Profitability ratios are a series of financial metrics that calculate a company’s profit and determine its ability to produce income (profit) in relation to sales, balance sheet assets, operating costs, and shareholders’ equity over a given time period. Profitability is just the ability to make a benefit, and a benefit is a thing that is leftover from pay procured after financial backers have deducted all expenses and costs identified with acquiring the pay. Most businesses aim for a higher ratio or worth because it shows that the company is doing well in terms of sales, earnings, and cash flow. When evaluating the percentages, they are most useful when compared to similar companies or previous times.

Profitability ratios can measure up to proficiency proportions, which consider how well an organization utilizes its resources inside to produce pay (rather than after-cost benefits). Proportions that show edges address the association’s capacity to make an interpretation of deal dollars into benefits at different phases of estimation. The ability to calculate the firm’s overall efficiency in producing returns for its shareholders is expressed by ratios that also display returns. Higher ratio outcomes are often more positive, but when compared to the results of comparable firms, the company’s own historical success, or the industry average, these ratios provide much more detail.

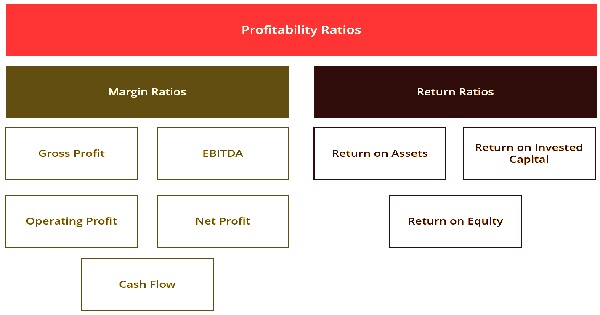

Companies use a number of profitability ratios to gain valuable insight into the financial health and success of their firms. All of these ratios fall into one of two groups, as seen below:

- Margin Ratios: At different levels of calculation, margin ratios reflect a company’s ability to turn revenue into profits. Gross profit margin, operating profit margin, net profit margin, cash flow margin, EBITDA, EBITDAR, NOPAT, operating cost ratio, and overhead ratio are all examples of profit margins.

- Return Ratios: Return ratios address the organization’s capacity to produce gets back to its investors. Models remember to return for resources, return on value, money return on resources, return on obligation, return on held profit, return on income, hazard changed return, return on contributed capital, and return on capital utilized.

As compared to comparable firms, the company’s own past, or industry average ratios, profitability ratios are most useful. The benefit of the organization which is surveyed by these proportions can be essentially characterized or clarified as the measure of income left in the wake of deducting all the costs and misfortunes which brought about in the comparable time-frame to create that income. Consequently, it would not be helpful to analyze a retailer’s final quarter net revenue with its first-quarter net overall revenue since they are not straightforwardly equivalent. It will be much more insightful to equate a retailer’s fourth-quarter profit margin to its fourth-quarter profit margin from the previous year.

The DuPont Model: Liquidity ratios, debt or financial leverage ratios, performance or asset management ratios, and profitability ratios are only a few examples of financial ratios. The DuPont Model will show a business owner where the components of the return on assets (or return on investment ratio) and return on equity ratio come from. The DuPont model will help business owners find out whether and when they need to make financial changes.

Most organizations allude to benefit proportions while investigating business profitability, by contrasting pay with deals, resources, and value. The productivity proportions are utilized to get an understanding of a business. It aids an analyst in assessing whether profits are necessary or adequate. It measures the rate of return and compares the company to its rivals as well as its own history. The following are some of the most widely used profitability ratios:

Gross Profit Margin: This is the ratio that is used to find out how much it costs to produce a product. It also assists in comprehending the company’s productivity and how it uses its capital to manufacture the product and then benefit by passing on the cost to the product’s customers.

Formula: Gross Profit Margin = (Gross profit / Net Sales) × 100

EBITDA Margin: EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It addresses the productivity of an organization prior to considering non-working things like revenue and charges, just as non-money things like deterioration and amortization. The advantage of measuring a company’s EBITDA margin is that it makes it easier to equate it to other businesses because it excludes costs that are potentially unpredictable or discretionary.

Operating Profit Margin: This is the metric that is used to measure a company’s operational performance. Earnings before interest and taxes, or EBIT, is a calculation used to assess how much profit a corporation has earned from its core operations. Working net revenue assesses this EBIT as a level of deals to comprehend the proficiency of the activities of the organization.

Formula: Operating Profit Margin = (Operating Profit / Net Sales) × 100

Net Profit Margin: The bottom line is the net profit margin. It measures a company’s overall revenue by dividing net profits by total revenue. It gives a full image of a company’s profitability after all costs, such as interest and taxes, have been deducted. The net revenue estimates benefit after thought of all costs including charges, interest, and deterioration. Motivation to utilize the net revenue as a proportion of benefit is that it considers everything.

Formula: Net Profit Margin = (Net Profit / Net Sales) × 100

Cash Flow Margin: The relationship between cash flows from operating activities and revenue created by the company is represented by cash flow margin. It assesses a company’s ability to turn revenue into cash. The higher the level of income, the more money accessible from deals to pay for providers, profits, utilities, and administration obligation, just as to buy capital resources. Negative income, in any case, implies that regardless of whether the business is creating deals or benefits, it might in any case be losing cash.

Return on Assets: It is the profitability ratio that is used to measure a company’s efficiency in producing profit from its properties. If the company’s assets aren’t used properly, it won’t be able to produce the optimal profit, and the return will be smaller.

Formula: Return on Asset = (Net Income / Assets) × 100

Return on Equity: The amount of net profits relative to stockholders’ equity, or the rate of return on the capital invested by equity investors, is known as return on equity (ROE). Stock analysts and investors pay careful attention to the return on investment (ROI) ratio. A well high ROE proportion is regularly referred to as motivation to buy an organization’s stock. The potential, just as existing financial backers, keep a mind this proportion as it gauges the profit from the speculation made in portions of the organization. When all is said in done, the higher the proportion, more great it is for the financial backers to put resources into the organization.

Formula: Return on Equity = (Net Income / Shareholder’s Equity Investment) × 100

Return on Invested Capital: Return on invested capital (ROIC) is a metric that calculates the benefit generated by all capital providers, including bondholders and shareholders. It is like the ROE ratio, however more sweeping in its extension since it incorporates returns produced from capital provided by bondholders. The ratio will increase due to higher net income due to a broader asset base financed by debt, so ROE can rise without additional equity investments.

Banks and financial companies use profitability ratios when lending to businesses so they guarantee that interest and installment payments can be paid on time. It includes a variety of different ways to determine a company’s potential to make a profit for its shareholders. The brokers as well as take a gander at these proportions to think about the organic products, their speculation will procure. The executives follows and investigations these proportions to spot out the lacuna in their activities and accordingly achieve the essential enhancements.

One of the most common metrics used in financial analysis is profitability ratios, which are divided into two categories: margin ratios and return ratios. Margin ratios provide details on a company’s ability to turn revenue into gains from a number of viewpoints. Employments of profitability ratios are diverse to the administration and the financial backers however the saying behind ascertaining them is to assess the benefit and execution of the organization. Different profitability ratios calculate profitability based on various aspects of an organization and assist management in operating more effectively to maximize income.

Information Sources: