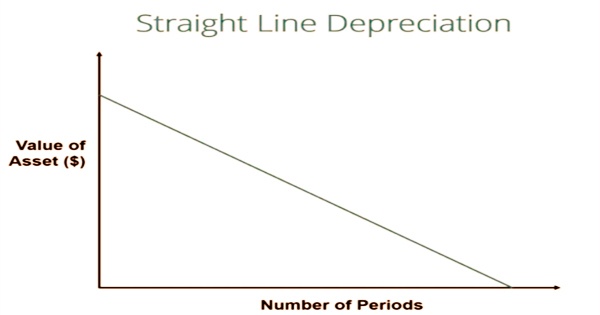

Straight line depreciation is the most basic and widely used approach for recognizing the carrying value of a fixed asset over the useful life of the asset. The value of an asset is decreased uniformly for each cycle with the straight line depreciation method until it reaches its salvage value. It is the easiest method to work out the deficiency of worth of a resource over the long run. Straight line premise is determined by splitting the contrast between a resource’s expense and its normal rescue esteem by the quantity of years it is relied upon to be utilized. The straight-line method is highly recommended because it is the simplest to calculate and results in the fewest measurement errors.

There are a variety of accounting conventions that are intended to adapt revenue and expenditures to the timeframe in which they occur. Depreciation and amortization are two accounting conventions that businesses follow. Straight line depreciation is the most normally utilized and clear deterioration strategy for apportioning the expense of a capital resource. It is determined by just isolating the expense of a resource, less its rescue esteem, by the helpful existence of the resource. The straight-line calculation steps are:

- Determine the initial cost of the asset that has been recognized as a fixed asset.

- Subtract the asset’s approximate salvage value from the sum it’s registered on the books.

- Determine the estimated useful life of the asset. It is easiest to use a standard useful life for each class of assets.

- Divide the estimated useful life (in years) into 1 to arrive at the straight-line depreciation rate.

- Multiply the depreciation rate by the asset cost (less salvage value).

When no accurate estimation of the pattern of economic benefits expected to be obtained over an asset’s useful life can be made, the straight line approach is also useful. Depreciation is used for real properties, while amortization is used for intangible assets like patents and software. The two shows are utilized to discount a resource throughout a more drawn out timeframe, not simply in the time frame it was bought. At the end of the day, organizations can extend the expense of resources over various time spans, which allows them to profit by the resource without deducting the full expense from net income (NI).

Straight line depreciation can be calculated using any of the following formulas:

Depreciation per annum = Cost − Residual Value / Useful life

Depreciation per annum = (Cost − Residual Value) × Rate of depreciation

Where:

Cost is the initial acquisition or construction costs related to the asset as well as any subsequent capital expenditure.

Residual Value, also known as its scrap value, is the estimated proceeds expected from the disposal of an asset at the end of its useful life. Since it is supposed to be recovered at the conclusion of an asset’s useful life, the part of an asset’s expense equivalent to residual value is not depreciated.

Useful Life is the estimated time period that the asset is expected to be used starting from the date it is available for use up to the date of its disposal or termination of use. Useful life is normally expressed in units of years or months.

Rate of depreciation is the percentage of useful life that is consumed in a single accounting period. Rate of depreciation can be calculated as follows:

Rate of depreciation = (1 / Useful life) × 100%

To measure straight line basis, deduct the asset’s purchase price from its salvage value, or its approximate sell-on value when it is no longer required. Then multiply the result by the total number of years the asset is supposed to be useful, also known as the useful life in accounting. When determined, depreciation expense is recorded in the bookkeeping records as a charge to the devaluation business ledger and a good representative for the amassed deterioration account. Gathered deterioration is a contra resource account, which implies that it is combined with and lessens the fixed resource account.

Other ways of measuring asset depreciation exist in addition to straight line depreciation. Different asset depreciation approaches are used to more reliably represent an asset’s depreciation and current value. In order to obtain tax or cash flow advantages, a business can choose one depreciation method over another.

- Double-declining balance method: A form of accelerated depreciation is the double-declining balance process. It means that the asset would depreciate more quickly than if it were depreciated using the straight line process. The double-declining balance approach results in higher depreciation costs early in an asset’s life and lower depreciation costs later. This approach is applied to properties that rapidly depreciate in value early in their useful life. This approach can also be chosen by a corporation if it provides tax or cash flow benefits.

- Units of production method: The units of production approach is focused on the use, operation, or number of units of goods generated by an asset. As a result, depreciation will be higher in high-use periods and lower in low-use periods. This approach can be used to depreciate assets where usage variance is a big factor, like cars based on miles driven or photocopiers based on copies made.

Accountants like the straight line strategy since it is not difficult to utilize, renders less mistakes over the existence of the resource, and costs a similar sum each bookkeeping period. The appraisals of helpful life or lingering worth of a resource may should be changed in ensuing bookkeeping periods to reflect all the more precisely the example of financial advantages considering new data. Unlike more complicated methodologies, such as double declining balance, straight line depreciation is straightforward and uses only three variables to measure the amount of depreciation per accounting cycle.

The most basic version of these changes is that a special deferred tax asset would be added to the balance sheet to compensate for the discrepancy between the income and cash flow statements. There are by and large acknowledged deterioration gauges for most significant resource types that give some requirement. Be that as it may, the straightforwardness of straight line premise is additionally perhaps the greatest disadvantage. The fact that the useful life estimation is based on guesswork is one of the most obvious drawbacks of this approach.

Information Sources: