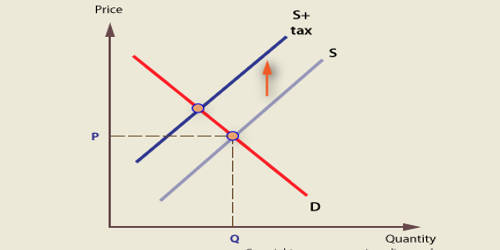

The tax shift is the passing of the tax burden from one economic agent to another. It is a change in taxation that eliminates or reduces one or several taxes and establishes or increases others while keeping the overall revenue the same. The term can refer to desired shifts, such as towards Pigovian taxes (typically sin taxes and ecotaxes) as well as (perceived or real) undesired shifts, such as a shift from multi-state corporations to small businesses and families. For example, the burden of a sales tax that is formally levied on a firm may be passed on to consumers in the form of higher prices.

Definition:

Tax shift is a kind of economic phenomenon in which the taxpayer transfers the tax burden to the purchaser or supplier by increasing the sales price or depressing the purchase price during the process of commodity exchange.

The tax shift is the redistribution of the tax burden. Its economic essence is the redistribution of the national income of everyone. Generally, the tax burden is shared between economic agents with the precise allocation determined by elasticities of demand and supply. The absence of redistribution of national income does not constitute an act of tax shift.

The tax shift is an objective process of economic movement. It does not include any emotional factors. Whether taxpayers take the initiative to raise or lower prices or passively accept price fluctuations is not related to tax shift. Whether the economic relationship between the taxpayer and the tax bearer is a class opposition or the unity opposition, it is also unrelated to the tax shift.

The tax shift is achieved through price changes. The price mentioned here includes not only the price of the output but also the price of the element. The price changes mentioned here include not only direct price increase and price reduction, but also indirect price increase and price reduction. No price change, no tax shift.

- A forward-shifted tax is a tax imposed on producers but passed on to consumers. The amount of a tax shifted forward depends on the price elasticity of demand for the taxed good.

- A backward-shifted tax is a tax borne by firms and input suppliers. The amount of backward shifting to input suppliers depends on their responsiveness to changes in input prices.

It has the following three characteristics:

(1) It is closely linked with the price increase and decrease;

(2) It is the redistribution of tax burdens among economic entities, and it is also a redistribution of economic interests. The result will inevitably lead to inconsistency between taxpayers and tax bearer;

(3) It is the taxpayer’s proactive behavior.