The main purpose of this report is to make an analysis of Financial Statement Analysis of Berger Paints in terms of the Paints Industry. The purpose is also to make recommendations for improving the financial stability and soundness of different services provided to the shareholders of Berger Paint Bangladesh Limited. Finally discuss Demonstrating knowledge of corporate financial statements and analyze business opportunities from a financial standpoint.

Purpose of the Study

The purpose of the study is to make an analysis of Financial Statements of Berger Paints in terms of the Paints Industry. This study attempted to understand the financial conditions of Berger paints on different segments such as liquidity, profitability & solvency. The purpose is also to make recommendations for improving the financial stability and soundness of different services provided to the shareholders of BPBL. It is also the purpose of the researcher to help the management by providing an idea to take appropriate decisions about the quality of the investing & financing in future.

Objective of the Study

In addition to developing and demonstrating specific knowledge through the development and presentation of a financial analysis to business and/or financial professionals (judges), the participants will develop or reinforce the following areas in relation to financial analysis, accounting principles, and the analysis of corporate financial statements:

- Demonstrating knowledge of corporate financial statements

- Interpreting financial statements, organizing thoughts and making recommendations

- Applying Generally Accepted Accounting Principles (GAAP) to corporate finances

- Evaluating the performance of your own corporation, or your competitors Examining financial statements to decide whether to extend credit to a particular corporation

- Choosing between alternatives for an organization’s investment portfolio

- Analyzing business opportunities from a financial standpoint

Methodology of the Study

Data sources The data and information for this report have been collected from both the primary and secondary sources. Among the primary sources, face to face conversation with the respective stuffs of the head office. The secondary sources of information are annual reports, websites, and study of relevant reports, documents and different manuals.

Data processing Data collected from primary and secondary sources have been processed manually and qualitative approach in general and quantitative approach in some cases has been used throughout the study.

Data analysis and interpretation Qualitative approach has been adopted for data analysis and interpretation taking the processed data as the base.

Company profile

Berger is one of the oldest names in the paint industry and the country’s major specialty paints business with products and ingredients dating back more than 250 years. Louis Berger, a German national, founded dye and pigment making business in England in 1760. Louis Berger & Sons Limited grew rapidly with a strong reputation for innovation and entrepreneurship, culminating in perfecting the process of making Prussian Blue, a deep blue dye– a color widely used for the uniforms of many European armies. Production of dyes and pigments evolved into production of paints and coatings, which till today, remains the core business of Berger. The company grew rapidly by establishing branches all over the world and through mergers and acquisitions with other leading paint and coating manufacturing companies. Berger has been involved in the paint business in this part of the world since 1950, when paints were first imported from Berger UK and subsequently, from Berger Pakistan. In 1970, Berger Paints Bangladesh Limited (BPBL), erstwhile Jenson & Nicholson, had set up its paint factory in Chittagong. The shareholders were Jenson & Nicholson (J & N), Duncan Macneil & Co. Limited and Dada Group. Duncan Macneil subsequently sold their shares to the majority shareholder J & N Group. The Dada Group’s share was ultimately vested with the Government of the Peoples’ Republic of Bangladesh after the independence of the country in 1971. The name of the company was changed from J & N (Bangladesh) Limited to Berger Paints Bangladesh Limited on January 1, 1980. In August 2000, J & N Investment (Asia) Limited purchased the Government shareholding.

In December 2005, the company issued 5% shares to the public and listed with Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE).With the entry of Berger Paints into the Bangladesh market, the country has been able to benefit from more than 250 years of global paint industry experience. Over the decades, Berger has evolved to become the leading paint solutions provider in this country and has diversified into every sphere of the industry– from Decorative Paints to Industrial, Marine and Powder Coatings. Berger has invested more in technology and Research & Development (R&D) than any other manufacturer in this market. It sources raw materials from some of the best known names in the world: MITSUI, MOBIL, DUPONT and BASF, to name a few. The superior quality of Berger’s products has been possible because of its advanced plants and strict quality controls equal to the best international standards. Investment in technology and plant capacity is even more evident from the establishment of Powder Coating and Emulsion plants at the Dhaka factory. The state-of-the-art Dhaka factory is an addition to Berger’s capacity, making it the paint giant in Bangladesh. With its strong distribution network, Berger has reached almost every corner of Bangladesh. The nationwide dealer network, supported by nine sales depots strategically located at Dhaka, Chittagong, Rajshahi, Khulna, Bogra, Sylhet, Comilla, Mymensingh and Barisal has enabled them to strategically cater to all parts of the country.

The product range includes specialized outdoor paints to protect against adverse weather conditions, Color Bank, Superior Marine Paints, Textured Coatings, Heat Resistant Paints, Roofing Compounds, Epoxies and Powder Coatings. In each of these product categories, Berger has been the pioneer. Berger also provides customer support; connecting consumers to technology through specialized Home Decor service; giving free technical advice on surface preparation, color consultancy, special color schemes etc. To bolster customer satisfaction, Berger launched Breathe Easy- the first odorless paint solution in Bangladesh. The company also maintained Innova Wood Coating, Power Bond adhesive and Tex Bond textile chemicals to cater to the needs of the customers. As part of the company’s endeavor for excellence and better service, Berger has expanded its operations to manufacture coil coatings through its joint venture with Becker Industrial Coatings Holding AB, Sweden named- Berger Becker Bangladesh Limited. Apart from business, being a responsible corporate citizen, Berger Paints Bangladesh Limited has been promoting the young and creative talents of the country through Berger Young Painters’ Art Competition (BYPAC), Berger Award for Excellence in Architecture (BAEA), Berger Awards Programme for Students of Architecture of BUET (BASAB), Khulna University Architecture Department-Berger (KUAD-BERGER) Award etc. Berger Paints has added another dimension to its social responsibilities by contributing to the well-being of autistic children in Bangladesh since 2009.

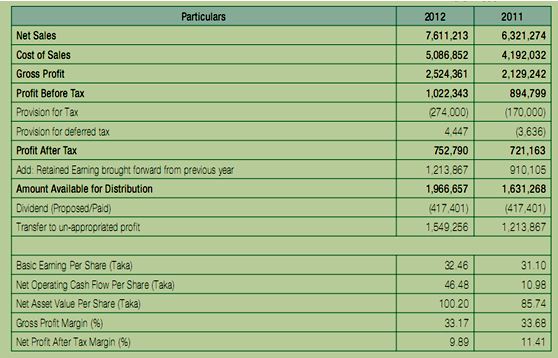

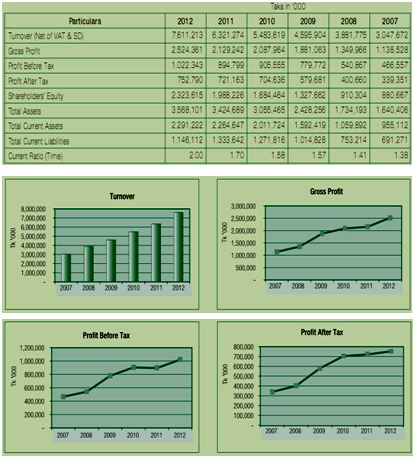

FINANCIAL PERFORMANCE

Resulting from substantial improvement in trade working capital the Net Operating Cash Flow Per Share (NOCFPS) of the Company improved significantly in 2012. The Company has invested a substantial amount for expansion of production capacity as well as diversification of products and businesses. However, the Directors are pleased to recommend a dividend of 180% i.e. Tk. 18 per share of Tk. 10 each for the year 2012.

Being a responsible corporate citizen, Berger has been contributing to different social causes to bring positive changes in the society. For the 4th year, Berger continued to provide financial and other material aids to organizations working for the development of autistic and differently challenged children in Bangladesh. This year the company gave such aid to nine organizations. During the year Berger made contribution for the aid of acid victims and severely cold affected people. Berger Paints organized the 17th event of Berger Young Painters’ Art Competition (BYPAC) in 2012 to encourage young talents. This year, Berger Young Painters’ Art Competition received tremendous response with submission of 563 paintings from all over the country. Berger paints also organized a painting competition for autistic children along with 17th BYPAC. The 1stand 2nd rounds of Khulna University Architecture Department-Berger (KUAD-BERGER) Award giving ceremony for the students of architecture, Khulna University took place in 2012 in coordination with Department of Architecture, Khulna University.

APPLICATION OF STANDARDS IN THE AUDITED FINANCIAL STATEMENTs

The following IASs and IFRSs are applicable for the financial statements for the year under review.

IAS 1 Presentation of Financial Statements

IAS 2 Inventories

IAS 7 Statement of Cash Flows

IAS 8 Accounting policies, Changes in Accounting Estimates and Errors

IAS 10 Events after the Reporting Period

IAS 12 Income Taxes

IFRS 8 Operating Segments

IAS 16 Property, Plant and Equipment

IAS 17 Leases IAS 18 Revenue

IAS 19 Employee Benefits

IAS 21 The Effects of Changes in Foreign Exchange Rates

IFRS 3 Business Combinations

IAS 23 Borrowing Costs

IAS 24 Related Party Disclosures

IAS 26 Accounting and reporting by retirement beneft plans

IAS 27 Consolidated and Separate Financial Statements

IAS 28 Investments in Associates

IAS 33 Earnings Per Share

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

IAS 38 Intangible Assets

Property, plant and equipment

Tangible fixed assets are accounted for according to IAS 16 Property, Plant and Equipment at historical cost less cumulative depreciation and the capital work-in-progress is stated at cost. The gain or loss arising on the disposal or retirement of an asset is determined as the difference between the sales proceeds and the carrying amount of the asset and is recognized as non-operating income and reflected in the statement of comprehensive income.

Depreciation of the fixed assets

Tangible assets are depreciated according to the straight-line depreciation method. Consistently, depreciation is provided on straight-line method on the cost at which the asset is carried in the books of account. Depreciation continues to be provided until such time as the written down value is reduced to Taka one. Depreciation on acquisition is made from the month following acquisition and charging of depreciation on item ceases from the month in which the deletion thereof takes place.

Stocks write off/down

It includes the cost of written off or written down values of redundant, damaged or obsolete stocks which are dumped and/or old stocks. However, “slow-moving” items are considered to be not material and capable of being used and/or disposed of at least at their carrying book value.

IAS 18

Revenue

This version includes amendments resulting from IFRSs issued up to 31 December 2009.IAS 18 Revenue was issued by the International Accounting Standards Committee in December 1993. It replaced IAS 18 Revenue Recognition (issued in December 1982). Limited amendments to IAS 18 were made as a consequence of IAS 39 (in 1998), IAS 10 (in 1999) and IAS 41 (in January 2001). In April 2001 the International Accounting Standards Board resolved that all Standards and Interpretations issued under previous Constitutions continued to be applicable unless and until they were amended or withdrawn. International Accounting Standard 18 Revenue (IAS 18) is set out in paragraphs. All the paragraphs have equal authority but retain the IASC format of the Standard when it was adopted by the IASB. IAS 18 should be read in the context of its objective, the Preface to International Financial Reporting Standards and the Framework for the Preparation and Presentation of Financial Statements. IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance.

Revenue Objective

ISO 18:

Income is defined in the Framework for the Preparation and Presentation of Financial Statements as increases in economic benefits during the accounting period in the form of inflows or enhancements of assets or decreases of liabilities that result in increases in equity, other than those relating to contributions from equity participants. Income encompasses both revenue and gains. Revenue is income that arises in the course of ordinary activities of an entity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties.

The objective of this Standard is to prescribe the accounting treatment of revenue arising from certain types of transactions and events. The primary issue in accounting for revenue is determining when to recognize revenue. Revenue is recognized when it is probable that future economic benefits will flow to the entity and these benefits can be measured reliably. This Standard identifies the circumstances in which these criteria will be met and, therefore, revenue will be recognized. It also provides practical guidance on the application of these criteria.

Berger Defines IAS 18:

Barger defines income in the Framework for the Preparation and there statement increase and decrease depends on economic benefits during the accounting period. Revenue is income that arises in the course of ordinary activities of an entity and is referred to by a variety of different names including sales, fees, interest, dividends and royalties, others operating charges net operating income and net others income. Revenue is recognized because it is created that future economic benefits will flow to the entity and these benefits can be measured reliably.

1) IAS 18 Standard shall be applied in accounting for revenue arising from the

Following transactions and events:

(a) The sale of goods;

(b) The rendering of services; and

(c) The use by others of entity assets yielding interest, royalties and dividends.

2) Goods include goods produced by the entity for the purpose of sale and goods purchased for resale, such as merchandise purchased by a retailer or land and other property held for resale.

3) The use by others of entity assets gives rise to revenue form Interest, royalties, dividends

4) This Standard does not deal with revenue arising from:

(a) Lease agreements (see IAS 17 Leases);

(b) Dividends arising from investments which are accounted for under the equity method (see IAS 28 Investments in Associates);

(c) Insurance contracts within the scope of IFRS 4 Insurance Contracts;

(d) Changes in the fair value of financial assets and financial liabilities or their disposal (see IFRS 9 Financial Instruments and IAS 39 Financial Instruments Recognition and Measurement);

(e) Changes in the value of other current assets;

(f) Initial recognition and from changes in the fair value of biological assets related to agricultural activity (see IAS 41 Agriculture);

(g) Initial recognition of agricultural produce (see IAS 41); and

(h) The extraction of mineral ores.

5) Revenue from the sale of goods shall be recognized when all the following conditions have been satisfied:

- the entity has transferred to the buyer the significant risks and rewards of ownership of the goods;

- the entity retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold;

(6) the amount of revenue can be measured reliably;

(a) it is probable that the economic benefits associated with the transaction will flow to the entity; and

- the costs incurred or to be incurred in respect of the transaction can be measured reliably.

07) Revenue arising from the use by others of entity assets yielding interest, royalties and dividends shall be recognised on the bases set out in paragraph 30 when:

- it is probable that the economic benefits associated with the transaction will flow to the entity; and

(b) the amount of the revenue can be measured reliably.

08) When unpaid interest has accrued before the acquisition of an interest-bearing investment, the subsequent receipt of interest is allocated between pre-acquisition and post-acquisition periods; only the post-acquisition portion is recognised as revenue.

09) Royalties accrue in accordance with the terms of the relevant agreement and are usually recognised on that basis unless, having regard to the substance of the agreement, it is more appropriate to recognise revenue on some other systematic and rational basis.

Disclosure

An entity shall disclose:

- the accounting policies adopted for the recognition of revenue, including the methods adopted to determine the stage of completion of transactions involving the rendering of services;

- the amount of each significant category of revenue recognized during the period,

including revenue arising from:(i) the sale of goods; (ii) the rendering of services; (iii) interest; (iv) royalties; (v) dividends; and (c) the amount of revenue arising from exchanges of goods or services included in each significant category of revenue

1) Berger follows the Standard revenue arising from the following transactions and events:

(a) The sale of goods;

(b) The rendering of services; and

(c) The use by others of entity assets yielding interest, royalties and dividends.

2) Barger includes goods produced by the entity for the purpose of sale and goods purchased.

3) The use by others of entity assets gives rise to revenue in the form of interest, royalties

dividends, training and consultancy fee.

4) This Report does not deal with revenue arising from:

(a) Lease agreements

(b) Dividends arising from investments which are accounted for under the equity method

(c) Insurance contracts within the scope

(d) Changes in the fair value of financial assets and financial liabilities or their disposal

(e) Changes in the value of other current assets;

(h) The extraction of mineral ores

5) The amount of the revenue can be measured reliably.

6) The costs incurred or to be incurred in respect of the transaction can be measured reliably.

7) Revenue arising from the use by others of entity assets yielding interest, royalties and

dividends shall be recognized

8) Only the post-acquisition portion is recognized as revenue unpaid interest has accrue

9) Royalties accrue in accordance with the terms of the relevant agreement and rational basis.

10) An entity shall disclose are use in this annual report example interest, royalties, dividends, the sale of goods, the rendering of services and etc

IAS 7

Statement of Cash Flows

International Accounting Standard 7 Statement of Cash Flows (IAS 7) is set out in paragraphs. All the paragraphs have equal authority but retain the IASC format of the Standard when it was adopted by the IASB. IAS 7 should be read in the context of its objective and the Basis for Conclusions, the Preface to International Financial Reporting Standards and the Framework for the Preparation and Presentation of Financial Statements. IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance.

Cash flow information

1) Historical cash flow information is often used as an indicator of the amount, timing and certainty of future cash flows. It is also useful in checking the accuracy of past assessments of future cash flows and in examining the relationship between profitability and net cash flow and the impact of changing prices.

2) Bank borrowings are generally considered to be financing activities.

3) The statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities.

4) The interest element may be classified as an operating activity and the capital element is classified as a financing activity.

5) Cash flows from operating activities are primarily derived from the principal revenue-producing activities of the entity. Therefore, they generally result from the transactions and other events that entJer into the determination of profit or loss. Examples of cash flows from operating activities are:

(a) Cash receipts from the sale of goods and the rendering of services;

(b) Cash receipts from royalties, fees, commissions and other revenue;

(c) Cash payments to suppliers for goods and services;

(d) Cash payments to and on behalf of employees;

(e) Cash receipts and cash payments of an insurance entity for premiums and claims, annuities and other policy benefits;

(f) Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities; and

(g) Cash receipts and payments from contracts held for dealing or trading purposes.

6) The separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by

(a) Cash proceeds from issuing shares or other equity instruments;

(b) Cash payments to owners to acquire or redeem the entity’s shares;

(c) Cash proceeds from issuing debentures, loans, notes, bonds, mortgages and other short-term or long-term borrowings;

(d) Cash repayments of amounts borrowed; and

(e) Cash payments by a lessee for the reduction of the outstanding liability relating to a

finance lease.

7) This Standard becomes operative for financial statements covering periods beginning on or after 1 January 1994.

Barger Defines IAS 7

01) The statement of cash flows shall report cash flows during the period classified by operating, investing and financing activities.

02) The interest element may be classified as an operating activity and the capital element is classified as a financing activity.

03) This report operative for financial statements covering periods beginning on or after 1 January 2012.

04) Bank borrowings are generally considered to be financing activities.

05) Historical cash flow information is used as an indicator of the amount, timing and certainty of future cash flows.

06) Cash flows from operating activities are primarily derived from

(a) Cash payments to suppliers for goods and services ;

(b) Cash payments to and on behalf of employees;

(c) Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities; and

07) The separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by

(a) Cash payments to owners to acquire or redeem the entity’s shares;

(b) Cash repayments of amounts borrowed and dividend

IAS 2

Inventories

International Accounting Standard 2 Inventories (IAS 2) replaces IAS 2 Inventories (revised in 1993) and should be applied for annual periods beginning on or after 1 January 2005. Earlier application is encouraged. The Standard also supersedes SIC-1 Consistency—Different Cost Formulas for Inventories.

IN01) The Standard does not permit the use of the last-in, first-out (LIFO) formula to measure the cost of inventories.

IN02) An entity shall apply this Standard for annual periods beginning on or after 1 January 2005. Earlier application is encouraged. If an entity applies this Standard for a period beginning before 1 January 2005, it shall disclose that fact. 40A IFRS 9, issued in November 2009, amended paragraph 2(b). An entity shall apply that amendment when it applies IFRS 9.

IN03) some entities adopt a format for profit or loss that results in amounts being disclosed other than the cost of inventories recognised as an expense during the period. Under this format, an entity presents an analysis of expenses using a classification based on the nature of expenses. In this case, the entity discloses the costs recognised as an expense for raw materials and consumables, labour costs and other costs together with the amount of the net change in inventories for the period.

IN04)The amount of inventories recognised as an expense during the period, which is often referred to as cost of sales, consists of those costs previously included in the measurement of inventory that has now been sold and unallocated production overheads and abnormal amounts of production costs of inventories.

IN05) Some inventories may be allocated to other asset accounts, for example, inventory used as a component of self- constructed property, plant or equipment. Inventories allocated to another asset in this way are recognised as an expense during the useful life of that asset.

IN06) When inventories are sold, the carrying amount of those inventories shall be recognised as an expense in the period in which the related revenue is recognised. The amount of any write-down of inventories to net realisable value and all losses of inventories shall be recognised as an expense in the period the write-down or loss occurs. The amount of any reversal of any write-down of inventories, arising from an increase in net realisable value, shall be recognised as a reduction in the amount of inventories recognised as an expense in the period in which the reversal occurs.

IN07 Other costs are included in the cost of inventories only to the extent that they are incurred in bringing the inventories to their present location and condition. For example, it may be appropriate to include non-production overheads or the costs of designing products for specific customers in the cost of inventories.IM08) The costs of purchase of inventories comprise the purchase price, import duties and other taxes (other than those subsequently recoverable by the entity from the taxing authorities), and transport, handling and other costs directly attributable to the acquisition of finished goods, materials and services. Trade discounts, rebates and other similar items are deducted in determining the costs of purchase.

Barger Defines IAS 2

IN01) the report does not permit the use of the last-in, first-out (LIFO) formula to measure the cost of inventories.

IN02) an entity shall apply this Standard for annual periods beginning on or after 1 January

IN03) entities adopt a format for profit or loss that results in amounts being disclosed other than the cost of inventories recognised as an expense during the period.

IN04) The amount of inventories recognized as an expense during the period, which is often referred to as cost of sales, consists of those costs previously included in the measurement of inventory that has now been sold and unallocated production overheads and abnormal amounts of production costs of inventories.

IN05) Information about the carrying amounts held in different classifications of inventories and the extent of the changes in these assets is useful to financial statement users.

In06) inventories may be allocated to other asset accounts. Inventory used as a component of self-constructed property, plant or equipment. Inventories allocated to another asset in this way are recognized as an expense during the useful life of that asset.

IN07)When inventories are sold, the carrying amount of those inventories shall be recognised as an expense in the period in which the related revenue is recognised. The amount of any write-down of inventories to net realisable value and all losses of inventories shall be recognised as an expense in the period the write-down or loss occurs.

IN08) The cost of inventories shall comprise all costs of purchase, costs of conversion and other costs incurred in bringing the inventories to their present location and condition.

WHAT TO BE ANALYZED AND HOW TO BE ANALYZED

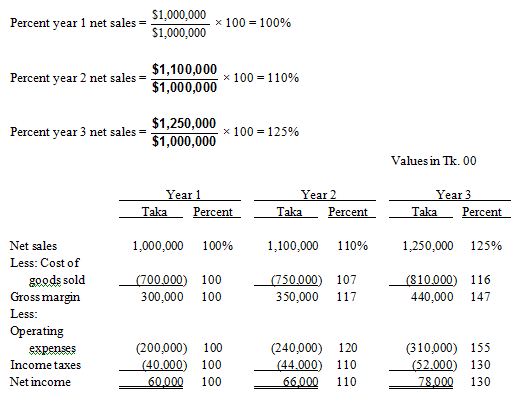

The two major types of financial statement analysis discussed in this paper are common-size analysis and ratio analysis.

- Horizontal analysis expresses line items of financial statements as a percentage of a prior-period amount. Vertical analysis expresses the line item as a percentage of some other line item for the same time period. Both should be done as each provides different insights into the financial strength of a company.

- Horizontal analysis reveals trends—both favorable and unfavorable. Vertical analysis reveals the current strengths and weaknesses of key financial factors. In both

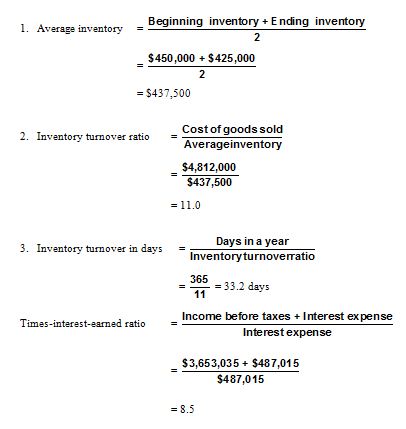

cases, the information provided is useful for decision making. For example, vertical analysis helps managers determine the relationship of costs to sales. Horizontal analysis can show the upward or downward trend in sales and costs over time. - Liquidity ratios measure the ability of a firm to meet its short-term obligations. Leverage ratios measure the ability of a firm to meet both long- and short-term obligations. Profitability ratios measure the earning ability of a firm.

- Two types of standards used in ratio analysis are historical and industrial standards. Historical standards allow one to assess trends over time. Industrial standards allow one to assess a company’s performance relative to that of other firms.

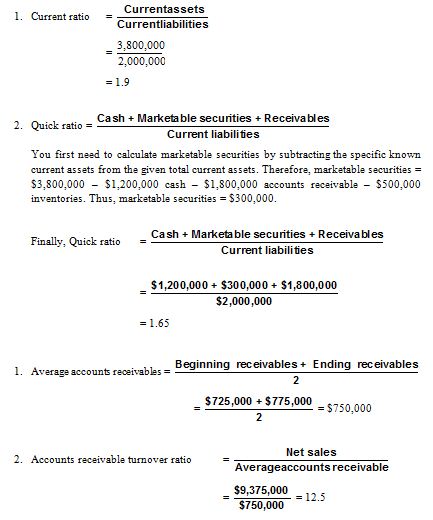

- The current ratio includes all current assets, from very liquid cash to less liquid inventories. The quick ratio excludes inventories and thus provides a better measure of liquidity (inventories are sometimes obsolete or may turn over slowly).

- It may indicate a need to modify credit and collection policies to speed up the conversion of receivables to cash.

- A high inventory turnover ratio does not necessarily provide evidence of stock outs and disgruntled customers. In a JIT environment, a high turnover ratio is desired and viewed as a positive signal of success. As long as the company is able to produce quickly to fill customer orders, a high inventory turnover ratio may be a good sign of success.

- The debt ratio is computed as total liabilities divided by total assets. By restricting the debt ratio, the bank is trying to reduce the risk of default by ensuring that assets remain relatively high compared with liabilities.

- The purchase alternative would increase the liabilities reported on the balance sheet. Increasing liabilities may cause the company to violate some existing debt covenants. The lease payment, however, had an immediate impact on the income statement rather than the balance sheet.

- The debt ratio may provide a measure of the riskiness of the investment. The higher the ratio, the more likely the company will go bankrupt, causing the investors to lose much of their investment.

- For someone retiring, an annual income would be needed. Accordingly, companies that have high yields and payout ratios would be preferred to those that have lower ratios.

- The price-earnings ratio can be compared with an investor’s expectation of future growth. If it is low (high) based on this expectation, then the price is too low (high) and the price will change based on the bidding that results.

- The dilutive effect is of interest to stockholders because their share of earnings can drop if and when conversions are made.

- The inventory turnover ratio can signal movement toward the goal of zero inventories.

- Yes. As inventories are reduced to insignificant levels, the current ratio approaches the quick ratio.

Ratio Analysis

| Balance Sheet Ratio | P&L Ratio or Income/Revenue Statement Ratio | Balance Sheet and Profit & Loss Ratio |

| Financial Ratio | Operating Ratio | Composite Ratio |

| Current Ratio Quick Asset Ratio Proprietary Ratio Debt Equity Ratio | Gross Profit Ratio Operating Ratio Expense Ratio Net profit Ratio Stock Turnover Ratio | Fixed Asset Turnover Ratio, Return on Total Resources Ratio, Return on Own Funds Ratio, Earning per Share Ratio, Debtors’ Turnover Ratio, |

Since the analysis is based on net sales, net sales in each year equals 100 percent of itself. Then, every line item on the income statement is expressed as a percent of that year’s net sales.