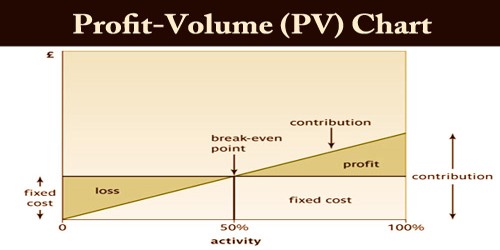

A chart or graph showing profit-volume (PV) illustrates the relationship between profit and volume of sales. Businesses may use profit-volume (PV) charts to set revenue goals, determine whether new products are likely to be competitive, or forecast breakeven points. When contracting this graph, various expenses and income lines are omitted here, as benefit points are plotted only. As such, it’ll be simpler to grasp the connection between profit and volume.

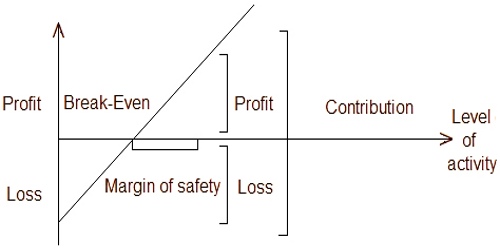

Also, the breakeven point (BEP) does not display the amount of income directly; it must be measured by calculating the vertical difference between the revenue and the total cost axes. The sales-volume chart offers a corporation a snapshot into how much product has to be sold to make a profit. A company’s operating costs include both variable and fixed costs. An income-volume diagram is another type of diagram used in management accounting to know about the level of business income.

Fixed costs represent the cash spent on assets needed to provide the merchandise, which may include the price of the building and equipment. Variable costs represent the prices that fluctuate with sales volumes, like raw materials and inventory. During this graph, sales volume is depicted on the horizontal line and profit or loss on the vertical line. The profit line is calculated by calculating the benefit or loss at each value, i.e. the difference between revenue and total expense, and BEP (Breakeven point) is the point at which the benefit line intersects the horizontal line.

When plotting the profit-volume (PV) chart, where the entire sales line intersects with the overall cost line is that the approximate breakeven point of a product in terms of volume. Determine an appropriate scale for sales volume on the horizontal axis (which forms the sales line) and this line must be involved within the middle portion of the graph so profit may be shown on the side above the sales line and loss or charge below the sales line.

In this way, the gross operating costs are shown below the revenue line on the left side of the vertical axis and revenues are displayed on the right side above the graph’s selling line. The full loss exists at zero production level and is equal to the overall fixed costs; this is the point of departure for income.

As the volume of sales increases, the road rises from left to right in an upward sloping manner so profits rise as sales increase. Revenue figures on the chart to the right of the breakeven point show gains, while figures to the left cause losses. Now, points are plotted for profits and fixed costs which are connected by a line which again intersects the sales line at the horizontal axis and BEP is that the point of intersection.

Profits or losses are plotted against the respective sales levels at different output levels. So these plotted points are connected by a straight line (called the benefit line) and are extended in both directions. The slope of the whole sales line is important; the steeper the slope, the less volume required to earn a profit. The steepness of the slope could be a function of the worth of the merchandise. The difference between prevailing sales and also the break-even sales represents the margin of safety. Apart from the pricing strategy, by manipulating a variable and fixed cost component, management can impact how a PV chart appears. Obviously any successful effort to reduce costs will shift the point of the breakeven volume to the left.

Information Sources: