The environmental impact of Bitcoin is well known. New research has indicated that it is more equivalent to the meat business than to the damage that gold mining has on our planet, despite some people making the comparison. The effects of mining for the digital currency as a percentage of the market price label it as “digital beef” and group it with a sector that uses many times more energy than the gold industry.

To ascertain the actual environmental cost of Bitcoin, analysis was done. Researchers wanted to do this since the market for digital currencies has grown rapidly recently, reaching a $960 billion market value in 2021, accounting for 41% of all digital currencies. The New Yorker noted that a single transaction can be as energy-intensive as running a home for a month, which is where intangible money turns out to be environmentally harmful.

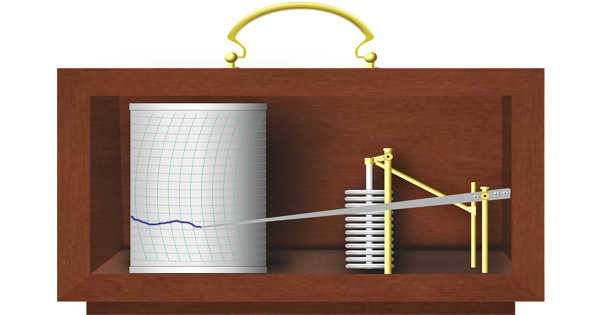

A team examined data gathered from Bitcoin mining between January 2016 and December 2021 to determine Bitcoin’s climate damages (the financial cost in carbon emissions and damages to the economy from the consequent climate change). According to their estimations, Bitcoin actually outperformed Austria and Portugal in 2020, utilizing 75.4 terawatt hours as opposed to 69.9 and 48.4, respectively.

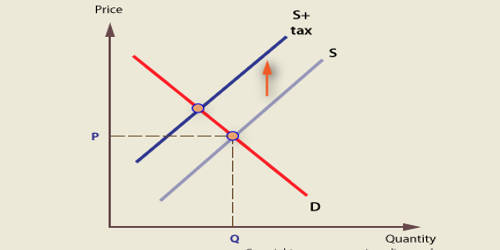

The assessment of the climate damage caused by bitcoin was based on whether the estimates changed over time, whether the market value of the cryptocurrency exceeded those estimates, and how the overall harm compared to other industries.

Between 2016 and 2021, Bitcoin’s environment harm amounts to an average of 35% of its market value, putting it between beef production (33%) and gasoline consumption (41 percent). It was shown to be much more harmful than gold mining and significantly less detrimental than energy generated by natural gas (46 percent) (4 percent).

From 0.9 tons of emissions per coin in 2016 to 113 tons per coin in 2021, the climate damage caused by mining Bitcoin climbed 126-fold. By the last year, the climate damage caused by mining a single Bitcoin was the same as $11,314 USD.

The authors wrote in their conclusion, “There is no shortage of champions for digitally scarce commodities, and the innovation they offer. Even in Nature Climate Change, Howson writes that “throwing the blockchain baby out with the bathwater is likely to encourage being too obsessed on the inefficiencies of specific cryptocurrencies.”

But the notion that , which hold the majority of the market share, do in fact deserve particular attention is supported by the risk of path dependence and technology lock-in with an emerging industry. We demonstrate that [Bitcoin] wouldn’t be sustainable without drastic modifications.