The conflict between Russia and Ukraine has had a significant indirect impact on the global food supply. Ukraine is known as the “breadbasket of Europe” because of its fertile agricultural land and large grain production. The conflict has disrupted agricultural activities in Ukraine, potentially affecting global food markets.

There are 192 countries and 125 different foods: A recent study by the Complexity Science Hub reveals global food supply interdependence. The researchers have discovered the profound – and also indirect – consequences of the Russia-Ukraine conflict.

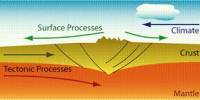

The most recent conflict between Russia and Ukraine demonstrated unequivocally that the global food supply chain functions as a complex network, connecting nations and facilitating the spread of disruptions from local to distant regions. “However, previous studies frequently focus on direct dependencies and overlook indirect dependencies resulting from the lack of essential inputs, making a comprehensive assessment of the global food system difficult,” says Complexity Science Hub research director Stefan Thurner.

This model enabled us to simulate shocks to specific products and countries, closely monitoring the subsequent effects across the entire supply chain.

Moritz Laber

INDIRECT EFFECTS OFTEN EXCEED DIRECT EFFECTS

To close this gap, the researchers created a dynamic global food system model that includes data from 192 countries and territories and 125 food and agricultural products. “This model enabled us to simulate shocks to specific products and countries, closely monitoring the subsequent effects across the entire supply chain,” says Moritz Laber of the Complexity Science Hub.

The researchers gained valuable insights into the magnitude of these shocks by quantifying the relative reduction in product availability compared to a baseline scenario (without the shock). Surprisingly, they discovered that indirect effects frequently outweighed direct effects. A shock to Ukrainian corn production, for example, resulted in a 13% decrease in pork availability in Southern Europe. A shock to Ukrainian pork production, on the other hand, had a negligible effect of less than 1%.

UP TO 85% LOSS OF MAIZE

The study revealed diverse effects on products and regions worldwide in a worst-case scenario simulation in which agricultural production in Ukraine was completely lost due to the Russia-Ukraine conflict. “Grain losses, particularly maize, reached up to 85%, while edible oils, particularly sunflower oil, suffered losses of up to 89%.” Furthermore, certain meat types, such as poultry, experienced losses of up to 25% in various countries,” Laber says. The number of products for which a region is dependent on Ukraine varies greatly: Southern Europe is the most affected, with 19 out of 125 products losing more than 10% of their value, followed by West Asia and North Africa, with 15 and 11 products losing more than 10% of their value, respectively.

These findings highlight the fact that localized production disruptions have far-reaching consequences that extend beyond geographic boundaries, affecting trade relationships and the entire production chain. As a result, when estimating losses and developing effective interventions, it is critical to consider both direct and indirect effects.

RISK NOT ONLY FROM WARS

According to the European Council, as the Russia-Ukraine conflict enters its second year, food prices remain above 2021 levels. Furthermore, various events such as extreme weather, economic crises, and geopolitical tensions can cause similar disruptions. This highlights the importance of investigating interdependencies within global food supply chains and gaining a thorough understanding of the direct and indirect effects of local shocks in order to raise awareness among policymakers and stakeholders of otherwise unnoticed risks within the global food system.

These findings represent an important first step toward understanding the complex dynamics of global food supply chains and their vulnerability to local shocks. More research is needed to map them at a granular level, taking individual products and subnational scales into account at a higher temporal resolution. Furthermore, the model currently assumes that countries do not change their trading partners following a shock. Restructuring trade relations, on the other hand, may exacerbate existing inequalities by allowing wealthier countries to secure remaining resources at higher prices from alternative suppliers.