The purpose of this report is to analyze the general procedures, criteria, activities and overall feedback of Human Resource Management procedure in the context of Mutual Trust Bank Limited. Report also focus on the value of the Human Resource Management Procedure in The Banking Industry. Finally draw SWOT analysis and suggest some recommendations for development of Human Resource Management procedure.

Objective of the Study:

- To know the concept of Human Resource Management procedure and its impact in Job Market of Bangladesh.

- To be familiar with Human Resource Management procedure procedures.

- To understand the terms and conditions of Human Resource Management procedure.

- To value the Human Resource Management Procedure in The Banking Industry.

- To suggest some recommendations for development of Human Resource Management procedure.

Data collection:

(i) Primary data- Discussion with the reactive organizations officials

(ii) Secondary data- For the completion of the present study, secondary data has been collected. The main sources of secondary data are:

- Annual report of Mutual Trust Bank Limited. (2009)

- Data from published reports of Bangladesh Bank

- Different Books, journals, Periodicals, News papers etc.

Mutual Trust Bank Limited: An Overview:

To achieve financial ideology Mutual Trust Bank Ltd was established (registered) as a public limited company on 29 September 1999. The inaugural ceremony took place on 27 September 1999. Some very renowned Banking Personnel and businessmen of the country are the sponsors of the bank. The Bank is committed to contribute significantly in the national economy. It has made a positive contribution towards the socio economic development of the country by opening 49 branches on which 16 authorized dealer (AD) throughout the country. To render improved services to the clients imbued with banking spirit of brotherhood peace and fraternity and by developing an institutional cohesion. The Bank is committed towards establishing welfare oriented banking system, economic uplift of the lower-income group of people, create employment opportunities.

Organization structure of Mutual Trust Bank Ltd:

Mutual Trust Bank Ltd. (MTBL) was incorporated on 29 September 1999, under the company’s act-1994 as a pioneer commercial bank in the private sector in Bangladesh with its Head Office in Dhaka. The bank started functioning from 05th October 1999 with the approval of Bangladesh Bank under the guidelines, rules and regulations given for scheduled commercial banks operating in Bangladesh.

Capital structure of Mutual Trust Bank Limited:

The authorized capital of Mutual Trust Bank Ltd. is 38, 00,000,000 divided into 38,000,000 ordinary shares of Tk.100 each. The total paid up capital rose to taka 2120.00 million at the end of 2009. At present the composition of the existing shareholders of the bank is as under:

1) Bangladeshi sponsors/ Directors: 41.59%

2) Bangladeshi General Public: 27.55%

3) Institute: 30.86%

Product Service Information of Mutual Trust Bank:

Finance/Loans:

- Cash Credit

- Secured Overdraft

- Bank Guarantee

- Long Term and Short Term Financing

- House Building Loan

- Car Loan

Foreign Exchange

- Non Resident Foreign Currency Account (NFCD)

- Non Resident BDT Deposit Account (NRTA)

- Resident Foreign Currency Deposit Account (RFCD)

- Foreign Currency Deposit Account

- Money Gram

Deposit Scheme

- Savings Bank Account (SB A/C)

- Current Deposit Account (CDA/C)

- MTBL Senior

- MTBL Inspire

- Fixed Term Deposit (FDR)

- Short Term Deposit (STD)

- Money Double Deposit Programs

- Premium Term Deposit

- Interest Earning Term Deposit

Human Resource Management of Mutual Trust Bank:

Human resource development and management has been proved as one of the most Critical aspects of attaining organizational effectiveness. Human Resource Management (HRM) is concerned with the ‘people dimension in management’. Mutual Trust Bank Limited. Since its inception, has placed equal emphasis on all the four key functions of the processor HRM-acquisition, development, motivation and retention. The various programs undertaken by the Mutual Trust Bank to enrich the quality of human resource are mainly aimed at increasing professional knowledge and skill levels of employees through training and development, in order to form a well-equipped work force for providing excellent services to the customers.

Moreover, top executive of the Bank are frequently send abroad for enabling them to know the functions and mechanisms of financial, money and security market of the developed countries and also to exploring business opportunities. Quit a large numbers of executives and officers of the Bank have so far been trained at Bangladesh Institute of Bank Management (BIBM), Bangladesh Bank Training Academy (BBTA) etc. covering divers areas of the financial system including commercial banking as carefully selected are largely concentrated around core banking issues like credit management, international Trade, treasury management, audit and inspection, loan review & monitoring and project management.

Job Requirement Analysis:

For effective recruitment and selection HR personnel of Mutual Trust Bank Limited does job Requirement analysis at first. In which post they need how many employee(s), what should be qualification of that employee(s), in which time they need the employee(s), for rural branch or out side of Dhaka branches from where they have to recruit employee(s) etc. Without this requirement analysis an organization can not requite effectively and efficiently.

Recruitment:

Recruitment refers to process of finding right people for the right job or function, usually undertake by Human Resource Department. Advertising is commonly part of the recruiting process and Mutual Trust Bank does it through newspapers. Mainly two newspapers they advertise for Prothom Alo and Daily Star. Different job required different skills. So, suitability for a job is typically assessed by looking for skills, e.g. communication skills, computer skills. Evidence for skills required for a job may be provided in the form of qualifications (educational or professional), experience in a job requiring the relevant skills or the testimony of references.

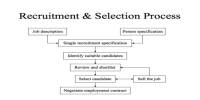

Recruitment Process:

Management Trainee recruitment process is different than other employee. In case of Management Trainee Mutual Trust Bank takes written examination. Other employee’s recruitment processes are as follows. After advertising the newspaper the Banking Officers and Trainee Officers of Human Resource Department collect the CVs from reception desk. CVs are posted by hand or by post. HR employee preliminary screen the CV by matching the post they want for. With the instruction of First Assistant Vice President (FAVP) of HRD Banking Officers and Trainee Officers start to entry the CVs in the software. Software is also screening the by matching the criteria, because software is designed as the criteria set up. If the criteria don’t match the software will not allow to entry the CV. After entering the CV in the software they printout the CV statement in quizzes format, six CVs are in one page. With the statement the Banking Officers go to the Head of the HRD. The Head of the HRD, Senior Executive Vice President (SEVP), Executive Vice President (EVP) do an informal discussion and screen the CV. Then these top level managers give a schedule for interview. First Assistant Vice President (FAVP) of HRD set the venue for interview and call the top level management to lead the interview. Banking Officers call the candidates to attend the interview. If the preliminary interview is successful, the candidate will be invited to another interview. Then the selected candidates have to face the final interview. It is not set that, there will be three interviews. It could be four or more, depends on situation and post.

Joining:

After selecting from the recruitment process bank offer the candidate to join the bank. If candidate agree to join, the bank then gives him/her appointment letter. In appointment letter the date of joining, which document should be attached, salary parameters are mentioned. With the reference of appointment letter within the joining date the candidate have to come in the Human Resource Department (HRD) in the Corporate Office. The Banking officer of the Human Resource Department (HRD) processes the joining. The candidate has to fill up a joining form, in which there are personal information, references, nominees name and percentage of given power of provident fund etc. S/he has to sign the Code of Conduct, and submit a joining letter and a confirmation letter. Banking Officer verifies his\her certificates, and collect nationality and medical certificates. In terms of some employee like Management Trainee, they have to sign bond to join the service. These all documents will enclose in his/her personal file. After collecting all the documents Banking Officer creates the candidate’s personal file and go to the Head of the HRD and DMD to accept his/her joining. After accepting his/her joining, now the candidate becomes an employee and Human Resource Department (HRD) gives him/her a posting order. In that posting order the branch and date of joining are mentioned. With the reference of that posting the employee have to report the mentioned Branch Manager within the mentioned date. A personal file contains:

- CV

- Offer of Appointment Letter and Appointment Letter

- Office notice of selected employee (with sign of FAVP, SEVP, MD)

- A copy of Certificates

- Joining Form

- Confirmation and Joining Letter

- Posting Order and Released Order

- Training Information (If any)

- Annual Confidential Report (ACR)

- Office notice of interview for Confirmation of Service

- Confirmation of Service Letter

- New Pay Scale

- Provident Fund Information

- Leave Fair Assistant (LFA)

- Office notice of interview for Promotion

- Promotion Letter (If any)

- Leave Information (If any)

- Trade Allowance and Daily Allowance(If any)

- Loan Information (If any)

Posting and Transfer:

An employee first joins in the Human Resource Department (HRD) in the Corporate Office. After accept his/her joining s/he is posted to Branch Office. Before to get the posting order employee doesn’t know in which Branch s/he will be posted. All jobs are transferable in this Mutual Trust Bank. The Competent Authority has the right to transfer employees of the Bank from one department to anther department or from one branch to another branch of the Bank. Human Resource Department keeps one copy of posting in employee’s personal file and the copy of posting order distribute among employee, the FVP and manager of employee’s branch, DMD and head of Corporate Affairs and Administration, Managing Director’s Secretariat Mutual Trust Bank Limited the FVP and manager of branch where employee will be posted and IT Department.

Annual Confidential Report (ACR):

Annual Confidential Report (ACR) is the evaluation report on the work performance and personal skills. In an ACR report there will be the basic information like employee’s personnel information, period of evaluation start to end, remarks (if any), rater name etc. This evaluation based on five-likart scale (Below average 1, average 2, good 3, very good 4 and outstanding 5) . Mutual Trust Bank evaluates two factors, one is personal traits and other is performance factors.

In personal traits evaluation there are ten things.

- Discipline and Punctuality

- Initiative and Drive

- Team Spirit

- Intelligence, Diligence and Alertness

- Honesty, Integrity and Sincerity

- Interpersonal Relationship Skill

- Creativity and Innovations

- Flexibility

- Loyalty and Devotion

- Fitness

And in performance factor there are also ten things.

- Professional Knowledge

- Improving Corporate Culture

- Decision making ability

- Ability of visualize and plan

- Ability to act on emergent situation

- Ability to implement decisions

- Ability to guide and create team work

- Communication Skills

- Customer Relationship

- Acquaintance with technological improvement

An employee has not any right access to his/her ACR, but s/he will be informed; so that s/he can correct/improve/rectify himself/herself from his/her weaknesses if s/he has any. After finishing the Annual Confidential Report (ACR) in paper HR department enter those reports in the database.

Confirmation of Service:

When an employee joins in the service s/he will remain under provision of one year. If the employee performs satisfactory in his/her job s/he will confirm of his/her service and thatis normally a promotion. For example, one employee joins as a Teller or Trainee Officer, if his/her performance is satisfactory then s/he will confirm as Banking Officer (BO). If the employee’s performance is not satisfactory then the bank can extent the provision or can confirm as Teller or Trainee Officer.

Leave Fare Assistant (LFA):

Leave Fare Assistant is the fifteen days leave with one month gross salary amount payment and this payment will not count in monthly salary. After one year of confirmation of service every employee will get this facility for every year. For mental And physical recreation of employee Mutual Trust Bank provides this facility and this mandatory for an employee. Leave Fare Assistant is payable to the employees or their nominee(s) who are not in the payroll of the bank on the date of payment due to retirement/death. With the provision that those who have completed one full year of service in the Bank before the date of payment will receive entire amount of LFA and others not completing one full year on the date of payment will receive LFA proportionate to his/her period of service during the concerned year.

Leave:

Following kinds of leave allowable to employees of the bank:

Earn Leave:

On completion of period of one year of continuous service in the Bank all employees get earned leave on full pay. The maximum amounts of such leave that may be accumulate four months.

Disability Leave:

Disability leave may be granted by the Board to an employee who is disabled by injury inflicted or caused in accident.

Maternity Leave:

Maternity leave may be granted by the competent authority to an employee for a maximum three months period at a time.

Casual Leave:

Casual leave means a leave of absence for very short period of days, granted to an employee who may be unable to attend duty due to sudden illness or urgent private/family affairs. On completion of period of three years of continuous service in the Bank employee may earn study leave without any pay and allowances, for a period not exceeding two years may be granted by the Board to an employee to enable him/her to study considered useful for his/her services under the Bank.

Pay and Allowance:

The scale of pay and other allowances of officers and employees of the bank are prescribed by the Competent Authority from time to time. The initial pay of an employee appointed or promoted to the higher post are ordinarily fixed at the initial stage of the scale of pay of the post to which he promoted or appointed.

President and Managing Director to Banking Officer the salary breaks down are Basic pay, House Rent Ceiling, Conveyance Allowance, Medical Allowance and Entertainment Allowance. Here House Rent Ceiling is 54%, Conveyance Allowance is 26%, Medical Allowance is 10% and Entertainment Allowance is 10% of basic salary. Tellers and Trainee Officers are got Consolidated Salary only, because they are on provision period.

Top level Officers from President and Managing Director to First Assistant Vice President (FAVP) got extra charges like House Maintenance, Utilities and Car Maintenance. Deputy Managing Director (DMD) and Senior Executive Vice President (SEVP) got Electricity, Gas, Telephone and Domestic Aids also.

President and Managing Director to Executive Vice President (EVP) got direct car from the bank. From Senior Vice President (SVP) to First Assistant Vice President (FAVP) got Car Loan facility. And President and Managing Director to First Assistant Vice President (FAVP) got House Loan also. These loan special for bank staff only, and the name of these loan are Staff Car Loan, Staff House Building Loan. The bank takes only 7% interest on these loan. Group Insurance facilities will get the entire confirmed employee. This insurance basically health insurance and will get facilities on only hospitalization. In this insurance officers and executives will get the benefit of one spouse and two children.

Kinds of Terminal Benefits:

The following kinds of terminal benefits are allowable to a regular and full-time employee of the bank. Gratuity Contributory Provident Fund Benevolent Fund

Festival Bonus:

Regular employee will be entitled to Festival Bonuses payable on the occasion of Eidul-Azha and Eid-ul-Fitre. The bonus amount will be the half of his/her salary.

Performance Bonus:

If the bank makes profit, the employees will be entitled to 3% of pre-tax profit as performance bonus. Fifty percent of such bonus distributed on the basis of basic pay of an employee, and balance fifty percent on the basis of performance of individual employees. Performance appraisal for the purpose made on the criterion set by the management time to time.

Cash award:

The Competent Authority may grand cash reward to any of its employee for performance of a work which is occasional in character and innovative or research and development oriented warranting special merit as to justify the payment of the same.

Rewards for Passing Banking Diploma Examination:

The employee of the who will pass Banking Diploma Part-I Examination in the first chance will get a cash reward of TK.25,000 and those who will pass Banking Diploma Part-II Examination in the first chance will get a cash reward of TK.50,000. Those who will pass Banking Diploma Part-I Examination in the first chance securing highest mark will receive an additional cash reward of TK.25,000 and those who will pass Banking Diploma Part-II Examination in the first chance securing highest mark will receive an additional cash reward of TK.50,000. The cash rewards for Banking Diploma Part-I and Part-II Examination in one more than one setting will be TK. 10,000 and TK. 20,000 respectively.

Annual Increment:

If employee’s service records and Annual Confidential Report (ACR) are satisfactory then the Competent Authority sanctions the increment on the salary. The percentage of salary increment is not fixed; it varies on Competent Authority decision. If the service records and Annual Confidential Report (ACR) are not satisfactory of an employee then the Competent Authority put him/her on special report for a period not exceeding six months and upon receipt of such report may sanction the increment either from demonstration or from immediate effect or may defer it for the whole year.

If an employee recognized of his/her outstanding and meritorious performance then the Board may decide to give him/her another special increment in one year period of time.

Travel allowance and Daily Allowance:

When bank send any employee for training and call any employee for interview then the bank will give him/her travel allowance and daily allowance. In this case the employee has to claim his/her allowance with bus/ train/ plane tickets. Human Resource Department will verify the claim and pay the employee.

4.11 Promotion:

The criteria for promotion to a specified post usually merit-cum-seniority. A person will be eligible foe promotion if he has the satisfactory records of service, meets the criteria for promotion, and has clear recommendation for promotion in his/her ACR. If there is any departmental proceeding in underway against him/her or any penalty other than censure or warning has been imposed on him/her within the last three years then the employee will not be promoted. In terms of every promotion the employee has to face interview board. There are number of years to become eligible for promotion from the ranks mentioned below to the next higher ranks:

Post Eligibility for Promotion:

Officer Two years experience as Junior Officer or one year’s experience as Probationary Officer selected through competitive test.

Training:

Training is the processes of teaching the employee the skill for their better act upon on the job. Training is very helpful for the employees for their better performance. There are many methods of training, but in the banks of Bangladesh two methods are commonly used, lecture and on-the-job training. Many institute and banks like BIBM, IBA, World Bank, Asian Development Bank, Bangladesh Bank, Citi Bank etc arrange varies kind of training. Lots of banks of Bangladesh have their own training institute and other banks employee can participate in that training. Mutual Trust Bank employees also participate in the other banks training also. Mutual Trust Bank doesn’t have its own training institute but this bank arranged many type of training in its corporate office and other banks employees can contribute these trainings. A number of trainings are specific for specific department like Awareness of fake money, money laundering, Q-cash debit card are compulsory for cash department employees. Other trainings are like Customer Credit Scheme and Lease Finance Scheme, Credit Risk Grading, Credit risk Management, Loan Classification and Provisioning, Loan Documentation, Lessons Learnt from Credit Feature, Structured finance for Large Projects in Bangladesh, Exchange Rate Management etc. Employee can not participate any in-house training from their own interest, Human Resource Department will select the employee to participate the training. Human Resource Department sends office notice to those employees to attend the training. After attending their training the employee have to submit a report on that training to the Human Resource Department. Some times Human Resource Department sends the employee to attend the training outside of the Bangladesh.

Recommendation

In Mutual Trust Bank Limited I worked in HR Department. Here I gather the practical experience of human resource management and how manage an information system of an organization. Though it’s my first experience, I gather some problems by discussing the HR personnel. So I would like to recommend about those problems as follows.

Extension of Human Resource Department:

With 49 branches Mutual Trust Bank has 711 employees. But in HR department the numbers of employees are 10 to 12. When something change for all employees like Increment it is tough for them to update whole employees’ file. It is too hard for HR employees to update all employees’ data. I have gone through a focus group discussion (FGD) with HR employees and they also discussing that, the HR department should be gradually extended at the branch level as the bank is expanding so that each branch has a HR official. A Study on Human Resource Management and Human Resource Information System of Mutual Trust Bank.

Stop Reference Appointment:

Mutual Trust Bank management and particularly the Board of Directors must change the System of appointing people by giving their reference. It has been deeply observed that most of the reference appointees are not up to the standard and have a poor performance.

For the sake of the bank’s future and further strengthening the quality of work force, this tendency to appoint people on reference must be stopped. It may not be absolutely possible to eliminate the reference appointment system as it is a local private company.

But still the tendency can be reduced to a certain extent if bold steps are undertaken by the management and the Board of Directors.

Trained System Operators:

Currently the branches do not have qualified system operators, rather ordinary persons have been appointed in this position and they learned the job by a trail and error process. This tendency should be eliminated immediately and next time the management or the concerned department should recruit qualified and skilled system operators who have both hands on experience as well as some academic background.

Utilize the Existing System:

Mutual Trust Bank has fully automated system in Human Resource Department. But they don’t totally utilize this software. Still they do paper based work. In case of Salary payment they use Excel Sheet Record. It is true that it is too hard for HR employees to update all employees’ data. But they have the system and they should utilize that properly.

Lesson I have learnt:

Formulating a succession planning and better salary package is helpful to retain the employee and it will save the organization from incurring loss in Training and Development program. If the succession planning and salary package is not attractive, the organization may face lack of talented employee.

A proper evaluation system is very essential for the organization. If the evaluation process does not reflect the real scenario all other efforts will be ruin miserably. In case of bank, as the branch Manager and Deputy Branch Manger handles the whole HR activities in the branch level, so they should be trained on Human Resource Management. To get proper evaluation result the HRD may go through a cross functional evaluation process, as instance, each and every member of a branch will evaluate separately all the employees, except thyself, of that branch.

The HRD may formulate a secret evaluation form which will be evaluated by each and every employee of a branch, except the branch Manager and the Deputy Manager to evaluate the HR practice of the Branch Manager and Deputy Branch Manager.

The Recruitment board should be HRD oriented. HRD can find out the best fitted employees for the organization. And the organization should not have any predetermined preference for any institute’s student, because sometimes it causes bias decision. The diversified workforce could be a better team which may fulfill the organization’s need properly.

Conclusion:

This report is the result of three month’s internship program in the Human Resource Department of Corporate Office of Mutual Trust Bank. Regarding my days spent at Mutual Trust Bank, I gathered knowledge that is going to help me in building my career in future.

In my report, I have tried to reflect my understanding and experience that I have gathered as correctly as possible. In spite of this, there may be some imperfections. From the practical point of view I can declare boldly that I really have enjoyed my Internship program at that branch from the very first day.