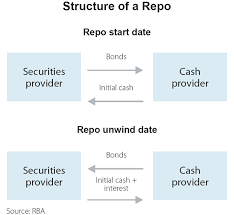

Repurchase agreement where a seller of some sort of security agrees to acquire it back from the buyer at a larger price on some sort of specified date. These agreements have been in effect loans concerning investors to suppliers, and are utilized usually for raising short-run finance by financial institutions and corporations. Repos are used also by the central banks seeing that instruments of financial policy. To temporarily expand the bucks supply, a central financial institution decreases the discount rate from which it buys back government securities in the commercial banks, to contract or maintain the money supply it raises the repo rate.

Repurchase Agreement