EXECUTIVE SUMMARY

The Dhaka Stock Exchange is the prime bourse of the country. Through its nonstop highly fault-tolerant screen based automated trading system, the exchange can offer facilities for transparent and highly efficient mechanism provisions for secondary market activities of shares, debentures and wide varieties of other securities. The Management of the Exchange is vested with the Board of Directors comprising 12 Members elected from the shareholders of DSE, 12 non-elected independent Directors representing different Institutions, Chambers and professional bodies and the CEO.

The overall operations of the exchange are run by a team of qualified executives. The bourse at present offers trading facilities for 310 securities worth Tk. 323.37 billion which accounts for 6.71% of the GDP of the country. The Dhaka Stock Exchange is the rallying point for enterprises to raise capital in Bangladesh. With a nationwide coverage by 230 brokers and dealers, DSE espouses shared vision of Bangladeshi business all over. The exchange maintains the lead in providing a launching pad for mobilizing savings of the public

1. INTRODUCTION

There are two stock markets in Bangladesh, one is named Dhaka Stock Exchange (DSE) in Dhaka and another one is called Chittagong Stock Exchange (CSE) in Chittagong. A central regulatory agency which is the Securities and Exchange Commission (SEC) overseeing the activities of the entire capital market including issue of capital, monitoring the issue of stocks, and operation of the stock markets. The number of listed companies in DSE are 378 of which are shares, 11 debentures, and 9 mutual funds. The listed companies in CSE are 232 with shares, 14 mutual funds and 1 debenture.

1.1 Objective

1. To provide the information of a full range of investment products- including stocks, bonds, mutual funds, and CDs available in Dhaka Stock Exchange.

2. To provide investment advisory and financial planning information- including sales, research, underwriting and trading for individuals and institutions.

1.2 Methodology

To attain the above stated objectives, we collected information about Dhaka Stock Exchange from internet. We also took some help from the Annual Report of DSE 2008.

1.2.1 Sources

We mainly used secondary source of data to conduct this report. Most of the information is collected from the internet. We also took some help from the annual report of Dhaka Stock Exchange 2008. We tried our level best to collect and present the latest information about DSE. The information that had been collected is till December 31st 2008.

1.2.2 Analysis Plan

At first we gathered at most information we can get about Dhaka Stock Exchange. Then we selected the data that are of use for this report. We divided the whole report into five parts and each of our group members was given a part to accomplish. After that we combined the five parts together and made the final report.

1.3 Scope

As we had a secondary data source, our scope was limited into website based information. For our limited time frame any physical interview was not possible.

1.4 Limitations

Mostly we relied on some websites containing information about Dhaka Stock Exchange. We collected a large part of information of this report from them. We could not verify the validity of all information. Invalid information can be there. This limitation lessens the possibilities of getting up to date information about our report topic. Limited time frame had become a limitation too. We could give more up to date and verified information if we would have more time.

2. DHAKA STOCK EXCHANGE

The necessity of establishing a stock exchange in the then east Pakistan was first decided by the government when, early in 1952.it was learnt that the Calcutta stock exchange had prohibited the transactions in Pakistani shares and securities. The provincial industrial advisory council soon thereafter set up an organizing committee for the formation of a stock exchange in East Pakistan. A decisive step was taken the second meeting of the organizing committee held on the 13th March, 1953. in the cabinet room, Eden building, under the chairmanship of Mr. a. Khaleeli, secretary government of east Bengal, commerce, labor and industries department at which various aspects of the issue were discussed in detail. The then central governments proposal regarding the Karachi stock exchange opening a branch at Dhaka. , did not find favor with the meeting who felt that East Pakistan should have an independent stock exchange. It was suggested that Dhaka Narayanganj chamber of commerce & industry should approach its members for purchase of membership cards at rs.2000 each for the proposed stock exchange. The location of the exchange it was thought should be either Dhaka Narayanganj or Chittagong. An organizing committee was appointed consisting of leading commercial and industrial personalities of the province with Mr. Mehdi Ispahani as the convener in order to organize the exchange.

The chamber informed its members and members of its affiliated associations of the proceedings of the above meeting, requesting them to intimate whether they were interested in joining the proposed stock exchange. This was followed by a meeting, at the chamber of about 100 persons interested in the formation of the exchange on 07.07.1953. The meeting invited 8 gentlemen to become promoters of the exchange with Mr. Mehdi Ispahani as the convener and authorized them to draw up the memorandum and article of association of the exchange and proceed to obtain register under the company’s act.1913. The other 7 promoters of the exchange were Mr. J M Addision-Scott, Mr. Mhodammed Hanif, Mr. A C Jain, Mr. A K Khan, Mr. M Shabbir Ahmed and Mr. Sakhawat Hossin.

It was also decided that membership fee was to be rs.2000 and subscription rate at 15 per month. The exchange was to consist of not more than 150 members. A meeting of the promoters was held at the chamber on 03.09.1953 when it was decided to appoint or Dignam & co., solicitors to draw up the memorandum and articles of association of the stock exchange based on the rules of stock exchange existing in other countries and taking into account local conditions.

The 8 promoters incorporated the formation as the East Pakistan stock exchange association ltd. on 28.04.1954. As public company on 23.06.1962 the name also revised to East Pakistan stock exchange ltd. again on 14.05.1964 the name of East Pakistan stock exchange limited was changed to “Dhaka stock exchange ltd.”

At the time of incorporation the authorized capital of the exchange was rs. 300000 divided into 150 shares of rs. 2000 each and by an extra ordinary general meeting adopted at the extra ordinary general meeting held on 22.02.1964 the authorized capital of the exchange was increased to Tk. 500000 divided into 250 shares of Tk. 2000 each. The paid up capital of the exchange now stood at tk.460000 dividend into 230 shares of Tk. 2000 each. However 35 shares out of 230 shares were issued at Tk. 80, 00,000 only per share of Tk. 2000 with a premium of Tk. 79, 98,000.

Although incorporated in 1954, the formal trading was started in 1956 at Narayanganj after obtaining the certificates of commencement of business but in 1958 it was shifted to Dhaka and started functioning at the Narayangonj chamber building in Motijheel c/a.

On 1.10.1957 the stock exchange purchase a land measuring 8.75 kattah at 9f Motijheel c/a from the government and shifted the stock exchange to its own location in 1959.

3. LEGAL CONTROL

The Dhaka Stock Exchange (DSE) is registered as a Public Limited Company and its activities are regulated by its Articles of Association rules & regulations and bye-laws along with the Securities and Exchange Ordinance, 1969, Companies Act 1994 & Securities & Exchange Commission Act, 1993.

4. FUNCTION OF DSE:

The major functions are:

– Listing of Companies. (As per Listing Regulations).

– Providing the screen based automated trading of listed Securities.

– Settlement of trading.(As per Settlement of Transaction Regulations)

– Gifting of share / granting approval to the transaction/transfer of share outside the trading system of the exchange (As per Listing Regulations 42)

– Market Administration & Control.

– Market Surveillance.

– Publication of Monthly Review.

– Monitoring the activities of listed companies. (As per Listing Regulations).

– Investors grievance Cell (Disposal of complaint bye laws 1997).

– Investors Protection Fund (As per investor protection fund Regulations 1999)

– Announcement of Price sensitive or other information about listed companies through online.

5. CLEARING AND SETTLEMENT MODULE

The Clearing and Settlement module provides the management of trade from the point of entry into the Settlement Pool trade database until it has been delivered, settled and removed from the Settlement Pool. It consists of three major business processes.

5.1 Clearing: participant trade reporting, affirmation, billing and assigning settlement instructions.

5.2 Settlement: the process of overseeing that delivery of all instruments to the buyer and payment of all moneys to the seller has occurred before removing the trade from the settlement pool.

Regulation 4 of the Settlement of Stock Exchange Transactions Regulation 1998 has been given effect time to time. A new directive was made by SEC dated on 18th March 2003 “Adjusted due position mechanism for settlement of scrip only as provided by regulation 4(1) of settlement of Stock Exchange Transaction Regulations, 1998 shall remain suspended from 19th March 2003 until further order”.

6. CURRENT SITUATION OF DSE IN CLEARING AND SETTLEMENT PROCESS

The Clearing and Settlement module provides the management of trade from the point of entry into the Settlement Pool trade database until it has been delivered, settled and removed from the Settlement Pool. It consists of three major business processes.

6.1 Clearing: participant trade reporting, affirmation, billing and assigning settlement instructions.

6.2 Settlement: the process of overseeing that delivery of all instruments to the buyer and payment of all moneys to the seller has occurred before removing the trade from the settlement pool.

Regulation 4 of the Settlement of Stock Exchange Transactions Regulation 1998 has been given effect time to time. A new directive was made by SEC dated on 18th March 2003 “Adjusted due position mechanism for settlement of scrip only as provided by regulation 4(1) of settlement of Stock Exchange Transaction Regulations, 1998 shall remain suspended from 19th March 2003 until further order”.

7. INSTRUMENTS

Here is a complete picture of the settlement system for all of our 378 Instruments in Five (5) groups in the Four (4) markets.

A Group: Number of Instruments are 164 (142 + 8D + 14M), Here D for Debentures, M for Mutual funds & TB for Treasury Bonds (Trading in Public, Block & Odd-lot Market with trade for trade settlement facility for scrip only through DSE Clearing House.

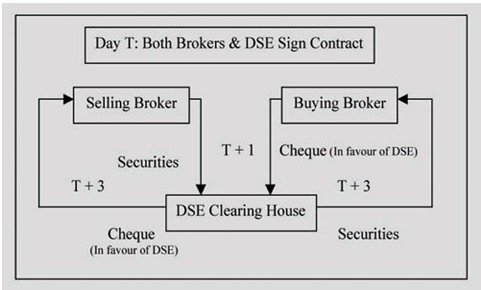

The above cycle is valid for A, B, G & N category instruments traded in Public, Block & Odd-lot market.

B Group: Number of Instruments are 18 (Trading in Public, Block & Odd-lot Market with trade for trade settlement facility through DSE Clearing House on T+1, T+3 basis). “B” and “DB” are marked in BASES columns for Non-Demit & Demit instrument respectively in our TESA Trading software.

G Group: Number of Instrument is 1 (Trading in Public, Block & Odd-lot Market with trade for trade settlement facility through DSE Clearing House on T+1, T+3 basis). “G” and “DG” are marked in BASES columns for Non-Demit & Demit instrument respectively in our TESA Trading software.

N Group: Number of Instrument is 14 (Trading in Public, Block & Odd-lot Market with trade for trade settlement facility through DSE Clearing House on T+1, T+3 basis). “N” and “DN” are marked in BASES columns for Non-Demit & Demit instrument respectively in our TESA Trading software.

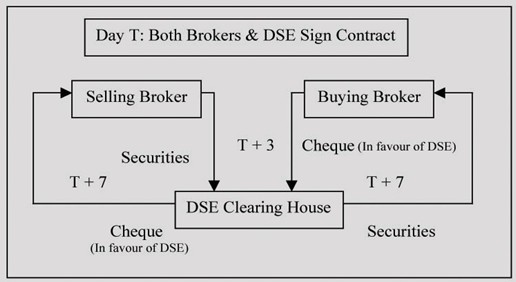

Z Group: Number of Instruments are 97(Trading in Public, Block & Odd-lot Market with trade for trade settlement facility through DSE Clearing House on T+3, T+7 basis). “Z” and “DZ” are marked in BASES columns for Non-Demit & Demit instrument respectively in our TESA Trading software.

This cycle is valid only for Z group instruments traded in Public, Block & Odd-lot market.

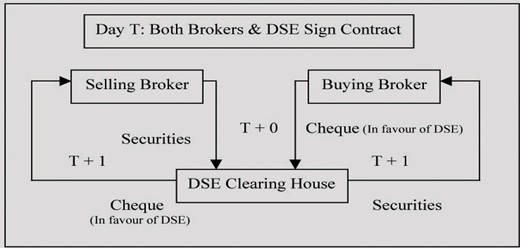

7.1 Instruments Of All Groups Traded In Spot Market:

The above cycle is valid for A, B, G, N and Z category instruments traded in spot market.

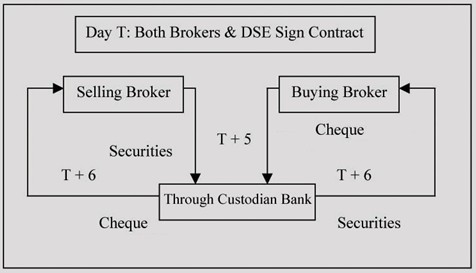

7.2 Instruments of Foreign Trades (DVP) Of All Groups:

The above cycle is valid for A, B, G, N and Z category instruments of foreign trade.

7.3 Remarks:

* If any instrument declared as Compulsory Spot then Trades of Block and Odd-lot market of that Instrument will be settled like Spot Market.

* Howla Charge, Laga Charge & Tax are always payable to DSE at Pay-In date for both Buyer and Seller traded in Public, Block & Odd-lot Market.

* Howla Charge, Laga Charge & Tax are always payable to DSE at T+1 day for both Buyer and Seller traded in Spot Market.

* Outside-Of-Netted settlement for “A” Group instrument has been withdrawn from 10th Dec 2006.

* DVP Trades are Off-Market Settlement (Broker to Broker).

8. SETTLEMENT FOR DIFFERENT CATEGORIES INSTRUMENTS

01) For A group Instruments:

Market name Trade for Trade System Settlement & Settlement Period

| Public | Trade for Trade * | T+1 & T+3 |

| Odd + Block | Trade for Trade | T+1 & T+3 |

| Spot | Trade for Trade | T+0 & T+1 |

02) For B group Instruments:

Market name Trade for Trade System Settlement & Settlement Period

| Public | Trade for Trade * | T+1 & T+3 |

| Odd + Block | Trade for Trade | T+1 & T+3 |

| Spot (Before Book-closer) | Trade for Trade | T+0 & T+1 |

03) For G group Instruments:

Market name Trade for Trade System Settlement & Settlement Period

| Public | Trade for Trade * | T+1 & T+3 |

| Odd + Block | Trade for Trade | T+1 & T+3 |

| Spot (Before Book-closer) | Trade for Trade | T+0 & T+1 |

04) For N group Instruments:

Market name Trade for Trade System Settlement & Settlement Period

| Public | Trade for Trade * | T+1 & T+3 |

| Odd + Block | Trade for Trade | T+1 & T+3 |

| Spot (Before Book-closer) | Trade for Trade | T+0 & T+1 |

* As netting system for shares has withdrawn, for A, B, G & N group instrument, member will have to deposit the full shares at the DSE on T+1 after selling the shares, In case of purchasing such shares, the buyer will have to deposit the Balanced (Netted) money traded in Public, Block & Odd-lot market at the DSE on T+1.

05) For Z group Instruments:

Market name Trade for Trade System Settlement & Settlement Period

| Public | Trade for Trade * | T+3 & T+7 |

| Odd + Block | Trade for Trade | T+3 & T+7 |

| Spot (Before Book-closer) | Trade for Trade | T+0 & T+1 |

** Under the Trade for trade settlement system, member will have to deposit the full money at the DSE on T+3 after purchasing the shares, In case of selling such shares, the seller will have to deposit the full shares at the DSE on T+3.

9. CURRENT SITUATION OF DSE IN TRADING PROCESS

TESA conducts trading in-4-phases.

9.1 Enquiry: In this session Brokers can logon to the system. No order will be submitted in this session. No trade will be executed. Only previous orders can be withdrew in this session

9.2 Opening: The Opening is a pure, single-price auction. All buy and all sell orders are compared and calculate the open-adjust price. No trades will be executed in this session

9.3 Continuous Trading: During this phase, participants enter orders and immediate execution or for inclusion in the book. Automatic matching and execution takes place based on best price/ first in, first out trading rules

9.4 Enquiry: Closing prices are calculated and disseminated to market participant. Market will be closed in this session & other facilities like the previous enquiry sessio

10. DISCLOSURE REQUIREMENT OF LISTED COMPANY

The listed companies are required to submit

– Yearly Audited Financial Statement within four months from the year end.

– Half-yearly un-audited financial statement within one month from the date of half year ends.

– Disseminating Price Sensitive information within 30 minutes of making any price sensitive decision or Occurrence of price sensitive event.

It is mandatory to follow the following standards in preparation of the accounts

– International Accounting Standards (IAS)

– International Standards for Auditing (ISA).

11. LISTED SECURITIES

The Listed Securities Including Mutual Funds, Debentures and Bonds in the DSE number 298 as on December, 2006. Apart from 310 listed companies including 137-A Category, 32-B Category, 1-G Category 94-Z Category and 4-N Category Companies, there are 13-Mutual Funds, 8-Debentures and 34-Bonds in the Stock Exchange. The Listed Companies are divided into 18 sectors. Of them 1-Bank, 2-Investment, 3-Engineering, 4-Food & Allied Products, 5-Fuel & Power, 6-Jute, 7-Textile, 8-Pharmaceuticals & Chemicals, 9-Paper & Printing, 10-Services & Real Estate, 11-Cement, 12-Information Technology, 13-Tannery, 14-Ceramics, 15-Insurance, 16-Debenture, 17-Miscellaneous and 18-Bonds.

12. SHARE ORGANIZATION: A, B, G, Z & N

The prime bourse of the country introduced “Group A” and “Group B” from July 2, 2000 based on its financial strength and performance to give clear information to investors for taking informed decision. DSE has further categorized the securities by introducing “Group Z” which came into effect from September 26, 2000. The Stock Exchange introduced another company category “Group G” on June 30, 2002. The categorization helps a lot the investors in choosing companies before making investment decision. N Category- the newest one was launched through an order of SEC on July 3, 2006.

13. CRITERIA OF THA SHARE CATAGORY

“A’ Category Companies: Companies which are regular in holding the Annual General Meetings and have declared dividend at the rate of 10 percent or more in a calendar year. (Mutual Funds, Debentures & Bond are being traded in this Category)

“B’ Category Companies: Companies which are regular in holding the Annual General Meetings but have failed to declare dividend at least at the rate of 10 percent in a calendar year.

“Z’ Category Companies : Companies which have failed to hold the Annual General Meetings or failed to declare any dividend or which are not in operation continuously for more than six months or whose accumulated loss after adjustment of revenue reserve, if any, is negative and exceeded its paid up capital.

“G’ Category Companies: Greenfield Companies.

“N’ Category Companies: All newly listed companies except Greenfield companies will be placed in this category and their settlement system would be like B-category companies.

| Clearing and Settlement 1. For A,B, G and N Group Instruments Market Name

Public Spot Odd + Block 2. For Z Group Instruments Public Odd + Block Spot (Before Book-Closer) Foreign delivery Vs payment (DVP) transaction are settled in | Trade for Trade System (for scrip only)

Trade for Trade Trade for Trade Trade for Trade

Trade for Trade Trade for Trade Trade for Trade | Settlement & Settlement Period

T+1 &T+3 T+1 T+1 &T+3

T+3 & T+7 T+3 & T+7 T+1 |

| Key Market Segments Public Market

Trading Lots

Block Market

Odd Lot Market

Foreign Transaction | :

:

:

: : | For General Trading of Securities Spot Market : For pre-book closer trading

Market lots vary from 1 share to 500 shares depends at par value.

Block Market transaction involved trading of Tk. 0.5 million or above. Any transaction for odd lot. May be exerted using custodial banks (Standard Chartered Bank, HSBC & City Bank NA) through DVP process (delivery vs. payment) |

14. TRADING SESSION

| Trading Session

Trading at DSE, is performed through a Non-Stop Platform in following sessions : Continuous Trading Hours : 10.00 am to 2.00 pm Trading Day : Sunday to Thursday. |

15. CONCLUSION

Dhaka Stock Exchange is most important issue for our country progress. We can not ignore its importance in the economic part of our country. In our report we try our level best to highlight the specific section of Dhaka Stock Exchange which are cleaning & settlement & trading of this business. Here we mention all the possible advantages& disadvantages in trading & settlement of DSE.

The Dhaka Stock Exchange (DSE) is registered as a Public Limited Company and its activities are regulated by its Articles of Association rules & regulations and bye-laws along with the Securities and Exchange Ordinance, 1969, Companies Act 1994 & Securities & Exchange Commission Act, 1993.

It also helps to do different kind of investing relationship: what really makes us different? It’s our underlying commitment to you-the individual investor- putting your interest first and doing what we can to help you to be successful.