EXECUTIVE SUMMERY

The internship is the linkage between the theoretical knowledge and real life experience. It is designed to have a practical experience while passing through the theoretical understanding. This report aims toward providing an overview on the Account Opening Procedure of Banking system practiced in Jamuna Bank Limited. The report is the result of 3 months of internship program with Jamuna Bank Limited.

The objective of the study and importance of the report have been enlisted in chapter one Methodology used in preparing this report is also a content of this chapter. Both primary and secondary data and information have been used in preparing this report. Like all study, this report has also certain limitations.

Chapter two portrays the profile of whole Jamuna Bank Limited. Jamuna Bank Limited started its operation in the year 2001, 3rd June with an authorized capital of Tk. 2900 Millions. Ensuring highest standard of clientele services through the best application of latest information technology is the vision of this bank.

Chapter three is the description of the profile of Jamuna Bank Limited Motijheel Branch.

Chapter four describes the internship position and duties in Jamuna Bank Limited Chapter five is the analysis on the overall findings of Jamuna Bank Limited and the bank is a heavy performer of account opening services. The main body of my report deals with the account opening procedures of JBL. Accounts Opening Procedure of Jamuna Bank Limited “is performing its account opening procedures in a standard way. It deals with all the legal formalities.

Chapter six is fully description of SWOT analysis

Finally, seven, is the conclusion and suggestion based on my three months performance in Jamuna Bank Limited Motijheel Branch

1.1 Introduction

I have participated in an internship program in Jamuna Bank Limited. to fulfill the requirement of the MBA program. As A MBA student, I was especially interested to gain practical knowledge about the activities of banking sector. I was interested to do my internship in banking sector. So I have chosen Jamuna Bank Limited. Jamuna Bank Limited plays an important role in the business sectors and in the industrialization in our country. It is the most successful private bank in our country. Last three month. I have gotten general knowledge about the banking activities from Jamuna Bank Limited.

1.2 Objective of the study

My primary objective behind this report is to get acquainted with the Accounts Opening Procedures. Without the specific objectives, any study cannot become the successful one. Before preparing the report, I would like to set up the objective of my study as:

1.2.1 Primary objective:

To acquire practical experience about the general banking activities, to know relation among staff, discipline and behavior of an organization that help me to build-up future working life, and fulfill requirement of the MBA program.

1.2.2 Specific objectives:

- Analyze the overall procedure of general banking activities to familiarize with Accounts Opening Procedures.

- Analyze the performance of accounts opening and clearing department.

- Provide some suggestions and recommendations on the basis of findings.

1.3 Scope of the study:

The scope of the organizational part covers the organizational structure, background. Objective, function and department and business performance of Jamuna Bank Limited as a whole. The report covers the operation of Accounts opening procedures and Clearings of general banking activities JBL, Motijheel Branch. This refers that how the bank helps the customers in accounts opening procedures requirements fulfill.

1.4 Methodology of the study:

This report contains information from both primary and secondary sources.

1.4.1 Primary data have collected through

- Face to face conversation with officials of Jamuna Bank Ltd

- Observation

1.4.2 Secondary Data have been collected through

- Official records of Jamuna Bank Limited

- Annual report:

- Working papers:

- Office files:

- Selected Books

- Printed forms

1.5 Limitations of the Study

Everything has its limitations. My report is not also out of weakness. For some certain causes, I could not afford to conduct my report properly. I have considered the following causes as the limitations of the study.

- It is not possible for me to gather all the information about the banking activities of Jamuna Bank Limited, Motijheel Branch in my 3 months internship period.

- Learning overall activities and performance of a bank within 3 months is really difficult.

- This bank has some policy for not disclosing some data and information for obvious reasons that could be very much essential.

- The data and information related with the topic was not easily available.

- The study was not done very successfully due to inexperience.

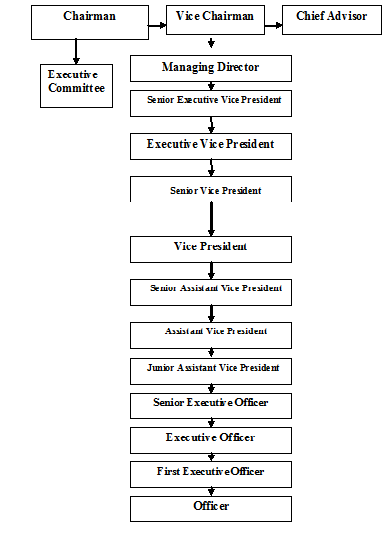

2.5 Functional Hierarchical Position of Jamuna Bank Ltd.:

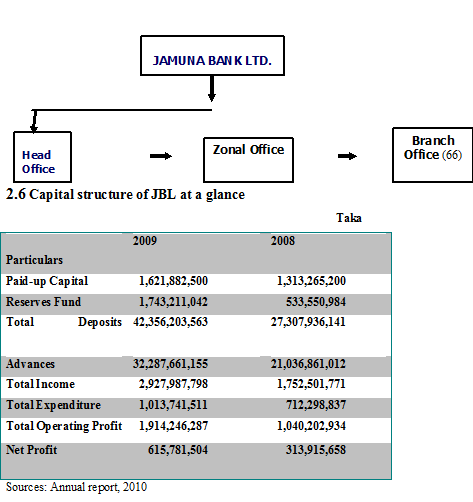

2.7. Corporate information at a glance:

Registered Name ………………………………….. Jamuna Bank Limited

Registered Head office…………………………….. Chini Shilpa Bhavan

3, Dilkusha C/A Dhaka-1000

Phone No. of Bank…………………………………. 9570912, 9555141

Fax No.…………………………………………….. 88-02-9570118, 9565762

E-mail address……………………………………… jamunabk@bd.com

Web Site…………………………………………… www.jamunabankbd.com

SWIFT……………………………………………… JAMUBDDH

Date of Incorporation………………………………. 3rd June, 2001

Authorized Capital………………………………… TK. 2900 Million

Paid up Capital…………………………………….. TK. 450 Million

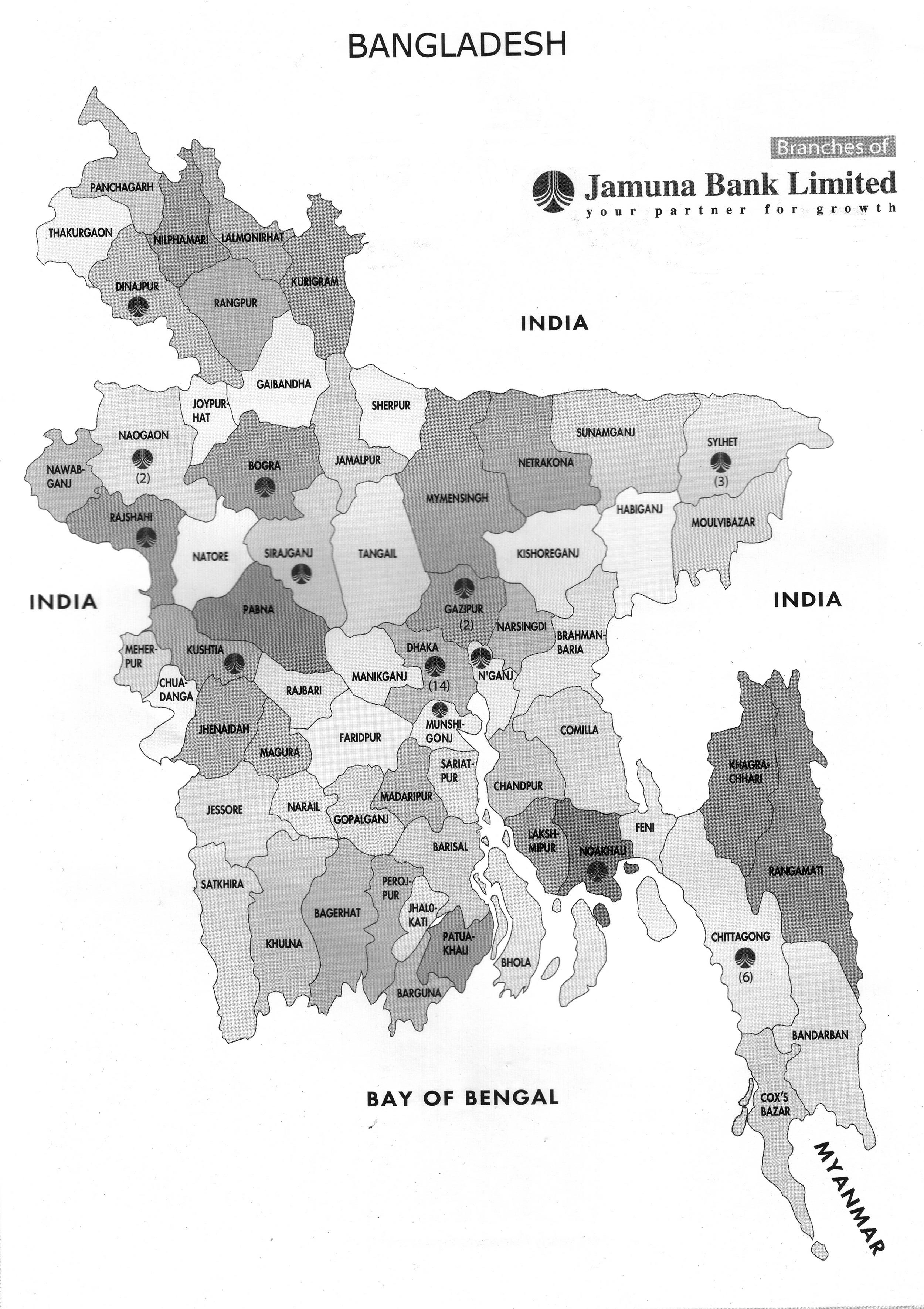

Number of Branches……………………………….. 59 branches

Chairman ………………………………………….. MR. MD. Tajul Islam

Managing Director………………………………… Mr.Md. Motior Rahman

Auditor……………………………………………. Ms. G. Kibria & Company,

Chartered Accountants

2.8. Ownership structure:

Leading industrialists of the country having vast experience in the field of trade and commerce own 52.84% of the share capital and the rest is held by the general public. JBL’s board currently consists of 13 (thirteen) Directors. Authorized capital is Tk.5600.00 million and paid up capital is Tk.3000.71 million as of 31st December 2009.

Sponsors:

The sponsors of Jamuna bank limited are highly successful leading entrepreneurs of our country. They have stakes in different segment of the national economy. They are eminent industrialist and businessmen having wide business reputation both at home and abroad. The names of the sponsors are given below:

1. Al-Haj M. A. Khayer

2. Mr. Arifur Rahman

3. Mr. Golam Dastagir Gazi (Bir Protik)

4. Mr. Fazlur Rahman

5. Mr. M. N. H. Bulu

6. Mr.Md. Sirajul Islam Varosha

7. Mr.Md. Irshad Karim

8. Mr. Shaheen Mahmud

2.9. Corporate Culture:

Employees of JBL share certain common values, which helps to create a JBL Culture

- The Clint comes first.

- Search for professional excellence.

- Openness to new ideas & new methods to encourage creativity.

- Quick decision- making.

- A sense of professional ethics.

2.10. Corporate Objective:

Objective of JBL:

- To earn and maintain CAMEL rating ‘Strong’.

- To establish relationship banking and improve service quality through development of strategies marketing plans.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To introduce fully automated system through integration of information technology.

- To ensure an adequate rate of return on investment.

- To keep risk position at an acceptable range (including any of balance sheet risk).

- To maintain adequate liquidity to meet maturing obligation and commitments.

- To maintain a healthy growth of business with desired image.

- To maintain adequate control systems and transparency in procedure.

- To develop and retain a quality work force through an effective Human Resources Management system.

- To ensure optimum utilization of all available resources.

- To pursue an effective system of management by ensuring compliance to norms, transparency and accountability.

2.11. Corporate Strategies & Business Plan:

- To identify customers credit and other banking needs and monitor their perception towards our performance in meeting those requirements.

- To review and update policies, procedures and practices to enhance the ability to extend better services to customer.

- To strive for customer satisfaction through quality control and delivery of timely services.

- To train and develop all employees and provide adequate resources so that customer needs can be responsibly addressed.

- To manage and operate the bank in most efficient manner to enhance financial performance and to control the cost of fund.

- To promote organizational effectiveness by openly communicating company plans, polices, practices and procedures to all employees in a timely fashion.

- To cultivate a working environment that fosters positive motivation for improved performance.

- To diversify portfolio both in the retail and wholesale market.

- To increase direct contract with customers in order to cultivate a closer relationship between the bank and its customers.

- Though Jamuna Bank is engaged in conventional banking it also considers the inherent desire of the religious Muslims, and has launched Islami Banking system and established one Islami banking Branch in the year 2003, the Islami Banking Branch is performing its activities under the guidance and supervision of a body called “SHARIAH COUNCIL”.

- The operations of the JBL are computerized to ensure prompt and efficient services to the customers.

- The bank is committed to continuous research and development so as to keep pace with modern banking.

- The bank has introduced camera surveillance system (CCTV) to strengthen the security services inside the bank site.

- The bank has introduced customer relation management system to asses the needs of various customers and resolves any problem on the spot.

- The bank has also introduced full online banking facility to the client.

2.12. Corporate Social Responsibilities of Jamuna Bank Limited:

As a part of the society all types of organization have the responsibility towards society. Jamuna Bank perceived its social corporate responsibility. So it always exercises its responsibility to the society. In the backdrop of profound success the board of directors considered the formation of JBL foundation through which some social welfare activities can be rendered to the society. Last few years they are consistently expanding their social welfare activities. During different calamity or disaster time period they have distributed relief to the affected people. They have stated scholarship program to the meritorious student who are not financially solvent. The authority also contributes to the Muktijoddha Jadughar and AtishDipankarUniversity for education purpose.

2.13. Credit Rating Report (Entity Rating):

| Year | Long Term | Short Term |

| Current Rating 2010 | A- | ST-3 |

| Previous Rating 2008 | BBB+ | ST-3 |

| Outlook | Stable | |

| Date of Rating | 30 June, 2010 | |

2.14. Operational Network Diagram of Jamuna Bank Limited:

2.15 Milestones in the development of Jamuna Bank Limited:

2001 – Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 with its Head Office at Chini Shilpa Bhaban, 3, Dilkusha C/A, Dhaka-1000. The Bank started its operation from 3rd June 2001.

2004 – IPO issued and traded in both Dhaka & Chittagong Stock Exchange

2005 – Jamuna Bank has launched its Online Banking services on April 05, 2005

2006 – Jamuna Bank Limited has installed its first Q-cash ATM.

2007 – Approved the new attractive salary structure to compete the top graded banks.

2008 – Jamuna Bank issue VISA card.

2009- jamuna bank developed foreign remittance system.

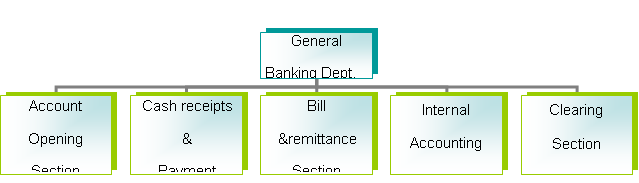

Every Branch of Jamuna Bank is divided into various departments namely as follows:

- General Banking department.

- Loan and Advances department.

- Foreign exchange department

- Accounts Section

- Deposit Section

- Account opening Section

- Cash Section

- Bills collection and Clearing Section

- Remittance and Pay order Section

3.1 JBL Motijheel Branch:

Motijheel Branch is one of the largest branches of Jamuna Bank Ltd. I joined in this Branch as Manager on June 2010. It is situated in Surma Tower,59/2 Purana Paltan, Dhaka-1000. This branch started operation in 07th December 2006 as 24th Branch of the Bank. The total offiers of this branch are 26 and staffs are 5.

3.2 Performance of Jamuna Bank Ltd. Motijheel Branch

| Sl. | Description | 2006 | 2007 | 2008 | 2009 | 2010 |

| 01. | Deposit (Tk.) | 2781.73 lac | 3434.06 lac | 7513.27 lac | 8240.92 lac | 16932.54 lac |

| 02. | Loans and Advance (Tk.) | 2.18 lac | 1378.96 lac | 1925.09 lac | 2105.71 lac | 12577.39 lac |

| 03. | Profit(Tk.) | (13.00) lac | (49.00) lac | 113.00 lac | 168.00 lac | 510.00 lac |

| 04. | No. of accounts | 74 | 674 | 3212 | 3473 | 6327 |

Sources: Annual Report, 2010

From the above table I have found that net profit of this branch has been increased in 2010 remarkably which exceeds the Branch annual target and which show the positive performance of the branch.

3.3 Functions of Jamuna Bank.

The general functions of Jamuna Bank Ltd, at Motijheel branch are:

- General Banking

- Loan and Advances

- Foreign Exchange Operations

General Banking:

Before the application of the parties to get loan from the bank, they must have to open an account i.e. current account. Proper understanding of general banking can help them to open such an account easily. For this regard, I have given concentrate on the general banking system of Jamuna Bank Ltd.. .

General Banking Dept.

The general banking activities of Jamuna Bank Ltd. are discussed in the below:

- Collection of deposits from the community.

- Opening different accounts.

- Customer information service.

- Lending to the borrowers from the deposits.

- Receipt/Payment of cheques in the mode of cash, clearing and transfer amount to the parties.

- Issue of DD, Pay order, FDR, Double/Triple Growth Deposit Scheme.

- Perform as a clearinghouse.

- Utility services.

- ATM card management.

- Maintaining Branch accounts.

Jamuna Bank Ltd. offers multiple special services with its network of branches throughout the country in addition to its normal banking operations. More over Jamuna Bank Ltd. provides its cash withdrawal facility throw through its own ATM Booths situated in different places all over Bangladesh and with joint collaboration of eight other commercial bank’s booth by VISA/Q-Cash card.

Collection

Telephone bills,Tuition fees, IPO Deposits, Passport fees and Travel tax, Customs & excise duties.

Sale & Encashment/Purchase

Different Govt.Bond/Treasury Bills, Prize Bonds, Lottery tickets of different Semi-Govt. and Autonomous Bodies.

Bank Remittance (DD & PO)

Banks extended this facility to its customers by means of receiving money at one branch of the bank and making arrangement for payment at another branch within the country. Bank takes the risk of theft or loss and ensures payment to the beneficiary in exchange of a little bit benefit known as exchange or commission. Considering the nature of transaction, the mode of bank remittance may be categorized as under–

- Demand Draft (DD)

- Payment Order (PO)

- On line banking.

Demand Draft (DD):

DD is a negotiable instrument payable on demand to the payee on proper identification. It is an instruction issued by one branch containing an order to another branch to pay a certain sum of money to a certain person or order on demand. This instrument can be purchased by a customer from a particular bank branch for himself or for beneficiary and is handed over to the purchaser for delivery to the beneficiary.

Payment Order (PO):

This instrument is issued if the remittance is within a district in the same clearing house.

Different Deposit Accounts: Products of Jamuna Bank Ltd. can be divided into two parts. They are asset product and liability product. Generally liability product means deposits of many kinds that are payable to parties. On the other hand, asset products are the products which clients are liable to pay to bank. Different types of undertaking by the bank to the clients or on behalf of the clients are also a type of liability to bank. On the other hand a different type of promises makes by the clients to bank is considered as bank’s asset.

3.4 Financial Performance of JBL Motijheel Branch:

3.4.1. Deposit & Advances of Motijheel Branch:

Interpretation:

From this table we can say that first few months of JBL Motijheel Branch Deposits and Loan & Advances was not so high. From the beginning of its operation to till December 2009 it was running with low deposit and advances. As a result it faces losses but gradually the scenario is changed and started earning profit

| Name of Month | Deposit (Amount in Thousand) | Loan & Advances (Amount in Thousand) |

| July,09 | 401645 | 42381 |

| August,09 | 411718 | 54224 |

| September,09 | 412440 | 54991 |

| October,09 | 422969 | 78011 |

| November,09 | 546257 | 87682 |

| December,09 | 354514 | 137896 |

| January,10 | 420186 | 152190 |

| February,10 | 448714 | 150132 |

| March,10 | 458519 | 166123 |

| April,10 | 489368 | 180741 |

| May,10 | 586252 | 191952 |

| June,10 | 592160 | 198736 |

Table01: Deposit & Advances of JBL Motijheel Branch

Sources: Annual Report 2010

Internship Position & Duties

An internship is a supervised pre-professional learning experience, in which students apply their skills, knowledge in a professional setting. It provides students with a full and realistic view of workplace, culture and experience etc.

As a part of internship program of Bachelor of Business Administration (BBA) course requirement, I was assigned to do my internship at Jamuna Bank Ltd. (Motijheel) for the period of three months.

4.1 Internship Position

I have started my internship from 09 January, 2011. I was assigned in the general banking sector for the most of time. I spent most of the time in the account opening section, although I had to work in all the sections of general banking. In my three months period of internship I have worked with the customer service officers and try to share relevant responsibilities. I didn’t have any chance to work in cash, as it’s the most sensitive part of the bank. So I worked basically more or less in the general banking section of the bank. The responsibilities that I performed through my internee period are as follows:

- I have started my work through registering letters in inward register book received from Head office or other organizations. .

- I received cheques of others bank.

- I have started registering the chequebook received from Head Office.

- I have learnt how chequebook will be issued to the valued clients.

- When the client will come up with a requisition slip the specimen signature will be verified by the officer) Then for saving I issue 10 leaves chequebook & for Current Accounts I issue 25/50 leaves chequebook. After that I will enter the branch seal in the chequebook. After providing initial at the top of the chequebook the chequebook will be given to the valued client for use.

- Then I have started to issue chequebook directly to the clients. .

- Every day I updated more than 20 account-opening forms. I used to fill up (Banker’s use only) portion.

- I used to check whether all the necessary documents are attached with the properly filled account opening forms or not. If not then I prepare a chart including customer name, Account number and the documents required. In a nutshell, I complete everything regarding form fill up except the prepared signature & the Authorized signature.

- Most of the time I deal directly with the customers regarding account opening.

- I have filled up the account opening forms of the highly valued clients.

- I usually write more than 10 pay orders everyday.

- I enter pay orders numbers in pay order register book.

- Registering in ward and out ward mail.

I have prepared a list of link accounts, which was opened for DPS & some other purposes. No regular transaction usually occurred in this type of account. That is why, no charge will be charged.

4.2 Internship Duties

I started my internship with the customer service officer and had direct interaction with the customers. I was assigned for opening different account and closing them too. I also

issued chequebook to the customers and gave posting online. My responsibility was to

receive cheque from customers.

All these works do need not only responsibility but also sincerity. Sometimes these works created lots of pressure on me to perform them simultaneously but my seniors helped me a lot to ease those situation. They helped me a lot when I made a mistake or I had any problems. In the next page the responsibilities of my internee are given in detail.

At the beginning of my internship I was assigned to open different types account. Every day on an average I had to open 10 accounts. Now opening an account is a lengthy process. If a customer has the documents needed to open a particular account then s/he

Must fill the form correct With relevant information. The main purpose of this form is to know about the customer and help the customer to know about the account as well.

When it comes to closing an account then the customer has to fill a form for seeking the permission to close the account. The form should be verified by authorized personal and then the account will be closed.

I also opened and closed savings account. MSS Account current account

This is one of my major responsibilities that I performed on a daily basis. I had to issue on an average 15-cheque books even day and also had to give the posting. This task sometime putted pressure on me when two or more customers wanted their chequebook at a time.

4.3 Learning Point:

I have learnt many things from Jamuna Bank limited at motijheel Branch. I have learnt how to:

- Open different types of accounts.

- About organizational behavior at Banking sector.

- How to deal with customers and clients.

5. Different types of Account opening Procedure Section:

This section mainly deals with different types of account opening. It also deals with the issuing of cheque books and different account openers inquiry. A customer can open and close different types of accounts through this department.

5.1. Compliance Guidelines:

In case of account opening officer have to follow some compliance guidelines. These are given below:

- Identification: As per Section 19 KA of the Prevention of Money Laundering Act 2002 requires all institution to seek satisfactory evidence of the identity of those with whom they deal and also as per Bangladesh Bank guidelines. Customer present address should be verified physically or issuing a thanks letter registered with the Acknowledge Due then the banks satisfy about the present address of the clients.

- Declaration: In the declaration form customer need to mention the monthly and yearly transfer volume which will be matched with the transaction profile.

- Transaction Profile: In the TP five major portions must have to be mentioned clearly. Relating officer of the bank will verify and monitor the transaction mentioned in the TP. If any major change in transaction a clarification should have to be kept in abnormal transaction file and existing TP will have to be change. In order to be able to judge weather a transaction is or not suspicious, institutions need to have a clear understanding of the business carried on by their customer

- Know your customer (KYC): As per Bangladesh Bank guidelines KYC is one more additional documents .By this document bank will be known customers detail and risk involvement of customer. If a customer has established an account using a false identify, she may be doing so to defraud the institution itself or to ensure that she can not be traced to the crime the proceeds of which the institution is being used to money launder.

A false name, address will usually mean that enforcement agencies can not trace the customer if he is needed for interview of an investigation.

5.2 Consideration for account opening:

The officer should also consider the following factor in case of account opening:

- Introduction: Introduction of an account holder is must. Because opening of an account banker must satisfy himself about the identity of the proposed account opener. Bank has been accustomed to obtaining an introduction for each account from a responsible existing account holder known to him, whose account is operative with the acceptable balance in his account which satisfies the banker.

- Specimen signature: One or more specimen signatures of the account opener’s are obtained in a prescribed card for record keeping by the banker. These are the signature the banker recognize the purpose of customer’s signing cheque on account and issue other instruction to the banker.

- Issuing of a checkbook:

If any one opens a Savings or Current account with JBL then he or she need cheque book for transaction purpose. For issuing a cheque book one need to go through some procedure. These are given below:

- For the first cheque book customer has to apply in a specified form along with the thanks letter which he or she has received after opening the account. Then for the

- New cheque book the clients have to apply through the requisition slip supplied with the previous check book.

- The leaves of the cheque book which is under issue shall be counted to ensure that all the leaves and the bank requisition slip are intact.

- The name and account number shall be written on the cover page of the cheque book. The account number of the client shall be entered on all the leaves of the cheque book along with its requisition slip.

- Next the name and account number of the customer shall in the cheque book register against the particular cheque book series.

- Officer who is in charge of the deposit department sign the register book along with the requisition slip.

- Finally the cheque book is handed over to the customer after taking acknowledgement on the requisition slip and the register book.

- Officer has to containing the requisition slip in a cover file. It shall be effectively preserved as vouchers. If the ledger keeper found any defect he will make a remark to that effect on the requisition slip and forward it to the cancellation officer to decide whether a new cheque book should issued or not.

5.3 Types of Account:

-Current Deposit Account (CDA)

-Savings Deposit Account (SDA)

-Short Term Deposit Account (STD)

-Fixed Deposit Receipt Account ( FDR)

5.3.1 Current Deposit Account:

CD stands for current deposit. It is cost free. No interest is given by the bank. As it has no cost and more over bank charges on different services, the target of the bank is to increase the number of current account clients. It can be only opened by the name of any organization and not in any personal name. Current account mainly opens by different types of organization for operating their business transaction smoothly. Proprietorship, Partnership, Limited companies and Club or Societies can open current account.

Bank authority charge twice in a year for operating the current account and its half yearly charge is TK.500. If any one wants to stop account then bank charges TK. 100. Opening balance of current account is minimum TK. 5000 but if the depositors have any problem then it can be open by TK. 2000. Requirements for different types of current accounts opening are given below:

Proprietorship Account:

- Introduction of account

- Two photographs of the account holder which is attested by the introducer.

- Valid copy of trade license

- Rubber stamp

- TIN number certificate (if any)

- Copy of voter ID card or passport or commissioner’s certificate

Partnership Account:

- Introduction of account

- Two photographs of the account holder which is attested by the introducer.

- Partnership letter duly sign by all partners (sign should be similar as stated in the Deed)

- Registration (if any)

- Rubber stamp

- Updated trade license

Limited company Account:

- Introduction of account.

- Two photographs of the account holder which is attested by the introducer.

- Valid copy of Trade license.

- Board resolution of opening account duly certified by the chairman Managing Director.

- Certificate of Incorporation.

- Certified (Joint Stock) true copy of the Memorandum and Article of Association of the company. Duly attested by the Chairman of Managing Director.

- List of director along with designation and specimen signature.

- Latest certified copy of form – X11 (to be certified by the registrar of Joint stock companies) in case of directorship change.

- Rubber Stamp

- Certified copy of certificate of commencement of Business.

- Latest audited balance sheet

- Tin certificate

- Certificate of Registration (in case of insurance companies)

Club/Societies Account:

- Introduction of the account

- Two photographs of the account holder which is attested by the introducer.

- Board resolution for opening account (Duly certified by President/Secretary)

- List of existing Managing Committee.

- Registration (if any)

- Rubber stamp

- Permission letter from Bureau of N.G.O (in case of N.G.O account)

5.3.2. Savings Account:

Bank considers it as Low Cost liability product. Savings account is mainly open by individual person. Generally householders and other small scale savers is the client of this account. Opening balance of savings account is TK. 2000. In case of savings account bank authority gives 6% interest based on its deposit to its clients and interest will be counted on daily basis.

Bank charge very limited amount because it is an interest bearing account. Bank half yearly service charge is TK. 300. If any one wants to close this account then they have to pay TK. 50. According to Bangladesh Bank instructions 90% of SB deposits are treated as time liability and 10% of it as demand liability. Generally banks require a 7-day prior notice if the total amount of one or more withdrawals on any date exceeds 25% of the balance of the account unless is given. But in JBL there is no restriction about drawing money from savings account. Any time holders may draw money of any amount without prior notice.

5.3.3. Short-Term Deposit:

Customers deposit money for a shorter period of time. STD account can be treated as semi-term deposit. STD should be kept for at least thirty days to get interest. The interest offered for STD is less than that of savings deposit. Bank authority gives 5.5% to its clients. Volume of STD A/C is generally high. In MBL, various big Companies, Organizations, Government Departments keep money in STD accounts. Frequent withdrawals are discouraged and require prior notice.

Interest rate of Current Deposit, Savings deposit and Short Term Deposit account are given below:

| Name of Account | Interest Rate |

| Current Deposit | 0% |

| Short Term Deposit | 5.5% |

| Savings Deposit | 6% |

| SB non chequing & No withdrawal for 6 months | 7.5% |

| SB non chequing & No withdrawal for 1 year | 8% |

Sources: Prospectus of JBL 2010

Table 03: Interest rate of SB, CD & SRD A/C

Incidental charges of different account are given below:

| Sl No | Category of charges | Rate/Annually |

| 01 | Charges on Savings deposit | 300+300=600 |

| 02 | Charges on current deposit | 500+500=1000 |

| 03 | Charges on Short term deposit | 500+500=1000 |

Sources: Official Record, 2010

Table 04: Incidental charges of JBL

5.3.4 Fixed Deposit Account:

In case of fixed deposit depositor deposit money for a fixed period of time like 1 month, 3 month, 6 month or 1 year. Fixed deposits are repayable along with profit or after maturation period. If the depositor wants then a matured FDR may be renewed for any of the periods mentioned above. The deposit will be automatically renewed from the date of expiry for a period of three months at the rate of profit applicable on the renewal if the depositor does not give any instruction to the branch within on month of the date of maturity of the FDR. If the depositor encashment the deposit before maturity no profit will be paid to the client. Recently Bangladesh bank has decided that the interest rate of FDR will lie between 9% to 11%. For this reason the Assets Liability committee of the bank has revised interest rate of FDR. The new rates are given below:

Interest of FDR:

| Period | Rate of interest |

| 1 Month | 9% |

| 3 Month | 10% |

| 6 Month | 9.75% to 10% |

| 1 Year | 9.5% to 10% |

Table 05: Interest of FDR

5.4 Schemes offered by JBL:

JBL has introduced some scheme for its customers which not only increase the profitability of the bank but also increase the saving tendency of the customer. These are given below:

5.4.1 Monthly Savings Scheme (MSS):

Savings is the best friend in bad days. Small savings can build up a prosperous future. Savings can meet up any emergencies. JBL has introduced Monthly Savings Scheme (MSS) that allows it clients to save on a monthly basis and get a handsome return upon maturity. The concerned customer can avail loan facility up to 80% of the deposited amount.

5.4.2. Education Savings Scheme:

Education is one of the basic needs of every citizen. Every parents want proper education to their children. Education is the prerequisite for the socio-economic development of a country. Higher education may be hindered due to the change of economic condition of their parents. To solve this problem JBL has introduced “Education Savings Scheme” which offers its clients to build up cherished fund by monthly deposit of small amount at client affordable capacity. The customer has the option for withdrawing total accumulated amount including principal on maturity date at a time or taking monthly benefit during the next five years from the date of maturity keeping the principal intact.

5.4.3 Marriage Deposit Scheme:

Marriage of children especially daughter is a matter of great concern in the context of our country. It involves expense of considerable amount. Practical parents make effort for gradual building of fund as per the capacity to meet the expenses. Parents get relief and feel secure if they can arrange the necessary fund for their children marriage, no matter whether they can survive or not.

By considering this factor JBL has introduced marriage deposit scheme which offer its clients to build up cherished fund by monthly deposit of small amount at client capability. It grows very fast at high rate of interest yielding a sizeable amount on maturity.

5.4.4. Lakhpati Deposit:

To become “Lakhpati” is simply a dream for the most of the people of Bangladesh especially to the lower and lower middle income group. Keeping that in mind JBL has introduced “Lakhpati Deposit Scheme” which has flexibility in report of maturity and monthly installment as per affordable capacity.

5.4.5. Kotipati Deposit Scheme:

Kotipati deposit scheme is one of the schemes of JBL. It is realizable for high income group who have strong determination and savings habit. JBL has introduced “Kotipati

Deposit Scheme” offering the savings plan fit to your income and executes your dream to be a Kotipati by monthly deposit at client affordable capability.

Monthly Savings Scheme, Education Savings Scheme, Marriage Deposit Scheme, Lakhpati and Kotipati Deposit Scheme have the following facilities:

- These types of deposit account can be opened at any branch of JBL.

- They can deposit at any branch of JBL and the same through on line banking

- Monthly installment can be automatically collected from client savings account maintained with JBL.

- Installment amount shall be deposited within 20th day of each month. If the 20th is holiday then customer may also installments on next working day.

- No loan facilities will be allowed from any other banks/ financial institution against the deposited amount except JBL.

5.4.6 Monthly Benefit Scheme:

Jamuna bank limited has introduced Monthly Benefit Scheme for the prudent person having ready cash and desiring to have fixed income on monthly basis out of it without taking risk of loss and without cashing the principal amount. This scheme offers highest return with zero risk.

Characteristics:

- Minimum Deposit: Tk. 1 lac.

- Maximum Deposit: Any amount multiple of Tk. 1 lac.

- After opening the account the profit element will be deposited in that account.

- Upon maturity the term may be renewed for the next tenure.

These scheme were effective on 18th April 2009, due to Bangladesh Bank decision JBL have stopped these scheme temporary. Soon they will revising the interest rate of the scheme and continue the scheme again.

5.4.7. Double/Triple Growth Deposit Scheme:

JBL has introduced Double/Triple Growth deposit scheme that offers its customer to make double or triple money within seven years and eleven years respectively resulting a high rate of interest.

Characteristics:

- Minimum Deposit: Tk. 1 Lac.

- Maximum Deposit: Any amount multiple of Tk. 1 Lac.

- Overdraft Facility: The concerned customer can avail loan facility up to 80% of the deposited amount.

Features of the Scheme:

| Deposit | Money including interest payable at maturity | |

After 7 Years | After 11 Years | |

| 100000 | 200000 | 300000 |

| 200000 | 400000 | 600000 |

| 500000 | 1000000 | 1500000 |

| Interest Rate | 12.25% | 12.25% |

Sources: office record

Table 06: Feature of the scheme

Terms & Conditions:

- If customer fails to deposit 3 consecutive installment then bank reserves the right to close the account.

- Customer will not get any profit if the scheme is closed within 6-months. If tit is closed after 6-mionths then client will get deposited amount along with interest rate. The rate is normal savings rate up to the closure time.

Like other scheme customers have to follow the government rules and regulations. They also have to follow the Bangladesh Bank rules.

5.5. Summary of the finding of JBL:

- Financing activities is related with progression of operation. JAMUNA’S operations are increasing gradually.

- Employees are friendly about customer service in Jamuna bank Ltd.

- In general banking department they follow the traditional banking system. The entire general banking procedure is not fully computerized.

- Customers are satisfied with the different types of service available in the branch.

- Day by day new upcoming banks are coming with many new services, which are a threat for the bank.

- Jamuna Bank Ltd. Is not using advance and develop software foe quick customer

- service.

- Each year deposits growth indicates Better movement in the banking field which

- Is satisfying clients.

- Clients are increasing ultimately equity is increasing. Gradually banks operations

- Are increasing.

- JAMUNA’S increasing movement is generating increasing profits. JAMUNA’S is

- Gaining huge profits by satisfying clients.

- Day by day. Increase the profit.

- The number of branches is not good enough.

- I also find out that the employees are bearing huge pressure.

- The computers are not enough in the branch.

- The Air conditions, fans and lights are not enough to create good environment.

- The number of peons and other staffs are very poor in number.

- The speeds of the service are not up to the mark.

- There is a shortage of the computer in General Banking Division.

- Customer is not fully satisfied with the service of the Jamuna bank ltd.

- Locker facilities are available in the branch.

- Insufficient employee is customer service department.

- Increase the deposit day by day.

6.1 SWOT Analysis of JBL:

SWOT analysis is the compete study of an organization’s exposure and potential in perspective of its Strength, Weakness, Opportunity and Threat. It assists the organization to make their existing line of performance and also forecast the future to improve their performance in comparison to their competitors. It also helps the organization to understand the present situation of the business and also considered as an important tool for making changes in the strategic management of the organization.

6.1.1. Strengths of JBL:

- Experienced top management for operating the business smoothly. The authority has employed some experienced bankers who have great experienced in this profession.

- To compete with the competitor the bank has satisfactory capital base for running the business

- Due to its careful decision low infection in loan exposure.

- Prospective IT infrastructure which help to maintain the online banking services.

- Jamuna Bank Limited is always engaged in a variety of corporate social activities in the country.

- For ensuring the maximum level of customer satisfaction and earning huge profit JBL is expanding the number of branches in new location.

- JBL has correspondent relationship with leading international banks in 117 countries to cover all important financial centers of the globe.

6.1.2. Weaknesses of JBL:

- Market is saturated because many competitors already exist in the market so they have to face lots of competition from the existing competitor bank.

- Already many bank established their position in the market so as a later entrant they need time to establish its position in the market. As a result they have limited market share.

- For making profit sometimes they exposure to large loan which is really risky for their business because their source of capital is the people deposit.

- The authority has excessive dependency on term deposit which decreases their profitability level.

- Weak fund management

- They give high interest rate for gaining fund as a result it increases the cost of fund and decrease the profitability level.

- Islamic Branch funds are not ring fenced.

6.1.3.Opportunities of JBL:

- Development of a country depends on both private and public sector. For this reason government give emphasis on the development of private sector. As a result regulatory environment favoring private sector.

- Although Credit card is not a new concept in out country but there is a huge potentiality for capturing this market. So JBL can take this opportunity.

- Small and medium enterprise is one of the big opportunities for JBL, because day by day the numbers of small and medium are increasing and they are one of the great sources of profit.

- Since JBL is not an old bank and has limited number of branches all over the country, so it has the opportunity to increase the number of branch all over the country.

- Now a day’s number of banks engaged in merchant banking so JBL has the opportunity to expand their business in this line.

6.1.4. Threats of JBL:

- Due to global economic crisis Bangladesh Bank have decided that all the will keep their loan rate within 13% as a result it will increase their profitable level.

- JBL has to revise its interest rate for deposit purpose as a result they have to face competition in case of collecting deposit.

- Some other banks offer great benefit for collecting the deposit which is a great threat for JBL. Like Daily basis interest on deposit offered by HSBC

- Banking is one of the profitable businesses as a result the numbers of banks are increasing gradually. As a result it increased competition in the market for quality assets.

- Sometimes they face supply gap of foreign currency.

- Overall liquidity crisis in market

From the analysis we can easily find out the strength and weakness of the bank which will help to compete with others bank. It also helps to find out the opportunity and threats of the bank which is a external factor. Without considering this factor bank can’t compete in the market.

Conclusion:

The modern business world is on the fastest flow of competition which is growing wider and wider. To have sustainability in this competitive world the organization are formulating new strategies and business plan with maximum efficiency levels in all sectors. Due to competition it is very difficult to build a strong base for the bank and to uphold the image of bank. Banking is becoming more and more vital for economic development of Bangladesh in mobilizing capital and other resources. Jamuna Bank, being a third generation bank, is also extending such contributions as to the advancement of the socioeconomic condition of the country. JBL has some problems but it is encouraging that they are trying to overcome these obstacles. To keep pace with current demand JBL should be more responsive. It should take necessary steps & spread over their products all over the country. Without a strong footing of deposit it is not possible to grant huge amount of loans and advance that is one of the major sources of income of a bank and without huge amount it is not possible to attract the major portion that enjoys credit facilities. It will more justify for JBL to concentrate on corporate banking than consumer banking i.e. the major portion of the profit will be generated from corporate sector not from consumer section.

As a BBA student I have completed my internship from Jamuna Bank Limited (Motijheel Branch). I have worked with clearing, foreign exchange and account opening Department. Jamuna Bank is almost a new player in the banking sector and is committed to provide high quality services to its stakeholders. It contributes to the GDP of a country through different financial product and profitable utilization of fund.

From the findings it can be observed that JBL trying it level best to maintaining the sustain growth level. Although it could not reach the highest position but it growth rate is continuously increasing. Based on the previous performance and the proper utilization of resources, hope that JBL will be able to achieve its goal and would become a finest corporate citizen’s in the Banking industry.

Recommendations:

I had the practical experience and exposure in Jamuna Bank Limited for just three months. Banking sector is very vast and complex so it is not easy for me to recommend some issues which enhance the performance level of the organization. During my internship period I have found some shortcomings regarding operational and other aspect of banking. I would like to present the following recommendation:

- The Bank should improve the quality of its service and ensure the maximum level of customer satisfaction.

- Officer should be more efficient for providing prompt services to its clients and ensure less time consumption regarding General Banking.

- There are huge gap between the customer’s expectation and actual services provided by the Bank. Bank should try to minimize this gape for improving the relationship between the clients and Banks.

- Training the employees one or two times in a year with latest banking technology which will help them to adjust in a new working environment.

- To attract more clients JBL should create a new marketing strategy, which will increase the profitability of the bank.

- If we consider the promotional activities then we can easily find out that other bank sponsored TV or Radio news, talk show and business news but still JBL ignore this side. So JBL should use this type promotional activity for capture the market.

- To establish a better social image the Bank should needs to participate more in social welfare activities.

- Bank should start SMS Banking because other private banks have already started this facility.

- Very often customer complained that the ATM machine is performing effectively and they can’t withdraw the money. So improve own ATM network and ensure better services.

- Number of ATM booth should be increased and maintain sufficient fund in ATM booth otherwise customer have to use other bank booth and bear additional charges for that.

- From my personal experience I have seen that many customers wait for along time for any services as they see that the some concerned officers are doing their best to meet the requirements of the clients. So Management should employee at least few more employees in General Banking and Foreign Exchange department of Motijheel Branch.

- Bank can introduce more advance MIS system to mobilize its day to day activities. It will help the employee to do their activities very quickly and the same time maintaining the quality of the work.

- Foreign exchange operation of this branch is not so dynamic and less time consuming like other private bank. So JBL should take some initiative steps to overcome this problem.

- To motivate the employees Bank should give good salary and attractive compensation packages and also Bank must adopt strict supervision and monitoring the performance of employees.

- JBL is very conservative for post shipment finance. To flourish the Foreign exchange department it should change its mentality and finance post shipment business.

- The Bank give emphasis on give large amount of loans but if the loan default then the bank will face great loss. So to avoid this Bank should also give emphasis on SME loan also.

- The Bank should offer introduce new innovative products to attract more new customers and provide different kind of benefit for its existing customers.

- Innovative loan scheme and service should be offered and should be more flexible in terms of SME loan repayment.