1.1 Introduction:

Banking constitutes an important segment of the financial infrastructure of any company. Generally, banking means deposit mobilization and development of those deposits into advances or investments in different sectors. That’s means bank collect deposit at lowest possible interest and provide loan and opportunity at highest interest. Between the two interests is the profit for bank. There are two type of banking that was commercial banking and another is investment banking. Commercial bank rise fund by collecting deposits from customer and business that use to make loan and customer at high interest for maximize profit. BRAC bank is one of the most popular and profitable commercial bank in Bangladesh.

As a kid banking industry BRAC Bank Limited was establish in June, 2001. Performing well as it has acquired as it has assets and human resources of higher quality. BRAC Bank Limited will be more effective in our economy by adopting modern financial technology by extending their activities in human and social welfare.

1.2 Background of the study:

Through this report an individual can expect to have a good knowledge and understanding on the various methods of operation performed by BRAC Bank Limited particularly in the area of Financial Institutional Services. From the last three months of the bank’s disbursement, everything is tried to include in precise form. I have tried my level best to put more emphasis on the Overall activities of telesales department this report is to be used only for the academic purpose. I have collected all the necessary and relevant data from various primary, secondary and tertiary sources. After three months long hard labor, it has become possible for me to make the report comprehensive and factual.

1.3 Significance:

This report is the result of three months internship in BRAC BANK LIMITED. I enter as an internee in BRAC BANK LIMITED beginning from 1st March. 2009 to 31st May 2009. And I have completed this internship period successfully. This internship report contains all the knowledge that I gather at the time of my internee in BRAC BANK LIMITED. In this internee time I noticed that they work completed day to day. They work hard and soul. My topic is Penal Calculation for Consumer loan of BRAC Bank. All these information will help the management to the study. Besides, it would be a great opportunity for me to get familiar with this system. So this study is very significant for both the company and me. They satisfy my work and give a opportunity for job.

1.4 Objective of the Report:

Broad Objectives:

The broad objective of this report is to study the overall activities and service providing process of Telesales Department of BRAC Bank Ltd.

Specific objectives:

- To know the activities of Telesales department in BRAC Bank Ltd.

- To know the products and services offered by BRAC Bank Ltd.

- To know the concept of Telesales and its impact in overall economy of Bangladesh

- To gain practical experience that will be helpful for my BBA program

- To identify differences between theory and practice by working directly in bank.

- To know the terms and conditions of Retail or consumers loans and deposit.

- To know the work process and monitoring system of Telesales Department.

1.5 Scope of the Report:

Scope of the study is quite clear. Since Telesales Department is dealing with all types of loan & deposit activities in the bank, studying these core themes, Opportunities are there to learn other aspects of RETAIL or Consumer matters.

- Concept of Telesales and its impact in overall economy of Bangladesh

- Importance of Telesales in context of Bangladesh

- Pioneer’s strategy regarding Telesales Department

1.6 Methodology of the Report:

The report is basically prepared on the basis of my experiences with BRAC Bank Ltd. The data have been used both as primary and secondary data.

Sources of Data Collection:

The basic sources of data collection based on primary and secondary which used in preparation of this report is obtained when I went to Telesales Department of BRAC Bank Ltd., Haqu Tower (4th floor), Tejgaon.

Primary data sources:

- Conversations with Associate Managers both asset and liabilities.

- Focus group meetings

- Direct observation

- Informal discussion

Secondary data sources:

- Operational manual

- Official Website

- Banking journals

- BBL newsletters

- Account statement

1.7 Data Analysis and Reporting:

Both the qualitative (such as SWOT analysis) and quantitative tools are used to analyze the gathered data and different types of computer software’s are used for reporting the gathered information from the analysis, such as – Microsoft word, Microsoft Excel, Microsoft PowerPoint.

1.8 Limitations:

The study has suffered from a number of barriers

- Lack of structured and current information as the Bank’s policy does not permit to disclose various data related to my study and this is the major problem among all the problems, I have encountered with.

- This report only focuses on Telesales Activities of BRAC Bank Ltd. But it does not cover other major activities like Investment, General banking and Foreign exchange etc.

- Data from BRAC Bank is highly confidential for the outside people and I had no authority to use the core banking software.

- BBL changes its core banking software, MBS to Finical that’s why all the employees are very busy with their work, sometimes I had to wait more than one week for a piece of information.

- Time is also a big constraint for my research. I have to submit a broader deal in a shorter form of outcome.

- It was difficult to communicate with the customers, as many of them were unable to give me much time for interview.

- I had to go under my day to day job responsibility that I was supposed to do so. So I could get few more time to spend in collecting data for preparing my internship report.

2.1 The Internship Position and Duties:

I joined in Brac Bank Ltd. as an intern on 1st March, 2009 and complete my three months internship on the 31st May, 2009. In this period I try to learn about organizational culture, their environment, punctuality, regularity, skill development, integrity etc.

At the vary beginning of my internship BBL, I learned how to open an account, which requirement is fulfill to open an account, how and home loan is provide, which criteria should fulfill to get a loan, and various type of retail product of BBL.

Firstly total duration was divided into total working days that came to a total working day of 3 months and were distributed in the following manner:

2.1.1 Training:

During the first month they trained up me about my work related activities such as how to react with customers, how to fill up the customer relationship from, what requirements is needed to open an account and what criteria should a customer meet to get a loan, and how to prepare a loan file for submission to get a loan. During the training period they provide me the following information:

- The overall retail products and services of the bank.

- Which criteria have to fulfill to open an account?

- Necessary documents needed to open an account.

- Which criteria have to fulfill to get a loan and how we can calculate DBR?

- Necessary documents needed to prepare a loan file.

- What is POS & How we can customers use POS

- How to encourage customer to take our products.

- Which step we have to follow to make customers done.

- Rate of interest and annul charge of various retail products and ATM cards of BBL.

2.1.2 Account Open & close during my internship period:

In second month I have work practically in the field. Here I collect my customer and invite them to open. For this I have to fill up their form and introduce myself with my PSO and CIF No which is needed to open an account in BBL.

Here I learn about how to open an account, FDR, & DPS, how many types of these, and which requirement is needed to open these. I have also learned about account closing requirement and their charges.

2.1.3 Prepare and Loan file & Loan Account during my internship period:

At the last month of my internship period I have worked in loan section. Here my duty is to collect right customer and open a loan account & prepare a loan file of them for submission.

Here I have learned about various type of loan products & loan accounts, who can fulfill loan criteria and which document is needed to prepare a loan file and how to calculate DBR & the formula of DBR.

Debt Burden Ratio (DBR) = (EMI / AMI) (100)

= (Equated Monthly Installments / Area Median Income) (100)

If the ratio of EMI is less or Equal 40% we can provide loan to the customers.

2.2 Performance during my Internship Period:

In these three months I have tried my best to encourage customer to open an account, FDR, DPS & make their loan file who are interested to take loan. The chart of my performance is shown bellow:

3.1 Organization Profile- an Overview of BRAC Bank Limited

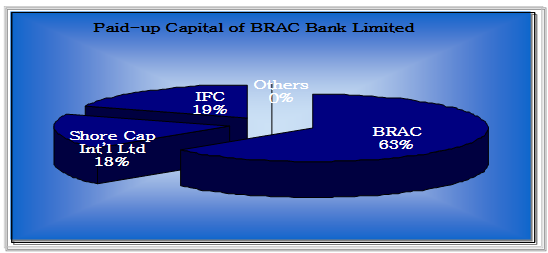

BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shorecap International, has been the fastest growing Bank in 2004 and 2005. The Bank operates under a “double bottom line” agenda where profit and social responsibility go hand in hand as it strives towards a poverty-free, enlightened Bangladesh.

A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last five years of operation, the Bank has disbursed over BDT 2500 core in loans to nearly 1,50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. Since inception in July 2001, the Bank’s footprint has grown to 56 branches, 350 RETAIL unit offices and 122 ATM sites across the country, In the years ahead BRAC Bank expects to introduce many more services and products as well as add a wider network of RETAIL unit offices, Retail Branches and ATMs and paid up capital of the same bank is Tk 500.million.

3.2 Background of the Organization:

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994. The primary objective of the Bank is to provide all kinds of banking business. At the very beginning the Bank faced some legal obligation because the High Court of Bangladesh suspended activity of the Bank and it could fail to start its operations till 03 June 2001. Eventually, the judgment of the High Court was set aside and dismissed by the Appellate Division of the Supreme Court on 04 June 2001 and the Bank has started its operations from July 04, 2001.

There are two process of Banking “Branch Banking” and “Alternative Banking” in Brac Bank Ltd. Telesales is the part of alternative banking and they are the part of RETAIL Division. In Bangladesh telesales is firstly used in 1999 but Brac bank firstly lunched their telesales department in 16 September, 2006 in a small range. But now it develops vastly with 180 employees (from them eighty are female and rest hundred are male)

3.3Corporate Vision:

Building a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free Bangladesh.

3.4Corporate Mission:

Achieve efficient synergies between the bank’s Branches, RETAIL Unit Offices and BRAC field offices for delivery of Remittance and Bank’s other products and services.

3.5 Goals:

BRAC Bank will be the absolute market leader in the number of loans given to small and medium sized enterprises through out Bangladesh. It will be a world-class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the world.

3.6 Objectives of the Bank:

- Building a strong customer focus and relationship based on integrity, superior service.

- To creating an honest, open and enabling environment

- To value and respect people and make decisions based on merit

- To strive for profit & sound growth

- To value the fact that they are the members of the BRAC family – committed to the creation of employment opportunities across Bangladesh.

- To work as a team to serve the best interest of our owners

- To relentless in pursuit of business innovation and improvement

- To base recognition and reward on performance

- To encourage the new entrepreneurs for investment and thus to develop the country’s industry sector and contribute to the economic development.

3.7 Achievements:

- Fastest growing bank in the country for the last two years

- Leader in SME financing through 350 offices

- Biggest suit of personal banking & SME products

- Large ATM (Automated Teller Machine) & POS (Point of sales) network

3.8 Departments of BRAC Bank Limited:

1. Human Resources Department

2. Financial Administration Department

3. Asset Operations Department

4. Credit Division

5. RETAIL Division (Telesales & Direct sales)

6. Internal Control & Compliance Department

3.9 History of Telesales:

Some people believe that in the 1950s, Dial America Marketing, Inc became the first company completely dedicated to inbound and outbound telephone sales and services. The company, spun-off and sold by Time, Inc. magazine in 1976, became the largest provider of telephone sales and services to magazine publishing companies. The term telemarketing was first used extensively in the late 1970s to describe Bell System communications which related to new uses for the outbound WATS and inbound Toll-free services.

3.10 Telesales Department of Brac Bank Ltd:

There are two process of Banking “Branch Banking” and “Alternative Banking” in Brac Bank Ltd. Telesales is the part of alternative banking.

In Bangladesh telesales is firstly used in 1999 but Brac bank firstly lunched their telesales department in 16 September, 2006 in a small range. But now it develops vastly with 180 employees (from them eighty are female and rest hundred are male). It provides different kind of service directly to the customers or the persons who are going to be customers. On the other hand customer takes the necessary and updates information and solves problems without physical present. The BE of telesales department play a vital role to achieve the goal of bank. The both male and female BE call new and existing customers and encourage them to open an account FDR, DPS, student file in our bank or help them to get a loan if they want. If the customer are being satisfy to hare the offer of BE, then he fixed a date to open an account and one of the BE (must be male) go to the nearest branch of customer and help the customer to fill up the Customer Relationship From and singe as a customer introducer.

3.11 Location of Telesales Office:

TelesalesCenter

191/A (4th Floor), Tejgan, Dhaka-1208.

Tel: +880-2-881 4441

Fax: +880-2-989 1915

E-mail: info@bracbank

3.12 Slogan of Telesales Department:

“Sell at least Three Products to an Individual Customer

3.13 Categories:

There are two major categories of telemarketing. These are

1) Business-to-business.

2) Business-to-consumer.

The Direct selling Department of Standard Chartered Bank maintains both type of Telemarketing. But the Telesales Department of BRAC Bank Ltd. deals with retail customer and provides them retail banking activities. The reason is that BRAC Bank Ltd has another corporate banking department named Direct Selling Department.

3.14 Customer Segmentation of Telesales:

Though telesales department is a part of Retail Banking they target their customer in four categories, these are as follows:

- Business man (SME)

- Private Customer

- Student

- House Wife

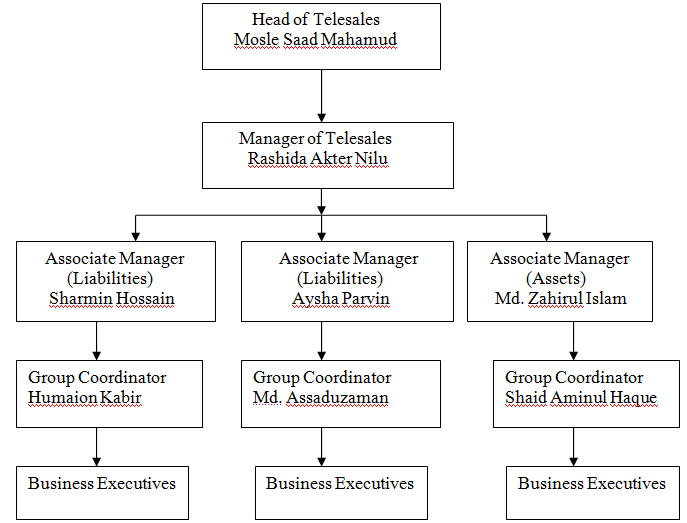

3.15 Organogrum of Telesales Department:

3.16 Different Branches & ATMs of Brac Bank Ltd:

Brac Bank has 56 Branches and 122 ATM Booths in Bangladesh. These are given below:

Branch Name Code No. |

Dhaka Zone |

Gulshan Branch 1501 Banani Branch 1507 Dhanmondi Branch 1506 Mothijheel Branch 1505 Moghbazar Branch 1503 Nawabpur Branch 1502 Satmoszid Branch 1509 Rampura Branch 1512 Keranigang Branch 1504 Narayangang Branch 4301 Genakbari Branch 1508 Mirpur Branch 1511 Motijheel Graphic 1513 Sonagazi Branch 1801 Comilla Branch 1301 Shamoli Branch 1514 Monohardi Branch 4401 Tongi Branch 1515 Dohar Branch 1516 |

Chittagong Zone |

Agrabad Branch 1101 Momin Road Branch 1102 Halishahar Branch 1103 CDA Avenue Branch 1104 Potia Branch 7101 Cox’s Bazar Branch 7401 |

Sylhet Zone |

Sylhet Branch 6301 Zindabazar Branch 6303 Beani Bazar Branch 6302 Biswanath Branch 6304 Nobigang Branch 6306 Moulovibazar Branch 6305 |

Jossor Zone |

Jossor Branch 2410 |

Rajshahi Zone |

Rajshah Branch 5501 |

Bogra Zone |

Bogra Branch 701 |

Barisal Zone |

Barisal Branch 501 |

3.17 On Sight & of Sight ATM Booths:

| On Sight ATM Booths: | |

| Gulshan Branch | Agrabad Branch |

| Banani Branch | Momin Road Branch |

| Dhanmondi Branch | Halishahar Branch |

| Mothijheel Branch | CDA Avenue Branch |

| Nawabpur Branch | Potia Branch |

| Satmoszid Branch | Cox’s Bazar Branch |

| Rampura Branch | Sylhet Branch |

| Keranigang Branch | Zindabazar Branch |

| Narayangang Branch | Beani Bazar Branch |

| Genakbari Branch | Biswanath Branch |

| Mirpur Branch | Nobigang Branch |

| Motijheel Graphic | Moulovibazar Branch |

| Comilla Branch | Jossor Branch |

| Sonagazi Branch | Rajshah Branch |

| Monohardi Branch | Bogra Branch |

| Tongi Branch | Moulovibazaar Branch |

| Dohar Branch | Barisal Branch |

| Of Sight Booths |

| Baily Road Baridhara Banani Basundhara Bazar Basabo Banglabazar |

Basundhara Housing BashundharaCity Bijoynagar

Raifels Square Jigatolla Mirpur Road

Donia Dakkhin Khan Elephant Road

Fakirapul Farmgate Gulshan: 1

Golapbag, Sayedabad Gulshan: 2 Hatiprpul

E-Lobby 1 Green Road Indira Road

Jatrabari Katabon Kakrail

Kazi Alauddin Road Kafrul Kakrail

Kamlapur Kawran Bazar Khilgaon

Khilkhet Kuril Malibagh

BRACUniversity Mohakhali Lalbagh

Moghbazar Manda Mohammadpur

Motijheel Monipuri Para Mirpur

Mugda Bishwa Road Narinda Rankin Street

Shamoly Wari Uttara

3.18 Different cash Deposit Machine of Brac Bank Ltd:

| Deposit Through ATM Machine |

| Serial No ATM Booth |

| 1. Gulshan |

2. Banani

3. Rampura

4. Uttara

5. Green Road

6. Rampura

7. Kazipara

8. Delta Mirpur

9. Bijoynagar

10. Motijheel Graphic

11. BRACUniversity

12. Raifels Square

13. Fakirapul

14. Fram Gate

15. Basabo

16. Katabon

3.19 How to Use Cash Deposit Machine:

- Maximum 50 but suggest the customer for 40 notes maximum.

- Complete the information requested at the back of envelops.

- Please cheque(s) and cash inside envelop and seal envelop.

- Don’t place any coins in envelop and follow the instruction of screen.

- Take transaction input details and keep for the future reference.

- Insert envelop into the slot.

- Take transaction input detail and keep for the future reference.

Some More Parts-

Report on Telesales Department Activities of Brac Bank Limited (Part-1)

Report on Telesales Department Activities of Brac Bank Limited (Part-2)

Report on Telesales Department Activities of Brac Bank Limited (Part-3)