FERA-1947:

FOREIGN EXCHANGE REGULATION ACT, 1947

ACT NO. VII OF 1947

IITH MARCH, 1947

(As modified up to 30th April, 2002)

An Act to regulate certain payments, dealings in foreign exchange and securities and the import and export of currency and bullion.

Whereas it is expedient in the economic and financial interests of Bangladesh to provide for the regulation of certain payments, dealings in foreign exchange and securities and the import and export of currency and bullion;

It is hereby enacted as follows:

1. (1) This Act may be called the Foreign Exchange Regulation Act, 1947.

(2) It extends to the whole of Bangladesh and applies to all citizens of Bangladesh and persons in the service of the Republic wherever they may be.

(3) It shall come into force on such date as the Government may, by notification in the official Gazette, appoint in this behalf.

2. In this Act, unless there is anything repugnant in the subject or context,

(a) “Authorized dealer” means a person for the time being authorized under section 3 to deal in foreign exchange;

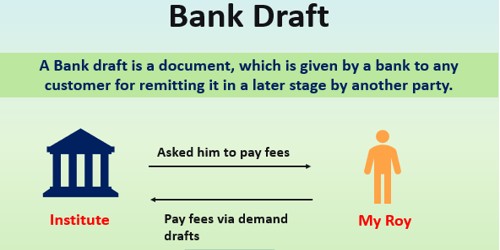

(b) “currency” includes all coins, currency notes, bank notes, postal notes, money orders, cheques, drafts, traveler’s cheques, letters of credit, bills of exchange and promissory notes;

(c) “Foreign currency” means any currency other than Bangladesh currency;

(d) “foreign exchange” means foreign currency and includes any instrument drawn, accepted, made or issued under clause (13) of Article 16 of the Bangladesh Bank Order, 1972, all deposits, credits and balances payable in any foreign currency and any draft, traveler’s cheque, letter of credit and bill of exchange expressed or drawn in Bangladesh currency but payable in any foreign currency;

(e) “Foreign security” means any security issued elsewhere than in Bangladesh and any security the principal of or interest on which is payable in any foreign currency or elsewhere than in Bangladesh;

(f) “Gold” includes gold in the form of coin, whether legal tender or not, or in the form of bullion or ingot, whether refined or not:

(g) “Bangladesh currency” means currency which is expressed or drawn in

Bangladesh Taka;

(h) “owner”, in relation to any security, includes any person who has power to sell or transfer the security or who has the custody thereof or who receives, whether on his own behalf or on behalf of any other person, dividends or interest there on and who has any interest therein and in a case where any security is held on any trust or dividends or interest thereon are paid into a trust fund, also includes any trustee or any person entitled to enforce the performance of the trust or to revoke or vary, with or without the consent of any other person, the trust or any terms thereof, or to control the investment of the trust moneys;

(i) “Prescribed” means prescribed by rules made under this Act;

(j) “Bangladesh Bank” means the Bangladesh Bank established under clause (1) of Article 3 of Bangladesh Bank Order, 1972;

(k) “security” means shares, stocks, bonds, debentures, debenture stock and Government securities, as defined in the securities Act, 1920, deposit receipts in respect of deposits of securities, and units or sub-units of unit trust, but does not include bills of exchange or promissory notes other than Government promissory notes;

(l) “Silver” means silver bullion or ingot, silver sheets and plates which have undergone no process of manufacture subsequent to rolling and incurrent silver coin which is not legal tender in Bangladesh or elsewhere:

(m) “Transfer” includes, in relation to any security, transfer by way of loan or security.

3. (1) The Bangladesh Bank may, on application made to it in this behalf, authorize any person to deal in foreign exchange.

(2) An authorization under this section

(i) May authorize dealings in all foreign currencies or may be restricted to authorizing dealings in specified foreign currencies only;

(ii) May authorize transactions of all descriptions in foreign currencies or may be restricted to authorizing specified transactions only;

(iii) May be granted to be effective for a specified period, or within specified amounts, and may in all cases be revoked for reasons appearing to it sufficient by the Bangladesh Bank.

4. Except with the previous general or special permission of the Bangladesh Bank, no person other than an authorized dealer shall in Bangladesh and no person resident in Bangladesh other than an authorized dealer shall outside Bangladesh, buy or borrow from, or sell or lend to, or exchange with, any person not being an authorized dealer, any foreign exchange.

5. The Government may, by notification in the official Gazette, impose such conditions as it thinks necessary or expedient on the use or disposal of or dealings in gold and silver prior to, or at the time of, import into Bangladesh.

12. (1) The Government may, by notification in the official Gazette, prohibit the export of any goods or class of goods specified in the notification from Bangladesh directly or indirectly to any place so specified unless a declaration supported by such evidence as may be prescribed or so specified is furnished by the exporter to the prescribed authority that the amount representing the full export value of the goods has been or will within the prescribed period be, paid in the prescribed manner.

(2) No person entitled to sell, or procure the sale of, said goods shall, except with the permission of the Bangladesh Bank.

(5) Where in relation to any such goods the value as stated in the invoice is less than the amount which in the opinion of the Bangladesh Bank represents the full export value of those goods, the Bangladesh Bank may issue an order requiring the person holding the shipping documents to retain possession thereof until such time as the exporter of the goods has made arrangements for the Bangladesh Bank or a person authorized by the Bangladesh Bank to receive on behalf of the exporter payment in the prescribed manner of an amount which represents in the opinion of the Bangladesh Bank the full export value of the goods.

15. The Government may, by notification in the official Gazette, order that except with the general or special permission of the Bangladesh Bank no person shall in Bangladesh issue any bearer security or coupon or so alter any document that it becomes bearer security or coupon.

17. (1) No person resident in Bangladesh shall, except with the general or special permission of the Bangladesh Bank, settle any property, otherwise than by will upon any trust under which a person who at the time of the settlement is resident outside Bangladesh elsewhere than in territories notified in this behalf by the Bangladesh Bank, will have an interest in the property or exercise, other than by will, any power for payment in favors of a person who at the time of the exercise of the power is resident outside Bangladesh elsewhere than in such notified territories.

(2) A settlement or power as aforesaid shall not be invalid except in so far as it confers any right or benefit on any person who at the time of the settlement or the exercise of the power is resident outside Bangladesh, elsewhere than in territories notified by the Bangladesh Bank.

18. (1) Except with the general or special permission of the Bangladesh Bank, no person resident in Bangladesh shall do any act whereby a company, which is controlled by person resident in Bangladesh ceases to be so controlled.

(2) Except with the general or special permission of the Bangladesh Bank, no person resident in Bangladesh shall lend any money or security to any company, not being a banking company which is by any means controlled, whether directly or indirectly by persons resident outside Bangladesh elsewhere than in the territories notified in this behalf by the Bangladesh Bank. In this sub-section “company” includes a firm, branch or office of a company or firm.

21. (1) No person shall enter into any contract or agreement which would directly or indirectly evade or avoid in any way the operation of any provision of this Act or of any rule, direction or order made there under.

(2) Any provision of, or having effect under this Act, that a thing shall not be done without the permission of the Government or the Bangladesh Bank, shall not render invalid any agreement by any person to do that thing, if it is a term of the agreement that that thing shall not be done unless permission is granted by the Government.

(3) Neither the provisions of this act nor any term (whether expressed or implied) contained in any contract that anything for which the permission of the Government or the Bangladesh Bank is required by the said provisions shall not be done without that permission, shall prevent legal proceedings being brought in Bangladesh to recover any sum which, apart from the said provisions and any such term, would be due, whether as a debt, damages or otherwise, but-

(a) The said provisions shall apply to sums required to be paid by any judgment or order of any Court as they apply in relation to other sums; and

(b) no steps shall be taken for the purpose of enforcing any judgment or order for the payment of any sum to which the said provisions apply except as respects so much thereof as the Government or the Bangladesh Bank, as the case may be, may permit to be paid; and

(c) for the purpose of considering whether or not to grant such permission, the Government or the Bangladesh Bank, as the case may be, may require the person entitled to the benefit of the judgement or order and the debtor under the judgments or order to produce such documents and to give such information as may be specified in the requirement.

(4) Notwithstanding anything in the Negotiable Instruments Act, 1881 neither the provisions of this Act or of any rule, direction or order made there under, nor any condition, whether express or to be implied having regard to those provisions, that any payment shall not be made without permission under this Act, shall be deemed to prevent any instrument being a bill of exchange or promissory note.

22. No person shall, when complying with any order or direction, under section 19, or when making any application or declaration to any authority or person for any purpose under this Act, give any information or make any statement which he knows or has reasonable cause to believe to be false, or not true, in any material particular.

23. Penalty and Procedure: (1) Whenever Contravenes, attempts to contravene or abets the contravention of any of the provisions of this Act or of any rules, direction or order made there under shall not -withstanding anything contained in the Code of Criminal Procedure, 1898 (Act V of 1898) be tried by a Tribunal constituted by Section 23A and shall be punishable with imprisonment for a term which may extend to four years or with fine or with both and any such Tribunal trying any such contravention.

(2) Notwithstanding anything contained in the Code of Criminal Procedure, 1898 (Act V of 1898), any offence punishable under this section shall be cognizable for such period as the Government may from time to time, by notification in the Official Gazette, declare.

(3) A tribunal shall not take cognizance of any offence punishable under this section and not declared by the Government under the preceding sub-section to be cognizable for the time being or of an offence punishable under section 54 of the Income-tax Act, 1922 (XI of 1922), as applied by section 19, except upon complaint in writing made by a person authorized by the Government or the Bangladesh Bank in this behalf. Provided that where any such offence is the contravention of any of the provisions of this Act or of any rule.

(4) Where the person guilty of an offence under this Act is a company or other body corporate, every Director, Manager, Secretary and other officer thereof who is knowingly a party to the offence shall also be guilty of the same offence and liable to the same punishment.

23. A. Tribunal, its powers, etc: (1) Every Sessions Judge shall, for the areas within the territorial limits of his jurisdiction be a Tribunal for trial of an offence punishable under section 23.

(2) A Tribunal may transfer any case for trial to an Additional Sessions Judge within its jurisdiction who shall, for trying a case so transferred, be deemed to be a Tribunal constituted for the purpose.

(3) A Tribunal shall have all the powers of a Magistrate of the First Class in relation to criminal trials, and shall follow as nearly as may be the procedure provided in the Code of Criminal Procedure, 1898 (Act V of 1898), for trials before such Magistrate, and shall also have powers as provided in the said Code in respect of the following matters, namely:

(a) Directing the arrest of the accused;

(b) Issuing search warrants;

(c) Ordering the police to investigate any offence and report;

(d) Authorizing detention of a person during police investigation;

(e) Ordering the release of the accused on bail.

(4) All proceedings before a Tribunal shall be deemed to be judicial proceedings within the meaning of sections 193 and 228 of the Penal Code (Act XLV of 1860), and for the purposes of section 196 thereof, and the provisions relating to the execution of orders and

Sentences in the Code of Criminal Procedure, 1898 (Act V of 1898) shall, so far as may be, apply to orders and sentences passed by a Tribunal.

(5) As regards sentences of fine, the powers of a Tribunal shall be as extensive as those of a Court of Session.

(6) The Bangladesh Bank or any other person aggrieved by judgments of a Tribunal may, within three months from the date of the judgments, appeal to the High Court Division.

(7) Save as provided in the preceding sub-section, all judgements and orders passed by a Tribunal shall be final.

24. (1) where any person is tried for contravening any provision of this Act or of any rule, direction or order made there under which prohibits him from doing any Act without permission, the burden of proving that he had the requisite permission shall be on him.

(2) 1f in a case in which the proof of complicity of a person resident in Bangladesh with a person outside Bangladesh is essential to prove an offence under this Act, then after proof of the circumstances otherwise sufficient to establish the commission of the offence, it shall be presumed that there was such complicity, and the burden of proving that there was no such complicity shall be on the person accused of the offence.

25. For the purposes of this Act the Government may from time to time give to the Bangladesh Bank such general or special directions as it thinks fit, and the Bangladesh Bank shall, in the exercise of its functions under this Act, comply with any such directions.

26. No suit, prosecution or other legal proceedings shall lie against any person for anything in good faith done or intended to be done under this Act or any rule, direction or order made thereunder.

27. The Government may, by notification in the official Gazette, make rules for carrying into effect the provisions of this Act.

UCP600:

ICC Uniform Customs and Practice for Documentary Credits (UCP 600)-are the latest revision of the Uniform Customs and Practice that govern the operation of letters of

Credit. UCP 600 comes into effect on 01 July 2007

This revision of the Uniform Customs and Practice for Documentary Credits (commonly called “UCP”) is the sixth revision of the rules since they were first promulgated in 1933. It is the fruit of more than three years of work by the International Chamber of Commerce’s (ICC) Commission on Banking Technique and Practice.

The 39 articles of UCP 600 are a comprehensive and practical working aid to bankers, lawyers, importers, and exporters, transport executives, educators, and everyone involved in letter of credit transactions worldwide.

UCP 600 – Article 1

Application of UCP:

The Uniform Customs and Practice for Documentary Credits, 2007 Revision, ICC Publication no. 600 (“UCP”) are rules that apply to any documentary credit (“credit”) (including, to the extent to which they may be applicable, any standby letter of credit) when the text of the credit expressly indicates that it is subject to these rules. They are binding on all parties thereto unless expressly modified or excluded by the credit.

UCP 600 – Article 2

Definitions:

For the purpose of these rules:

Advising bank means the bank that advises the credit at the request of the issuing bank.

Applicant means the party on whose request the credit is issued.

Banking day means a day on which a bank is regularly open at the place at which an act subject to these rules is to be performed.

Beneficiary means the party in whose favors a credit is issued.

Complying presentation means a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of these rules and international standard banking practice.

Confirmation means a definite undertaking of the confirming bank, in addition to that of the issuing bank, to honor or negotiate a complying presentation.

Confirming bank means the bank that adds its confirmation to a credit upon the issuing bank’s authorization or request.

Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honor a complying presentation.

Honor means:

a. to pay at sight if the credit is available by sight payment.

b. to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred

Payment.

c. to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance.

Issuing bank means the bank that issues a credit at the request of an applicant or on its own behalf.

Negotiation means the purchase by the nominated bank of drafts (drawn on a bank other than the nominated bank) and/or documents under a complying presentation, by advancing or agreeing to advance funds to the beneficiary on or before the banking day on which reimbursement is due to the nominated bank.

Nominated Bank means the bank with which the credit is available or any bank in the case of a credit available with any bank.

Presentation means either the delivery of documents under a credit to the issuing bank or nominated bank or the documents so delivered.

Presenter means a beneficiary, bank or other party that makes a presentation.

UCP 600 – Article 3

Interpretations:

For the purpose of these rules:

Where applicable, words in the singular include the plural and in the plural include the singular. A credit is irrevocable even if there is no indication to that effect.

A document may be signed by handwriting, facsimile signature, perforated signature, stamp, symbol or any other mechanical or electronic method of authentication.

A requirement for a document to be legalized, visited, certified or similar will be satisfied by any signature, mark, stamp or label on the document which appears to satisfy that requirement. Branches of a bank in different countries are considered to be separate banks. Terms such as “first class”, “well known”, “qualified”, “independent”, “official”, “competent” or “local” used to describe the issuer of a document allow any issuer except the beneficiary to issue that document.

Unless required to be used in a document, words such as “prompt”, “immediately” or “as soon as possible” will be disregarded.

The expression “on or about” or similar will be interpreted as a stipulation that an event is to occur during a period of five calendar days before until five calendar days after the specified date, both start and end dates included.

The words “to”, “until”, “till”, “from” and “between” when used to determine a period of shipment include the date or dates mentioned, and the words “before” and “after” exclude the date mentioned.

The words “from” and “after” when used to determine a maturity date exclude the date mentioned.

The terms “first half” and “second half” of a month shall be construed respectively as the 1st to the 15th and the 16th to the last day of the month, all dates inclusive.

The terms “beginning”, “middle” and “end” of a month shall be construed respectively as the 1st to the10th, the 11th to the 20th and the 21st to the last day of the month, all dates inclusive.

UCP 600 – Article 4

Credits v. Contracts:

a. A credit by its nature is a separate transaction from the sale or other contract on which it may be based. Banks are in no way concerned with or bound by such contract, even if any reference whatsoever to it is included in the credit. A beneficiary can in no case avail itself of the contractual relationships existing between banks or between the applicant and the issuing bank.

b. An issuing bank should discourage any attempt by the applicant to include, as an integral part of the credit, copies of the underlying contract, proforma invoice and the like.

UCP 600 – Article 5

Documents v. Goods, Services or Performance:

Banks deal with documents and not with goods, services or performance to which the documents may relate.

UCP 600 – Article 6

Availability, Expiry Date and Place for Presentation

a. A credit must state the bank with which it is available or whether it is available with any bank.

A credit available with a nominated bank is also available with the issuing bank.

b. A credit must state whether it is available by sight payment, deferred payment, acceptance or negotiation.

c. A credit must not be issued available by a draft drawn on the applicant.

d.i. A credit must state an expiry date for presentation. An expiry date stated for honor or negotiation will be

Deemed to be an expiry date for presentation.

ii. The place of the bank with which the credit is available is the place for presentation. The place for

e. A presentation by or on behalf of the beneficiary must be made on or before the expiry date.

UCP 600 – Article 7

Issuing Bank Undertaking

a. Provided that the stipulated documents are presented to the nominated bank or to the issuing bank and that they constitute a complying presentation, the issuing bank must honor if the credit is available by:

i. sight payment, deferred payment or acceptance with the issuing bank;

ii. sight payment with a nominated bank and that nominated bank does not pay;

iii. deferred payment with a nominated bank and that nominated bank does not incur its deferred payment undertaking or, having incurred its deferred payment undertaking, does not pay at maturity;

iv. Acceptance with a nominated bank and that nominated bank does not accept a draft drawn on it or, having accepted a draft drawn on it, does not pay at maturity;

v. negotiation with a nominated bank and that nominated bank does not negotiate.

b. An issuing bank is irrevocably bound to honor as of the time it issues the credit.

c. An issuing bank’s undertaking to reimburse a nominated bank is independent of the issuing bank’s undertaking to the beneficiary.

UCP 600 – Article 8

Confirming Bank Undertaking

a. Provided that the stipulated documents are presented to the confirming bank or to any other nominated bank and that they constitute a complying presentation, the confirming bank must:

i. honour, if the credit is available by

i. sight payment, deferred payment or acceptance with the confirming bank;

ii. sight payment with another nominated bank and that nominated bank does not pay;

iii. deferred payment with another nominated bank and that nominated bank does not incur its deferred payment undertaking or, having incurred its deferred payment undertaking, does not pay at maturity;

iv. acceptance with another nominated bank and that nominated bank does not accept a draft drawn on it or having accepted a draft drawn on it, does not pay at maturity;

v. negotiation with another nominated bank and that nominated bank does not negotiate.

b. A confirming bank is irrevocably bound to honour or negotiate as of the time it adds its confirmation to

The credit.

c. A confirming bank undertakes to reimburse another nominated bank that has honored or negotiated a complying presentation and forwarded the documents to the confirming bank.

d. If a bank is authorized or requested by the issuing bank to confirm a credit but is not prepared to do so, it must inform the issuing bank without delay and may advise the credit without confirmation.

UCP 600 – Article 9

Advising of Credits and Amendments

a. A credit and any amendment may be advised to a beneficiary through an advising bank. An advising bank that is not a confirming bank advises the credit and any amendment without any undertaking to honor or negotiate.

b. By advising the credit or amendment, the advising bank signifies that it has satisfied itself as to the apparent authenticity of the credit or amendment and that the advice accurately reflects the terms and conditions of the credit or amendment received.

c. An advising bank may utilize the services of another bank (“second advising bank”) to advise the credit and any amendment to the beneficiary. By advising the credit or amendment, the second advising bank

d. A bank utilizing the services of an advising bank or second advising bank to advise a credit must use the same bank to advise any amendment thereto.

e. If a bank is requested to advise a credit or amendment but elects not to do so, it must so inform, without delay, the bank from which the credit, amendment or advice has been received.

f. If a bank is requested to advise a credit or amendment but cannot satisfy itself as to the apparent authenticity of the credit, the amendment or the advice, it must so inform, without delay, the bank from which the instructions appear to have been received.

UCP 600 – Article 10

Amendments

a. Except as otherwise provided by article 38, a credit can neither be amended nor cancelled without the agreement of the issuing bank, the confirming bank, if any, and the beneficiary.

b. An issuing bank is irrevocably bound by an amendment as of the time it issues the amendment. A confirming bank may extend its confirmation to an amendment and will be irrevocably bound as of the time it advises the amendment.

c. The terms and conditions of the original credit (or a credit incorporating previously accepted amendments) will remain in force for the beneficiary until the beneficiary communicates its acceptance of the amendment to the bank that advised such amendment.

d. A bank that advises an amendment should inform the bank from which it received the amendment of any notification of acceptance or rejection.

e. Partial acceptance of an amendment is not allowed and will be deemed to be notification of rejection of the amendment.

f. A provision in an amendment to the effect that the amendment shall enter into force unless rejected by the beneficiary within a certain time shall be disregarded.

UCP 600 – Article 13

Bank-to-Bank Reimbursement Arrangements

a. If a credit states that reimbursement is to be obtained by a nominated bank (“claiming bank”) claiming on another party (“reimbursing bank”), the credit must state if the reimbursement is subject to the ICC rules for bank-to-bank reimbursements in effect on the date of issuance of the credit.

b. An issuing bank must provide a reimbursing bank with a reimbursement authorization that conforms with the availability stated in the credit. The reimbursement authorization should not be subject to an expiry date.

c. An issuing bank is not relieved of any of its obligations to provide reimbursement if reimbursement is not made by a reimbursing bank on first demand.

UCP 600 – Article 14

Standard for Examination of Documents

a. A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank must examine a presentation to determine, on the basis of the documents alone, whether or not the documents appear on their face to constitute a complying presentation.

b. A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank shall each have a maximum of five banking days following the day of presentation to determine if a presentation is complying.

c. A presentation including one or more original transport documents must be made by or on behalf of the beneficiary not later than 21 calendar days after the date of shipment as described in these rules, but in any event not later than the expiry date of the credit.

d. Data in a document, when read in context with the credit, the document itself and international standard banking practice, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the credit.

e. In documents other than the commercial invoice, the description of the goods, services or performance, if stated, may be in general terms not conflicting with their description in the credit.

UCP 600 – Article 17

Original Documents and Copies

a. At least one original of each document stipulated in the credit must be presented.

b. A bank shall treat as an original any document bearing an apparently original signature, mark, stamp, or label of the issuer of the document; unless the document itself indicates that it is not an original.

c. Unless a document indicates otherwise, a bank will also accept a document as original if it:

i. appears to be written, typed, perforated or stamped by the document issuer’s hand; or

ii. Appears to be on the document issuer’s original stationery; or

iii. States that it is original, unless the statement appears not to apply to the document presented.

d. If a credit requires presentation of multiple documents by using terms such as “in duplicate”, “in two fold” or “in two copies”, this will be satisfied by the presentation of at least one original and the remaining number in copies, except when the document itself indicates otherwise.

UCP 600 – Article 18

Commercial Invoice

a. A commercial invoice:

i. must appear to have been issued by the beneficiary

ii. Must be made out in the name of the applicant

iii. Must be made out in the same currency as the credit; and

iv. Need not be signed.

b. A nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank may accept a commercial invoice issued for an amount in excess of the amount permitted by the credit, and its decision will be binding upon all parties, provided the bank in question has not honored or negotiated for an amount in excess of that permitted by the credit.

c. The description of the goods, services or performance in a commercial invoice must correspond with that appearing in the credit.

UCP 600 – Article 20

Bill of Lading

a. A bill of lading, however named, must appear to:

i. indicate the name of the carrier and be signed by:

– The carrier or a named agent for or on behalf of the carrier, or

– The master or a named agent for or on behalf of the master.

Any signature by the carrier, master or agent must be identified as that of the carrier, master or agent.

ii. Indicate that the goods have been shipped on board a named vessel at the port of loading stated in the credit by:

– Pre-printed wording, or

– An on board notation indicating the date on which the goods have been shipped on board.

Iv. be the sole original bill of lading or, if issued in more than one original, be the full set as indicated on the bill of lading.

v. contain terms and conditions of carriage or make reference to another source containing the terms and conditions of carriage.

vi. Contain no indication that it is subject to a charter party.

b. For the purpose of this article, transshipment means unloading from one vessel and reloading to another vessel during the carriage from the port of loading to the port of discharge stated in the credit.

c. i. A bill of lading may indicate that the goods will or may be transshipped provided that the entire carriage is covered by one and the same bill of lading.

UCP 600 – Article 23

Air Transport Document

a. An air transport document, however named, must appear to:

i. indicate the name of the carrier and be signed by:

– The carrier, or

– a named agent for or on behalf of the carrier.

Any signature by the carrier or agent must be identified as that of the carrier or agent.

ii. Indicate that the goods have been accepted for carriage.

iii. Indicate the date of issuance. This date will be deemed to be the date of shipment unless the air transport document contains a specific notation of the actual date of shipment.

iv. Indicate the airport of departure and the airport of destination stated in the credit.

b. For the purpose of this article, transshipment means unloading from one aircraft and reloading to another aircraft during the carriage from the airport of departure to the airport of destination stated in the credit.

c. i. An air transport document may indicate that the goods will or may be transshipped, provided that the entire carriage is covered by one and the same air transport document.

ii. An air transport document indicating that transshipment will or may take place is acceptable, even if the credit prohibits transshipment.

UCP 600 – Article 24

Road, Rail or Inland Waterway Transport Documents

a. A road, rail or inland waterway transport document, however named, must appear to:

i. indicate the name of the carrier and:

– be signed by the carrier or a named agent for or on behalf of the carrier, or

– indicate receipt of the goods by signature, stamp or notation by the carrier or a named agent for or on behalf of the carrier.

Any signature, stamp or notation of receipt of the goods by the carrier or agent must be identified as that of the carrier or agent.

ii. Indicate the date of shipment or the date the goods have been received for shipment, dispatch or carriage at the place stated in the credit.

iii. Indicate the place of shipment and the place of destination stated in the credit.

b. i. A road transport document must appear to be the original for consignor or shipper or bear no marking indicating for whom the document has been prepared.

ii. A rail transport document marked “duplicate” will be accepted as an original.

iii. A rail or inland waterway transport document will be accepted as an original whether marked as an original or not.

c. i. A road, rail or inland waterway transport document may indicate that the goods will or may be transshipped provided that the entire carriage is covered by one and the same transport document.

ii. A road, rail or inland waterway transport document indicating that transshipment will or may take place is acceptable, even if the credit prohibits transshipment.

UCP 600 – Article 26

On Deck”, “Shipper’s Load and Count”, “Said by Shipper to Contain” and Charges Additional to Freight

a. A transport document must not indicate that the goods are or will be loaded on deck. A clause on a transport document stating that the goods may be loaded on deck is acceptable.

b. A transport document bearing a clause such as “shipper’s load and count” and “said by shipper to contain” is acceptable.

c. A transport document may bear a reference, by stamp or otherwise, to charges additional to the freight.

UCP 600 – Article 27

Clean Transport Document

A bank will only accept a clean transport document. A clean transport document is one bearing no clause or notation expressly declaring a defective condition of the goods or their packaging. The word “clean” need not appear on a transport document, even if a credit has a requirement for that transport document to be “clean on board”.

UCP 600 – Article 28

Insurance Document and Coverage

a. An insurance document, such as an insurance policy, an insurance certificate or a declaration under an open cover, must appear to be issued and signed by an insurance company, an underwriter or their agents or their proxies. Any signature by an agent or proxy must indicate whether the agent or proxy has signed for or on behalf of the insurance company or underwriter.

b. When the insurance document indicates that it has been issued in more than one original, all originals must be presented.

c. Cover notes will not be accepted.

d. An insurance policy is acceptable in lieu of an insurance certificate or a declaration under an open cover.

e. The date of the insurance document must be no later than the date of shipment, unless it appears from the insurance document that the cover is effective from a date not later than the date of shipment.

f. i.The insurance document must indicate the amount of insurance coverage and be in the same currency as the credit.

ii. A requirement in the credit for insurance coverage to be for a percentage of the value of the goods, of the invoice value or similar is deemed to be the minimum amount of coverage required.

iii. The insurance document must indicate that risks are covered at least between the place of taking in charge or shipment and the place of discharge or final destination as stated in the credit.

g. A credit should state the type of insurance required and, if any, the additional risks to be covered. An insurance document will be accepted without regard to any risks that are not covered if the credit uses imprecise terms such as “usual risks” or “customary risks”.

h. When a credit requires insurance against “all risks” and an insurance document is presented containing any “all risks” notation or clause, whether or not bearing the heading “all risks”, the insurance document will be accepted without regard to any risks stated to be excluded.

i. An insurance document may contain reference to any exclusion clause.

j. An insurance document may indicate that the cover is subject to a franchise or excess (deductible).

UCP 600 – Article 38

Transferable Credits

a. A bank is under no obligation to transfer a credit except to the extent and in the manner expressly consented to by that bank.

b. For the purpose of this article:

Transferable credit means a credit that specifically states it is “transferable”. A transferable credit may be made available in whole or in part to another beneficiary (“second beneficiary”) at the request of the beneficiary (“first beneficiary”).

Transferring bank means a nominated bank that transfers the credit or, in a credit available with any bank, a bank that is specifically authorized by the issuing bank to transfer and that transfers the credit. An issuing bank may be a transferring bank.

Transferred credit means a credit that has been made available by the transferring bank to a second beneficiary.

c. Unless otherwise agreed at the time of transfer, all charges (such as commissions, fees, costs or expenses) incurred in respect of a transfer must be paid by the first beneficiary.

d. A credit may be transferred in part to more than one second beneficiary provided partial drawing or shipments are allowed. A transferred credit cannot be transferred at the request of a second beneficiary to any subsequent beneficiary. The first beneficiary is not considered to be a subsequent beneficiary.

UCP 600 – Article 39

Assignment of Proceeds

The fact that a credit is not stated to be transferable shall not affect the right of the beneficiary to assign any proceeds to which it may be or may become entitled under the credit, in accordance with the provisions of applicable law. This article relates only to the assignment of proceeds and not to the assignment of the right to perform under the credit.

INCOTERMS:

The INCOTERMS (International Commercial Terms) is a universally recognized set of definitions of international trade terms, such as FOB, CFR and CIF, developed by the International Chamber of Commerce (ICC) in Paris, France. It defines the trade contract responsibilities and liabilities between buyer and seller. It is invaluable and a cost-saving tool. The INCOTERMS was first published in 1936—INCOTERMS 1936—and it is revised periodically to keep up with changes in the international trade needs. The complete definition of each term is available from the current publication—INCOTERMS 2000. The publication is available at your local Chamber of Commerce affiliated with the International Chamber of Commerce (ICC).

Under the INCOTERMS 2000, the international commercial terms are grouped into E, F, C and D, designated by the first letter of the term (acronym), as follows:

Group | Term | Stands For |

E- Departure | EXW | Ex Works |

F- Main carriage unpaid | FCA FAS FOB | Free Carrier Free Alongside Ship Free On Board |

C- Main carriage paid | CFR CIF CPT CIP | Cost and Freight Cost, Insurance and Freight Carriage Paid To Carriage and Insurance Paid To |

D- Arrival | DAF DES DEQ DDU DDP | Delivered At Frontier Delivered Ex Ship Delivered Ex Quay Delivered Duty Unpaid Delivered Duty Paid |

Group E – Departure:

EXW {+ the named place}

Ex Works

Ex means from. Works means factory, mill or warehouse, which is the seller’s premises. EXW applies to goods available only at the seller’s premises. Buyer is responsible for loading the goods on truck or container at the seller’s premises, and for the subsequent costs and risks.

The term EXW is commonly used between the manufacturer (seller) and export-trader (buyer), and the export-trader resells on other trade terms to the foreign buyers. Some manufacturers may use the term Ex Factory, which means the same as Ex Works.

5.3.2 Group F – Main carriage unpaid:

FCA {+ the named point of departure}

Free Carrier

The delivery of goods on truck, rail car or container at the specified point (depot) of departure, which is usually the seller’s premises, or a named railroad station or a named cargo terminal or into the custody of the carrier, at seller’s expense. Buyer is responsible for the main carriage/freight, cargo insurance and other costs and risks.

In the air shipment, technically speaking, goods placed in the custody of an air carrier are considered as delivery on board the plane. In practice, many importers and exporters still use the term FOB in the air shipment. Some manufacturers may use the former terms FOT (Free On Truck) and FOR (Free On Rail) in selling to export-traders.

FAS {+ the named port of origin}

Free Alongside Ship

Goods are placed in the dock shed or at the side of the ship, on the dock or lighter, within reach of its loading equipment so that they can be loaded aboard the ship, at seller’s expense. Buyer is responsible for the loading fee, main carriage/freight, cargo insurance, and other costs and risks.

In the export quotation, indicate the port of origin (loading) after the acronym FAS, for example FAS New York and FAS Bremen. The FAS term is popular in the break-bulk shipments and with the importing countries using their own vessels.

FOB {+ the named port of origin}

Free On Board

The delivery of goods on board the vessel at the named port of origin (loading), at seller’s expense. Buyer is responsible for the main carriage/freight, cargo insurance and other costs and risks.

Under the rules of the INCOTERMS 1990, the term FOB is used for ocean freight only. However, in practice, many importers and exporters still use the term FOB in the air freight.

Group C – Main carriage paid

CFR {+ the named port of destination}

Cost and Freight

The delivery of goods to the named port of destination (discharge) at the seller’s expense. Buyer is responsible for the cargo insurance and other costs and risks. The term CFR was formerly written as C&F. Many importers and exporters worldwide still use the term C&F.

Under the rules of the INCOTERMS 1990, the term Cost and Freight is used for ocean freight only. However, in practice, the term Cost and Freight (C&F) is still commonly used in the air freight.

CIF {+ the named port of destination}

Cost, Insurance and Freight

The cargo insurance and delivery of goods to the named port of destination (discharge) at the seller’s expense. Buyer is responsible for the import customs clearance and other costs and risks.

Under the rules of the INCOTERMS 1990, the term CIF is used for ocean freight only. However, in practice, many importers and exporters still use the term CIF in the air freight.

CPT {+ the named place of destination}

Carriage Paid To

The delivery of goods to the named place of destination (discharge) at seller’s expense. Buyer assumes the cargo insurance, import customs clearance, payment of customs duties and taxes, and other costs and risks.

In the export quotation, indicate the place of destination (discharge) after the acronym CPT, for example CPT Los Angeles and CPT Osaka.

CIP {+ the named place of destination}

Carriage and Insurance Paid To

The delivery of goods and the cargo insurance to the named place of destination (discharge) at seller’s expense. Buyer assumes the import customs clearance, payment of customs duties and taxes, and other costs and risks.

In the export quotation, indicate the place of destination (discharge) after the acronym CIP, for example CIP Paris and CIP Athens.

Group D – Arrival

DAF {+ the named point at frontier}

Delivered At Frontier

The delivery of goods to the specified point at the frontier at seller’s expense. Buyer is responsible for the import customs clearance, payment of customs duties and taxes, and other costs and risks.

In the export quotation, indicate the point at frontier (discharge) after the acronym DAF, for example DAF Buffalo and DAF Well and.

DES {+ the named port of destination}

Delivered Ex Ship

The delivery of goods on board the vessel at the named port of destination (discharge), at seller’s expense. Buyer assumes the unloading fee, import customs clearance, payment of customs duties and taxes, cargo insurance, and other costs and risks.

In the export quotation, indicate the port of destination (discharge) after the acronym DES, for example DES Helsinki and DES Stockholm.

DEQ {+ the named port of destination}

Delivered Ex Quay

The delivery of goods to the quay (the port) at destination at seller’s expense. Seller is responsible for the import customs clearance and payment of customs duties and taxes at the buyer’s end. Buyer assumes the cargo insurance and other costs and risks.

In the export quotation, indicate the port of destination (discharge) after the acronym DEQ, for example DEQ Libreville and DEQ Maputo.

DDU {+ the named point of destination}

Delivered Duty Unpaid

The delivery of goods and the cargo insurance to the final point at destination, which is often the project site or buyer’s premises, at seller’s expense. Buyer assumes the import customs clearance and payment of customs duties and taxes. The seller may opt not to insure the goods at his/her own risks.

In the export quotation, indicate the point of destination (discharge) after the acronym DDU, for example DDU La Paz and DDU Ndjamena.

DDP {+ the named point of destination}

Delivered Duty Paid

The seller is responsible for most of the expenses, which include the cargo insurance, import customs clearance, and payment of customs duties and taxes at the buyer’s end, and the delivery of goods to the final point at destination, which is often the project site or buyer’s premises. The seller may opt not to insure the goods at his/her own risks.

In the export quotation, indicate the point of destination (discharge) after the acronym DDP, for example DDP Bujumbura and DDP Mbabane.

International commercial terms or Incoterms are a series of sales terms that are used by businesses throughout the world. Incoterms are used to make international trade easier. They are used to divide transaction costs and responsibilities between buyer and seller. Incoterms were introduced in 1936 and they have been updated six times to reflect the developments in international trade. The latest revisions are sometimes referred to as Incoterms 2000.

Incoterms are 13 standardized definitions of commonly used shipping and trade terms that cover issues such as control of goods and financial responsibilities such as payment of cargo insurance and freight. Incoterms provide traders with a common set of rules outlining each party’s obligations, thus reducing misunderstandings.

Circulars of BD:

Circulars/Circular Letters Published of Bangladesh Bank for various departments:

Foreign Exchange Investment Department:

| 08/04/09 | FEID Circular Letter No. 01: Sending necessary information/documents to Foreign Exchange Investment Department for getting Permission/Renewal/Inclusion under Section 18A & 18B of Foreign Exchange Regulation Act, 1947. |

| 07/05/09 | FEID Circular Letter No. 02: Sending necessary information/documents to Foreign Exchange Investment Department for getting Permission/Renewal/Inclusion under Section 18A & 18B of Foreign Exchange Regulation Act, 1947. |

| 30/07/09 | FEID Circular No. 03 : Submission of quarterly statement by authorized approved agents of foreign principles working under section 18A and 18B of Foreign Exchange regulation act, 1974 |

Forex Reserve & Treasury Management Department:

| 30/06/2009 | FRTMD Circular No. 01: Regarding Export Development Fund |

Department of Financial Institutions and Markets:

| 17/09/2009 | FID Circular Letter No. 12: 23rd September, 2009 is declared Govt. holiday for Eid-ul-Fitr subject to the appearance of the moon |

| 30/08/2009 | DFIM Circular No. 07 |

| 18/08/2009 | DFIM Circular Letter No. 11 : Office Time Schedule for the month of Holy Ramadan, 1430 Hijri (2009 AD) |

| 21/07/2009 | DFIM Circular No. 06 : Formation of Financial Institutions Inspection Division |

Agricultural Credit and Special Programmes Department:

| 07/09/2009 | ACSPD Circular Letter No. 07: Submission of Statement relating to Agricultural Credit Disbursement for Effective Monitoring of Agricultural/Rural Credit Activities of the Fiscal Year 2009-10. |

| 26/08/2009 | ACSPD Circular Letter No. 06: Inclusion of “Potato Seed Production Through Tissue Culture” in Agricultural/ Rural Credit Policy and Programme for the Fiscal Year (2009-2010) |

| 03/08/2009 | ACSPD Circular No. 06: Refinance Scheme on Solar Energy, Bio-gas and Effluent Treatment Plant |

| 14/07/2009 | ACSPD Circular No. 04: Agricultural/Rural Credit Policy and Programme for the Fiscal Year (2009-2010) |

| 14/07/2009 | ACSPD Circular No. 05: Fresh Agri-loan Facilities for Rehabilitation of Agriculture Sector in Cyclone ‘Aila’ Affected Areas. |

Banking Regulation and Policy Department:

| 20/07/2009 | BRPD Circular Letter No. 05: Risk Factors Relating to Islamic Mode of Investment under Risk Based Capital Adequacy for Banks |

| 30/06/2009 | BRPD Circular No. 10 : Displaying Complete Schedule of Charges and its Uploading in the Website |

Department of Off-Site Supervision:

| 17/08/2009 | DOS Circular Letter No. 14 : Office hours and Transactions period of Banks during the Holy Ramadan. |

| 06/07/2009 | DOS Circular Letter No. 13 : Monthly statement regarding holding of shares |

| 30/06/2009 | DOS Circular Letter No. 12 : Treasury branches of concerned scheduled banks will remain open up to 7.00 PM.Tuesday, 30th June, 2009 |

Equity and Entrepreneurship Fund Unit:

| 16/07/2009 | EEF Circular No. 29 : Transfer of Equity and Entrepreneurship Fund (EEF) activities to Investment Corporation of Bangladesh (ICB) as Sub-Agent of Bangladesh Bank |

Findings & Recommendations

Findings:

♣ Deposits are the heart of running banking activities but Jamuna Bank’s Deposit growth is not good enough to meet the growing demand of credits of current market. One of the main reasons behind this low deposit volume is the lower deposit rate than other commercial banks.

♣ JBL has lack of proper training arrangements for it’s employees. As a result, employees are not comfortable enough to use new technologies. Most of the employees are not familiar with the new banking tools & software.

♣ JBL faces difficulties with those clients who have not enough knowledge in banking transactions and banking rules.

♣ JBL generally follows the policy of risk averse, in today’s world all other organizations are moving in approach of risk taking. As a result JBL is facing tuff competition from other commercial bank those are risk takers.

♣ Lack of new product developments; such as student loan, medical loan, marriage loan is another backdrop for JBL.

♣ the rate of interest is quite high for various types of credits. In many cases productivity of investment may inadequate that leads the borrower to become incapable of repaying loan.

♣ Bank should attach special attention in supervising and monitoring the loan cases, which have already been scheduled. When a borrower has already been proved to be vulnerable, he needs to be specially censored for the better interest of not only the bank but also the customer.

♣ Jamuna Bank has insufficiencies of Authorized Dealer Branch in respect of the total foreign business of the country. Bank has only nine branches with AD licenses. As a result in total foreign exchange business is has a very small market share.

♣ Pre-shipment inspection certificate should obtain from the exporter of back to back L/C. In case of import against master export L/C, but all the time this pre-shipment inspection certificate are not wanted by the bank.

♣ In foreign exchange department, JBL facing problem to deal with unknown customers.

Recommendations:

Based on the evaluation of different aspects of Jamuna Bank Limited, the following recommendations have been made:

♣ Skilled personnel should be recruited for the banks and professionalism should get priority.

♣ The branch manager should ensure proper distribution of works responsibility among personnel and strictly monitor the activities of officers to ensure efficient service to their valuable clients.

♣ JBL Should expand its technology based banking in respect to the customers’ demand. JBL should develop effective online banking system to compete with other commercial banks.

♣ Each complain form customers should be noticed and efforts should be made to properly address those.

♣ In order to face the challenge increasing demand for various consumer & commercial loans of current credit market JBL should come up with more new loan products like: Leasing, Apartment loan, Marriage loan etc.

♣ To combat the problem of mobilizing deposit in the form of credit, JBL should focus on intensive marketing effort.

♣ The Bank should re-calculate its lending rate on a periodic basis to cope up with changing lending scenario.

♣ Borrower selection is the key to successful lending, JBL should focus on the selection of true borrower. But at the same time it must be taken into account that right borrower selection does not mean that JBL has to adopt conservative lending policy but rather it means that compliance with the KYC or Know Your Customer to ascertain the true purpose of the loan.

♣ Bangladesh Bank should have minimum interference on foreign trade to facilitate them to run their business independently.

♣ Foreign Exchange Department should be managed efficient and intelligent officials. It should be an exclusive department with promising career path for its members. Officers of this department should not be transferred to other departments. Man behind the desk is equally important in a well-knit and efficient system. So, personnel placed in foreign exchange department should have of extra-ordinary quality and integrity.

♣ JBL should be more careful to deal with both known and unknown customers.

♣ Government should take guard against policy of waiver especially foreign exchange department.

Conclusion:

To compete in the environment of advancing technology and faster communication JBL should depend more heavily on the quality service and information technology. No doubt about it that JBL has achieved a superior position in our banking industry but to cope with customer JBL should think how to make it services proactive. Compared with other Banks JBL also contributes more of their funds in fruitful projects or development sectors of our country.

JBL try to satisfy its customers in various ways. Depositors and borrowers are the primary customers for all banks. JBL strives for a customer-oriented banking culture, with prudent lending and attractive deposit schemes. JBL aims at maintaining the high quality of services it has already achieved, at the same time being in a sound financial health.

The study mainly focus the nature and extent of a particular department of JBL, i.e. export-import financing. The authorized dealer must motivate the importer to import Raw materials, Fabrics, Accessories, Chemicals, Vegetable Fat etc. JBL acts as a media for the system of foreign exchange policy. Imports or exports are motivated by the JBL to the foreign exchange business, particularly to open the letter of credit. To provide International Trade related services JBL has established Correspondent Banking relationship with 336 locations of 106 world reputed Banks in more than 100 countries.

Jamuna Bank Ltd. is committed to Boost up the export position and diminishes the import position, rising of Gross Domestic Product (GDP) maximizing the national growth & abolishing the unemployment percent of the educated sector of nation.

BIBLIOGRAPHY

Books:

1. Madura Jeff, International Financial management, 8th edition.

2. Rose S. Peter, Commercial Bank Management, 5th edition.

Different Bank Publications:

1. JBL General Banking Policy Book

2. Credit Risk Grading Policies of JBL

3. JBL Foreign-Exchange Banking policy guideline

4. Annual Report of JBL year 2007

5. Annual Report of JBL year 2008

Website:

- www.jamunabankbd.com

- www.bangladeshbank.org.bd

3. www.iccwbo.org