Re-arrangement of Reserve and Surplus and Accumulated Loss of the Firm at the Time of Admission of New Partner

Reserves are the number of profits, which is set aside until there is a need for money for some purpose. The surplus is where the profits of the company reside. At the time of admission of a new partner, if there exists any reserve or accumulated profit in the books of the firm, these should be transferred to the old partners’ capital/current accounts in the old profit sharing ratio. Because these items belong to the old partners, not the new partner. Accumulated profits are the balance of profits earned by the company since its inception, after paying out dividends and making transfers to reserves.

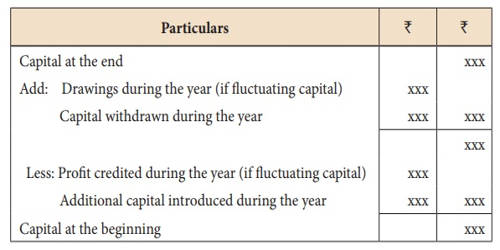

In the same manner, old partners’ capital/current accounts should be debited in the old ratio if there appear any accumulated losses in the assets side of the balance sheet. The journal entries are:

(1) For Accumulated Profits/Reserves:

Profit and loss A/C……………………………….Dr.

General reserves A/C…………………………..Dr.

Workmen compensation reserve A/C……Dr.

(excess over actual liability)

Investment fluctuation reserve A/C………Dr.

Joint life policy reserve A/C……………………Dr.

To old partners’ capital/current A/C

(Being transfer of reserves and profit to old partners in their old profit sharing ratio)

(2) For Accumulated Loss

Old partners’ capital/current A/C……………..Dr.

To profit and loss A/C

To Deferred revenue expenditure A/C

To Preliminary expenses A/C

(Being transfer of accumulated losses to the old partner in the old ratio)

However, all the partners(including new) may also decide to show the reserves in the books at its original or same agreed value. In such a situation, all the partners’ capital A/Cs are debited in new profit sharing ratio and reserves are credited at agreed value:

All partners’ Capital A/C…………….Dr.

To General Reserves A/C

(Being general reserve brought)