to be given for dispatching the goods either by train or by truck duly insured. Before sending the documents to the port city branch the following charge documents have to be executed by the importer:-

i) DP Note (Demand Promissory note).

ii) Letter of Arrangement.

iii) Letter of Disbursement.

iv) Letter of pledge.

v) Any other document of necessary.

The following accounting entries and vouchers are generally to be passed in the set of Retirement Vouchers on the same day at the branch:-

Dr. Customer A/C

Dr. LIM

Cr. IBTA / Pay order

Cr. PAD

The particulars of LIM A/C must be entered and voucher to be posted in the LIM Register.

After clearance, the goods should be stored either in Bank’s godown or in importer’s godown under bank’s lock and key and the particulars of goods to be entered in the space provided in the LIM Register. At the same time insurance of goods covering fire and other risk are to be made. Godown staff salary, godown rent (if the goods stored at the Bank’s godown) and other miscellaneous charges in connection with the LIM A/C will be realized by debit to party’s LIM A/C under advice to the importer.

Disposal of LIM Stocks:

Forced Lim Account

Immediately after lodgment of documents the branch incumbent and concerned dealing official shall vigorously pursues importers for retirement of bills. PAD should not remain outstanding for more than 30 days from the date of lodgment as per norms.

If the party fails to retire the documents within 30 days or within the date of arrival of ship which ever is earlier, the branch should arrange clearance of the goods by creating forced LIM. Other formalities in connection with the forced LIM will be the same as in the case of LIM created on importer’s request.

No further L/C’s of the party for whom the Bank was forced to clear the consignment and the party failed to take delivery of the goods within the time specified under the Head office approval should be opened without prior approval from Head Office even if the same is within the discretionary power of branch Manager.

a) The LIM liability should be adjusted within a maximum period of 45 days from the date of storage for commercial importer and 60 days for industrial importers. (It may vary as per circular)

b) Part delivery against payment may also be allowed if so desired by the party to clear the LIM liability within the aforesaid time, after recovery margin over the landed cost if possible, but such payment should be proportionate with outstanding LIM liability taking into account the interest, godown rent and other charges up to eventual date of final delivery. This should be so arranged that with the last delivery the entire LIM liability is fully adjusted. Special care should however to be taken to protect bank’s interest in case where all the packets / bundles are not of equal size quality and price.

c) Additional 30 days may be allowed to both commercial and industrials, if so approached by them for final adjustment. In the event of importer’s failure to lift the goods on payment of bank’s dues in full even within the extended period of 30 days, the following steps shall be taken by the branch incumbent:

- Final notice shall be issued on importer’s giving 15 days time for payment.

- In case the concerned borrowers do not liquidate the liability within the stipulated time limit, but come forward with prayer for further time, in such cases bank may allow further 30 days time only provided that bank is satisfied that the importer will be in a position to repay the outstanding dues within the extended period under advice to Head Office.

- In case the party fails to liquidate their liability within the extended time granted as mentioned in the proceeding Para, the matter should be referred to Head Office asking their final instruction for disposed off the goods.

Letter of Trust:

By executing the standard letter of trust (or trust receipt) the customer acknowledges receipt of the documents of title to goods, as the case may be and agrees to hold them and the relative goods, when delivery thereof is taken by him, in trust as agents for the bank until the goods are sold or used for the express purpose for which they were released to him. The customer also undertakes to keep the transaction separate and assign and deposit with the bank the sale proceeds immediately realization but in any case not later than time period stipulated in the letter. Further, the customer undertakes to keep the goods insured and in the event the goods or may part thereof cannot be used by him for the declared purpose or on demand being made by the bank for the return of the documents / goods, he promised to restore the goods or documents to the bank’s custody. The trust receipt, thus, enables the importer customer to take re-delivery of the documents pledged to the pledge bank.

Conclusion

Modern Commercial Banking is exacting business. The reward are modest, the penalties for bad looking are enormous. Commercial Banks are great monetary institutions, important to the general welfare of the economy more than any other financial institution. It has a vastly sobering and exacting responsibility.

Rupali Bank Limited (RBL) playing a vital role in financing of import and exports of the country. Without Bank’s co-operation, it is not possible to run any business or production activity in this age. Exports and import need finance in various stages of their activities. Export and import financing is letter of credit (L/C), payment against documents (PAD), loan against imported merchandise (LIM) etc.

All these facilities are provided by RBL. For this purpose Bank’s consider the borrower’s business standing, integrity, liability with the bank term and conditions of the L/C. There are a lot of risks involved in foreign business. So, the Rupali Bank Limited (RBL) has to clearly justify the customers from a neutral point and gather the current information about the market.