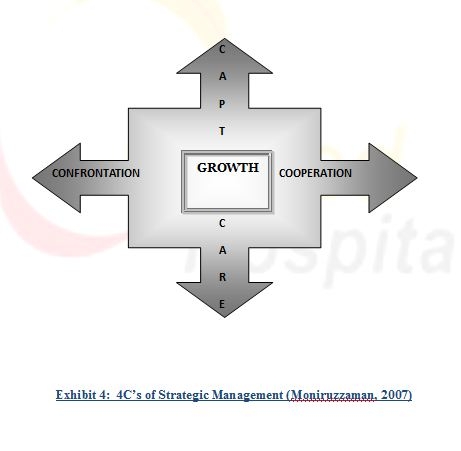

For this project, we collected data from both primary sources and secondary sources. Both the sources are explained below – Primary Sources: A face to face interview questionnaire designed by our honourable faculty Mohammad Moniruzzaman was used to conduct personal interview with Syed Moniruz Zaman, Supervisor CRD. From this, we got valuable insight i.e. marketing views, visions, and tactical plans about United Hospital Ltd. The frameworks or models provided by Mohammad Moniruzzaman (2006) were the tools that we used to analyze and to come up with solutions and the service marketing implications. Secondary Sources: For secondary research, the website of United Hospital Ltd. has provided much useful information to us.

This report covers all the steps of strategic service marketing plans (Moniruzzaman, 2006) i.e. Strategic analysis, Service strategy formulation, Strategy implementation and Evaluation.

Chapter 1: Introduction: In the Introduction, all the activities included in this chapter are explained. In the second section the methodology of the project that is mean the data collection techniques used is explained briefly. And lastly the third part involves the report structure that involves all the brief explanation of each subsequent chapter and its contents.

Chapter 2: Strategic Analysis: This is one of the most important chapters of this report and contains the strategic analysis of UnitedHospital by analyzing the resources and capabilities of the Hospital and comparing them with the environmental issues, identifying the potential effects of the compatibility between the environmental issues and the Hospital’s resources and capabilities, analyzing the implications of such compatibility. Below given the list of strategic analysis that we use to determine the strategy:

Chapter 3: Services Strategy Formulation: Service strategy formulation is very important for United Hospital Limited’s future prospect. We have identified key success factors (KSFs), and the Favorable/Unfavorable, we formulate services strategies for the United Hospital Limited which discuss detailed in this chapter.

Chapter 4: Implementation & Evaluation: In this chapter we have discussed about the plans that are made regarding the successful implementation of these strategies. This chapter contains information which will help the hospital to implement strategic options. After that we discussed about how UHL can evaluate the formulated services.

Chapter 5: Strategic Plan: This chapter is all about the results of the strategic services marketing process of UnitedHospital. We have suggested some strategies to the UnitedHospital which will help the hospital to achieve their desired goal.

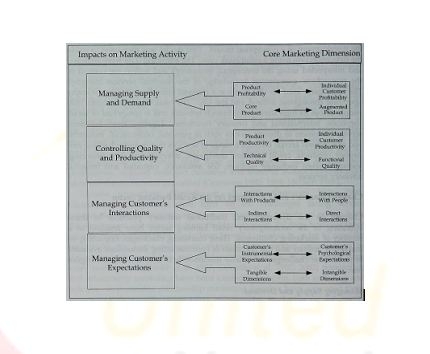

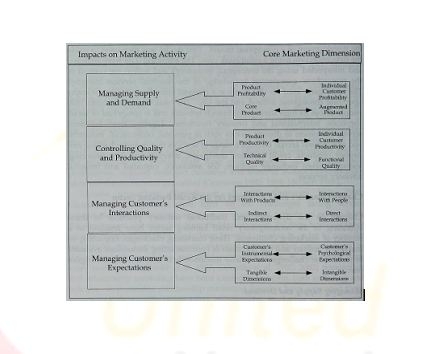

Environmental Demands: According to the framework of strategic initiatives presented to us by our faculty Dr. M. Moniruzzaman, there are four environmental demands, namely:

- A. Macro-Environmental Demand

- B. Customer Demand

- C. Competitor-Specific Demand

- D. Company Internal Demand

The strategic services marketing framework entails the analysis of the three types of environmental forces: (i) macro forces; (ii) micro forces; and (iii) internal forces. All the above mentioned four environmental demands can be categorized under these three forces. The macro-environmental demands falls under macro forces; customer and competitor-specific demands falls under micro forces and company internal demands falls under internal forces. All these four major categories of demands fall under the positive model in the framework. Triangular Model: Exhibit 1: Triangular Model Capability vs. Orientation Capability refers to a firm’s ability to respond to environmental demands. Such ability may include financial ability, brand recognition or ability to understand customers. On the other hand, orientation relates to the firm’s willingness or commitment to environmental response. Indeed, for a firm to respond both effectively and efficiently, it must be both committed and able to respond to environmental variables. Capability-specific items or measures:

- Sales productivity in currency

- Productivity in terms of current prospects

- Productivity in terms of future prospects

- Amount of time it takes to convert prospects into buyers

- Level of commitment exhibited by a typical buyer

- Ability to accurately qualify a prospect

- Ability to determine a buyer’s wants and needs

These items would use a five-point scale, in which 1 represents ‘very dissatisfied’ and 5 represents ‘very satisfied ’. In Context of United Hospital Ltd: We have calculated the mean for capability of United Hospital from survey data. Mean: 51/13= 3.9 The minimum cut off level is 4. Therefore, United Hospital does not have the capability to meet up their orientation/ commitment/ willingness. External Customer-orientation One major determinant of customer satisfaction and retention is the customer orientation of a service firm. Customer orientation reflects the disposition of individuals working in service industries to focus on and meet customers’ needs. Previous research has found customer orientation to be associated with important outcomes such as repurchase intentions, loyalty, and customer value perceptions. For services firms, a major determinant of customer retention is a satisfactory relationship between customers and service providers. In financial services, satisfaction with the relationship leads not only to increased customer loyalty and retention, but results in greater referrals and reduces clients’ perceived risk and transaction costs. Relationship satisfaction also leads to increased customer commitment. Creating strong, satisfactory relationships with clients involves more than just being skilled in financial services. It involves understanding the ‘whole picture’ of a client and staying connected through open communication. It requires listening, managing clients’ emotional states and tendencies, and ensuring trust. Empathy has been suggested as being related to satisfaction as well. Enhancing customer relationships may also require investments in technology such as a customer relationship department (CRD) system. The benefits of an effective CRD system include not only higher efficiency but also higher levels of client service, satisfaction, and retention (and ultimately increased profitability). Firms’ central role is to apply emotional intelligence to services planning and manage the relationships with their customers on a deeply personal level. There is some empirical evidence that customer orientation is related to relationship quality in that the use of customer-oriented selling has been found to be related to the quality of the customer – salesperson relationship. Customer orientation has also been empirically linked with a number of important client outcomes such as customers’ perceptions of employee performance, customers ’ perceptions of value, repurchase intentions, loyalty, and word-of-mouth behavior. Customer orientation-specific measures:

- I find it easy to smile at each of my customers.

- I enjoy remembering my customers’ names.

- It comes naturally to have empathy for my customers.

- I enjoy responding quickly to my customers’ needs.

- I get satisfaction from making my customers happy.

- I really enjoy serving my customers.

- I try to help customers achieve their goals.

- I achieve my own goals by satisfying customers.

- I get customers to talk about their service needs with me.

- I take a problem solving approach with my customers.

- I keep the best interests of the customer in mind.

- I am able to answer a customer’s questions correctly.

Customer orientation is measured using a 12-item scale. Respondents would be asked to indicate their level of agreement/disagreement with statements such as, ‘I enjoy responding quickly to my customers’ needs’ and ‘I get customers to talk about their service needs with me’. The items use a five-point scale in which 1 represents ‘strongly disagree’ and 5 represents ‘strongly agree’. The scale items, presented above, are averaged across the 12 items to arrive at an overall customer orientation score. Coefficient alpha for the customer orientation measure must be =>.88 to confirm strong internal consistency. In Context of United Hospital Ltd: Customer Advisor of United Hospital: From capability-specific questions, we calculated a mean of (51/13) = 3.9. The minimum cut off level is 4. Therefore, UnitedHospital has not required capability to meet up their orientation/ commitment/ willingness. From the external-customer orientation of customer advisor and CRD of United Hospital, we computed a mean of (291/70) = 4.16. We have taken five interviews on “External Customer Orientation”. Therefore, Mean: (70+56+60+54+51)/ (14*5) = 291/70 = 4.16 The minimum cut off level is 3. Therefore, UnitedHospital has strong orientation/ commitment/ willingness to try to help customers achieve their goals. Customer Analysis:

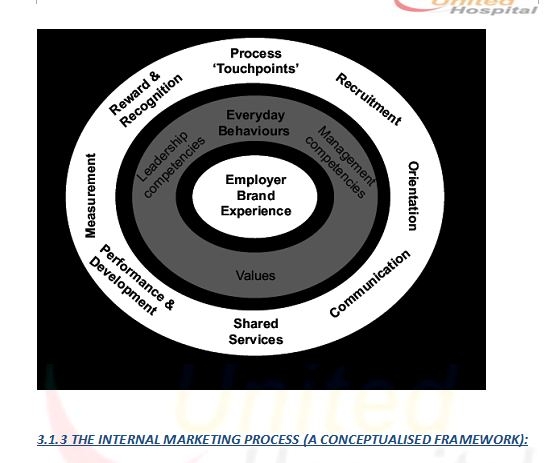

- Propensity to Evaluate (PEV):

From the customer analysis segment of the questionnaire, we calculated a mean of 4.78 for Propensity to Evaluate (PEV). Therefore, Mean: 359/ (5*15) = 4.78 The minimum cut off level is 4. Therefore, UnitedHospital has strong orientation/ commitment/ willingness to know customer preference. Image: We have analyzed the mean of 4.73 for the category of image. Mean: 71/ (5*3) = 4.73 The minimum cut off level is 4. Therefore, UnitedHospital has strong orientation/ commitment/ willingness to create positive image compared to other hospital. Commitment: In term of commitment of the clients toward UnitedHospital the mean is 4.48. Therefore, Mean: 157/ (5*7) = 4.48 The minimum cut off level is 4. Therefore, UnitedHospital has moderate orientation/ commitment/ willingness for customer welfare. Quality/Reliability: For quality/ reliability the mean is 4.52. Therefore, Mean: 113/ (5*5) = 4.52 The minimum cut off level is 4. Therefore, UnitedHospital has moderate orientation/ commitment/ willingness to deliver quality service for its customers. Satisfaction: For the satisfaction of the health care customers toward the service of UnitedHospital, the mean is: Mean: 90/ (5*4) = 4.5 The minimum cut off level is 4. Therefore, UnitedHospital has moderate orientation/ commitment/ willingness to make the customers satisfied through meeting up their expectations. Capability vs. External Customer-orientation Therefore the capability of United Hospital is not consistent with the customer orientation. Internal customer orientation: A service company can be only as good as its people. A service is a performance, and it is usually difficult to separate the performance from the people. If the people don’t meet customers’ expectations, then neither does the service. To realize its potential in services marketing, a firm must realize its potential in internal marketing (IM) —the attraction, development, motivation, and retention of qualified employee-customers through need-meeting job-products. With services, internal marketing paves the way for external marketing. The rationale for the adoption of IM is the increasing recognition of the importance of the employees’ role in the service industry. By treating employees as internal customers, one can ensure higher employee satisfaction and, subsequently, the development of a more customer conscious, market-oriented and sales-minded workforce. More than 20 years ago, IM was first proposed as a solution to the problem of delivering consistently high quality of service. Today the concept is being increasingly discussed in the literature as a strategic tool for meeting and exceeding customers’ expectations. Several IM definitions have been developed over the years and all have at their heart the notion of viewing and treating employees as internal customers. What follows is a small sample of definitions in order to illustrate the concept’s underlying principles. ‘Internal market of employees is best motivated for service mindedness and customer-oriented behaviours by an active, marketing-like approach, where marketing-like activities are used internally’. IM is defined as: ‘Any form of marketing within an organization which focuses staff attention on the internal activities that need to be changed in order to enhance external marketplace performance’. IM is also defined as: ‘a planned effort using a marketing-like approach to overcome organizational resistance to change and to align, motivate, and inter-functionally coordinate and integrate employees towards the effective implementation of corporate and functional strategies in order to deliver customer satisfaction through the process of creating motivated and customer-oriented employees’. The logic of viewing employees as ‘internal customers’ is that by satisfying the needs of internal customers, a firm should be in a better position to deliver the quality desired to satisfy external customers. Implicit in this logic is the underlying assumption that the satisfaction of employee needs enhances employee motivation and retention, and subsequently the higher the degree of employee satisfaction, the higher the possibility of achieving external satisfaction and retention. The companies that practice internal marketing most effectively will: (1) compete aggressively for talent market share: (2) offer a vision that brings purpose and meaning to the workplace: (3) equip people with the skills and knowledge to perform their .service roles excellently: (4) bring people together to benefit from the fruits of team play: (5) leverage the freedom factor; (6) nurture achievement through measurement and rewards: and (7) base job-product design decisions on research. Exhibit below presents a rating sheet that we have used to evaluate internal marketing capability and orientation UnitedHospital. The above rating device allows you to determine both the capability and orientation (commitment) with regards to your firm’s internal customers’ demands. In term of United Hospital, they have excellent internal marketers as their total score is 20. Internal coordination & innovativeness: The inter-functional coordination is the coordinated utilization of company resources & capabilities in creating superior value for target customers. Any point in the buyer’s value chain affords an opportunity for a seller to create value for the buyer firm. Therefore, any individual in any function in a seller firm can potentially contribute to the creation of value for buyers. Creating value for buyers is much more than a “marketing function;” rather, a seller’s creation of value for buyers is analogous to a symphony orchestra in which the contribution of each subgroup is tailored and integrated by a conductor—with a synergistic effect. If senior managers have a close relationship with current and prospective customers, this indicates a robust inter-functional coordination and if they actively seek and encourage innovative ideas based on research results, they will have an emphasis on innovativeness. Inter-functional Coordination (N of items=7)

- Our top managers from every function regularly visit our current customers.

- Our top managers from every function regularly visit our prospective customers.

- Our managers understand how employees can contribute to value of customers.

- All of our business functions are responsive to each other’s needs.

- Information about our customers is freely communicated throughout our organization.

- All of our business functions are integrated in serving the needs of our target markets

- All of our business developments are responsive to each other’s requests.

The mean for inter-functional coordination is: Mean: 29/7= 4.14 The minimum cut off level is 4. Therefore, UnitedHospital has good orientation/ commitment/ willingness to contribute the value to its customers. Innovativeness (N of items=5)

- Management actively seeks innovative ideas.

- Innovation, based on research results, is readily accepted in our organization.

- Innovation is readily accepted by management.

- People are penalized for new ideas that don’t work.

- Innovation in our organization is encouraged.

The mean for innovativeness is: Mean: 16/5= 3.2 The minimum cut off level is 3. Therefore, UnitedHospital has good orientation/ commitment/ willingness to generate new ideas to sustain in the business. Overall Capability vs. Overall Company Orientation: The Mean of capability is 3.9. The minimum cut off level is 4. Therefore, UnitedHospital has not required capability to meet up their orientation/ commitment/ willingness. Therefore Capability of United Hospital is not consistent with Inter-functional Coordination & Innovativeness. Competition orientation: Competitor orientation means that a firm understands the short-term Fs and Ds and long-term strategies of both the key current and the key potential competitors. Paralleling customer analysis, the analysis of principal current and potential competitors must include the entire set of initiatives capable of satisfying the current and expected needs of the firm’s target buyers. Competition orientation depends on top management taking a strong interest in competitor actions as well as in responding to such actions if they result in either/or F/D for its own firm. Competitor orientation (N of items=12):

- Our firm analyses the assumptions of our major competitors about their own status/position.

- Our firm analyses the assumptions of our major competitors about other firms.

- Our firm analyses the assumptions of our major competitors about customers.

- We regularly analyze competitors’ Ds.

- We regularly analyze competitors’ Fs.

- We always determine the success of our competitors.

- We always determine the failure of our competitors.

- We identify the initial objectives set out by our major competitors.

- We identify competitors’ realized strategies.

- We conduct our ‘relative capability analysis’ to determine our relative F/Ds.

- We rapidly respond to competitive actions that lead to a D (s) for us.

- We target customers where we have an F for competitive advantage.

Competitor orientation (According to UnitedHospital) From the data given by the UnitedHospital we have calculated the mean for competition which is: Mean: 41/12= 3.4 The minimum cut off level is 4. Therefore, UnitedHospital does not have strong orientation/ commitment/ willingness to conduct ‘relative capability analysis’ to determine its relative F/Ds. Competitor orientation (According to LABAID) From the data given by the LABAID we have calculated the mean for competition which is: Mean: 50/12= 4.16 The minimum cut off level is 4. Therefore, LABAID has strong orientation/ commitment/ willingness to conduct ‘relative capability analysis’ to determine its relative F/Ds. Overall Capability vs. Overall Competitor Orientation The Mean of capability is 3.9. The minimum cut off level is 4. Therefore, UnitedHospital has not required capability to meet up their orientation/ commitment/ willingness. Therefore the capability of UnitedHospital is not consistent with the Competitor Orientation. Macro orientation Macro forces affect a firm in various ways. These forces along with the forces discussed above interfere with a firm’s activities. Known as the ‘intervening conditions’, these factors determine a firm’s success or failure. Most firms, particularly, service firms tend to discount significance of the macro-environmental forces and have consequently, suffered both economically and socially. Examples include the airlines industry (after 9/11), the tourism industry in certain countries (e.g., India-Kashmir), and recently, the hotel and the banking sectors (due to global recession). Macro orientation (N of items=5):

- Our firm has a formal framework to scan the macro factors.

- We use this framework regularly.

- We are able to identify the macro factors that would affect our firm.

- We use a framework to priorities the macro issues.

- We are able to determine how the macro forces would affect our firm.

The mean for United Hospital’s Macro orientation: Mean: 20/5= 4 The minimum cut off level is 3. Therefore, UnitedHospital has strong orientation/ commitment/ willingness to determine the macro forces that could affect them Overall Capability vs. Overall Macro Orientation The Mean of capability is 3.9. The minimum cut off level is 4. Therefore, UnitedHospital has not required capability to meet up their orientation/ commitment/ willingness. Therefore, Capability of United Hospital is not consistent with the Macro Orientation. 2.3 EFFECT-IMPLICATION-OBJECTIVE-KSF Customer Analysis: Propensity to Evaluate (PEV): Effect:

- Health care consumers are unaware of many of the new services offered by the United Hospital Ltd. As a result client’s retention rate is low.

Implication:

- Customer Relationship Department (CRD) should be developed to identify the clients’ needs.

Objective:

- At least twenty people should be trained within three months.

KSF:

- Train employees.

Image: Effect:

- United Hospital emphasizes less on their brand recognition. It increases the probability to lose future prospects.

Implication:

- Promotional activities should be implemented for brand recognition and to attract future prospects.

Objective:

- Emotional appeal and slice of life must be applied in promotion for client retention in the long run.

KSF:

- Brand recognition to increase brand loyalty.

Commitment: Effect:

- Client’s commitment to the service of the hospital is very low.

Implication:

- Health care consumer relationship should be developed for retention of loyal customers.

Objective:

- United Hospital should give priority to the patient’s feedback.

KSF:

- Customer retention.

Quality/Reliability: Effect:

- Any disruption to provide quality service will increase the number of disappointed clients.

Implication:

- United Hospital should provide high level of quality service to its patients. It will lead to client satisfaction and will increase the number of committed health care consumer.

Objective:

- United Hospital should regularly inspect their service quality they promised.

KSF:

- Inspect service quality to provide quality service.

Satisfaction: Effect:

- Health care consumers are dissatisfied due to lack in providing the level of quality services promised by the hospital.

Implication:

- Client’s expectation from the hospital should be taken in to account.

- Surveys must carry out to learn what clients want from.

- Management team should be trained to identify the problems and respond effectively and efficiently.

Objective:

- Health care consumer research should be conducted.

KSF

- Health care consumer research to understand customers demand.

Internal customer orientation:

Inter-functional Coordination:

Effect:

- Customer’s dissatisfaction increases due to lack in serving the desired demand.

Implication:

- United Hospital should increase the efficiency level of the doctors and nurses.

Objective:

- Increase internal communication of customer relationship department managers.

- Initiate training and development process by collaborating with medical universities.

- Training and development must be initiated in order to train the nurses.

KSF:

- Enhance internal communication to provide better services to the customers.

Innovativeness Effect:

- Increase the probability to lose market position.

Implication:

- United Hospital should encourage innovativeness to the employees in terms of promotional activities, providing service, resource management and maintenance.

Objective:

- Motivate employees to encourage innovation.

- Separate salary, compensation and benefit packages for the foreign trained doctors and nurses in order to retain them.

KSF:

- Encourage innovativeness to capture market position.

Initiate effective Human Resource Management Policies and Practices 2.3.3 Competition orientation Effect:

- Probability to loss current customer and future prospects.

- Services provided by the competitors will capture more customers from UnitedHospital.

- Competitor’s investment in health care technology will lead to lose competitive advantage in the health care industry.

Implication:

- United hospital should analyze competitor’s initiatives regularly.

- United hospital must compete aggressively for talent market share.

Objective:

- United Hospital should develop strategy to analyze competitors move.

- High qualified doctors to gain competitive advantage over competitors.

KSF:

- Analyze Competitors’ Actions to determine its current positions.

- Offer adequate salary and compensation packages.

Macro orientation:

Effect:

- Lack of technological advancement will hamper the complex services provided by the hospital.

Implication:

- United hospital should develop framework to identify the macro factors that affecting the operation of the hospital.

- United hospital should invest more in health care technology to serve better quality services to the patients.

Objective:

- United hospital should determine how the macro forces would affect their firm by using the framework.

KSF:

- Develop framework to analyze the macro factors that affects the hospital.

- Adapt new health care technology.2.4 Comparison Model:

Exibit 2: Comparison Model

Based on our survey on UnitedHospital we have found out that there is no compatibility between Orientation and Capability of any demands. Therefore, every demand is incompatible.

Unfavorable: | Macro |

Unfavorable: | Customer |

Unfavorable: | Competitor |

Unfavorable: | Company Internal |

Key Success Factors (KSFs): Macro:

- Develop framework to analyze the macro factors that affects the hospital.

- Adapt new health care technology.

Competitor:

- Analyze Competitors’ Actions to determine its current positions.

- Offer adequate salary and compensation packages.

Customer:

- Propensity to Evaluate (PEV):

- Train employees.

- Image:

- Brand recognition to increase brand loyalty.

- Commitment:

- Customer retention.

- Quality/Reliability:

- Inspect service quality to provide quality service.

- Satisfaction:

- Health care consumer research to understand customers demand.

Company Internal:

- Internal coordination:

- Enhance internal communication to provide better services to the customers.

- Innovativeness:

- Encourage innovativeness to capture market position.

- Initiate effective Human Resource Management Policies and Practices.

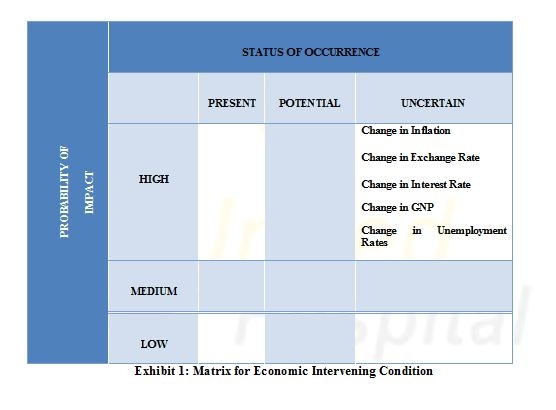

Intervening Condition: Intervening conditions define the overall condition that exists in the environment which might work or favor of the company or create problem for the company.

Economic:

- 1. Change in Inflation

- 2. Change in Exchange Rate

- 3. Change in Interest Rate

- 4. Change in GNP

In the analysis of intervening condition, at first we are going to discuss about the economic factors.

Exhibit 1: Matrix for Economic Intervening Condition

Changes in Inflation:

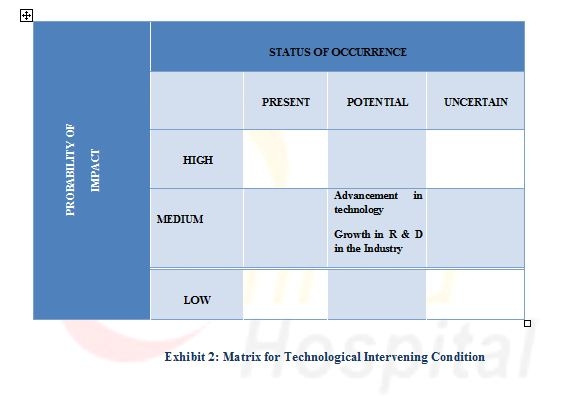

Change in inflation has been rated uncertain for UnitedHospital as it is health care industry inflation plays a very little role to affect the operation of their service. This is why the impact of economic factors is low on the company. Change in Exchange Rate: The status of occurrence for Exchange rate is uncertain in the environment for UnitedHospital, which impact very low in the firm. Change in Interest Rate: Interest rate rarely impact on the operation of the hospital. This is why is uncertain and the impact on the hospital is low. Change in GNP: Change in GNP is uncertain and the impact on the hospital is low. Change in Unemployment Rate: Unemployment rate is uncertain and the impact on the hospital is low. Technological: Advancement in Technology Growth in R & D in The Industry The second division of intervening condition that we are going to discuss is technological factors.  Advancement in Technology: Advance in technology is very important intervening for health care industry. Advance in technology will give the competitor to capture the market share. Most of the complex operations are done with the combination of qualified doctors and technology. In case of UnitedHospital this component has been rated as potential in the status of occurrence and the probability of impact is moderate for the hospital. Growth in R&D in the Industry: Research and development is also an important component for hospital. It was rated as potential for the company and the probability of impact on the company is moderate. Governmental/Political/Legal:

Advancement in Technology: Advance in technology is very important intervening for health care industry. Advance in technology will give the competitor to capture the market share. Most of the complex operations are done with the combination of qualified doctors and technology. In case of UnitedHospital this component has been rated as potential in the status of occurrence and the probability of impact is moderate for the hospital. Growth in R&D in the Industry: Research and development is also an important component for hospital. It was rated as potential for the company and the probability of impact on the company is moderate. Governmental/Political/Legal:

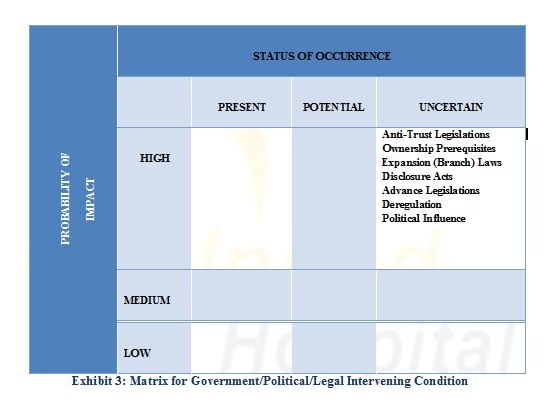

- Anti-Trust Legislations

- Ownership Prerequisites

- Expansion (Branch) Laws

- Disclosure Acts

- Advance Legislations

- Deregulation

- Political Influence

The third division of intervening condition that we are going to discuss is government/political/legal factors. Anti-trust legislations are rated uncertain in the status of occurrence and the impact on the company is low.  Ownership Prerequisites: Ownership Prerequisites are rated uncertain in the status of occurrence and the impact on the company is low.

Ownership Prerequisites: Ownership Prerequisites are rated uncertain in the status of occurrence and the impact on the company is low.

- 2. Expansion (Branch) Laws:

Expansion (Branch) Laws are rated uncertain in the status of occurrence and the impact on the company is low.

- 3. Disclosure Acts:

Disclosure Acts are rated uncertain in the status of occurrence and the impact on the company is low.

- 4. Advance Legislations:

Advance Legislations are rated uncertain in the status of occurrence and the impact on the company is low.

- 5. Deregulation:

Deregulation is rated uncertain in the status of occurrence and the impact on the company is low.

- 6. Political Influence:

Political Influence is rated uncertain in the status of occurrence and the impact on the company is low.

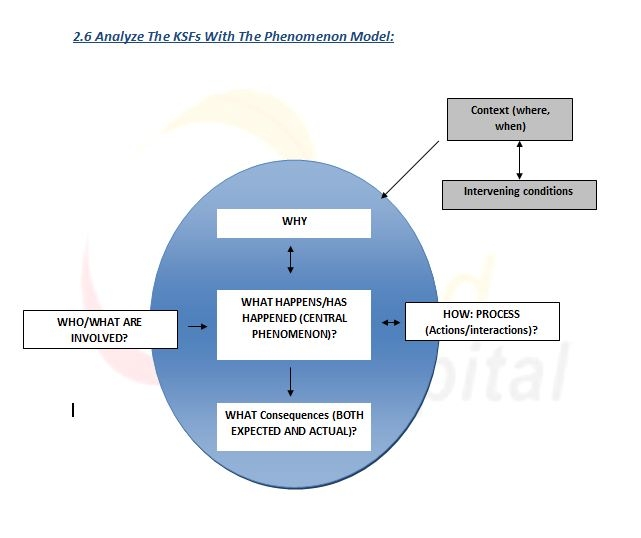

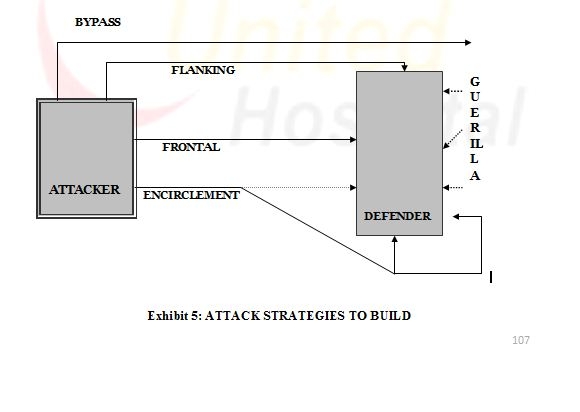

EXHIBIT 3: THE PHENOMENON MODEL (Moniruzzaman, 2006)

Train employees:

- What is going on here?

United Hospital should train their employees.

- Why is it happening? Or what’s its reason for existence?

Customers are not aware of many existing services and new services offered by the UnitedHospital. This affects the overall process of the service which leads to customer dissatisfaction and decrease the profitability of the hospital. To identify clients need and want and aware the client about the services offered by the hospital, employees should be trained.

- Who/what are involved in it?

Customer Relationship Department (CRD) employees are involved in it. The resources for training the employees for example: expanse, time are also involved in this process. CRD employees communicate directly with the customers or patients. If they lack their capability to provide the service than the hospital will face loss. This is why they are playing a vital role in the overall process of service providing. It will be a good step to train them to learn about the customers demand.

- What are the consequences of its occurrence?

The expected outcomes: United Hospital expects to provide their client with quality services. Clients will be fully aware of their service. Their demand will be fulfilled. The actual outcomes: United Hospital is failing to provide their service to the customer as Clients are not fully aware about the services. This is affecting the service predictability of UHL.

- What is the context in which it occurs?

In the context of customers demand.

- How does it happen?

United Hospital should select CRD employees based on their performance. After that they should arrange training for them. Brand recognition to increase brand loyalty

- What is going on here?

United hospital should increase their promotional activities to increase their Brand recognition. Brand recognition will help UnitedHospital by leaning people toward their hospital while health problems arise.

- Why is it happening? Or what’s its reason for existence?

To increase loyalty among the target customers of united hospital needs strong brand recognition. Strong Brand recognition will help them to retain customers and also to improve brand image and positive word of mouth.

- Who/what are involved in it?

Top level management of united hospital must recognize the importance of brand recognition. To have an effective promotional campaign they could hire ad agency.

- What are the consequences of its occurrence?

The expected outcomes: With proper promotional activities united hospital can expect that the level of brand recognition will increase. At the same time customer loyalty and preference will also go up.

- What is the context in which it occurs?

It is occurring in the context of competitive market, where competitors are aggressively promoting their brand to increase target customer preference, loyalty and also retention.

- How does it happen?

To capture most of the market share higher brand recognition is must. Brand which has higher recognition can sell them. Like other success factors brand recognition is also started with recognizing customer’s demand. What services really the target customers want to united hospital. Also selecting the target customers are also important in this process. Customer retention:

- What is going on here?

Commitment of the customers to united hospital is significantly low. Therefore, retention rate is also low. To keep the profitability higher customer retention is an important factor.

- Why is it happening? Or what’s its reason for existence?

Higher customer retention will improve brand image. With higher retention rate will help united hospital to enjoy consistence profitability in the short term as well as in the long term. This will also attract new customers by generating positive word of mouth by the existence customers.

- Who/what are involved in it?

Only by providing superior high quality services united hospital can retain their old customers. So the people who are involved in the process must consist of top level to lower level employees.

- What are the consequences of its occurrence?

The expected outcomes: The expected outcome of customer retention is higher profitability. Customer will come back for services only if they are satisfied with the services and satisfied customers not only increase the profitability but also help the company to attract new customers.

- What is the context in which it occurs?

In the context of external customer.

- How does it happen?

Customer retention makes it easy for the organization to increase profitability, attracting new customers etc. The process of retaining customers starts with providing high quality services in all the level of the hospital. And also important to provide superior services consistently. Inspect service quality to provide quality service.

- What is going on here?

Disruption in providing quality service will lead to disappoint and dissatisfied customers. United Hospital should have a formal framework to inspect their service quality time to time.

- Why is it happening? Or what’s its reason for existence?

Ensuring quality service is an important measure to retain customers and to increase the level of profitability.

- Who/what are involved in it?

United hospitals quality Management department is related with the task. They have the all the resources to maintain quality service and o innovate new services.

- What are the consequences of its occurrence?

The expected outcomes: The expected outcome from the quality service management is to increase customer satisfaction, increase customer retention and attract new customers.

- What is the context in which it occurs?

Customer’s demand for high quality services, competitor’s continuous innovation is the main factors to improve and inspect services.

- How does it happen?

By analyzing customer demand for quality services and then matching with companies own capability united hospital improve their services. Health care consumer research to understand customers demand.-satisfaction

- What is going on here?

Health care consumers are dissatisfied due to lack in providing the level of quality services promised by the hospital. Therefore, to survive in the long run it is important to find out what customer’s really want.

- Why is it happening? Or what’s its reason for existence?

To retain customers in the long run and to maintain the profitability it is important to find out the customer demand. Otherwise UnitedHospital can survive in the market.

- Who/what are involved in it?

Top level management has to develop a framework and according to that they should conduct research time to time also they could look out for competitor’s success factors. They also could take expert help from outside their hospital to conduct such research.

- What are the consequences of its occurrence?

The expected outcomes: In the short term the expected outcome is customer satisfaction leads to higher customer retention in the long run. And smooth profitability in the long run.

- What is the context in which it occurs?

To understand customer is vital for any company in any industry. As a matter of fact customers are always right and should treat like a king. So, understand customers are a major part of business and in the health care services it is crucial to be trusted among the target customers.

- How does it happen?

United hospital’s top management has to conduct a research to find out customers demand. After gathering the data they should follow a formal procedure to analyze the data and deliver according to that. Enhance internal communication to provide better services to the customers.-inter fun

- What is going on here?

Increase internal communication of customer relationship department managers to avoid customer’s dissatisfaction that increases due to lack in serving the desired demand.

- Why is it happening? Or what’s its reason for existence?

It is important to have proper inter-functional coordination among different department to provide solid services. Otherwise there are possibilities not to provide promising services. Also to reduce conflict among different and to provide timely service it is important.

- Who/what are involved in it?

Doctors, nurse, boys also the management all are involved in this process.

- What are the consequences of its occurrence?

The expected outcomes: The expected outcome is to provide superior services and satisfaction, increase loyalty among customers.

- What is the context in which it occurs?

In the context of internal communication.

- How does it happen?

Top management of UnitedHospital should develop the culture of friendly work environment. Also the doctors, nurses could take initiative to develop and practice such process. Encourage innovativeness to capture market position:

- What is going on here?

United hospital should encourage their employees to increase their innovativeness in providing the service.

- Why is it happening? Or what’s its reason for existence?

Lack of innovativeness in the organization will give the competitors an advantage to capture the clients from UnitedHospital. It will affect the company’s overall service providing process, which will lead to customer dissatisfaction and decrease in market share.

- Who/what are involved in it?

Employees responsible for providing the service, employees responsible for promotional activities and resource planning and the customers are involved with the process.

- What are the consequences of its occurrence?

The expected outcomes: United hospital is expecting to attract new prospect by promoting their services in an innovative way. The actual outcomes: Competitors are attracting more prospects by providing their service in innovative ways.

- What is the context in which it occurs?

In the context of internal customer innovativeness.

- How does it happen?

Motivate employees to encourage innovation. Separate salary, compensation and benefit packages for innovative employees. Initiate effective Human Resource Management Policies and Practices.

- What is going on here?

United Hospital should initiate effective Human Resource Management Policies and Practices.

- Why is it happening? Or what’s its reason for existence?

Effective Human Resource Management Policies and Practices will ensure the quality of service in the organization.

- Who/what are involved in it?

Employees from Human Resource Management.

- What are the consequences of its occurrence?

The expected outcomes: Provide service efficiently and effectively. The actual outcomes: Expected outcome is not fulfilling as competitors are capturing their clients by offering more flexible service.

- What is the context in which it occurs?

In the context of internal customer innovativeness.

- How does it happen?

-Motivate employees to encourage innovation. -Separate salary, compensation and benefit packages for innovative employees. Analyze Competitors’ Actions to determine its current positions.

- What is going on here?

United Hospital should analyze competitor’s action.

- Why is it happening? Or what’s its reason for existence?

United hospital can determine its position analyzing competitors action, based on which they will take initiatives.

- Who/what are involved in it?

Employees of United Hospital.

- What are the consequences of its occurrence?

The expected outcomes: United Hospital will capture the maximum market share.

- What is the context in which it occurs?

In the context of competitors action.

- How does it happen?

Analyze competitors F/D. Use framework to manage the services to be provided. Analyze competitor’s assumption. Offer adequate salary and compensation packages

- What is going on here?

United Hospital should offer adequate salary and compensation packages to the qualified doctors.

- Why is it happening? Or what’s its reason for existence?

Competitors can gain advantage by hiring qualified doctors.

- Who/what are involved in it?

Management of United Hospital and the Doctors.

- What are the consequences of its occurrence?

The expected outcomes: Expecting to capture more prospect than the competitors.

- What is the context in which it occurs?

In the context of competitors action.

- How does it happen? [This refers to the process that includes a sequence of steps]

Hire high qualified doctors to gain competitive advantage over competitors. Develop framework to analyze the macro factors that affects the hospital

- What is going on here?

United Hospital should develop framework to analyze the macro factors that affects the hospital.

- Why is it happening? Or what’s its reason for existence?

Macro factor are very important for any organization. Advance in technology or investment in R & D sector will help the hospital to gain competitive advantage. These factors will help the health care organization to step ahead from its competitors.

- Who/what are involved in it?

Management of United Hospital Ltd.

- What are the consequences of its occurrence?

The actual outcomes: The impact of technology and R & D is moderate in United Hospitals.

- What is the context in which it occurs?

In the context of Macro factors.

- How does it happen?

UHL should encourage its management to analyze its macro factor regularly. Adapt new health care technology.

- What is going on here?

United Hospital should adapt new health care technology.

- Why is it happening? Or what’s its reason for existence?

Advance in health care technology will promote competency of the UHL. It will create a demand for the customer; this will lead to attract new prospects.

- Who/what are involved in it?

Management of the United Hospital Ltd.

- What are the consequences of its occurrence?

The expected outcomes: Customers are expecting to get upgraded services from UHL.

- What is the context in which it occurs?

In the context of macro factor.

- How does it happen?

Invest more in health care technology. Train the employee to deal with the technology. Create a maintenance team to maintain the technology and overcome any problem within short time.