A vertical spread is a trading strategy in options trading that involves trading two options at the same time; it is the most fundamental spread of options. This includes the simultaneous purchase and sale, but at different strike rates, of options of the same form (puts or calls) and expiration. The term starts from the exchanging sheets that were utilized in the open objection pits on which choice costs were rattled off by expiry date and strike value, accordingly peering down the sheet (vertical) the dealer would see all choices of similar development. If they expect a modest change in the price of the underlying asset, traders will use a vertical spread.

Binary options can often be approximated by vertical spreads and can be generated by vanilla options. Vertical spreads are primarily directional spreads and can be customized to reflect the view of traders, bearish or bullish, on the underlying asset. Contingent upon the kind of vertical spread sent, the merchant’s record can either be credited or charged. Alternatives can be offered to gather time expenses since, in such a case that a choice is out of the cash by the lapse date, it gets useless. To be out of the money implies that the share price stays below the maximum limit set by the speculator.

(Example of Vertical Spread)

Since a vertical spread includes the selling or writing of an option, the proceeds should cover the premium paid to buy the other leg of this strategy, namely the purchase of the option, partially or entirely. A lower-cost, lower-risk trade is the result. For instance, if the supply of Company X is exchanging at $930 per share, and the broker plans to wager that the market value stock will by no means go over $100 per share, which is known as the section cost. A merchant can sell a $100 strike call choice for $3, and in the event that the choice remaining parts out of cash until the termination date, at that point they will keep the whole acknowledge receipt worth $300 as a benefit.

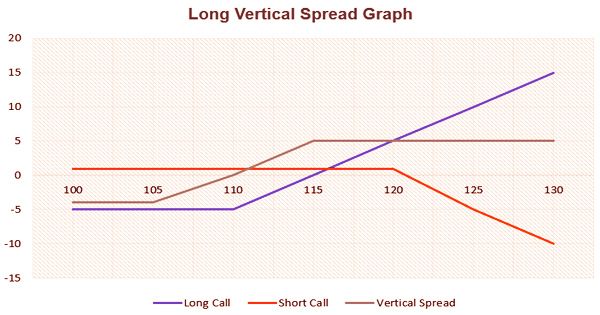

The risk is undefined here; however, as the share price can very well skyrocket beyond $0 per share. The requirement of capital to sell the option may also be very high. A vertical spread is not an acceptable strategy if an investor expects a significant, trend-like change in the price of the underlying asset. There are a few assortments of vertical spreads. Bullish dealers will utilize bull call spreads, otherwise called long call vertical spreads, and bull put spreads. For the two procedures, the broker purchases the alternative with the lower strike cost and sells the choices with the higher strike cost.

Calculating Vertical Spread Profit and Loss: All examples do not include commissions.

Bull call spread: (premiums result in a net debit)

Max profit = the spread between the strike prices – net premium paid.

Max loss = net premium paid.

Breakeven point = Long Call’s strike price + net premium paid.

Bear call spread: (premiums result in a net credit)

Max profit = net premium received.

Max loss = the spread between the strike prices – net premium received.

Breakeven point = Short Call’s strike price + net premium received.

Bull put spread: (premiums result in a net credit)

Max profit = net premium received.

Max loss = the spread between the strike prices – net premium received.

Breakeven point = Short Put’s strike price – net premium received.

Bear put spread: (premiums result in a net debit)

Max profit = the spread between the strike prices – net premium paid.

Max loss = net premium paid.

Breakeven point = Long Put’s strike price – net premium paid.

The vertical spread helps the trader to offer time premiums instead of selling a naked option by trading a vertical spread. It also makes it possible for them to reduce the overall risk and use little money. The biggest variance is in the pacing of the cash flows, aside from the disparity in the option forms. The bull call spread outcomes in a net charge, while the bull put spread outcomes in a net credit at the beginning. When selling a vertical spread, the most extreme benefit is essentially the net cost for which the spread is sold. The difference between the width of the strike and the entry price is the maximum loss, which is also the capital requirement for trading.

Information Sources: