Introduction

The beverage industry of Bangladesh is an old, steady yet neglected industry. For many years, the only product of the industry was Carbonated Beverage or Carbonated Soft Drink (CSD) and the number of players was limited to only a handful. Today, the industry has flourished considerably with a bunch of new enterprises and through the introduction of newer and more diverse products.

1.2 Objective

The major purpose of this report is to focus light on one of the oldest and key player of the beverage industry of Bangladesh, Abdul Monem Ltd. (abbreviated as AML). The underlying objectives of the report are :

• To know about the inception of the enterprise, as a whole and of its beverage unit as well.

• To know the operations and the management structure of AML.

• Put light on the production, distribution and promotion of the beverage products of AML.

• To review the strategic moves and plans of AML as a Strategic Business Unit to gain market share, make good profit and achieve sustainable growth.

• Recommend relevant strategic moves to achieve even better result.

• Conduct a sample survey and interpret the results to visualize whether the strategies of AML are working well for the enterprise.

1.3 Methodology

The mode of methodology selected for this research is known as Multi-methodology. Also known as Mixed Methods Research, Multi-methodology is an approach to professional research that combines the collection and analysis of both quantitative and qualitative data.

Qualitative Analysis

The sample data gathered in qualitative research are analyzed and categorized into patterns as the primary basis for organizing and drawing results for the report. Qualitative research for this report involved three methods for gathering information:

• Direct observation

• in depth interviews and

• analysis of documents and materials.

The key methods to be used for data collection are the Key Informant Interview (KII) and Depth Interview.

Quantitative Analysis

The objective of quantitative research is to develop and employ mathematical models, theories and/or hypotheses pertaining to natural phenomena. The Quantitative Research techniques applied for this report are :

• Collection of sample data

• Modeling and analysis of data

• Evaluation of results

1.4 Conceptual Framework

1.5 Scope

Due to several unavoidable situation and reality, the extent of this report has been compromised up to certain limit. The boundaries of this report are thus :

• This report focuses only on the beverage production units and facilities of AML, the other business fronts of AML are not covered in this report.

• This report will focus on the value chain activity of the beverage production unit of AML, from production to promotion, and the key strategic factors affecting those activities.

• The report will also focus on the ethical and CSR activities of AML as a whole, i.e. for every business unit of the enterprise.

1.6 Limitations

The extent and limit of the report were constricted due to some of the following considerations:

• The time allocated for the report was limited which constricted the extent of this report.

• The beverage industry of Bangladesh is not well documented, so no strict facts and figures were found from the enterprise respondants or any other secondary sources.

Chapter 2

An Overview of Abdul Monem Ltd.

2.1 Introduction

Abdul Monem Ltd. (AML) is the only official bottler of Coca Cola, Sprite, Fanta Orange and Fanta Lemon in Bangladesh authorized by the Coca Cola International headquarter located in Atlanta, USA. Through three bottling plants located in Dhaka, Comilla and Chittagong and with a devoted distribution channel spread all around the country, AML has well established its strong and dominant presence in beverage industry of Bangladesh.

2.2 Inception and Expansion

AML started its operation back in 1956 as a construction firm and was engaged in major government construction work. Within a few decades, the organization diversified its operation in other industries, especially in food and beverage industry. AML started its Ice Cream Plant in Chittagong in 1964 with a brand name IGLOO followed by the bottling license and distributorship of Coca Cola in 1982. Today, AML has eight different business lines running with a yearly turnover of over US$ 85.7 million dollar or BDT 6 billion. The group of business of AML are consist of :

• Construction Contractors for the road & highways, bridges, buildings & flood embankment

• Bottler and Distributor of Coca Cola, Fanta & Sprite

• Manufacturer of IGLOO Ice Cream

• Abdul Monem Sugar Refinery Ltd.

• AM Pharma Ltd.

• Manufacturer of AmoMilk Liquid Pasteurized Milk

• Manufacture of IGLOO Ghee

• Manufacture of IGLOO Sugar

• Trading & Distributing product of Danone Brands

• AML InfoTech Ltd.

2.3 LOGISTICS support for the Beverage Unit

The Company has strong logistic fleet and manpower to ensure the distribution of its beverage product to each corner of the market place. Even the unit has its own Cargo Vessels to service the Southern part of the country where waterways is holding a major part of the land. The satellite warehouses established at different logistic locations help to facilitate keeping the sufficient stocks in the remote areas.

The bottling plants of AML for bottling Coca Cola are located in Dhaka, Comilla and Chittagong. However, at present, the operation of Dhaka plant is suspended and the total bottling operation is constricted to the other two plants. The details of the Chittagong and Comilla plant are given below :

Chittagong Comilla

Site Area 10 Acres 6 Acres

Year of operation 1997 1987

Line KHS – Germany

(PLC Controlled-Fully Automated) H&K / KHS – Germany

Capacity 600 BPM 450 BPM

6.5 Mill. cases/Yr 4.5 Mill. cases/Yr

Packages 250 ml, 1000 ml 175 ml, 250 ml, 1000 ml

Capability Plastic cases

Fill height detector

2.4 Mission Statement

The mission of Abdul Monem Ltd is to build business ventures committed to achieving the highest quality product and serve the betterment of society.

While the mission statement of AML is desirable and focused, it lacks clarity, is too generic and swarming with superlatives like best and highest. The mission statement lacks motivation and is so broad that it really doesn’t rule out any opportunity that the management may opt to pursue.

2.5 Vision Statement

Abdul Monem Ltd aims at providing the society with significant assistance in achieving the maximum potentiality.

The vision statement of AML is focused and obtainable. The vision guides its personnel to a definite direction and provides an idea about its utilization of its potentials.

2.6 Objectives : The Balanced Scorecard Approach

AML strives to set up well defined and obtainable strategic and financial objectives while keeping in mind the long range and short range goals. To maintain an organizational profile that is trustworthy to all its stakeholders, AML gives more priority to provide a uniform balance on all objective fronts.

Financial Objective

Abdul Monem Limited aims at generating appropriate financial results through sustainable growth and constant renewal of balanced business structure.

Strategic Objective

Abdul Monem Limited is open and trustworthy to all its business partners and consumers. Through devoted business activities, it wish to make worthwhile contribution to the progress of the country.

Short Term Goals

AML aims to be one of the top market leaders, if not the supreme, while maintaining its profit and goodwill assuring maximum benefit to its clients and employees. To achieve the company’s short term goals, the senior executives exhibit behavior based on the principles of leadership and teamwork in general and situational leadership model in particular. They are result oriented, accountable, open and humane.

Long Term Goals

Guided by the vision, AML believes in ensuring long term existence by being profitable, successful and sustainable. This is achieved by the company’s commitments in providing value-adding products and services demonstrate the company’s commitment to use resources optimally.

2.7 Strategy Making Hierarchy

The beverage unit of Abdul Monem Limited works under two different managements. The production and quality control of the beverage is maintained and strictly monitored by the international Coca Cola authority headquartered at Atlanta, USA, whereas the local operations are maintained under the supervision of Abdul Monem Limited Beverage Unit Management Board.

International Management of Coca Cola

At the lowest level of the International Coca Cola management team is the local authorized bottler, Abdul Monem Limited. AML is accountable to the Country Manager of Coca Cola Far East Limited office located in Bangladesh. The hierarchy then goes up to the Vice President of South West Asia Regional Office to the President of Coca Cola India to President of Coca Cola EURESIA Group which is directly responsible to the highest authority for the operation of Coca Cola all over the work, the President of Board of Director of Coca Cola at Atlanta, USA.

Local Management for Beverage Operation

The strategies and operations of the beverage unit of AML are maintained under the control of the General Managers of corresponding divisions. The General Managers are supervised by the Chief Operating Officer of the Coca Cola Operations, who is accountable to the Board of Directors composed of The Managing Director and Deputy Managing Directors. The operation and performance of the Coca Cola operations of AML are closely monitored by the International Coca Cola Authority through its regional stations.

A conceptual flow diagram of the strategy making hierarchy of Abdul Monem Limited is given below:

2.7 SWOT Analysis

The Strengths and Weakness of an enterprise represents its internal health and vulnerability whereas the Opportunity and Threats represents its degree of external exposure and interactivity. SWOT analysis provides a good overview of whether its overall situation is fundamentally healthy or unhealthy and provides the basis for crafting strategy on every front.

SWOT Matrix

Strengths

1. International brand image of Coca Cola

2. Technical expertise and R&D provided by international authority of Coca Cola

3. Nationwide distributorship driven by highly motivated workforce

4. Value chain integration through the efficient use of the other business entities of the group, such as the products of IGLOO Sugar is used as a base ingredient in Coca Cola.

Weakness

1. Over dependency on the international Coca Cola authority.

2. No room for crafting brand level strategies concerning the beverage Coca Cola

Opportunities

1. At present, AML only bottles and distributes only three brands of beverages – Coca Cola, Sprite and Fanta. It is always possible to introduce other world famous Coca Cola brands like Bislery (Drinking Water), Maaza (Mango Drink) and others.

2. AML currently can distribute its beverages only in Chittagong, Khulna, Sylhet and Barishal Division. The acquisition of the distributorship of the whole Bangladesh will be a great opportunity for AML.

Threats

1. The ever rising number of new entrants in the business.

2. Narrow band of beverage product line compared to the competitors.

3. Dominance of substitute beverage products like fruit juice.

2.8 Major Rivals

The rivals for the beverage unit of AML range from the rivals producing other carbonated beverages as well as from the producers of other beverages such as Fruit Juices, Flavored Milk, Synthetic Drinks and Pure Drinking Water. Notably, the major rivals of AML are:

Rival Carbonated Beverage Producers

• Transcom Beverage (Pepsi Cola, 7up, Mirinda)

• Pertex Group (RC Cola, RC Lemon)

• AMCL – PRAN (Pran Cola, Pran Up)

• Globe Beverage (Uro Cola, Uro Lemon)

• Akij Food and Beverage Limited, AFBL (Lemu, Mojo, Spa)

Rival Fruit Juice Producers

• AMCL – Pran (Pran Fruit Juice)

• Acme Pharmaceuticals (Acme Juice)

Rival Other Beverage Producers

• AMCL – Pran (Synthetic Lychi Drink)

• Milk Vita (Flavored Milk)

• Arong (Flavored Milk)

2.9 Recognition

In 1991 the Company was awarded with the President’s Turtle Award by the President of The Coca-Cola Company for recognition of its contribution for positioning the brand. This is the most prestigious reward to the Bottlers from The Coca-Cola Company (TCCC).

Chapter 3

Abdul Monem Limited : Strategical Analysis

3.1 Competitive Strategy

AML and its beverage products, i.e. Coca Cola, Sprite, Fanta Orange and Fanta Lemon are well known for providing best value to its clients for the cost they pay for it. AML only have four products in its beverage line, so clearly they are not going for Broad Differentiation. Though the competition in the industry is tense than ever, still the price set by AML is in the top region, so they are not eyeing to be the Low Cost Provider either. They produce no products for any niche group or for any special price facilitated groups. Thus, strategically AML can be classified as he Best Cost Provider.

3.2 Complementary Strategy

3.2.1 Strategic Alliances or Collaborative Partnership

From the very beginning of its beverage operation, AML has been the market leader by a great distance. They never felt any necessity to make collaboration with any rivals. However, since AML is authorized for distributing its products only in half of the regions of the country, they made a strategic alliance with the enterprise, Tabani Beverage, that distributes on the other half of the country. According to this alliance, AML will provide and supply Tabani Beverage with all the products they need and Tabani Beverage is only authorized to distribute those to its own territory. Due to this alliance, though AML lost the authority for the distributorship all over the country, they made sure to utilize their total capacity of production by producing beverage products for the whole nation.

3.2.2 Merger and Acquisition

Though no record for merger was found in the history of AML, the entrance of AML in beverage industry was the result of a huge acquisition of cotemporary scenario. Till 1982, the authorized bottler of Coca Cola for Bangladesh was entitled to K. Rahman & Company. AML took over its bottling operation by acquiring the plant of the K. Rahman & Company in Chittagong in 1982. It has set up two more bottling plants, one in Dhaka and other in Comilla, till then.

3.2.3 Value Chain and Vertical Integration

As a group of company, AML enjoys the privilege of vertical integration through both forward and backward linkage operations. It has its own plants for producing raw materials and own diverse and well equipped distribution channel for distributing the finished product.

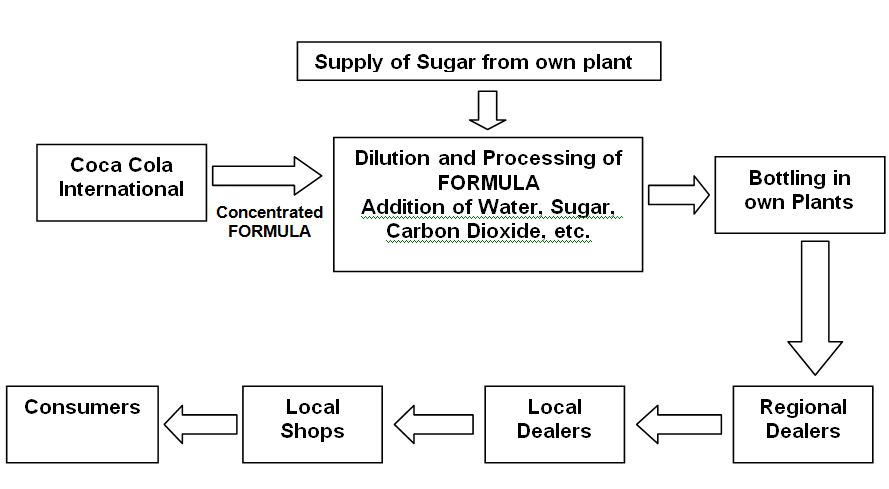

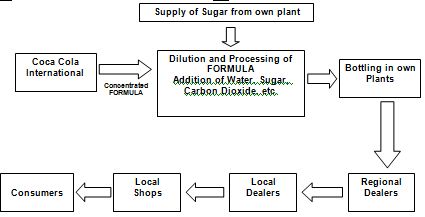

The Value Chain starts from acquiring the main ingredient of the beverage, called the FORMULA. The FORMULA is a chemical compound that works as the heart of the beverage and due to business secret, no one except for the original Coca Cola Company can produce it. After receiving the concentrated FORMULA, it is diluted and processed by adding other components like drinking water, sugar, Carbon Dioxide and so on. The sugar used in this process demand high quality, so AML established its own sugar plant, IGLOO Sugar to get a regular supply of high quality sugar.

The finished beverage is then bottled and sent to the major regional distributors who make it available in the shops for the customers through local dealers.

A flow chart for the complete Value Chain process is given below :

3.2.4 Outsourcing

The only outsourced item in the total value chain process of AML in producing, bottling and distributing Coca Cola is the making of the bottle itself. For the case of glass bottles, the regional headquarter of Coca Cola, Coca Cola India (CCI) supplies AML the bottle they require to ensure the quality of the bottle regarding shape, strength and safety. For the PET bottles, AML has outsourced them through making special orders to the outside producers of PET bottles.

3.2.5 Strategic Moves

For decades, the beverage industry of Bangladesh has been a monopolistic market with Coca Cola the only market leader. Thus, undertaking any strategic moves, offensive or defensive, was unnecessary. However, as the competition grew, being offensive or defensive through adopting new strategic moves became more and more crucial.

In 1987 the Company made an aggressive move to expand the market by installing a new H&K bottling line with an installed capacity of 450 Bottles Per Minute (BPM) bottling capacity at Comilla. With this move, the Company immediately gained the market leadership position from the Pepsi which was the leader for more than 27 years. Long term planning and aggressive marketing approach rewarded the Company with the market leadership position for the brands that remains till date.

AML also takes defensive moves time to time by sending messages of retaliation to its rivals by occasional price cut and offering frills. Such moves have become more and more common especially during the festive seasons like Eid.

3.3 Functional Area Strategy

Functional Area Strategies are mostly monitored and supervised by the Board of Directors. This is due to the necessity to keep balance between different lines of business that the enterprise pursues. While the Technological support and Research and Development activities are mostly provided by Coca Cola International, AML is responsible for the production, bottling, marketing and sales and distribution of Coca Cola in Bangladesh. While the accounts and finance division is separate for the beverage unit of AML, the Human Resource Department works for the whole enterprise as a whole.

3.4 Timing of Strategy

As a player of a monopolistic market, the timing of strategy was never been a problem for AML as a bottler and distributor of Coca Cola in Bangladesh. Almost all the technology and approaches in the beverage industry of Bangladesh are one way or another introduced by Coca Cola and AML. In this regard, AML and Coca Cola has always been the First Mover in the beverage industry of Bangladesh.

3.5 Business Ethics and Social Responsibility

Business Ethics for the beverage industry mainly comes from the health perspective. All the ingredients used in the production of Coca Cola under AML are strictly monitored by the Coca Cola Company, USA. Any violation from the required standard would result in a cancellation of the license.

As for the social responsibility, AML runs one madrasa, one college and one Etimkhana for the poor people of the village Brijesswar in Brahmanbaria under the financing of AML Foundation. AML Foundation is also engaged in providing micro finance to the poor of the village. Other than that, AML runs relief works and provides pure drinking water in any case of natural disaster.

Chapter 4

Findings & Recommendations

4.1 Findings

• The carbonated beverage industry of Bangladesh is visibly a matured and declining industry.

• The existing market of carbonated beverage is seriously threatened by the emergence of other substitute beverage products.

• Due to the narrow product line, AML and its beverage unit is having a hard time to maintain its share in the market.

• Over the last decade, numerous number of new enterprises has entered the industry and eventually have swamped the industry for its volume.

• The policy and technology determined by the Coca Cola Company, USA are not always suitable for the case of Bangladesh.

4.2 Recommendations

• To introduce other well anticipated products of Coca Cola Company in local market.

• Going for some alliance with some of the major rivals or if possible acquiring some of them.

• As the oldest enterprise in the beverage industry of the country, the only cost AML can consider is the variable cost of the product and can forget about the establishment cost as it should have been recovered after all these days. Thus, AML can consider a serious price cut to rule out the smaller player from the market and gain more share.

Strengths of AML

• International brand image of Coca Cola

• Technical expertise and R&D provided by international authority of Coca Cola

• Nationwide distributorship driven by highly motivated workforce

• Value chain integration through the efficient use of the other business entities of the group, such as the products of IGLOO Sugar is used as a base ingredient in Coca Cola.

Weakness of AML

• Over dependency on the international Coca Cola authority.

• No room for crafting brand level strategies concerning the beverage Coca Cola

Opportunities for AML

• At present, AML only bottles and distributes only three brands of beverages – Coca Cola, Sprite and Fanta. It is always possible to introduce other world famous Coca Cola brands like Bislery (Drinking Water), Maaza (Mango Drink) and others.

• AML currently can distribute its beverages only in Chittagong, Khulna, Sylhet and Barishal Division. The distributor for the rest of the country is Tabani Beverage, who gets the supply of beverages from AML. The acquisition of the distributorship of the whole Bangladesh will be a great opportunity for AML.

Threats for AML

• The ever rising number of new entrants in the business.

• Narrow band of beverage product line compared to the competitors.

• Dominance of substitute beverage products like fruit juice.

Chapter 3

Abdul Monem Limited : Strategic Analysis

3.1 Competitive Strategy

AML and its beverage products, i.e. Coca Cola, Sprite, Fanta Orange and Fanta Lemon are well known for providing best value to its clients for the cost they pay for it. AML only have four products in its beverage line, so clearly they are not going for Broad Differentiation. Though the competition in the industry is tense than ever, still the price set by AML is in the top region, so they are not eyeing to be the Low Cost Provider either. They produce no products for any niche group or for any special price facilitated groups. Thus, strategically AML can be classified as he Best Cost Provider.

3.2 Complementary Strategy

3.2.1 Strategic Alliances or Collaborative Partnership

From the very beginning of its beverage operation, AML has been the market leader by a great distance. They never felt any necessity to make collaboration with any rivals. However, since AML is authorized for distributing its products only in half of the regions of the country, they made a strategic alliance with the enterprise, Tabani Beverage, that distributes on the other half of the country. According to this alliance, AML will provide and supply Tabani Beverage with all the products they need and Tabani Beverage is only authorized to distribute those to its own territory. Due to this alliance, though AML lost the authority for the distributorship all over the country, they made sure to utilize their total capacity of production by producing beverage products for the whole nation.

3.2.2 Merger and Acquisition

Though no record for merger was found in the history of AML, the entrance of AML in beverage industry was the result of a huge acquisition of cotemporary scenario. Till 1982, the authorized bottler of Coca Cola for Bangladesh was entitled to K. Rahman & Company. AML took over its bottling operation by acquiring the plant of the K. Rahman & Company in Chittagong in 1982. It has set up two more bottling plants, one in Dhaka and other in Comilla, till then.

3.2.3 Value Chain and Vertical Integration

As a group of company, AML enjoys the privilege of vertical integration through both forward and backward linkage operations. It has its own plants for producing raw materials and own diverse and well equipped distribution channel for distributing the finished product.

The Value Chain starts from acquiring the main ingredient of the beverage, called the FORMULA. The FORMULA is a chemical compound that works as the heart of the beverage and due to business secret, no one except for the original Coca Cola Company can produce it. After receiving the concentrated FORMULA, it is diluted and processed by adding other components like drinking water, sugar, Carbon Dioxide and so on. The sugar used in this process demand high quality, so AML established its own sugar plant, IGLOO Sugar to get a regular supply of high quality sugar.

The finished beverage is then bottled and sent to the major regional distributors who make it available in the shops for the customers through local dealers.

A flow chart for the complete Value Chain process is given in the following page.

3.2.4 Outsourcing

The only outsourced item in the total value chain process of AML in producing, bottling and distributing Coca Cola is the making of the bottle itself. For the case of glass bottles, the regional headquarter of Coca Cola, Coca Cola India (CCI) supplies AML the bottle they require to ensure the quality of the bottle regarding shape, strength and safety. For the PET bottles, AML has outsourced them through making special orders to the outside producers of PET bottles.

3.2.5 Strategic Moves

For decades, the beverage industry of Bangladesh has been a monopolistic market with Coca Cola the only market leader. Thus, undertaking any strategic moves, offensive or defensive, was unnecessary. However, as the competition grew, being offensive or defensive through adopting new strategic moves became more and more crucial.

In 1987 the Company made an aggressive move to expand the market by installing a new H&K bottling line with an installed capacity of 450 Bottles Per Minute (BPM) bottling capacity at Comilla. With this move, the Company immediately gained the market leadership position from the Pepsi which was the leader for more than 27 years. Long term planning and aggressive marketing approach rewarded the Company with the market leadership position for the brands that remains till date.

AML also takes defensive moves time to time by sending messages of retaliation to its rivals by occasional price cut and offering frills. Such moves have become more and more common especially during the festive seasons like Eid.

Value Chain Activities of the Beverage Unit of Abdul Monem Limited

3.3 Functional Area Strategy

Functional Area Strategies are mostly monitored and supervised by the Board of Directors. This is due to the necessity to keep balance between different lines of business that the enterprise pursues. While the Technological support and Research and Development activities are mostly provided by Coca Cola International, AML is responsible for the production, bottling, marketing and sales and distribution of Coca Cola in Bangladesh. While the accounts and finance division is separate for the beverage unit of AML, the Human Resource Department works for the whole enterprise as a whole.

3.4 Timing of Strategy

As a player of a monopolistic market, the timing of strategy was never been a problem for AML as a bottler and distributor of Coca Cola in Bangladesh. Almost all the technology and approaches in the beverage industry of Bangladesh are one way or another introduced by Coca Cola and AML. In this regard, AML and Coca Cola has always been the First Mover in the beverage industry of Bangladesh.

3.5 Business Ethics and Social Responsibility

Business Ethics for the beverage industry mainly comes from the health perspective. All the ingredients used in the production of Coca Cola under AML are strictly monitored by the Coca Cola Company, USA. Any violation from the required standard would result in a cancellation of the license.

As for the social responsibility, AML runs one madrasa, one college and one Etimkhana for the poor people of the village Brijesswar in Brahmanbaria under the financing of AML Foundation. AML Foundation is also engaged in providing micro finance to the poor of the village. Other than that, AML runs relief works and provides pure drinking water in any case of natural disaster.

Chapter 4

Findings & Recommendations

4.1 Evaluating the Strategies of Abdul Monem Ltd.

The last and the most important of all phases of Strategy Making Process or Strategy Executing Process is the Evaluation. An evaluation of the effectiveness of existing strategies enables the management to review, correct and adjusts any flaw in the system. Evaluation also dictates the effectiveness of the employees who employ the strategies as well as the effectiveness of the management itself.

For the beverage industry of Bangladesh, at the present scenario, the major objective of all the players are to grab the maximum of the potential market share. This is due to the following reasons:

• The market size is limited and the possibility of expansion of new market is very low.

• The industry is overcrowded with huge number of players that the market can withstand.

• New players are emerging all the time.

• The products are seriously competed against the rival substitute products.

• The industry, as a matured or even declining industry, is loosing its consumer base day by day.

• Introduction of new product or new technology is apparently absent.

4.1.1 Method of the Survey

To identify the market share of the beverage products of Abdul Monem Ltd. in the beverage product market in Bangladesh, a questionnaire survey was conducted. Due to the time constraints, the survey was conducted in only three retail stores located in three major locations of Dhaka city. It is to be noted that as the number of sample is less than thirty in this case, the results of this survey cannot be considered for any statistical analysis. However, the result should give a qualitative view of the relative position of Abdul Monem Ltd. among the other competitors in the beverage market of Bangladesh.

4.1.2 Detail of the Survey

The survey was conducted in three prominent retail stores located in three prime locations of Dhaka city; Bikrampur General Store at Kalabagan, Tasmia Departmental Store at Palashi and Big Bazar at Mirpur. A formatted questionnaire was supplied to each of the store keepers to fill out. The questionnaire contained both open ended and close ended questions regarding the products of Abdul Monem Ltd, as the focus of the survey was to distinguish the difference between the market share of Abdul Monem Ltd. and its rivals, not any other single enterprise.

4.1.3 Results from the survey

The results of the survey show that all the stores under consideration sell the beverage products of Abdul Monem Ltd. for a long period of time, though over the last few years, demand for other brands and vendors are on an increasing trend.

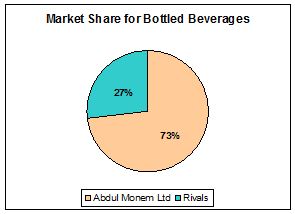

Abdul Monem Ltd. markets its beverages in three different packaging systems; glass bottles, PET bottles and Cans, whereas, most of the other beverage manufacturers packages their product in only PET and Can form. Thus, the market share of Abdul Monem Ltd. in glass bottle beverages is expectedly high compared to its rivals. Survey show that Abdul Monem Ltd. holds more than 70 percent of the total market share of glass bottled beverage industry.

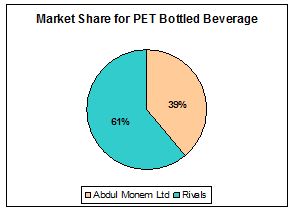

For the PET bottled beverage industry, Abdul Monem Ltd. is facing a serious challenge from its rival. Almost all of the rivals have diversified their PET bottled line of beverage to suit the volume difference of the clients, whereas Abdul Monem Ltd. has a very limited number of diversified PET bottle series. This narrow band of diversification has cost them to lose valuable market share in the industry.

Also in the canned beverage market, Abdul Momen Ltd. lost its major market share to the new comers for the lack of its marketing priorities. Abdul Momen Ltd. considers marketing its glass bottled and PET bottled products as top priority and provides less than adequate attention to its Canned beverage item. The rivals took the advantage of this opportunity and gained major market share over Abdul Monem Ltd. at this segment of the market.

However, the distribution network, availability and consumer response seems to have always been in favor for Abdul Monem Ltd. and Coca Cola. The retailers are more than happy with the efficient distribution channel run by Abdul Monem Ltd. compared to that of other vendors. The availability of the product is also very good throughout the year and the consumers also value the beverage products of Abdul Monem Ltd. as best value, mainly due to the brand image of Coca Cola and shear quality control.

4.1.4 Findings from the survey

• Abdul Monem Ltd. is still the market leader for the glass bottled beverage market in Bangladesh, mainly due to the fact that most of the rivals do not produce glass bottled beverages.

• Its market share in PET bottled and Canned beverage market has seriously declined and on a serious threat under the aggression of the rivals in this segment.

• However, the establishment and infrastructure of Abdul Monem Ltd. to distribute the product to the footstep of the consumer remained best of all

4.2 Key Findings

• The carbonated beverage industry of Bangladesh is visibly a matured and declining industry.

• The existing market of carbonated beverage is seriously threatened by the emergence of other substitute beverage products.

• Due to the narrow product line, AML and its beverage unit is having a hard time to maintain its share in the market.

• Over the last decade, numerous number of new enterprises has entered the industry and eventually have swamped the industry for its volume.

• The policy and technology determined by the Coca Cola Company, USA are not always suitable for the case of Bangladesh.

4.3 Recommendations

• To introduce other well anticipated products of Coca Cola Company in local market.

• Going for some alliance with some of the major rivals or if possible acquiring some of them.

• As the oldest enterprise in the beverage industry of the country, the only cost AML can consider is the variable cost of the product and can forget about the establishment cost as it should have been recovered after all these days. Thus, AML can consider a serious price cut to rule out the smaller player from the market and gain more share.

![Report on One Bank LTD [Part-4]](https://assignmentpoint.com/wp-content/uploads/2013/03/one-bank1-200x58.jpg)