Introduction:

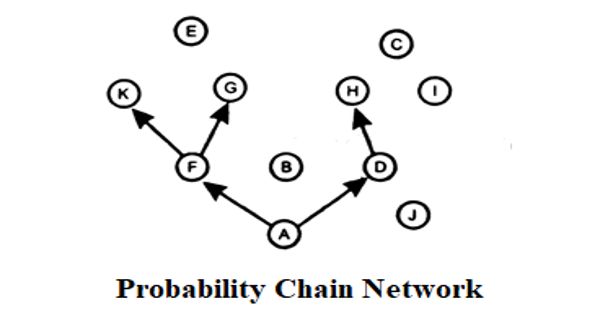

One of the largest businesses carried out by the commercial bank is foreign trading. The trade among various countries falls for close link between the parties dealing in trade. The situation calls for expertise in the field of foreign operations. The bank, which provides such operation, is referred to as rending international banking operation. Mainly transactions with overseas countries are respects of import; export and foreign remittance come under the preview of foreign exchange transactions. International trade demands a flow of goods from seller to buyer and of payment from buyer to seller. In this case the bank plays a vital role to bridge between the buyer and seller.

Foreign Trade

Foreign trade can be easily defined as a business activity, which crosses national boundaries. These may be between parties or government ones. No country can produce all kinds of goods and another country, from this sense; mainly this is the origin of foreign trade. When two countries exchange goods or services between them we can call it foreign trade.

Different modes of International Trade Payments

In International trade methods of payment could take any of the following forms:

1. Cash in advance

2. Open account

3. Collection

4. Documentary credit

The first three are traditional trade payment methods, which view the bank’s role as an agency for transmitting and receiving funds or documents. Under documentary credit, on the other hand, the bank assures payment subject to the completion of documentary conditions.

1. Cash in advance:

Under this system the exporter may receive value of export in advance from the importer before the actual shipment of goods through Cheque, draft or T.T. This practice though expensive and risky is resorted to in cases where either the buyer’s credit worthiness is doubtful or where there is an unstable political or economic environment in the buyer’s country or where manufacturing process or service delivered are specialized and capital intensive.

2. Open account

An open account method is an arrangement between the buyer and seller whereby the goods are manufactured and delivered before payment is made. Under this method, since the payment has to be made at some stated future date and there is no negotiable instrument in evidence of the buyer’s commitment to pay the seller faces the risk of release of goods without assurance of payment.

3. Collection

Collection is a method under which goods are shipped and the bills of exchange (Draft) is drawn by the seller on the buyer. The documents are sent to the bank with clear instruction for collection through one of its correspondent bank located in the buyer’s country. The documents are to be delivered only after the payment has been made or Draft is accepted.

4. Documentary Credit

Documentary credit is the classic form of international trade payment, especially in trade between distance partners. This method substantially reduces payment related risk for both exporter and importer.

Documentary credit is a conditional bank undertaking of payment. It is a conditional undertaking given by a bank (Issuing Bank) at the request of a customer (Applicant) or on its own behalf to pay a seller (Beneficiary) against stipulated documents provided all the terms and conditions of the credit are complied with.

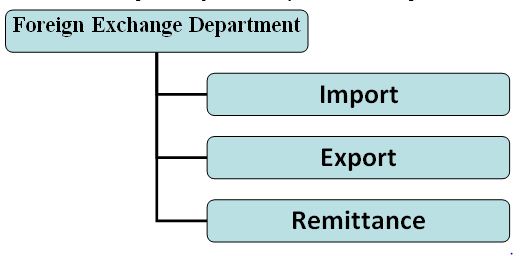

Foreign exchange division

One of the largest businesses carried out by the commercial bank is foreign trading. The trade among various countries falls for close link between the parties dealing in trade. The situation calls for expertise in the field of foreign operations. The bank, which provides such operation, is referred to as rending international banking operation. Mainly transactions with overseas countries are respects of import; export and foreign remittance come under the preview of foreign exchange transactions. International trade demands a flow of goods from seller to buyer and of payment from buyer to seller. In this case the bank plays a vital role to bridge between the buyer and seller.

In the MTBL Dhanmondi Branch there are five peoples are working continuously with great effort and teamwork there are quite efficient skill and talented the above jobs are performed in this department. The Bangladesh Bank and the respected VP of this section control them. There are more than 70 clients and 25 countries they are dealing with. They believe in teamwork and extreme hard work.

Documentary credit/ Letter of credit (L/Cs)

Documentary Credit is an assurance of payment by the bank. K is art arrangement raider which the bank at the request of the buyer or on its own undertakes to make payment to the seller provided specified documents are submitted.

Documentary Credit is an arrangement whereby a bank (issuing bank) acting at the request and on the instruction of a customer (the applicant) or on its own behalf undertakes to make payment to or to the order of a third party (the beneficiary) or to accept and pay bills of exchange (draft) drawn by the beneficiary, or authorize another

bank to negotiate against stipulated documents provided the terms and conditions to the credit are complied. Thus, Documentary Credits are akin to bank guarantees. In popular language, they are known as Letters of Credit (L/Cs).

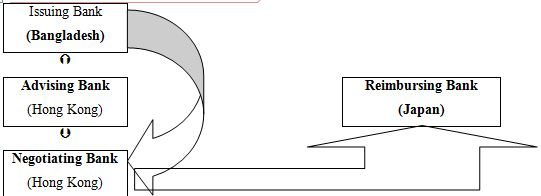

Bank as a party of Documentary credit

Parties to the documentary credit may be an issuing bank, an advising bank, a confirming bank, a reimbursing bank or a negotiating bank.

¨ Issuing Bank: The Issuing Bank or the Opening Bank is one which issues the credit, i.e., undertakes, independent of the undertaking of the applicant, to make payment provided the terms and conditions of the credit have been complied with. The payment may be at sight if the credit provides for sight payment, or at maturity dates if the credit provides for deferred payment.

¨ Advising Bank: The Advising Bank advises the credit to the beneficiary thereby authenticating the genuineness of the credit. The advising bank is normally situated in the country/ place of the beneficiary.

¨ Confirming Bank: A Confirming Bank is one which adds its guarantee to the credit opened by another bank, thereby, undertaking the responsibility of payment/negotiation/acceptance under the credit in addition to that of the issuing bank. A confirming bank normally does so if requested by the issuing bank and it is normally the advising bank.

¨ Negotiating Bank: A Negotiating Bank is the bank nominated or authorized by the issuing bank to pay, to incur a deferred payment liability, to accept drafts or to negotiate the credit.

¨ Reimbursing Bank: A Reimbursing Bank is the bank authorized to honor the reimbursement claims in settlement of negotiation/acceptance/ payment lodged with it by the negotiating bank or accepting bank. It is normally the bank with which the issuing bank has account from which payment is to be made.

Authorized dealer

In administering exchange control and foreign trade, Central Bank of the country (Bangladesh Bank in case of Bangladesh) authorizes few branches of commercial banks to deal in foreign exchange. These branches are known as “Authorized

Dealers”. They act as agent of the Central Bank and work under the exchange control regulations and guidelines issued from time to time.

MTBL Dhanmondi branch as an authorized dealer

Foreign Exchange Department is an important one in MTBL Dhanmondi Branch that deals with import, export, and foreign remittance and post import financing. This branch get the dealership in 2007. Through this is an ancillary service provided by the Bank, The Bank is purchasing primary security by giving loan in form of loan against trust receipt (LTR). Bank branch should be ‘Authorized Dealer’ with the approval of Bangladesh Bank to run foreign exchange business. This department is playing an important role in enhancing export earnings, which aids economic growth and, in turn, will be helpful for economic development. On the other hand, it also helps to meet those goods and services, which are more demandable and not adequate in our country

3.5. Types of letter of credit

Documentary cre.dits are basically two types:

I. Revocable

II. Irrevocable

I. Revocable credit: This type of credit can be revoked or caned at any time me consent of, or notice of the beneficiary. In case of seller (beneficiary), revocable credit involves risk, as the credit may be amended or cancelled while the goods are in transit and before the documents are presented, or although presented, before payment has been made. In modern banking, the use of revocable credit is not widely spread.

II. Irrevocable Credit: The irrevocable credit is a commonly used type of documentary credit. The credit which can not be revoked, varied or change/ amended without the consent of all parties- buyer, seller, issuing bank, and confirming bank irrevocable credit gives the seller grater assurance of payments, but he remains dependent on an undertaking of a foreign bank. Irrevocable credit may be confirmed or unconfirmed.

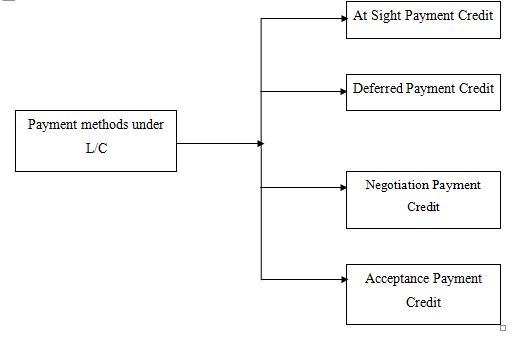

Types of documentary credits according to payment methods:

· Sight Credit

· Deferred payment credit

· Sight Payment: The payment is made as soon as documents shown to the issuing Bank and payment received from importer; Instruction is given to reimbursing bank to give payment.

· Deferred Payment The payment of this kind of L/C is made after 30/60/90/120 or 180 days soon as documents shown to the issuing Bank. The credit with deferred payment differs only slightly in its effect on the beneficiary from the credit with time draft.

Functions of foreign exchange department

The Functions of Foreign Trade department mainly covers the following areas:

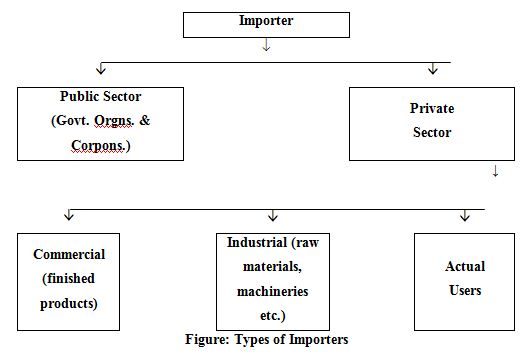

Import section

Import is the flow of goods and services purchased by economic agents located in one country from economic agents located in another. Imports of goods into Bangladesh is regulated by the ministry of commerce and industry in terms of die Import and Export (Control) Act, 1950, with import policy orders issued by annually, and Public Notices issued from time to time by the office of the Chief Controller of Import and Export (CCI & E). Through the process of import some vital but which are inadequate in our country products are imported to meet the local needs of the people. MTBL also plays in important role of importing goods.

Import Business

Mutual Trust Bank supports its customers by providing facilities throughout the import process to ensure smooth running of their business. The facilities are:

a. Import Letter of Credit

b. Post Import Financing (LIM,LTR etc)

c. Import collection services & Shipping Guarantees

Import procedure

An importer is required to submit the following documents in order to get a license to import through Dhanmondi Branch of Mutual Trust Bank Ltd.-

¨ A bank account with the branch

¨ Applicant has to submit IRC (Indenters Registration Certificate). It is a certificate being renewed every year. This certificate is necessary if the contract is made between the buyers and the agents of the sellers. IRC is of two types- COM and IND. COM is given for commerce purpose and IND is given for industrial purpose.

¨ Tax Payer’s Identification Number (TIN)

¨ Proforma Invoice Indent

¨ Membership Certificate from a recognized Chamber of Commerce & Industry or Town Association or registered Trade Association

¨ Letter of Credit Authorization (LCA) Form properly filled in quintuplicate signed by the importer

¨ L/C Application duly signed by the importer

¨ One set of IMP Form

¨ Insurance Cover Note with money receipt

¨ VAT Registration Certificate (for Commercial Importers)

¨ In ease of Public Sector, attested photocopy of allocation letter issued by the allocation authority, Administrative Ministry or Division specifying the source, amount, purpose, validity and other terms and conditions against the imports

¨ Any such documents as may be required as per instructions issued/to be issued by the Chief Controller of Imports & Exports (CCI&E) from time to time,

¨ Report on past performance with other bank. MTBL collects this report from Bangladesh Bank.

¨ (Credit Information Bureau) report from Bangladesh Bank.

¨ A proposal approved by the meeting of executive committee of the bank. It is necessary only when the L/C amount is small or there is no limit.

¨ If the L/C amount is large or there is a limit, then an approval from Bangladesh Bank is needed. Usually this approval is needed for amount more than one core.

Proposal for opening of L/C

In case of an L/C of a small amount only the prescribed application form, i.e. the LCA Form is enough to open an L/C. But when the L/C amount is reasonably high, then the importer needs to submit an application to the Foreign Exchange Department of Dhanmondi Branch for getting a limit of the L/C amount. The salient features of the application are-

o Full particulars of the bank account

o Nature of business

o Required amount of limit

o Payment terms and conditions

- Goods to be imported

- Offered security

- Repayment schedule

The L/C application form

UC Application Form is a sort of an agreement between customer and bank on the basis of which letter of credit is opened. Dhanmondi Branch provides a printed form for opening of L/C to the importer. A special adhesive stamp of value Tk.150 is affixed on the form in accordance with Stamp Act in force. While opening, the stamp is cancelled. Usually the importer expresses his decision to open the L/C quoting the amount of margin in percentage. Usually the importer gives the following information-

- Full name and address of the importer

- Full name and address of the beneficiary

- Draft amount

- Availability of the credit by sight payment/acceptance/negotiation/deferred payment

- The bar within which the documents should be presented

- Sales type (CIF/FOB/C&F)

- Brief specification of commodities, price, quantity, indents no. etc.

- Country of origin

- Bangladesh Bank registration no.

- Import License/ LCAF no.

- IRC no

- Account no.

- Documents no.

- Insurance Cover Note/Policy no., date, amount

- Name and address of Insurance Company

- Whether the partial shipment is allowed or not

- Whether the transshipment is allowed or not

- Last date of shipment

- Last date of negotiation

- Other terms and conditions (if any)

- Whether the confirmation of the credit is requested by the beneficiary or not,

- The L/C application must be completed/filled in properly and signed by the authorized person of the importer before it is submitted to the issuing bank.

The L/C application needs to be submitted along with the following documents-

(1) Proforma Invoice stating description of the goods including quantity, tent price etc.

(2) The Insurance Cover Note, issuing company and the insurance number

(3) Four set of IMP Form

Examination of L/C application

On receipt of L/C application, the branch officials scrutinize the same very carefully giving emphasis to the following points-

- L/C application is stamped (as per Govt. Stamp Rule) as it is a guarantee of payment

- All information mentioned in different columns have been furnished

- The items to be imported are eligible according to import entitlement

- If L/C is opened against indent, Bangladesh Bank’s permission, valid registration, authority to issue indent by indenter are to be checked

- The terms and conditions stipulated in the L/C application are consistent with the Bangladesh Bank Foreign Exchange Guidelines, Import Trade Regulations, UCPDC etc,

- The amount and description of merchandise are relevant to LCAF and proforma invoice/indent/purchase order.

- Survey Report or Certificate in case of old machinery

- Carrying vessel is not of Israel or Serbia-Montenegro

Amendment of L/C

Parties involved in a L/C, particularly the seller and the buyer cannot always satisfy the terms and conditions in full as expected due to some obvious and genuine reasons. In such a situation, the credit should be amended. Dhanmondi Branch transmits the amendment by SWIFT, airmail or courier service to the advising bank.

But in case of irrevocable letter of credit, it can never be amended nor I without the agreement of the issuing bank, the confirming bank (if any) and the beneficiary. If the L/C is amended, amendment charge and telex charge, as per HO r, are debited from the party’s A/C accordingly.

Presentation & examination of shipping document

The seller being satisfied with the terms and the conditions of the credit proceeds to dispatch the required goods to the buyer and after that, has to present the documents evidencing dispatching of goods to the Negotiating Bank on or before the stipulated expiry date of the credit After receiving all the documents, the Negotiating Bank then checks the documents against the credit. If the documents are found in order, the bank will pay, accept or negotiate the documents and will dispatch to Dilkusha Branch, The branch, checks the documents. The usual documents are-

· Invoice

· Bill of Lading

· Certificate of Origin

· Packing List

· Shipping Advice

· Non-negotiable Copy of Bill of Lading

· Bill of Exchange

· Pre-shipment Inspection Report

· Shipment Certificate

Dhanmondi Branch officials check whether these documents have any discrepancy or not. Here, “Discrepancy” means the dissimilarity of any of the documents with the terms and conditions of L/C. In case of discrepant documents, the branch advices the

discrepancy/ discrepancies to the negotiating bank within five (05) working days after the documents. Some the usual discrepancies are-

· L/C expired

· Late shipment

· Amount drawn in excess of the letter of credit

· Bill of exchange not property drawn

· Description of goods differ

· Interest clause is missing in bill of exchange, where stipulated

· Bill of exchange is not drawn/ signed by the beneficiary of the credit

· Bill of Lading or Airway Bill stale or Bill of Lading is issued under a charter party

· Insurance cover not as per terms of L/C and insurance does not cover the entire voyage and insurance policy is not properly stamped.

Lodgment of the Documents

After receiving the documents from the exporters, at first MTBL write it in the PAD Registrar. PAD Register contains date, PAD number, L/C number, and flame of the drawer, name of the drawer, amount, and number of copies of various documents, name of the imported items. This written procedure is called Lodgment.

Accounting Application

While doing lodgment, MTBL makes the following entries-

PAD Account ——————————————Dr.

MTBL General Account ——————————Cr.

Exchange Gain Account ——————————Cr.

The reversal entries are as follows

Bankers —————————————————Dr.

Customer’s Liability—————————————Cr.

(When lodgment is passed)

MTBL stakes the payment to the reimbursing bank against the documents. That’s why, it debts the PAD Account.

For payment, MTBL deposits the money at the miscellaneous account @ 69.60 (current rate). And sends an Inter Branch Credit Advice (IBCA) to credit the amount to a nostro account maintained in a bank of exporters’ country from which payment will be made.

Retirement of the Documents

The process of collecting documents from bank by the importer is called retirement of the documents. The importer gives necessary instructions to the bank for retirement of the import bills or for the disposal of the shipping documents to clear the imported goods from the customs authority. The importer may instruct the bank to retire the documents by debiting his current account with the bank or by creating Loan against Trust Receipt (LTR). Following steps are taken while retiring the documents-

· Calculation of interest.

· Calculation of other charges.

· Passing vouchers.

· Entry in the register.

· Endorsement in the Bill of Lading and other transport documents and in the bill of exchange.

Accounting Treatment

Suppose the banker has the following information

Document Value: Tk. 500000.00

Margin: Tk.10,000.00

Date of negotiating 02.01.09

Date of retirement 12.02.09

Rate of interest : 16%

Interest paid for (02.01.09 to 12.02.09) = 40 days.

(500000.00- 100000.00)* 16% * 40

Interest = ______________________________

360

= TK. 7111.00

Then the following vouchers will be made:

a) For interest:

PAD Account ———————————— Dr. 7111.00

Interest on PAD Account ———————— Cr. 7111.00

b) While receiving the payment:

Party Account ————————————— Dr. 407111.00

Margin Account ———————————— Dr. 100000.00

PAD Account ————————————— Cr. 507111.00

But when the party takes the endorsement of the non-negotiable copy, then “Other Fees & Commission ‘Takes place instead of “Interest on PAD Account”. Generally, MTBL charge 15% on the document value for collecting the document at that time.

Post-Import financing

If there is no available in cash in importer’s hand, he can request the bank to grant loan against the documents for the purpose 6f pest import finance. The is one following forms of post import finance available in MTBL Dhanmondi Branch.

LTR (Loan against Trust Receipt).

On the arrival of goods and lodgment of import documents, import may request the bank for clearance of goods from the port (custom) and keep the same to bank go down. Proper sanction from the competent authority is to be obtained before clearance of consignment Foe giving these types of loan, officer makes lean proposal and sends it to H/O for approval. After getting approval from H/O, bank grants loan in the form of LTR,

Loan against Trust Receipts (LTR):

1. Advance against a Trust Receipt obtained from the Customers are allowed to only first class tested parties when the documents covering an import shipment or other goods pledged to the Bank as security are given without payment However, for such advances prior permission/sanction from Head Office must be obtained.

2. The customer holds the goods or their sale-proceeds in trust for the Bank, till such time, the loan allowed against the Trust Receipts is fully paid off.

3. The Trust Receipt is a document that creates the Banker’s lien on the goods and practically amounts to hypothecation of the proceeds of sale in discharge of the lien:

Accounting treatment

LTR creation:

LTR A/C ———————————————————— Dr.

PAD Account —————————————————— Cr.

After payment of me loan or delivery of goods:

Party A/C ———————————————————— Dr.

LTR A/C ———————————————————— Cr.

Interest A/C ——————————————————— Cr .

By and large, it is mentioned herewith that bank only deals with the documents, not with goods & services in case of foreign exchange business.

Export section

In order to Creation of wealth in any country depends on the expansion of production and increasing participation in international trade. By increasing production in the export sector we can improve the employment level of such a highly populated country like Bangladesh. Bangladesh exports a large quantity of goods and services to foreign households. Readymade textile garments (both knitted and woven), Jute, Jute-made products, frozen shrimps, tea are the main goods that Bangladeshi exporters export to foreign countries. Garments sector is the largest sector that exports the lion share of the country’s export. Bangladesh exports most of its readymade garments products to U.S. A and European Community (EC) countries. Bangladesh exports about 40% of its readymade garments products to U.S. A.

Export L/C operation is just reverse of the import L/C operation. For exporting goods by the local exporter, bank may act as advising banks and collecting bank (negotiable bank) for the exporter. MTBL also have the capacity to support the exporters of businessman’s in Bangladesh.

Export Business

Mutual Trust Bank offers extra cover to its customers for the entire export process to speed up receipt of proceeds. The facilities are:

a. Export Letters of Credit advising

b. Pre-shipment Export Financing

c. Export documents negotiation

d. Letters of Credit confirmation

Export policy

Export policies formulated by the Ministry of Commerce, GOB provide the overall guideline and incentives for promotion of exports in Bangladesh. Export policies also set out commodity-wise annual target, ft has been decided to formulate these policies to cover a five year period to make diem contemporaneous with the five-year plans and to provide the policy regime.

The export-oriented private sector, through their representative bodies and chambers are consulted in the formulation of export policies and are also represented in the various export promotion bodies set up by the government.

Export procedures

The import and export trade in our country are regulated by the Import and Export (Control) Act, 1950.

Under the export policy of Bangladesh the exporter has to get valid Export registration Certificate (ERC) from Chief Controller of Import & Export (CCI&E). The ERC is required to renew every year. The ERC number is to incorporate on EXP forms and other papers connected with exports.

In the Export Section, two (02) types of L/Cs are handled –

1) Back-to-Back L/C

2) Export L/C

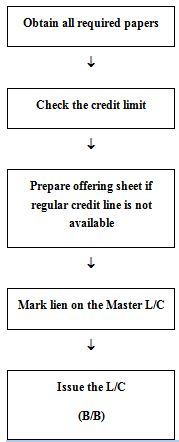

Back- to-back L/C

In case of a “Back-to-Back” letter of credit, a new L/C (an import L/C) is opened on the basis of an original L/C (an export L/C). Under the “Back-to-Back” concept, the seller as the beneficiary of the first L/C offers it as a ‘security’ to the Advising Bank for the issuance of the second L/C. The beneficiary of the back-to-back L/C may be located inside or outside the original beneficiary’s country. In case of a back-to-back L/C, no cash security (no margin) is taken by the bank; bank liens the first L/C. In case of a back-to-back L/C, die drawn bill is usage/time bill.

In Dhanmondi Branch, papers/documents required for opening of back-to-back L/C are as follows:

- Master L/C

- Valid Import Registration Certificate (IRC) and Export Registration Certificate (ERC)

- L/C Application and LCAF duly filled in and signed

- Proforma Invoice or Indent

- Insurance Cover Note with money receipt

- EXP Form duly signed.

Payment for back-to-back L/C

In case of back-to-back L/C for 30/60/90/120/180/360 days of maturity period, deferred payment is made. Payment is given after realizing export proceeds from the L/C Issuing Bank. For Garments Sector, the duration can be maximum 180 days. For importing machinery, without permission from Bangladesh Bank, Dhanmondi Branch can authorize for 360 days.

Reporting to Bangladesh bank

At the end of every month, the reporting to Bangladesh Bank regarding the following information is mandatory-

¨ Filling of E-2/P-2 Schedule of S-l category that covers the entire month’s amount of import & Export, category of goods, currency, county etc.

¨ Fining of E-3/P-3 Schedule of for all charges, commission with T/M Form.

¨ Disposal of IMP Form that includes: (a) original IMP is forwarded to Bangladesh Bank with invoice and indent, (b) duplicate IMP is kept with the branch along with the Bill of Entry/Certified Invoice, (c) triplicate IMP is kept with the branch for office record, (d) quadruplicate is kept for submission to Bangladesh Bank in case of imports where documents are retired.

Export L/C

There are a number of formalities, which an exporter has to fulfill before and after shipment of goods. These formalities or procedures are enumerated as follows,-

1)Obtaining Export Registration Certificate (ERC)

2)Obtaining EXP

3)Signing of the Contract

4)Receiving the Letter of Credit

5)Procuring the materials

6)Shipment of goods

7)Presentation of export documents for negotiation

8)Examination of Document

9)Negotiation of export documents

Negotiation stands for payment of value to the exporter against the documents stipulated in the LAC. If documents are in order, MTBL purchases (negotiates) the same on the basis of banker- customer relationship. This is known as Foreign Documentary Bill Purchase (FDBP).

A. Procedure for FDBP

1. After purchasing the documents, MTBL gives the following entries,

FDBP A/C —————————————————————— Dr.

(At Doc. rate)

Postage A/C ————————————————————— Cr.

Handling charge A/C —————————————————— Cr.

Negotiation A/C ———————————————————— Cr.

Source Tax A/C ———————————————————— Cr,

Customer A/C ————————————————————— Cr.

(Before realization of proceeds)

2. Subsequently, Bank with send the documents to the L/C opening Bank for payment with a forwarding letter detailing the enclosures. Upon realization of proceeds the Negotiating Bank would pass the following vouchers:

MTBL General A/C ———————————————— Dr.

(At T.T Doc. rate)

FDBP A/C ———————————————————— Cr.

Income A/C (Profit on exchange gain) ————————— Cr.

(Adjustment after relation proceeds)

3. A FDBP Register is maintained for recording all the particulars.

B. Foreign documentary bills for collection (FDBC)

MTBL forward the documents for collection due to the following reasons-

¨ If the documents have discrepancies

¨ If the exporter is a new client

¨ The banker is in doubt

MTBL check the documents forward to the issuing bank and following entries are given-

FDBL A/C …………………………………………………………… Dr.

FDBC A/C …………………………………………………………… Cr.

FDBC signifies that the exporter will receive payment only when the issuing bank gives payment. MBTL make regular follow-up with the L/C opening Bank in case of any delay in getting payment.

The exporter submits duplicate EXP Form and Commercial Invoice. Subsequently, the value of the bill is calculated and the following accounting entries are given-

MTBL General A/C ………………………………………………… Dr.

(At T. T Doc. rate)

Collection commission ……………………………………………. Cr.

Government Tax A/C (0.25% of Invoice) …………………… Cr.

Postage A/C …………………………………………………………… Cr.

Client’s A/C ………………………………………………………….. Cr.

(At T.T Doc rate)

The reversal entries are as follows-

FDBC A/C ……………………………………………. Dr.

FDBL A/C ……………………………………………. Cr.

After passing the above vouchers, an Inter Branch Exchange Trading Debit Advice is sent for debiting the NOSTRO account. An FDBC Register is maintained, where first is given when the documents are forwarded to the issuing bank for collection and the second one is done after realization of the proceeds. In case of discrepancies of minor native, Bank may negotiate the documents depending on their confidence on the customer against execution of the Letter of Indemnity.

Settlement of local bills

MTBL, Dhanmondi branch only purchase the local bill is known as Inland Documentary Bills for Purchase (IDBP)

The Inland documentary bills for purchase (IDBP) is done in the following ways,-

a. MTBL gets L/C from other Bank.

b. Then MTBL officer advising the L/C to the party/Beneficiary.

c. Customers then present the documents for negotiation to MTBL.

d. MTBL official scrutinizes the documents to ensure the conformity with the terms and conditions with L/C.

e. The documents are then forwarded to the L/C opening bank.

f. The L/C issuing bank gives the acceptance and forwards an acceptance letter,

g. In the acceptance letter there is a maturity date when the will payment the bill.

h. After receiving the acceptance letter, payment is given to the customer on by purchasing the bill of Acceptance.

Accounting treatment for purchase of local bills

IDBP ———————————————————————————— Dr.

Party A/C —————————————————————————— Cr.

Commission ————————————————————————— Cr.

Charge A/C ————————————————————————— Cr.

A LDBP Register is maintained to record the acceptance of the issuing bank. Until the acceptance is obtained, the record is kept in a collection register.

While receiving the payment the bank relished JDBP A/C and gives following entry-

Sundry deposit A/C ——————————————————— Dr.

IDBPA/C ——————————————————————— Cr.

Party A/C (If any surplus) ————————————————— Cr.

Mode of payment of Export bill under L/C

As per UCP 600, 2007 revision there are four types of credit. These are as follows:

a. Sight payment

b. Deferred payment

c. By acceptance

d. Negotiation

Export Financing:

Financing exports constitutes an important part of a bank’s activities. Exporters require financial services at four different stages of their export operation. During each of these phases’ exporters need different types of financial assistance depending on the nature of the export contract. MTBL play a vital role in performing such jobs and help the businessmen’s to carry on their business operation the activities are:-

I. Pre-shipment credit,

II. Post-shipment credit.

Pre-shipment credit:

Pre-shipment credit, as the name suggests, is given to finance the activities of an exporter prior to the actual shipment of the goods for export. The purpose of such credit is to meet working capital needs starting from the point of purchasing of raw materials to final shipment of goods for export to foreign country. Before allowing such credit to the exporters the bank takes into consideration about the credit worthiness, export performance of the exporters, together with all other necessary information required for sanctioning the credit in accordance with the existing rules and regulations. Pre-shipment credit is given for the following purposes:

- Cash for local procurement and meeting related expenses.

- Procuring and processing of goods for export.

- Packing and transporting of goods for export,

- Payment of insurance premium. Inspection fees.

- Freight charges etc.

An exporter can obtain credit facilities against lien on the irrevocable, confirmed and unrestricted export letter of credit in form of the followings:

1. Packing credit

2. Export cash credit (Hypothecation)

3. Export cash credit (Pledge)

4. Export cash credit against trust receipt.

5. Back to back letter of credit.

6. Credit against Red-clause letter of credit.

II. Post Shipment Credit

This type of credit refers to the credit facilities extended to the exporters by the banks after shipment of the goods against export documents. Necessity for such credit arises,

as the exporter cannot afford to wait for a long time for without paying manufacturers/ suppliers. Before extending such credit, it is necessary on the part of to look into carefully the financial soundness of exporters and buyers as well as relevant documents connected with the export in accordance with the rules and regulations in force. Banks in our country extend post shipment credit to the exporters through:

1. Negotiation of documents under L/C;

2. Foreign Documentary Bill Purchase (FDBP):

3. Advances against Export Bills surrendered for collection

Export document checking

1. General verification:

a) L/C restricted or not.

b) Exporter submitted documents before expiry date of the credit.

c) Shortage of documents etc.

2. Particular verification:

a) Each and every document should be verified with the L/C.

3. Cross verification:

a) Verified one documents to another.

After proper examination or checking of a described Export document bank may find following discrepancies:

General:

1. Late shipment

2. Late presentation

3. L/C expired

4. L/C over-drawn

5. Partial shipment or transshipment beyond L/C terms.

Bill of exchange (B/E):

1. Amount of B/E differ with Invoice.

2. Not drawn on L/C issuing Bank.

3. Not signed

4. Tenor of B/E not identical with L/C.

5. Full set not submitted.

Commercial Invoice (C/I):

1. Not issued by the Beneficiary.

2. Not signed by the Beneficiary.

3. Not made out in the name of the Applicant

4. Description, Price, quantity, sales terms of the goods not corresponds to the Credit.

5. Not marked one fold as Original.

6. Slipping Mark differs with B/L & Packing List.

Packing List:

1. Gross Wt, Net Wt. & Measurement, Number of Cartoons/Packages differs with B/L.

2. Not market one fold as Original.

3. Not signed by the Beneficiary.

4. Shipping marks differ with B/L.

Bill of Lading/ Airway Bill (Transport Documents);

1. Full set of B/L not submitted.

2. B/L is not drawn or endorsed to the Order of MTBL Bank Ltd.

3. “Shipped on Board”, “Freight Prepaid” or “Freight Collect” etc. notations are not marked on the B/L.

4. B/L not indicate the name and the capacity of the party i.e. carrier or master, on whose behalf the agent is signing the B/L.

5. Shipped on Board Notation not showing name of Pre-carriage vessel/intended vessel.

6. Shipped on Board Notation not showing port of loading and vessel name (In case B/L indicates a place of receipt or taking in charge different from the port of loading).

7. Short Form B/L

8. Charter party B/L

Others:

1. N.N. Documents not forwarded to buyers or forwarded beyond L/C terms.

2. Inadequate number of Invoice, Packing List, and B/L & Others submitted.

3. Short shipment Certificate not submitted.

While checking the export documents following things must be taken in consideration

L/C terms:

Each and every clause in the L/C must be complied with carefully and ensure the following:

1. That the documents are negotiated within the L/C validity, It a credit expire on a recognized bank holiday its life is automatically become valid up to the next works day.

2. That the documents value does not exceeds the L/C value.

Draft/ Bill of Exchange

Draft is examined under:

1. Draft must be dated

2. It must be made out in the name of the beneficiary’s bank or to be endorsed to the bank.

3. The negotiating bank must verify the signature of the drawer.

4. Amount must be tallied with the Invoice amount.

5. It must be marked as drawn under L/C No… Dated… Issued by………..Bank.

Invoice

It is to be scrutinized to ensure the following:

1. The Invoice is addressed to the Importer

2. The full description of merchandise must be given in the invoice strictly as per L/C.

3. The price, quality, quantity, etc. must be as per L/C.

4. The Invoice must be language in the language of L/C.

5. No other charges are permissible in the Invoice beyond the stipulation on the L/C.

6. The amount of draft and Invoice must be same and within the L/C value.

7. If L/C calls for consular invoice, then the beneficiary’s invoice is not sufficient.

8. Number of Invoice will be submitted as per L/C.

Foreign Remittance Section

‘Foreign remittance’ means purchase and sale of freely convertible foreign currencies as admissible under Exchange Control Regulations of the country. That means transfer of find from one place to another place in foreign currency. Foreign remittances pay a significant role in contributing to the growth of overall foreign exchange business.

We see that there are two types of Foreign Remittance;

¨ Foreign Inward Remittance

¨ Foreign Outward Remittance

Sources of inward Foreign Remittance:

I. Export proceeds

II. Remittance by emigrant Bangladeshi nationals working abroad

III Commissions, fees etc. earned by local business people

IV. Foreign loans and grants, donation and gift.

Sources of outward Foreign Remittance:

I. Payment of import liabilities

II. Payment of consular fees and commissions etc.

III. Foreign travel quota through travelers cheque/ foreign currency

IV. Educational expenses for students abroad/ medical expenses and other purposes

V. All other payments sent abroad in foreign currency.

Foreign Inward Remittance

MTBL has established remittance arrangements with a number of exchange houses to facilitate wage earners to remit their money to Bangladesh. This bank has already been in operation with UAE Exchange Centre LLC, Wall Street Exchange LLC, Trust Exchange, Route of Asia money Exchange Ltd, Instant Cash and Bangladesh Money Transfer, Al Ahalia Exchange Bureau. The extensive branch network of these Exchange Houses has been largely helping Bangladeshi expatriates working in the UAE, UK, Qatar, and Oman to transfer their funds speedily and efficiently through online network. MTBL is exploring further avenues of remittance from other countries such as Saudi Arabia, Malaysia, USA and Italy in the near future.

The Foreign Remittance department of MTBL Dhanmondi Branch is equipped with a number of foreign remittance facilities. Following are the types of foreign remittance facilities offered by MTBL Dhanmondi Branch.

¨ Issuance of Foreign Demand Draft (FDD)

¨ Collection of FDD

¨ Open foreign currency account

¨ Issuance of travelers Cheques (TC)

¨ Endorsement

Foreign Demand Draft (FDD)

The foreign bank/exchange company on local bank usually issues foreign Demand Draft. ft is an order to pay a certain sum to a certain person or as his instruction, issued by the bank on its overseas branch or on its correspondent bank. The demand draft is handed over to the purchaser who sends it to the beneficiary. The beneficiary obtains payment on presentation to the bank on which the draft is drawn.

Encashment of FDD may take place in two ways-

1) Issuance

2) Sending for collection.

Issuance of FDD

MTBL issues the Foreign Demand Draft for the charges for TOEFL, SAT, GMAT, registration fee, membership fee and also for the application or processing fee for die student who are interested to study abroad. MTBL opens Student Files to issue Foreign Demand Draft following the permission of Bangladesh Bank. Before issuance of FDD, MTBL asks the students to fill up the TM Form; which contains the following particulars-

- Name of the student

- Full address of the student

- Amount of FDD in Foreign Currency

- Purpose of Remittance

- Address of the Institution to which the FDD will be favored

- Country receiving payment

- Passport no. of the student with date of issue

- Signature of the student

The TM Form is sent to Bangladesh Bank with photocopies of the Passport of the student FDD issued.

¨ Commission for issuance of FDD @ Tk.500.

¨ Commission for Cancellation of FDD @ Tk.500.

The following vouchers are passed for issuing FDD:

Party/ Cash A/C —————————————— Dr.

MTBL General A/C —————————————Cr.

Commission A/C (1% of total amount) —————Cr.

VAT A/C (15% of commission) ————————Cr.

Collection of FDD:

If a person has FC account with our branch and he received remittance from another bank then it is sent for collection to the branch of the bank on which it is drawn. It is sent to MTBL Head office through Bangladesh bank clearing house.

After receiving credit advice the following vouchers are passed.

MTBL General A/C————————————————Dr.

Commission A/C—————————————————Cr.

Charges A/C———————————————————Cr.

Party A/C ________________________________________ Cr

Open foreign currency account (FC)

All local and foreign banks in Bangladesh, who are authorized by Bangladesh bank to deal in foreign exchange, may maintain FC (Foreign Currency) accounts in die name of Bangladesh nationals or persons of Bangladesh origin working and earning abroad including self-employed Bangladeshi migrants.

MTBL Dhanmondi branch issues exporters retention quota account and resident & nonresident foreign currency deposit account. Before opening FC account the officer checked die following thing of the prospective account holder-

- The account holder is a Bangladeshi national.

II. He is ordinarily resident abroad.

III. He does not receive any foreign exchange from Bangladesh source.

Issuance of traveler’s Cheque

There are no sources in the current document.

For traveling purpose each person has a yearly foreign currency quota as follows:

| Particulars | In cash | In TC | Total | |

| For outside SAARC countries | $2000 | $1000 | $3000 | |

| For SAARC Countries | Byroad | $500 | $500 | $1000 |

| By air | $700 | $300 | $1000 | |

The yearly quotas are mutually exclusive to each other. But for the FC A/C hold a special advantage is prevailing there and that is the person can get TC for any amount as much as his FC A/C balance permits.

First, the party will fill up the form (purchase agreement) and sign it. Again he will sign the T/M form. After that the banker will endorse the party’s passport and ticket declaring the amount of foreign currency issued in cash and in the form of TC. Then the following vouchers are passed:

Party/ cash A/C —————————————— Dr.

MTBL General A/C ———————————— Cr.

Commission A/C (1% of total amount) ————— Cr.

VAT A/C (15% of commission)———————Cr.

Endorsement A/C (Taka 350)————————Cr.

Income A/C (Taka 100 per passport)—————Cr.

Then, entry is made in the TC issue register. Original copy of the purchase agreement, photocopy of the ticket and passport are kept with the T/M form and the purchase agreement copy along with the TC, passport and ticket are handed over to the party after getting after getting his “received” signature in the TC issuing register.

Endorsement:

MTBL endorses US Dollar in passports. To endorse US Dollar, the client has to apply in the prescribed from (TM Form).

The following entries are given in this regard:

Party/Cash A/C ——————————————— Dr.

Foreign Currency on Hand (Dollar) ——————— Cr.

Recommendation

- Banking is a service oriented organization. Its business profit depends on its service quality. That’s why the authority always should be aware about their service quality.

- To provide service to the customer it is necessary to have a trained team of an organization of an institution. For this reason the Bank should recruit more fresh, bright and energetic person. In this case the Bank can consider MBA, BBA, MBM and etc.

- The bank has a provision for internship program, but it is not well organized. Although the officials are very careful and co-operative with the interns, the authority should be more structured. If they can properly make them trained it will be very fruitful to recruit them. Because they learn overall banking in the internship period, so from the beginning of the job they can work as experienced persons. It is also very important that they should give an honorarium to the intern.

- Now a day’s world is going very fast. MTBL should started credit card facility.

- One of the business strategies is promotion. Successful business depends how they can promote their products of services to the customer. That is why, to improve the business bank should introduce more promotional programs.

- All the clients are not in favor of introducing system, if possible the rule of introducing to pen and account should be changed. Because many people face in problem to arrange an introducer in the time of opening accounts.

CONCLUSION

Mutual Trust Bank Limited (MTBL) is a third generation private commercial bank in the country with commendable operating performance directed by the mission to provide prompt and different services to clients. MTBL successfully celebrated its eight years of operation. It provides a wide range of commercial banking services MTBL has achieved success among its peer group within a short span of time with its professional and dedicated team of management having long experience, commendable knowledge and expertise in conversation with modern banking. MTBL Is engaged modern banking. The management of the bank is maintaining an efficient portfolio in order to have a healthy worth and retain customer satisfaction. The management of the bank is planning to meet the required capital adequacy withering the stipulated time frame, and a loan and advance policy that expected the loan loss provisioning in the future will be within tolerable limit having little material impact on the future profitability as well as net worth. MTBL aspire to be the most admired financial institution in the country, recognized as a dynamic, innovative and client focused company, that offers overall array of products and services geared for excellence and create an impressive economic value. MTBL has adequate modem technology to meet its present requirement and it proceeding aggressively to enhance its technology level.