BACKGROUND OF THE STUDY

In Department of accounting and information systems, the University of Dhaka, BBA program is comprises of 8 semesters and as a requirement for the fulfillment of our BBA program we have to perform three months internship. As student of BBA I have gathered enough theoretical knowledge, and now I want to put my potentiality in the practical field. Sonali Bank Ltd. has given me the opportunity to commence my internship there from 1st December 2008 to 28th February 2009.

During the internship program, students are required to prepare a report on the organization where they have been attached. Sonali Bank Ltd. and all the officials always encourage and welcome the students for their internship program. I have tried my best to properly apply my potentiality and theoretical knowledge to make the report reliable and information worthy. My honest effort will be regarded as successful if this dissertation fulfills the objective of the program.

TOPIC OF THE STUDY

The topic of the report is –

“Remittance management system of sonali bank ltd”

OBJECTIVES OF THE STUDY

Broad objectives:

Broad objective of this report is to meet the partial requirements for the fulfillment of BBA program.

Specific objectives:

In specific objective I have to prepare a sound report that must be reliable and dependable for the Bank’s officials.

This study is intended for providing me invaluable practical knowledge about banking operation system in Bangladesh. The prime objective of this report is to achieve practical exposure to organizational environment as well as to understand the system and methodology adopted in conducting day to day banking by Sonali Bank Ltd .

The specific objectives to help in explaining the broad objectives are as follows:

- To gain practical knowledge by working in different desks of Corporate Branch of Sonali Bank limited.

- To review the consumer banking services and operating system of Sonali Bank Ltd.

- To accomplish the partial requisite of BBA Program and to achieve of good judgment with theoretical base.

- To have a revelation on the banking environment of Bangladesh.

- To achieve overall understanding of Sonali Bank Ltd

- To evaluate the factors affecting performance of the bank.

- To suggest the better ways of enhancing the performance of the bank.

- To apply theoretical knowledge in the practical field.

- To acquire knowledge about the every day banking operation of Sonali Bank.

- To make myself more confident and active in future to finger my job.

- To analyze the financing systems of the bank to find out any contributing field.

- To suggest the better ways of enhancing the performance of the bank.

- To examine the profitability and productivity of the bank.

- To make a association between the theories and practical procedures of banking day-to-day operations

- To get an overall idea of banking from banker’s point of view.

- To review the techniques used by the bank to make it lucrative.

- To assesses the decision undertaken by the top-level management to keep the rein with the competitiveness of the market.

- To describe the organizational structure, management, background, functions and objectives of the bank and its contribution to the national economy.

- To understand the recent complexity of banking in the wake of rising terrorism and fundamentalism.

- To investigate the different functions performed by different departments.

- To find out the challenges associated with the activities concerned with remittance department.

- To review the management system of the bank.

- To have an idea about profit and loss position of Sonali Bank Ltd.

- To observe the working environment of remittance department.

- To understand the real management situation and try to recommend for improving existing problems.

SCOPE OF THE STUDY

This report has been prepared through extensive discussion with bank employees and with the clients. While preparing this report, I had a great opportunity to have an in depth knowledge of all the banking activities practiced by the Sonali Bank limited. It also helped me to acquire a fast hand perspective of a leading commercial bank in Bangladesh.

RATIONALE OF THE REPORT

Knowledge and learning become perfect when it is associated with theory and practice. Theoretical knowledge gets its perfection with practical application. As our educational system predominantly text based, inclusion practical orientation program, as an academic component is as exception to the norm. As the parties; educational institution and the organization substantially benefit from such a program, it seems a “win-win situation”. It establishes contracts and networking contracts. Contracts may help to get a job. That is, students can train and prepare themselves for the job market. A poor country like Bangladesh has an overwhelming number of unemployed educated graduates. As they have no internship experience they have not been able to gain normal professional experience of establish networking system, which is important in getting a job. That’s why practical orientation is a positive development in professional area. Recognizing the importance of practical experience, Department of A&IS, has introduced a practical exposure as a part of the curriculum of BBA program. In such state of affairs the present aiming at analyzing the experience of practical orientation related to an appraisal of Sonali bank Ltd at Shilpa Bhaban corporate branch.

METHODOLOGY OF THE STUDY

Correct and smooth completion of research work requires adherence to some rules and methodologies. Rules were followed to ease the data collection procedure. Accuracy of study depends on the information and data analysis.

STUDY AREA

The area of my study has been encompassed the operation area of Sonali Bank ltd Shilpa Bhaban Corporate Branch.

TARGET GROUP

To accumulate the required data I have contacted with departmental head along with other concerned officers of Sonali Bank Ltd. In case of remittance I have got in close with the responsible personals of remittance department to collect the information.

Primary Sources

1. Personal Interview – Face-to-face conversation and in depth interview with the respective officers of the branch.

2. Survey- Customer survey based on appropriate questionnaire.

3. Personal observation – Observing the procedure of banking activities followed by each department.

4. Practical work exposures on different areas of the branch.

5. Informal conversation with the clients or customers.

6. Relevant documents related to the study as provided by the officers.

Secondary Sources

- Annual report of sonali Bank Ltd.

- Periodicals Published by Bangladesh Bank.

- Different publications regarding Banking functions.

- Internet was also used as a theoretical source of information.

- Websites and Newsletters are also used as major sources.

Printed Materials: This study is mostly dependent on the printed materials which may include the newspapers, magazines, journals, directories, annual reports, Bangladesh bank publications, Sonali Bank Ltd Annual Report etc.

Internet: Internet was another major secondary source that we have used to collect related information to conduct the study.

Newspapers: We have collected some information from the various dailies and business articles.

LIMITATIONS OF THE STUDY

This Internship Report is my first assignment outside our course curriculum in the practical life. I am the student of “Department of Accounting and information systems”, just have completed my BBA Program. After gathering the institutional experience, practical performance in the formal stages becomes difficult. So in preparing this report, lack of proper knowledge greatly influenced me in this performance.

Besides above, I had to face some other limitations.

These are as follows:

- Learning all the banking functions within just 90 days was really tough.

- Another limitation of this report is Bank’s policy of not disclosing some data and information for obvious reason, which could be very much useful.

The Bank authority was very busy, so they could not give me enough time for discussion about various problems.

This study completely depended on official records and annual reports.

To prepare an analytical report need financial assistance.

The financial assistance provided by the department is insufficient. In perspective of lack sufficient money, various types of analysis did not become possible.

Lack of availability of data

Improper combination among various departments

Up-to-date information were not available

Sufficient records, publications, facts and figures are not available. These constraints narrowed the scope of the real analysis.

For the reason of confidentiality, some useful information cannot be expressed in this report.

HISTORICAL BACKGROUND OF THE BANKING INSTITUTIONS IN BANGLADESH

The territories, which now constitute Bangladesh, were integral part of Mughal Empire and thereafter British-India and then Pakistan. Hence we have the common historical background of banking and banking institutions as that of Pakistan and India. For the beginning of banking in the territory now comprised Bangladesh, we must go back to the Calcutta Agency Houses. These trading firms started their banking operations for the welfare of their constituents. The important among those Houses were Messers. Alexander & Co., Messers. Fargusson & Co.; both the firms started the business of banking with other business, and both were the predecessors of the early Joint Stock Banks in the then India. The Bank of Hindustan was the earliest bank started under the direction of the British rule in British-India.

After the partition of British-India into Pakistan and India, the territories now form- Bangladesh became integral part of Pakistan and was called East Pakistan. Immediately after partition, as aforesaid, in 1947, an Expert Committee was appointed to study the issue of banking in the then Pakistan. On the recommendation of the Expert Committee the Reserve Bank of India continued its function in Pakistan up to 30th September, 1948 and thereafter the State Bank of Pakistan, having been established on the 1st July, 1948 started functioning and assumed full control of banking and currency.

BEGINNING OF BANKING IN BANGLADESH

After independence the Government of Peoples Republic of Bangladesh was formally to cover the charge of the administration of the territory now constitute Bangladesh. In an attempt to rehabilitate the war-devastated banking of Bangladesh, the government promulgated a law called Bangladesh Bank (temporary) Order, 1971 (Acting President’s Order No.2 of 1971). By this Order, the State Bank of Pakistan was declared to be deemed as Bangladesh Bank and offices, branches and assets of said State Bank was declared to be deemed as offices, branches and assets of Bangladesh Bank. On that date there existed 14 scheduled banks with about 3042 branches all over the country.

On the 16th December 1971, there existed the following 12 banks in Bangladesh, namely:

- National Bank of Pakistan

- Bank Bahwalpur Ltd.

- Premier Bank Ltd.

- Habib Bank Ltd.

- Commerce Bank Ltd.

- United Bank Ltd.

- Union Bank Ltd.

- Muslim Commercial Bank Ltd.

- Standard Bank Ltd.

- Australasia Bank Ltd.

- Eastern Mercantile Bank Ltd.

- Eastern Banking Corporation Ltd.

NATIONALIZATION OF BANKS IN BANGLADESH

Immediately after the Government of Bangladesh consolidated its authority, it decided to adopt socialist pattern of society as its goal. Hence in order to implement the above mentioned state policy; the Government of Bangladesh decides to nationalize all the banks of the country accordingly on the 26th March, 1972, Bangladesh Banks (Nationalization) Order, 1972(President Order No. 26 of 1972) was promulgated.

| Existing Bank | New Bank |

| National Bank of Pakistan. Bank of Bahawalpur Ltd Premier Bank Ltd. | Sonali Bank Ltd.

|

| 4. Habib Bank Ltd. 5. Commerce Bank Ltd | Agrani Bank Ltd.

|

| 6. United Bank Ltd. 7. Union Bank Ltd. | Janata Bank Ltd |

| 8. Muslim Commercial Bank Ltd. Standard Bank Ltd. 10. Australasian Bank Ltd. | Rupali Bank Ltd. |

| 11. Eastern Mercantile Bank Ltd. | Pubali Bank Ltd. |

| 12 Eastern Banking Corporation Ltd. | Uttara Bank Ltd. |

Table-Nationalization of banks

BANKING OPERATION IN BANGLADESH

The development process of a country largely depends upon its economic activities. Banking is a powerful medium among other spheres of modern socio-economic activities for bringing about socio-economic changes in a developing country like Bangladesh. Three different sectors like Agriculture, commerce, and industry provide the bulk of a country’s wealth. The nourishment of these three is only possible through an adequate banking facility. The banking service facilitates these three to be integrated in a concerted way. For a rapid economic growth a fully developed banking system can provide the necessary boost. The whole economy of a country is linked up with its banking system.

With the passage of time the functions of the bank has got a multi-dimensional configuration. All the functions of a modern bank, lending is by far the most important. They provide both short-term and long-term credit. The customers come from all walks of life, from a small business a multi-national corporation having its business activities all around the world. The banks have to satisfy the requirements of different customers belonging to different social groups. The banking business has, therefore, become complex and requires specialized skills. They function as catalytic agent for bringing about economic, industrial and agricultural growth and prosperity of the country. The banking can, therefore, be conceived as “a sector of Economy on the one hand and as a lubricant for the whole economy on the other”. As a result different types of banks have come into existence to suit the specific requirements.

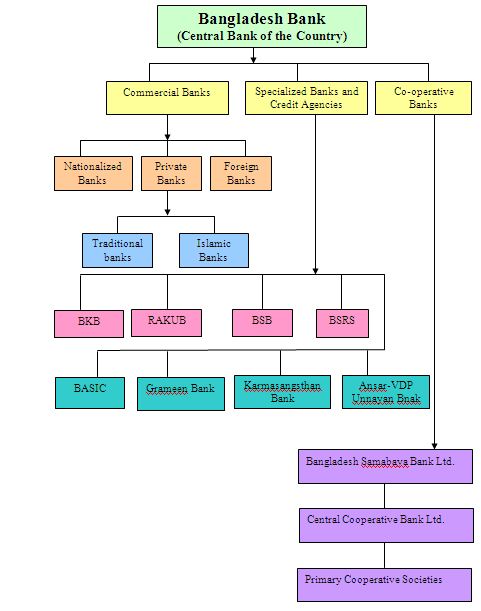

Regardless of the numbers of banks and nature of their functions and activities, a central bank exists to regulate the activities of other banks. All the commercial private and/or nationalized, and specialized banks perform service related activities within the jurisdiction of the central bank. In our country, Bangladesh the role of the central bank is entitled to be executed by Bangladesh Bank.

As different banks are in the field to satisfy the customers of different requirement, we can classify the banks using a diagram that is replicated in the following page.

Some words used in abbreviated form in the following diagram require explanation.

1. BKB = Bangladesh Krishi Bank

2. RAKUB = Rajshahi Krishi Unnayan Bank

3. BSB = Bangladesh Shilpa Bank

4. BSRS = Bangladesh Shilpa Rin Shangstha

5. BASIC = Bank of Small Industries and Commerce, Bangladesh Ltd

ESTABLISHMENT

Sonali Bank Ltd, the largest commercial bank in the country, was established under Bangladesh Banks (Nationalization) Order 1972 (Presidency Order No. 26 of 1972). By taking over branches of former National Bank of Pakistan, Bank of Bahawalpur Limited and Premier Bank Ltd. were two private banks performing class banking over the century in that period and National Bank of Pakistan was government supported bank which was established to finance the Jute Sector in East Pakistan in the early period of Pakistan. After the birth of Bangladesh on 16th December 1971, newly formed Sonali Bank for mass banking got special facilities from the government to work on behalf of Bangladesh Bank in those areas where Bangladesh Bank is not available. With the increase of responsibility and by virtue of performance within a few years, it becomes the largest commercial Bank of the country with 1183 branches up to now.

OBJECTIVES

The main objective of the Bank is to provide all of banking services at the doorsteps of the people. The Bank also participates in various Social and Development programs and also takes part in implementation of various policies and promises made by the Government.

Sonali Bank has the following specific objectives:

- To collect scattered savings of the people.

- To maintain a satisfactory deposit mix.

- To extend credit facilities to agriculture, rural development, commercial and industrial sectors.

- To increase loan portfolio diversification and geographical coverage.

- To develop human resources through continuous training.

- To provide Export Finance

- To provide Import Finance

- To provide Foreign Remittance

- To create new employment.

MANAGEMENT

The management of the bank is vested on a Board of Directors, subject to overall supervision and directions on policy matters by the board which is constituted in terms of Bangladesh Bank (Nationalization) Order 1972 (Figure-2.1). Board of Directors, constituted by seven members, has authority to organize, operate and manage its affairs on commercial consideration within the Board policy of government.

There are directors appointed by the government. Others members of the Board including MD are also government appointed out of that at least three have the experience in the field of Finance, Banking, Trade, Commerce, Industry and Agriculture. The managing director is the Chief Executive of Bank. He executes all the activities under the direction of Board.

BROAD CATEGORIES OF LOANS IN SONALI BANK LIMITED

1. Rural Credit

2. Micro Credit

3. Industrial Credit

4. HouseBuilding loan

5. Consumer loan

Rural Credit:

Rural Credit Division controls and monitors this type of loan. Generally this type of loan is disbursed in the rural areas. It can be classified into six types-

(a) SACP-Special Agriculture Credit Program: It starts in 1977. This credit program is especially for Agriculture crops. Tk.100 crore was sanctioned for the program last year. Its main objective is to finance in the rural economy.

(b) Pond fisheries: Its main objective is to encourage the fisheries sector and thus to solve the unemployment problem. Duration of the credit is three years.

(c) Farming and off farming loan:

This credit program is for agro based or non agro based product.

(d) Special Investment Scheme: This credit program was started in 1993. Its main objective is to reduce the import of milk. Tk.400-500 crore was required to import milk. But after starting the program the amount go down in Tk. 200 crore.

(e) Social a forestation credit program: Its main objective is to greening the country involving the rural people and thus to improve the ecological condition of the country along with the improvement of the economic condition of the people.

(f) Agri farm credit program: Its main objective is to build up a large comprehensive farm and thus to encourage the agriculture sector of the country and to solve the unemployment problem.

Micro Credit:

Govt. patronized NGO BRDB (Bangladesh Rural Development Board) implement the micro credit program in three sectors. Sonali Bank Ltd. sanctions loan in the name of BRDB and BRDB disburse the loan through TCCA or UCCA ( Village level samity)

(a) Crop loan

(b) Integrated Women Development Program

(c) Prawn Cultivation (generally in Khulna and Satkhira region)

2. Agriculture Equipment Loan

3. Sanirvar: This credit program started in the village level named “Dheki Rin”.But the program failed due to corruption. Loan sanctioned in the member level.

4. Credit program through BARD

5. Credit program through RDA (Concentrated in Bogra district)

6. Sasso Gudam Biz

7. Credit for disabled people

8. CUMED (Credit for Urban Women Entrepreneur Development)

9. Unmash (Concentrated in Moulovibazar district)

10. Goat Farming

11. Small farming

12. Rural Small Business

13. Salt cultivation

14. Poverty Alleviation

15. NGO Linkage Loan

Industrial Credit:

Due to the failure of BSB and BSRS Sonali Bank Ltd. started to play role for industrialization. In 1977 SBL started different small loan projects. SBL started financing the small industries and started to get success. After getting the SBL started financing all the small or big industries. But with the passage of time credit recovery is getting worsening. At present defaulter case is 32-40% and the main reason is political influence.

HOUSE BUILDING LOAN:

Housing loan for general people:

House Building Finance Corporation (HBFC) is the main institution to meet the requirement of loans in this field but Sonali Bank Ltd. also supplement to this sector. Advances for construction of residential houses against real estates as primary securities as allowed by banks up to TK. 5.00 lacs per party (including cost of land) minus any loan taken from HBFC for these purpose. Sonali Bank Ltd. may grant advances for construction of commercial building also against real states. The rate of interest for all such loans is 16% per annum and maximum repayment period is 20 years. At present housing loan for general people is stopped due to bad experiences of credit recovery (CR)

Housing loan for SBL staff

It is a great advantage for SBL staff getting housing loan at a lower interest rate. It is now only 5%. The staffs repay the loans with interest at a monthly installment. For this cheque book of each borrower is maintained. A certain installment is cut from the salary each month.

Consumer loan:

Consumer loan is provided to the middle income people to make them able to purchase different furniture, motor cycle, bicycle etc. Main copy of indem (name of furniture, price etc.), Salary statement, no claim report etc. are required. Cheque is maintained and a certain installment (Tk.3370) is cut from the salary. Max. 1 lakh Tk. is given in this purpose. Interest rate is 14%. Payment period is 3 years. Besides there are bicycle loans and motor cycle loans. In this copy of license is taken

MISSION OF SONALI BANK LIMITED

- To provide all kind types of banking service at the doorsteps of the people.

- To establish a countrywide information network system to facilitate monitoring and to improve the quality of service of the bank.

- To provide general advances in different sectors to up-gearing the economic activities.

- To promote the economic development of the country as well as increase per capital income.

- To provide term loan to establish new industries to create opportunities for new employment.

CUSTOMER SERVICE

To ensure qualified customer service Sonali Bank has started in addition to computerization corporate client service and one stop service. To facilitate the foreign exchange activities Sonali Bank has launched SWIFT (Society for Worldwide Inter bank Finance and Telecommunication) system in its 12 branches. The bank has launched Website, Reuter service, Internet service, and Ready cash service. The bank has taken a plan to launch shared ATM system in various important places. Already, it has given work order for this.

UTILITY SERVICE

Sonali Bank Ltd offers multiple special services with its network of branches throughout the country in addition to its normal banking operations.

| Collection | ||

| Gas bills | ||

| Electricity bills | ||

| Telephone bills | ||

| Water/Sewerage bills | ||

| Municipal holding Tax | ||

| Passport fees and Travel tax | ||

| Payment | ||

| Pension of employees of Government and other Corporate Bodies | ||

| Army pension | ||

| British pension | ||

| Students’ stipend/scholarship | ||

| Widows, divorcees and destitute women allowances | ||

| Freedom Fighters’ allowances | ||

| Govt. & Non-Govt. Teachers’ salary. | ||

| Sale & Encashment/Purchase | ||

| Savings Certificates | ||

| ICB Unit Certificates | ||

COMPUTERIZATION

Sonali bank Ltd starts its computerization process at December, 1989. After that it expands its computerization process by establishing RISE System (RS 16000) OS/2, LAN etc. Up to this time 113 branches are under computerized system. Besides this ‘One Stop’ is being given in its 56 branches. Moreover,

> Foreign exchange business and standard of customer services is being increased and speed up of information flow by using the computerization system LAN (Local Area Network) and WAN (Wide Area Network).

> It has established 7 subsidiary companies in United States named Sonali Exchange Company Incorporated (SECI) and 5 offices of Sonali Bank, UK Ltd. establish with 49% share with govt. in UK so that the Non-Resident Bangladeshi can send their money to Bangladesh through a valid channel as fast as possible.

> Recently SECI established a Web based Remittance Software in United States.

> Sonali Bank Ltd Wage Earners Corporate Branch established electronic link with its branch in Middle East Branch through which remittance is to be sent. Besides this 5 electronic link is in implementation process in Oman, Qatar and Bahrain.

IFRMS (Instant Financial Reconciliation and Messaging System) has enabled the bank to remit fund by DD, TT, Inter branch Debit/Credit advice. This has been started as an experimental but this system will be started among 300 branches soon.

GOVERNMENT INTERVENTION

Financial services have traditional been the subject of close government scrutiny and it is to be expected that rates, interest rates, and terms of credit should be closely monitored in the public interest. In the recent years, however, government have tried to use interest rates, credit regulations and informal controls on banks as a means of managing the supply of money in the economy in an effort to increase or reduce consumer spending and to hold back or promote investment by business. During the 1976 to now, the effect of these policies has been to add a new dimension of risk and uncertainty to financial markets which were already fluctuation wildly because of the oil crisis, the commodity boom, increasing inflation and controlled exchange rates.

However, net income of local banks is drastically reduced, as the required to maintain very large provisions for bad debts and interest suspense accounts.

OPERATIONAL NETWORK

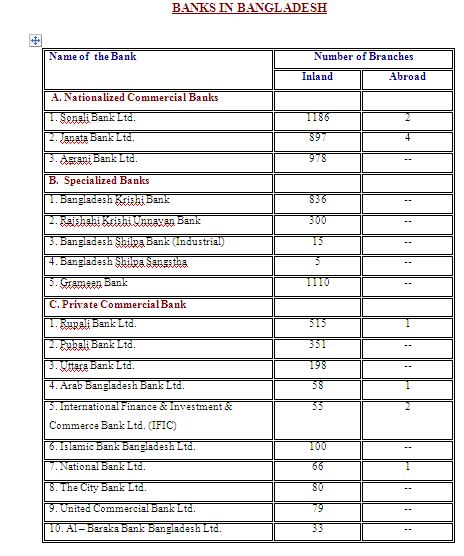

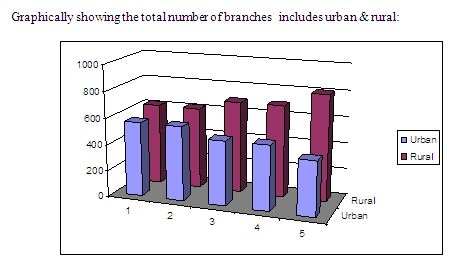

The Bank through its 1186 branches- 1184 domestic and 2 overseas (Kolkata and Siliguri in India) have been providing banking services to its customers. Out of total 1186 branches, 696 are operating in rural areas and 490 in the urban areas. Besides, 26 booths under different branches are performing specialized functions at different locations. It is note worthy that during 2003, 37 branches have been closed/ merged for rationalization of he branches within the country.

The Head office of the Bank is located at the Motijheel Commercial Area, Dhaka consisting of 41 Divisions and 59 Departments. The Divisions are headed by the DGMs and the Departments are by AGMs. There are also many Sections under each Department in the Head Office. The Sections are run by Senior Principal Officers (SPOs).

The Bank has eight (08) GM Offices in six Divisional Headquarters and 27 Principal Offices and 62 (27+35) Regional Offices. A DGM is the chief of the Principal Office and an AGM usually run a Regional Office. Principal Offices have jurisdiction over the entire area of a district, i.e., Principal Offices are the local points of the bank’s administrative zone in the districts. The Regional Offices, under the control and supervision of the Principal Offices, are responsible for their performance and activities to the district-level Principal Offices.

The Regional Heads exercise control and supervision over all the branches within their jurisdictions and keep the Head of the Principal Office informed about the developments of their respective areas from time to time.

There are also 21 Corporate Branches existing in different important places over the country and 11 of them are in Dhaka. The Corporate Branches are nearly equivalent to the GM office and usually headed by DGMs. They are called “Corporate Branch” as they provide all the banking services, e.g., general banking, foreign exchange, credit services etc., in one place and they have their own discretionary power.

From 10 December, 2002 Sonali Bank (UK) Ltd. (a joint venture Company of sonali Bank & Govt. of Bangladesh) is operating to channels banking activities covering the whole Europe.

Besides, the Bank established a wholly owned subsidiary company in New York, USA in the name of sonali Exchange Company Inc. to act as an international money remitter through which Bangladeshi citizens living in the USA are conveniently remitting money to Bangladesh. There are three representative offices of Sonali Bank in Jeddah and Riyadh of KSA and another in Kuwait of Middle East engaged in motivating Bangladeshi expatriates living there to remit money through banking channel.

CHAIN OF COMMAND

Offices/ Divisions/Branches of Sonali Bank:

SL.No. | Office/Branch | No. |

1 | Head Office | 1 |

2 | Division of Head Office | 30 |

3 | Managing Director’s Office | 6 |

4 | Principle Office | 42 |

5 | Local Office | 19 |

6 | Branch (including 2 Foreign Branch) | 1186 |

7 | Sonali Bank UK Ltd. | 6 |

8 | Sonali Exchange Co. Ink. (USA) | 8 |

9 | Representative Office (Jeddah, Riyadh, Kuyet) | 3 |

| 10 | SonaliBankStaffCollege | 1 |

11 | Training Institute | 5 |

(Sources: SBL Staff College)

INTRODUCTION

Remittance Management System is a customized process of sonali Bank Ltd. This is totally bank’s own system where foreign remittances were processed. Basically bank collects the remittance from the 41 exchange houses of different foreign countries. These exchange houses collect money from the customers and then send information about the customers to the bank. There are two processes for sending the information to the bank.

EFT (Electronic Fund Transfer)

SWIFT (Society for worldwide inter bank finance & telecommunication)

After receiving this data bank process this data with the help of customized software which is prepared for process this data. This software is called Remittance Management System (RMS) software. Some high quality, energetic, IT specialist and dynamic young group are engage to ensure the faster and swift service to the customers.

The exchange house collect information from the customer’s regarding their –

- PON (Payment Order No) No.

- Date

- Beneficiary Name

- Account Name

- Amount

- Remitter Name

- Beneficiary Branch Name etc.

The bank has installed RMS at Wage Earner’s Corporate Branch (WECB), Dhaka. The incoming remittances are downloaded and processed at WECB using RMS.

RMS captures various structured remittances from various exchange company and converts it into a unique structure and imposes a security. After capturing the remittances RMS receives an administrative password, a part-1 test key holder password, a part-2 test key holder password and two signatures activation password daily. In RMS there are 20 (Twenty) parameterized signature. We can change the signatory dynamically per day. RMS has automated secured test key module. So RMS generates test key automatically for every amount. Then we accumulate the TRA data of various exchange company and impose three types of security and validate using RMSDataCenter for live outlets.

The RMS module of outlets receives incoming remittance data packet & validate it. After validation the TRA prints automatically with two signatures and a test number. An authorized signatory of outlets sign on TRA as third signature and distribute it. The TRA of distance location is distributed over phone initially and put a seal on TRA as “ credit over phone”.

The outlet collects the credit date of TRA from branches and sends a feedback file to WECB. This feedback is used for Reconciliation and overseas exchange company/Bank.

DEFINITION

Remittance means transfer of money from one to another. Bank provides this facility to their customer as a part of essential services provided to them. The transfer of money can take place either within the country or from one country to another.

The remittance of freely convertible foreign currencies which we are receiving from abroad against which the Authorized Dealers making payment in local currency to the beneficiaries may be termed as Foreign Inward Remittance. The transfer of money can take place either within the country or from one country to another.

> Foreign Remittance.

> Local Remittance.

FOREIGN REMITTANCE

INTRODUCTION:

Foreign remittance, in simple terms, means money remitted in foreign currency. More precisely, it is termed as remittances in foreign currency that are received in & made out abroad. Conceptual Issues International remittances are defined as the portion of migrant workers’ earnings sent back from the country of employment to the country of origin (ILO, 2000). Remittance can also be sent in kind. Transfers that take place in kind is quite difficult to measure. Remittances can be individual and it can also be collective. When individuals send remittance to his/her household or kith and kin that can be termed as individual remittance. When a group of migrants, their associations or professional bodies mobilize resource together and send for collective or community program that can be termed as collective remittance. Individual remittances are mostly geared towards the family whereas collective remittances are generally used for community development.

Transfer of remittances takes place through different methods. 46% of the total volume of remittance has been channeled through official sources, around 40% through hundi, 4.61% through friends and relatives, and about 8 percent of the total was hand carried by migrant workers themselves when they visited

Definition

When transfer of money occurs from any foreign country to the home country it is called foreign remittance. The economy of Bangladesh is mainly depended on this sector. A lot of people staying outside the country send money to their relatives and family. Both the receiver and sender want this money to be transferred. safely and rapidly. Bank provides these services to them in a secured way.

TYPES

Two types of Foreign remittance:-

- Foreign Inward Remittance.

- Foreign Outward Remittance.

FOREIGN INWARD REMITTANCE

The remittance of freely convertible foreign currencies which we are receiving from abroad against which the Authorized Dealers making payment in local currency to the beneficiaries may be termed as Foreign Inward Remittance.

FOREIGN OUTWARD REMITTANCE

The remittances in foreign currency which are being made from our country to abroad is known as foreign outward remittance.

PURPOSE OF OUTWARD REMITTANCE

- To settle Import Payment.

- To meet Travel Expenses/Medical Expenses/Educational Expenses etc.

There are three foreign remittance management processes. These are:

REMITTANCE THROUGH THE DIRECT ARRANGEMENT WITH SONALI BANK

Sonali Bank has arrangement with some foreign bank and transfer agencies in various countries. When transfer is made from those countries and through any of those financial institutions, they transfer it directly to the Sonali Bank. This transfer is made through online. Generally Sonali Bank Wage Earners Branch receives all these remittance and then sends it to the respective branches of the bank. This is transferred by filling up a TTPO (Telegraphic Transfer Pay Order) form or FTT (Foreign Telegraphic Transfer) form.

Remittance through any other Bangladeshi Banks:

When there is no arrangement between the foreign financial institution and Sonali Bank, the foreign institution transfer it to any other bank in Bangladesh with whom it has arrangement. Then the bank transfers it to the Sonali Bank. When the transferor and transferee bank are within the same clear house area, the transferor uses P0 (Pay Order). And if the two banks are in different clearing house area, the transferor uses DD (Demand Draft)

REMITTANCE THROUGH ANY OTHER BANGLADESHI BANKS

When there is no arrangement between the foreign financial institution and Sonali Bank, the foreign institution transfer it to any other bank in Bangladesh with whom it has arrangement. Then the bank transfers it to the Sonali Bank. When the transferor and transferee bank are within the same clear house area, the transferor uses P0 (Pay Order). And if the two banks are in different clearing house area, the transferor uses DD (Demand Draft)

REMITTANCE THROUGH A FOREIGN BANK

The remitter can send money through any financial institution which has branches in both countries. In this case, the bank in Bangladesh receives the amount from its foreign branches and then transfers it to the bank where the client wishes to draw the money. Here the bank needs to fill up a C’ form if the amount of money is $2,000 or more. It is done for the declaration for remittance received from foreign country in the amount of $2,000 or more.

LOCAL REMITTANCE

When money is transferred through one place to another place within the country, it is called Local Remittance. Sonali Bank has highest number of branches all over the country and offers various kinds of remittance facilities to the public.

MODE OF INWARD REMITTANCES (Also Outward Remittance):

The following are the mode of Inward/Outward Remittances.

- TT = Telegraphic Transfer.

- MT = Mail Transfer.

- FD = Foreign Drafts.

- PO = Payment Order.

- TC = Travelers Cheque.

- EFT = Electronic Fund Transfer

PAY-ORDER (P0)

Payment Order is an instrument that is used to remit fund within a local area i.e. within the same clearing house area. For example, if we want to remit fund from one place of Dhaka to another place, we generally use payment order.

DEMAND DRAFT (DD)

It is an instrument that is drawn on one banker office to another or other banker’s branch to pay certain sum of money to the named person. It is generally used to remit fund from one corner of the country to another. For example,, if we want to remit fund from Dhaka to Khulna we use DD. DD is very popular instrument for remitting money from one corner of the country to another.

Difference between Pay-Order and Demand Draft:

There are some differences between pay order and demand draft. These are given below

# In case of Demand Draft both the payer and payee need to have accounts. But there is no certain rule for pay order.

# PU is used in the same clearing area; DD is used for all kinds. DD can not be done in the same clearing area.

# DD is drawn on a certain bank office. But there is no certain rule for pay order(PO).

TELEGRAPHIC TRANSFER (TT)

Some times the remitter of the fund wants the money to be available to the receiver’s account immediately. In that case bankers arrange to remit the fund telegraphically. Here the remitter bears the additional charge for telex/telephone.

MAIL TRANSFER (MT)

It is an instrument that is drawn by one banker office on another or other banker’s branch to pay certain sum of money to the named person. This instrument is not given to the holder but the bank carries it and a message is sent to the particular branch. It is generally used to remit fund from one corner of the country to another.

Commission for MT, DD, & TT are giving below:

| Total Amount | Commission |

| UP to TK 20,000 | Tk 20 |

| Above Tk 20,000 | Per thousand costs Tk 1 |

For MT minimum charge is Tk. 15. And for IT in addition to the commission TT charge is paid Tk. 50 and a VAT is paid on the commission @15%

FEATURES OF RMS (REMITTANCE MANAGEMENT SYSTEM) FOR MIDDLE EAST REMITTANCE

- Credit beneficiary Account within 8-24 Hours.

- Auto Test Number for any amount (Parameterized)

- Auto Signature (Parameterized)

- Highly secured data transmission

- Auto Feed Back

- Data Ready for Reconciliation

- Unique platform for all exchange company

- Consolidated Data packet for all overseas exchange/Bank

- Missing data packet traceable by outlet software

- Single Copy instrument print

- Additional instrument copy prints with “Care Duplicate”.

- Generate all types of required statements

- 100% parameterized Software

FOREIGN CURRENCY NOTES (ON LINE REMITTANCES)

A remitter abroad simply has to approach a bank branch there with certain amount to be deposited beneficiary in Bangladesh either in foreign currency or in equivalent Taka currency. The Branch so approached abroad usually should have agency arrangement with the paying banks in Bangladesh. However, in the absence of any such agency arrangement, remittance may also be made by transferring cover value of the remittance to the paying bank’s account abroad by the remitting bank.

SOURCE OF INWARD REMITTANCE:

- Expatriate Bangladeshis.

- Exporters.

- Visitors.

PURPOSE OF REMITTANCE

In short, remittances are being sent from abroad for the following purposes:-

- Family maintenance

- Indenting Commission

- Recruiting Agents Commission

- Realization of Export Proceeds

- Donation

- Gift

- Export broker’s Commission etc.

APPROVAL OF BANGLADESH BANK

Bangladesh is always in a scarcity of foreign exchange and foreign exchange business is restricted and controlled by the Central Bank of the country. For this reason Bangladesh Bank’s prior permission is required for any remittance to be made to outside the country.

Bangladesh Bank provides permission/approval for outward remittances to the applicants who are to lodge an application for the purpose on the following prescribed forms with an Authorized Dealer who forwarded the same to Bangladesh Bank for approval.

MAIN FLOW OF FOREIGN REMITTANCE

- Saudi Arabia

- Kuwait

- Qatar

- Oman

- Iraq

- Libya

- Bahrain,

- Iran

- Malaysia

- South Korea

- Singapore

- Hong Kong

- Brunei

These are some of the major countries of destination. Saudi Arabia alone accounts for nearly one-half of the total number of workers who migrated from Bangladesh. Labor market of Bangladeshi workers is not static. During the 1970s Saudi Arabia, Iraq, Iran and Libya were some of the major destination countries. While the position of Saudi Arabia remains at the top, Malaysia and UAE became important receivers. In mid-1990s, Malaysia became the second largest employer of Bangladeshi workers. However, since the financial crisis of 1997, Bangladeshis migrating to Malaysia dropped drastically. Now UAE has taken over its place.

Over the past 25 years labor migration from Bangladesh has registered a steady increase. From 1990 onwards on an average 3, 25,000 Bangladeshis are migrating on short-term employment, mostly to 13 countries. In the past the bulk of the migrants consisted of professional and skilled labor. However, the recent trend is more towards semi- and unskilled labor migration. Due to increase in the flow of unskilled and semi- skilled labor, remittance is increasing at a much lower rate than the labor flow. Remittance is crucial for Bangladesh’s economy. It constitutes almost one-third of the foreign exchange earning. About 25 percent of remittance senders were students when they went abroad and another 25 percent were living off their own land. A large segment of them were working as construction laborers overseas, another group worked as agricultural laborers. UAE, Saudi Arabia and Singapore constituted the most of important destinations of these migrants.

One survey comments that if the migrant workers’ total income abroad and the present family income from other sources is combined and then compared with the pre- migration family income, it registers an increase in total income by 119 percent. On an average, the interviewee households annually received about Tk.72,800 as remittance. This means that a typical migrant remits 55.65 percent of his income. Remittance constitutes 51.12% of the total income of these families. Transfer of remittances takes place through different methods. 46% of the total volume of remittance has been channeled through official sources, around 40% through hundi, 4.61% through friends and relatives, and about 8 percent of the total was hand carried by migrant workers themselves when they visited

CONTRIBUTION OF REMITTANCE TO THE NATIONAL ECONOMY

Labor migration plays a vital role in the economy of Bangladesh. Bangladesh has a very narrow export base. Readymade garments, frozen fish, jute, leather and tea are the five groups of items that account for four-fifths of its export earnings. Currently, garments manufacturing is treated as the highest foreign exchange earning sector of the country (US $ 4.583 billion in 2003). However, if the cost of import of raw material is adjusted, then the net earning from migrant workers’ remittances is higher than that of the garments sector. In 2003, net export earning from RMG should be between US$2.29-2.52 billion, whereas the earning from remittance is net US$3.063 billion. In fact, since the 1980s, contrary to the popular belief, remittances sent by the migrants played a much greater role in sustaining the economy of Bangladesh than the garments sector.8 For the last two decades, remittances have been at levels of around 35% of export earnings, making it the single largest source of foreign currency earner for the country. This has been used in financing the import of capital goods and raw materials for industrial development. In the year 1998-99, 22 percent of the official import bill was financed by remittances (Afsar, 2000; Murshed, 2000 and Khan, 2003). The steady flow of remittances has resolved the foreign exchange constraints, improved the balance of payments, and helped increase the supply of national savings (Quibria 1986). Remittances also constituted a very important source of the country’s development budget. In certain years in the 1990s remittances’ contribution rose to more than 50 percent of the country’s development budget. Government of Bangladesh treats Foreign aid (concessional loan and grants) as an important resource base of the country. However, remittances that Bangladesh received last year was twice that of foreign aid. Remittances have played a major role in reducing the extent of the country’s dependence on foreign aid. The contribution of remittance to GDP has also grown from a meager 1 percent in 1977-1978 to 5.2 percent in 1982-83. During the 1990s the ratio hovered around 4 percent. However if one takes into account the unofficial flow of remittances, its contribution to GDP would certainly be much higher. Murshed (2000) finds that an increase in remittance by Taka 1 would result in an increase in national income by Tk 3.33. Following the expiry of multi-fiber agreement (MFA), Bangladesh will face steep competition in export of RMG. The country will cease to enjoy any special quota. It is apprehended that Bangladesh’s RMG export will decline sharply. This will result in loss of job of many workers and shortfall in foreign exchange earning. Potential of retaining employment and export earning through export of frozen fish, jute, leather and tea seems rather bleak. It is in this context labour migration has become key sector for earning foreign exchange and creating opportunities for employment. Therefore, the importance of migrant remittance to the economy of Bangladesh can hardly be over emphasized.

ROLE OF DIFFERENT INSTITUTES CONSIDERING FOREIGN REMITTNCE

MINISTRY OF FINANCE:

Ministry of Finance (MoF) is the prime policy making body regarding banking and remittance. Macro-economic policies that affect exchange rate, monetary and fiscal mechanisms, foreign exchange reserve etc. are regulated by this ministry.

BANGLADESH BANK:

Bangladesh Bank (BB) is the central bank of Bangladesh. Among other powers and functions, BB regulates scheduled bank activities, acts as a clearing-house, maintains foreign exchange reserves and monitors floating exchange rate mechanism in the current accounts. Bangladesh Bank encourages the nationalized and private banks to link up with foreign banks and exchange houses in the destination countries. It has a separate department for regulating and monitoring remittance entitled Foreign

EXCHANGE POLICY DEPARTMENT :

It also generates analyses, interprets and distributes data on inflow of remittance.

NATIONALISED COMMERCIAL BANKS:

Nationalized Commercial Banks (NCBs) of Bangladesh make direct banking facilities available at the doorsteps of Bangladeshi emigrants especially in those countries where a large number of Bangladeshis are employed. Five NCBs are deeply involved in remittance transfer. These are Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank Ltd. and Bangladesh Krishi Bank (BKB). Among the NCBs, BKB is solely targeted towards agricultural development in rural areas. Within Bangladesh these five NCBs have 2945 branches. Through them they can disburse remittances even in distant areas. Besides their own branches, NCBs have opened exchange houses in joint collaboration with different banks and financial institutions in different countries of the world.

PRIVATE COMMERCIAL BANKS:

Private Commercial Banks (PCBs) are also involved in remittance transfer. Of the PCBs, Islami Bank of Bangladesh Ltd. has been found to be most proactive in the area of migrants’ remittance. National Bank, International Finance and Investment Corporation (IFIC), Prime Bank and Uttara Bank are other private banks involved in remittance transfer. Most of their activities are in the Middle East. Saudi Arabia is the major working area of Islami Bank along with Qatar, Bahrain and UAE. National Bank is operating in Oman, Kuwait, UAE, Qatar, Bahrain and Saudi Arabia. IFIC has curved out a major niche in Bangladeshi community in Oman and has its largest share with 41% of the market. It also has branches and exchange offices in Nepal and some other Middle Eastern countries. Uttara Bank runs exchange house in Qatar in collaboration with a local financial institution. Corresponding Relationships In almost all countries of the world, both NCBs and PCBs have corresponding relationships with banks through which Bangladeshi migrants may easily send their money to their beneficiaries’ accounts with any branch of any bank in Bangladesh.

COUNTRY WISE COMPARATIVE STATEMENT OF FOREIGN REMITTANCE:

| Month | Jan-06 | Jan-07 | Feb-06 | Feb-07 | Mar-06 | Mar-07 | Apr-06 | Apr. 07 | |

| Country | NO OF REMITTANCE | ||||||||

| Saudi Arabia | 18390 | 22640 | 19734 | 25314 | 23989 | 28734 | 21344 | 31418 | |

| Kuwait | 1229 | 1288 | 1305 | 1142 | 1317 | 1096 | 1135 | 1325 | |

| Qatar | 8 | 10 | 13 | 10 | 9 | 9 | 11 | 7 | |

| U.A.E. | 293 | 392 | 223 | 404 | 225 | 457 | 245 | 504 | |

| Oman | 40 | 37 | 28 | 36 | 52 | 42 | 35 | 39 | |

| Bahrain | 184 | 103 | 151 | 96 | 170 | 120 | 135 | 145 | |

| U.K. | 15990 | 8570 | 13378 | 8431 | 12948 | 8771 | 11157 | 8870 | |

| U.S.A. | 14378 | 12560 | 13236 | 12272 | 15843 | 14743 | 15455 | 15582 | |

| Japan | 47 | 39 | 49 | 52 | 48 | 48 | 56 | 68 | |

| Singapore | 4 | – | – | – | 10 | – | |||

| Germany | 133 | 139 | 171 | 130 | 185 | 162 | 169 | 187 | |

| Malaysia | 626 | 293 | 468 | 355 | 557 | 367 | 394 | 417 | |

| Other | 334 | 357 | 301 | 320 | 326 | 381 | 367 | 499 | |

| Total: | 51656 | 46428 | 24 | 48562 | 55669 | 54930 | 50513 | 59061 | |

Source: Wage Earner’s Corp BR Dhaka.

MAJOR FINDINGS

I have found out some points by screening the whole study, which are expressed as major findings. The conversations with the Sonali bank Ltd officials were very significant for the findings.

> As a commercial bank, SBL still follows the traditional banking. This organization still concentrates on production oriented approach but for the present era of Marketing. The large distribution channel and the inefficiency of the employees do not permit the proper marketing orientation in Banking.

> There is a training institution and a human resource division of SBL to run the activities of human resources.

> The communication of SBL is open and free. SBL uses notice board, magazine, newsletters, the suggestion programs etc as a method of communication.

> It uses pay, financial incentives, flexible working hours, work sharing, promotions, giving responsibilities, autonomy and decision as a method of motivating employees.

> It provides compensation according to the government pay scale.

> It has no any procedure to determine salaries and wages.

> There is no provision for overtime in SBL.

> It uses negotiation procedure to grievance handling.

> It has a better labor management relationship.

> There is no specific job analysis for the evaluation of the position in the SBL.

> SBL describes the duties and responsibilities of the department and the department describes the duties and responsibilities of the sections of the department.

> Sometimes inefficient allocations of resources have created a huge amount of had debt.

> Sometimes pressure groups are involved sanctioning loan.

PROBLEMS OF SONALI BANK AND SUGGESTION

There are many problems, which affect the smooth and profitable operations of commercial banks. For Sonali Bank as well these problems pose a great threat of carrying out its normal operations smoothly. They are summarized below:

PROBLEMS IN RMS & SUGGESTIONS

PROBLEMS:

a) Lack of skilled manpower

b) Lack of Internet facility

c) Lack of management

d) Lack of data processing system

e) Lack of networking

f) Lack of monitoring

g) Lack of reporting

h) Problems in software (it is now in the ongoing process)

SUGGESTIONS:

- Manpower should be trained

- High speed internet facility should be implemented

- Proper computerization should be implemented

- Networking should be improved

- Established a proper monitoring cell to control the queries of the customers

- Reporting system should be developed

- Problems of software should be managed soon.

OTHER PROBLEMS AND SUGGESTIONS

BANKING POLICY:

Banking policies are generally made at the Ministry of Finance and the policies are scrutinized and implemented by the Bangladesh Bank. Later, the Bangladesh bank enforces these rules and regulation, interest rates, loan disbursement etc. important banking factors for other commercials banks and financial organizations. In many cases, the faulty decision-making and policymaking costs commercial banks dearly. So, before making any sort of drastic decision regarding policymaking the government should at least discuss with the top management of the commercial banks.

WEAK MANAGEMENT:

Sonali bank Ltd faces severe lack in strong management policy. Most of the top management are influenced by the government bodies like Bangladesh bank and Ministries. They are not allowed to work freely rather depend heavily on government organizations as such. So in most cases independent decisions do not come from bank officials.

EMPLOYMENT BALANCE:

There are more than 1,000 branches of Sonali Bank all over Bangladesh and outside Bangladesh. But all the branches are not balanced from employment point of view. Some branches of Regional/Principal offices have over employment while some faces the problem of under employment. The balance of the personnel working in each branch has to be set properly depending on the volume of work.

POOR SERVICE:

This is basically due to lack of manpower against huge amount of work the bank usually deals with. Sonali bank does what a private bank does, apart from that it also works as the treasury service of the government, utility services, passport services, foreign currency service and virtually all the services that can be done by a bank is done by Sonali Bank. Considering huge amount of work some branches notoriously lag enough manpower against it. It is not the efficiency of the workers that is lagging, but it is the huge amount of work to be done is not met by mere manpower.

LOAN DEFAULT:

We have already considered data where we have found the recovery of Sonali Bank’s credit is very poor. There are many reasons behind it. The culture of loan default has to be overcome taking appropriate measures.

Sonali bank Ltd has to follow the above suggestive measures, so that its performance, deposit disbursement, recovery, investors, importer, goodwill etc. will be increased.

ONLINE BANKING:

Although Sonali Bank Ltd has taken the facility of using computers in maintaining cash and other sections but still it has not taken the full advantage of the modern day wonder of full fledged computer facilities. Most of the private banks are operating 24 hour basis online banking – the sector still ignored by Sonali Bank. All the branches do not maintain their ledgers using computers yet. Money transfer in different modes, wage earners and foreign exchange etc. has not still taken up by the computers till now.

RECOMMENDATIONS

- To deliver faster services to the customer’s convenience, Sonali Bank Ltd should provide more personnel to customers.

- Proper communication system and maintenance of files & machineries like phone, computer, fax, and photocopier need to be ensured.

- To ensure error free faster services, the bank should be fully computerized.

- Effective strategies must be undertaken against defaulters.

- Research & Development activities should be taken into consideration

- Office should be fully decorated to attract clients to take its services.

- More employees are to recruit. For the better service, training is must and according to the skill and education background of employee needs to be positioned.

- The Bank should absolutely maintain on its own rules and procedures.

- The Bank should introduce reward system for good borrowers as well as punishment for bad borrowers.

- The Bank should apply modernized Marketing Information System.

- The Bank should act without any kind of political influence.

STRENGTH, WEAKNESS, OPPORTUNITY AND THREAT (SWOT) ANALYSIS

STRENGTH:

- Largest commercial bank in Bangladesh.

- Widely recognized and strong brand name.

- Agent of Bangladesh bank.

- Qualified and experienced workforce.

- Strong liquidity and financial condition.

- Strong networks all over in Bangladesh.

WEAKNESS:

- Huge amount of bad/debt loan.

- Lack motivation of workers.

- Service is not up to the mark.

- Online banking is not strong.

- Absence of teamwork.

- Weak branch controlling and monitoring system.

OPPORTUNITY:

- Investment potentiality in Bangladesh.

- Increasing demand of customer finance.

- Enormous opportunity in foreign remittance section.

- By implementing e-commerce and online banking remarkable

- Opportunities are created.

THREATS:

- High standard Commercial/Foreign bank as well as private bank.

- Illegal interference of CBA in banking activities.

- Highly qualified and experienced bankers leave the bank a very high percentage.

- Cannot take proper action against bad debtor due to political interference.

- Increasing percentage of shifting customer loyalty.

- Low Interest rate compare to private /Foreign banks.

CONCLUSIONS

The Banking arena in recent time is one of the most competitive business fields in Bangladesh. As Bangladesh is a developing country, a strong banking sector can change the socio economic structure of the country. So we can say, the whole economy of the country in linked up with its banking system. There are 54 banks in Bangladesh in which 38 are indigenous commercial Banks. Sonali Bank ltd is the largest commercial Bank of Bangladesh. This bank performs hundreds of important activities both for the public and for the government as a whole. It has an outstanding bearing to thrive our business sector. It has strong performance on General Banking, Loans & Advances, Industrial credit and foreign Exchange. I had the privilege to learn many things about the remittance management system from the SHILPA BHABAN Corporate Branch through my active involvement in this branch.