Purchase price allocation (PPA) is a goodwill accounting technique in which one firm (the acquirer) allocates the purchase price of a second firm (the target) to various assets and liabilities acquired as a result of the transaction. It is a significant advance in bookkeeping revealing after the consummation of consolidation or securing. The Financial Accounting Standards Board’s (“FASB”) Statement of Financial Accounting Standards No. 141 (updated 2007) “Business Combinations” (“SFAS 141r”) and SFAS 142 “Goodwill and Other Intangible Assets” (“SFAS 142”) are commonly used in the United States to conduct a PPA.

The at present acknowledged bookkeeping principles, like the International Financial Reporting Standards (IFRS), require utilizing the price tag assignment strategy for a business blend bargain, including the two consolidations and acquisitions. It’s worth noting that in the past, purchase price allocation was only required in takeover negotiations. The PPA procedure determines usable life for identified assets and allocates the cost of an acquired firm to the Fair Value of assets purchased and liabilities assumed.

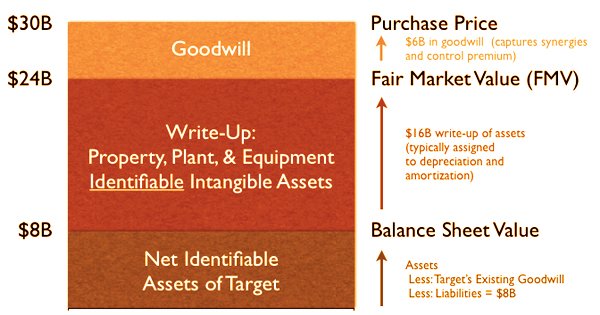

Moreover, the standards going with Purchase Price Allocations expect organizations to survey the reasonable worth of recorded generosity and recognizable immaterial resources on at any rate a yearly premise and in some cases all the more regularly. The basic concept is exactly what it sounds like. The purchase price or consideration paid for the business is allocated to acquired assets and assumed liabilities by the investor. Purchase price allocation (PPA) primarily consists of the following components:

Net identifiable assets: The acquired company’s net assets are equal to its total assets less its entire liabilities. In order to comply with ASC 805, all assets acquired and obligations undertaken in a PPA must be valued at fair value rather than book value. In that capacity, there might be a need to change those book esteems to reasonable worth. Basically, the net recognizable resources address the book worth of resources on the accounting report of the procured organization. It’s vital to remember that identifiable assets can be both tangible and intangible. There are two types of assets that can be purchased: tangible and intangible assets.

- Because tangible assets are physical and measurable, they are easy to recognize.

- When compared to physical assets like inventory and equipment, intangible assets are non-monetary assets with no physical substance. Intangible assets, like tangible assets, are intended to create future economic returns for the acquirer.

Write-up: If the carrying value of an asset is less than its fair market value, a write-up is applied to the book value of the asset. When an independent business valuation specialist completes an assessment of the fair market worth of a target company’s assets, the write-up amount is established.

Goodwill: The amount paid for the purchased company in excess of its net assets is referred to as goodwill. The gap between the acquisition price and the total fair value of the acquired company’s assets and liabilities is known as goodwill. Because both US GAAP and IFRS require a corporation to re-evaluate all reported goodwill at least once a year and make impairment adjustments if necessary, goodwill is crucial in an acquirer’s accounting reporting. Although goodwill is not depreciated, it is occasionally amortized over time.

Acquisition-related costs such as legal, advising, and consulting fees, among others, are not factored into the purchase price allocation. An acquirer must expense expenditures once they have been charged while the related services have been given, according to accounting standards.

The motivations behind the PPA necessities are for more prominent straightforwardness to financial backers. Yet, the principles likewise permit more noteworthy subjectivity in the distribution of resources as amortizable or non-amortizable and more prominent responsibility for the acquirer. The FASB “Accounting Standards Codification” (“ASC”) reorganizes the FASB statements and constitutes a single authoritative source of U.S. accounting and reporting standards for nongovernmental businesses, effective for financial statements filed for interim and annual periods ending after September 15, 2009.

Purchase price allocations (PPAs) are carried out in accordance with the merger and acquisition accounting purchase technique. Subjectivity is associated with price tag portion with assessing the future worth capability of brands, innovation, client connections, altruism, and how the acquirer perceives and gauges its gained immaterial resources will affect its future income. Intangible business has completed a number of sophisticated cross-border Purchase Price Allocations involving legal entities from around the world. A PPA is often required once an entity has acquired a controlling interest in a company.

Information Sources: