Foreign exchange market and Bangladesh:

The foreign exchange market is a market where conversions take place. Inter bank foreign currency /Exchange Market operate through electronic media using dealing room of Bank/ financial institution for buying and selling of foreign currency among banks and other financial institutions at floating rate based on market demand and supply. Only authorized dealers deal directly with each other in foreign exchange markets that are licensed to operate in the foreign market by the Bangladesh Bank. Authorized dealers who are generally commercial bank on behalf of their customer handle all the foreign transaction.

There are three types of foreign exchange market existed in our country.

Where exchange of our currency with another takes place on the spot.

Forward market:Where actual delivery of the currency will happen at a future dates as per agreement of present date.

Option market:Where in a contract is made specifying the night to buy or sell a standard amount of foreign currency within a specific date at a certain price.

Foreign exchange products in Bangladesh:

Bai: Buy & Sale

- Bai is defined to mean simultaneously ‘purchase & sale’ i.e. the exchange of a thing of value by another thing of value.

- The general rules for sale.

- The subjects of sale must be sale at the existing time of sale.

- The subject of sale must be in the ownership of the seller at the time of sale.

- The subject of sale must be in the physical or constructive possession of the seller exceptions only in case of Bai Salam and Istisna.

- Product: Murabaha Import.

Shirkat: Partnership:

- Shirkat means partnership for undertaking any lawful business

- There are two broad categories of partnership include: Mudaraba (capital trusts / silent or indirect partnership) & Musharaka (Equity Participation).

- product: Musharaka Import

Ijarah: Leasing

- It is an arrangement to lease equipments, buildings or other facilities to a client against an agreed rental.

- There are two broad categories of Ijarah: (1) Ijarah Muntahia Bil Tamelk (Hire purchase) (2) Ijarah WA Iqtina (Leasing).

- Product: Hire Purchase Under Shirkatul Melk (HPSM)

Different foreign exchange rate in Bangladesh:

i) APPROPRIATE EXCHANGE RATE:

~ The central bank may be in a better position to gather all the relevant information than the other participants in the market. Hence it can appropriately predict the future course of policies and their implications on the exchange rate. So, it can plan its intervention in the market according to the situation and influence the exchange rate. In absence of intervention, the market may indulge in speculation due to lack of accurate information.

ii) CONTROL OVER DISTORTIONS IN ECONOMIC ACTURTIES:

~ Exchange rate which deviate from the real exchange rate (in relation to the purchasing power parity) may lead to distortion in resource allocation between external and domestic sectors.

Undervaluation leads to inflationary pressure whereas overvaluation leads to higher rates of unemployment.

Either undervaluation or overvaluation brings in uncertainty and affects investment decisions. This can be controlled by intervention of the monetary authorities by making necessary adjustments in the exchange rates.

iii) SMOOTHENS ECONOMIC ADJUSTMENT PROCESS:

A persistent surplus or deficit in the balance of payments leads to changes in the exchange rate to correct the disequilibrium.

These changes may result in disturbances in the domestic economic activities.

Intervention can reduce such disturbances and their effects.

iv) OTHERS ARGUMENTS:

Managed flexibility facilitates economic growth due to proper flow of foreign trade.

Higher economic growth increases employment and improves the standard of living of the people.

Managed flexibility also facilitates higher investment due to growth potential which further boosts the economic growth of a nation.

RBI AND EXCHANGE RATE:

In India, the exchange rate policy at present is guided by principles of monitoring and management based on the underlying demand and supply conditions.

The following are the objectives of RBI’s intervention:

Determining the exchange rate movements in an orderly manner.

Reducing excess volatility.

Preventing the occurrence of destabilizing speculation.

In order to carry out these objectives, the RBI tries to maintain adequate foreign exchange reserves so that it can conduct the intervention operation.

CHANGE IN THE EXCHANGE RATE:

RUPEE-DOLLAR EXCHANGE RATE

Rs 45.99 per US dollar

Rupee depreciated by 12.5%

RS 50.062 per US dollar

Rs 46.629 per US dollar

Rupee appreciated by 9.2%

History of exchange rate system in Bangladesh:

Being a member of the IMF, India followed the exchange rate system as per IMF policy from 1947-1971.

Under this policy, the exchange rate was fixed at 4.15 grains of fine gold. It maintained par value at +/- 1% using pound sterling as intervention currency.

In 1971, the Bretton Woods system collapsed and Indian rupee was pegged to US$ at Rs 7.50 and sterling at Rs 18.9677 with a 2.25% margin on either side.

From 1975 to 1992 Indian rupee was pegged to basket of currencies of India’s major trading partners.

In 1992, the RBI introduced the Liberalised Exchange Rate Management System (LERMS) with 40-60 dual rates for converting export proceeds.

The Budget 1993-94 made Indian Rupee fully convertible on trade account and LERMS was withdrawn. Subsequently, in April 1994, Rupee was made fully convertible on current account as well. Thus, all transactions of goods and services were converted at market rate without any restrictions.

EXCHANGE MARKET INTERVENTION:

Exchange Market Intervention’ is defined as the sale or purchase of monetary authorities with the aim of changing the exchange rate of their own currency vis-a- vis on or more currencies.

If there is too much demand for foreign currency, that currency will appreciate too much and depreciate the domestic currency. At this point, the central bank intervenes by releasing the foreign currency (from its reserves) in the market to stabilize the exchange rate.

Similarly, if there is too less demand for foreign currency, that currency will depreciate and the domestic currency appreciates too much. At this point, the central bank intervenes by purchasing foreign currency from the market to stabilize exchange rate.

Inter bank transaction in foreign exchange:

Usually three terms used in the inter bank transaction in FX.

Arbitrage:

Spot purchase of FC where the price is law and to sell where the price is high i.e. Buy low & sell high.Currency Arbitrage due to price difference in two financial centers. SWAP:

Purchasing FC on the spot for sell forward or selling spot for purchasing forward .Due to difference in interest rate of the conserved currencies.

Hedging:

To avoid exchange risk, agreement is made to day to buy or sell FC to be delivered at some future date at a rate agreed upon to day.

Movement of monthly averages of USD/BDT exchange rate:

NET SALE (-)

PURCHASE (+)

(US$ MILLION)

Pound Sterling

Average 2008-09

April 2009

August 2009

(+) 181

To invest and accumulate silver coins, there is no cause for concern. The method is simple to understand. How do you assess its value and depreciated, and when is the best time on the market, however, requires the simple facts. In this highly competitive world of business is elementary, to a buyer and a seller that are sensitive to them, to prevent corrupt companies or individuals.

Thus, RBI’s intervention meagerly depends on the size of foreign exchange reserves. The adoption of full convertibility requires a large amount of foreign exchange reserves for intervention operation.

Under globalizations, exchange rate is likely to become highly liberal, thus increasing the responsibility of the central banks.

Category wise position of inter bank FX transaction:

Foreign exchange business consists of three categorizes of business that are important export & remittance .So in foreign exchange department of IBBL there are three separate section to handle foreign exchange business .This part focuses on overall operational activity procedures , accounting system of these three sections in three separate section.

- Section – A describes import business procedure .How an important L/C opened, what the procedure followed & document maintained by bank , how bank make payment settlement, how shipping documents are handed over – all necessary activities including accounting procedure are presented in the section.

- Section – B focus on export business procedure covering overall procedures of especially for RMG products & export financing offered by IBBL ,their accounting procedure of all transactions related export business.

- Section – C describes remittance business, FC account of IBBL. In this section type of remittance fund transferring procedure & channel, payment system for inward remittance & also issuing procedure for outward remittance are clearly defying.

Foreign exchange department:

BBL does many functions in foreign exchange department. It does export, import and foreign remittance related tasks. To boost national economy is the main purpose of this department. To implement this Purpose bank does lots of work, the works and functions are given below:

Foreign exchange department:

Import Formalities:

Procedure opening Letter of Credit (L/C):

For opening L/C the following documents are to be obtained by the bank from the clients. Such as:

- Valid IRC (Import Registration Certificate)

- TIN certificate (Tax Payer’s Identification Certificate)

- Membership Certificate from chamber of commerce or any recognized Business Association

- Trade License from the respective municipal corporation or competent authority

- Importer’s Photograph (Preferably)

- VAT registration Certificate (Value Added Tax)

Upon receipt of the above documents from the client, the Bank will supply the following forms/ papers to them for their due filling, signing and resubmission to the bank.

- L/C application i.e. Agreement on bank’s printed form (stamped) (F27).

- Application for facility against Import.

- L/C authorization form (LCAF) (F-112)

- Agreement for Murabaha Import.

- Other charge documents like D.P note, D.P note delivery letter, balance confirmation, Letter of Disbursement, Letter Installment. Trust Receipt, Purchase schedule etc.

- IMP Form.

L/C contained mainly the following Information:

- Issuing bank’s Name & address in full.

- L/C number with Test Number (Incase Telex L/C)

- Date & place of Issue.

- Advising Bank’s name and address

- Beneficiary name & address

- L/C amount in words and in figure.

- Tenor and availability of credit

- Last date of shipment

- Last date for negotiation / Expiry date.

- Short description of goods with country of origin

- port of shipment & port of delivery

- Other terms & conditions

- Instruction for negotiating bank/ paying bank

- Reference of UCPDC

- Signature of the authorized officer of issuing bank with the signature number.

- Mudaraba

- LTR (Letter of Trust Receipt)

- Bai-Salam

- Ijtishna

Papers / Documents Supply by IBBL incase of Import:

IBBL will supply the following papers / documents before import the goods. Such as-

- LCAF

- IMP form

- TM Form

- Mudaraba agreement form

- Charges Documents

- Guarantee form

The above papers must be completed duly filled and signed by the party and to be verified the signature.

Checking of Document Incase of Import :

Before lodgment, documents must be checked with the file. IBBL checking the following documents incase of import.

- Invoice

- bill of Lading

- Bank forwarding date

- Packing list

- Inspection certificate

- Radiation free certificate (incase food items

- Draft

- Insurance cover note

- Bonded warehouse License etc.

EXPORT FINANCE:

Export means flow of goods and services produced within Bangladesh but purchased by economic agent (individuals, firms & government) of other countries. In other words in case of exports products sold outside the country. So getting payment against such sale usually require different time span depending on the terms of sale contract or relative payment terms of export L/C.

In view of above exporter require immediate fund and other financial facilities to execute their export order. It is the bank who extends such facilities as needed by the exporter. And facilitating export by financing exporter at different stages is now important part of bank’s activities.

Exporter requires financial assistance at two stages namely

1. Pre-shipment stage &

2. Post–shipment stage

So, export finance is classified into two categories

1. Pre-Shipment finance

2. Post-Shipment finance

Different Islamic modes are there for financing export at two different stages as mentioned above.

Pre-Shipment Finance under Islamic Modes:

Pre-shipment finance as the name suggest, given to finance the activities of an exporter prior to the actual shipment of goods for export. The purpose of such finance is to meet Working Capital needs starting from the point of purchasing raw materials to transportation of goods for export to foreign country. Pre-shipment finance is given for the following purposes.

- Finance for local procurement of goods.

- Procuring and processing of goods

- Packing & transportation of goods

- Payment of Insurance premium

- Payment of utility bill

- Payment of wages and salary

- Freight charge.

Pre-shipment finance can be made under Islamic mode as follows.

BACK-TO-BACK L/C:

To purchase/procure goods for export processing bank may provide facility in the way of Back-to-Back L/C opened under Bai-Muajjal mode. If the back-to-back L/Cs are opened deferred payment basis no finance by the bank is required except if they fail to make shipment in time.

IMPORTS UNDER BAI-MUAJJAL:

Meaning of Bai-Muajjal:

It is a Contract between a Buyer and a Seller under which the seller sells certain specific goods (permissible under Shariah and law of the land) to the buyer at an agreed fixed price payable at a certain fixed future date in lump sum or within a fixed period by installment.

BAI-MURABAHA TR:

For purchase of goods for export shipment bank can finance under Bai-Murabaha TR mode. That means the exportable goods or raw materials are purchased under Bai-Murabaha mode and delivered to the exporter client for export or export processing against Trust Receipt duly signed by the client.

BAI-SALAM:

- The mechanism of Bai-Salam is- goods purchase in advance against payment now but delivery of goods will be made after a specified time.

- For meeting the expenses other than procurement of goods bank make finance under Bai-Salam mode to the exporter. Through Bai-Salam bank purchase a portion of exportable goods in advance and make payment. After production exporter makes shipment of the goods, this is already sold to the bank.

Calculation of Purchase Price and Realization of Bank’s finance

Purchase price can be calculated by deducting the expected profit from the export price of that portion of goods which are purchased by the bank along with his portion. After getting export payment bank realize the sale proceeds of their portion of goods at the original sale price of export.

MUSHARAKA:

Pre-shipment can be made through Musharaka mode if pre-arrangement is made.

POST SHIPMENT FINANCE:

Post shipment finance is made by the bank after shipment of the good by the exporter. Exporter made/arranged all document as per the requirement of the L/C terms or as per contract terms, then submit to their bank (IBBL in case of our exporter client). Upon submission of the documents bank provide finance under the following modes:

BAI-AS-SARF (FDB):

Bank purchase the foreign currency value of the documents under Bai-As-Sarf: Foreign Documentary Bill (FDB).

Bai-As-Sarf is a trading mechanism where the bank buys foreign currency from the client at an agreed rate. In case of Bai-As-Sarf: FDB bank purchase the value of the export documents expressed in Foreign Currency and paid equivalent taka in favor of the client. The client will get net amount after adjustment of their respective liabilities, if any.

After realization of documents value from the issuing bank/importers bank abroad the FDB liability will be adjusted and bank will earn exchange income from it.

The Bai-As-Sarf (FDB) is introduced in IBBL vide Instruction Circular No. IBW/32/2007/3608, Dated 23.05.07

Musharaka Documentary Bills (MDB) Inland:

In order to avoid the risk associated with the Foreign Currency Positions against purchase of Inland Export Bills and at the same time to meet the finance need of the valued clients, Islami Bank Bangladesh Ltd. introduced Musharaka mode of finance in place of Inland Bills Purchased (IBP) as Post shipment finance. The new investment mode will be titled “Musharaka Documentary Bills (MDB) inland”.

Under this “Musharaka Documentary Bills (MDB) Inland” investment mode, after shipment of the goods, the client will submit their proposal for Musharaka Finance in the prescribed format declaring his/their equity portion and profit of the deal and the ratio at which profit to be shared with the Bank accompanying the required documents as per LC/Contract. Branch will complete appraisal of the proposal (as per prescribed format) to see the profitability of the proposal. If the proposal is found profitable & satisfactory (keeping in view the anticipated minimum profit/R.R. of the bank) Branch will first enter into a Musharaka Agreement with the client and then will send the documents to the L/C Issuing Bank for Acceptance. Upon receipt of the Acceptance, Branch will issue Sanction Advice in favor of the client & after completing proper documentation, Branch may/will disburse the Musharaka investment taking into consideration the equity of the client and anticipated profit of the deal.

Mentionable that, if the client availed any pre shipment finance i.e Bai-Salam investment against the related export LC/Contract or any other investment in the form of MPI, Bai-Murabaha or HPSM under Project/Working Capital investment, Branch will adjust the said liability from the disbursed amount of Musharaka finance proportionately.

Disbursement Procedure:

It is observed from the past trends that proceeds of most of the local export bills are not realized in time, sometimes, it requires at least 25 to 30 days more. Keeping that in view, in order to optimize Banks return, period of realization may be treated 30 (thirty days) more than the actual nuisance period. Thus for an export bill of 90 days Usance Period, profit will be determined treating the tenor at 120 days. In case of early realization, rebate will be allowed as per Banks norms.

Musharaka Documentary Bills (MDB) Inland is introduced in IBBL vide Instruction Circular No. IBW/67/07/9370, Dated 20/09/07.

Export Formalities:

Checking & Advising of export L/C:

On receipt of export L/C it is to be recorded in the banks inward register and than the signature on the L/C is to be verified by an authorized officer of the bank and finally it is to be forwarded to the beneficiary under forwarding schedule.

Processing & Opening of BB L/C:

An exporter desired to have an import L/C limit under Back to Back arrangement. In that case the following papers & documents are required:

- Full particulars of bank account

- Balance sheet

- Statement of assets & liabilities

- Trade License

- Valid bonded warehouse License

- Membership certificate

- Income tax declaration

- Memorandum of articles

- Partnership deed

- Resolution

- Photographs (all Directors)

On receipt of above documents and papers the BB L/C opening section will prepare a credit report. Branch must obtain sanction from head office for opening of BB L/C. Exporters prepare the documents and submit the same to the bank for negotiation.

Preparation of export documents:

The following documents must be prepared incase of export of goods. The documents are in below:

- Bill of exchange or Draft

- Commercial Invoice

- Bill of Landing

- Inspection certificate

- Packing List

- Export License

- Shipment advice

- Certificate of origin

- Weight certificate

- Photo sanitary certificate

- Certificate of analysis

- Quality certificate

- EXP form

- Courier receipt.

Export Documents Checking :

General Verification:

- L/c transferable or not

- Exporter us to submit documents before expiry date of the credit

- Shortage of documents etc.

Particular Examination:

- Each and every document should be verified with the L/C.

Cross Examination:

- Verified one document to another.

Amendments:

- On receipt of amendment, must be authenticated the test or verify the signature. if the rest number is incorrect or signature differs, cable confirmation must be obtained from the L/C opening bank

- Make entry of the amendment particular in the L/C advising register under amendment column corresponding to the other particulars of the relative L/C

- Make photocopy of the amendment. Use the forwarding letter, enclose the original amendment and acknowledgement with forwarding letter and retain it with the office copy for record.

- Dispatch under register mail or by special messenger.

Import Formalities:

Procedure opening Letter of Credit (L/C):

For opening L/C the following documents are to be obtained by the bank from the clients. Such as:

- Valid IRC (Import Registration Certificate)

- TIN certificate (Tax Payer’s Identification Certificate)

- Membership Certificate from chamber of commerce or any recognized Business Association

- Trade License from the respective municipal corporation or competent authority

- Importer’s Photograph (Preferably)

- VAT registration Certificate (Value Added Tax)

Upon receipt of the above documents from the client, the Bank will supply the following forms/ papers to them for their due filling, signing and resubmission to the bank.

- L/C application i.e. Agreement on bank’s printed form (stamped) (F27).

- Application for facility against Import.

- L/C authorization form (LCAF) (F-112)

- Agreement for Murabaha Import.

- Other charge documents like D.P note, D.P note delivery letter, balance confirmation, Letter of Disbursement, Letter Installment. Trust Receipt, Purchase schedule etc.

- IMP Form.

L/C contained mainly the following Information:

- Issuing bank’s Name & address in full.

- L/C number with Test Number (Incase Telex L/C)

- Date & place of Issue.

- Advising Bank’s name and address

- Beneficiary name & address

- L/C amount in words and in figure.

- Tenor and availability of credit

- Last date of shipment

- Last date for negotiation / Expiry date.

- Short description of goods with country of origin

- port of shipment & port of delivery

- Other terms & conditions

- Instruction for negotiating bank/ paying bank

- Reference of UCPDC

- Signature of the authorized officer of issuing bank with the signature number.

- Mudaraba

- LTR (Letter of Trust Receipt)

- Bai-Salam

- Ijtishna

Papers / Documents Supply by IBBL incase of Import:

IBBL will supply the following papers / documents before import the goods. Such as-

- LCAF

- IMP form

- TM Form

- Mudaraba agreement form

- Charges Documents

- Guarantee form

The above papers must be completed duly filled and signed by the party and to be verified the signature.

Checking of Document Incase of Import :

Before lodgment, documents must be checked with the file. IBBL checking the following documents incase of import.

- Invoice

- bill of Lading

- Bank forwarding date

- Packing list

- Inspection certificate

- Radiation free certificate (incase food items

- Draft

- Insurance cover note

- Bonded warehouse License etc.

EXPORT FINANCE:

Export means flow of goods and services produced within Bangladesh but purchased by economic agent (individuals, firms & government) of other countries. In other words in case of exports products sold outside the country. So getting payment against such sale usually require different time span depending on the terms of sale contract or relative payment terms of export L/C.

In view of above exporter require immediate fund and other financial facilities to execute their export order. It is the bank who extends such facilities as needed by the exporter. And facilitating export by financing exporter at different stages is now important part of bank’s activities.

Exporter requires financial assistance at two stages namely

1. Pre-shipment stage &

2. Post–shipment stage

So, export finance is classified into two categories

1. Pre-Shipment finance

2. Post-Shipment finance

Different Islamic modes are there for financing export at two different stages as mentioned above.

Pre-Shipment Finance under Islamic Modes:

Pre-shipment finance as the name suggest, given to finance the activities of an exporter prior to the actual shipment of goods for export. The purpose of such finance is to meet Working Capital needs starting from the point of purchasing raw materials to transportation of goods for export to foreign country. Pre-shipment finance is given for the following purposes.

- Finance for local procurement of goods.

- Procuring and processing of goods

- Packing & transportation of goods

- Payment of Insurance premium

- Payment of utility bill

- Payment of wages and salary

- Freight charge.

Pre-shipment finance can be made under Islamic mode as follows.

BACK-TO-BACK L/C:

To purchase/procure goods for export processing bank may provide facility in the way of Back-to-Back L/C opened under Bai-Muajjal mode. If the back-to-back L/Cs are opened deferred payment basis no finance by the bank is required except if they fail to make shipment in time.

IMPORTS UNDER BAI-MUAJJAL:

Meaning of Bai-Muajjal:

It is a Contract between a Buyer and a Seller under which the seller sells certain specific goods (permissible under Shariah and law of the land) to the buyer at an agreed fixed price payable at a certain fixed future date in lump sum or within a fixed period by installment.

BAI-MURABAHA TR:

For purchase of goods for export shipment bank can finance under Bai-Murabaha TR mode. That means the exportable goods or raw materials are purchased under Bai-Murabaha mode and delivered to the exporter client for export or export processing against Trust Receipt duly signed by the client.

BAI-SALAM:

- The mechanism of Bai-Salam is- goods purchase in advance against payment now but delivery of goods will be made after a specified time.

- For meeting the expenses other than procurement of goods bank make finance under Bai-Salam mode to the exporter. Through Bai-Salam bank purchase a portion of exportable goods in advance and make payment. After production exporter makes shipment of the goods, this is already sold to the bank.

Calculation of Purchase Price and Realization of Bank’s finance

Purchase price can be calculated by deducting the expected profit from the export price of that portion of goods which are purchased by the bank along with his portion. After getting export payment bank realize the sale proceeds of their portion of goods at the original sale price of export.

MUSHARAKA:

Pre-shipment can be made through Musharaka mode if pre-arrangement is made.

POST SHIPMENT FINANCE:

Post shipment finance is made by the bank after shipment of the good by the exporter. Exporter made/arranged all document as per the requirement of the L/C terms or as per contract terms, then submit to their bank (IBBL in case of our exporter client). Upon submission of the documents bank provide finance under the following modes:

BAI-AS-SARF (FDB):

Bank purchase the foreign currency value of the documents under Bai-As-Sarf: Foreign Documentary Bill (FDB).

Bai-As-Sarf is a trading mechanism where the bank buys foreign currency from the client at an agreed rate. In case of Bai-As-Sarf: FDB bank purchase the value of the export documents expressed in Foreign Currency and paid equivalent taka in favor of the client. The client will get net amount after adjustment of their respective liabilities, if any.

After realization of documents value from the issuing bank/importers bank abroad the FDB liability will be adjusted and bank will earn exchange income from it.

The Bai-As-Sarf (FDB) is introduced in IBBL vide Instruction Circular No. IBW/32/2007/3608, Dated 23.05.07

Musharaka Documentary Bills (MDB) Inland:

In order to avoid the risk associated with the Foreign Currency Positions against purchase of Inland Export Bills and at the same time to meet the finance need of the valued clients, Islami Bank Bangladesh Ltd. introduced Musharaka mode of finance in place of Inland Bills Purchased (IBP) as Post shipment finance. The new investment mode will be titled “Musharaka Documentary Bills (MDB) inland”.

Under this “Musharaka Documentary Bills (MDB) Inland” investment mode, after shipment of the goods, the client will submit their proposal for Musharaka Finance in the prescribed format declaring his/their equity portion and profit of the deal and the ratio at which profit to be shared with the Bank accompanying the required documents as per LC/Contract. Branch will complete appraisal of the proposal (as per prescribed format) to see the profitability of the proposal. If the proposal is found profitable & satisfactory (keeping in view the anticipated minimum profit/R.R. of the bank) Branch will first enter into a Musharaka Agreement with the client and then will send the documents to the L/C Issuing Bank for Acceptance. Upon receipt of the Acceptance, Branch will issue Sanction Advice in favor of the client & after completing proper documentation, Branch may/will disburse the Musharaka investment taking into consideration the equity of the client and anticipated profit of the deal.

Mentionable that, if the client availed any pre shipment finance i.e Bai-Salam investment against the related export LC/Contract or any other investment in the form of MPI, Bai-Murabaha or HPSM under Project/Working Capital investment, Branch will adjust the said liability from the disbursed amount of Musharaka finance proportionately.

Disbursement Procedure:

It is observed from the past trends that proceeds of most of the local export bills are not realized in time, sometimes, it requires at least 25 to 30 days more. Keeping that in view, in order to optimize Banks return, period of realization may be treated 30 (thirty days) more than the actual nuisance period. Thus for an export bill of 90 days Usance Period, profit will be determined treating the tenor at 120 days. In case of early realization, rebate will be allowed as per Banks norms.

Musharaka Documentary Bills (MDB) Inland is introduced in IBBL vide Instruction Circular No. IBW/67/07/9370, Dated 20/09/07.

Export Formalities:

Checking & Advising of export L/C:

On receipt of export L/C it is to be recorded in the banks inward register and than the signature on the L/C is to be verified by an authorized officer of the bank and finally it is to be forwarded to the beneficiary under forwarding schedule.

Processing & Opening of BB L/C:

An exporter desired to have an import L/C limit under Back to Back arrangement. In that case the following papers & documents are required:

- Full particulars of bank account

- Balance sheet

- Statement of assets & liabilities

- Trade License

- Valid bonded warehouse License

- Membership certificate

- Income tax declaration

- Memorandum of articles

- Partnership deed

- Resolution

- Photographs (all Directors)

On receipt of above documents and papers the BB L/C opening section will prepare a credit report. Branch must obtain sanction from head office for opening of BB L/C. Exporters prepare the documents and submit the same to the bank for negotiation.

Preparation of export documents:

The following documents must be prepared incase of export of goods. The documents are in below:

- Bill of exchange or Draft

- Commercial Invoice

- Bill of Landing

- Inspection certificate

- Packing List

- Export License

- Shipment advice

- Certificate of origin

- Weight certificate

- Photo sanitary certificate

- Certificate of analysis

- Quality certificate

- EXP form

- Courier receipt.

Export Documents Checking :

General Verification:

- L/c transferable or not

- Exporter us to submit documents before expiry date of the credit

- Shortage of documents etc.

Particular Examination:

- Each and every document should be verified with the L/C.

Cross Examination:

- Verified one document to another.

Amendments:

- On receipt of amendment, must be authenticated the test or verify the signature. if the rest number is incorrect or signature differs, cable confirmation must be obtained from the L/C opening bank

- Make entry of the amendment particular in the L/C advising register under amendment column corresponding to the other particulars of the relative L/C

- Make photocopy of the amendment. Use the forwarding letter, enclose the original amendment and acknowledgement with forwarding letter and retain it with the office copy for record.

- Dispatch under register mail or by special messenger.

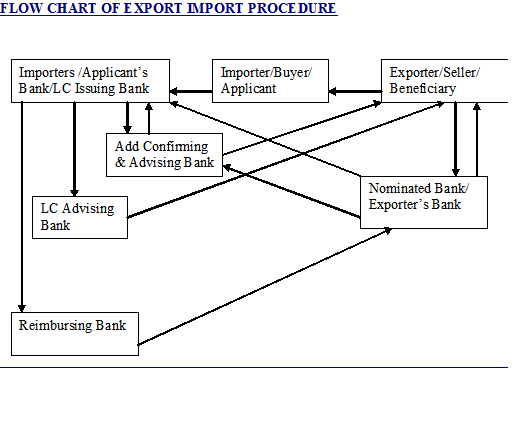

FLOW CHART OF EXPORT IMPORT PROCEDURE:

Inward Remittance:

When migrants send home part of their earnings in the form of either cash or

Goods to support their families, these transfers are known as workers’ or migrant

Remittance or Inward remittance. Remittances have been growing rapidly in the past few years and now represent the largest source of foreign income for our country.

The official data on the inflow of remittances into Bangladesh refers to the transfer of funds made by migrant workers through the banking channel is called inward remittance. Inward remittance mainly transfers in IBBL through some modes. Such as-

- Telegraphic Transfer

- Demand Draft

- Spot cash

- Foreign Demand Draft

- Foreign Currency Account etc .

Outward Remittance:

When Bangladeshi resident send money outside the Bangladesh or country then it is called the outward remittance. But outward remittance of Bangladesh is very small against the inward remittance. People send remittance for some purpose. Such as-

- Education

- Medical

- Travel

- Importer Inspection Fees

- Lab Test

- Credit card bills payment etc .

Import:

Buying goods and service from foreign countries for sale (or consumption) is considered as import. According to Skinner & Ivancevich “Purchasing goods made in another country is import” Import of goods into Bangladesh is regulated by the Ministry of Commerce in terms of the Import and Export (control) Act 1950 with Import Policy Order and Public notice issued from time to time by the Office of the Chief Controller of Import & Export (CCI&E). Authorized Dealer Banks are allowed to import goods into the country following instructions of the ministry.

During the year 2009 import business was Tk1, 11,854 million against Tk. 168329 million in 2008 33.55% growth. IBBL is the 1st in import business in banking sector in 2009.

During the year 2010 bank opened 46,736 import Letters of credit for Tk. 246,281 million as against 38,717 letters of credit for Tk.161, 230 million in 2009 showing 53.00% growth in amount.

Table – 3 : Import of IBBL

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010 |

| Import Business (Million in Tk.)

| 96,870 | 137,086 | 168,329 | 161,230 | 246,281 |

[Figure: 4 Import Business Performance of IBBL 2006-2010]

Export:Export means lawfully carrying goods or anything from one country to another country for sale. According to Skinner & Ivancevich “Selling domestic made goods in another country is export”.

Foreign Exchange Regulation Act, 1947 states that nobody can export by post and otherwise than by post any goods either directly or indirectly to any place outside Bangladesh, unless a declaration is furnished by the exporter to the collector of customs or to such other person as the Bangladesh Bank may specify in this behalf that foreign exchange representing the full export value of the goods gas been lawful procedure must be followed in case of export of goods and services.

During the year 2009 export business was Tk. 78479 milliom against Tk 93962 million in 2008 showing -16.48 % growth. IBBL is the 1st in export business in banking sector in 2009.

During the year 2010 bank handled 46,699 export bills for Tk.148, 421 million as against 44,291 export bills for Tk.106, 424 million in 2009 showing 39.00% growth in amount.

Table – 4 Export of IBBL

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010

|

| Export Business (Million in Tk.) | 51,133 | 66,690 | 93,962 | 106,424 | 148,421 |

[Figure: 5 Export Business Performance of IBBL 2006-2010]

Investments of IBBL:

The special feature of the investment policy of Islami Banks is to invest on the basis of profit-loss sharing system in accordance with the tents and principles of Islamic Shari’ah. Earning profit is not the only motive and objective of the investment policy rather emphasis should be given in attaining social good and in creating employment opportunities.

In Islamic banks different types of investment modes are used, they are mainly under the following mechanism of investment.

- Bai Mechanism

- Bai-Murabaha

- Bai-Muajjal

- Bai-Salam

- Ishtishna

- Share Mechanism

- Mudaraba

- Musharaka

- Ijarah Mechanism

- HPSM

- Quard

a. Quard-al-Hasana

Bai Mechanism:

- Bai-Murabaha

Bai-Murabaha may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the land), to the buyer at a cost plus agreed profit payable in cash or on any fixed future date in lump-sum or by installments. The profit marked-up may be fixed in lump-sum or in percentage of the cost price of the goods.

There are two types of Murabaha. First one is Ordinary Bai-Murabaha and the second one is Bai-Murabaha on demand and promise.

- Bai-Muajjal

Bai-Muajjal may be defined as a contract between a buyer and a seller under which the seller sells certain specific goods (permissible under Islamic Shariah and the Law of the country), to the buyer at an agreed fixed price payable at a certain fixed future date in lump-sum or within a fixed period by fixed installments. The seller may also sell the goods purchased by him as per order and specification of the buyer

Bai-Salam:Under this mode bank will execute purchase contract with the client and make payment against purchase of product, which us under process of production. Bai-salam contract will be executed after making any investment showing price, quality, quantity, time, place and mode of delivery. The profit is to be negotiated. In this mode the payment as the price of the goods is made at the time of agreement and the delivery of the goods is deferred.

Istisna:Istisna is a sale contract by which “al-sani” (Seller) on the basis of the order placed by “al-mustasni” (Buyer) after having manufactured or otherwise acquired “al-masnoo” (goods) as per specification sells the same to “al-mustasni” for an agreed upon price and method of settlement whether that be in advance, by installments or deferred to a specific time. It is a condition of Istisna contract that the seller should provide either the raw material or the labor.

Share Mechanism:

Mudaraba:

It is a form of partnership where one party provides the funds while the other provides

the expertise and management. The first party is called the Sahib-Al-Maal and the latter is referred to as the Mudarib. Any profits accrued are shared between the two parties on a pre-agreed basis, while capital loss is exclusively borne by the partner providing the capital.

- Musharaka

An Islamic financial technique that adopts “equity sharing” as a means of financing projects. Thus, it embraces different types of profit and loss sharing partnership. The partners (entrepreneurs, bankers, etc.) share both capital and management of a project so that profits will be distributed among them as per ratios, where loss is shared according to ratios of their equity participation .

HPSM (Hire Purchase Under Shirkatul Melk):

Hire purchase under shirkatul melk is a special type of contract which has been developed through practice; actually it is a synthesis of three contracts;

- Shirkat

- Ijarah and

- Sale

Shirkat:

Shirkat means partnership, shirkatul Melk means share in ownership. When two or more persons supply equity an asset, own the same jointly and share the benefit as per agreement and bear the loss in proportion to their respective equity, the contract is called shirkatul melk contract.

Ijarah:

The term Ijarah has been derived from the Arabic words Ajr and Ujrat which means considerations, return, wages or rent. This is really the exchange value or consideration, return, wages, rent of service of an asset. Ijarah has been defined as a contract between two parties, the hiree and hirer where the hirer enjoys or reaps a specific service or benefit against a specified consideration or rent from the asset owned by the Hiree. It is a hire agreement under which a certain asset is hired out by the Hiree to a Hire against fixed rent or rentals for a specified period.

Sale:

This is a sale contract between a buyer and a seller under which the ownership of certain goods or asset is transferred by seller to the buyer against agreed upon price paid/to be paid by the buyer.

Important features of Bai-Murabaha & Bai-Muajjal Investment:

- It is permissible for the Client to offer an order to purchase by the Bank particular goods deciding its specification and committing himself to buy the same from the Bank on Bai-Muajjal i.e. deferred payment sale at fixed price.

- It is permissible to make the promise binding upon the Client to purchase from the Bank, that is, he is to either satisfy the promise or to indemnify the damages caused by breaking the promise without excuse.

- It is permissible to take cash / collateral security to Guarantee the implementation of the promise or to indemnify the damages.

- It is also permissible to document the debt resulting from Bai-Muajjal by a Guarantor, or a mortgage. or both like any other debt. Mortgage / Guarantee / Cash security may be obtained prior to the signing of the Agreement or at the time of signing the Agreement.

- Stock and availability of goods is a basic condition for signing a Bai-Muajjal Agreement, Therefore, the Bank must purchase the goods as per specification of the Client to acquire ownership of the same before signing the Bai-Muajjal Agreement with the Client.

- After purchase of goods the Bank must bear the risk of goods until those are actually delivered to the Client.

- The Bank must deliver the specified Goods to the Client on specified date and at specified place of delivery as per Contract.

- The Bank may sell the goods at a higher price than the purchase price to earn profit.

- The price once fixed as per agreement and deferred can not be further increased

The Bank may sell the goods at one agreed price which will include cost & profit.

Important Features of Mudaraba:

- It is permissible for the Client to offer an order to purchase by the Bank particular goods deciding its specification and committing himself to buy the same from the Bank on Murabaha, i.e. cost plus agreed upon profit.

- It is permissible to make the promise binding upon the Client to purchase from the Bank, that is, he is to either satisfy the promise or to indemnify the damages caused by breaking the promise without excuse.

- It is permissible to take cash/collateral security to guarantee the implementation of the promise or to indemnify the damages.

- It is also permissible to document the debt resulting from Bai-Murabaha by a Guarantor, or a mortgage, or both like any other debt. Mortgage/ Guarantee/ Cash Security may be obtained prior to the signing of the Agreement or at the time of signing the Agreement.

- Stock and availability of goods is a basic condition for signing a Bai-Murabaha Agreement. Therefore, the Bank must purchase the goods as

- Per specification of the Client to acquire ownership of the same before signing the Bai-Murabaha agreement with the Client.

- After purchase of goods the Bank must bear the risk of goods until those are actually sold and delivered to the Client, i.e., after purchase of the goods by the Bank and before selling of those on Bai-Murabaha to the

Client buyer, the Bank shall bear the consequences of any damages or defects, unless there is an agreement with the Client releasing the Bank of the defects, that means, if the goods are damaged, Bank is liable, if the goods are defective, (a defect that is not included in the release) the Bank bears the responsibility.

- The Bank must deliver the specified Goods to the Client on specified date and at specified place of delivery as per Contract.

Papers/Documents to be obtained from the client:

- Client’s application on letter head pad.

- Completed feasibility study

- Machinery pro-forma invoices / Indent / Quotation

- Machinery Catalogues

- Civil work drawings and estimate of the costing.

- Machinery layout plan.

- Balance sheets (Where applicable).

- Inspection report of the project / Business establishment.

- Copy of board resolution for taken investment from IBBL

- CIB inquiry from with forwarding letter

- Declaration of liabilities with others bank.

- CIB report

- Complete application form with photograph.

- Memorandum & articles of the association

- Certificate of Incorporation.

- Particulars / Bio-data of directors.

- Assets & Liabilities Statements

- TIN certificate

- Valid Trade License

- Clearance certificate of authorized bodies.

- Appraisal report

- Project implementation schedule.

Performance of Investment:

Successfully mobilized Tk.291, 283 million deposits from 49, 39,502 depositors and deployed Tk.292, 084 million as investment to 5, 25,984 accounts up to 31st December 2010. Growth rate of investment in 2010 is 22%.

Table – 5 : Investment Deployed of IBBL

| Particulars | 2006 | 2007 | 2008 | 2009 | 2010

|

| Investment (Million In Taka) | 123,959 | 174,365 | 198,763 | 255,272 | 292,084 |

[Figure: 6 Investment Deployed of IBBL 2006-2010]

4.1.8 Investment Schemes of IBBL

1. Household Durables Scheme (HDS)

2. Investment Scheme for Doctors (ISD)

3. Small Business Investment Scheme (SBIS)

4. Agricultural Implements Investment Scheme (AIIS)

5. Housing Investment Scheme (HIS)

6. Real Estate Investment Program (REIP)

7. Rural Development Scheme (RDS)

8. Transport Investment Scheme (TIS)

9. Car Investment Scheme (CIS)

10. Mirpur Silk Weavers Investment Scheme (MSWIS)

11. Micro Industrial Investment Scheme (MIIS)

12. Household Durables Scheme (HDS)

13. Women Entrepreneur Investment Scheme (WEIS)

14. Palli Griha Nirman Beniyog Prakalpa (PGNBP)

Investment decision Model:

Performance of IBBL:

Table – 7 Performance of IBBL

( Amount In Million Taka )

| Particulars | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Authorized Capital | 3,000.00 | 3,000.00 | 5,000.00 | 5,000.00 | 5,000.00 | 10,000.00 | 10,000.00 |

| Paid-up Capital | 1,920.00 | 2,304.00 | 2,764.80 | 3,456.00 | 3,801.60 | 4,752.00 | 6,177.60 |

| Reserves Fund | 3,280.37 | 4,329.92 | 5,450.94 | 6,551.23 | 7,418.04 | 9,308.00 | 13,927.94 |

| Total Equity | 5,266.47 | 6,691.12 | 8,331.14 | 10,435.96 | 14,957.74 | 18,572.00 | 23,619.81 |

| Total Deposits (Including bills payable) Gross | 70,552.65 | 88,452.18 | 108,261 | 132,814.00 | 166,812.78 | 200,725.00 | 244,292.14 |

| Total Investments (Including Inv in Share) Gross | 62,755.90 | 83,893.63 | 102,145 | 123,959.00 | 174,365.55 | 198,763.00 | 255,272.41 |

| Import Business | 46,237.00 | 59,804.00 | 74,525.00 | 96,870.00 | 137,086.00 | 168,329.00 | 161,230.00 |

| Export Business | 21,738.00 | 29,151.00 | 36,169.00 | 51,133.00 | 66,690.00 | 93,962.00 | 106,424.00 |

| Remittance | 16,668.00 | 23,669.00 | 36,948.00 | 53,819.00 | 84,143.00 | 140,404.00 | 194,716.00 |

| Total Foreign Exchange Business | 84,643.00 | 112,624.00 | 147,642.00 | 201,822.00 | 287,919.00 | 402,695.00 | 462,370.00 |

| Total Income | 6,710.44 | 8,262.73 | 10,586.78 | 14,038.30 | 17,699.51 | 23,454.00 | 25,403.86 |

| Total Expenditure | 5,908.42 | 6,419.74 | 8,424.36 | 11,129.63 | 13,918.70 | 15,151.00 | 18,886.20 |

| Net Profit before Tax | 802.02 | 1,842.99 | 2,162.42 | 2,908.67 | 3,780.82 | 6.348.00 | 6,517.66 |

| Payment to Government (Income Tax) | 426.61 | 829.35 | 973.09 | 1,490.12 | 2,322.46 | 3,647.00 | 3,253.23 |

| Dividend | 20% (Stock) | 20% (Stock) | 25% (Stock) | 15% (Cash) 10% (Stock) | 25% (Stock) | 30% (Stock) | 10%(Cash) 20%(Stock) |

| Total Assets (including Contra) | 98,046.85 | 125,776.94 | 150,959.66 | 188,115.27 | 250,012.79 | 288,017.19 | 340,638.49 |

| Total Assets (Excluding Contra) | 81,704.75 | 102,149.28 | 122,880.35 | 150,252.82 | 191,362.35 | 230,879.14 | 278,302.84 |

| Fixed Assets | 2,036.66 | 2,552.70 | 3,067.99 | 3,724.69 | 3,987.23 | 4,407.00 | 6,512.36 |

| No. of deposit account holder | 1,994,266 | 2,291,269 | 2,705,180 | 3,207,131 | 3,802,709 | 4,361,896 | 42,72,123 |

| No. of investment account holder | 223,954 | 264,863 | 297,943 | 421,751 | 508,758 | 498,362 | 1,62,736 |

| Cumulative amount of disbursement from RDS | 2,923.60 | 4,216.77 | 6,033.36 | 9,303.12 | 13,969.01 | 18,768 | 24,239.00 |

| Outstanding Investment of RDS | 570.90 | 789.97 | 1,106.00 | 2,242.00 | 2,885.00 | 3,012 | 3,752.00 |

| RDS no. of A / C holder | 130,465 | 163,465 | 164,116 | 295,012 | 350,278 | 321,484 | 492,475.00 |

| RDS no. of village | 3,700 | 4,230 | 4,560 | 8,057 | 10,023 | 10,763 | 10,751.00 |

| Number of Foreign Correspondents | 840 | 850 | 860 | 870 | 884 | 906 | 919 |

| Number of Shareholders | 14,196 | 15,892 | 17,201 | 20,960 | 26,488 | 33,686 | 52,164.00 |

| Number of Employees | 4,673 | 5,306 | 6,202 | 7,459 | 8,426 | 9,397 | 9,588 |

| Number of Branches | 141 | 151 | 169 | 176 | 186 | 196 | 231 |

| Book value per Share ( Taka) | 2,743 | 2,904 | 3,013 | 3,020 | 4,147 | 238 | 325 |

| Earning per Share (Taka) | 195.52 | 518.59 | 487.57 | 368.42 | 375.46 | 56.29 | 55.10 |

| Market Value per Share (Taka) (Highest) | 4,548.00 | 5,110.00 | 5,580.00 | 4,749.00 | 6,986.00 | 830 | 890.00 |

| Capital Adequacy Ratio | 9.43% | 9.21% | 9.44% | 9.43% | 10.61% | 10.72% | 11.65% |

Ratio Analysis:

Figure: 01: Net Profit Ratio

From Figure: 01: We see Net profit ratio was highest in 2005 and lowest in 2006 then again increased in 2007. And from the figure we see net profit ratio had a fluctuating trend.

Profit per Taka of expenditure: Banks earned profit by incurring expenditure for their operations. Effective usage of financial resources led to a commendable profit situation. ‘How much profit earned by spending one taka’ is the measure of efficiency of an organization.

Formula= Net Profit after Tax/ Total Expenses.

Figure: 02: Profit Per Taka of Expenditure Ratio

From Figure: 02: We see Profit per taka was highest in 2004 and lowest in 2006 and from the figure we see Profit per Taka of Expenditure ratio had a declining trend.

Profit per employee: Effective utilization of human resources produces higher return. Earned more profit by few numbers of employees indicates commendable performance of the banks and human efficiency. Since the nature of the industry is service oriented, human efficiency depends on intellectual abilities of the employees.

Formula= Net Profit after Tax/ Total No.

Figure: 03: Profit Per Employee

From Figure: 03: We see Profit per employee was highest in 2004 and lowest in 2005 and again increased in 2006 so from the figure we see net profit per employee ratio had a fluctuating trend.

Profit per Branch: All categories of banks have numbers of branches covering wide range of the population of the country. To provide service to the wide range of people, banks have to establish multiple branches. Contribution to the total profit of different branches was varied depending on the amount of deposits and advances.

Formula= Net Profit after Tax/ Total No. of Branch

Figure: 04: Profit Per Branch

From Figure: 04: We see Profit per branch was highest in 2006 and lowest in 2005 and from the figure we see profit per branch ratio had a fluctuating trend.

Return on Equity: One of the most important profitability metrices is return on equity (ROE). Return on Equity is the bottom line measure for the shareholders, measuring the profits earned for each dollar invested in the firm’s stock. ROE of a bank measures the ability of the management of the bank to generate adequate returns for the capital invested by the owners of a company.

Formula= Net Profit After Tax/ Shareholder’s Equity

Figure: 05: Return on Equity

From Figure: 05: We see Return on Equity was highest in 2004 and lowest in 2005 and again increased in 2006.from the figure we see return on equity ratio had a fluctuating trend.

SWOT Analysis:

Strengths, Weaknesses, Opportunities &Threats (SWOT) Analysis of IBBL:

SWOT analysis is the detailed study of an organization’s exposure and potential in perspective of its strength, weakness, opportunity and threat. This facilitates the organization to make their existing line of performance and also foresee the future to improve their performance in comparison to their competitors. As though this tool, an organization can also study its current position, it can also be considered as an important tool for making changes in the strategic management of the organization.

Strengths :

- IBBL is a financial sound company.

- Different type of Islamic products.

- Branch network all over the country.

- The technology of IBBL is Up-to-date and experienced management team.

- Clients have faith & inclination towards Islamic Banking.

- Huge amount of deposited money.

- SWIFT facility exists with major Banks.

- Dedicated and experienced human resources.

Weaknesses:

- mproper maintenance of automation system.

- Insufficient Islamic Investment Risk Analysis and measurement methodology by the employees

- Lack of human resource to cover the work load.

- Non-offering special deposit & investment schemes for the emigrant.

- Insufficient number of ATM booth and inadequate logistic support.

- Concentration of remittance operation though a single location.

Opportunities:

IBBL can introduce more innovative and modern customer services.

Many branches can be open in remote location.

On-line banking facilities are stronger in near future.

Floating and attractive Exchange Rate.

IBBL can recruit experienced, efficient and knowledgeable work force as it offers good working environment

Threats:

Local competitors can captured huge market shares by offering similar products.

Lots of new banks are coming in the scenario with new service.

Frequently money devaluation and foreign exchange rate fluctuation is a causing problem.

Recommendations:

After observing the all activities and performance of Islami Bank Bangladesh Limited, the following recommendations are given for the IBBL:

- IBBL should take proper steps to attract deposit from the customers. If necessary IBBL should introduce new deposit product for the new as well as the existing customer.

- IBBL must be provide good online banking service to the existing client and IBBL must upgrade it server and other IT facilities to provide quick service to the clients.

- To increase the mobilization of the deposit IBBL should open separate inquiry desk about the deposit product of the bank. Where customers can easily know about all the existing products and its features from one desk.

- IBBL must increase ATM facilities to capture the market share and also increase the ATM Both as soon as possible.

- IBBL should develop Information technology to ensure better service for the customer and also set up high bandwidth internet connection to run banking activities properly.

- Numbers of employees should be increased to support and provide the better service to the clients.

- Any kind of bank, Shariah based or interest based has to operate under regulatory environment prepared and approved by the government. There are conflicts between Islami Shariah and general Government rules and banking law. That’s why Islami bank does not get the opportunity and help from the running law of government.

- Insurance company pools large amount of money, which is mainly invested by bank. Islami bank does not get benefit from insurance companies directly. Because insurance companies are not guided by Islami Shariah. So Islami Bank is not interested to get insurance from that companies that’s why it is necessary to establish Islami insurance policy.

- Islami bank cannot accept securities & bonds from Bangladesh Bank because these securities & bonds are not well instructed by Islami Shariah. Besides the conventional banks get these benefits from Bangladesh Bank that helps them to increase their wealth.

- Islami bank lacks efficient manpower. In our country Islami Bank is spreading very rapidly but still skilled manpower is not sufficient. Islamic banking and Islamic economy must be included in the syllabus of schools and universities so that Islami educated people can have opportunity to get employed in Islami bank and the service of Islami bank can be better with the help of these skilled personnel.

Conclusion:Islami Bank Bangladesh Limited was incorporated on 13th March 1983 as a public company with limited liability under the companies’ act 1913. The bank started functioning with effect from 30 March, 1983. IBBL is the first interest free bank in south Asia. The establishment of this bank conducted new age in Bangladesh, the 3rd largest Muslim country in the world.

The bank is committed to run all its activities as per Islami Shariah. At present, IBBL is one of the leading private commercial bank in Bangladesh. IBBL play a vital role in the country economy and IBBL show the important of its all activities in every sector. Like in Import such as machinery, garments, fabrics and accessories and other items. On the other hand in exports are Jute goods, readymade garments, leather, frozen food, pharmaceuticals etc. There are many Islamic banking and financial institutions established all over the world. The banking system of some country is totally based on the Islami Shariah.

IBBL will be more effective in Bangladesh economy through its activities and also by creating the employment opportunities all over the country. IBBL also participate to increase the foreign exchange reserve by its activities.

IBBL also invest in agriculture and rural sector of the country to create opportunity for employment and raising income of the rural people with a view to alleviation poverty. This is very effective for the country economy.

IBBL already establish a superior and welfare oriented banking system as well as IBBL participate in socio-economic uplift and developing the community through its activities, which is very important and create a positive image for the country economy.

Bibliographies:

- Annual Report (2009) of Islami Bank Bangladesh limited

- Various types of Publications of IBBL

- Handouts provided by IBTRA.

- A Hand Book of Islami Banking & foreign exchange Operation

-By: Md. Haider Ali Miah

- Training Materials of IBTRA.

- Different Types of Products of IBBL i.e. Leaflets, Brochures,

Synopsizes etc.

Appendice-2

Date:

Vice president

Islami Bank Bangladesh Ltd.

Rampura Branch

Dhaka-1219.

Sub: 7 days prior Notice for withdrawal of fund against account No MSA………

Muhtaram,

Assalamu Alaikum.

Reference to the above, I would like to inform you that I am badly in need for withdrawal TK……………….. from my above account which may kindly be allowed to meet up my urgent requirement. I have placed my cheque no ……………… date …………….in this regard.

Ma-assalam

Yours faithfully

(Signature)

Name:

A/C No:

Appendice-3

Date:

The Vice President

Islami Bank Bangladesh Ltd

Rampura Branch

Dhaka.

Sub: Closing of MSA/MSS/MTDR/MSB/MMPDRS/HAJJA/C NO………….

Muhtaram

Assalamu Alikum

I have been maintaining a Deposit Account bearing No……..favoring…….with you. Now I would like to close above mentioned Deposit Account and want to cash/A/C No……….. of my deposit figure.

Ma Assalam

Yours faithfully

…………………..

(Signature)

Name:

A/C No.