Introduction:

The special feature of the investment policy of the bank is to invest on the basis of profit loss sharing system in accordance with the tents and principles of Islamic Shariah. Earning profit is not the only motive and objective of the Banks investment policy rather emphasis is given is attaining social good and in creating employment opportunities.

Pursuant to the investment policy adopted by the bank a 7 years perspective investment plan has been drawn up and put into implementation. The plan aims at diversification of the investment portfolio by size, sector, geographical area, economic purpose and securities to bring in phases all sectors of the economy and all types of economic groups of the society within the fold of banks investment operations.

Accordingly the plan envisages composition of the investment prot-folio with for agriculture and rural investment, 19% for industrial term investment, 24% for industrial working capital, 8% for housing and real estate, 3% for transport arid communication, 0% for electricity, gas, water and sanitation services, 2% for storage’s 40% for import, export and local trade and trade related activities and14 % for other productive purposes by the end of the plan period, i.e. the year 2007.Further, in order to diversify investment profit-folio, the bank engaged itself in investment operations through special schemes introduced during the years. The Bank is planning to introduce yet other new investment schemes in addition to welfare oriented investment schemes, Rural Development scheme. Transport investment schemes, car investment scheme, small business investment schemes, Doctors investment scheme, Household Durables investment scheme, Housing investment scheme and agricultural implements investment scheme etc. Besides the bank is financing various economic groups in different sectors in both urban and rural areas for enlistment of their economic condition.

Islami Bank Bangladesh is a financial institution whose status, rules and procedures expressly state its commitment to the principle of Islamic Shariah. Consequently Islamic banks operate on Islamic principles of profit and loss sharing, strictly avoiding interest, which is the root of all exploitation and is responsible for large-scale inflation and unemployment. In this report, we undertake microscopic analysis mainly on different Modes of Investment of IBBL.

This report is based on an internship program. IslamiBankTraining & ResearchersAcademy arranges internship program to gather practical knowledge about banking activities followed by IBBL for University students as Universities conducted with different organization after the completion of theoretical courses of program of Masters of Business Administration (MBA). Each intern must carry out a specific project, which is assigned by the IBTRA. Consequently a report based on the projects is to be submitted to the authority of IBTRA. I select Islamic Bank Bangladesh Limited (IBBL) for my internship & since then I have started our realistic orientation program in General Banking, Investment & foreign exchange department. But I have prepared my project paper on investment as it is assigned by IBTRA.

The first objective of writing the report is fulfilling the partial requirements of the MBA program. In this report, I have attempted to give on overview of Islami Bank Bangladesh Limited in general. Following are the main objectives

- To familiar with the history and operations of Islami Banking in Bangladesh.

- To show the investment mechanism and product offerings in different modes of IBBL.

- To show overall investment proposal, appraisal procedures, documentation system of IBBL and Conventional Banks.

- To show the differences with conventional banking regarding investments aspects

- To identify strength and weakness of investments of IBBL.

- To identify the problems related to investments faced by IBBL.

- To recommend actions that may be necessary to redesign the investments of IBBL.

In our economy, there are mainly three types of schedule commercial banks are in operation. They are Nationalized Commercial Banks, Local Private Commercial Banks and Foreign Private Commercial Banks. Islami Bank has discovered a new horizon in the field of banking area, which offers different General Banking, Investments and Foreign Exchange banking system. So we have decided to study on the topic “Different Investment Modes of IBBL”. Because the Internship program of the university is an integral part of the MBA program. This also provides an opportunity to the students to minimize the gap between theoretical and practical knowledge. During the internship program the teachers of the department are attached to actively and constantly guide the students. Students are required to work on a specific topic based on their theoretical and practical knowledge acquired during the period of the internship program and then submits it to the teacher. That is why I have prepared this report.

For carrying out this project paper I had to study the actual banking operations of IBBL.

In order to carry out this study, two sources of data and information have been used:

a) Primary data

I discussed with the executives & officials of the IBBL and found the approximate data, which has been presented in the report. I also discussed with the officials of conventional Banks & IBTRA regarding the issue and found necessary information, which has been presented in the report.

b) Secondary data

● Annual Reports of 2006-2007 of Islami Bank Bangladesh Ltd.

● Desk report of the related department

- Manuals of Islami Bank Bangladesh Limited (Bai-Murabaha, Bai-Muajjal, Bai-Salam, Musharaka)

- Training sheets which are provided by Islami Bank Training and Research Academy (IBTRA).

- Online data form IBBL website.

The scope of this paper is limited to the organizational structure, background, and objectives, functions, and investment performance of IBBL as a whole. The scope is also limited to different investment schemes, modes, mechanism, investment proposal appraisal procedures, monitoring and documentation of IBBL.

There are some limitations of the study. I faced some problems during the study, which I am mentioning them as below-

i) Lack of time:

The time period of this study is very short. I had only 8 weeks in my hand to complete this report, which was not enough. So I could not go in depth of the study. Most of the times the officials were busy and were not able to give me much time.

ii) Insufficient data:

Some desired information could not be collected due to confidentiality of business.

iv) Other limitations:

As I am newcomer, there is a lack of previous experience in this concern. And many practical matters have been written from my own observation that may vary from person to person.

CHAPTER 2

About Islami Bank Bangladesh Limited

What is Islamic banking?

Islami banking has been defined in different ways.the definition of Islamic bank, as approved by the Secretariat of the OIC, is stated in the following manner.

“An Islami bank is a financial institution whose stratus, rules and procedures expressly state its commitment to the principle of Islamic Shariah And to the banning of the receipt and payment of interest on any of its operations”(Ali & Sarker 1955,pp.20-25).

Shawki Islami Shehta viewing the concept from the prospective of an Islamic Economy and the prospective role to be played by an Islamic bank therein opines:

“It is, therefore, natural, and indeed, imperative for an Islamic bank to incorporate in its functions and practices commercial investment and social activities, as an institution designed to promote the civilized mission of an Islamic Economy”(Ibid).

Ziauddin Ahmed says, “Islamic banking is essentially a normative concept and could be defined as conduct of banking in consonance with the ethos of the value system of Islam” (Ibid).

It appears from the definition that Islamic banking is systems of financial intermediation that avoids receipt and payment of interest in its transaction and conducts its operation in a way that it helps achieve the objectives of an Islamic economy. Alternatively, this is a banking system whose operation is based on Islamic principles of transaction of which profit and loss sharing (PLS) is a major feature, ensuring justice and equity in the economy. That is why Islamic banks are often known as PLS bank.

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur’an and the Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. In August 1974, Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganize its economic and financial system as per Islamic Shariah. In January 1981, Late President Ziaur Rahman while addressing the 3rd Islamic Summit Conference held at Macca and Taif suggested. “The Islamic countries should develop a separate banking system of their own in order to facilitate their trade and commerce”.

This statement of Late President Ziaur Rahman indicated favorable attitude of the Government of the People’s Republic of Bangladesh towards establishing Islamic banks and financial institutions in the country. Earlier in November 1982, Bangladesh Bank, the country’s Central Bank, sent a representative to study the working of several Islamic Banks abroad. In November 1982, a delegation of IDB visited Bangladesh and showed keen interest to participate in establishing a joint venture Islamic Bank in the private sector. They found a lot of work had already been done and Islamic banking was in a ready form for immediate introduction. Two professional bodies Islamic Economics Research Bureau (IERB) and Bangladesh Islamic Banker’s Association (BIBA) mode significant contributions towards introduction of Islamic Bank in the country.

They came forward to provide training on Islami Banking to top bankers and economists to fill up the vacuum of leadership for the future Islamic banks in Bangladesh. They also help seminars, symposia and workshops on Islamic economics and banking throughout the country to mobilize public opinion in favor of Islamic banking.

Their professional activities were reinforced by a number of Muslim entrepreneurs working under the aegis to the then Muslim Businessmen society (now reorganized as industrialist & Businessmen Association). The body concentrated mainly in mobilizing equity capital for the emerging Islamic Bank.

At last, the long drawn struggle to establish an Islamic bank in Bangladesh becomes a reality. Islamic Bank Bangladesh Limited was established in March 1983. In which 19 Bangladeshi nationals, 4 Bangladeshi institutions, and 11 banks, financial institutions and government bodies of the Middle East and Europe Including IDB and two eminent personalities of the kingdom of Saudi Arabia Joined hands to make the dream a reality.

The establishment of Islami Bank Bangladesh Limited is the true reflection of this inner urge of its people, which started functioning with effect from March 30, 1983. This Bank is the first of its kind in Southeast Asia. It is committed to conduct all banking and investment activities on the basis of interest-free profit-loss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam.

The philosophy of IBBL is to the principles of Islamic Shariah. The organization of Islamic conference (OIC) defines an Islamic bank as “a financial institution whose status, rules and procedures expressly state its commitment to the principles of Islamic Shariah and to the banking of the receipt and payment of interest on any of its operations. The sponsor, perception is that IBBL should be quite different from other privately owned and managed commercial bank operating in Bangladesh, IBBL to grow as a leader in the industry rather than a follower. The leadership will be in the area of service, constant effort being made to add new dimensions so that clients can get “Additional” in the matter of services commensurate with the needs and requirements of the country’ growing society and developing economy.

Islami Bank Bangladesh Limited (IBBL) was incorporated on13.03.1983 as a public company with limited liability under the companies act, 1913. The bank started functioning with effect from 30.03.1983 as the first Shariah based interest-free bank in South-East Asia.

The bank is committed to run all its activities as per Islamic Shariah. IBBL through its steady progress and continuous success has, by now, earned the reputation of being one of the leading private sector banks of the country. The distinguishing features of IBBL are as under:

All its activities are conducted on interest-free system according to Islamic Shariah.

Investment is made through different modes permitted under Islamic Shariah.

Investment income of the bank is shared with the Mudaraba depositors according to a ratio to ensure a reasonably fair rate of return on their deposits.

Its aims are to introduce a welfare-oriented banking system and also to establish equity and justice in the field of all economic activities.

It extends Socio-economic and financial services to the poor, helpless and low-income group of the people for their economic upliftment particularly in the rural areas.

It plays a vital role in human resource development and employment generation particularly for the unemployed youths.

Its aim is to achieve balance growth & equitable development of the country through diversified investment operations particularly in the priority sectors and in the less developed areas.

· To conduct interest-free banking.

· To establish participatory banking instead of banking on debtor-creditor relationship.

· To invest on profit and risk sharing basis.

· To accept deposits on Mudaraba & Al-Wadeah basis.

· To establish a welfare-oriented banking system.

· To extend co-operation to the poor, the helpless and the low-income group for their economic upliftment.

· To play a vital role in human development and employment generation.

· To contribute towards balanced growth and development of the country through investment operations particularly in the less developed areas.

- To contribute in achieving the ultimate goal of Islamic economic systems

- To establish a well-balanced economic system.

The operation of Islamic Bank Bangladesh limited can be divided into three (3) major categories:

- General Banking:

It includes: –

a. Mobilization of deposits

b. Receipts and payment of cash.

c. Handling transfer transaction.

d. Operations of clearing house

e. Maintenance of accounts with Bangladesh bank and other bank.

f. Collection of cheques and bill.

g. Issue and payment of Demand Draft, telegraphic transfer and payment

Order.

h. Executing customers standing instructions.

i. Maintenance of safe deposit lockers.

j. Maintenance of internal accounts of the bank.

While doing all the above noted work IBBL issue cheques-book, Deposit account operating form, SS card, Ledgers, Cash book, Deposit account ledgers, preparation statement of accounts, Pass book, Balance of different accounts and calculates profits.

Islami Bank Bangladesh limited offers to open the following account to the depositors:

1. Al-Wadeah Current Account.

2. Mudaraba Savings Account.

3. Mudaraba term deposit Account. (3 month / 6 month / 12 month / 36 months term)

4. Mudaraba Special notice Account

5. Mudaraba Hajj Savings Account (1 year to 25 year term)

6. Mudaraba Special savings (pension) Account (5 year to 10 year term)

7. Mudaraba Savings bond Scheme (5 year & 8 year term)

8. Mudaraba Foreign Currency Deposit Account.

9. Mudaraba Monthly Deposit Account.

10. Mudaraba Moharana Account.

2. Investment:

It includes:

IBBL invests its money in various sectors of the economy through different modes permitted by shariah and approved by Bangladesh Bank. The modes of investment are as follows:

Bai-Mechanism

- Bai-Murabaha

- Bai- Muazzal

- Bai-Salam

- Istishna

Leasing, Ijara, Hire Purchase (HP) Hire Purchase under shirkatul Melk (HPSM)

Shirkatul Mechanism

- Musharaka

- Mudaraba

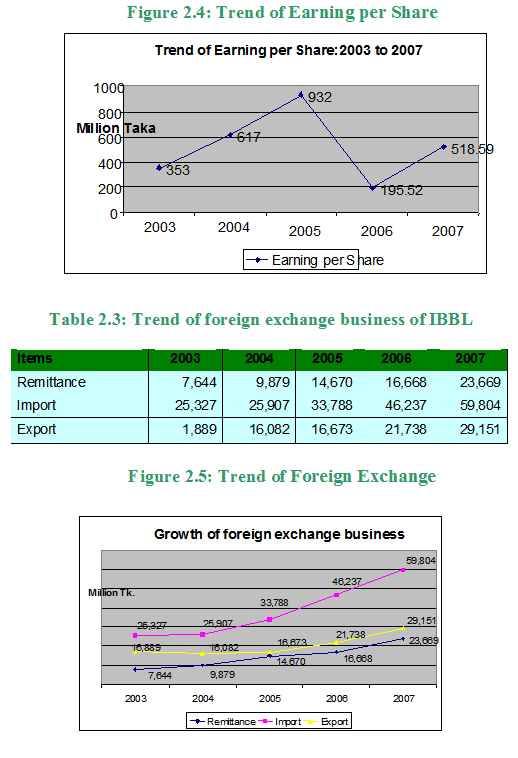

3. Foreign Exchange Business:

Foreign Exchange Business plays a vital role in providing substantial revenue in the bank income pool. Like all modern Banks IBBL operates in the area of the foreign Exchange business. IBBL performs the following tasks:

a) Opening letter of credit (LC) against commission for importing industrial, agricultural and other permissible items under Islamic Shariah and Import policy.

b) Opening letter of credit on the principle of Mudaraba sale, on the principle of Musharaka sale and under wage earner scheme.

c) Handling of export/import document.

d) Negotiation of export / import document when discrepancy occurs.

e) Financing in import under MPI (Mudaraba Post Import)

f) Financing to export on profit or loss sharing.

g) Handling Inward and outward remittance.

4. Other activities:

The IBBL performs the following task for the welfare of the society:

Income generating scheme for the unemployed youth of the nation.

Monorom sale center for marketing homemade garments, handicrafts and other items.

Education scheme for assisting poor scholar student to case and help them to continue their study.

Health scheme for fulfillment of health needs of rural people.

Islamic bank hospital was established to extend first hand modern and contemporary medical service to the people on non-profit business.

Humanitarian assistance is being provided to the poor, families affected by river erosion and for marriage of poor girls.

Energy relief operations are provided to the people affected by natural calamities.

Assistance to mosque for construction, repair and renovation.

Shariah Council of the Bank is playing a vital role in guiding and supervising the implementation and compliance of Islamic Shariah principles in all activities of the Bank since its very inception. The Council, which enjoys a high status in the structure of the Bank, consists of prominent ulema, reputed banker, renowned lawyer and eminent economist.

Members of the Shariah Council meet frequently and deliberate on different issues confronting the Bank on Shariah matters. They also conduct Shariah inspection of branches regularly so as to-ensure that the Shariah principles are implemented and complied with meticulously by the branches of the Bank.

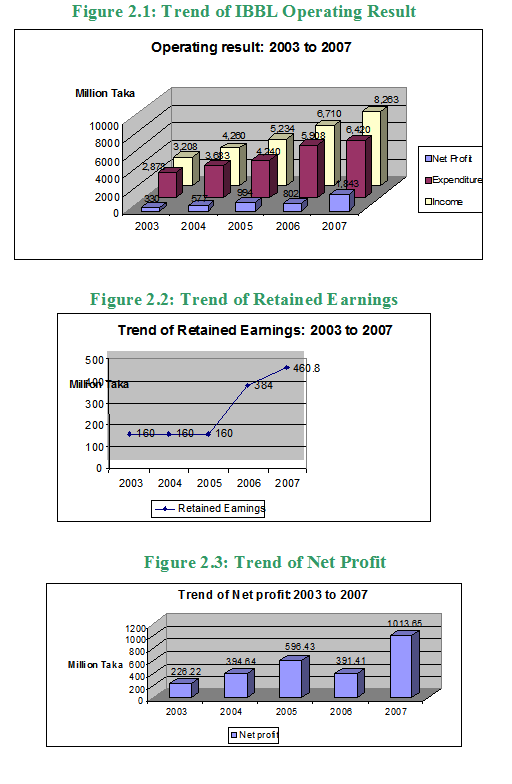

Table 2.1: Performance of IBBL for last 5 years

(amount in million Taka)

(Note : One Million = Ten Lac) |

Table 2.2: Overall position of the equity and capital adequacy of IBBL

(amount in million Taka)

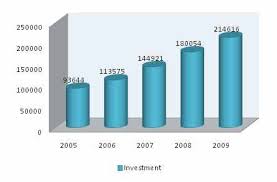

Items | 2003 | 2004 | 2005 | 2006 | 2007 |

| Total investment | 35,238 | 46,281 | 59,007 | 75,858.63 | 93,644.51 |

Risk weighted assets | 32,387.79 | 40,973.53 | 55,851.30 | 72,628.26 | 88,545.37 |

%of the total investment | 92% | 89% | 95% | 86.57% | 86.69% |

Required equity | 2,591.02 | 3,277.88 | 5,026.62 | 6,536.54 | 7,969.08 |

Actual equity | 2,993.24 | 3,540.52 | 5,266.47 | 6,691.12 | 8,272.49 |

Surplus equity | 402.22 | 262.64 | 239.85 | 154.58 | 303.41 |

Capital adequacy ratio | 9.24% | 8.64% | 9.43% | 9.21% | 9.34% |