Objective of BOI:

Broadly, the objective of BOI is to encourage and promote investment in the private sector both from domestic and overseas sources and to provide necessary facilities and assistance in the establishment of industrial sectors with a view to contribute to the socio-economic development of Bangladesh.

Functions & Facilities:

Broadly, BOI is responsible for facilitating private investment in the country. According to the BOI Act, its functions are:

- Providing all kinds of facilities in the matter of investment of local and foreign capital for the purpose of rapid industrialization in the private sector;

- Implementation of the government policy relating to the investment of capital in industries in the private sector;

- Preparation of investment schedule in relation to industries in private sector and its implementation;

- Preparation of area-schedule for establishment of industries in the private sector and determination of special facilities for such areas;

- Approval and registration of all industrial projects in the private sector involving local and foreign capital;

- Identification of investment sectors and facilities investment in industries in the private sector and giving wide publicity thereof abroad;

Invention of specific devices for the purpose of promotion of investment in industries in the private sector and their implementation;

Creation of infrastructural facilities for industries in the private sector;

Determination of terms and conditions for employment of foreign officers and experts and others employees necessary for industries in the private sector in the private sector;

Preparation of policies related to transfer of technology and phase-wise local production in the private sector and their implementation;

Providing necessary assistance in the rehabilitation of sickly industries in the private sector;

Financing and providing assistance in the financing of important new industries in the private sector;

Adoption of necessary majors for creation of capital for investment in industries in the private sector;

Collection, compilation, analysis and dissemination of all kinds of industrial data and establishment of data-bank for that purpose; and

Doing such other acts and things as may be necessary for the performance of the above functions.

In addition to the above, recently BOI has been entrusted to give approval of foreign offices i.e. brunch, liaison , representative and buying houses.

Facilities Available from BOI:

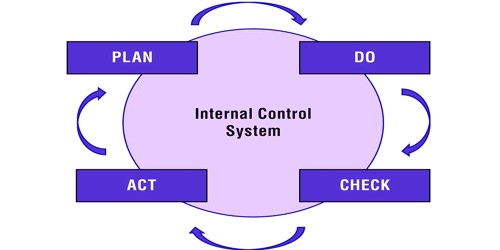

To summarize, facilities and services available to the investors from BOI could be described in three stages.

Stage 1: Pre-investment Information and Counseling

At this stage, BOI provides all sorts information required by an investor to undertake initial investment move. Professional investment and business counselors provide cordial assistance upon visit to the BOI office over phone, by email & fax and express mailing. It also assists in company formation.

Stage 2: Special Welcome Service to Foreign Investors

BOI has a welcome service desk Zia International Airport (ZIA) operating round- the-clock. It assists in obtaining necessary immigration and Visa on Arrival / Landing Permit, hotel accommodation and counseling arrangement.

Stage 3: Investment implementation and Commercial Operation

Once the investor decides to invest and forms a company, BOI provides following specific facilities and comprehensive services upon confirmation of the first one i.e. / registration of the company with BOI.

- Registration of the company

- Obtaining Industrial plot

- Obtaining Utility Connections

- Registration / Approval for foreign loan, Suppliers’ Credit, PAYE

- Scheme etc.

- Import of Machinery & Raw Materials

- Obtaining Work Permit

- Remittance of Royalty, Technical know-How and Technical

Assistance Fees.

Business set up at a Glance:

Implementing a 100% foreign-owned or joint venture industrial project in Bangladesh is a rather simplified process. The entire Process is divided into 5(five) major steps as presented the following diagram. BOI supports are available in step 1 through 4.

Terms and Condition of BOI:

1) Investors shall have to take necessary safety measures as Factory Act, 1965;

2) Investors shall have to arrange sufficient fire fighting equipment as safety measures of the project;

3) Investors shall have to import the machinery, spare parts and raw materials as per existing Import Policy Order of the Government;

4) Investors shall have to obtain necessary clearance from the Deptt. Of Environment to ensure that the manufacturing process do not pollute the environment;

5) Investors shall have to arrange preservation of rain water for using in the factory to reduce pressure on ground water;

6) Investors shall have to should have to submit the quarterly report to BOI (IIMC) regarding progress of implementation of the project in every quarter till the unit goes into commercial production. After going into commercial production, half-yearly performance report regarding production and employment of the project shall have to be submitted ;

7) Investors shall have to take prior permission from BOI in case of any amendment of this registration letter including ownership or location of the project;

8) Any effluent of the industrial unit should not be discharged into the nearby river connecting lake or general water reservoir without proper treatment.

9) Investors shall have to provide/ create the following facilities, if applicable;

(1)Day care center;

(2)Maternity leaves;

(3)Low cost and safe housing facilities for the low paid female workers, near & around the factory;

(4)Equal space and allowances for male & female workers in the organization;

(5)Low prices canteen;

(6)Enact effective rules of conduct to enable favorable working atmosphere among the male and female workers;

10)All other terms and conditions the registration letter No. IP/ P&P / 9(1639)/ 243 dated 02-02-1998 will remain unchanged..

The Board of Investment reserves the right to cancel the registration of an investment if any of the above conditions or any part of the condition is violated.

FDI Inflow survey in Bangladesh

Foreign private capital flows into Bangladesh have taken three forms: FDI, portfolio investment, and foreign currency loans (supplier credit or commercial loan). But liberalization of the investment regime, while making foreign investment procedures simpler, has also made it difficult for the central bank to mobilize information on capital flows. The Bangladesh Bank has been experiencing difficulty reporting FDI accurately as private capital flows emerge as a significant component in the balance of payments.

FDI Inflow Survey 2002 was successfully conducted by BOI, for the first time in Bangladesh in February 2003.It was the first-ever attempt to gather credible data on actual FDI inflow on the basis of definition given by UNCTAD. The World Investment Report 2003 (UNCTAD-2003) mentioned that ”FDI flows to Bangladesh and other countries in the sub region declined. However, in the case of Bangladesh, FDI flows in 2002 would have been higher if investment in kind were included.

The FDI census in Bangladesh:

The Bangladesh Board of Investment (BOI) conducted a census of foreign direct investors in February 2003 to gather comprehensive primary data and actual FDI inflows based on projects registered with BOI and the Bangladesh Export Processing Zones Authority.

| Actual FDI Inflow in Bangladesh in 2002 and 2003 | ||||

| Components | 2002 | 2003 | Growth | Component |

Jan-Dec | Jan-Dec | (%) | Share | |

| 1.Equity | 133.8 | 198.36 | 48.30% | 45.90% |

| 2.Reinvstment | 116.8 | 186.47 | 59.60% | 43.20% |

| 3.Intra-Company Borrowing | 77.7 | 46.97 | -39.50% | 10.90% |

| Total | 328.3 | 431.8 | 31.50% | 100% |

Source: 1. Bangladesh Bank Enterprise Survey

2. Provisional of FDI inflow Survey by BOI and EPZA

•FDI inflows in 2002 were $328 million (compared with $ 58 million on a balance of payments basis reported by the Central Bank of Bangladesh). Half of it was financed by equity, 31% by reinvested earnings and 19% by intra-company loans. This is an example of how careful FDI statistics need to be interpreted, given the different ways in which they are compiled.

Summary of FDI inflow by components:

According to the commitments made in the Mid-term Strategic Promotional Plan 2003-04 of BOI, the first half yearly FDI Inflow survey of 2003 was undertaken by BOI in cooperation with BEPZA. This Report, the second of its kind, presents the findings of the survey in detail.

Distribution of FDI inflow by Components:

- Total FDI inflow during January-June 2003 is US$ 287.667 million.

- Equity is the major portion of the inflow constituting 59%.

- Reinvestment stands for about 34% of the total investment.

- Intra-company borrowing comprises of 7% of the FDI.

Equity capital is the foreign direct investor’s purchase of shares of an enterprise in a country other than its own.

Reinvested earnings comprise the direct investor’s share (in proportion to direct equity participation) of earnings not distributed as dividends by affiliates, or earnings not remitted to the direct investor. Such retained profits by affiliates are reinvested.

Intra-company loans or intra-company debt transactions refer to short- or long-term borrowing and lending of funds between direct investors (parent enterprises) and affiliate enterprises.

Table: Summary of FDI inflow in Bangladesh during January – June 2003

| FDI Component | BOI Registered | BEPZA Registered | Total |

| In million US $ | In million US $ | In million US $ | |

| 1. Equity | 126.316 | 42.339 | 168.655 |

| a. Capital machinery | 52.219 | 29.528 | 81.747 |

| b. Cash | 74.097 | 12.811 | 86.908 |

| 2. Reinvestment | 72.833 | 25.060 | 97.893 |

| 3. Intra Company borrowing | 6.819 | 14.300 | 21.199 |

| Total | 205.968 | 81.699 | 287.667 |

Source: 1. Bangladesh Bank Enterprise Survey

2. Provisional of FDI inflow Survey by BOI and EPZA

- FDI in the form of equity is significantly higher in BOI registered projects (61%) in comparison to BEPZA projects (51%).

In the above graph foreign Direct investment interns of component is higher increase of Equity is 59% and Re-investment is the 34% and third is enter company Borrowing 7% in year 2003.

Comparative Statement of FDI Inflow:

Table: Comparative Statement of FDI Inflow during Jan-June 2002 and

Jan- June 2003. (FDI component in million U.S. $)

| Particulars | FDI inflow Jan – June’ 2002

| FDI inflow Jan – June’ 2003

| Periodic Growth |

| 1. Equity | 113.176 | 168.655 | 49.00% |

| a. Capital Machinery | 64.528 | 81.747 | 26.70% |

| b. Cash | 48.648 | 86.908 | 78.6% |

| 2. Reinvestment | 26.0725 | 97.893 | 275.5% |

| 3. Intra company borrowing | 28.910 | 21.199 | – 26.9% |

| Total | 168.158 | 287.667 | 71.10% |

Source: Bangladesh Bank Enterprise Survey

2. Provisional of FDI inflow Survey by BOI and EPZA

- The highest growth has been experienced in reinvestment marking 276%. It definitely shows the confidence of the existing investors on the investment climate and performance of the economy as a whole.

- Growth in the equity (49%) was immensely contributed by increase cash inflow (78.6%), which should be reflected in the country’s Balance of Payment Statement.

Sectoral Distribution of FDI:

The growth of manufacturing sector is evident from the table below:

Table: Sectoral Distribution of FDI during Jan-June 2003

| Sector

| BOI Registered | BEPZA Registered

| Total

| Sectoral Share | Sectoral Ranking |

| In million US $ | In million US $ | In million US $ | % | Position | |

| a. Manufacturing | 133.309 | 81.170 | 214.479 | 74.56 | — |

| Textile | 31.096 | 65.820 | 96.916 | 33.69 | 1 |

| Chemicals | 78.056 | 9.490 | 87.546 | 30.43 | 2 |

| Agro – based | 16.663 | — | 16.6636 | 5.79 | 4 |

| Engineering | 2.285 | 4.750 | 7.608 | 2.64 | 5 |

| Food and allied | 3.392 | — | 3.392 | 1.18 | 6 |

| Tannery & Rubber | 1.244 | 1.110 | 2.354 | 0.82 | 7 |

| b. Service | 72.013 | 0.130 | 72.143 | 25.08 | 3 |

| Telecommunications | 38.500 | — | 38.500 | 13.38 | A |

| Energy & Gas | 30.527 | — | 30.527 | 10.61 | A |

| Power generation | 6.747 | — | 6.747 | 2.35 | A |

| Oil & gas | 22.182 | — | 22.182 | 7.71 | A |

| LPG bottling | 1.598 | — | 1.598 | 0.56 | A |

| Other services | 2.986 | 0.130 | 3.116 | 1.08 | A |

| Computer software | 0.771 | — | 0.771 | 0.27 | A |

| Others | 2.215 | 0.130 | 2.345 | 0.82 | A |

| c. Miscellaneous | 0.646 | 0.399 | 1.045 | 0.36 | 8 |

| Total (a+b+c) | 205.968 | 81.699 | 287.667 | 100% | 100% |

Not ranked separately Included in Service Sector.

Source: IIMC, Board of Investment, June 2003

- Textile is the highest recipient of FDI (33.69%) followed by chemicals (30.43%). The garments in EPZs largely contribute textile sector. However, chemical sector is largely contributed by cement (60%) followed by garment accessories. A detail study on cement sector of Bangladesh is available in BOI quarterly newsletter “Bangladesh Investment Review”, Vol. 1, Issue 1, published for the period April-June 2003.

- Energy and gas sector has sharply declined (only 10.6%) to attract FDI during this period. Given the present utility infrastructure situation of the country and projecting faster growth of industry in coming years, energy and gas could be attractive sector for investment in future.

- Manufacturing continues to receive the highest FDI (74.6%).

- A tremendous growth in the manufacturing sector indicates prospective growth of the industry in the upcoming years. It will also facilitate creating job opportunities and SME development.

- Telecommunication has emerged as the 3rd largest sector having huge growth potential in the reformed environment of telecom sector.

Trends of FDI Inflow by Sources:

Country wise distribution of foreign private investment

The major sources of investment in 2002 were Asia (45%), followed by Europe (32%) and North America (17%). Norway was the single largest investor (19%), followed by the United States (17%), Singapore (14%) and Hong Kong (China) and Malaysia (9% each). Most of the FDI from Norway was in telecom and from the United States in the services sector (i.e. power generation, oil and gas, liquefied petroleum gas bottling, Medicare service). Investments from Asia, particularly South, East and South-East Asia, were concentrated in manufacturing.

•The major investors include ASE and Unocal (United States), BASF (Germany), Cemexs (Mexico), Holcim and Nestle (Switzerland), Lafarge and Total FinaElf (France), Taiheyo (Japan), Telenor (Norway) and TMI (Malaysia).

Country-wise Distribution of Foreign Private Investment Registered with BOI from FY 1996-97 to 2002-03.

(In million US$)

| Country

| 1996-1997 | 1997-1998 | 1998-1999 | 1999-2000 | 2000-2001 | 2001-2002 | 2002-2003 | Sharein 2002-03 |

| Japan | 12.42 | 58.56 | 68.32 | 24.46 | 0.94 | 0.82 | 106.00 | 28.77% |

| U.K. | 73.39 | 32.12 | 827.15 | 15.96 | 28.08 | 3.88 | 88.40 | 23.99% |

| Nether land | — | 2.63 | — | 3.04 | 4.82 | 27.21 | 42.64 | 11.57% |

| South K. | 84.75 | 89.78 | 14.10 | 5.14 | 43.19 | 24.61 | 27.28 | 7.40% |

| Taiwan | — | — | — | — | — | — | 23.49 | 6.38% |

| Australia | — | — | — | — | — | — | 17.41 | 4.73% |

| Singapore | 132.15 | 33.06 | 273.14 | 20.39 | 86.11 | 2.28 | 16.05 | 4.36 |

| U.S.A. | 8.17 | 1378.54 | 382.01 | 1178.35 | 308.99 | 2.51 | 13.00 | 3.53% |

| U.A.E. | 7.24 | 1.97% | ||||||

| Malaysia | 43.67 | 288.02 | 16.36 | 6.13 | 11.39 | 1.19 | 5.70 | 1.55% |

| India | 48.83 | 5.48 | 154.87 | 7.60 | 31.62 | 15.32 | 5.11 | 1.39% |

| Hong Kong | 484.92 | 156.54 | 13.18 | 35.48 | 1.17 | 59.75 | 4.78 | 1.30% |

| China | 9.97 | 25.38 | 18.33 | 10.29 | 27.23 | 9.49 | 2.86 | 0.78% |

| Finland | — | — | — | — | — | — | 1.81 | 0.49% |

| Thailand | — | — | — | — | — | — | 1.55 | 0.42% |

| Germany | 12.63 | 23.59 | 57.74 | 1.93 | 115.54 | 1.79 | 1.07 | 0.29% |

| Norway | — | — | — | — | 518.16 | — | 1.02 | 0.28% |

| Others | 142.60 | 1,346.35 | 100.34 | 811.11 | 94.64 | 152.67 | 3.00 | 0.82% |

| Total | 1,053.50 | 3,440.05 | 1,925.54 | 2,119.88 | 1,271.88 | 301.52 | 368.42 | 100% |

Source: Board of Investment publishment

On the above table, a country-wise analysis of foreign investment projects registered in FY 2002-03 shows that top five investment registering countries are Japan (28.8 percent), UK (24 percent), Netherlands (11.6 percent), South Korea (7.4 percent) and Taiwan (6.4 percent).

European Union and Western Europe; South, East and South East Asia; and North America are the main sources of FDI in Bangladesh.

- Europe as a whole is the largest source (44%) of FDI in Bangladesh during January-June 2003. This was mainly geared up by French investment in cement sector.

- South, East and South East Asia is the second largest source (39%) of FDI led by Hong Kong (13.94%), South Korea (10.62%) and Malaysia (9.28%).

- European investments spread over manufacturing and service sectors like textile, cement, agro chemical, leather goods, drugs and pharmaceuticals, tale-communication, LPG bottling, lubricants, power generation, industrial gas etc.

- Investments from South, East and South East Asian nations like China, Hong Kong, India, Malaysia, Pakistan, Singapore, Sri Lanka, Taiwan and Thailand are concentrated on manufacturing sectors.

Investment in EPZ’s:

Investment & employment

EPZ’s in Bangladesh are another potential export oriented sectors where FDI is used.

Tables provide data relating to the number of operational industries, investment, manpower and export of the six EPZs at Dhaka, Chittagong, Comilla, Mongla, Uttara and Iswardhi.

Table: Number of Units, Investment and Employment in Operational Units

Under EPZ (up to June, 2003).

| Products

| No of units

| Total investment (million US $)

| Manpower (Local)

| Manpower (Foreign)

| Total Manpower

|

| Garments | 42 | 178.681 | 64260 | 312 | 64572 |

| Textiles | 18 | 133.407 | 12168 | 162 | 12330 |

| Terry Towel | 15 | 22.953 | 5216 | 10 | 5229 |

| Knit & other textiles | 15 | 53.455 | 19004 | 281 | 19285 |

| Garments Accessories | 17 | 30.852 | 1408 | 20 | 1428 |

| Caps | 7 | 31.687 | 9442 | 97 | 9539 |

| Tents | 3 | 10.351 | 4218 | 16 | 4234 |

| Electronics | 11 | 39.324 | 2152 | 18 | 2170 |

| Foot ware & Leather | 11 | 45.624 | 5459 | 11 | 5470 |

| Metal Products | 9 | 15.276 | 469 | 10 | 479 |

| Plastic Goods | 11 | 16.886 | 1294 | 5 | 1299 |

| Paper Product | 2 | 0.787 | 120 | 0 | 120 |

| Fishing Real | 1 | 31.582 | 901 | 1 | 902 |

| Rope | 2 | 5.748 | 301 | 2 | 303 |

| Service Industries | 4 | 3.780 | 338 | 2 | 340 |

| Agro Product | 2 | 0.570 | 294 | 1 | 295 |

| Miscellaneous | 10 | 13.080 | 1870 | 10 | 1880 |

| Total | 180 | 634.039 | 128917 | 958 | 129875 |

Source: BEPZA

Up to June 2003, 180 industrial units were operational in the sixteen zones with a total investment of US$ 634.04 million.Of the operational units, 23 percent were RMGs and 10% textiles. 1,28,917 local manpower have been employed in these industries.

Investment & Export

Table: Annual Investment and Export: Dhaka, Chittagong, Mongla, Comilla,

| EPZ

|

| 1994-1995 | 1995-1996 | 1996-1997 | 1997-1998 | 1998-1999 | 1999-2000 | 2000-2001 | 2001-2002 | 2002-2003 |

| Dhaka

| Investment amount | 8.26

| 14.45

| 31.01

| 26.24

| 35.45

| 19.80

| 24.05

| 32.01

| 59.14

|

| Export amount | 41.28

| 73.22

| 119.45

| 185.64

| 259.58

| 364.72

| 447.51

| 466.76

| 554.79

| |

| Chittagong

| Investment amount | 27.67

| 16.13

| 22.89

| 42.59

| 36.11

| 14.18

| 24.30

| 22.37

| 42.14

|

| Export amount | 186.98

| 263.8

| 343.31

| 450.41

| 452.12

| 526.01

| 620.35

| 680.70

| 641.28

| |

| Mongla

| Investment amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.045

| 0.043

| 0.011

|

| Export amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.048

| 1.55

| 2.99

| |

| Comilla

| Investment amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.64

| 1.05

|

| Export amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.012

| 1.15

| |

| Uttara

| Investment amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.16

| 0.20

|

| Export amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| —

| —

| |

| Iswardhi

| Investment amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.01

| 0.50

|

| Export amount | 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| 0.00

| —

| —

| |

| Total investment amount | 35.93 | 30.58 | 53.90 | 68.83 | 71.56 | 33.98 | 48.41 | 55.71 | 103.13 | |

| Total export amount | 228.26 | 337.02 | 462.77 | 636.05 | 711.69 | 890.82 | 1067.87 | 1077.03 | 1200.22 | |

Uttara and Iswardhi EPZs (1994-95 through 2002-2003)

From the above table Upto June 2003 goods valuing of US$ 1077.02 million were exported from the Zones during 2001-02, which account for 18 percent of national exports. During 2002-03 the amount of export was US$ 1200.22 million, which is 18.33 percent of total export.

The total Investment by EPZA is higher in 2002-2003 that is 103.12 million US $. Which is low in 1995-1996 that is 30.58 million US $. Here the investment trend is increase for investment incentives are increase and terms & condition of investment by foreigner are relaxed in our country. In the same way the export are increase and the trend is upward moved. Here the export is higher than the investment so here are higher incentives in future to participate in national export.

Major conclusion from the study of FDI inflow in Bangladesh

Four major conclusions can be drawn from the study:

- Bangladesh has experienced a more stable (less vulnerable) form of capital inflow, with FDI making up about 85-90 percent of the total inflows so far.

- Both FDI and private debt inflows in Bangladesh have largely financed imports of machinery and equipment a sign that Bangladesh is only in the preliminary phase of FDI flows.

- FDI and debt inflows have not helped in augmenting foreign exchange reserves so far and are not expected to do so over the next 10 years. In fact, as inflows grow, so do outflows in the medium- to long-term.

- The benefits of FDI are many and worth harnessing. But the downside risks must not be overlooked. The growing repayment obligation presents the prospects of net negative transfers in the future and poses major challenges requiring the country to search for new avenues of earning (or saving) additional foreign exchange.

The benefits of FDI in terms of physical capital formation, transfer of technology, and know-how are sufficient to justify sustaining these flows. Capital controls are not the answer to a rising flow of FDI. To ensure that resulting payments liabilities remain within the country s debt-servicing capacity, it is essential to develop an effective non-intrusive reporting and monitoring system the main ingredients of which are presented in the study.

Future of FDI in Bangladesh

According to a recent study, FDI inflows are projected to average about $900 million annually from 2000-2010, as compared to $620 million annually during 1992-2000. Outflows in this case would rise, on an annual basis, from a mere $129 million during 1996-2000, to almost $600 million during 2001-2005, and $1.2 billion during 2006-2010.

The energy sector has been the principal recipient of the inflows but, if current trends continue, foreign investment in telecom, manufacturing, and services could overtake energy by 2006. All these expected trends in FDI depend on several factors. The regulatory body like Board of Investment and other government and non-government institution should take proper step to remove the obstacles in the way of foreign direct investment.

Problems of FDI in Bangladesh & precise issues for their solutions

Despite substantial changes in government policy, Bangladesh has failed to attract satisfactory levels of FDI and reasons for this failure can be identified quite easily. Government policy is obviously an important factor influencing inflows of FDI. But, there are other, equally important factors. So far as the investment related policies of the government are concerned, these are fine in spirit, but their actual implementation continues to create obstacles for both local and foreign investors. An inefficient and not-too honest bureaucratic system is primarily responsible for this problem. All the administrative barriers are in fact generated from this non-investment-friendly bureaucratic system.

Extent of the barriers: Policy legislation and implementation

In this context, the extent of the administrative barriers is quite longwinded and inter-related. Poor policy design and implementation, competitive weakness, structural impediments, low quality of infrastructure and skills, weak institutions, poor governance and administrative hassles represent the administrative barriers that discourage potential FDI. But the main drawbacks in the bureaucratic system are inefficiency and corruption, turning the whole administrative functionaries into a harassing experience.

Administrative barriers are also translated in different forms and vary from sector to sector. In Bangladesh, we are used to face barriers in different regulatory bodies in the form of their policy, legislation and functions. National Board of Revenue (NBR) and Board of Investment (the Investment Promotion Agency) are two important agencies directly related with FDI operations.

Cost of inefficiency is high indeed

The governance and management of the government entities has been largely inefficient, ineffective and unresponsive. The cost of economy of inefficient services of state-owned entities in energy, telecommunication, ports, railways and other public utilities and banking, in terms of increased cost of doing business has been high indeed. Power outages and voltage fluctuations, shortage of gas supply particularly due to limited network, limited telephone services, inadequate urban water supply, and the high incidental and transaction costs associated with these services have imposed considerable costs on entrepreneurs. In fact, the activities of the public sector utility service providers have been inward looking and have not worked well, while the rationale for ‘public’ provision has been weak or missing in many areas. And much of the shortfall in their performance can be linked to ineffective and inefficient management and unresponsive governance.

Corruption is a disguised form of taxation

Reasons for the extensiveness of official corruption can be numerous. Many of these are cultural or sociological, but the more important ones are organization-related and economic policy-related in nature. Corruption thrives in an environment of pervasive bureaucratic and regulatory controls. Extensive discretionary powers in the hands of the officials and weakness in the legal framework also induce corruption. Though corruption afflicts different sections of the society in diverse ways, its costs fall heavily on the investors, entrepreneurs as well as the business community. For them, corruption is a disguised form of taxation. When regulations and controls are pervasive, and effective means of obtaining redress through legal or administrative procedures are absent, businessmen end up bribing officials to overcome them. Many companies regard bribery as just one of the costs of doing business and show these payments as legitimate business expenses.

Policy discrepancy

Bangladesh offers generous opportunities for investment under its liberalized Industrial Policy and export-oriented, private sector-led growth strategy and the relevant policies are attractive in paper. But, there are several policy discrepancies that are quite enough to discourage FDI.

Differential treatment

Although existing regulations provide for equal treatment of domestic and foreign investors, certain discriminatory rules continue with regard to foreign investment. Sanctioning requirements for particular categories of foreign investment, restrictions against capacity expansion, special regulations for supplier’s credit and pay-as-you-earn-schemes are some of the areas of differential treatment.

One stop service of BOI

In Bangladesh, the Board of Investment (BOI) has created a cell to provide all types of services and assistance to private investments including FDI. But, offering one stop service to the existing and prospective investors in real terms is yet to materialize. The officials of several state-owned utility service providers, working for BOI one stop service, are less capable and less powered to provide necessary service.

Dictated regulatory authority

To facilitate investment and business activities, there are some government agencies working as regulatory authorities for the respective sectors. Though these regulatory bodies were supposed to enjoy operational autonomy, in practice their autonomy has been limited. This has affected their ability to respond effectively and quickly through prompt decisions catering to demands and necessity of the entrepreneurs and investors. For instance, supervisory control over the Public Finance Institutions (PFIs) by the Ministry of Finance, rather than Bangladesh bank (Central Bank), has weakened their autonomy and politicized their management. As a result, required services from PFIs become less effective and time spending.

Legal paradox

The legal procedure is very cumbersome in most South Asian countries and laws are not properly implemented. The archaic laws and regulations are not supportive of the policy incentives to FDI. Judicial dispensation process is mostly too lengthy and at times takes more than a decade in handing out a judgment. This is discouraging for investors in general and foreign investors in particular.

Protection of Intellectual Property Rights (IPR)

It is being observed that Bangladesh is not moving quickly enough to ensure that the country’s laws and regulations are in conformity with the WTO Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS). Although there are existing laws in the country for IPR protection, these are not adequate. It is well known that there exists a direct relationship between increased foreign direct investment and IPR protection and in the backdrop of declining FDI flow; governments of South Asian countries must take immediate steps for protection of IPR.

Lawsuits

There are many lawsuits by taxpayers against the government and majority of which the government loses. But, due to cumbersome legal procedure such lawsuits become inconvenient for the businessmen.

Hassles in implementation

The major quandary of administrative barriers lies in the gap between investment and trade related policies, and lack of co-ordination between various government agencies in the implementation process. As a result, investors face hassles and the cost of doing business goes up.

Discretionary authority of tax officials

Tax officials have enjoyed the discretionary power and it appears that they exercise it to harass businessmen and investors. The discretionary authority of Tax officials made many of them corrupt. Some time, those who are willing to pay taxes are not able to pay even the amount assessed by tax officials themselves as the corrupt officials seek a ‘percentage’ from taxpayers in lieu of reducing the assessed value.

Registration complexity

The procedure for registration with the sponsoring agency has been an annoyance to entrepreneurs and does not serve any useful purpose. With regard to registration with the ‘Inspectorate of Factories and Establishments’ the rules governing the role of the inspector seem to provide ample discretionary power and put industries in a disadvantaged situation.

Lack of coordination among state entities

There is a serious lack of co-ordination between the policy implementing agencies of the government and because of this investor’s suffering goes up. This induces lot of hassles in the implementation process and creates barriers for the investors in getting due incentives offered by the government and ultimately discourages foreign investors to proceed on.

Fiscal policy changes

Any change in the fiscal change after passage of Finance Act seriously disturbs any business plan and discourages FDI in particular. In Bangladesh, quite often policies are changed through issuance of Statutory Regulatory Orders (SROs).

Lengthy customs processing

It takes something like 25 signatures to release a consignment from customs. And it takes more than the stipulated time to release a consignment supervised by an authorized PSI firm even when the consignment is not selected for physical inspection.

Infrastructure

Also linked with administrative barriers the level of infrastructure development is another factor that affects the level of foreign investment and it can be hardly claimed that South Asian countries have reached a level of infrastructure development that will satisfy foreign investors. Again this administrative and bureaucratic inefficiency failed to increase proper infrastructure support.

Restricted telecommunication access

Bangladesh’s telecommunication sector lags considerably behind compared to most other developing countries of the region and the sector strategy has been highly inward looking. Restricted access to telephone connections, noncompetitive pricing and poor quality of services, linked to the inefficiency of old telephone exchanges and transmission links and public monopoly in fixed lines, have imposed a high cost on the economy. This has raised the cost of doing business.

Power supply

Bangladesh has one of the lowest per capita consumption of power and coverage of electrification among developing countries. System losses in the power sector have often exceeded 40 per cent of gross generation. Involvement of the government in the power sector has created an overlapping and confusing situation regarding responsibilities. In fact, inadequate and inefficient power supply continues to impose a high cost on the economy. The extensive load-shedding from time to time, particularly during peak hours, has disrupted industrial production thus affecting the country’s external competitiveness.

Expensive port

The cost of inefficient cargo handling at the Port has been particularly high, thus affecting the external competitiveness of the economy. There are numerous workers’ unions at the port, all of which are crucial for handling cargo. In case that one of these associations decides to call a strike, the whole system comes to a standstill.

There are, of course, the hidden unofficial costs for clearing cargo, be it for import, be it for exports. In fact the port happens to be one of the most expensive ports (container wise) in the world, singularly due to these “unofficial” payments, to which the authorities concerned are comfortably oblivious, evidently to their benefits.

Another factor is the inefficiency and bureaucratic logjam, which increases the lead-time for shipments. Hence, even if a foreign client is interested in ordering from Bangladesh, the company is compelled to procure the products from elsewhere if it is quite urgent. Not only do the entrepreneurs lose, the government also loses its due tariffs and levies from the port.

Impact of FDI Barriers on MNC’s:

In this section we highlighted the experience of two renewed multinational companies that are operating their business for a long period. Especially we highlighted the experience they had in handling their business operation in our country.

Experience of BOC Bangladesh Ltd.

BOC Bangladesh Ltd. has been operating in Bangladesh for several decades now starting from pre-independence time and has been facing the existing administrative barriers, which the company finds manageable with difficulty. If these barriers were not there, the company’s profitability would increase. It may be mentioned here that in light of the global position of BOC, profitability in Bangladesh is quite impressive.

Experience of Siemens Bangladesh Ltd.

Siemens Bangladesh Ltd. started its operation here in 1962. Since then it is contributing a great in the economic progress of our country. Although the company has the good track record in our country it faces difficulty at various period to conduct its normal operation. They pointed out the political influence and corruption as the root of all evil. They have to comply with various fake changes in the political power and have to spend a lot of money to have the hassle free operation in Bangladesh. Should the company need not to spend such money the profitability of the company must increase.

Recommendation

Overcoming the barriers

One can now look for the ways to overcoming the barriers to FDI as we have mentioned above. Here, we would recommend following measures that the authorities concerned might consider:

Ensuring good governance

Good governance denotes a desirable state of affairs and so is the key to success of all the reforms. Political and bureaucratic accountability are the two principal components of good governance, and without ensuring them, good governance is not possible. Securing progress on this front is the highest priority as continued difficulties pose a serious threat to the sustainability of even the development achieved already. Establishing the rule of law is in fact a pre-requisite to ensuring good governance.

Accountability and transparency

Accountability and transparency continue to remain the twin elusive prerequisites for the overall development of the country. Private sector investment and FDI inflow are severely hindered by the administrative barriers that arise out of a lack of transparency and accountability, which logically leads to inefficiency and corruption. Competence and efficiency, which are both appallingly, lacking in the bureaucracy, will both become achievable goals with the infusion of transparency in decision-making and governance. This will also greatly reduce what is commonly known as “red-tapism” or “bureaucratic wrangling” since the tiers of the decision making process are bound to become fluent and responsible if they are held accountable for their work.

Co-ordination among state agencies

Without reducing the utter lack of co-ordination among the state agencies, the services and functionaries cannot be efficient. Assuring proper co-ordination among ministries, departments, regulatory bodies, and faster decision-making in the implementation process will enhance the flow of investment.

Strengthening the regulatory authority

Government agencies responsible for facilitating investment need to be more active. In this regard, full autonomy to the agencies like the central bank, investment promotion agencies, telecom regulatory authority, energy regulatory authority, securities and exchange commissions etc., is a prerequisite.

Rightsizing the government

The size of the state organs is quite large and thus mostly inefficient, unproductive and hazardous. So, rightsizing the government is important. By reducing the number of officials in the decision making process in various state organs, transparency and accountability of bureaucracy can be established. Offering a reasonable compensation package to the officials retained is also one of the key factors in ensuring transparency and accountability.

Judicial and legal reforms

A sound judicial system, which is a must for good governance, is possible when the judiciary can exercise its authority independently. In this regard, separation of the judiciary from executive branch of the government is essential as influence of the executive on the lower judiciary continues to be exercised. There is need for capacity building in the judicial system in order to ensure speedy disposal of cases. Archaic laws, especially those related with trade and investment should be updated in line with the needs of the day.

Tackling corruption

Tackling corruption in banking, power, other state-owned enterprises and tax administration ought to be an urgent priority. A comprehensive resolution of the corruption problem in banking, power and other state-owned enterprises will require privatization along with independent regulatory bodies functioning in the public sector.

Fiscal reform

Regarding tax administration, reform option includes establishing an autonomous tax institution with proper incentive and accountability. Countries of the region can learn from the international experience of a number of countries including the Internal Revenue Service of the USA. There is, however, a need for further deregulation of authority. It is also necessary to establish a coordinating mechanism to take decisive and continuous steps in resolving problems identified in relation to project implementation.

Infrastructure reform

The main policy challenge is to redefine the role of public sector in infrastructure development by gradually allowing the private sector to play a bigger role. Public sector’s role should be restricted to regulatory functions only. Mention may be made here that, Bangladesh’s existing Industrial Policy includes infrastructure as a thrust sector acknowledging a lead role of the private sector supported by special incentives and the Finance Minister of Bangladesh, in his 2002 budget speech, stressed the need for more private sector participation in infrastructure development of the country. The Infrastructure Investment Facilitation Center (IIFC) of Bangladesh has been interacting with the private sector to attract private investment in this sector. Other countries of the region could take lesson from Bangladesh in this regard.

Conclusions

In conclusion, it could be said that experiences referred to as above are based on the same encountered in Bangladesh. But, these are more or less the same in other countries of the region. If the respective governments do not take appropriate measures, it would be difficult to attract the expected level of FDI.

The policy regarding the foreign direct investment should be clear and flexible and should contain some lucrative options for foreign investors. This will certainly boast up the health of FDI in our country.

Our country is very much underdeveloped. In the context of an underdeveloped country the role of FDI is very vital and essential. We do not have sufficient internal resources to meet up the growing demand of increasing population at different aspect. As a result we have to rely greatly on FDI to accelerate our economic growth and to meet up the demand

Another point is credible and must have to note is the necessity of common census of foreign direct investment. Only few months back the BOI and BB have provided contradictory result regarding the FDI in our country. But there should not be any discrepancy in regard to this. This figure represents the condition of the country and should be accurate in nature.

First part of the post: