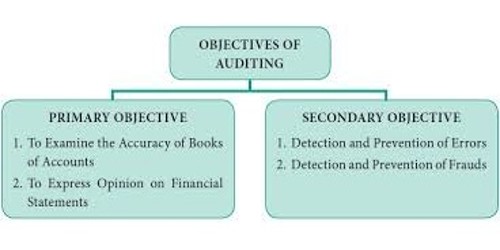

Subsidiary objectives of Audit

The audit is a critical review of the system of accounting and internal control. The objective of an audit is to express an opinion on financial statements. These are such objectives that are set up to help in attaining primary objectives. In that process, an auditor may come across some errors and frauds. They are as follows:

(i) Detection and prevention of errors

Errors refer to an accidental mistake in the commercial data arising due to ignorance of accounting procedures. Due to the wrong posting, such errors may occur. Errors are those mistakes that are committed due to carelessness or negligence or lack of knowledge or without having vested interest. Detection of errors is, therefore, an essential prerequisite for confirmation of accounts and financial results. Errors may be committed without or with any vested interest. So, they are to be checked carefully. Errors are of various types. Some of them are:

- Errors of principle – These errors arise out of transactions recorded in a way contrary to the accepted principles of accounting.

- Errors of omission – It is to enter a transaction in a subsidiary book

- Errors of commission – It comprising the posting of an amount to a wrong account on the correct side or a mistake in the calculation is difficult to find out for the same reason.

- Compensating errors – These error involving one wrong entry being off-set by another wrong entry in the opposite direction is difficult to detect as none of them affects the agreement of the trial balance.

(ii) Detection and prevention of frauds

Frauds are those mistakes that are committed knowingly with some vested interest in the direction of top-level management. Management commits frauds to deceive tax, to show the effectiveness of management, to get more commission, to sell a share in the market or to maintain the market price of a share, etc. Such detection is only possible through a thorough examination of all financial and other concerned data. Detection of fraud is the main job of an auditor. Such frauds are as follows:

- Misappropriation of cash – This may be perpetrated by complete or partial omission to enter receipts of money in the cash book or by the inclusion of fictitious payments and of larger sums than have been actually paid.

- Misappropriation of goods – This involves pilferage of stock and is very difficult to detect, particularly in the case of small pilferages, unless a strong and efficient system of stock recording.

- Manipulation of accounts or falsification of accounts without any misappropriation

(iii) Under or overvaluation of the stock

Normally such frauds are committed by the top-level executives of the business. So, the explanation was given to the auditor also remains false. So, an auditor should detect such frauds using skill, knowledge, and facts.

(iv) Other objectives

- To provide information to the income-tax authority.

- To satisfy the provision of the company Act.

- To have moral effects.

Information Source: