There is a great supportive role of banking system in human society. It plays a vital role for the economic development of a country. The local banking system of Bangladesh is developing their services day by day by following the multinational banks. Standard Chartered Bank is one of multinational bank who is leader and follower of the other local banks. At the same time it brings different modern technology in our banking culture.

In Bangladesh Standard Chartered Bank operate the banking operation over the Sixty Two (62) years. In that time it did lots of changes in this sector and it promoted many new ideas in this sector. Standard Chartered Bank is trying to develop economic condition of the country. In the SME, SCB has five different products for their different customer choice. Today this bank provides loan facility TK 10 Lac (BDT 1 million) to TK 15 crore (BDT 150 million) to that small and medium enterprise that has no easy access to banks or financial institutes. In the portfolio of SME, SCB gave loan (BDT 7.5 billion) TK 750 crore in the year of 2011. It is a huge amount of money that SCB providing for their customer in the SME loan.

The success of SME will largely depends on the selection of a business and man behind the business. Standard Chartered Bank provides this facility to those whose business operation is minimum one year and environment friendly business. At the same time the business should be legally registered and must have valid trade license. The entrepreneur should be physically able, preferably between the ages 25 to 50. Entrepreneur must have the necessary technical skills to run the business and acceptable social standing in the community.

The core competence of the Standard Chartered Bank is to provide the fastest loans to the customers in this country. To retain this competitive advantage Standard Chartered Bank would provide latest facilities whether they can give fastest services to clients than other banks. Regarding the services by the Relationship Officer (RO) or sales executive, almost all clients are satisfied by get these quick facilities from them. In the survey it is found that most of the clients give a suggestion to decrease the interest rate and loan processing fees. So, personally I think SCB management look after this things from the view point of customer and the competitor banks. By this way the Bank will be able to keep on playing its important roles in our economy.

Introduction

In Bangladesh By increasing a dynamic small and medium enterprise (SME) sector is seen as a priority amongst economic development goals, in both developed and emerging economies. SMEs are a primary driver for job creation and it also contributes on GDP growth. It is greatly contribute to economic diversification and social stability and its play an important role in private sector development. The Standard Chartered Bank (SCB) is one of them who introduce this SME finance in this country. We know that, SCB is the biggest bank in Asia, Africa, UK, USA and Middle East with its significant lending, investment and insurance activities around the world. SCB is considered as one of the largest banking and financial services organization in the world. In Bangladesh it has made its place as the fastest growing bank. In the SME sector in Bangladesh SCB has five different products and only SCB provide both the term loan and working capital finance. Though SCB also have another different loan product but it gives more emphasize on the SME loan because, in Bangladesh the SME loan is much more popular from another business loan. At the same time the percentage of new entrepreneur are increasing day by day. So as a business loan of SME is much popular and it has much more opportunity to grow up in Bangladesh.

Objective

Broad Objective

The broad objective of this project:

1. How Standard Chartered Bank operates SME banking operation around the country though its extensive network.

2. Why Market concentration and product diversification are considered the main strategies for expanding the SME business.

Specific Objective

To support the broad objectives better we have developed some specific objectives. These are:

1. How Standard Chartered Bank operates SME banking operation around the country though its extensive network

• History of Standard Chartered Bank SME

• SME Product Details

• Operation Process of SME Loan Disbursement of SCB

2. Why Market concentration and product diversification are considered the main strategies for expanding the SME business.

• Market segmentation

• Target consumer

• Target market

• Developing marketing mix

• SWOT Analysis

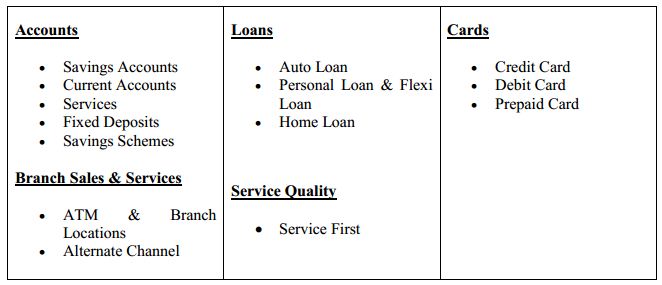

Products and Services

Personal Banking

Personal banking means the consumer or person before opening a bank account and then commit to transition on their own needs or other purposes. Currently Standard Chartered Bank Bangladesh provides different type of personal banking and all of these are much more helpful to their clients and customers.

Priority Banking

Priority Banking are categorized into 4 parts;

• Priority Privileges

• Priority Suites

• A world without borders

• Be our Priority today

Priority Privileges

At Priority Banking, SCB make everything our value from their priority. In essence SCB categorized it into 3 sectors; these are- you, your family and your business.

Priority Suites

Peace of mind. It is the feeling you get when you stroll through a forest, walk along the bank of a meandering stream, or step into the Priority Banking Centre, with its use of natural elements such as wood, stones and water, color palette of beige and brown, and seasonal accents of blue and green.

A world without borders

Standard Chartered Priority Banking is available across an extensive network. So, whether you are on the move or at home, you can be sure of constant access to the most privileged levels of personalized banking in our branches across the world.

Be our Priority today

Standard Chartered offer an exclusive banking service for those who want the best. To enjoy this exclusive Priority Banking membership and all the benefits and privileges that come with it, simply maintain an average balance of Tk. 35 Lakhs in any one or combination of the following products – Savings Accounts, Term Deposits, Business plus Current Accounts.

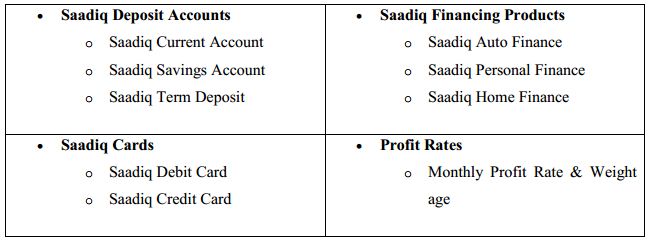

Islamic Banking

Standard Chartered has been offering world-class and completely Shariah-compliant Islamic Banking solutions since 1993; and at present has coverage in 6 countries including Bahrain, Bangladesh, Indonesia, Malaysia, Pakistan and UAE. At Standard Chartered Saadiq, respect our Islamic beliefs and values. That’s why it offer world class Islamic Account solutions combined with modern banking facilities. The Islamic Banking is categorized into 4 parts;

SME Banking

The constant economic growth in Bangladesh means ample opportunities for growing our dream of business. Standard Chartered Bank’s SME Banking comes into play with its wide range of business responsive products, services and superior customer service. SME Banking are categorized into 5 parts;

1. Business Installment Loan

2. Orjon

3. Loan Against Property

4. Trade & Working Capital

5. Transaction Services

- Business Priority Account

- Business Premium Account

- Business Plus Account

- Straight 2 Bank

- Door Step Banking

Wholesale Banking

• Schedule of Charges

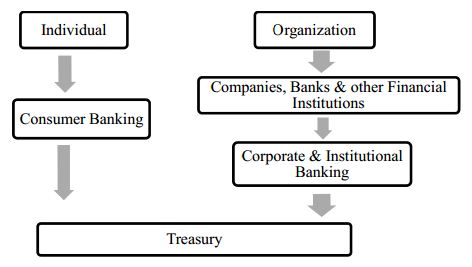

Product Division of SCB-Consumer, Corporate and Institutional Banking.

Different types of customers are targeted by different divisions. Consumers Banking Division and Corporate Banking Division namely Corporate and institutional Banking (C & I) are two main divisions.

Consumer Banking

Consumer Banking division meets the needs of individual customers with various products like Savings Account, Extra Value Saving Account, VIP Saver’s Account, Freedom Account, Access Account, Call Deposit, Graduate Account, FCY (foreign currency) Deposit, NFCD (Nonresident Foreign Currency Deposit) Fixed Deposit, RFCD (Residence Foreign Currency Deposit) Account, Personal Loans, Auto Loans, Flexi Loans, Cash Line, Installment Loans etc.

Corporate & Institutional Banking

Corporate and institutional banking meets the needs of companies, banks and other financial institutions. Standard Chartered provides a full range deposit and loan products to its corporate clients. Rapid decision making is an important feature of SCB’s services to international and domestic companies doing business in Bangladesh. All accounts are assigned to a Relationship Manager to look after client needs. Each Relationship Manager keeps close contact with the client obtaining in depth knowledge of the client’s business and providing timely advice. This division’s also include products such as;

♠ Network banking and borrowing services like working capital loan, long-term loan, short-term loan, and margin account.

♠ Commercial large loan

♠ Real estate apartment loan

♠ Heavy transport buying loan

♠ Construction loan

♠ Restaurant loan

It also includes like international trade related services such as L/C issuing, L/C amendment, L/C transfer, L/C confirmation, negotiation, bank guarantees etc. These products are only served to the corporate clients of the bank, and those are mostly local corporate, large and local corporations, multinational national companies.

Relationships between respective customers with different departments of SCB

This focus allows the business to develop an in-depth understanding of the bank’s customer’s evolving requirements. This in turn enables them to develop the products and services that help SCB stand out from the competition. Treasury provides support to the customers of both these business and develops customers of their own.

Definition of SME

In Bangladesh SMEs have assumed special significance for poverty reduction programs and potential contribution to the overall industrial and economic growth. An SME (Small and Medium Enterprise) is defined as, “A firm managed in a personalized way by its owners or partners, which has only a small share of its market and is not sufficiently large to have access to the stock exchange for raising capital”. SMEs ordinarily have few accesses to formal channels of finance and depend primarily upon savings of their owners, their families & friends. So, as a result, most SMEs are sole proprietorships & partnerships.

SMEs have been defined against various criteria. The three parameters that are generally applied by the Governments to define SMEs are:

♦ Capital investment in plant and machinery.

♦ Number of workers employed.

♦ Volume of production or turnover of business.

A quantitative definition in each national context is, however, advantageous, as it makes it easier to target macro-level policies for a specific group of enterprises. The countries with such definitions have recorded a higher growth rate in the SME sector. This indicates that the more precise the definition, the more effective the transaction of policies intended to benefit the sector with actual results. In countries where no definition exists, the enterprises are in a disadvantageous position.

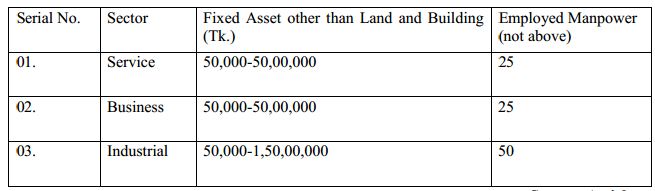

Definition of SME as per Bangladesh Bank

In Small Enterprise:

Small Enterprise refers to the firm/business which is not a public limited company and complies the following criteria:

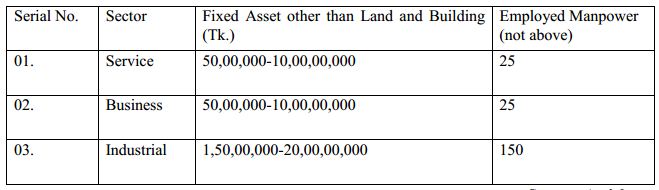

In Medium Enterprise:

Medium Enterprise refers to the establishment/firm which is not a public limited company and complies the following criteria:

Purpose

• Contribute to the socio-economic development of the country.

• Encourage small and medium industry especially agro-based industry of the country.

• Participate in reduction of poverty through employment generation and income generating projects.

• Provide financial assistance to small and medium enterprise, which have limited access to the formal financial markets.

Classification of Entrepreneurs

Two types of entrepreneurs will come under this scheme:

1. New and inexperienced entrepreneurs.

2. Experienced and successful entrepreneurs.

SME Banking in Standard Chartered Bank

Standard Chartered Bank provides SMEs with its wide range of business responsive products and services. To help expand the business and tackle all fund related constrains of SMEs, Standard Chartered offers business installment loans of up to Tk 70 lakh (BDT 7 million) from a minimum of Tk 10 lakh (BDT 1 million). The loan requires a cash security of 30 to 50 per cent (%) of the loan amount depending on existing repayment track record. This loan is repayable in three to five years at the interest rate of 19.5 per cent (%). Any business having at least three years of experience in the same business and a minimum turnover of Tk 120,00000 can apply for this loan.

Its loan scheme Orjon however has been crafted to support the business needs of women entrepreneurs and enables SMEs to obtain financing without any requirement of collateral. The features and eligibility requirements of this scheme are similar to the business installment loans, except for an interest rate of 18.5 percent (%). Standard Chartered also offers loan against property ranging from Tk 14 lakh (BDT 1.4 million) to Tk 2.8 crore (BDT 28 million), to enterprises with annual turnover of Tk 70 lakh (BDT 7 million), at the interest rate of 16 per cent(%) which is repayable over three to 10 years. The bank also offers trade and working capital financing and different SME transaction services, online based Straight 2 Bank service and Doorstep Banking (which allows secure banking

transactions without leaving the doorstep).

SME Products

Business Installment Loan (BIL)

Here the customers do not let fund shortage hold back their business expansion. The customer can take the lone on the full amount what they demand and they can repay the loan at the monthly installment process. Customer can take up to BDT 7 Million to truly start their business.

Features

This loan will help the customer to meet their financial needs for their business expansion. A customer can make long term investments with this business loan and build up their equity by repaying the loan in convenient Equated Monthly Installments (EMI). Customer can avail this loan through some simple documentation and against competitive cash securities.

♦ Maximum Loan: BDT 7,000,000 (Seventy Lacs) only

♦ Minimum Loan: BDT 1,000,000 (Ten Lacs) only

♦ Interest Rate: 19.5% per annum

♦ Tenor: 3 Years – 5 Years (i.e. 36 to 60 EMI payments)

♦ Cash Security: 30% to 50% of the loan amount

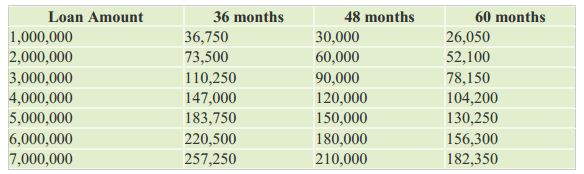

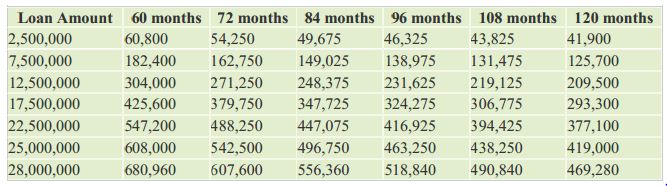

Following table indicates the monthly repayment amount or EMIs against different loan amounts and tenors:

Loan Against Property (LAP)

At Standard Chartered we strive to meet customer needs in a competitive and dynamic business environment. Standard Chartered Bank understands that, as an SME, customers require quick access to cash, and the flexibility to leverage their assets to fuel their business growth. Standard Chartered’s Loan Against Property (LAP) provides the liquidity to the customer to need to grow their business or meet cash flow requirements. The loan enables to the customer to leverage their property to obtain financing.

Features

Loan against property is very flexible and is designed to meet the different financial needs of the business. With Loan Against Property (LAP) customer can undertake long term investments for expansion. In the process Loan Against Property (LAP) also enables to customer to build up their business equity by repaying the loan in monthly installments.

♦ Maximum Loan: BDT 28,000,000 (taka two crore eighty lac) only

♦ Minimum Loan: BDT 1,400,000 (taka fourteen lac) only

♦ Interest Rate: 16% per annum

♦ Tenor: 3 Years – 10 Years (i.e. 36 to 120 EMIs payments)

♦ Maximum % of loan amount against market value of the property: For Commercial

Property 60% of property’s current market value. For Residential Property 70% of property’s current market value.

Following table indicates the monthly repayment amount or the equal monthly installments (EMI) is given below:

Trade and Working Capital Financing

Here Standard Chartered Bank offer this service to their clients on hand in hand and at the same time if the clients business requires various combinations of banking facilities then the Trade and Working Capital Financing is here to provide their the perfect blend.

The lists of benefits that Standard Chartered Bank offers to their client’s needs and these are:

• Letter of Credit (LC)

• Loan Against Trust Receipt (LATR)

• Revolving Loan (RL)

• Local Bill Discounting (LBD)

• Term Loans

• Bank Guarantee

• Shipping Guarantee

• Foreign Exchange Forward

• Overdraft Facilities

Features

The beneficial features of Standard Chartered Trade and Working Capital are:

• Facilities of up to BDT 120,000,000 (taka twelve crore) only for single customers and up to BDT 150,000,000 (taka fifteen crore) only for groups.

• Fast access to trade lines and transactions.

• Dedicated experts to support with all your banking needs.

• Easy access to operational accounts.

• Competitive rates for foreign exchange services.

• Wide options of instruments to serve as security or collateral.

• Acceptable collaterals: Property, Cash/Bond/FD, Stock Hypothecation, Personal Guarantee, Corporate Guarantee, etc.

Eligibility

To avail these benefits a business must fulfill the following criteria:

• Minimum Annual turnover of BDT 200,000,000 (Taka twenty crore) only.

• 3 years of business experience.

Transaction Service

To bring out the best option form the client business’ deposits, Standard Chartered Bank offers its SME Transaction Services. SCB have formulated a matrix of stages with respective features that are bound to show up with the most beneficial transactions. Standard Chartered Bank offers three types of accounts. These are SME Business Priority

Account, SME Call Account and Business account. Each of these account types are subdivided into Business Plus, Business premium and Business Priority segments.

The following tables highlights all features and charges of the all the SME transaction services.

Business Priority Account

The Business Priority Account means a client who will want to enjoy the extra privileges of personalized and the superior account services for their business from the bank. SCB try to provide that kind of superior services for their clients. A certain class of people takes that kind of service from the SCB.

Benefits

• Tiered Interest Rate

• Online Banking facility across all Standard Chartered branches

• Access to ATMs (Sole Proprietorship Only)

• Internet Banking and SMS Banking

• Evening Banking Facility in select Branches

• 24-hour Contact Center (Sole Proprietorship Only)

Experienced Relationship Manager to take care of all your daily banking requirements

• FREE Issuance of Pay Order and Demand Draft

• FREE Online Intercity Transaction Facility

• FREE Over-the-Counter Transaction

• FREE Monthly Account Statements

• FREE Daily e-Statements

• FREE Exclusively Designed Personalized Cheque Book

• A host of other exclusive privileges offered by Priority Banking, including free valet parking, discounts, fee waivers and privileges

Eligibility

By maintaining a minimum half-yearly average balance of BDT 1,000,000 Lac, any of the following type of business entities & individuals can benefit from Business Priority Account. SME Activities of Standard Chartered Bank in Bangladesh

• Sole Proprietorship

• Partnerships

• Self-Employed Professionals

• Limited Liability Company (LLC)

• Local Development Organizations (Only Liability Relationship)

Business Premium Account

The Business Premium Account has been designed to create a relevant and exclusive package only for making the clients business flourish. By becoming a Business Premium Accountholder, anyone can enjoy the following distinctive services:

Benefits

• Tiered Interest Rate

• Online Banking facility across all Standard Chartered branches

• Access to ATMs (Sole Proprietorship Only)

• Internet Banking and SMS Banking

• Evening Banking Facility in select Branches

• 24-hour Contact Center (Sole Proprietorship Only)

Team of Relationship Managers

• FREE Exclusively Designed Personalized Cheque Book

• FREE Online Intercity Transaction Facility.

• FREE Over-the-Counter Transaction

• FREE Monthly Account Statements

• FREE Daily e-Statements

Eligibility

By maintaining a minimum half-yearly average balance of BDT 500,000 Lac, any of the following type of business entities & individuals can benefit from Business Premium Account.

• Sole Proprietorship

• Partnerships

• Self-Employed Professionals

• Limited Liability Company (LLC)

• Local Development Organizations (Only Liability Relationship)

Business Plus Account

Standard Chartered has put together the custom-made Business Plus Account especially designed to support the ambitious growth of SMEs. By becoming a Business Plus Accountholder, anyone can enjoy the following distinctive services:

Benefits

• Tiered Interest Rate

• Online Banking facility across all Standard Chartered branches

• Access to ATMs (Sole Proprietorship Only)

• Internet Banking and SMS Banking

• Evening Banking Facility in select Branches

• 24-hour Contact Center (Sole Proprietorship Only)

Free up-gradation from normal Current Account to Business Account

• FREE 1st Cheque book

• FREE Out-Station Cheque Collection

• FREE Monthly Business Statements

Eligibility

By maintaining a minimum monthly average balance of BDT 250,000/-, any of the following business entities can benefit from Business Plus Account.

• Sole Proprietorship

• Partnerships

• Self Employed Professionals

• Limited Liability Company (LLC)

• Local Development Organizations (Only Liability Relationship)

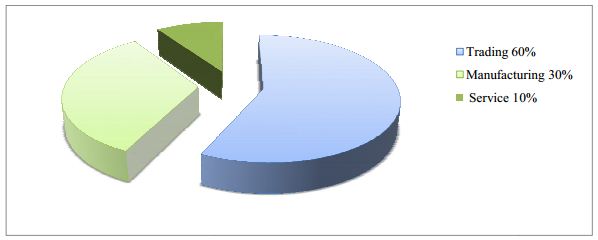

Sector wise Distribution of SMEs

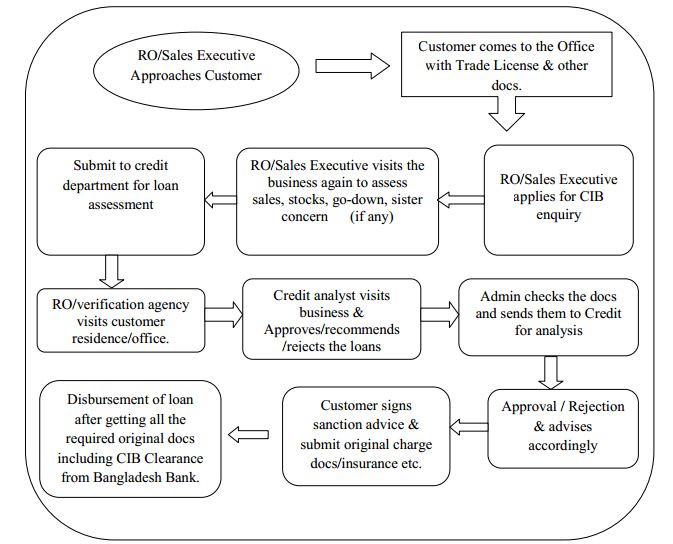

SME Loan Process Flow

When a customer comes to the unit office for a loan request, first he/she meets with the Relationship Officer (RO) or sales executive to discuss about the loan, which loan product is suitable for him/her. After then the following process takes place.

Flow Chart of SME Loan Process

Monitoring

Monitoring is a system by which a bank can keep track of its clients and their operations. So monitoring is an essential task for a Relationship Officer (RO) to know the borrowers activities after the loan disbursement. This also facilitates the buildup of an information base for future reference.

Importance of Monitoring

Through monitoring a Relationship Officer (RO) can see whether the enterprise invested the sanctioned amount in the pre-specified area of his business, how well the business is running, the attitude of the entrepreneur, cash credit sales and purchase, inventory position, work in process and finished goods etc. This information will help the RO/Standard Chartered Bank to recover the loan accruing to the schedule and to take the necessary decisions for repeat loans. Moreover, monitoring will also help to reduce delinquency. Constant visit over the client /borrower ensures fidelity between the bank and the borrower and tends to foster a report between them.

Area of Monitoring

The purpose is to know the entire business condition and all aspects of the borrowers so that mishap can be avoided.

i. Business Condition: The most important task of the Relationship Officer (RO) to monitor the business frequently, it will help him to understand whether the business is running well or not, and accordingly advice the borrower, whenever necessary. The frequency of monitoring should be at least once month if all things are in order.

ii. Production: The RO will monitor the production activities of the business and if there is any problem in the production process, the RO will try to help the entrepreneur to solve the problem. On the other hand the RO can also stop the misuse of the loan other than for the purpose for which the loan was disbursed.

iii. Sales: Monitoring sales proceed is another important task of the RO it will help him to forecast the monthly sales revenue, credit sales etc. which will ensure the recovery of the monthly loan repayments from the enterprise as well as to take necessary steps for future loans.

iv. Investment: It is very important to ensure that the entire loan has been invested in the manner invented. If the money is utilized in other areas, then it may not be possible to recover the loan.

v. Management of raw materials: In case of a manufacturing enterprise, management of raw materials is another important area for monitoring. If more money is blocked in raw materials then necessary, then the enterprise may face a fund crisis. On the other hand the production will suffer if there are not enough raw materials.

Monitoring System

The Relationship Officer (RO) can consider the following thing for monitoring:

I. The RO will monitor each business at least once a month. He/she will make a monitoring plan or schedule at the beginning of the month. During monitoring the RO must use the prescribed monitoring from and preserve in the client file and forward a copy of the report to SME head office immediately.

II. A SME branch will maintain the following files: The file will contain Purchase Receipt, Delivery Memo’s, and Quotations. In addition, all other papers related to furniture and fixture procurement.

III. Other fixed assets and refurbishment: All fixed assets and refurbishment related papers such as purchase receipt, delivery memo’s, quotation, guarantee and warrantee papers, servicing related papers and any other paper related to fixed assets are refurbishment will be in this file.

IV. Lease agreement file: This file will contain all papers related to lease agreement between the lease giver and owners of the leased premises.

V. Individual client file: Individual files are to be maintained for each borrower and that will hold loan application, Loan Proposal, Copies of Loan Sanction Letter, Disbursement Memo, Monitoring Report, CIB (Credit Information Bureau) application and Report, Credit report from other bank and all other correspondents including bank receipt.

VI. Statement file: All types of statement sent to SME head office will be kept in this file chronologically. The Statement file is so important for the bank.

VII. Office instruction file: All kind of office instruction regarding administration should be kept in this file.

VIII. Operating instruction and guideline files: All kind of office instruction and guidelines related to operating should be kept in this file.

IX. Security documents and legal aspect file: One set of security documents and lawyer’s opinions and suggestions regarding issue will be kept in this file.

X. Survey form file: After conducting survey, all survey will be kept in this file sequentially.

SME Relates With Modern Marketing Concept

At the present world SME banking is an industry in transition. From a market that was considered too difficult to serve, it has now become a strategic target of banks worldwide. In our country perspective, the objective of modern marketing concept is the customer satisfaction and this satisfaction comes through incorporated marketing efforts. In terms of SME the goal is to economic development of our country through meeting and exceeding customer needs better than competition. In terms of customer point of reference, SME provides the best facilities to customers regarding their needs. The marketing process of SME that is related on the modern marketing concepts are briefly

describing in the below;

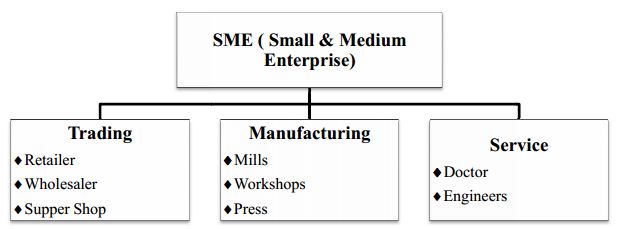

Market Segmentation

The market consists of many types of customers, products and needs and the marketer has to determine which segments offer the best opportunity for achieving company objectives. SME segments the market into three categories: Trading, Manufacturing, and Service.

Target Customer

Today’s business world is a competitive business world and it is tough to take a good market position in any kind of business. So, to succeed in today’s competitive marketplace, organization must be customer centered and keeping them by delivering greater value. But before it can satisfy customers, organization must first understand their needs and wants. There are too many different kinds of consumers with too many different kinds of needs and some organizations in a better position to serve certain segments of the market. In terms of SME Loan of Standard Chartered Bank, their target customers are small and medium enterprises. And at the same time the fresh entrepreneurs are also the target customer of SCB. So SCB mainly targeted those clients who actually understand their own business.

There are three sectors of target customers which SME follows: Trading, Service and Manufacturing. Basically according to the clients demand, SME support them financially to enhance their business.

Target Market

SME products of SCB have build with the objective to support small & medium enterprises of Bangladesh. The target market for SME credit is;

1. Service (Professional) Sector (Doctors, Engineers, etc.)

2. Trading Sector (Retailers, Wholesalers, Supply chain)

3. Manufacturing Sector.

4. Business Sector (Advertising agencies, Consultants, Developers, etc.)

Although SME has several products like; Business Installment Loan (BIL), Overdraft etc.

Developing Marketing Mix

Marketing mix is very important for any organization, because the set of convenient strategic marketing tools like; “product, price, place and promotion” that the organization combine to produce it wants in the target market. The many possibilities can be controlled into four groupsof variables known as the four P’s: Product, Price, Promotion and Place.

Product

Product means the goods and services combination the company offers to the target market. In view of SME, they have short term and medium term loans whether RO provide quick and quality services to clients. Customer service is another element of product strategy. A company designs its products and support services to profitability meet the needs of target customers. Short terms products means 3/6/9/12 months loan (not more than one year) and midterm product means 15/18/24/30/36/48/60/72 months loan (it’s up to 10 years or more).

Price

In the competitive market price is the very sensitive issue for the customer. Price is the amount of money customers have to pay to obtain the products. In terms of SME of Standard Chartered Bank, clients have to pay a certain amount of processing fees and stamp costs to get the loan. SCB charges this price on the basis of competitive market. Standard Chartered Bank charge SME interest rate up to 20% for per annum. It is very low from the other competitive banks because the other banks charge interest rate 22% to 26% per annum. At the same time SCB carry

the charge of CIB (Credit Information Bureau) that is taken from the Bangladesh Bank.

Place

Place means where the products or services are available for the customer. Place includes company’s activities that make the product available to target consumers. SCB already try to spread out its unit offices around the country. At the same time, SCB tries to reach each and every small business enterprise to meet client’s demands through the SME service.

Promotion

Promotion means to promote the goods or services for the customer. It means activities that communicate the merits of the product and persuade target customers to buy it. So, advertisement is one of the major elements in promotion. SME is focusing customers by printing various leaflets, magazines and showing banners in front of their respective unit offices. For example; Door Step Banking is one kind of promotional activities. It is a door-to-door customer

services to clients.

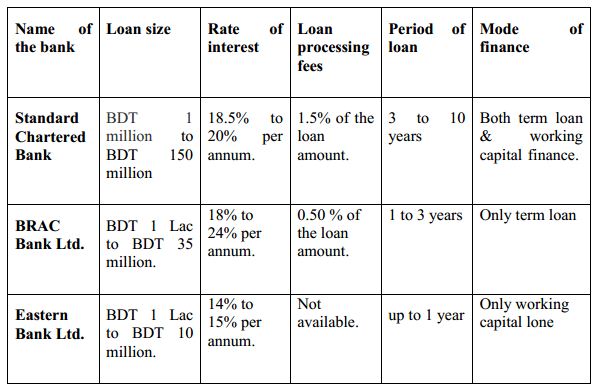

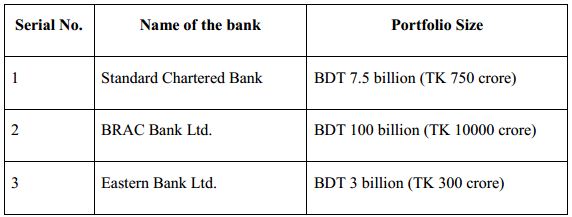

Comparative Analysis of SME Credit Scheme of Two Different banks

Portfolio Size of three different banks in SME Sector

On the basis year of 2011 SME loan portfolio information we can see that, the BRAC bank is the highest investor in the SME sector and take the first position, Standard Chartered Bank stay in the second position and Eastern Bank Ltd. stay in the third position.

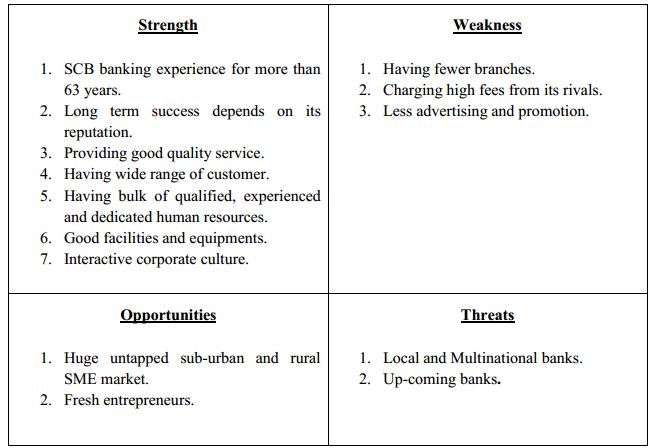

SWOT Analysis

SWOT analysis means the comparison of Strengths, Weaknesses, Opportunities and Threats. Its essential purpose is to identify the strategies that will create a firm-specific business model that will best line up, fit, or match a company’s resources and capabilities to the demands of the environment in which it operates. It helps the organization to identify how to evaluate its performance and examine the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition.

Findings

The findings of this report are given below;

• Small number of branches.

• No specific guideline to deal with applied cases.

• Most of the customers want to reduce the interest rate and increase tenure.

• Security size is highest among all consumer banking products.

• Huge number of documents in the helpdesk causes delay in the disbursement process.

• Process time sometimes even longer due to delayed submission of CIB report.

• Lack of marketing activities in the sub-urban and rural area, whereas other competitors are giving more advertising at different spot.

• In the size of loan amount, SCB give the loan up to BDT 150 million (per person) that is higher from the other banks loan amount.

• In terms of interest rate SCB charge 18.5% to 20% per annum that is more or less average interest rate from the other banks.

• In terms of loan processing fees SCB charge 1.5% of the loan amount that is high from the other competitors and at the same time this high charge impose the negative impact on the customer.

• In terms of loan period SCB give 3 to 10 years that create positive impact on the customer mind and it provide the maximum time of the loan from the other competitors.

• In the mode of finance SCB give both term loan & working capital finance that impose the very effective things on the customer mind.

Recommendation

SCB is a well known international bank with a reputation to live up to. It is high time to improve the performance of SME. For better improvement of SME, SCB can consider the following recommendation;

• Try to open new branches in this country.

• Structure should be developed to deal with demand cases.

• More SME service center need to be added to fully take the advantage of the huge potential customer segments.

• The Bank should have more conference in overseas, work shop, symposium, and seminar for more expansion of SME loan.

• Loan facility parameter should be expanded so that all the people can get loan according to their needs.

• Barriers should be removed by taking advanced steps in mode of disbursement, charge documents and approval process.

• SME Loan sanctioning and disbursement procedure should be easy and flexible being considered the requirements of different classes of people.

• Reduce the interest rate because most of the competitors are providing loans at a lower rate.

• Reduce the loan processing fees.

• Try to reduce the amount of security size because most of the competitors are providing loans by taking minimum securities.

• Introducing more business loan or SME products.

• Giving more training to the sales people to ensure the quality submission of application.

• Training programs should be developed for credit support employees.

• Increase marketing activities in the urban and rural area.

• Increasing minimum loan amount up to 15 Lac, for attracting small business.

• Re-verification policy should be applied properly.

Conclusion

Standard Chartered Bank is a strong and effective player in the financial system in Bangladesh. It is a forward-looking, modern multinational bank with a record of sound performance in this country. In this country it is committed to provide high quality financial services to contribute to the growth of GDP of the industrialization, increasing export & import, creating employment opportunity, rising standard of living and overall sustainable socio-economic development. In Bangladesh it is now one of the top listed and most profitable private sector commercial bank. It also emphasizes on the domestic scenario more closely and analyzes any certain trends and

strategies of their competitors. The bank must accept any failures and think of them as an objective to pursue future goals instead of blaming such failures on other factors and in this way the Bank will be able to keep on playing its important roles in our economy. At the same time to cope with recent challenge of banking sector Standard Chartered Bank is creating an environment where employees are happy to build their career and customers feel good doing business with them.