9.1 Documentary Credit

In simple terms; a Documentary Credit is a conditional bank undertaking of payment

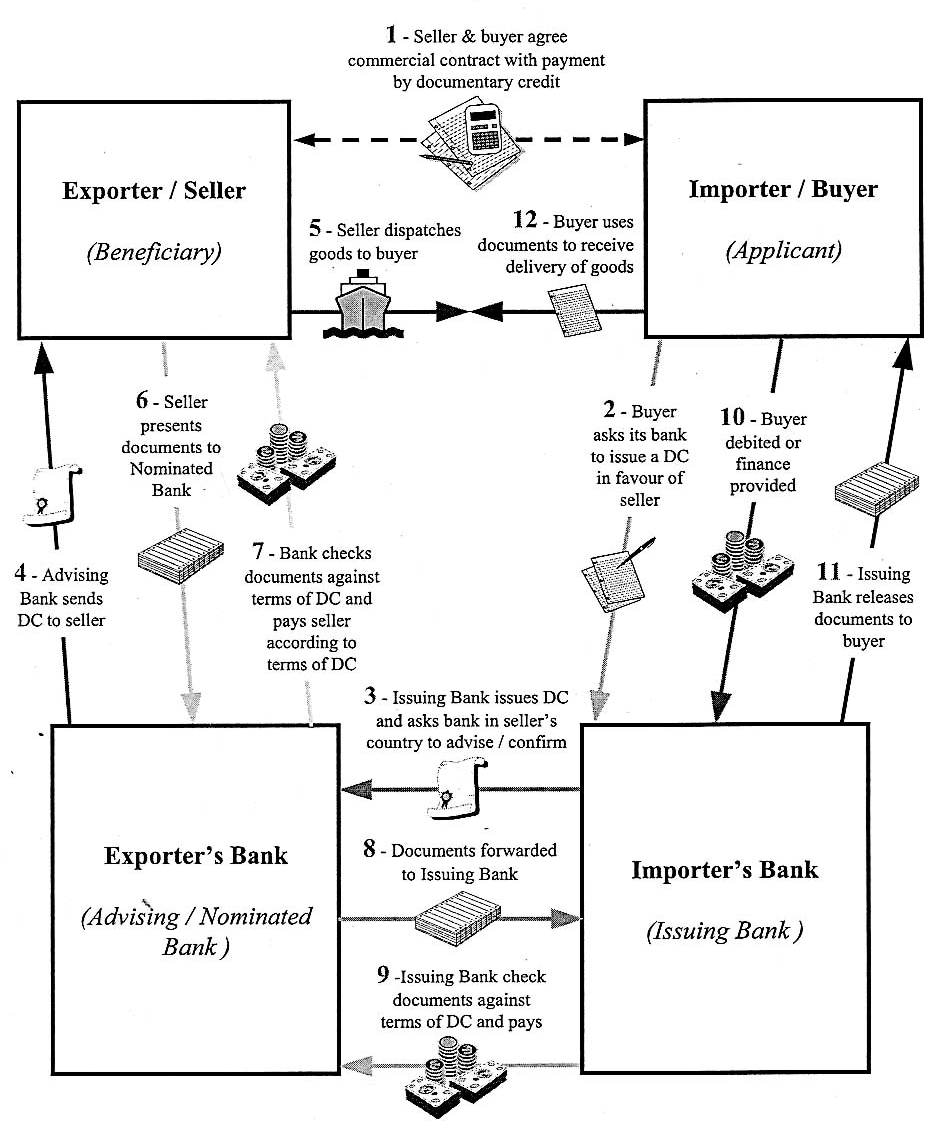

Documentary Credit: A Typical Transaction

Expressed mire fully, it is a conditional Undertaking given by bank [Issuing Bank] at the request of a customer [Applicant] or on its own behalf to pay a seller [Beneficiary] against stipulated documents provided all the terms and conditions of the Credit is complied with.

These stipulated documents are likely to include those required for commercial, regulatory, insurance or transport purposes such as commercial invoice, certificate of origin, insurance policy or certificate and a transport document of a type appropriate to the mode [s] of transport used.

Documentary credits offer both parties to a transaction a degree of security, combined with possibility, for creditworthy party, of securing financial assistance more easily.

Documentary credits therefore-

■ Are arrangements by banks for settling international commercial Transactions.

■ Provide a form of security for the parties’ involved.

■ Ensure payment provided that the terms and conditions of the credit have been fulfilled.

■ Mean that payment by such means is based on documents only, and not on merchandise or services involved

9.2 Types of Letter of Credit:

9.2.1 Documentary credits according to the degree of security provided –

a) Revocable L/C:

A revocable credit can be modified or cancelled by the issuing bank at any time even after shipment provided no payment has been made with or without notice to the seller. A credit is taken to be revocable if it does not expressly state that it has been irrevocably opened. Since this type of letter of credit can be cancelled at any time, is very risky to the seller.

b) Irrevocable, Unconfirmed Credit:

An irrevocable credit constitutes a definite undertaking of the issuing bank, provided that the terms and conditions of the credit are complied with. The irrevocable, unconfirmed credit is a commonly used type of documentary credit. Once this commitment has been entered into, the bank cannot decline responsibility without the agreement of the beneficiary as in the case of a revocable credit.

c) Irrevocable, Confirmed Credit:

An irrevocable credit can also be confirmed. Whenever the Advising Bank/Issuing Bank’s Agent adds its own confirmation to the credit is called a Confirmed Irrevocable Letter of Credit. Otherwise, it is to be treated as unconfirmed L/C. Here the beneficiary not only has the undertaking of the Issuing Bank abroad but also that of a Bank in his own country and is of value if the Issuing Bank’s standing is doubtful, The confirmed credit offers a very high degree of security for the exporter.

9.2.2 Documentary credits according to Payment Methods:

a) Sight Credit:

When the payment terms stipulate the presentation of sight draft, the beneficiary (the seller) receives the proceeds of the credit upon presentation and examination of the documents. The negotiating bank after making payment to the exporter sends the documents to issuing bank. After determining that the documents are in order, the issuing bank delivers them to the buyer and at the same time debits the buyer’s account, which offsets reimbursements to the seller’s bank.

b) Acceptance Credit/Term Credit (Credit with time drafts):

In case of acceptance credit the exporter draws a time draft either on the issuing or confirming bank or on the buyer or on another bank depending upon the credit terms. The payment date may be for example 90 days after the invoice date or the date of transport documents. When the documents are presented the draft is accepted instead of payment being made.

c) Deferred Payment Credit:

The credit with deferred payment differs slightly in its effect on the beneficiary from the time draft. The main difference is the lack of a draft. Upon presentation of the proper documents, the bank so authorized issues a written promise to make payment on the due date. Term credits i.e. acceptance credits and deferred payment credits are financing instruments for the buyer. During the payment period, the buyer can often sell the goods and pay the credit amount with the proceeds.

d) Credit with Advance Payment:

Some letters of credit provide for advance payment of a portion of the credit prior to compliance with all the credit provisions. The purpose of this advance is to give the exporter, the fluids necessary to purchase or process merchandise especially for the buyer. Two typical arrangements deserve mention.

i) Progress Payments:

The beneficiary is allowed to draw on the credit in proportion to the progress achieved in production of the merchandise or completion of a project. This arrangement is used in case of large capital out lays such as heavy machinery, plants and roads. The balance of the credit is available against complete compliance along with relevant documents.

ii) Red Clause Credit:

Under this type of letter of credit the opening bank instructs the negotiating (advising) bank to make advances to the beneficiary up to an aggregate amount in order to enable him to purchase and process merchandise. The advances with interest are to be realized on purchasing/negotiation of export bills to be tendered by the exporter. In this case all risks goes to issuing bank since the issuing bank undertakes the payment of such advances with interest should they not be repaid by the beneficiary prior to the expiration of this credit. In the event of non-delivery of shipping documents by the beneficiary in time, the issuing bank will recover the amount advances plus the interest and any charges from the applicant who assumes all risks.

It is so called because clause was originally written in red ink to draw attention to the unique nature of credit. It specifies the amount of the advance that is authorized, in some instances it is for the full amount of the credit.

A Red Clause Credit is used for example by a wool importer in England to enable wool shipper in Australia to obtain funds to pay the actual suppliers by direct purchase obtaining a loan from the proceeds due to the Australia bank. This bank would get repayment of the plus interest from the proceeds due to the Australian beneficiary when the wool are shipped and documents presented in accordance with the terms of the Credit If however the beneficiary failed to ship the wool and so repay the loan by presenting documents called for by the Credit the Australian bank would have the right to demand repayment with interest from the issuing bank and that bank would have a similar right receipt against the applicant for the credit.

9.2.3 Green Clause Credit:

A Green Clause Credit is a credit with a special clause incorporated into it that which only authorizes the advising bank to grant pre-shipment advances but also storage for storing the goods prior to shipment. It is useful in situations where shipping space not readily available, i. e., some African countries. It is so called because the clause originally written in green ink to draw attention to the unique nature of this Credit present this type of Credit is not in us.

9.2.4 Special types of Letter of Credit:

a) Revolving Credit:

When the importer anticipates having a regular flow of merchandise from a particular foreign supplier, he may wish to open a revolving letter of credit. Under a revolving credit the amount of the credit is automatically reinstated after drawing is fully met or after a specified period of time. Revolving Credit may be revocable or irrevocable. It can revolve in relation to time or value. But Credit that revolves in relation to value is not in common use. The text of such a credit might read as follows:

“Amount of credit USD 10,000 revolving 5 times to a maximum of USD 60,000”. As soon as the first installment of USD 10,000 has been utilized, the credit automatically becomes valid for the next USD 10,000 until the maximum amount of USD 60,000 is reached.

In case of a Credit that revolves in relation to time e.g. which is available for up to &15,000 per month during a fixed period of time say, six month the Credit is automatically available for $ 15,000 each month irrespective of whether any sum was drawn during the previous month. A credit of this nature can be cumulative or non- cumulative. If the credit is stated to be “cumulative” any sum not utilized during the first period carries over and may be utilized during a subsequent period. If the credit is “non- cumulative” any sum not utilized in a period ceases to be available i.e… It is not carried over to a subsequent period.

b) Transferable L/C:

Under this type of L/C, the beneficiary is permitted to transfer his rights in part or in full to another party. In some cases the seller is not the actual producer or manufacturer of the goods. In such cases the original beneficiary request for a transferable credit. The issuing bank can transfer a credit only if it is expressly designated a “transferable”. A transferable credit can be transferred once only.

c) Standby L/C:

The Standby Letter of Credit is very similar in nature to a guarantee. The beneficiary can claim payment in the event that the principal does not comply with its obligation to the beneficiary. Payment can usually be realized against presentation of a sight draft and written statement that the principal has failed to fulfill his obligations.

With this instrument the following payments and performance, among others, can be supported:

– Repay funds borrowed or advanced

– Fulfill subcontracts

– Undertake payment of invoices made on open account.

d) Back-to-Back L/C:

One credit backs another. It may so happen that the beneficiary/ seller of an L/C is unable to supply the goods direct as specified in the Credit as a result of which he need to purchase the same and make payment to another supplier by opening a second Letter of Credit. In this case, the second Credit called to “Back to Back Credit”. These concepts involve opening of credit on the strength of first credit i.e., mother L/C opened by foreign importers.

Under Back-to-Back concept, the mother L/C stands as security for opening of second credit i.e., Back to Back Credit. The beneficiary / seller of the first credit as applicant of the second credit remains responsible to the bank for payment whether payment against first credit is made or not.

Back-to-Back Credit is opened in conformity to the terms and conditions as stipulated in mother credit expect the price of the goods. Shipment period and vanity of Back-to-Back Credit the negotiated price is quoted. The shipment period and vanity of Back-to-Back Credit are given earner than the original vanity as stipulated in the mother L/C that helps the seller of the first credit to substitute his drafts, commercial invoices and other documents, if any with that drawn by the seller of Back-to-Back Credit.

The handling of a “Back-to-Back” credit is similar to a transferable one. If the original L/C allows partial shipment, several back-to-back letters of credit may be issued against it.

There are two types of Back-to-Back L/C viz. Inland and Foreign. Inland Back-to-Back L/C is opened on account of intermediary local buyers who process the goods from local mills/traders for ultimate export.

Foreign Back-to-Back L/C is established in our country in the field of Garments Industry against or on the basis of a Foreign Export L/C for import of raw materials from foreign countries for execution of the relative export order.

9.3 Parties to a Letter of Credit:

A letter of credit is a legal instrument, which binds all parties according to the terms and conditions incorporated in the credit. There are four principal parties in a Letter of Credit:

a) The Importer/Buyer/Opener:

The purchaser of the goods is called importer. Once the buyer and the seller have agreed to the sales transactions, it is the buyers’ responsibility to initiate the opening of the letter of credit.

b) Issuing Bank/Opening Bank:

The Bank, which at the request of his customer (importer) opens a Letter of Credit is named as Issuing Bank. The Issuing Bank is the buyer’s bank/opening bank of the credit.

c) The Seller/Exporter/Beneficiary:

The supplier of the goods is called as seller or exporter or the beneficiary. The seller after shipping the goods as per terms of the credit presents the documents to the negotiating bank.

d) Advising Bank:

It is the correspondent bank of the issuing bank of the credit through which the credit issued by the opening bank is advised at seller’s country. Advising bank may also be a negotiating bank.

e) Negotiating Bank:

The bank who negotiates/purchases/discounts the documents tendered by the exporter as per terms of the credit is known as negotiating bank.

9.4 Additional parties to the Letter of Credit:

a) Confirming Bank:

Performing the same service as an Advising bank, the confirming bank, in addition, becomes liable to pay for documents in conformity with the letter of credit’s terms and conditions.

b) Accepting Bank:

A bank that (as specified in the letter of credit) accepts time usance drafts on behalf of the importer is called an accepting bank. The accepting bank can also be the issuing bank.

c) Paying Bank:

The bank that affects payment to the beneficiary (as named in the letter of credit) is known as Paying Bank/ Drawee Bank.

d) Reimbursing Bank:

If the Issuing Bank does not maintain any account with a bank that will be negotiating documents under a L/C, then arrangement is made to reimburse the Negotiating Bank for the amount to be paid under a credit from some other bank with which the Issuing Bank maintains his account. The latter bank is termed as Reimbursing Bank.

9.5 Steps Involved in Import Procedures

1. Procurement of IRC from the concerned authority

2. Signing purchase contract with the seller.

3. Requesting the concerned bank (importer’s bank to open an L/C (irrevocable) on behalf of the importer favoring the exporter/ seller/ beneficiary

4. The issuing bank opens/ issues the L/C in accordance with the instruction/ request of the importer and request another bank (advising bank) located in seller’s /exporter’s country to advise the L’C to the beneficiary. The issuing may also request the advising bank to confirm the credit, if necessary.

5. The advising bank advises/informs the seller that the L/C has been issued.

6. As soon as the exporter/seller receives the L/C and is satisfied that he can meet L/C terms and conditions, he is in a position to make shipment of the goods.

7. After making shipment of goods in favor of the importer the exporter/s submits the documents to the negotiating bank for negotiation.

8. The negotiating bank scrutinizes the documents and if found o.k. Negotiate documents and sends the said documents to the L/C issuing bank

9. After receiving the documents the L/C issuing bank also examines the document and if found o.k. And makes payment to the negotiating bank.

10. The L/C opening bank then requests the importer to receive the document payments.

9.6 Registration of Importer:

To carry on the business of import the first thing one needs is registration with the licensing authority of the area. To get this registration the interested person /institution submits the application along with the following Papers documents directly to the Chief Controller Imports and Exports or respective zonal office of CCI & E.

1. Income tax registration certificates.

2. National certificate.

3. Certificates from Camber of Commerce and Industry or Registered

Trade Association.

4. Bank solvency certificate.

5. Copy of Trade license.

6. And any other document if required by CCI&E.

7. Partnership deed in case of partnership firms

8. Certificate of Registration Memorandum and Articles of Association

in case of limited company.

The nominated bank of the application will scrutinize the papers document verify the signature of the application. After securitization and verification, the non-bank will forward the same to the respective CCI&E office with forwarding such duplicate through banks representative. The CCI&E office will acknowledge duplicate copy of the forwarding schedule and return back to the bank representative.

On being satisfied, after securitization of the documents the respective office of CCI&E will issue Import Registration Certificate (IRC) to the application. Registration is not required for import of goods by Government department authorities and statutory bodies recognized educational institutions and hospital addition, registration is not required for import of goods, which do not involve foreign exchange.

9.7 Import Formalities

Import of goods from outside Bangladesh is regulated by the Ministry of Commerce in accordance with Imports and Exports (Control) Act 1950 and the Notifications issued there under. Goods from South Africa and Israel or goods originated from these countries are not importable. Import of goods into Bangladesh is no permissible on the flag vessel of Taiwan, South Africa and Israel. Import formalities to be observed by an importer for import of goods into Bangladesh are briefly enumerated below:

The intending importers holding a valid IRC may approach his nominated Authorized Dealer to open L/C for the import of the permissible item as per current Import Policy Order (IPO). For establishing the intended L/C, the importer is required to submit the following documents/papers with the Authorized Dealer:

a) L/C application in the printed format of the designated bank (A.D.) duly filled in and signed by the importer or his authorized agent. This L/C application is also an agreement between the importer and the bank. This form is to be stamped with Tk.50 adhesive stamp affixed on it under the Stamp Act in force in Bangladesh.

b) The importer must also submit the LCA Form, together with Indent/Contract/Purchase Order/Performa Invoice/Sale Order (duly accepted by the importer) along with L/C application.

c) The importer has also to obtain Marine Insurance cover for the import and submit the Marine Insurance cover note for the purpose of opening the L/C.

d) Original IRC (duly renewed up to current date) should also be produced to the bank for verification and return.

e) Membership Certificate of Local Chamber of Commerce and Industries as well as Municipal Trade License issued in favor of the importers should also be submitted to the bank for verification and return.

f) Authorized Dealer should also, in this connection, get a full set of IMP Form duly signed by the importer which subsequently is to be submitted to Bangladesh Bank along with monthly return for sale of Foreign Exchange for the import covered under the L/C.

9.8 Opening Of Import Letter Of Credit

The import of goods into Bangladesh is regulated by the Ministry of Commerce in accordance with the imports and exports (control) Act 1950 and notifications issued there under while Bangladesh Bank control the financial aspects such as method of payments, rates of exchange, remittances against imports through its exchange control department under the provisions of foreign exchange regulation Act 1947. The Customs Authorities physically supervised the goods to ensure that the items imported are permissible under import trade control regulations before release of the same for consumption in the country.

9.8.1 Pre-Requisite For Opening Of A Letter Of Credit

a) Must be a client/account holder.

b) Request letter from the client to open L/C.

c) Original IRC (Import Registration Certificate) duly renewed upto current date should also be produced to the bank for verification and return.

d) Valid Membership Certificate from a registered Chamber of Commerce and Industries/Trade Association. .

e) Trade License.

f) Income Tax declaration in triplicate/TIN Certificate.

g) INDENT issued by the local indenting agent or PROFORMA INVOICE issued by the foreign supplier/contract/purchase order/sale order (duly accepted by the importer).

h) Fixing up of margin of L/C on mutual basis.

9.8.2 Documents Required from the Importer

a) DOCUMENTARY CREDIT APPLICATION (supplied by the Bank -duly filled in by the importer or his authorized Agent. This application is an agreement between the importer and the Bank. This form is to be affixed with Tk. 150/- adhesive stamp.

b) INSURANCE COVER NOTE (Marine/Air/Post) in favor of the

Bank

c) One set of IMP FORM (4 copies) duly signed by the importer. 3 (three) copies are to be left blank and are to be filled in after the documents arrive from the Negotiating Bank. The remaining one copy is kept for Bill of Entry purpose, which is signed by the Bank for submission to Bangladesh Bank along with the monthly return for sale of foreign exchange for the import covered under the L/C.

d) UNDERTAKING for Fluctuation of Foreign Currency duly signed.

e) LC AUTHORISATION FORM In Lieu of Import License duly signed by the importer and permission from Bangladesh Bank (may be taken by the client and/or by the Bank on behalf of the importer).

9.8.3 Points to be scrutinized on Receipt of L/C Application from the Importer

a) Verify the signature of the importer with the specimen signature available with the Bank.

b) Imported items are in accordance with Indent/ Pro-forma Invoice.

c) Item being imported is not banned or restricted.

d) L/C clauses contravene the exchange control regulations.

e) The indent bears signature of the indenting agent as well as that of the importer.

f) The marine insurance Cover Note mentions the items to be imported and the port of shipment, the destination, the mode of shipment and risk covers.

g) The indenters IRC number & registration number with Bangladesh Bank have been quoted.

If the above documents are found in order, the Bank approves the amount of margin on the basis of his past performance, his financial position, marketability of the goods, the type of credit to be opened and the type of financing the importer needs after arrival of the goods. Head Office sanctions the margin only after careful consideration to safeguard the interest of the Bank.

9.8.4 Opening of L/C

After receiving the above documents and on scrutiny of the documents on the basis of importers application, Indent/ Pro-forma Invoice, the Bank performs the following tasks:

a) Prepare the L/C (Irrevocable L/C) 6 sets signed by two authorized signatories of the Bank.

b) Reimbursement Authority (2 copies)

After preparation of the above documents (by Issuing Bank), send the following documents to Advising Bank with a forwarding letter enclosing therewith a duplicate copy of Letter of Credit in favor of the beneficiary:

a) Send two copies of L/C papers (one for Negotiating Bank and another for the Exporter/Seller) with a forwarding letter to the Negotiating Bank. Also send “Reimbursement Authority” separately to reimbursement Bank.

b) Original copy of Reimbursement Authority (1 copy) and a copy of L/C be sent to the reimbursement Bank separately.

In case L/C – At sight

Reimbursement Authority to be sent to Advising Bank to honor reimbursement claim of the claiming/Negotiating Bank against above noted credit by debit to our Head Office A/c No.____ maintained with Advising Bank in that country.

In case L/C – Deferred Payment

A clause be incorporated in the Original L/C that “claim reimbursement on maturity date” from Head Office account.

9.8.5 Prior Permission of Bangladesh Bank for Import

All imports into Bangladesh against cash foreign exchange resources of the country are subject to prior permission of the Bangladesh Bank in the form of registration of Letter of Credit Authorization Forms from the Bangladesh Bank Registration Units stationed at all offices of the Chief Controller of Imports and Exports. Ministries and Govt. Departments may; however, import goods against specific allocations given to them by the Ministry of Finance subject to obtaining specific clearance from the Exchange Control Department of Bangladesh Bank and no L.C. Authorization Form, Import Permit or Clearance Permit are required for their import.

For import under External Economic Aid, Loan/ Credit, Commodity Exchange and Wage Earner’s Scheme, no L.C. Authorization Form is required to be got registered with Bangladesh Bank Registration Unit unless otherwise specifically mentioned by Bangladesh Bank in any Foreign Exchange Circular for any particular category/item of import. Imports under Secondary Exchange Market Scheme (SEM), however, necessitate prior registration of L.C. Authorization Forms with the Bangladesh Bank Registration Units.

9.8.6 L.C. Authorization Form (Letter of Credit Authorization Form)

L/C. Authorization Forms are available in sets (each set consisting of five copies) with all Authorized Dealers of Foreign Exchange. The copy marked “For Exchange Control Purpose” acts as the basis on which remittances against imports into Bangladesh are permitted. No Letter of Credit may be opened and/or remittances of foreign exchange effected by an Authorized Dealer to cover import of goods into Bangladesh unless the Exchange Control copy of a valid L/C. Authorization Form that is duly registered with the Bangladesh Bank, where such registration is required, covers the import.

In case of imports against barter/loan/aid etc. where registration of L.C. Authorization Forms will not be needed the nominated bank of the importer will submit the Form directly to the designated bank. The designated bank will countersign the Form under their seal with date. The designated Bank will retain the original and duplicate copies of the Form and send triplicate and quadruplicate copies to the licensing office and quintuplicate copy to the importer’s bank.

The Authorized Dealers will not issue blank L.C. Authorization Forms to their clients.

The importers should sign the L.C. Authorization Forms themselves in all cases in the presence of the Authorized Officer of the bank. The Authorized Dealer should sign the LCAF evidencing verification of the importer’s signature and his entitlement. Authorized Dealer (A.D.) should, however, be satisfied before allowing their clients to sign the LCAFs that they have got entitlement of the amount for importing goods under the current Import Policy as declared by the Government. A.Ds, should also ensure that while signing the L.C. Authorization Forms, the Bank’s official concerned puts his signature with date and seal, hi no case A.D. will accept authenticated LCAFs (for opening L.C.) direct from the parties.

Bangladesh Bank’s registration of all LCAFs for import of industrial raw and packing material and also for import of commercial items will remain valid for remittance for one year subsequent to the month of registration e.g. 15.01.99 Reg. Valid until 31.01.2000. Registration of LCAFs issued for import of capital machinery and spares will remain valid for 18 months subsequent to the month of Registration.

A.Ds should not under any circumstances, make remittance against any LCAF after expiry of the registration validity without first obtaining revalidation of registration from the Bangladesh Bank. A.Ds should ensure that registration number as given by the Bangladesh Bank is correctly and legibly reproduced on the IMP forms covering the sale of exchange as also on the relative schedules.

9.8.7 Letter of Credit and Remittances against Imports

A.Ds should established L.C. against specific authorization only on behalf of their own customers who maintain accounts with them and are known to be participating in the trade. Payments in retirement of the bills drawn under L.Cs must be received by the A.Ds by debit to the account of the concerned customer or by means of a crossed cheque drawn on the drawee’s other bankers. These restrictions will not only apply to import of articles for the private use of the importer (actual user).

All L/Cs and similar undertaking covering imports into Bangladesh must be documentary L.C. and should provide for payment to be made against full sets of on board (shipped) bills of lading, air consignment notes, railway receipts, post parcel receipts showing dispatch of goods covered by the credit to a place in Bangladesh. All L/Cs must specify submission of signed invoices and certificates of origin. If any particular LCAF requires the submissions of any other document or the remittance of exchange at certain periodical intervals or in any other manner, the L/Cs should be opened incorporating the instruction contained on the LCAF.

It is not permissible to open L/C for imports into Bangladesh in favor of beneficiaries in countries imports from which are banned by the competent authority.

A.Ds will open L/Cs invariably in the currencies (approved ones as notified by the Bangladesh Bank from time to time) in which the indents are procured by the importers.

L/Cs covering import of goods into Bangladesh against valid LCAF should be opened within the period prescribed by the Licensing Authority.

No amendment or revalidation of L/C against LCAF will be valid without the prior permission of the Licensing Authority. However, this restriction shall not be applied where the amendment is of technical nature or where the extension is made upto the period of validity for shipment against relative LCAF.

9.8.8 Advising of Letter of Credit

Advising means forwarding of a Documentary Letter of Credit received from the Issuing Bank to the Beneficiary (exporter). Before advising an L/C the Advising Bank must see the following:

1. Signatures of Issuing Bank officials on the L/C verified with the Specimen Signatures Book of the said bank when L/C received by airmail.

2. If the Export L/C is intended to be an operative cable L/C, Test Code on the L/C invariably be agreed and authenticated by two authorized officers.

3. L/C scrutinized thoroughly complying with the requisites of concerned UCPDC provisions.

4. Entry made in the L/C Advising Register.

5. L/C advised to the Beneficiary (exporter) promptly and advising charges recovered.

9.8.9 Amendments to Letter of Credit

After issuance and advising of a Letter of Credit, it may be felt necessary to change some of the clauses of the Credit. All these modifications are communicated to the Beneficiary through the same Advising Bank of the Credit. Such modifications to a LC are termed as amendment to a Letter of Credit.

There may be some of the conditions in a Credit are not acceptable by the beneficiary. In this case, beneficiary contact applicant and request for amendment of the clauses. On receipt of such request applicant approaches his banker i.e. issuing bank with a written request for amendment to the Credit. The issuing Bank scrutinize the proposal for amendment and same are not in contravention with the Exchange Control Regulation and bank’s interest bank may then process for amendments form an integral part of the original Credit.

L/C amendments are to be communicated by telex, SWIFT or mail. If there are more than one amendment to a Credit, all the amendment must bear the consecutive serial number that the advising bank can identify the missing of any amendment.

The Issuing Bank has to-

a) Obtain written application from the applicant of the credit duly signed and verify the bank.

b) In case of increase of value, application for amendment is to be supported by Indent/ Pro-forma Invoice evidencing consent of the beneficiary.

c) In case of extension of shipment period, it should be ensured that relative LCA valid/revalidated/increased up to the period of proposed extension.

d) Amendment on increase of Credit amount and extension of shipment of shipment period because amendment of Insurance Cover Note also to be submitted.

e) Proper recording and filing of amendment is to be maintained.

f) Amendment charges (if on account of applicant) will be recovered and necessary voucher is to be passed.

The following clauses of L/C are generally amended-

1. Increase/decrease value of L/C and increase/decrease of quantity of goods.

2. Extension of shipment/negotiation period.

3. Terms of delivery i.e. FOB, CFR: CIF etc.

4. Mode of shipment.

5. Inspection clause.

6. Name and address of the supplier.

7. Name of reimbursing bank.

8. Name of the shipping line etc.

9.9 After Shipment of Goods

The beneficiary of the L/C (supplier) after effecting shipment of the goods as per terms of the L/C, prepares/collects mil set of B/L, Bill of Exchange, Commercial Invoice and necessary documents as required under the terms of the L/C and presents the drafts to the negotiating bank along with the supporting documents for negotiation.

The negotiating bank negotiates the drafts and if they find the documents in order as per terms of L/C, they make payments to the beneficiary and forward the Drafts and the shipping documents to the L/C opening Bank under cover of a forwarding letter containing necessary instructions for L/C opening Bank. The negotiating bank also obtains reimbursement of the amount paid against the Draft either by debit to Nostro account of the L/C opening Bank or otherwise as stipulated in the L/C.

When does Negotiating Bank send documents for collection to Issuing Bank (Advising Bank)?

a) In case discrepancies are found by the Negotiating Bank.

b) In case of minor discrepancies, at the request of the beneficiary (seller/exporter).

c) In case Negotiating Bank does not want to negotiate (purchase) documents/does not want to effect payment without collection of documents from the Advising Bank (L/C Issuing Bank).

9.9.1 Documents of Import Bill

Import Bill comprises of the following documents:

Documents Source

a) Covering letter of Negotiating Bank.

b) Bill of Exchange or Draft Exporter

c) Bill of Lading Shipping

Declaration to Bill of Lading.

d) Shipment Airway Bill. Air Line

e) Commercial Invoice Exporter

f) Packing List. Exporter

g) Certificate of Origin. Chamber of Commerce

Indus.

h) Pre-shipment Inspection Local Agent of seller.

Certificate/Clean Report

of Findings (CRF).

i) Shipment Advice Shipping Agent

j) Beneficiary’s Certificate.

k) Weight Note.

l) Custom Certificate,

m) Other documents, if called

for under the credit.

9.9.2 Scrutiny Of Shipping Documents/Lodgment Of Import Bills

On receipt of shipping documents from the negotiating bank, the same should be very carefully scrutinized to ensure that they have been drawn strictly as per terms of the relative credit.

The Bank will look into the following main points and scrutinize the documents with reference to the terms of the credit:

a) The documents have been negotiated within the stipulated date and the amount of the draft is within the L/C amount. The draft has been drawn in accordance with the L/C terms and is endorsed to the order of the Bank.

b) The invoices have been properly and correctly drawn and signed by the supplier giving full description of the merchandise along with unit price as per Indent. The Invoice must bear the LCA number, IRC number of the importer, ITC schedule number and Registration number of the Indenter.

c) The Bill of Lading is a clean “Shipped on Board” B/L showing freight prepaid and is duly endorsed to the order of the Issuing Bank. The B/L must not show any adverse clause about the condition of the goods. The port of shipment, port of destination, date of shipment, name of consignee, notify party as shown in the B/L must agree with those mentioned in the L/C. The B/L must bear the authorized signature and cover the merchandise described in the Invoice.

d) The Certificate of Origin given by the supplier should be in conformity with that mentioned in the L/C.

e) Other documents such as packing and weight lists, should also accompany the shipping documents and must correspond with the terms of the L/C.

f) A copy of the Insurance declaration is attached to the documents which should be sent by the beneficiary to the importer/insurance company immediately after the shipment has taken place.

g) Verify if the foreign correspondent’s dues are charged in accordance with the instructions contained in the L/C.

h) All other documents required in the L/C are received.

If any discrepancy is noticed, the same should be brought to the notice of the importer immediately for his written instruction before lodgment in BLC and payment is made. If the importer refuses to accept the documents, the negotiating bank should be advised within 3 working days of receipt of the documents by cable/telex for instruction with regard to the disposal of the goods and the documents.

9.9.3 Bills Under Letter Of Credit (BLC)

It is a funded credit facility extended to the customers to lodge the import bills after satisfying that the documents have been drawn strictly in accordance with the credit terms and conditions. Usually, bills drawn under cash L/C are to be paid at sight. But most of the cases, it is observed that clients fails to place the required fund at the bank’s disposal to settle the negotiating bank’s claim. In such cases, Bank has to create a BLC account in the name of customer towards settlement of claim within 3 working days from the date of receipt of shipping documents. It is worth mentioning here that BLC is created for full invoice value from the date of negotiation of documents by the foreign banks and in this case clients participation i.e. margin will not be taken into consideration.

When Bank lodges the import documents through debit of BLC, the documents are thereafter stamped with BLC number and entered into BLC Register. The shipping documents are then kept in safe custody for ultimate delivery to the importer. The importer should be immediately called in writing to retire the import documents.

BLC liability is supposed to be adjusted with up-to-date interest within 21 days from the date of negotiation of shipping documents by the foreign banks. If an importer retires the documents within the stipulated 21 days, he will be entitled to receive interest on the margin amount at the prevailing savings rate of interest.

9.9.4 Retirement of Import Bills

Retirement means release of document on receipt of full payment of the bills from customers. This process of settlement of import claims is technically known as retirement of bills. Before retirement bank should ensure that all payables have been recovered and that all formalities including exchange control requirements are complied with.

On receipt of intimation, the importer gives necessary instructions with regard to retirement of bill. The importer may ask the bank to retire the bill by debit to his account. The shipping documents are handed over to the importer after adjustment of the loan to the debit of his account. Before delivering the import documents to the importer, the Bank should –

a) Endorse on the invoices the amount that they have remitted from Bangladesh.

b) Endorse the bill of exchange and bill of lading to the order of the importer.

c) Return the custom purpose copy of the LCA to the importer for clearance of the consignment from the custom authority.

The importer may request for providing LIM facility, if arranged earlier, hi case L1M facility is given, normally bank itself will arrange for clearance of the goods on payment of import duty, sales tax and other charges and store the goods at the bank’s go-down subject to release on production of delivery order as per arrangement.

Sometimes the documents are also handed over to the importer against Trust Receipt (TR) for clearance of the goods on the clear understanding that the importer will hold he goods or the sale proceeds thereof in trust with him at the disposal of the bank till the entire loan is liquidated.

All payments for imports into Bangladesh are REQUIRED TO BE REPORTED to Bangladesh Bank with the original copy of the IMP form duly certified by the Bank. The importer is required to produce exchange control copy of customs bill of entry to the bank within 4 months from the date of remittance.

9.9.5 Shipping Guarantee for Release of Imported Goods

The original shipping documents are evidence of shipment of merchandise under documentary credit. The importer gets the goods released from the port by presenting the original Bill of Lading (BL).

Sometimes the goods arrive before the receipt of shipping documents by the Bank, hi such cases; the importer may be able to obtain a STEAMSHIP GUARANTEE from the Bank for the merchandise. He can then turn this guarantee over to the carrier, in place of the Bill of Lading, and pick up his goods.

A steamship guarantee is a document issued by the bank and addressed to the carrier. It asks the carrier to accept the guarantee in place of all original bills of lading and to release certain merchandise to the importer. The guarantee promises that there will be no legal consequences on the carrier because he has released the merchandise without a bill of lading and that an original bill of lading will be forwarded as soon as it is received.

The bank will realize full payment before issuance of a shipping guarantee. The importers will undertake/accept original documents even with discrepancies. The bank will also endorse non-negotiable shipping invoice and bill of lading in favor of the importer. The bank will maintain a register for issuance of shipping guarantee.

9.10 Financing Of Import

9.10.1 Post import finance-

9.10.1(A) Loan Against Imported Merchandise

The Loan against Imported Merchandise (LIM) or Trust Receipt (TR) is post-import financing allowed by the Bank to its valued customers in specific cases. At the time of retirement of import documents, the importer may request the Bank for providing LIM facility.

In case LIM facility is given, normally bank itself will arrange for clearance of the goods on payment of import duty, sales tax and other charges and store the goods at the Bank’s godown subject to release on production of delivery order as per arrangement.

The loan against security of merchandise imported through the Bank are allowed against pledge of goods, retaining margin prescribed on their landed cost, depending on their categories and credit restrictions imposed by the Bangladesh Bank. The letter of undertaking and Indemnity shall be obtained from the client before the goods are cleared through LIM account.

The clearance of the goods should be taken through approved clearing agent of the bank. The landed cost of the merchandise shall properly be worked out before the goods are delivered to the customer against proportionate payment. In case of part delivery, it must be ensured that the valuable and less valuable items are not averaged together.

The following documents must be obtained from the customer before creating LIM:

a) Demand Promissory Note.

b) Letter of Agreement.

c) Letter of Pledge with Supplementary Agreement.

d) Merchandise to be duly insured with specific risk clauses along with Bank’s mortgage clause.

e) Letter of disclaimer to be obtained from the owner of the godown in case of rented godown.

9.10.1(B) Trust Receipt (T.R.)

Trust Receipt is a non-renewable funded credit facility allowed by the Bank to its exclusively valued clients only. For such loan prior approval from Head Office must be obtained, hi case of LTR, import documents are delivered to the customer WITHOUT PAYMENT.

The period of Trust Receipt may be 30, 45, 60 or 90 days as allowed by Head Office, The loan is adjustable within the period. The customer holds the goods or their sale proceeds in Trust for the Bank till the loan is fully adjusted. The Trust Receipt is a document that creates the Bank’s lien on the goods. The sale proceeds of goods held in Trust must be deposited in the Bank by the borrower, irrespective of the period of the Trust Receipt. Trust Receipt is always calculated on the amount arrived at after deducting the amount held in margin account.

The following documents must be obtained before allowing LTR:

a) Demand Promissory Note.

b) General Letter of TR with supplementary Agreement.

c) Letter of Agreement.

d) Personal Guarantee of all the partners in case of Partnership firm.

e) Personal Guarantee of all Directors in case of Limited Company.

9.10.2 Clean Import Loan (CIL)

This is a clean advance to the importer and the bank has no control over the goods. The bank is given a promissory note and sight bills are settled by debiting the importer’s CIL A/C with the full bill amount. The marginal deposit (if any) should be credited to the CIL account treating it as partial payment. The CIL is repayable at maturity with interest calculated in arrears. Bank charges the importer prevailing commercial interest rate for the amount of loan sanctioned. Maturity ranges from say, 30 days to as much as 180 days or more after the loan is drawn down depending on the customers’ trade cycle.

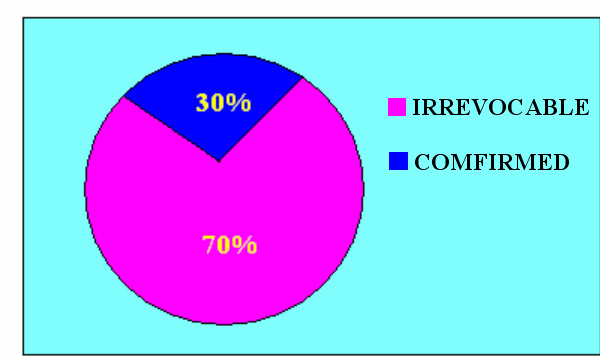

10.1 Volume of different types of L/C in HSBC regarding the degree of security

TYPES | VOLUME |

IRREVOCABLE | 70% |

CONFIRMED | 30% |

ANALYSIS:

This graph is based on the volume of different types of L/Cs according to security provided by the bank. There are several types of L/Cs issued by Import department such as Revocable, Irrevocable, confirmed. The graph shows the percentage of these L/Cs. From here we can see that the Irrevocable L/Cs are in most common L/C (70%). And then revocable & confirmed are in 00% & 30% respectively. Irrevocable L/C constitutes a definite undertaking of the issuing bank, provided that the terms and conditions of the credit are complied with.

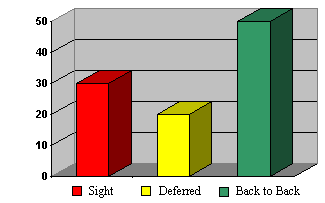

10.2 Volumes of different types L/C according to payment methods

TYPES | VOLUME |

Sight | 30% |

Deferred | 20% |

Back to Back | 50% |

ANALYSIS:

This graph shows the different types of L/Cs regarding payment method. It means when customer opens L/C they have to ensure the payment method that in which method they will pay the bill. In that case the bank provide them a specific time period and by this time the customer have to complete their payment otherwise the bank will charge interest. In this method the sight, deferred and back-to-back L/C have 30%, 20%, 50% volume respectively.

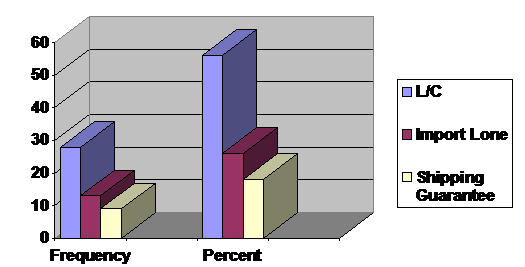

10.3 Customer View point regarding the products of HSBC

Products | Frequency | Percent |

L/C | 28 | 56% |

Import Loan | 13 | 26% |

Shipping Guarantee | 9 | 18% |

Total | 50 | 100 |

This graph has a clear indication of the various products of HSBC. Banking products means the services that a bank provides to its customer. In export and Import business, it is observed that L/C has the top most priority to the customer. On the other hand the bank earns their major revenue from L/C department. And the other products: import loan (26%), and shipping guaranty (18%) volume accordingly.

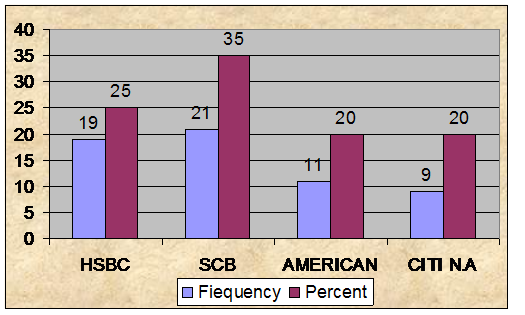

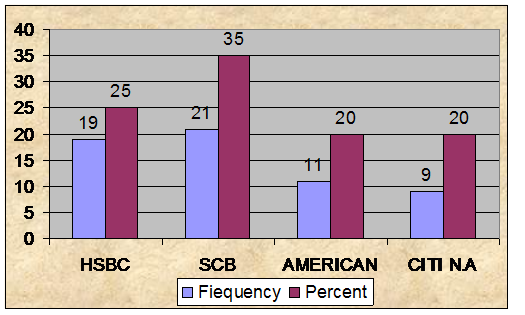

10.4 Ranking of the different Banks regarding customer View Point

Bank | Frequency | Percent |

HSBC | 19 | 25% |

SCB | 21 | 35% |

AMERICAN EXPRESS | 11 | 20% |

CITI N.A | 9 | 20% |

TOTAL | 50 | 100 |

ANALYSIS:

This graph shows the ranking of different banks leading in Bangladesh regarding customer viewpoint. According to that, 35% of the total customer conducts business with Standard Chartered which is the highest and 14% conduct transaction with HSBC, the second highest, hi case of other banks Amex and Citibank are in same position.

10.5 Level of customer Satisfaction

LEVEL | FREQUENCY | PERCENT |

SATISFACTION | 15 | 30 |

HIGHLY SAT | 9 | 18 |

NEUTRAL | 11 | 22 |

DISSATISFACTION | 8 | 16 |

HIGH DIS | 7 | 14 |

TOTAL | 50 | 100 |

ANALYSIS:

This graph is based on level of satisfaction regarding to customer point of view. This level of satisfaction is based on the service standard. Here the products mean the service provided by the trade services department and if it matches with expectations then the customer experience satisfaction if not then dissatisfaction. According to the chart it is apparent that majority (30%) of the respondents are satisfied with the service that they got from the bank. The interesting fact is that 22% of the respondents are in neutral position that is they don’t know whether are satisfied or not.

10.6 The Charges Of Import L/C

Import | On Shore Corporate Banking Charges | Off Shore Corporate Banking Charges | ||

Product | Charge | Minimum | Charge | Minimum |

| Documentary Credit (DC) | ||||

| Opening | ||||

| Documentary Credit-Sight | 0.50% 1st qrt 0.30% subsequent qrt | BDT1000+Transmission Charges | 0.50% 1st qrt 0.30% subsequent qrt | USD20+Transmission Charges |

| Deferred Payment credit-usuance | 0.50% 1st qrt 0.30% subsequent qrt | BDT1000+Transmission Charges | 0.50% 1st qrt 0.30% subsequent qrt | USD20+Transmission Charges |

| Back to Back Credit (BBC) | 0.60% 1st qrt 0.40% subsequent qrt | BDT1000+Transmission Charges | 0.60% 1st qrt 0.40% subsequent qrt | USD20+Transmission Charges |

Amendment | ||||

| Increase of amount/Extension of Validity | 0.50% 1st qrt 0.30% subsequent qrt | BDT1000+Transmission Charges | 0.50% 1st qrt 0.30% subsequent qrt | USD20+Transmission Charges |

| Other DC Terms | BDT1000+Transmission Charges/Courier Charges | USD20+Transmission Charges | ||

Cancellation | ||||

| Per DC | BDT1500 | USD25 | ||

Shipping Guarantee/Airway Bill Release/Delivery Order | ||||

| Issuance/amendment | BDT1500 | USD25 | ||

Import Bills | ||||

| Acceptance Commission | 0.50% 1st qrt 0.30% subsequent qrt | BDT1000+Transmission Charges | 0.50% 1st qrt 0.30% subsequent qrt | USD20+Transmission Charges |

| Handling of DC/ Non Dc Sight Bills | BDT1000 per presentation | USD20 per presentation | ||

| Collection of Usance Non DC Bills | 0.30% per presentation | BDT1000 per presentation | 0.30% per presentation | USD20 per presentation |

| Other Charges (on account of Beneficiary) | ||||

| Discrepant Document Handling Fee | USD75 per presentation | USD75 per presentation | ||

| Reimbursement Fees | USD75 per presentation | USD75 per presentation | ||

| Payment Cable Chares | USD20 per presentation | USD20 per presentation | ||

| Foreign Correspondent Charge | At Actual + Transmission Charges | At Actual + Transmission Charges | ||

| Registration of Letter of Credit Authorization (LCA) | BDT500 per LCA | |||

| Pre-shipment Inspection (PCI) | ||||

| Processing charge | BDT200 per DC | |||

11.1 Recommendation

The recommendation of this research paper is based on three perspectives.

I. Systems Implementation,

II. Systems Maintenance, and

III. Further Improvement

11.1.1 Systems Implementation

It is never possible to develop a system based on one single scratch. An information system development is a matter of multiple phased efforts of the developers of the system. The proposed system is currently in development phase. Which includes-

- System development (Module and integration testing).

- System Testing.

Specifically the current project is at module and integration testing and system testing stage. It is a parallel process with system development. In this stage the modules of the system is created and tested by the developer. During integration testing groups of modules are combined into test modules and tested together (Hawryszkiewycz, 1998). This is also known as integration testing. The goal is to determine whether the interfaces between modules work perfectly. Then the entire system will be tested. The entire system will be tested by the end users (bank users). The use of proto typing tools can be employed to show the users the functionality of the system. The end users will provide their suggestions, advice for the improvement of the system. To increase the adaptability of the user to the system, three or four training sessions are necessary to make the users acquaintance.

10.1.2 Systems Maintenance

Maintenance is necessary to eliminate errors in the system during its working life and to tune the system to any variations in its working environment (Hawryszkiewycz, 1998). The system maintenance will be based on the user’s suggestions. Moreover, the maintenance of the web server will performed according to the organizations IT policy. System software will be maintenance by the IT department of the organization.

11.1.3 Further Improvement

Further improvement of the system can be performed according to the user’s requirements. A web based LC related issues such as complaint, enquiry, suggestions can be added as modules in the current modules of LC tracking system.

12. Conclusion

The task of developing an information system based on the real world business process is very crucial as the acceptability of the information system depends on the user’s requirement and adaptability with the new system. The implementation of a new system is subject to organizational change. Whether the organization accepts this change is based on the successful implementation of the systems development and the organization is prepared take to such change. The researcher with his sincere effort has tried to analyze the business process, take accurate user requirements and to design based on the user’s need. This report is an effort to implicate the theoretical knowledge in the practical field based on real life scenario.

![Report on L/C Tracking System of HSBC [part-3]](https://assignmentpoint.com/wp-content/uploads/2013/03/hsbc1.jpg)