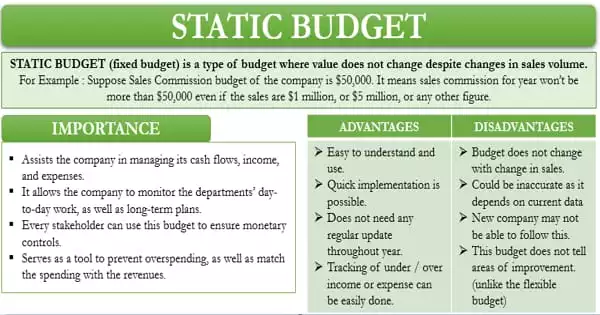

Static budgets are tools for projecting business expenses for an accounting period. It is a type of budget in which the income and expenditures of the relevant body are pre-determined for the coming period. There will be differences between the budgeted amount and the actual spending amount, especially if you are dealing with fluctuating raw material costs or the cost of goods sold. These differences are referred to as a static budget variance. It is based on the assumption that the conditions will remain constant.

When you reach the end of a production cycle and need to account for actual expenses, you must combine the static budget variances with the initial static budget. It is a budget in which the quantitative figures of income and expenditure of a person, team, business, company, or even the government are fixed based on assumptions and prior data collected for a fixed period that can range from daily to annual or even longer. Consider a static budget to be a projection budget to keep things simple.

For example, a company estimated its revenue to be $20 million and its expenses to be $8 million for its fiscal year 2021. However, at the end of the year, its income was only $ 16 million. A static variance is a difference between the two values. However, because the assumed and actual data differed, determining the cost of goods and setting prices became difficult. As a result, while it is useful for variance analysis, it is not realistic because change is the only constant in economies.

You will estimate all of your costs, including fixed and variable costs. This is a simpler budget to create because all figures are predetermined and do not take into account any future fluctuations or changes in activity levels. Throughout the accounting period, you’ll keep track of the actual figures, including:

- Actual output

- Actual sales volume

- Actual revenue

You can compare the budgeted costs and results to the actual costs and results. With that information, you can make changes to your budget forecasting for the next period in order to limit unfavorable variances (those in which you spent more money than planned) for the next budget period. Static budgets remain unchanged even if the circumstances that were assumed during planning change significantly.

Pros of a Static Budget –

- Easy to implement and follow since they do not require constant updating,

- Offers great insight into a company’s costs and profits, when you perform a variance analysis,

- Built-in cost controls and accountability since there’s no “wiggle room” built into the budget,

- Great for a master budget,

- Simplifies taxes and makes it easier to estimate taxes owed.

Cons a Static Budget –

- No flexibility. If the budget is built on a certain production level, and production volume changes significantly, resources can’t easily be reallocated to account for the change.