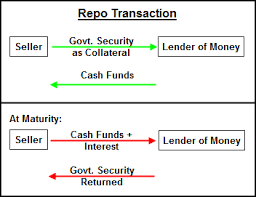

Repurchase agreement is a type of short-term borrowing with regard to dealers in federal securities. The dealer sells the us government securities to shareholders, usually on an overnight basis, and buys them back the next day. A repurchase agreement, also known repo, is the purchase of securities in addition to an agreement to the seller to invest in back the securities at a later time. The repurchase price need to be greater than an original sale price, the actual difference effectively which represents interest, sometimes called the repo rate.

Repurchase Agreement Definition