Executive Summary

The Present Internship Report “The General Banking of Al Arafah Islami Bank Ltd. Gazipur Branch” an internship paper on Al- Arafah Islami Bank Ltd has been prepared under the honorable supervision of Muhammad Sahadat Hossain, Lecturer, Department of Business Administration, Model Institute of Science & Technology (MIST). The period of Internship is three months.

Commercial banks are one of the key contributors in the economy of developing countries. They act as financial intermediaries by performing the function of mobilizing the funds from one group and lending the same to another while making a reasonable amount of profit after meeting the cost of fund. Banking sector in Bangladesh has been pursuing the policy of expansion and growth of branches. People and the government itself are very much dependent on the services provided by the 88 banks in the financial market. To know how well commercial banks perform actually, a case study on Al-Arafah Islami Bank Ltd. is being taken. The banking practice of conventional banking and Islamic banking is highly different from the concept.

Through This Internship Report an attempt has been to assess the performance of private Commercial Banks ownership in our country Bangladesh and to find out the limitations, if there is any in light of collected data on different functional areas of Al-ArafahIslami Bank Limited (AIBL).

AIBL in its all transaction restricts interests and conducts its investments portfolio under 3 Mechanisms Viz; a) Bai-Mechanism, b) Leasing of Ijara Mechanism c) Share Mechanism. Al-ArafahIslami Bank Limited is committed to operate to the principles of Islamic Shariah.

1.1 Statement of the research problem:

This report is based on an internship program. Actually, this Internship report is submitted as a partial fulfillment of the requirement of Bachelor of Business Administration. The work presented in this report titled “General Banking” of Al-Arafah Islami Bank Limited Gazipur Branch. I have learnt some valuable information about over all general banking of AIBL. I believe it will help me in future. I was assigned to do my practical orientation in Al-Arafah Islami Bank Limited.

Bank is important financial intermediary in the economy. It plays crucial role of transferring the resources from surplus area to the surplus area to the supply constraint area. Bank performs its job through introducing various financial products and services to the market. Among them loan is the most crucial product .Loan is the product that generates major profit for the bank. Since, banks receive deposits from lenders at a certain interest rate and give the loan at the higher interests. The private banking industries are at its growth in Bangladesh.

In August 1974, Bangladesh signed the charter of Islamic Development Bank and committed itself to reorganize its economic and financial system as per Islam

Ice Shariah. Bangladesh government subscribed recommendation of Islamic Foreign Minister’s conference held in Senegal in 1978 regarding systematic efforts to establish Islamic banks in the member countries gradually. In January 1981, the then president of the People’s Republic of Bangladesh while addressing the 3rd Islamic Summit Conference held at Makkah and Taif suggested, “The Islamic countries should develop a separate banking system of their own in order to facilitate their trade and commerce.” Earlier in November 1980, Bangladesh Bank, the country’s Central Bank, sent a representative to study the working of several Islamic banks of different countries. In November 1982, a delegation of IDB visited Bangladesh and showed keen interest to participate in establishing a joint venture Islamic Bank in the private sector. They found a lot of work had already been done and Islamic banking was in a ready form for immediate introduction. Two professional bodies Islamic Economies Research Bureau (IERB) established in 1976 and Bangladesh Islami Bankers Association (BIBA) established in 1980 made significant contributions towards introduction of Islamic banking in the country. They came forward to provide training on Islamic banking to top bankers and economists to fill-up the vacuum of leadership for the future Islamic banks in Bangladesh. They also held seminars, symposia and workshops on Islamic economics and banking throughout the country to mobilize public opinion in favor of Islamic banking. At last, the long drawn struggle to establish an Islamic bank in Bangladesh became a reality and Islami Bank Bangladesh Limited was founded on 30th March, 1983 in which 19 Bangladeshi national, 4 Bangladeshi institutions and 11 banks, financial institutions and government bodies of the Middle East and Europe including IDB and two eminent personalities of the kingdom of Saudi Arabia joined hands to make the dream a reality.

At present there are7full Islamic bank is performed there Islamic banking activities .Until now, a good number of research studies in the area of nationalized commercial banks have been conducted. But few comprehensive studies have been done in the area of performance of private commercial banks / In order to unfold the performance

dynamics of Islamic Banking, a case study of an Islamic bank that experienced serious problems in the past has been chosen for investigation. The present study is a modest attempt to address the performance evaluation of the Al-Arafah Islami Bank Limited.

1.2 Objectives of the Report:

The main objectives of this report are:

To have exposure to the functions of general banking section.

To know about the profile of AL-Arafah Islami Bank Limited.

To know about performance of the Bank.

To apply theoretical knowledge in the practical field.

1.3 Variables Covered:

In the light of objectives of the study the following variables are selected for analyzing the performance of the Bank.

Deposits

Investment (Credit)

Foreign Trade

Profit

Capital

Income

Assets

Expenditure

1.3 Methodology:

This report is aimed at presenting experiences gathered in the work place regarding the General Banking Activities. With this end of view I have collected data on the structure. The methodology of my internship report is described in the following paragraphs.

Data collection:

For the data collection purpose, I have used several procedures. For the organization part basically it was observation and also I took the help of the Al-Arafah Islami Bank Limited.

Source of Data:

The data presented in the report is a combination of both the primary & secondary data.

Primary sources:

A Lot of the required information came from primary sources. I have used convenience sampling method. These sources are-

Officer

Customer

Secondary Source:

Conceptual parts of the report have been collected by studying different literatures regarding credit appraisal system. Some of these secondary sources are-

Annual report of the organization.

Corporate head office.

Company website.www.aibl.com

Sample Size:

22 Customers

3 Officers

Sampling Method:

Convenience Sampling

1.5 Scope Of The Report:

As I was working in the Al-Arafah Islami Bank Limited (AIBL), I got the opportunity to learn different part of banking system. My supervisor divided the whole banking in two parts so that I can get the opportunity to work in the General Banking division. I did get any practical knowledge about this division. My supervisor gives me an overall briefing about General Banking division.

1.6 Limitation of this report:

The report is accompanied with the following limitations;

Access to data regarding different performance indicators of AIBL.

The report is mainly based on the secondary data which published by different organization as annually, half-yearly, monthly, weekly or daily.

Time constraints are another limitation of this report.

Due to some legal obligation and business secrecy banks are reluctant to provide data. For this reason, the study limits only on the available published data and certain degree of formal and informal interview.

The bankers are very busy with their jobs, which lead a little time to consult with.

Finally, some recent data which were needed to enrich this report but the unwillingness of executives of the bank due to confidentiality was made my report limited to data content.

Lack of my experience and practical exposure.

2.1 Historical Background of AIBL:

Al-Arafah Islami Bank Limited was incorporated on 18th June, 1995 under the companies Act, 1994 as a banking company with limited liability by share. It started business on 27 September of that year with an authorized capital of Tk.1, 000 million. At inception, its paid up capital was Tk. 101.20 million divided into 101.200 ordinary shares of Tk. 1,000 each. 23 sponsors of the bank subscribed the total issued capital. In 2000 the paid up capital of the bank increased to Tk. 253 million, of which Tk. 126.50 million were paid by the promoters/ sponsors and Tk.126.50 million by the general public. The bank is listed in the two stock exchange of the country and has offered 126,000 shares for subscription and trading by the public.

Al-Arafah Islami bank is an Interest-free shariah Bank and its modus operandi is substantially different from those of regular commercial banks. The bank however, renders all types of commercial banking services under the regulation of the Bank Companies Act 1991. It conducts its business on the principles of musharaka, bai-murabaha, bai-muajjal and hire purchase transactions. A Shariah Council of the bank maintains constant vigilance to ensure that the activities of the bank are being conducted according to the precepts of Islam. All activities of the Al-Arafah Islami Bank Limited are conducted of an interest-free system according to Islamic Shariah. It invests all of halal commondities and on a profit and loss sharing basis. A fixed percentage of income derived from investment of mudaraba deposits is distributed to the mudaraba deposit holders.

AIBL was established not onoly to earn profit and to develop economy of the country but alsjo it had an ultimate goal to get reward in the Heaven by banning interest in business. The Islam loving people specially who are not interested with interest, should help this bank giving deposit and taking investment from this bank. The Bank is committed to contribute significantly in the national economy. It has made a positive contribution towards the socio-economic development of the country by opening 66 branches on which 16 authorized dealer (AD) throughout the country. The equity of the bank stood at 2,705.74 million as on 31st December 2008, the manpower was 1080 and the number of shareholders was 10,664.

2.2 Special Feature of AIBL:

As an Islami bank, we are singular in every positive aspect. We provide a bunch of state-of –art banking services within the wide bracket of shariah. We are unique with our products, strict with our principle and uncompromising with our honesty. Here are some special features of us that make us notable in Islami banking sector.

All activities of AIBL are conducted under a profit/loss based system according to Islamic Shariah to get the nation rid of Usury.

Its investment policies under different modes are fully Shariah compliant and well monitored by the board of Shariah Council.

During the year 2007, 70% of the investment income has been distributed among the Mudaraba depositors.

In 2008, AIBL has included online banking in its wide range of services. Bangladesh software has been introduced in this feature to promote the local developers.

AIBL regularly arranges its AGMs (Abbual General Meeting). Whenever needed EGMs (Extraordinary General meeting) are also arranged.

We regularly pay dividend to our valued shareholders. For the year of 2007, we declared 20% bonus dividend to our shareholders.

We believe in providing dedicated services to the clients imbued with Islamic spirit of brotherhood, peace and fraternity.

The bank is committed towards establishing a welfare-oriented banking system to meet the needs of low income and underprivileged class of people.

The bank upholds the Islamic values of establishment of a justified economic system through social emancipation and equitable distribution of wealth.

Following the Islamic traditions, it is assisting in the economic progress of the socially deprived people; in the creation of employment opportunities and in promotion of rural areas to ensure a balance development of the country.

2.3 Characteristics of Al-Arafah Islami Bank:

It is a financial institution.

It is a business institution.

It operates its business activities free from interest.

It is run according to rules and regulations formed and amended by Shariah Council.

It is profit-loss sharing business organization.

It provides loan as Quard Hasana for social welfare.

It gives zakat on its capital according to Islamic Shariah.

It leads all of its transaction according to Islamic law.

No form of work is done which is non-Islamic etc.

Al-Arafah Islami Bank Ltd means not business product but running business through money.

2.4 Necessity of Al-Arafah Islami Bank:

Islamic banking is not only to earn profit, but also to make welfare to the people. Islam upholds the concept that money, income and property belong to Allah and this wealth is to be used for the good of the society. Al-Arafah Islami Bank Ltd operates of Islamic principles of profit and loss sharing, strictly avoiding interest, which is the root of all exploitatrion and is responsible for large-scale inflation and unemployment. Al-Arafah Islami Bank Limited is committed to abolish such disparity and establish justice in the economy, trade, commerce and isdustry build socio-economy infrastructure and create employment opportunities.

2.5 Vision of Al-Arafah Islami Bank Limited:

To be the pioneer bank in the banking arena of Bangladesh under the Shariah guidelines and contribute significantly to the national economy.

2.6 Mission of Al-Arafah Islami Bank Limited:

Achieving the satisfaction of Almighty Allah both here and hereafter.

Proliferation of Shariah Based Banking Practice.

Quality financial service adapting the latest technology.

Fast and efficient customer service.

Maintaining high standard of business ethics.

Steady and competitive return on shareholder’s equity.

Innovative banking at a competitive price.

Attract and retain quality human resources.

Extending competitive compensation packages to the employees.

Firm commitment to the growth of national economy.

Involving more in Micro and SME financing.

2.7 Objective of Al-Arafah Islamic Bank Limited:

Al-Arafah Islami Bank Limited is Islamic Banking institutions that operates with the objectives implement and materialize the economic and financial principles of Islamic

in the baking arena. The objectives of AIBL are not only to earn profit, but also to do good and welfare to the people. The main objectives of AIBL are listed below-

To conduct interest free banking.

To establish participatory banking instead of banking on debtor creditor relationship.

To incest through different modes permitted under Islamic Shariah.

To accepts deposits on profit loss sharing basis.

To establish as welfare-oriented banking system.

2.8 Commitments of Al-Arafah Islami Bank Limited:

AIBL is a customer focused modern Islamic Banking making sound and steady growth in both mobilizing deposit and making quality investment to keep our position as a leading islami bank Bangladesh.

Their business initiatives are designed to match the changing trade and industrial needs of the clients.

2.9 Product & Service:

Deposit

Investment

Foreign Trade

Deposits:

Al Wadea Current Deposit (CD)

Mudaraba Saving Deposit (MSD)

Mudaraba Tem Deposit (MTD)

Mudaraba Short Notice Deposit (SND)

Monthly Installement Based Term Deposit (ITD)

Monthly Instalment Based Hajj Deposit (MHD)

Onetime Hajj Deposit (THD)

Marriage & Investment (MIS)

AL-Arafah Savings Bond (ASB)

Foreign Currency Deposit (FCD)

Pension Deposit Scheme (PDS)

Cash Waqfa Deposit Scheme (CWD)

Mudaraba Millionaire Deposit scheme

Mudaraba Double Deposit Scheme

Mudaraba Lacpoti Deposit Scheme

Mudaraba Kotipoti Deposit Scheme

Investment:

Investment in Agricultural Sector

Investment in Industrial Sector

Investment in Business Sector

Investment in Foreign Trade

Investment in Construction and Housing

Investment in Transportation Sector

Hire Purchase (HPSM)

Investment Schemes in Masque and Madrasa (MMIS)

Position in the stock market

Banks share sustained a steady strong position throughout since its inception at Dhaka & Chittagong Stock Exchange in1998.In Dhaka Stock Exchange the face value of taka1000 of our share was treaded at taka3099.50 highest in 2008.

The market trend of AIBL share in Dhaka Stock Exchange between January to December 2010 is stated below:

Stock Market

| Month | Highest | Lowest | Closing |

| January | 3099.50 | 3025.00 | 3030.50 |

| February | 2910.00 | 2900.00 | 2901.00 |

| March | 2959.00 | 2920.00 | 2951.25 |

| April | 2967.00 | 2940.00 | 2947.25 |

| May | 2325.50 | 2305.00 | 2313.25 |

| June | 2225.00 | 2225.00 | 2225.00 |

| July | 2210.00 | 2200.00 | 2200.75 |

| August | 2380.00 | 2350.00 | 2364.75 |

| September | 2426.50 | 2400.00 | 2400.50 |

| October | 2301.25 | 2280.00 | 2295.00 |

| November | 2415.00 | 2397.00 | 2410.00 |

| December | 2440.00 | 2400.00 | 2420.25 |

Progressive Analysis

At the end of current year, the number of depositors stood at 243273 and the amount of deposit has accumulated to Tk.16775.33 million. The total numbers of investors are 13213 and total investment extended to them was a sum of total taka17423.19 million.

The bank has earned Tk. 2172.48 million and incurred an expense of Taka1202.71 million in the current year. At the end of the year the profit before tax has stood TK.855.47 million, which is78.97% more than TK.478.00 million pre-tax income of the last year.

Capital of Al–Arafah Islami Bank Limited

The Bank Company Act, 1991, which amended in the march 2003, includes a provision of raising the capital to a new level of taka 100 crore for the commercial banks within March 2005. In compliance with the new provision, the bank has raised its capital from Tk. 41.58 crore in the year 2002 to TK.85.56 crore in 2003 by issuing a right share against each of the existing shares in the year 2003 and declared16% bonus dividend from the profit of the year2003. The bank again declared 15.50% bonus dividend from the profit 2004. As a result, the paid up capital of the bank stood at Tk. 67.79 crore as at 31st December 2005.

Bank declared 26.00% bonus dividend for the year 2005. As a result the paid up capital of the Bank stood at TK. 85.42 crore as at 31st December 2006. In this fund bank experience a growth rate 64.18%

Reserve Fund

The total balance of the reserve fund stood at Tk. 61.01 crore in the current year against 835.94 million compared to previous year 2006.

Capital Adequacy

The Bangladesh Bank has fixed the ratio of capital adequacy against risk-Weighted Assets at 9.00% in place of 8.00% in the month of September 2002. In 2002, the amount of total capital of the bank was 41.57 crore taka, which stood at Tk.104.27 crore in the year 2004 and taka 130.56 crore in the year 2005. This year it stood at taka 183.04 crore at the end of December 2006, the capital adequacy ratio of the bank is 10.71% against 12.17% at the same period of 2005.

Deposit

The total deposit of the bank was Tk. 16775.33 million at 31st December 2006, of which bank deposit was 611.72 million taka and general deposit was 16136.61 million taka. At the same period in the last year, the amount of total deposit was 11643.66 million taka. In this area the growth rate is 44.07%.

Investment

At the end of the year 2007, the amount of investment of the bank was Tk.17423.19 million in comparison to Tk.11474.41 million of the last year 2005. The amount of investment has increased 5948.78 million taka within this period, which is around 5184%.

Foreign Trade

At the year of 2006, the bank experienced satisfactory growth in the foreign trade. At the end of 2005, the total amount of foreign trade (export,import,remittance) was 18020.10 million taka, which has increased at 60.18% to reach 28865.00 million taka in 2006. The total export of the bank was 4932.90 million taka in 2005, which has increased at 85.34% growth rate to reach 9142.70 million taka in 2006, whereas the national growth was 85.34% during the same periods. Similarly the amount of import has increased from 12631.60 million taka of 2005 to 18821.40 million taka in 2006, experiencing a growth rate of 49.80%. Last year the amount of remittance through the bank was 455.60 million taka, which grows to 900.90 million taka in the current year.

Income

Investment Income

The total income generated from the investment is Tk. 1701.40 million which is 78.32% of the total income. At the corresponding period of 2005, this income was TK. 1118.38 million. It indicates an increasing growth rate of 52.14%.

Income from other than investment

The bank was earned Tk. 471.19 million from other source than investment like commission income, exchange income, locker rent etc. In the current year which is 21.68% of total income. The bank earned Tk. 334.35 million from the same source in the corresponding period for the last year, which indicates 40.90% growth rate.

Expenditure

Profit paid to Depositors

The bank has paid the depositors 819.71 million taka, which is 70% of the investment income and 68.16% of total expenditure of the year 2006. The amount of this expenditure was 550.79 million taka in the last year. In this purpose the expenditure has increased 268.92 million taka or by 48.82% compared to previous year.

Administrative and other expenses

The administrative and other expenses have increased by 8.29% in 2006, in compare to that of 2005. The administrative and other expenses were tk.353.68 million in the last year and it amounts to tk. 382.99 million in the current year which is 31.84% of the total expenditure.

Operating Profit

The bank has earned Tk. 969.77 million as operation profit during the year. In 2005 it was tk. 548.20 million. The growth rate is 76.90%.

Dividend

The bank has been paying dividends in every year from 1998 when it was established as a public limited company. The bank paid dividend at the rate of 15% in 1998, 12% in 2000, 7.5% in 2001, and 20% in 2003. Bank declared bonus dividend at the rate of 16%, 15.50%, 26%, and 35% to its shareholders in the year 2003, 2004, 2005 & 2006 respectively.

Audit and Inspection

A total number of 12 employees including 1 Assistant Vice President and 11 other Executives and officers have been working at the Audit and Inspection department under the direct Supervision of the Managing Director.

Web Site

To present the overall picture of the bank to the Depositors, Shareholders, Investment Clients and Well wishes in home and abroad more transparently and to adopt the developmental of the Information Technology of 21st century bank designed a web site for its own.

Staff Welfare Project

The bank always kept a careful eye on the economic security and benefit of its staffs & officers. The bank operates a contributory provident fund a social security & benevolent fund and a gratuity fund for its employees. Till now a total of taka 1 crore has been paid from the fund to the families of late officers & staff of the bank.

Human Resource

The bank has recruited experienced new manpower to coordinate its extended operation. The total manpower employed in the bank including managing directors is 771 at 31st December 2005, which were 912 at the end of the last year.

Training & Motivation

Training and motivation are Utmost important to bring about positive change in the outlook of the manpower and to increase efficiency. AIBL has been training & various motivational program and incentives every year.

Al-Arafa Islami Bank Ltd Foundation a portion of income of the bank is being spent on philanthropic activities. Among other philanthropic activities, running of Al-Arafah English Medium madrasa and library are praiseworthy.

Al-Arafah English Medium Madrasa

Al-Arafah English Medium Madrasa has been established by the Al-Arafah Islami Bank Ltd. Foundation with a view to building next generation, according to the ideas of peace and equality of Islam and to establishing banking and other aspect of life in the way of Islam. The prime aim of this madrasa is to contribute towards building human resource and in the broader sense to ensure human welfare.

Al-Arafah Islami Bank Library

Library is the carrier & reservoir of knowledge. Al-Arafah Islami Bank Ltd. has shown that other than generating profit, it can also contribute significantly in the field of providing good source of knowledge by establishing a public library. Thus strengthening social is development. It is placed in sound, healthy surroundings.

BUSINESS NETWORK OF AIBL

NAME OF AIBL BRANCH.

Branch Code | Name |

|

|

1 | Motijheel | 25 | O.R.Nizam Road, CTG |

2 | Moulvi Bazar, Dhaka | 26 | Moulvibazar, Sylhe |

3 | Laldighirpur, Sylhet | 27 | Choumohani |

4 | Agrabad | 28 | Comilla |

5 | Khulna | 29 | Jessore |

6 | Rajshahi | 30 | Dhanmondi |

7 | Bogra | 31 | Mohadevpur |

8 | Katungonj | 32 | Madhabdi |

9 | Barisal | 33 | Pagla |

10 | Sathhira | 34 | Rupuspur |

11 | Nawabpur | 35 | Joydevpur |

12 | Benapole | 36 | Mohammadpur, Dhaka |

13 | VIP Road, Dhaka | 37 | Narayangonj |

14 | Corporate, Dhaka | 38 | Companigonj |

15 | New Elephant Road | 39 | Gallai |

16 | UttaraModelTown | 40 | Islampur, Dhaka |

17 | Jublee Road | 41 | Dilkusha, Dhaka |

18 | North South Road | 42 | Badda |

19 | Banani, Dhaka | 43 | Kapohia |

20 | Mirpur, Dhaka | 44 | Beani Bazar |

21 | Mymensingh | 45 | Feni |

22 | Zindabazar, Sylhet | 46 | Mirpur |

23 | Mouchak, Dhaka | 47 | Kolabagan |

24 | Syedpur | 48 | Gazipur |

2.10 Activity of Shariah Council

Shariah Council consist of 6(six) members specialized in Fiqhul Muamalat (Islamic Commercial Low) as guideline given by Bangladesh bank to ensure whether all banking operations are transacted in accordance with Islami Shariah i.e. Quran, Sunnah, Ijmah and Iztihad.

Shariah Council advised everybody concerned to comply shariah requirements and render all out effort to increase the standard of service rendered to the clients.

Besides, compemsation received from different branches, interest received from correspondence bank of Nostro a/c and Bangladesh bank clearing a/c as well as doubtful income amounting to Tk. 1,40,52,662 advice to set aside from bank total halal income.

A library is established in the Shariah Council Secretariat of Al-Arafah Islami bank Ltd. with about 500 books on Qur’an, Hadith, Fiqh, Islamic Economics and Islami Banking.

This is a great honor for AIBL as the Chairman and Member Secretary of the Shariah Council are playing the role of Vice Chairman and Secretary-general respectively in Central Shariah Board. The shariah Council of the AIBL is playing an active role in enhancing brotherhood and establishment of cordial relationship amongst Islamic banks of Bangladesh, increasing cooperation and develop the standard of Shariah principles on Islami banking.

2.11 Pledges and Commitments of the sponsor Directors of Al-Arafah Islami Bank Limited

Whenever a new institution comes into existence, the sponsors claim that it would be an institution with a difference. If a new institution does not have any novelty, why it should at all be brought into existence?

The sponsors of Al-Arafa Islami Bank Ltd in conformity with the tradition claim that it would be a bank with a difference. In what respect? Let us try to substantiate our claim.

The sponsors and promoters of Al-Arafa Islami Bank Ltd made a few firm pledges and commitments in the name of Allah. Such categorical commitments have never been made by the promoters of any bank in Bangladesh or anywhere in the subcontinent, to their knowledge.

Let us have a look at some of these commitments,titled “Agreements,Pledges and Commitments of the Promoters,Sponsors and Directors Of Al-Arafa Islami Bank Ltd”

Objective of the Sponsors

We declare that Al-arafa Islami Bank Ltd has not been set up with the objectives of economic welfare and financial benefit of the sponsors and promoters on this world, on the economy, we are desirous of our welfare in the next world and Nazat in Akhirat which could be achieved more by rendering credit services by the sponsors and bankers to others than any service to themselves.

Misuse of Power and Undue Advantages

We shall not try to avail undue advantages of any kind from the bank for ourselves, or for firms, companies, institutions in which we have financial or other interest. The facilities which are legal, just and due to us, that shall avail of should be transparent and known to the Board of Directors leaving little scope for misunderstanding.

Motivating Sprit of Qurbani

We are determined to rise above Nafsaniyyat of self-service and have come forward imbued with the spirit of Quarbani and sacrifice and to build up a model credit institution in which selfish, nafsaniyyat shall not be cultured on the mere pretext of majority view of the sponsors.

Inspiration for Qurbani of Nafsaniyyat or self-interest

The Promoters and sponsors of Al Arafa Islami Bank Ltd are imbued with the spirit of sacrifices and Quarbani of the family of Hazrat Ibrahim (A.) and which was rekindled by our beloved prophet Muhammad (Sm.) and Sahaba-I- keram and thereafter by the Sufi saints who made supreme sacrifices and Qurbani for preaching of Deen of Allah to all corners of the world, particularly to this region.

Clean Banking is “Ibadat”

We agree to conduct the clean banking under patronization of the government and firmly believe that the association with this bank would be nothing but ‘Ibadat’ and that we shall act accordingly.

Environment of Al-Arafah Islami Bank

AIBL shall bear the mark of sunnah of our Prophet Muhammad (Sm.) of our faith and conviction, our values and attitudes towards life and that the entire environment of the bank shall in conformity with Sunnah.

Sunnah of Keeping Deposit as “Amanat”

We firmly and solemnly pledge and promise to hold the deposits and other fund at our disposal as ‘Amanat’ and sacred trust keeping in mind the Sunnah of our beloved Prophet Muhammad (Sm.) who would hold the money and materials deposited with him even by the infidels in great trust for which he earned the title of ‘Al-Ameen’.

Groping and Lobbing

We shall not indulge in grouping and lobbying most particularly, in financial matters and banking business for the personal interest of anybody.

Responsibility to depositors

We are conscious that the deposit of our clients might be more than 90% of the disposable loans and credit and we shall put priority on their interest over that of shareholders or directors

Employment Policy

We agree that all recruitment be made on merit and rules. All employees after employment must confirm to Faradh and Wajib with in the time determined, but not exceeding two years.

Freedom from Nepotism and Districtism

We are totally committed not to indulge overtly or covertly in any kind of nepotism or favoritism due to relationship, friendship, acquaintance, regionalism, districtism or locally as regards to loan facilities or employment or any other aspect directly or indirectly.

Bases of Conscience of Directors

We do hereby promise and pledge that in addition to the laws, regulations in force in the country, we shall be bound to and abide by the dictates of our conscience based on faith and trust on Allah and expectation of Shafayat from our beloved prophet Hazrat Muhammad (Sm.)

2.12 Special Features of the Bank

All activities of the bank are conducted according to Islami Shariah where profit is the legal alternative to interest.

The banks Investment policy follows difference modes approved by Islamic Shariah based on Quran & Sunnah.

The banks committed towards establishing welfare oriented banking system, economic upliftment of the low-income group of people, create employment opportunities.

According to the needs and demands of the society and the country as a whole the bank invests money to different Halal business. The bank participates in different activities aiming at creating jobs, implementing development projects taken by the government and developing infrastructure.

The bank is committed to establish an economic system through social justice and equal distribution of wealth. It is committed to bring about changes in the underdeveloped rural areas for ensuring balanced social economic development of the country through micro credit program. According to Mudaraba system, the depositors are the partners of the investment income of the bank. During their period under review, 70% of the investment income has been distributed among the Mudaraba depositors.

To render improved services to the clients imbued with Islamic spirit of brotherhood, peace and fraternity and by developing an institutional cohesion.

The bank is contributing to economic and philanthropic activities side by side. Al-Arafah English Medium Madrasa and AIBL Library are among mention worthy.

2.13 Aim and Objectives:

! To get Nazat in Akhirat and Jannat by service

! To management of bank as regard the rules of Shariah.

! Interest Interest free modern banking.

! To serve the businessman the banking services including investment banking.

! By providing investment in various sectors like Agriculture, urban/real estate, self employment etc for the tolerant of social financial development.

! To develop human resource and create the opportunity of employment.

! To develop the living status of small and medium earnest employee help to purchase of their expected product

! Investment In least developed and developing area of the country and for the rehabilitation and create employment opportunity

! Providing help in HAJJ and OMRAH those who are interested.

! Investment activity based on mosque to financial development with Islamic commends.

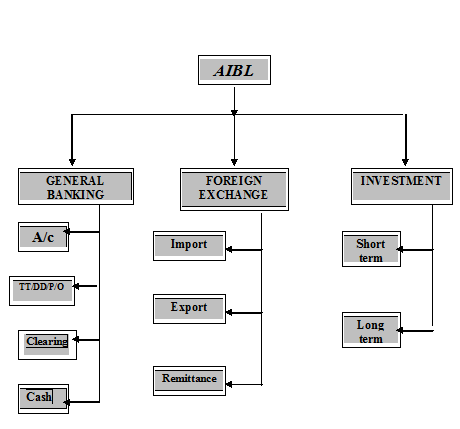

Introduction

General Banking of Al Arafah Islami Bank Ltd consists of several types of services for their valued client. They provide various services to perform jobs with speed and accuracy to maintain of all affairs of banking in a uniform way to check fraud & forgeries as well as to fix-up responsibilities to satisfy their valuable customers.

3.1 General Banking services of Al-Arafah Islami Bank Ltd :

Account Open

Account Close

Remittance

Cash

Clearing

Account Opening

Banker customer relationship is established through opening an account on obtaining introductory reference and introduction. If there is any lapse in this regard bank may suffer loss subsequently. Bank shall not get protection under section 131&131(a) of Negotiable Instruments Act 1981 for negligence and will be guilty of conversion in case of collection of a cheque instrument having defective title if the account is not opened without proper introduction & inquiry. There are many kinds of account and schemes maintain by the Al-Arafah Islami Bank Limited to their customers required. Such as:

Sharia principle of current, saving, and term deposit account:

Current Account

Deposit in Current account in Islami Bank is accepted under the principle of Al -Wadia. It means that the bank receives money in current account as Al- Amana (on trust). As such the bank is under obligation to return the entire money on demand by the customer and the customer in on way shall bear the loss which the bank sustains in its operation. The bank however, can use money at its risk with the prior permission from customer. As agreed upon by prior contract, the customer may also receive any benefit from the bank. In our bank, however, no benefit is given to the current account holder as per prior contract. The bank has also the discretion to recover the incidental charges for the maintenance of the account or any other services rendered.

Procedures to open a Current Account:

At the name of any person:

- Two stamp size attached photograph duly signed by the acceptable introducer of the bank.

- Nominee.

- Photograph of the nominee.

- Photocopy of passport/voter identity/commissioner certificate.

For self-proprietorship Institution:

- Two stamp size-attached photograph duly signed by the acceptable introducer of the bank.

- Nominee.

- Photograph of the nominee.

- Photocopy of Trade License.

For partnership company:

- Copy of partnership certificate.

- Photocopy of Trade License.

- Two stamp size-attached photograph duly signed by all parsons who will maintain the account.

For public limited company:

- Along with above paper have to submitted certificate of commencement.

Saving, & term deposit

Deposit in saving, shorts notice & term deposit accounts are accepted on the Mudaraba Principle of Islami Sharia. Under the above principle the client is the Shaheb- Al-mal and the bank is Mudareb. As per contract the bank is authorized to invest Mudaradba funds at joint risk of the client and the bank. The clients can not interfere/participate in the management of the fund. Any profit resulting from the investment of the Mudaraba Fund is distributed between the client and the bank as per principle of distribution of profit announced by the bank as at the beginning of the year or as per contract. Loss is to be borne by Shaheb Al-Mal after adjustment of the same from equity and the bank does not get any remuneration for the management of fund.

Procedures to open a Saving Account

Personal, partnership, and club, school, madrasa etc financial institution can open this type of account.

- One passport Two stamp size-attached photograph duly signed by the acceptable introducer of the bank.

- Regulation copy to operate the account.

- Nominee.

- Photograph of the nominee.

- Photocopy of passport/voter identity/commissioner certificate.

- Photocopy of Trade License.

Short Notice Deposit (SND)

Bank accepts such kind of deposit, which is withdrawal at notice of seven to Twenty nine days, and thirty days and over with profit. The account is maintained like that of a Mudaraba savings account.

Sundry & other deposits

Sundry & other deposits are also treated to be accept under Al-Wadia Principle. Al-Arafa Islami Bank Limited do maintain various term deposit account and deposit scheme

Hajj account deposit

Hajj deposits at monthly installment for any period from 1(one) year to 20(twenty) years are accepted under the above scheme to enable the account holder to perform Hajj.

One Time Hajj deposit

For once time a certain amount of money can be deposited from 1(one) year to 25(twenty-five) years under the one time Hajj scheme to perform Hajj at the maturity period.

Monthly profit Based Term Deposit

Under the above scheme, deposits of Tk.1.00 Lac, 1.10 Lac, 1.20 Lac, 1.25 Lac and multiple thereof are accepted for a term of 5(five) years and the bank gave profit thereon Tk. 969 per month per Lac and proportionately on the rest amount of deposit under the category during the year under review. The aforesaid rate shall, however, be adjustable at the close of calendar year on finalization of accounts.

Installment Term Deposit (ITD)

According to mudaraba rules this deposit is accepted. The main attraction is its profit is calculated on daily deposited amount. Under this scheme a form has to be filled. One parson can have more than one ITD account in same branch it’s sustained for:

Table for Deposit in monthly installment and maturity Periods:

Name of Scheme | Installment | Maturity Periods |

ITD | 200.00 | 5-12 years |

300.00 | Do | |

500.00 | Do | |

1000.00 | Do | |

1500.00 | Do | |

2000.00 | Do | |

3000.00 | Do | |

4000.00 | Do | |

5000.00 | Do |

The schemes of Mudaraba Milliner Deposit Scheme (MMDS )accounts are:

Name of Scheme | Maturity Periods | Monthly Installment | Receivable Amount |

MMDS | 3 years | 23950.00 | 10.00(Lac) |

| 4 years | 16950.00 | 10.00(Lac) | |

| 5 years | 12750.00 | 10.00(Lac) | |

| 6 years | 9950.00 | 10.00(Lac) | |

| 7 years | 8000.00 | 10.00(Lac) | |

| 10 years | 4600.00 | 10.00(Lac) | |

| 12 years | 3345.00 | 10.00(Lac) | |

| 15 years | 2170.00 | 10.00(Lac) | |

| 20 years | 1150.00 | 10.00(Lac) |

Mudaraba Lakhopoti Deposit Scheme (MLDS) account are

Name of Scheme | Maturity Periods | Monthly Installment | Receivable Amount |

MLDS | 3 years | 2375.00 | 1.00(Lac) |

5 years | 1275.00 | 1.00(Lac) | |

8years | 670.00 | 1.00(Lac) | |

10 years | 460.00 | 1.00(Lac) | |

12 years | 335.00 | 1.00(Lac) |

Mudaraba Term Deposit (MTDR)

Multiple of 1.00 Lac & over in multiples of that are accepted for 3or 5 years and the bank give profit of Tk.969for each month on per Lac and rest amount are adjusted with deposit. There are several type of deposit is known as Mudaraba Term Deposit

They have also Mudaraba Kotipoti Deposit Scheme and Mudaraba Double Deposit Scheme of various periodic.

Savings Investment deposit

Deposit under the scheme is accepted by monthly installment and after expiry of the term, double amount of such savings in given as investment in feasible sectors by the bank as per choice of the depositors without any collateral security. Any one by saving under the scheme can take business venture on utilizing the amount saved under the scheme as well as availing ban investment.

Marriage Savings Deposits and Investment Scheme:

Fixed monthly installment for a particular period is to be deposited to defray the expenses of marriage and the bank allows double of Saving or Tk. 30,000 which is higher as investment to procure ornaments, furniture, fixture, etc. repayable in 24 monthly installment without any collateral security.

Savings Bond Deposit

Under this scheme the bank has introduced saving bonds for Tk.10,000, Tk. 100.000 for 3,5 and 8 years. After the completion of the tenure the deposited money may increase by 1.5 even two times, Insha-Allaha

Revised Provisional Rate of Mudaraba Deposit from 1st January 2011

| SL.NO | Types of Mudaraba Deposits | Provisional Rate |

| 01. (a) (b) (c) (d) (e) | Mudaraba Term Deposit | |

| 36 Months | 10.00% | |

| 24 Months | 10.00% | |

| 12 Months | 12.00% | |

| 06 Months | 11.50% | |

| 03 Months | 11.00% | |

| 02. | Mudaraba Term Deposit | 5.00% |

| 03. | Short Notice Deposit(SND) | 4.00% |

| 04. | Monthly Hajj Deposit | 10.25% |

| 05. | Monthly Installment Term Deposit(ITD) | 10.25% |

| 06. | Monthly Profit Base Term Deposit(PTD) | 11.25% |

| 07. | Monthly Saving Investment(SID) | 8.00% |

| 08. | One Time Hajj Deposit | 9.50% |

| 09. (a) (b) (c) 10. | Al-Arafa Saving Bond(3 Years) | 10.00% |

| Al-Arafa Saving Bond(5 Years) | 10.50% | |

| Al-Arafa Saving Bond(8 Years) | 11.00% | |

| Marriage Savings Investment Scheme | 8.25% | |

| 11. | Pension Scheme | 10.80% |

| 12. | Special Saving(Pension) Scheme | 10.25% |

| 13. | Cash WAQF | 9.50% |

| 14. | Lakhopati Deposit Scheme | 10.25% |

| 15. | Kotipati Deposit Scheme | 10.25% |

| 16. | Millinier Deposit Scheme | 10.25% |

| 17. | Double Benefit Deposit | 12.25% |

ACCOUNT CLOSSING

Whenever a customer approaches for closing an account, he may be requested to submit an application mentioning the reason of closure of a/c along with the unused leaves of cheque book and pass book (if any) issued to him.

On receipt of the application, it should invariably be brought to the notice of the manager who will personally see the matter.

On being satisfied of the reason of closure. Manager will pass an order to that end.

If an account is closed closing charge shall have to be realized.

The closing balance after recovery of incidental charges shall be paid through an unused cheque/ pay order.

Beside of the above procedure account may close by following matter:

Death of constituent.

Disbursement from deceased account.

Prohibitory orders from court.

Freeze of account.

Blocked account.

Bank rights to close an account.

3.1.3 Types of Remittance

Between banks and non banks customer

Between banks in the same country

Between banks in the different centers.

Between banks and central bank in the same country

Between central bank of different customers.

The main instruments used by the NBL of remittance of funds are

payment order (PO)

Demand Draft (DD)

Telegraphic Transfer (TT)

So the basic three types of local remittances are discussed below

Points | Pay Order | Demand Draft | TT |

| Explanation | Pay order gives the payee the right to claim payment from the issuing bank | Demand Draft is an order of issuing bank on another branch of the same bank to pay specified sum of money to payee on demand. | Issuing branch requests another branch to pay specified money to the specific payee on demand by Telegraph/ Telephone |

| Payment from | payment from issuing branch only | Payment from ordered branch | Payment from ordered branch |

| Generally used to Remit fund | Within the clearinghouse area of issuing branch. | Outside the clearinghouse area of issuing branch. Payee can also be the purchaser. | Anywhere in the country |

| Payment Process of the paying bank | payment is made through clearing | Confirm that the DD is not forged one. Confirm with sent advice Check the ‘Test Code’ Make payment | Confirm issuing branch Confirm Payee A/C Confirm amount Make payment Receive advice |

| Charge | Only Commission | Commission + telex charge | Commission +telephone |

Western Union Money Transfer

Joining the world largest money transfer service, AIBL has introduced Bangladesh to the fastest track of money remittance. Western Union is a Very familiar name in the world of money transfer for sending speedy money from one country to another country in a few minutes. AIBL has made an arrangement with Western Union Remittance Services, which has over 127 years experience for speedy remittance or money with more than 140 countries, Now AIBL is on line to establish trade and communication with the prime international banking companies of the world. As a result AIBL will be able to build a strong root in international banking horizon. Bank has been drawing arrangement with well conversant money transfer service agency “Western Union”. It has a full time arrangement for speedy transfer of money all over the world.

Cash

Receipt of cash

Cash is received by the cash/ assistant cash officer, over the counter during banking hour. Any transaction outside the counter as well as beyond banking hour shall not constitute valid banking transaction. While receiving cash, the cash officer examines the following points/procedures:

Pay in slip/ voucher is properly filled in i.e. with Title of A/c, account number if any date, particulars, if any and denominations of notes, amount in wards and futures. In cash of DD.PO.TT.TDR etc, particulars like name of payee, name of Drawee Branch if any, and date, have been given. All pay in slips/vouchers/application are signed by the depositor/preferably by the account holder in cash of deposit A/Cs.

Receipt of cash cheque/instruments

Cheque, voucher and instruments shall be received for payment of cash by an officer of the bank. While receiving the same, the receiving officer shall obtain the signature of presenter in his presence in the back of the cheque/ voucher / instruments. He shall encircle the signature of the presenter and shall attest the same under his signature to facilitate payment by the cashier after posting, passing of the same on obtaining similar signature in the back of the same. While receiving the cheque the concerned officer invariably look in to the instrument relates to the branch, not undated/ anti-dated/ postdated.

Cash payment

An amount of cash payment shall be made by the cashier against a cheque/ voucher / instrument duly passed for payment under fill signature of authorized official(s) with in his /their passing power schedule preferably in red ink obtaining respective signature of the presenter of the cheque/ voucher / instrument as attested earlier by the receiving official as on acknowledgment of receipt of amount mentioned in the cheque/ voucher / instrument. In case of the signature does not conform payment shall not be made.

Late payment of cash

Late payment of cash always discouraged as it involves risk. The instrument must be initialed by the manager authorizing late payment. The cheque must be posted in cash payment register in advance date.

Closing of the cash

As soon as the business hour is closed all cash paid instruments/vouchers being again be checked and verified. The entries are in accordance with the amount of the instruments. The Cashier- in charge/cash officer shall prepare the cash position in cash position book adding the day’s total receipt with the balance of previous day and thereafter subtracting the payment of the day. Above when it will be assumed that the cash is balanced. Any shortage in cash balance must be recovered from the concerned official on the same day under intimation of the head office. Similarly any excess found in cash balance shall also be credited to sundry creditors A/C under intimation to head office.

Evening Banking

As per existing rules Bangladesh Bank License is required to conduct evening banking. It may be borne in mind that evening banking means receiving of cash from the customer in the evening hour.

Custody of keys

The keys of cash safe and strong room is retained by the Custodian and joint custodian records of keys is maintain in key register and the keys being duly received by the retainer under their signature and authentication of Manager.

Clearing

Receiving cheques/ instruments

Bank received cheques/ instruments for clearing/collection. Cheqes received from customer which are drawn on other bank situated on the same locality (clearing house) and happen to be member of clearing house are treated as clearing cheque.

Clearing House

Inter branch cheques and instruments drawn on the branches which are situated in the same locality when received for collection is treated under this mechanism.

Process of inward clearing:

After receiving cheques from the local office of AIBL, those cheques are directly send to the computer section for checking the balance of those specific accounts from which money should be collected. If the required balance available there then amount is debited from that account and the cheque is honored. But incase if the require balance is not available the authorize officer of clearing department immediately informs to the head of the customer service or he tries to connect the account holder. If the account holder does not deposit the required balance immediately the cheque is dishonored. Finally the authorized officer gives all the entry of those cheques in inward clearing register.

The format of the register book is given below:

SL# | Bank Name | Branch Name | Cheque No. | Amount | Drawn on | Remarks |

After giving the entries, a credit advice is sending to the local office of Al-Arafah Islami Bank Limited .

Process of outward clearing:

For outward clearing cheques, the bearer of the cheques must have an account in V.I.P. Road branch of AIBL. After the submission of the cheques, authorized officer gives the entries in software, which is provided by Bangladesh bank. The name of the software is Nikash. After giving all the entries are printed and are enclosed with the cheques. Then all the cheques with the enclosed sheets are sent to the local office of AIBL for the collection of money. The local office sends it to clearing house.

Collection Cheqes Outward

Out-station collection cheques are to be accepted from the customers and local banks only.

Collection Cheqes Inward

Cheques/ instruments received for collection from upcountry branches/ other banks are known as Inward cheques for collection.

Transfer of cheques

Cheques and instruments drawn on the branch and also deposited in the same branch for credit of customer’s account are called transfer of cheque/ instruments.

CLEARING HOUSE:

In Bangladesh bank there is a very large room which contains fifty (50) is more tables for each bank that is called the clearing house. All the scheduled banks are the members of clearing house of Bangladesh bank.

The following instrument are bringing brought to the clearing house.

This are-

Cheque.

Demand Draft

Pay Order

Pay Slip.

Security Deposit Slip.

Treasury bill.

Dividend Warrant

Debenture.

CLEARING ACTIVITIES AT BRANCHES:

The clearing activities at branches are of two kinds:

1) Outward Clearing and

2) Inward Clearing.

When parties of a branch place Cheque and other instruments of other banks the collection of these Cheque and instrument through clearing process is known as inward clearing.

When Cheque of a branch come for collection through clearing process is known as inward clearing.

NATURE OF CLEARING HOUSE:

1ST Clearing house

Return Clearing House

3.2 Foreign Exchange

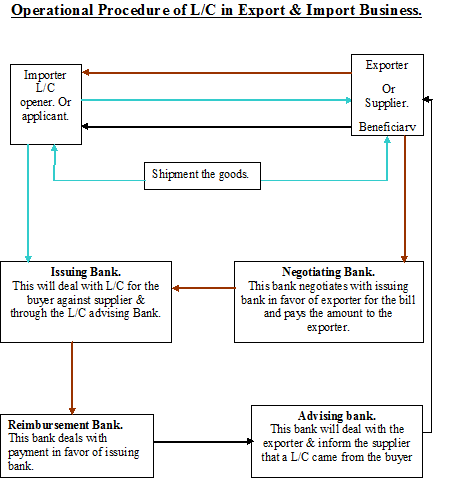

Foreign trade can be easily defined as a business activity. This transcends national boundaries. These may be between parties or Government ones. Trades among nations are a common occurrence and normally benefits both the exporter and importer. In many countries international trade accounts for more than 20% of their national incomes.

Foreign trade can usually be justified on the principles of comparative advantage. Accounting to this economic principle it is economical profitable for a company to specialize in the production of that commodity in which the producer country has the greater comparative advantage and to allow the other country to produce that commodity in which it has the lesser comparative advantage. It includes the spectrum of good services investment technology transfer etc.

This trade among various countries causes for close linkage between the parties dealing.

In trade the bank which provides such transactions is referred to as rendering international banking operations. International trade demands a flow of goods and payment are done through letter of credit L/C.

Function of foreign Exchange department:

Imports:

- Bills for collection.

- Advance bills.

- Opening of letter of credit (L/C).

- Import loan & guarantees.

Export:

- Pre-shipment advantages.

- Negotiating of foreign bills.

- Exports guaranties.

- Purchase of foreign bills

- Advance against bills for collection.

- Advising/ conforming setters (latter of credit).

- Advance for differed payments.

Remittances:

- Issue of DD, TT, MT, etc.

- Payment of DD, TT, MT, etc.

- Sales and enhancement of foreign currency notes.

- Issue and enhancement of traveler cheque.

The most commonly used document in foreign exchange:

- Documentary latter of credit.

- Bill of exchange

- Bill of lading

- Commercial Invoice.

- Certificate of origin of goods.

- Inspection certificate

- Packing list

- Insurance policy

- Pro-forma invoice

- Master receipt

- GSP certificate.

Foreign exchange Risk Management:

Foreign exchange risk is defined as the potential change in earnings arising due to change in market prices. As per Foreign Exchange risk Management Guideline, bank has physically establishment a separate Treasury Department at Head Office. Under the Treasury Department, Foreign exchange Font Office, Foreign exchange Back Office and Local Money Market have been physically demarcated. Duties and responsibilities of them have also been defined. All foreign exchange transactions are revalued at Market-to Market rate as determined by Bangladesh Bank at the month-end. All Nostro accounts are reconciled on monthly basis and outstanding entry beyond 30 days is reviewed by the Management for its settlement. Regulatory reports are submitted on time to Bangladesh Bank.

3.3 Investment

INVESTMENT MODES:

The special feature of the investment policy of the Bank is to invest on the basis of profit – loss sharing system in accordance with the tenants and principles of Islamic Shariah. Earning is not only motive and objective of the Back’s Investment policy rather emphasis is given in attaining social goal and objective in creating employment opportunities.

Bai- Murabaha:

Bai –Murabaha may be define as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the law of the land) to buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump sum or by installments. The profit marked –up may be fixed in lump sum or in percentage of the cost price of the goods.

Important Feature:

Bank must purchase the goods so that ownership of bank on the goods is established at least for a moment.

There must three parties in order to perform buying & selling under Murabaha (a) Bank (b) Seller of goods (c) Purchaser of goods. Goods must also be halal as per shariah.

A commodity in the true sense of the term must be involved in buying & selling.

There must be an agreement between the bank and the Clint cost of the goods sold and the amount of profit added therewith should be separately & clearly mentioned in the MURABAHA AGREEMENT.

Bai- Muajjal:

Meaning:

It is a mode of investment under which the Bank at the instance of the client products

Certain goods permissible under Shariah and the law of the country & sells those to

the client at a price payable at fixed future date in lump sum or in fixed installments

under this mode goods are delivered in advance and price is paid later agreed by the

Parties.

Important Feature:

1. Goods are to be purchased from a third party excluding sister concern(s) of the client.

2. Ownership of Bank on the goods must be established at least for a single moment before salling the same to the client.

3. Like Murabaha, Bank is not bound to declare cost of goods and profit mark up separately.

4. It is a credit sale by which ownership of the goods is transferred by the Bank to the client before receipt a sale price. That is payment is deferred considering the security aspects. (However, in our Bank, generally, goods are delivered to the investment client but sufficient collateral and T.R. are kept.)

Ijara Bil-Bie (Hire Purchase):

The hire purchase method of financing enables a bank to finance the purchase of movable and immovable assets. It is a joint ownership agreement subject to the provision of security/surety provided by the client. In addition to the repayment of the principal amount, the bank receives a share in the net rental value after allowing for necessary deduction on account of depreciation of asset. This payment is made after adjusting the bank’s outstanding share of the asset, which reduces with each installment payment made by the client. The cost of insurance of the asset is shared by the bank and the other party in proportion of their capital contribution to the asset. After the full payment has been made, the client becomes the owner of the asset. Until full payment has been made the client is only entitled to the use of the asset.

Since this mode of Financing involves inflow of cash over a considerable period of time, the discounting techniques can be applied to evaluate the acceptability of the project. Each and every expected installment payment should be converted to present value by applying the appropriate discount rate. The next step would be to sum up the present value of the streams of cash inflows and compare it with the purchase price. A proposal yielding a positive net present value would be accepted and otherwise rejected. The same concept applies while applying the IRR method.

whereby the minimum expected rate of return is calculated which would equate the present value of cash inflows with the initial cash outflow. An investment proposal failing to yield this minimum required rate of return should be rejected.

Other special Investment Scheme:

- Masque Based Investment Scheme

- Vachels Investment Scheme

- Consumer Investment Scheme

- Small investment Scheme

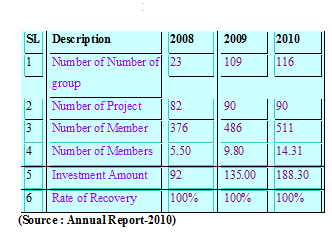

Grameen & Small investment scheme:

An investment product “Grameen & Small investment” is in operation. The objective of this project is to introduce Shariah based banking system in rural and village area, creating employment through financing to low income group, build up savings attitude, improvement of living standard of rural low income mass people, creating opportunity to carry out Islamic lifestyle by way of alleviating poverty and at the same time to make other financially established by investing in small investment projects. Initially this scheme was introduced in three branches of AIDL i.e Gallai, Comilla Ruposhpur Srimongal and Companion Comilla. There is a plan to expand this project gradually in other rural branches.

Within the scope of Grameen and Small investment schame, Investment has been made in the following sectors:

1) Fisheries.

2) Poultry Rearing.

3) Cattle Rearing.

4) Goat Rearing.

5) Beef fattening.

6) Poultry Firm

7) Procesing of muree

8) Processing of Sweets

9) Sationary business

10) Vegetables business

11) Tailorin Business

12) Cultivation of Betle Lealf

13) Woek of baboo and cane

14) Cultivation of pineapple

15) Cultivation of lemon

16) Processing of Crockeries

17) Purchasing of Rickshaw

3.3.6 Deposit Mobilization:

Deposits are mobilized through the following deposit account:-

- Al- wadiah Current Deposit (AWCD) Account.

- Mudaraba Savings Deposit (MSD) Account.

- Mudaraba Short Notice Deposit (MSND) Account.

- Mudaraba Term Deposit (MTD) Account

Modes of Investment

Funds are invested through the following mechanism:

- Musharaka

- Musharaka

- Murabaha

- Bai-Muajjal

- Bai- Salam

- Ijara a) Ijara-Bil-Bai/Hire Purchase

b) Hire-Purchase Shirkatul Mulk.

7. Instalment sale

8. Direct Finance

9. P.T.C

10. Investment Auctioning

11. Time Multiple Counter Loan

12. Quard etc.

Distinguishing Features of Islamic Bank

An Islamic bank has several distinctive features as compared to its conventional counterpart. Some essential difference as blow.

- Abolition of interest (Riba)

- Adherence to public interest

- Multi purpose bank

- More careful evaluation of investment demand

- Work as catalyst of development

Procedure of taking investment facilities

v Open a current account in any nearest branch.

v Minimum transact three months so that it indicates the client’s cash inflow.

v Past experience is needed for that investment facility.

v Must have business organization/office/shop.

v Applying nearest branch where the business /office/ shop is situated

v Last six month fluctuate Statement of those goods which are bought by bank must be submitted.

v Application for investment under different schemes shall be made in prescribed forms developed for each of the Schemes.

v Obtain & affix attested photograph(s) of the proprietor/partners/directors on the top right hand corner of the application form.

v Scrutinized the application of the client to see that.

v All columns are properly filled in.

v Particulars and information given therein are complete and correct.

v All required documents/papers as listed in the footnote of the application form are submitted.

v Invoice / Quotation of the goods intend to purchase preferably competitive 3 (three) sets, rate specification etc. to be furnished thereon.

v Trade license, partnership agreement, certified copy memorandum and articles of association Board resolution.

v Special permission /license from the complete authority for conduction such type of business as per law of land.

v Three years financials of the firm/ co. (preferably audited).

v Personal net worth statement.

v CIB enquiry form.

v Head Office current investment policy guidelines shall be checked.

v Confidential opinion may be obtained from the local influential business magnet and also from the local bank including previous bank of the customer.

v Declaration of the customer about his liability (both contingent and real) to be obtained.

v Valuation of proposal collateral securities to be made by the enlisted surveyor along with Bank Officials.

v Lawyer’s opinion may be obtained for determining prima-facie title of the proposed mortgage over the property proposed for mortgage.

v Balance sheet of the company to be analyzed to assess / determine the financial strength of the customer, business prospects etc. Cash flow of the company also to be analyzed to assess the quantity and potentiality of the proposal specially to assess the net cash generation volume of the customer / company.

v Different financial ratios also may be work out fro the balance sheet of the company to assess the customer’s liquidity position, debt service convey earring forecasting / ratio etc.

v Proposal to be sent to Head Office for sanction.

v Purchase the goods as per purchase schedule IBADV-12 duly signed by the client and 39.Murabaha Agreement and store the goods under effecting control of the Bank.

v Enter the A/C in investment ledger in the computer including detail information of the customer.

v Complete all ledger head particulars and get that authenticated by the officer / in charge.

v It should be carefully noted that purchase of goods shall be made only after completion of documentation as per sanction stipulation of Head Office.

v After obtaining approval from Head Office the sanction message shall be intimated to the customer vide INV-135 mentioning all the terms and

condition induplicate to the and endorse one copy to Head Office retaining one copy in the client file.

v Allot number to each proposal sanctioned. For this purpose use investment A/C opening register.

3.4 Risk management:

The risk of Al-Arafah Islami Bank limited is defined as the possibility of losses, financial or otherwise. The risk management of the Bank covers 6 (six) Core risk Areas of banking I, e Credit risk management, foreign exchange risk management, Assets Liability Management, prevention of money laundering and establishment of Internal Control and Compliance and information & Communication technology. The prime objective of the risk management is that the Bank takes well calculative business risk while safeguarding the Bank‘s capital, its financial resources and profitability from various risks. In this context, the Bank took steps to implement the guidelines of Bangladesh Bank as under.

Credit Risk management:

Credit risk is one of the major risks faced by the Bank. This can be described as potential loss arising from the failure of a century party to perform as per contractual agreement with the Bank. The failure may result from unwillingness of the counter party of decline in his/her financial condition. Therefore, Bank’s credit risk management activities have been designed to address all these issues. The bank has an Investment (Credit) Risk management Committee at Head Office. The Committee reviews the Investment risk issues on monthly basis. The bank has segregated the Investment Approval, Investment Administration, Investment Recovery and Legal Authority. The Bank has segregated duties of the officers/executives involved in credit related activities.

A separate Business Development (Marketing) Department has been established at Head Office, which is entrusted with the duties of maintaining effective relationship whit the customer, marketing of credit products, exploring new business opportunities etc. In the branches of the bank separate officials are engaged as Relationship Manager, Documentation Officer, Verification Officer, disbursement Officer and

Recovery Officer. Their jobs have been allocated and responsibilities have been defined.

Investment (Credit) Risk Grading Manual:

The bank has implemented the Investment (Credit) Risk Grading Manual (IRGM) since April, 2006 which is made mandatory by Bangladesh Bank vide BRPD Circular No. 18 of December 11, 2005. Investment Officials of the bank have been trained on IRGM. Investment Risk Grading is incorporated in the Investment presentation from for all the cases.

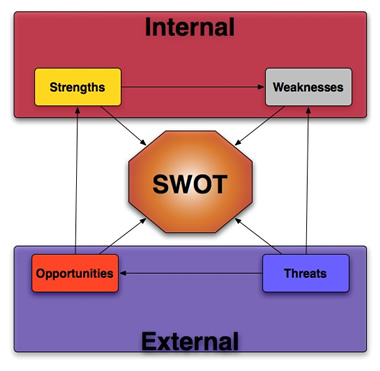

SWOT Analysis:

Not surprisingly, in the competitive arena of marketing era SWOT analysis is a must based on Product, Price, Place and Promotion of a financial institute like private bank. From the SWOT analysis we can figure out ongoing scenario of the bank. So to have a better view of the present banking practices of Al-Arafah Islami Bank Ltd.

In SWOT analysis two factors act as prime movers:

- Internal factors which are prevailing inside the concern which include Strength and weakness.

- On the other hand another factor is external factors which act as opportunity and threat.

Strength:

- Usage of faster PC Bank software.

- Membership with SWIFT.

- Good banker-customer relationship.

- Online banking system.

Weakness:

- Reluctance to ad campaign.

- Existing manual vouchers.

- Lack of consumer credit scheme.

- Manpower is not sufficient.

- Huge business area.

- Introducing consumer credit scheme.

- Growth of sales volume.

- Introducing branch banking through online.

Opportunity:

Threats:

- Competitors have more attractive deposit schemes.

- Bangladesh Bank has no well established Islami Banking Rules.

- Different classic services of other banks.

FINDINGS

Last but not least they have a Saria Council of credit management which follows the rules of Sunnah in implicating the credit disbursement according to islami sharia that save them from the affect of interest.

At the end of the GENERAL BANKING of AIBL ‘’ the following information are found:

- AIBL follows the strong overview guidelines to through out the general banking assuming greater priority in view of the changes in the scenario of the banking practices due to liberalization, deregulatory measures and globalization of business and financial transactions.

- In compliance with the decision of Bangladesh Bank circular, Al-Arafah Islami Bank Limited has prepared risk profile in line with the guidelines and framework provided by Bangladesh Bank to customize in their existing framework to better manage the general banking to suit the new changes.

- AIBL has a great number of reliable clients to invest their fund and will be back in time.

- AIBL follows the most liberal process of disbursement process, which made the clients, inspires to take advance and help them to pay in time.

- They have interest free banking. They only receive profit of the goods.

- It has a lowest profit rate comparatively to other commercial bank, which is affordable for the clients.

- The have a significant role in social and financial development by investing like, masque, madrasa, grameen and small enterprise.

Recommendation:

The respondent Bank employees face the following Problems in rendering customer services:

- Some customers do not understand form.

- Refusing to provide introducer or photo for opening accounts.

- Cheques, deposit slips are not to be written properly.

- Some customers are not interested or not able to write D.D., T.T., pay order voucher.

- Misbehavior of some customer.

- Lack of education and of adequate knowledge of general banking peoples in our country are not interested in involving Bank activities.

- Failure of the electricity created problems to be done properly.

- The telephone network of our country will have not been expended developed.

- .Not adequate knowledge for the development of a decent Banking culture in the country.

- The Bank personnel should help the customers to understand the form.

- Bank employees should be more diplomatic for acquiring information of the customers.

- A bank employee requires more patients for the misbehavior of customer.

- To provide proper education to the customer concerning general banking services.

- Government should take necessary measures for development of electricity.

- Government and Private sector should give adequate knowledge for the development of a decent banking culture in the country.

- Management information System should immediately be developed.

- Making correspondence with the customers.

- Making good behavior with the customers.

- Call centre can be established for receiving complains and suggestions.

- Telephone network should be developed.

- All the tasks should be equally distributed to all the employees.

- The charge of PO, DD,TT etc can be exempted in the case of AIBL customers.

- Fund transfer, payment of utility bill, balance inquiry etc can be done through internet.

- AIBL can join to the western union money transfer. As a result, Money transfer from anywhere in the World to Bangladesh in minutes and money transfer between Bangladesh and any other part of the globe is safer and faster than ever before.

- AIBL can introduce debit card. So, people will feel more comfortable to expend money.

- When a customer opens a new account then a cheque book can be delivered at that time in name of welcome account with containing 5 pages.

- It is observed that bank executives have little idea about their customer behavior; attempts should be taken to bring customers orientation in banking management.

- Training programs should be undertaken to develop the interpersonal dealings of Bank employees. It is unanimously expressed that customers expect better dealings from Bank executives.

- It is noted that “delay in service” is one of the problems faced by Bank customers. Attempts should be made to strengthen the banking procedure. Front line cashiers may be empowered to entertain cheques up to a certain limit on an experimental basis which will save time and cost on the one hand and improved the banking service on the other hand.

- It is intended to identify the types of services suggested by Bank customers to be rendered by banks. Services that are desired by depositors are given below:

Payment of insurance premium.

Payment of various bills

Prompt Banking service.

Giving security grantee, etc.

Extension of Banking time/ Evening Banking.

Conclusion

General Banking development performs the core functions of the bank, operated the day-to-day transactions, all other department is linked with these departments. They take the deposit from the customers and meet their demand for cash honoring their cheques. The department is very rush and the employees here are too upgrade to their duty.

After comparing the interviews, it has been seen that the customers are more or less satisfied with the overall services of customer service and the behavior of employees. They also have some complains which make them unsatisfied in some cases. From the survey I have noticed that the customers prefer prompt service, want to avoid more formalities for issuing D.D, T.T, P.O, opening account etc. So AIBL should try heart & soul to please those customers in a smart & trusting way.

I have also noticed that AIBL has a better position for providing General Banking Services comparing with other private sector Banks. There is a word in business sector.

“A company must diminish from the market when it ceases to serve its customer.” So it is necessary to provide quality of services to make customer satisfied. Thus, an organization can achieve its goal successfully.