Executive summery:

This report focuses on the entrepreneurial challenges and the process of overcoming them specially reinforcing the financial issue. The report presents both the entrepreneur and financial institution’s view on financing opportunities for SME institutions. As a financial organization the report shed light on BSRS and its BCC/BASIS/ICT Incubator and its adjacent financing modules. From entrepreneur’s point of view a number of incubator listed firms were selected and their financing process has been introduced.

This report exclusively focused its view toward ICT SMEs. The fact that ICT Incubator is only accessible to IT companies and the importance of ICT in Bangladesh economy growth has an implicit importance in this regard. The report took this issue further by listing the bars that remains in today’s financial market for an ICT SME.

The report also contains critical analysis of the whole financing process and its pro/cons. The submitters took the liberty of comparing BSRS normal SME financing schemes and its past data with BSRS/BCC/ICT Incubator financing schemes. This report also showed the Requirements, Paper works, Validation process, Other payment options & Follow through of the whole financing process. Past data of BSRS financial investments and loan disbursements as well as data on participation in ICT incubator has also been included.

Recent times have seen an encouraging up rise of women participation in SME institutions. This fact has not been ignored and an analysis with relevant data on women participation in BSRS and ICT Incubator scenario has been introduced.

The investment process for SMEs has been presented with diagrams and charts. A relatively unique data follow through method has been introduced with computerized application attached with this report. The software (Internally developed by the submitters) sheds a bird’s eye view of the whole report and its contents.

Introductory Words:

As a term paper on the course of Entrepreneurship, in this report we wish to focus on the entrepreneurship development process by sequencing both the financier and the entrepreneur point of views. As a financial organization we have selected BSRS

( Bangladesh Shilpa Rin Sangstha ) following their track record of successfully implementing growth prospective financing to entrepreneurial ventures and their active part in the industrial development process of SME ( Small and Medium Enterprise ) sectors. We have followed their financing process closely and documented it step by step. We have also enriched the report by adding BSRS’s previous years’ records in loan disbursement and recovery data.

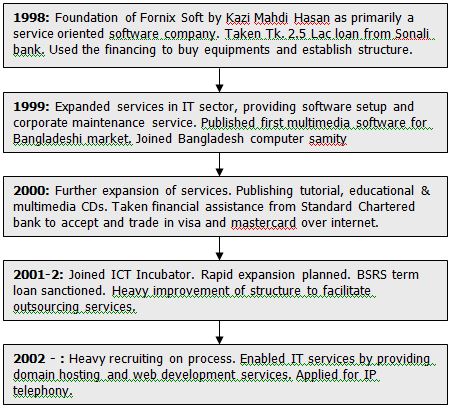

To make the view point more focused, we narrowed our search to the ICT field and included the ICT Incubator program of the Ministry of Science and Information, BASIS & BSRS. We have also focused on the entrepreneurial view by including Fornix Software Limited as a recipient of ICT Incubator program and also a debtor of BSRS. We followed their development process from inception and have shown how they have used the loan and the Incubator program to improve and develop their business.

This paper also includes a very unique feature worth mentioning; an interactive CD has been prepared showing the whole report in a presentation format also includes interactivities concerning all relevant industry, sector and organizational data.

By showing the entrepreneurial development in a unique point of view; following step by step process of financing as well as their uses by historical data, we hope to combine both the financier and financed organization views.

We didn’t overlook the improvement in current gender inequality position in our country. We have investigated the women participation in the relative field – ICT.

Overview of Bangladesh ICT Industry:

Bangladesh ICT industry has come a long way in last several decades. Particularly, in recent years, ICT in Bangladesh is experiencing an exponential growth and making its presence strongly felt both in the public & private sector in the country. Some of the major driving force of the industry are – Increasing availability of computers (PC import in the country has been growing by more than 35% during last five years; current number of PCs stands at 1.5 million), widespread Internet availability (nearly 1 million Internet users) and the recent explosion of telecommunication network across the country (number of mobile connection projected to reach 10 million from the current 3 million in next three years; more than 20 PSTN license issued to private sector Telecommunication companies in recent months and average growth of number of connections is also projected more than 200% for next years). But, perhaps the most important factor in the continuing development of the sector is the presence of a large number of good quality software application development houses (more than 350 companies with 15,000+ programmers & technical staffs).

The ICT industry in Bangladesh is thriving in a positive business environment. The legal and policy framework for the industry is already in place. ICT policy has been formulated in 2002. The IPR Law has already been enacted in the parliament in 2000. To monitor the development of the sector and formulate action plans, there is a very high level Task Force for ICT sector that is headed by Prime Minister. Already, different Ministries & agencies of the Government have initiated e-Governance projects for delivering service to the citizens in efficient ways. The existing government policy of allocating minimum 2% of the Annual Development Budget for ICT procurement is a big encouragement for the industry. During recent times, the private sector organizational buyers are also increasingly emphasizing on using ICT for tapping competitiveness in business, both at domestic and international market level. Increasing ICT use at both the public and private sector has initiated good demand situation for software and ICT services industry in the country.

In the International Software and ICT market, Bangladeshi companies have started to make their mark. The country is already exporting software & ICT services to 23 countries. Last year, the sector achieved 43% growth rate in export.

The sector is well prepared for high growth in the next few years. A lot of young & talented entrepreneurs are joining this sector and putting their creative effort in new business ideas. To ensure the human resource requirement of the sector, more than 10,000 ICT students are graduating from around 300 good quality Universities & IT Training Institutes every year.

The incubator Business concept: Bangladesh perspective

As Entrepreneurs generally are in need of finding a market and a base for start as well as growth, Incubator Business concept provides the necessary nurturing to pull them through the most difficult first few years.

In the incubator facility (Usually a set of offices in the same building), different businesses share the cost of services. The purpose is to help the businesses grow so they can graduate from the incubator to full fledged independence. The services that the incubators generally provide are ranked here in order of importance:

1. Business plan guidance

2. Marketing advice/ marketing plan development.

3. Information on government grants and loans

4. Computer training

5. Guidance in government procurement procedures.

6. Financing for selected sectors.

Incubator business process is relatively new in Bangladesh. The government faced the need of rapid growth in ICT industry in the challenging 21st century, and established an ICT Incubator, bringing 3 organizations together, BSRS, BCC & BASIS.

The BSRS/BCC/ICT Incubator :

Under the government ICT policy and BCC code, the government took the initiative of creating a short sized “silicon Valley” for Bangladeshi IT industry and thus ICT Incubator came into being.

In 2002, Science, Information and Communication Technology Ministry took the initiative and brought BSRS and BCC together in forming the ICT incubator. Under the MoU, BSRS will provide housing and space for the Incubator companies and possible future financing while, BCC will overview the IT enabled services as well as sort the IT company applicants for Financing from BSRS.

Distribution of space for the software exporters and IT-enabled service companies in the newly set up ICT Incubator began on 1st January 2002. The government provided 68,000 squire feet of area at Bangladesh Shilpa Rin Sangstha (BSRS) Bhaban at Kawran Bazar to install the incubator costing Tk3.6 crore. Under the agreement, spaces from the 3rd to the 9th floors of BSRS are provided for the software exporters and IT-enabled service companies at a subsidized rate. BSRS also prioritized its financing process for incubator participants and many of the firms took loans from BSRS. BCC provides a generator for round-the-clock uninterrupted power supply and a broadband Internet connection for the software exporters and the IT-enabled service companies. So far, 63 software exporters and IT-enabled service companies have joined the Incubator.

BASIS

Bangladesh Association of Software and Information Services (BASIS) was formed in 1997 with the mission to mobilize regulatory and policy support to this industry and to assist member firms in building capacity for better addressing the needs of the domestic and overseas markets.

BASIS started with 17 charter members. Today the membership stands at 116 (January 2004). Members of BASIS account for more than 90% of the total software and IT services revenue of the country. Its members have among their clients, fortune 1000 companies in Europe, North America and Austral-asia. On a regular basis its members export software and IT services to more than 20 countries of the world.

BASIS has meticulously fostered close working relationships with the policy makers, government functionaries and the academia to ensure unhindered growth of this industry in Bangladesh. BASIS was instrumental in getting software Copyright Amendment Law enacted in the year 2000. BASIS is also working with other chambers in scrutinizing the Draft Electronic Transaction and Cyber Crime Law. BASIS actively provides assistance and support to all overseas clients of software and IT services and also to overseas investors looking for business opportunities in Bangladesh.

BCC

The main objective of establishing BCC was to ensure the effective application and expansion of the use of information technology. In view of this BCC has been formulating appropriate policies and implementing them since its inception. The description and the lists depicting the steps taken and other activities are presented in the following sections.

We have chosen BSRS to portray the financier point of view in the process of entrepreneurial development.

BSRS History

Bangladesh Shilpa Rin Sangstha (BSRS) was established on October 31, 1972 under the Bangladesh Shilpa Rin Sangstha Order, 1972 (President’s order No. 128 of 1972) to provide credit facilities and other assistance to industrial concerns and encourage and broaden the base of investment in Bangladesh.

BSRS extends medium and long term credit facilities to industrial projects mainly in private sectors. Besides, it provides, underwriting advance /bridge finance/debenture loans to public and private limited companies. BSRS also guarantees under certain conditions, deferred payments of machinery imported under supplier’s credit and provides guarantee and counter guarantee for loans for loans , debts, credits, performance of contract and financing arrangements with foreign leading agencies as well as local banks and financial institutions. BSRS is an active member of Dhaka Stock Exchange (DSE), engages in trading securities in both the primary and secondary securities market. It also acts as a manager and banker to the public issues of the securities. BSRS started commercial banking operations from 4th may, 1997.

Organizational setup:

BSRS has 18 operational departments under 4 divisions at its head office in Dhaka. It has one commercial banking branch at Motijheel and a corporate branch in Karwan Bazar, Dhaka. BSRS has four branch offices outside Dhaka, one each at Chittagong, Rajshahi, Khulna and Sylhet.

Capital and Resources:

Currently the resources of BSRS consist of local currency funds only. Since 1985, BSRS has not received any foreign currency fund. Prior to 1985, the foreign currency funds were the lines of credit channeled by the government from various international and regional leading agencies. The foreign currency reserves were also augmented by contracting direct credit lines from different foreign countries and by borrowing foreign currency from the Government or from any bank or financial institution in Bangladesh or from any foreign countries, governments, or foreign banks or financial institutions. The local currency fund of BSRS consists of paid up capital, reserves, deposits and borrowing from the Government.

The authorized and paid up capital of BSRS are Tk. 2,000 Million and 700 million respectively. BSRS equity as on june 30, 2001 stood at Tk. 1,573,707 million ( Including reserves and surplus )

The resource position of BSRS as on June 30, 2001 is shown below.

Table -1: RESOURCES

| Source | 30th June | |

| 2001 | 2000 | |

| Paid up Capital | 700.000 | 700.000 |

| Reserves | 873.707 | 755.654 |

| Borrowing / Term loans | 500.667 | 584.000 |

| Deposits | 135.445 | 89.447 |

| Total | 2,209.819 | 2,129.101 |

Major sectors of BSRS loan disbursement:

BSRS’s major sector wise loans and advances are presented here. Please note in point that ICT loan is not indexed separately as it constitutes a very little part of the organization’s total disbursement. It has been included in the miscellaneous section

BSRS

Sector wise loan and advances

| Industry Sector | Long term loan | Debentures & underwriting loan | Total |

| Food & Allied | 3,004.699 | 47.045 | 3051.744 |

| Jute & Allied | 5,596.139 | 61.660 | 5657.799 |

| Textile & Allied | 3303.556 | 41.444 | 3345.000 |

| Paper & Printing | 71.348 | 60.218 | 131.566 |

| Chemicals, Pharmaceuticals | 2379.390 | 37.957 | 2417.347 |

| Tannery, Leather & rubber | 159.014 | 3.472 | 162.486 |

| Transport | 1196.791 | 2.155 | 1198.946 |

| Services | 698.147 | 39.003 | 737.150 |

| Engineering | 556.756 | 20.656 | 577.412 |

| Misc. | 92.334 | – | 92.334 |

| 17371.784 | |||

| Others | |||

| Commercial Loans | 2.228 | ||

| Loan Under investors’ scheme | 2.445 | ||

| Staff loan | 88.658 | ||

| Total Taka | 17058.174 | 313.610 | 17465.115 |

Project Implementations and Recovery:

Close monitoring & supervision of projects are undertaken to ensure that the projects are implemented on schedule. During the year, 2 projects went into commercial operations and 1 project went into partial operation. At the end of FY 2000-2001, 11 projects were under different stages of implementation.

Table -2: Stages of Implementation of Projects

(No. of Projects)

| Sl. No. | Status of Projects | 1999-2000 | 2000-2001 |

| 1 | Commercial operation | 02 | 02 |

| 2 | Total Operation | 02 | 01 |

| 3 | Under construction | 03 | 03 |

| 4 | Documentation not completed | 04 | 05 |

| Total: | 11 | 11 |

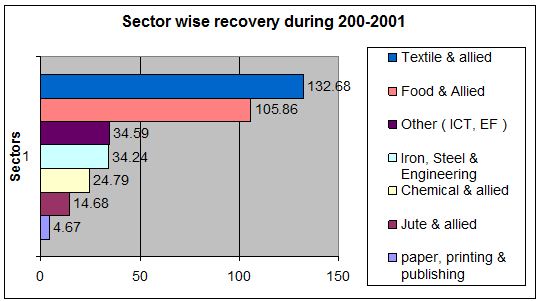

Chart 1: Sector wise recovery during 2000-2001

Recovery trends and status:

In order to ensure credit discipline, BSRS strictly observed the credit guidelines of the Bangladesh bank. as on 30 June 2001, 91.10% of industrial term loans was classified. The amount of provisions (including interest suspense) kept in books of accounts was 91.05% of the loan portfolio.

Recovery of due / overdue loans received utmost priority during FY 2000-2001 as in the previous years. BSRS provided a number of incentives, rebates and concessions to the borrowers for repaying the dues on or before scheduled dates. (This trend continues throughout the better part of 2004 as increasing pressure from government forced BSRS to close many of its overdue accounts as bad debts and reconcile many others. Relevant data and trend graphs are presented afterwards. )

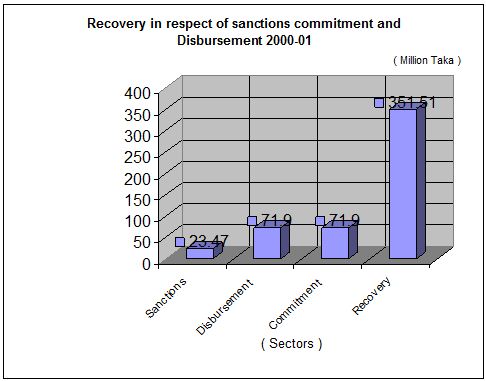

During FY 2000-2001, BSRS recovered a total amount of Tk. 351.506 million. It comprised of recovery of 334.709 million in respect of term loans in foreign and local currency and Tk. 16.797 million on account of other operations such as dividends on shares and interest on debentures.

Chart2: Recovery in respect of sanctions commitment and Disbursement 2000-01

Outstanding and overdue loans of BSRS during the 1997 to 2001

| Outstanding | Overdue | Overdue as % of outstanding | |||||

| Year | Private | Public | Total | Private | Public | Total | |

| 1997 | 15,249.02 | 391.58 | 15,640.60 | 12,987.76 | 203.55 | 13,191.31 | 84.34 |

| 1998 | 16,513.44 | 369.60 | 16,883.04 | 14,271.06 | 219.63 | 14,490.69 | 85.90 |

| 1999 | 17,865.91 | 353.98 | 18,219.89 | 15,141.05 | 230.87 | 15,371.92 | 86.58 |

| 2000 | 17,578.73 | 274.86 | 17,853.59 | 15,517.55 | 207.00 | 15,724.55 | 88.07 |

| 2001 | 17244.02 | 221.10 | 17,465.12 | 15232.47 | 207.00 | 15,439.47 | 88.40 |

Highlights of BSRS’s Activities in the last six years

| Particulars | Years | Cumulative (Since Inception) | |||||

|

Years >> | 2002-2001 | 2001 – 2000 | 2000 – 1999 | 1999 – 1998 | 1998 – 1997 | 1997 – 1996 | |

| Net Approvals: | |||||||

| Term loans | 23.47 | 83.70 | 97.17 | 241.55 | 226.61 | 5183.58 | |

| Underwriting Advance & Debenture loans | 6.38 | 34.67 | 20.00 | 48.20 | 132.31 | ||

| Equity Investment | 27.42 | 35.13 | 8.84 | 42.42 | 31.46 | 259.34 | |

| Debentures Investment | 63.43 | ||||||

| Disbursement: | |||||||

| Term Loans | 65.52 | 121.98 | 199.90 | 212.41 | 114.18 | 4899.49 | |

| Underwriting advance & debenture loans | 6.38 | 29.09 | 40.38 | 18.20 | 115.65 | ||

| Equity investment | 27.42 | 35.13 | 8.84 | 42.42 | 31.46 | 259.34 | |

| Debenture Investment | 64.43 | ||||||

| Recovery: Economic Highlights | 351.51 | 278.13 | 261.52 | 302.85 | 291.03 | 7905.45 | |

| Gross Investment | 41.82 | 659.70 | 508.32 | 970.43 | 607.00 | 10246.74 | |

| Job Creation (nos) | 80 | 628 | 658 | 1135 | 213 | 3117 | |

| Financial Highlights: | |||||||

| Paid up capital | 700.00 | 700.00 | 700.00 | 700.00 | 700.00 | 700.00 | |

| Reserves | 873.71 | 755.65 | 690.61 | 620.07 | 547.32 | 873.71 | |

| Borrowings/term debts | 500.67 | 584.00 | 584.00 | 584.34 | 501.00 | 500.67 | |

| Total Assets | 18608.43 | 18834.46 | 19212.21 | 2429.56 | 2366.14 | 18608.43 | |

| Total Income | 247.35 | 196.14 | 161.63 | 174.19 | 260.90 | 7205.06 | |

| Total Expenses | 139.24 | 129.30 | 121.96 | 119.02 | 215.56 | 5507.54 | |

| Total expenses to total Income (%) | 56.29 | 65.92 | 75.65 | 68.33 | 82.50 | 56.29 | |

| Total Income to total Assets (%) | 1.33 | 1.04 | 6.17 | 7.17 | 11.65 | 1.33 | |

| Total expenses to total Assets (%) | 0.75 | 0.69 | 4.60 | 4.90 | 9.62 | 0.75 | |

| Net Income before tax | 108.11 | 66.82 | 39.25 | 55.17 | 44.54 | 1908.78 | |

| Net income after tax | 69.11 | 44.42 | 39.25 | 55.17 | 32.92 | 832.03 | |

| Tax paid | 22.45 | 7.29 | 6.52 | 19.64 | 47.77 | 1649.28 | |

| DSL payment to GOB | 135.68 | 115.00 | 32.99 | 44.00 | 1790.00 | 5541.94 | |

| DSL payment to Donors | 0.69 | 0.69 | 350.07 | ||||

| Contribution to national Exchequer | 8.75 | 8.75 | 7.00 | 7.00 | 7.00 | 168.18 | |

| Debt-equity ratio | 0.32:1 | 0.40:1 | 0.41:1 | 0.44:1 | 0.40:1 | 0.32:1 | |

| Debt service coverage | 2.58 | 5.28 | 4.53 | 3.23 | 0.25 | 2.58 | |

Notes:

a. Color codes:

| Approximate position as on June, 2001 | Percentage | Ratio | Numbers |

b. These data have been provided by BSRS’s MIS department and DSE Library and subject to changing in approximate values.

Investment process for BSRS:

To apply for financial assistance from BSRS and inclusion in ICT Incubator a potential SMEs has to go through a set schedule of processes. They have been described below.

- Formal Application to BSRS for loan or financial support:

- The applicant company has to acquire formal application from BSRS office paying

Tk 100 as pay order to BSRS chief disbursement officer.

- While receiving the form these documents have to be shown.

- The memorandum of association. ( For Limited Companies )

- Listing certificate from Registrar of Joint Stock companies. or

- Listing from city corporation as registered partnership or proprietorship

Business.

- The VAT certification Number or

- TIN number ( Tax Identification Number )

- List of Directors and their consent letter.

- The Application submission :

The formal application consists of primarily information about the applicant and the intended business pattern he or she likes to chose. Please refer to appendix 1.02 for a demo of the formal application form/

- The application Processing:

The BSRS authority takes a disclosed time (Usually 2 to 3 weeks) to process the submitted application. This time is spent evaluating the given data in the application and a preliminary assessment of the applicant for loan purposes. The data collection usually revolves around:

- The assessment of truth in

Business Address

Business Capital

Business Partners

Business Registration

Government taxes payment trends.

- Eligibility findings.

This process is dedicated in assessing whether the applicant passes the

Eligibility qualifications, as in education, financial solvency, nationality,

Affiliation with government service, etc.

4. Preliminary interview & submission of project proposal:

If the application passes through the preliminary application processing, he/she is notified of the eligibility and is asked to appear before an assessment officer with a copy of the financial proposal paper for the financing asked from BSRS. The project paper or proposal is an integral part of the processing as the actual loan disbursement decision largely depends on the soundness of the report. The report paper should contain

- The proposed financial structure of the organization after the receiving of the financial assistance from BSRS.

- The allocation of funds from the financing opportunity.

- The forecasted company / organization accounts.

- Future payment method preference.

- Possibility survey and product line feasibility study.

- Market structure for the organization’s products.

- The administrative structure and future capabilities.

- Past and future forecasted growth rate of the profitability.

- Market share status and achievement report.

- Total overview of the company / organization operations.

- Current accounting methods.

- If previously any finance acquired, the name of the FI and the payment history.

In the interview the applicant is asked on these and other relevant issues focusing on the above noted issues. Then the applicant is asked to come back when the project proposal passes the investment board of BSRS’s approval.

- Final approval for BSRS financing:

If the board of BSRS finds the project proposal lucrative and feasible, it passes through the investment board. The applicant is asked to appear before the board for the final time and submit the final proposal regarding the financing interest rate and payment method. Here some distinct points are settled. They are –

- The interest rate set by the BSRS.

- The Payment method and period

- Whether BSRS holds steak in the new organization.

- If so, the applicant is asked to increase its capital by the financing and issue new shares on behalf of BSRS. BSRS follows a rule where the new organization is financed up to 49% of its working capital and 33% if the company or organization already has other institutionalized financing options received.

Upon the settlement of these factors, BSRS instructs the applicant to open a new account in any nationalized commercial bank and transfers the money ( Amount financed ) to the account. The account is jointly held by the applicant and BSRS.

6. ICT incubator Space allocation process:

In this segment if the company chooses to take part in ICT Incubator, the applicant has to apply formally to BSRS for allotment of space and take part in the ICT Incubator program. Upon application BSRS instructs the applicant to collect a separate application form from BASIS under BCC (Bangladesh Computer Council) for space allocation in ICT Incubator.

The form is given in the appendix

7. Receiving of the allotted space:

The ICT incubator form from BASIS should be taken from BSRS Bhaban, BASIS office in ICT Incubator. The paperwork that includes in this form are

- The trade license

- Registrar certificate

- Form of organization

- Required space, (Minimum 500 sft.)

- Vat/ TIN number.

After submitting the filled out form with all the paperwork, BCC evaluates the request and if accepted instructs BASIS to allocate space and necessary infrastructure to the applicant organization.

8. The final allotment:

After the space allotment the applicant organization has the choice to join BASIS, which enables the organization to receive added infrastructural and market support from BASIS. The applicant occupies the ICT Incubator space and informs BSRS about the allotment. The allottee should first pay BCC/BSRS 3 months rent in advance as required by the space taken.

Thus concludes the entrepreneurial financing process of BSRS/BCC/Basis ICT Incubator.

The flowchart of the financing process:

Critical Analysis of BSRS Investment process:

Though in truest sense, BSRS is one of the most prominent among the handful of financing options available for ICT companies, the financing process is not without its critics. A long process of finalizing the disbursement and sanctions makes BSRS ICT loans one of the costliest in the country. Also, BSRS deeply divides its ICT Incubator financing with its normal industry financing. The terms and conditions for ICT institutions on or off Incubator are distinctly different. The case stands, a company cannot achieve easy financing without participating ICT Incubator. On the other hand ICT Incubator loan consists of 3 organizations. BASIS for space allocation, BCC for Incubator participation and BSRS for Financing. The continuous and often unduly strenuous paperwork reduces the competitive edge of the participating companies.

On another somber note, even the normal financing rate and the Incubator financing rate also are different. Where a firm outside Incubator can be subjected to loan interest according to the Government’s industry policy, the Incubator participants have the opportunity to have reduced interest rates.

Reduced interest rate is not also without its demerits. It is often seen that the firms needing most ( Startups, Small Entrepreneurs ) are deprived while big names in ICT industry get the often reduced loan interest rate from BSRS. The time frame of the total allocation and financing process is too long to be comfortable for any enterprise. As the space allocation is overseen by BASIS and financing is overseen by BSRS any lagging in either part causes further time delay.The entrepreneurial View:

This report is rightly divided into two parts. In Entrepreneurial development, the first part focuses on the financier’s point of view, while the second part focuses on the entrepreneur’s perspective.

To emphasize and present the Entrepreneurial perspective as closely as possible, we have chosen an IT/ICT company that falls in the category of SME institution But have taken part in both BSRS and other FI financing and the ICT Incubator.

Fornix SOFT Ltd: An overview:

| Company Name | : | Fornix Soft Limited | ||

| Address | : | Shahara Monjil, 3/2 Lalmatia, Block C, Dhaka-1209, Bangladesh. | ||

| Telephone | : | (880-2)9122351, 011-804448 | ||

| Fax | : | (880-2) 8121000 | ||

| : | info@fornix-soft.com | |||

| Year of Establishment | : | 1998 | ||

| Sectors

| :

| Software Development and Marketing, Networking Design and Implementation, Hardware Marketing, Web and E-Commerce, Multimedia Authoring, IT Training. | ||

| Chief Executive Officer | : | Engineer Kazi Mah-dee Hasan, Managing Director | ||

| Employee Strength (2001) | : | Marketing Personnel Software Professionals Hardware Engineers Finance & Administration Personnel Total | : : : : : | 10 8 5 7 30 |

| Bankers | : | a) Standard Chartered Grindlays Bank Ltd. 2, Dilkusha Commercial Area Dhaka-1000, Bangladesh. b) Standard Chartered Bank Ltd. Dhanmondi 2, Dhaka-1209, Bangladesh. c) Sunali Bank Firmgate, Dhaka-1209, Bangladesh. d) BSRS Corporate Branch, Karwan Bazar, Dhaka – 1011 | ||

Fornix Soft Limited is the member of the following organizations.

- Bangladesh Computer Somity (BCS)

2. Bangladesh Association of Software Development and Information Services (BASIS)

3. Institute of EngineersBangladesh ( IEB )

Fornix Soft: Organizational structure:

From Inception to achievement: FORNIX SOFT

From the beginning of its outset, Fornix Soft Limited has taken up bold and innovative assignments in IT Sector. The company has emerged as a system integrator with a vision to develop customized and tailored software, Multimedia programming, Networking and Data Entry for domestic and international market. The other objective of the company is to incorporate advance level computer education & training with an intention to make the company instrumental in reducing the existing wide gap between huge demand and very low supply of the IT Professionals by creating skilled manpower in the IT field of the country. This would also help in recruitment of IT professionals and to develop a continuous process for development and keep abreast of latest technological advancement for the in-house professionals. Fornix Soft Limited (Training Division) has a computer education and training center at Dhanmondi, Dhaka for development of human resource in IT field. Since its inception the company has grown moderately into a medium sized organization employing over 20 professionals of Computer Science and other academic backgrounds.

Fornix Soft Limited has a set of experts who have proficiency in Database, graphics, multimedia and web based software. The IT professionals of the company has combination of educational qualification and years of experience in the field of information Technology which is very much required to implement successfully any sort of project from tailor made Database Software to establishment of LAN/WAN, Intranet and Internet systems. With the latest in-house equipment facilities, resources and project management skills, the company has the capability to undertake large ‘Turn-key’ software development projects, based on collection of information needs, feasibility study, design, development and implementation, comprising of distributed and heterogeneous data environment. Its primary objective is to be a One Stop IT Solution Provider, and is thus dedicated in providing services that enable its clients to meet their business goals and challenges through interactive information technology solutions and expertise in cutting-edge technologies. The driving policy is to meet customer satisfaction and build a lasting partnership with its clients. A team of experienced and budding professionals is the driving force of

Fornix Soft Limited and dedicated to make the enterprise IT enabled. The company believes every business should operate with cutting edge technologies to make its operation globally competitive and innovative. We are always interested to provide total solution for our subscribers. Whenever they needed for network based database application. We are providing the establishment of network connectivity and all the relevant hardware setup with the software application also using UTP, Co-axial and fiber Optic Module even VSAT and Microwave Linking for wide aria network if required.

Line of credit taken by Fornix Software & description:

| Year and source of Debt 0Finance | Amount | Portion in Total Debt (Relative to the year taken) | Utilization Sector | Repayment/ Provision | Rate |

| Sonali Bank (1998) | Tk.2,50,000 | 85% | Inception, Structure, Facilities, Equipment, recruiting | Nil (1997), Tk. 20000 periodical bi monthly after words | 9.75% |

| Standard Chartered Bank (2000) | Tk.2,00,000 (Not in cash but as VISA and MASTERCARD acceptance license on credit) | 5% | Business service expansion | Tk. 85,000 (1999) | 11.75% |

| BSRS (2001) | Tk.20,00,000 | 98% | Structural improvement, Equipment and expansion | Nil / 221,115 | 10.49% |

Fornix Soft Development and growth: form inception to date

[1] The last two phases in timeline can overlap each other bearing a total time frame of 10 -12 weeks.

Critical Analysis of Fornix Soft’s Performance in growth:

As one of the pioneers of Bangladeshi multimedia software arena, Fornix Softs growth is admirable. Unlike all other IT companies, Fornix Software’s growth was very rapid in the early years. From 1998 to 2000 it has achieved nearly the top spot in Bangladeshi retail software industry. But from 2000 it has changed its business process somewhat. By expanding its services horizon, Fornix decided to enter the international outsourcing market. Heavy structural changes and improvements followed.

The effect of the change in business strategy is yet to be seen. As the new quota less market shows startling promise ahead, the lack of proper support in the sector also poses a problem. The company never suffered difficulties in repayment of its loans while growing. All predictions points to a steady growth in near future.

Fornix can be termed as a small enterprise as not having employees over 100 persons. But in Bangladeshi ICT industry context it is a considerable achievement, as most of the outsourcing and programming/data entry jobs are handled by part timers in adhoc pay per work basis. Fornix took a bold step in not outsourcing its gathered jobs outside the firm to other local IT companies but attempt to provide total service in house.

Although Fornix’s admirable business strategy, in Bangladeshi context, where market does not always react to positive inputs, it remains also to be seen, how much the company can forward itself in the coming years.

A look in ICT entrepreneurial sector:

Problems, prospects and recommendations

Problems in financing for Bangladesh ICT SMEs:

Software industry is one of the essential components of IT industry with global market of US $ 276 billion in 1996. It is still largely dependent on human resources and some of the developing countries are taking advantage of this opportunity. India is one of the most successful countries in developing its software industry and in 1996, it generated revenues totaling US $ 3.20 billion (out of which export was around 40%), with an annual growth rate of about 70%.

The present size of software industry in Bangladesh is very small. Only a few firms are involved in export of software and data entry services, and the total volume of revenue generated is negligible. These factors can be identified as the major problems which are impeding the growth of software industry. These are summarized in the following tables under four functional areas:

o Fiscal

o Human Resource Development

o Infrastructure

o Marketing

A. FISCAL PROBLEMS

1. High rate of Duties & Taxes on Hardware and Software

2. Absence of export incentive

3. Absence of Domestic software industry

4. Complicated banking procedures

5. Bank borrowing rate is prohibitive

6. Difficulties in Customs clearance

7. Fund constraints for computer purchase

8. Absence 9. Absence of funds for market promotion

of sources of financing

10. Absence of funds for R&D

B. HUMAN RESOURCE DEVELOPMENT PROBLEMS

1. No strong Government agency for promoting growth of IT, particularly HRD.

2. Acute shortage of tutors

3. Graduates lack computer skills

4. Number of graduates in computer related subjects is very low

5. Course curricula for computer related subjects do not reflect market needs.

6. Quality control of computer training courses lacking

7. Low level of computer literacy

8. Facilities for high level training in IT inadequate.

9. Interaction between industry and academic lacking.

C. INFRASTRUCTURE PROBLEMS

1. No copyright protection for software, which deters

Foreign firms from out-sourcing from Bangladesh.

2. Facility for high speed data communication is limited.

3. Internet connection slow.

4. Internet connection expensive

5. No facility for video-conferencing

6. BTTB satellite communication links slow and expensive

7. Customs clearance at ports is time consuming

8. Lack of latest books, journals and manuals.

9. Association of firms involved in Software Development

and Data Processing Services does not exists.

10. Strengthen EPB’s role to support software export

12. Poor National telecom infrastructure

13. No communication hub in the country

14. Lack of mechanism for implementation, monitoring and

updating of policy for software export.

D. MARKETING PROBLEMS

1. Capability of Bangladeshis in software sector is not known

internationally.

2. Tendency to use pirated software deters foreign firms.

3. Domestic market is very small.

4. Efforts to market Bangladeshi ability/products lacking.

5. No organized publicity of capabilities of firms involved in software

development.

6. Difficulties in obtaining direct access to market.

7. No participation in international fairs, which provide opportunities for

marketing

8. No opportunity for exhibiting local software capabilities.

9. Marketing efforts in large software markets non-existent.

10. Information on Bangladesh IT professionals lacking.

11. Quality of Bangladeshi software developers unknown.

12. Opportunities for IT manpower not exploited.

The barriers in ICT SME financing in Bangladesh:

There are many integral barriers standing in the way of ICT SMEs today. As this report focuses on entrepreneurial development in ICT industry, the barriers have been divided in some logical segments. They are described below.

1. The Lack of Seed capital

One of the first and foremost barriers for ICT Industries in Bangladesh is the lack of seed money for ICT companies. As an unrealistic trend goes on here, where the fresher form IT related institutions are more interested in entrepreneurial steps more than the seasoned veterans, the obvious inexperience in the business field makes it very difficult for new start ups. Two of its more dominant features are

Idea generation, concept demonstration.

Nurturing startups

The first problem is with market worthy product design and new ideas. The entrepreneurs here lacks the proper knowledge of demonstrating a concept to financiers as well as have minuscule opportunity from the financier themselves for doing so. The other great problem is for the startups to nurture their institutions, i.e to ride out the potential loss in the first few quarters and gain experience to developed improved and business worthy strategies. The two reasons are interlinked as nurturing a startup often requires more work in the field of financing as well as idea generation.

2. Lack of Long-term capital

Our local ICT companies suffer most from the lack of long term capital. Though the current history in global economic scene encourages more financing in IT sector, Bangladesh is surprisingly different in this respect.

Banks and other Financial Institutions are legendary in their un-acceptance of an IT

Entrepreneurial idea. Despite having record growth rate in the region and all over the world the trend for Bangladeshi FIs are heartbreaking in the sense that more than 100% less productive sectors like real estate development is given more preference over IT entrepreneurships. Which originates these related problems for a startup.

a. Company level infrastructure development.

b. Process, technology and quality capacity development.

c. Human resource development.

d. Product development.

e. Business development.

f. Management capacity development.

3. Short-term capital

The same problems apply for this segment. As a highly dynamic field the sudden increase in working capital requirement is not unexpected. IT entrepreneurs in most cases fail to attract working capital finance which in turn makes them unable to meet client requirements and loose more money in turn. More on this genre are

a. Working capital against work orders.

b. Short-term loan dealing with cash-flow gap.

4. Capital for clients for sourcing software solutions.

The most profitable venture for IT companies is the growing mega market of outsourcing. Without unfettered financial support they fail to accept sourcing requirements from clients from abroad. The lack of capital here constitutes of Human resource development, working capital and outsourcing from within.

Sources of finance for ICT SMEs:

As this report focuses on the entrepreneurial development for IT sector the current possibilities for finance in this sector are also listed below.

Love money. ( In house investments accumulated by the entrepreneurs)

Public grants.

R&D, concept generation, company incubation.

Angel investors. ( Silent or sleeping partners, financing the project not operating it )

Loans from financial institutions.

Venture capital fund.

Capital market.

Current status of access to finance:

The current position or status is more or less discouraging for an ICT company. The current status for IT financing is listed below.

Limited availability of love money.

Limited availability of public grants.

Limited or non-availability of VCs.

Limited availability of institutional financial products.

Constraints in implementation of available products.

Causes of Current Status:

Causes of current status cannot be summarized in one point. During our preparations for this report, we came across some of the leading causes that proponent the current position or status in IT financing in Bangladesh. They are listed below.

Lack of awareness and confidence.

Weak capability of making the valuation of intangible assets of software companies.

Low risk management capability.

Lack of demonstration that substantial return could be obtained by investing in software (both in vendor and user levels).

Propositions:

This stalemate can be overcome by taking both short and medium term consideration for strengthening the current IT sector. In our view, they can be divided in two segments

a. The structural or integral change propositions and

b. The policy propositions

The structural or integral change propositions

To convince financial agencies to provide seed capital for startups.

To mobilize love money and angel investors.

To develop, promote and implement the guideline for making valuation of intangible assets of software companies.

To work with financial institutions for developing and offering financial products.

To encourage homegrown and international VCs.

To demonstrate that investment in software is low risk with the potential of high return.

Proposition on policies:

It is easily recognizable that it is not possible to implement all the recommendations at once, and that all the suggested measures are not needed at the same time. Therefore, recommended actions can be classified under ‘Short Term’ and ‘Medium Term’, depending on the priority and importance. (The time frame for Short Term should be in our view a year and for Medium Term 3 to 4 years). We feel that in the very rapidly changing scenario of IT Industry growth, it is very difficult to go for a longer time horizon.

The recommendations have been grouped under the following areas , the same way that the problems have been identified elsewhere in this report:

• Fiscal

• Human Resource Development

• Infrastructure

• Marketing

Short Term

Fiscal

a) To exempt Computer Hardware, Software, Peripherals, Communication Equipment, related components, and spare parts thereof, from Import Duty, VAT, Infrastructure Development Surcharge, Import License Fee, Advance Income-Tax etc.

b) To allow Tax Holiday for the export-oriented Software and Data Processing Services Industry, for 10 (ten) years (a unit will be considered export-oriented, if at least 70 % of its revenue comes from export).

c) To give a 15 % price advantage (i.e. “domestic preference”) to local Software developers over import of the same products.

d) To allow export of Software and Data Processing services through Sales Contract, instead of Letters of Credit.

e) To bring the Bank interest rate on loans / advances / overdraft down to the level applicable to other export-oriented thrust sectors.

g) To create a Special Fund to be administered by the Ministry of Science and Information & Communication Technology for giving interest-free loans to teachers and students for purchase of computers and related equipment, through financial institutions who should be reimbursed with the interest lost.

h) To create a Venture Capital Fund of at least Tk.10 Crore at Export Promotion Bureau for equity participation in export-oriented Software and Data Processing Services Companies.

Human Resource Development

a) To introduce ‘Basic Computer Skills’ as a Compulsory Subject for all students in all Universities of the country at Graduation level, starting from 1998.

b) To introduce ‘Computer Science Department’ in all Polytechnics, BITs, Universities and selected Colleges, with at least 50 seats per class per year per institute.

f) To empower Bangladesh Computer Council to develop a national examination and certification system for the private IT Training institutions, to give Certificates to those passing such examinations, and to encourage employers of both Government and Private Sectors to give preference to such Certificate holders for jobs.

Infrastructure

a) To enact appropriate laws for the protection of Intellectual Property Rights, as required under the WTO Charter.

b) To set up low-cost high-speed data and voice communication link with the USA and the UK, with a minimum speed of 2 Mbps. Private Sector should be allowed to provide such service along with BTTB.

c) To set up an Internet Node in the country.

d) To make Internet connectivity available at affordable rate, not exceeding Tk.0.50 (fifty paisa) per minute of use.

e) To make Video Conferencing facility available through VSAT.

f) To allow Private Sector to set up their own Satellite Communication links in order to obtain competitive price advantage and greater availability of Communication facilities.

g) To create separate Cells at Chittagong, Dhaka, Kamalapur and Benapole Customs Houses to handle all incoming and outgoing equipment / documents /data media of export-oriented IT Industry, so as to ensure clearance of such equipment / documents within 24 hours.

h) To create a Central Resource Center at Bangladesh Computer Council with current Books, Magazines, Periodicals, Software, Manuals etc. on IT related subjects.

i) To encourage software firms to form an association primarily to protect the interest of the Software and Data Processing Services Sectors, in line with NASSCOM, ASOCIO, WITSA, JISA etc.

j) To assign one Assistant Director of Export Promotion Bureau for this sector on a full time basis.

Marketing

a) To arrange meetings/seminars in selected locations in USA with a concentration of IT Professionals of Bangladeshi origin (e.g. Silicon Valley, California, USA) to inform them about the incentives being provided by GOB and mobilize their support to help Bangladeshi entrepreneurs. These meetings should be addressed by policy makers/high officials/IT professionals representing GOB.

b) To ban use of all pirated Software in all organizations, both in the public and private sectors.

c) To encourage all Government, Semi-Government, Autonomous organizations, Sector Corporations, Banks, Insurance Companies etc. to replace the manual system of documentation and records by Computerized system through the use of locally developed Customized Application Software.

d) To send Marketing Missions to North America / E. U. consisting of Members from IT Associations and EPB, on a regular basis, with a view to publicizing Bangladesh Software and Data Processing Services capabilities as well as establishing personal contacts with the prospective customers.

f) To explore the possibility of obtaining business on sub-contract basis from the suppliers of Software and Data Processing Services in India, Sri Lanka and the Philippines etc.

g) To empower Export Promotion Bureau to ensure regular participation in all major International Exhibitions / Fairs for IT products and services.

h) To ask the concerned Trade Associations to organize International Exhibitions / Fairs in Bangladesh for IT products and services, in collaboration with Export Promotion Bureau.

In recent years, like other developing countries of the world, Bangladesh has been focusing attention on the most disadvantaged group in the society – the women. Realization has gradually dawned on all concerned that a society cannot afford to waste half of its human resources by discrimination on grounds of sex. This increasing awareness on the part of the government has led to the adoption of national policies to facilitate a development process involving women in all spheres particularly in economic activities focusing especially on entrepreneurship development. The overwhelming majority of women in Bangladesh are not only poor, but also caught between two vastly different worlds — the world determined by culture and tradition that confines their activities inside family homesteads, where they are regarded more as a commodity necessary only for bearing and rearing children and the world shaped by increasing landlessness and poverty that focus them outside into various economic activities for survival. In Bangladesh, the women entrepreneurs, who have accepted the challenges of life and have emerged as leaders in the socio- economic development, earn for themselves and for their families or contributing towards the socio- political upliftment of the women. In our country women lack assistance is in the access to credit, provision of skill training, and market facilities.

Women entrepreneurship in the rural industries is a new arena in the socio- economic environment of Bangladesh. In view of the need to bring the rural womenfolk in the development stream of the country, both the Government, the NGOs and other related agencies have provided ample opportunities to promote entrepreneurial skill among women. Income- generating activities, credit facilities, skill training, market opportunities have all combined to pave the way for the emergence of entrepreneurial development among women in rural Bangladesh.

Women have achieved good prospects in industry, especially the small and cottage and micro-home-based ones. Their present involvement in manufacturing and in the recent trends of their involvement in construction activities in growing numbers is likely to continue. Women have emerged as exporters and their control of export- oriented industries, are promising areas for enhanced female participation and employment. Women’s growing involvement in the construction of civil works gives evidence to their potential regarding market growth opportunities and should be encouraged. To stimulate female entrepreneurship and create further employment opportunities, training programs for relevant issues, need to be provided to women currently in business. Where women have access to market information and display of products they can increase their business acumen, especially with respect to demand for a wide- range of products they might choose to produce.

Types of Production Units and Trades include the common small scale production units such as Handicrafts with various types of raw materials, Handloom Weaving & Spinning, Basketry, Mat making, Manufacture of Coir products. Fishing Net making, Paddy husking by Dheki, Oil production by Ghani, Jute production and sale, Jute goods production. Pottery, Cane and bamboo products, Seri culture, Silk weaving, Honey Making, Screen print & Batik, Embroidery, Dressmaking. Tailoring, Puffed Rice Making, Food production( packed or retail sale of dry food), Food Processing, Wood craft & Furniture, Molasses making, Biri( indigenous cigarette made with special leaves) production, Milk production units, dairy and milk products, Dyeing and printing, Book Binding, Confectionery, Urea Molasses Block( cattle feed) etc., Nursery and Horticulture production. Kitchen gardening, poultry rearing( sale of eggs, poultry, chicks), goat and sheep rearing, cattle fattening are common agro- based occupations.

Women entrepreneurs should be provided special facilities to develop their enterprises. These include:

(1) Development Banks with separate advisory service cell for women;

(2) Separate counters in counters in commercial banks for women;

(3) Arrangement of exclusive fairs to promote products manufactured by small & cottage based units;

(4) Fixed quota of stalls for women entrepreneurs at export fairs;

(5) Special market facilities both in the domestic and the international arena.

Government resources are limited. Infrastructure development and other broad sectors of economy demand and consume major share of the national development budget. It is thus sometimes said that poverty alleviation goal receives more palliatives than substance. In face of things as they stand, both the GOs and the private sector have a major responsibility to promote entrepreneurship development for women. Without that the advancement of women will remain a far cry.

Role played by BSRS for women entrepreneur development:

On behalf of the government BSRS has arranged some policies and schemes to promote the development of women entrepreneurship. Very few women entrepreneurs have so far taken loan from BSRS. This is due to the loan granting process and the formalities that are required to meet make a bit difficult for women to get the loan amount. However BSRS with the help of some other NGOs’ has taken initiatives such as:

(1) Setting up of a Women Entrepreneurship Development Cell;

(2) Identification of women entrepreneurs of Bangladesh;

(3) Planned Publication of a directory of women entrepreneurs with their

addresses, forms of business, products manufactured etc.;

(4) Organizing entrepreneurship development training;

(5) Co-organizing convention of women entrepreneurs, discussion meetings on the problems and prospects of women entrepreneurship in Bangladesh in the grass root level

(7) Arranging market opportunities.

Women in ICT: Bangladesh View:

General perception of ICT sector comes as a non discriminatory sector. With intellectual labor as its capital, ICT can become as a magic wand to disseminate all inequality.

This year marks (March 08) the 96th International Women’s Day (IWD). Pursuant to the declaration by the Socialist Party of USA, the first National Women’s Day was observed across the United States on February 28, 1909. But in the 2nd International Conference of Socialist Women, held in Copenhagen in 1910, it was resolved to observe an annual women’s day as a uniform international action. The date was nominated in recognition of the United States’ Garments workers’ demonstration, which was held on March 08, 1857. The purpose of the demonstration was to increase the wage and reduce the working hours of the Garments workers. Government of Bangladesh started to observe the International Women’s Day since March 08, 1984.

International Women’s Day stands for equality between women and men. During International Women’s Year in 1975, International Women’s Day was given official recognition by the United Nations and was taken up by many governments throughout the world. International Women’s Day is a time to reflect on progress made to call for change and to celebrate acts of courage and determination by ordinary women who have played an extra ordinary role in the history of women’s rights.

In our country also women are being seen in frontlines to fight against hunger, poverty and environmental degradation. So, on this day, let us think about empowering women also through ICT (Information and Communication Technology). Because it is an essential part like other goals for winning the fight in the lives of women. It will increase resources in their hands to be self reliant and empowered and reduce discrimination against them. It is a part of placing their issues at the forefront of policy action.

Micro-credit for self-employment empowers women’s decision-making capacity. Likewise, an amount of money, which women need to be ICT experts and to establish ICT firms, will help them earn more money and to be more empowered. 2005 has been declared as the Year of Micro Credit by the United Nations.

This is why Government of Bangladesh as well as the non governmental organizations (NGOs) should start to distribute small loans among interested women to encourage them to be self-reliant by learning and working in ICT sector. The third of the Millennium Development Goals (MDGs) of the United Nations is to achieve gender equality and empower women. It seeks to rectify the disadvantages through policies and programmes which build women’s capabilities, improve their access to economic and political opportunity guaranteeing their safety. So, ICT will definitely play a supportive role to reach this goal soon.

How can ICT help women?

ICT can benefit women in many ways. It can facilitate their participation in different sectors and different regions. It can provide the information women need to improve their own well-being and that of their families. The introduction of computers into offices has improved the quality of work and scope for women in data entry, analysis, programming, clerical and administrative occupations. More over ICT allows them to exchange views, opinions and information so much, which may not be possible through other media.

ICT has a strategic link with poverty reduction. The Internet, email and mobile phones top the list of new tools. ICT can directly empower women as well as the poor people by offering access to services historically unavailable to them because of high cost or lack of infrastructure, particularly in rural areas. Now buying-selling or renting ICT equipment itself is a source of income. Mobile phone has already ushered in such income among many a rural woman in Bangladesh. The computer training institutes in our country should set the course curriculum in accordance with the need and demand of our country. Access to the Internet is still very limited for several reasons, like poor teledensity, poor electricity, poor affordability of computer and knowledge about the Internet. Public Internet access is very limited in the private telephone canters and cyber cafes. Though the divisional headquarters and some district towns have access to Internet, but the commercial use of Internet is limited due to the bandwidth limitation. Despite the rapid fall in the cost of the Internet services, it is still high for the general people and students. That is why it is necessary that,

*Access to Internet exchange should be at par throughout the country.

*A high-speed national data network for the country connecting all important cities, district headquarters and important upazilas should be established. BTTB’s upazila level Internet project should be implemented.

*Technical assistance from internationally reputed companies should be sought to build proper networking infrastructure throughout the country. The relationship with International Telecommunication Union (ITU) should be strengthened for reducing digital divide.

*Proper use of Global Information Superhighway should be ensured.

*All schools, colleges and universities should be brought under Internet network. This is an emergency programme to be initiated earlier. As a result women from rural areas will be able to get access to use of Internet as well as to be trained up on ICT.

Access to ICT at university level has achieved a very limited success. The ICT penetration in primary, secondary and higher secondary level is not satisfactory at all. Only a limited number of urban schools and colleges have ICT facilities for education purpose. There is a huge mismatch between the market demand and the courses offered. We do not produce adequate number of qualified ICT professionals in our educational and training institutions to cater to domestic demand. The migration trend of quality ICT professional is alarming. So, we should:

*Implement education programme in software engineering, computer communication and multimedia with curriculum that incorporates the latest technology.

*Introduce ‘basic computer skills’ as a compulsory subject for all students at Intermediate and Graduate level.

*Polytechnics and other training institutes should offer diploma in ICT.

*Unemployed girls, women and youth should be encouraged and given priority for ICT training courses vis-à-vis market demand.

*Diploma and trade courses should be introduced in distance education system through ICT network under Open University.

* A national specialized training of teachers centre should be established for solving the problem of acute shortage of quality teachers in ICT.

* Female students and teachers of university and colleges should get free or subsidized access to Internet.

*All universities and higher educational institutions should be networked for better access to knowledge and information.

*Primary and secondary level education should be emphasized for long run return in ICT industry.

*More training institutes on ICT for the girls and women should be established. Poor and meritorious students, unemployed girls, women should be given free of cost training, accommodation, training materials etc.

* After completion of training, bank loan may be offered to them on easy terms to set up cyber café or computer, training institute in urban and rural areas.

*’JAWS’ talking software can be given free of cost from the educational institutes or Govt. offices to the visually impaired female and male students as well as the normal software to the disabled students.

*Govt. of Bangladesh, BTTB as well as the mobile phone companies in our country should encourage more unemployed women to run business of phone, FAX, computer compose, etc.

ICT policy : Women Issues

Honorable Prime Minister has already declared ICT as the thrust sector. The ICT policy aims at building an ICT-driven nation comprising of knowledge-based society by the year 2006. According to the ICT policy, to implement the target areas, we should work hard from now and take necessary initiatives earlier. On the other hand, more female IT professionals should be encouraged to join in accomplishing the policy and to reach the goal of ICT also as a part of opening and building up their carrier.

Conclusion

To be kept focused on the subject of entrepreneurship during the course of this report was one of the most rewarding experiences. As we took BSRS to portray the investor outlook on entrepreneurship, in our view, a rare glimpse inside the corporate mindset toward SME entrepreneur development has been unveiled. We have explored both the entrepreneurial and the facilitator viewpoints as we have also introduced Fornix Soft Ltd. As a case study to see the results of BSRS financing in entrepreneurship. We tracked the growth of Fornix Soft. We connected the reality with the theory of entrepreneurial development that we studied in this course, in the critical analysis section. We have also tried to analyze the performance of BSRS by introducing numerical data for the past 6 years. We explored their loan disbursement/recovery performance critically.

In this paper we focused on the ICT industry. As we were to produce this report on SME entrepreneurial development, our view of ICT industry both as a thrust potential industry and an industry consisting SMEs largely made us focus on that. We also explored the participation of women issue in view of the ICT industry. At the end, we followed the market trend and tried to piece together a case in point of the prospects and barriers; and propositions for the ICT industry for entrepreneurial development.