ARR Stands for the Accounting Rate of Return (ARR) or Average Rate of Return (ARR). It is the percentage rate of return expected on investment or asset as compared to the initial investment cost. It is also referred to as the simple rate of return. Accounting Rate is the most important capital budgeting technique that does not involve discounting cash flows. ARR does not consider the time value of money or cash flows, which can be an integral part of maintaining a business.

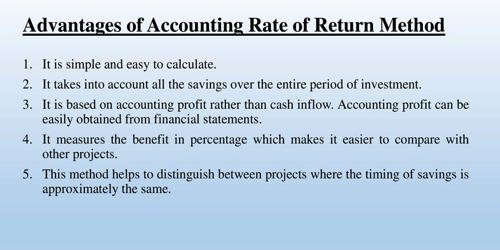

Advantages of Accounting Rate of Return (ARR)

(a) Accounting rate of return (ARR) is a simple and widely used technique of comparing capital projects which can be understood easily by everyone. It is based on accounting information, therefore, other special reports are not required for determining ARR.

(b) ARR method is easy to calculate and simple to understand. It is very easy to calculate the ARR of different projects. It is very easy to calculate and simple to understand like payback period. It considers the total profits or savings over the entire period of the economic life of the project. It can be determined by using a simple formula which is given below.

Accounting Rate Of Return (ARR) = (Average Net Income/Average Investment) x 100

(c) ARR method is based on accounting profit hence measures the profitability of the investment. This method recognizes the concept of net earnings i.e. earnings after tax and depreciation. This method alone considers the accounting concept of profit for calculating the rate of return. Moreover, the accounting profit can be readily calculated from the accounting records. This is a vital factor in the appraisal of an investment proposal.

(d) It is easy to take a decision regarding a suitable capital project. ARR is helpful in determining the annual percentage rate of return of a project. A project with higher ARR is selected and the project with lower ARR is ignored.

(e) ARR can be used when considering multiple projects since it provides the expected rate of return from each project. This method facilitates the comparison of new product projects with that of cost-reducing projects or other projects of competitive nature.

(f) ARR measures the profitability of a project which is beneficial for shareholders and owners. This method gives a clear picture of the profitability of a project.

(g) This method satisfies the interest of the owners since they are much interested in return on investment. This method is useful to measure the current performance of the firm.