The objectives of this report is to analysis Problems and Prospects of Footwear Industry in Bangladesh. Here main discussion are Financial Feasibility Analysis and analysis the overall international trade statistics for last 5 years. Finally analysis the barriers and challenges of Footwear sector and suggest strategies to overcome the Barriers and Challenges.

Introduction

Footwear is a traditional export item of Bangladesh. Footwear produced from high quality leather in the country enjoys a good reputation worldwide for their quality. The country, however, has a growing success in this sector. The business experts believe that export earnings from the sector could be substantially increased if we use advanced technology to produce high quality footwear. This, however, depends on adoption of appropriate policies on the part of the government and business community to develop the sector. The products must be improved to satisfy the quality requirements demanded by the consumers of the international market especially of the developed world. The low wage rate and poor enforcement of environmental laws and rules have given the country’s footwear sector a comparative advantage in the world market. Moreover, the country enjoys duty exemption under the GSP (Generalized System of Preference) from the most of the importing countries of the developed world. Bangladesh also enjoys a reduction of Tariff and other non-Tariff barriers from WTO (World Trade Organization). While this provide an opportunity for a country like Bangladesh to boost up its export.

Objectives:

The objectives of this study are as follows:

- To know about the environment of selected products sectors- Footwear.

- To know about the overall international trade statistics for last 5 years.

- To know about the problems and prospects of Footwear Industry.

- To know about the barriers and challenges of Footwear sector.

- Suggesting strategies to overcome the Barriers and Challenges.

Methodology:

This study is based on both primary and secondary data/information. Primary Data for this study was gathered by primary data collection method through personal administered questionnaire and telephonic discussion from some industries and secondary data/information was collected from published articles, magazines, different books, internet etc. After assisting a respondent in completing a survey, the data collector would then approach the next available person and resume the screening process. The response rate was very high due to the fact that, the researchers’ pursued all respondents personally and motivate respondents to participate the survey.

Introduction to the Research Proposal

Footwear Industry in Bangladesh: A Short history

The Footwear Industry in Bangladesh is at its early stage of development. There was no mechanized Footwear Industry in the country until early 1900’s and the footwear manufacturing was limited to cottage and family level small factories. The first mechanized industry, Bata Shoe Co. (Bangladesh) Ltd., a multinational enterprise. Followed by Eastern Progressive Shot industries and Bengal Leather which used to produce mainly for domestic supply. Indeed, the shoe industry started featuring in Bangladesh in 1990 with the introduction of encouraging government policy measures of granting fiscal and financial incentives for production of leather footwear in the country for export. There has been a rapid growth in footwear production capacity. Both complete leather shoes and sports shoes manufacturing for export during last decade. There are now about 42 Mechanized and over 4500 non-mechanized small and cottage level units in Bangladesh producing various types of footwear for both domestic market and export. Most of the mechanized units are export oriented.

Footwear Sector, as a sub sector of Leather Sector gets also priority from Government but this sector as well was ignored by the Government for many years. Now in the era of globalization, nobody can find an alternative of product diversification (export diversification). For this reason government is now started looking after Footwear Sector rather than Jute and Tea.

Export position of Footwear during 2009-2010:

According to the Export Promotion Bureau Footwear was 8th Position which given in the following table and the chart:

Table:

| Serial no. | Commodities | Percentage |

| 01 | Woven Garments | 37.11 |

| 02 | Knitwear | 40.11 |

| 03 | Frozen Food | 2.73 |

| 04 | Jute Goods | 4.87 |

| 05 | Leather | 1.40 |

| 06 | Agro Products | 1.50 |

| 07 | Engg. Products | 1.92 |

| 08 | Footwear | 1.26 |

| 09 | Others | 9.21 |

Major companies involved presently in manufacturing footwear in Bangladesh:

A new era started in this sector during 1979-90. Some product units especially footwear have been established and exporting of shoes and shoes uppers. A group viz. Apex came forward as pioneer to produce export quality footwear and penetrating in the international market. Now according to Leather goods & Footwear Manufacturers & Exporters Association of Bangladesh there have the following listed footwear companies:

Table:

| Serial No. | Name of the company |

| 01 | M/s. Apex Adelchi Footwear Ltd Celebration Point, Plot # 3,5 Road # 113A, Gulshan-2, Dhaka |

| 02 | M/s. Jennys Shoes Ltd. Jennys House, House # 6, Road # 68/A Gulshan-2, Dhaka |

| 03 | M/s. Legacy Footwear Ltd. 64, Bijoynagar, Kakrail, Dhaka |

| 04 | M/s. Landmark Footwear Ltd. 64, Bijoy Nagar (3rd Floor) Kakrail, Dhaka |

| 05 | M/s. Surma Leather & Footwear Ind. Ltd. Corner Court, 29 Toynbee Circular Road Motijheel C/A, Dhaka |

| 06 | M/s. Bay Footwear Ltd. Wasa Bhaban (3rd Floor) Kazi Nazrul Islam Avenue, Dhaka |

| 07 | M/s. Tropical Shoes Ind. Ltd. A. R. Tower (3rd Floor) 24, Kamal Ataturk Avenue, Banani |

| 08 | M/s. H.N. Shoes Ltd House # 69, Road # 8/A, Dhanmondi R/A, Dhaka Name of the company |

| 09 | M/s. Leatherex Footwear Ind. Ltd House # 34/A, Road # 10/A Dhanmondi R/A. Dhaka |

| 10 | M/s. Advance Industrial Management Co. Ltd. Baipal, Savar |

| 11 | M/s. Savar Industries (Pvt.) Ltd. DEPZ |

| 12 | M/s. Malim (BD) Co. Ltd. |

| 13 | M/s. Five-R-Footwear Ltd. |

| 14 | M/s. Vannara Corporation Ltd. |

| 15 | M/s. Shampan Shoes Ltd. |

| 16 | M/s. Rimex Footwear Ltd. |

| 17 | M/s. Adelchi Footwear Bangladesh Ltd. |

| 18 | M/s. F.B. Footwear Ltd. |

| 19 | M/s. Bata Shoe Co. (BD) Ltd. |

| 20 | M/s. Akij Footwear Ltd. |

| 21 | M/s. Lalmai Footwear Ltd. |

Financial Feasibility Analysis and Findings

Market size of Footwear in the World:

Present scenery of world Footwear production is given bellow:

| Region | Quantity ( Million Pairs) | Percentage share |

| WESTERN EUROPE | 777 | 4.58% |

| EASTERN EUROPE | 371 | 2.18% |

| MIDDLE EAST | 589 | 3.47% |

| AFRICA | 647 | 3.81% |

| ASIA PACIFIC | 13453 | 79.26% |

| NORTH AMERICA | 331 | 1.95% |

| LATIN AMERICA | 805 | 4.74% |

| WORLD | 16972 | 100.00% |

Source: BLSC

Country-wise market size of Footwear items in the world: The status of Bangladesh

| Parameter | Exported value in 2007,US $ thousand | Exported value in 2008, US $ thousand | Exported value in 2009, US $ thousand | Exported value in 2010, US $ thousand | Exported value in 2011,US $ thousand |

| World Footwear export | 83,909,121 | 92,860,466 | 82,564,928 | 99,247,716 | 116,594,945 |

| Bangladesh footwear export | 137,487 | 186,462 | 216,959 | 267,954 | 381,402 |

| Percentage | 0.16% | 0.20% | 0.26% | 0.27% | 0.33 % |

Sources: ITC calculations based on UN COMTRADE statistics.

Countrywide Footwear export in the world:

| Exporters | Exported value in 2007 | Exported value in 2008 | Exported value in 2009 | Exported value in 2010 | Exported value in 2011 |

| World | 83,909,121 | 92,860,466 | 82,564,928 | 99,247,716 | 116,594,945 |

| China | 25,350,737 | 29,720,438 | 28,016,268 | 35,633,851 | 41,722,333 |

| Italy | 11,011,374 | 11,456,558 | 9,212,744 | 9,852,113 | 11,598,552 |

| Viet Nam | 4,076,199 | 4,872,365 | 4,151,908 | 7,527,764 | 8,586,520 |

| Hong Kong, China | 5,962,447 | 5,980,830 | 4,757,046 | 5,576,873 | 5,655,701 |

| Germany | 3,557,912 | 4,076,616 | 3,656,028 | 3,950,566 | 4,967,401 |

| Belgium | 3,396,171 | 3,703,291 | 3,486,261 | 3,742,158 | 4,181,935 |

| Netherlands | 2,683,544 | 2,817,447 | 2,779,541 | 3,032,298 | 3,464,975 |

| Indonesia | 1,637,955 | 1,885,473 | 1,736,114 | 2,501,850 | 3,301,943 |

| Spain | 2,583,274 | 2,888,447 | 2,615,654 | 2,557,084 | 3,126,565 |

| France | 1,984,034 | 2,142,325 | 1,906,979 | 2,081,723 | 2,549,347 |

| India | 1,412,039 | 1,581,201 | 1,481,177 | 1,642,895 | 2,534,046 |

| Portugal | 1,801,224 | 1,975,019 | 1,744,409 | 1,780,183 | 2,150,294 |

| Romania | 1,782,507 | 1,749,188 | 1,359,777 | 1,475,815 | 1,818,402 |

| Brazil | 2,038,057 | 2,025,176 | 1,477,085 | 1,631,516 | 1,498,768 |

| United Kingdom | 1,074,641 | 1,150,740 | 1,106,698 | 1,309,521 | 1,481,360 |

| Slovakia | 667,664 | 904,741 | 807,428 | 929,149 | 1,300,978 |

| United States of America | 887,422 | 1,038,396 | 945,299 | 1,103,837 | 1,287,506 |

| Panama | 798,380 | 890,023 | 823,811 | 936,305 | 1,131,408 |

| Austria | 775,724 | 859,595 | 747,102 | 778,562 | 978,260 |

| Thailand | 976,421 | 960,745 | 793,655 | 821,262 | 926,326 |

| Denmark | 603,973 | 632,525 | 544,010 | 659,016 | 754,415 |

| Tunisia | 575,817 | 608,039 | 512,264 | 566,385 | 753,515 |

| Cambodia | 78,973 | 87,949 | 108,470 | 177,108 | 744,943 |

| Poland | 409,767 | 464,521 | 399,565 | 513,743 | 621,459 |

| Czech Republic | 386,043 | 418,851 | 421,799 | 474,757 | 618,064 |

| Morocco | 338,732 | 363,660 | 357,292 | 351,856 | 533,487 |

| Hungary | 396,508 | 421,650 | 398,627 | 419,701 | 528,189 |

| Mexico | 341,212 | 318,247 | 306,028 | 384,902 | 468,784 |

| Republic of Korea | 462,637 | 483,065 | 375,107 | 435,862 | 463,472 |

| Turkey | 316,740 | 344,890 | 289,569 | 395,739 | 441,300 |

| Bangladesh | 137,487 | 186,462 | 216,959 | 267,954 | 381,402 |

| Chinese Taipei | 328,883 | 319,113 | 254,919 | 302,754 | 330,507 |

| Bosnia and Herzegovina | 242,354 | 272,656 | 243,945 | 274,507 | 323,767 |

| Dominican Republic | 215,745 | 209,040 | 148,233 | 198,701 | 319,842 |

| Bulgaria | 247,473 | 244,209 | 205,247 | 252,582 | 307,919 |

| Albania | 226,799 | 227,721 | 210,616 | 243,250 | 300,195 |

| Sweden | 231,171 | 243,540 | 207,784 | 235,997 | 295,649 |

| Singapore | 208,957 | 226,235 | 184,728 | 248,997 | 295,534 |

| Switzerland | 190,739 | 264,677 | 255,678 | 223,048 | 286,911 |

| Serbia | 204,741 | 241,351 | 192,912 | 209,689 | 269,975 |

| Canada | 230,346 | 249,971 | 211,244 | 230,812 | 243,820 |

| Malaysia | 178,321 | 199,473 | 206,922 | 221,502 | 204,018 |

| Ukraine | 143,479 | 170,823 | 138,872 | 169,323 | 202,516 |

| Croatia | 201,164 | 211,080 | 190,354 | 193,967 | 199,406 |

| Finland | 127,049 | 137,887 | 112,619 | 134,428 | 166,110 |

| Slovenia | 137,647 | 150,783 | 137,391 | 137,375 | 153,733 |

| Estonia | 98,644 | 86,818 | 58,470 | 72,253 | 139,504 |

| Chile | 10,815 | 98,340 | 94,959 | 109,732 | 138,521 |

| Belarus | 113,726 | 131,131 | 110,814 | 130,865 | 130,568 |

| Pakistan | 113,216 | 133,177 | 117,259 | 92,694 | 112,259 |

| Myanmar | 52,968 | 101,351 | |||

| Europe Othr. Nes | 101,843 | 147,746 | 208,480 | 117,984 | 91,076 |

| Greece | 66,830 | 102,648 | 97,684 | 89,539 | 90,420 |

| Luxembourg | 13,777 | 18,877 | 67,634 | 96,474 | 89,850 |

| The former Yugoslav Republic of Macedonia | 83,287 | 79,148 | 82,159 | ||

| Ireland | 43,514 | 41,346 | 35,836 | 67,302 | 78,161 |

| Japan | 65,765 | 79,689 | 57,499 | 67,038 | 70,572 |

| Colombia | 161,302 | 220,686 | 111,708 | 44,407 | 52,195 |

| Australia | 36,570 | 41,422 | 34,252 | 38,268 | 51,757 |

| Republic of Moldova | 39,926 | 47,555 | 26,070 | 30,375 | 49,452 |

| Israel | 43,723 | 0 | 42,354 | 49,870 | 49,214 |

| Lithuania | 29,378 | 37,066 | 30,923 | 30,800 | 43,519 |

| Ecuador | 32,248 | 33,498 | 33,653 | 34,938 | 42,980 |

| Kenya | 45,654 | 38,990 | 34,831 | 41,201 | 41,754 |

| Côte d’Ivoire | 23,454 | 29,039 | 37,200 | 41,348 | 41,662 |

| El Salvador | 29,476 | 31,586 | 30,902 | 36,285 | 41,638 |

| Guatemala | 30,954 | 35,537 | 31,994 | 37,888 | 40,917 |

| Nicaragua | 1,643 | 1,671 | 1,932 | 2,514 | 35,457 |

| South Africa | 19,997 | 22,328 | 24,507 | 30,160 | 34,228 |

| Argentina | 33,486 | 33,885 | 27,132 | 30,190 | 33,783 |

| New Zealand | 43,544 | 39,848 | 36,777 | 41,419 | 32,388 |

| United Arab Emirates | 253,170 | 234,982 | 72,755 | 77,120 | 32,374 |

| Russian Federation | 31,779 | 30,079 | 28,325 | 30,659 | 32,169 |

| Syrian Arab Republic | 214,522 | 191,438 | 94,547 | 106,926 | 29,087 |

| Latvia | 17,348 | 20,606 | 22,529 | 15,339 | 26,411 |

| Free Zones | 23,826 | 36,770 | 21,052 | 16,557 | 22,865 |

| Peru | 14,249 | 17,331 | 15,220 | 16,911 | 21,673 |

| Norway | 26,315 | 28,234 | 23,136 | 18,228 | 21,548 |

| Egypt | 8,171 | 17,159 | 17,394 | 18,465 | |

| Rwanda | 648 | 1,019 | 1,499 | 17,942 | |

| Sri Lanka | 24,116 | 21,650 | 17,206 | 19,502 | 16,710 |

| Paraguay | 164 | 1,063 | 8,994 | 17,496 | 16,697 |

| Jordan | 4,820 | 4,225 | 3,110 | 3,722 | 14,247 |

| Cyprus | 3,773 | 5,059 | 5,149 | 8,424 | 13,455 |

| Macao, China | 48,801 | 16,808 | 9,157 | 0 | 12,940 |

| Philippines | 30,581 | 31,000 | 22,080 | 8,332 | 12,135 |

| Lao People’s Democratic Republic | 8,858 | 6,789 | 11,430 | 9,438 | 11,574 |

| Ethiopia | 8,200 | 9,670 | 6,611 | 7,962 | 8,637 |

| Honduras | 5,631 | 5,154 | 4,006 | 5,591 | 5,771 |

| Uganda | 3,902 | 2,997 | 17,502 | 6,030 | 4,839 |

| Cape Verde | 4,598 | 3,657 | 4,186 | 4,730 | |

| Malta | 4,989 | 4,523 | 2,747 | 3,835 | 4,368 |

| Kyrgyzstan | 1,544 | 3,737 | 2,760 | 2,021 | 3,256 |

| Guinea | 8 | 0 | 9 | 73 | 3,121 |

| Uzbekistan | 142 | 203 | 1,666 | 1,466 | 2,846 |

| Bolivia | 3,399 | 2,584 | 1,979 | 2,170 | 2,789 |

| Iran (Islamic Republic of) | 126,731 | 2,470 | |||

| Nigeria | 59,705 | 55,178 | 85,799 | 340,865 | 2,242 |

| Democratic People’s Republic of Korea | 337 | 342 | 159 | 196 | 2,218 |

| United Republic of Tanzania | 4,683 | 2,560 | 4,561 | 4,707 | 2,108 |

| Lebanon | 17,842 | 18,480 | 16,081 | 20,393 | 2,105 |

| Senegal | 2,879 | 4,076 | 3,517 | 3,595 | 1,981 |

| Zimbabwe | 3,790 | 1,458 | 1,061 | 2,162 | 1,944 |

| Sierra Leone | 387 | 157 | 277 | 1,279 | 1,912 |

| Zambia | 1,860 | 2,345 | 2,384 | 1,655 | 1,843 |

| Mongolia | 118 | 941 | 570 | 1,179 | 1,799 |

| Uruguay | 3,826 | 3,373 | 3,182 | 3,080 | 1,743 |

| Cameroon | 409 | 288 | 74 | 85 | 1,731 |

| Botswana | 2,190 | 2,126 | 2,493 | 2,326 | 1,435 |

| Dominica | 0 | 1 | 0 | 1 | 1,365 |

| Armenia | 1,315 | 1,012 | 794 | 1,333 | 1,364 |

| Costa Rica | 544 | 868 | 625 | 1,006 | 1,327 |

| British Virgin Islands | 1,268 | 1,283 | 741 | 1,880 | 1,114 |

| Bahrain | 82 | 164 | 438 | 350 | 984 |

| Netherland Antilles | 77 | 40 | 2,788 | 2,191 | 944 |

| Jamaica | 426 | 463 | 170 | 275 | 927 |

| Nepal | 6,656 | 8,383 | 909 | ||

| Ghana | 1,784 | 77 | 79 | 197 | 765 |

| Montenegro | 431 | 831 | 667 | 456 | 620 |

| Togo | 1,078 | 926 | 423 | 150 | 574 |

| United States Minor Outlying Islands | 627 | 851 | 1,137 | 657 | 569 |

| Gambia | 0 | 11 | 699 | 96 | 566 |

| Andorra | 365 | 251 | 853 | 879 | 564 |

| Saudi Arabia | 9,180 | 0 | 0 | 6,561 | 547 |

| Fiji | 1,929 | 1,374 | 872 | 923 | 542 |

| Palestine | 24,658 | 27,237 | 25,805 | 25,712 | 509 |

| Mauritius | 652 | 477 | 544 | 434 | 498 |

| Azerbaijan | 189 | 64 | 154 | 24 | 440 |

| Aruba | 315 | 26 | 416 | ||

| Micronesia (Federated States of) | 1 | 3 | 45 | 2 | 371 |

| Libya | 20 | 279 | 22 | 15 | 336 |

| Oman | 19,365 | 19,435 | 17,571 | 14,627 | 330 |

| Qatar | 952 | 870 | 104 | 227 | 323 |

| Venezuela | 5,184 | 747 | 548 | 312 | |

| Benin | 28 | 16 | 11 | 12 | 297 |

| America not elsewhere specified | 4 | 3 | 4 | 235 | 261 |

| Belize | 1 | 0 | 0 | 0 | 248 |

| Georgia | 765 | 1,098 | 1,112 | 159 | 233 |

| Mozambique | 38 | 47 | 20 | 84 | 219 |

| Namibia | 1,568 | 2,347 | 161 | 185 | 218 |

| Samoa | 4 | 4 | 18 | 101 | 186 |

| New Caledonia | 97 | 133 | 189 | 185 | 179 |

| Kuwait | 2,791 | 3,243 | 117 | 192 | 173 |

| Kazakhstan | 1,112 | 1,840 | 3,544 | 171 | 167 |

| Iceland | 151 | 191 | 107 | 106 | 163 |

| Seychelles | 0 | 3 | 7 | 145 | |

| Tajikistan | 19 | 141 | 397 | 1,886 | 140 |

| European Union Nes | 137 | ||||

| Cocos (Keeling) Islands | 55 | 80 | 31 | 411 | 134 |

| St. Pierre and Miquelon | 131 | ||||

| Cook Islands | 32 | 5 | 115 | ||

| Comoros | 34 | 7 | 56 | 18 | 113 |

| Angola | 119 | 46 | 16 | 10 | 88 |

| Cuba | 407 | 167 | 139 | 47 | 83 |

| British Indian Ocean Territories | 2 | 93 | 28 | 46 | 81 |

| Madagascar | 181 | 79 | 51 | 38 | 74 |

| Burkina Faso | 2 | 41 | 29 | 0 | 55 |

| Algeria | 101 | 269 | 169 | 13 | 45 |

| Trinidad and Tobago | 112 | 74 | 148 | 68 | 42 |

| Christmas Islands | 3 | 516 | 12 | 40 | |

| Timor-Leste | 9 | 2 | 39 | ||

| Northern Mariana Islands | 3 | 53 | 73 | 106 | 39 |

| Saint Kitts and Nevis | 1 | 1 | 1 | 25 | 37 |

| Eritrea | 1 | 113 | 28 | 20 | 37 |

| Bhutan | 0 | 0 | 0 | 0 | 37 |

| Gabon | 31 | 29 | 6 | 31 | 36 |

| Suriname | 91 | 36 | |||

| Swaziland | 104 | 56 | 293 | 41 | 35 |

| Turks and Caicos Islands | 180 | 30 | 9 | 452 | 35 |

| Djibouti | 29 | 53 | 34 | ||

| French Polynesia | 4 | 6 | 32 | 28 | 30 |

| Iraq | 47 | 5 | 169 | 15 | 28 |

| Yemen | 2,051 | 633 | 1,048 | 49 | 27 |

| Saint Lucia | 23 | 2 | 5 | 22 | 23 |

| Niger | 1,198 | 1,733 | 984 | 555 | 22 |

| Somalia | 52 | 89 | 218 | 21 | 22 |

| Antigua and Barbuda | 39 | 71 | 386 | 661 | 22 |

| Congo | 4 | 22 | 9 | 7 | 22 |

| Brunei Darussalam | 199 | 107 | 141 | 43 | 21 |

| Tokelau | 42 | 15 | 26 | 33 | 21 |

| Barbados | 58 | 4,171 | 3,856 | 3,816 | 19 |

| Anguilla | 6 | 3 | 12 | 2 | 17 |

| Tonga | 0 | 0 | 0 | 15 | |

| Greenland | 12 | 8 | 10 | 5 | 15 |

| Mali | 57 | 149 | 310 | 15 | |

| Haiti | 339 | 174 | 271 | 82 | 14 |

| French South Antarctic Territories | 1 | 283 | 192 | 32 | 14 |

| Bahamas | 2 | 23 | 7 | 7 | 12 |

| Afghanistan | 0 | 0 | 0 | 12 | |

| Papua New Guinea | 2 | 10 | 6 | 15 | 12 |

| Pitcairn | 134 | 94 | 87 | 35 | 10 |

| Equatorial Guinea | 63 | 7 | 25 | 25 | 9 |

| Vanuatu | 0 | 5 | 90 | 9 | |

| Mauritania | 0 | 0 | 8 | ||

| Malawi | 266 | 86 | 196 | 252 | 8 |

| Bermuda | 23 | 5 | 13 | 14 | 7 |

| Chad | 132 | 87 | 18 | 57 | 6 |

| Kiribati | 5 | ||||

| Guinea-Bissau | 49 | 1 | 5 | ||

| Sao Tome and Principe | 0 | 0 | 0 | 22 | 4 |

| Wallis and Futuna Islands | 5 | 3 | 1 | 4 | |

| Guyana | 233 | 167 | 146 | 134 | 4 |

| Democratic Republic of the Congo | 306 | 46 | 67 | 66 | 4 |

| Saint Helena | 14 | 12 | 61 | 3 | |

| Turkmenistan | 3 | 40 | 2 | ||

| Faroe Islands | 1 | 1 | 5 | 5 | 2 |

| Cayman Islands | 6 | 50 | 9 | 2 | |

| Solomon Islands | 20 | 19 | 54 | 2 | |

| Grenada | 0 | 3 | 35 | 1 | |

| Liberia | 17 | 38 | 166 | 1 | 1 |

| Nauru | 14 | 14 | 6 | 10 | 1 |

| Saint Vincent and the Grenadines | 3 | 1 | 1 | 18 | 1 |

| Africa not elsewhere specified | 8 | 12 | 20 | 239 | 1 |

| Central African Republic | 8 | 1 | 1 | 0 | 0 |

| Burundi | 6 | 1 | 2 | 48 | 0 |

| Falkland Islands (Malvinas) | 1 | 39 | |||

| Mayotte | 0 | 2 | 0 | ||

| Montserrat | 0 | 5 | 0 | ||

| Oceania Nes | 25 | ||||

| Lesotho | 5 | 17 | 24 | 64 | |

| LAIA not elsewhere specified | 21 | ||||

| Gibraltar | 14 | 9 | 48 | 5 | |

| Niue | 13 | 33 | |||

| Norfolk Island | 8 | ||||

| Marshall Islands | 49 | 19 | |||

| Palau | 1 | ||||

| Tuvalu | 2 | 1 | 1 | ||

| Western Sahara | 2 | 2 | |||

| Sudan | 0 | 0 | 129 | ||

| Ship stores and bunkers | 10 | 1 |

Countrywide Footwear exports statistics of Bangladesh, 2011-2012 (July-May), Value US$

| Footwear | 301,697,878.70 |

| UNITED ARAB EMIRATES | 1,246,832.09 |

| ARGENTINA | 204,310.29 |

| AUSTRIA | 4,545,137.15 |

| AUSTRALIA | 174,517.22 |

| BOSNIA AND HERZEGOVINA | 229,923.72 |

| BELGIUM | 7,045,606.64 |

| BAHRAIN | 165.10 |

| SAINT BARTHÉLEMY | 11,847,452.19 |

| BOLIVIA, PLURINATIONAL STATE OF | 9,509.12 |

| BRAZIL | 530,270.52 |

| CANADA | 3,362,478.94 |

| SWITZERLAND | 4,223,808.17 |

| CHILE | 590,189.78 |

| CHINA | 1,336,425.00 |

| COLOMBIA | 158,615.48 |

| CYPRUS | 235,958.70 |

| CZECH REPUBLIC | 1,398,484.42 |

| GERMANY | 36,650,942.82 |

| DENMARK | 69,912.54 |

| ESTONIA | 254,047.06 |

| SPAIN | 35,023,716.01 |

| FINLAND | 911,622.64 |

| FIJI | 99,528.27 |

| FRANCE | 24,223,782.18 |

| UNITED KINGDOM | 3,798,357.16 |

| GEORGIA | 45,910.57 |

| GREECE | 559,461.02 |

| HONG KONG | 5,655,743.58 |

| CROATIA | 93,099.47 |

| HUNGARY | 60,999.16 |

| INDONESIA | 380.17 |

| IRELAND | 179,613.35 |

| INDIA | 79,658.33 |

| IRAQ | 2,880.09 |

| ITALY | 24,634,420.26 |

| JAPAN | 65,047,840.77 |

| KOREA, REPUBLIC OF | 8,909,522.68 |

| KUWAIT | 56,537.96 |

| LEBANON | 2,289.99 |

| SRI LANKA | 119,375.70 |

| LITHUANIA | 61,915.07 |

| LIBYAN ARAB JAMAHIRIYA | 23,319.00 |

| MYANMAR | 57,584.53 |

| MALTA | 61,810.38 |

| MAURITIUS | 2,612.69 |

| MALDIVES | 323.04 |

| MEXICO | 1,553,536.96 |

| MALAYSIA | 131,161.18 |

| NETHERLANDS | 17,371,943.33 |

| NORWAY | 387,107.62 |

| PANAMA | 349,786.90 |

| PERU | 1,124,898.35 |

| PAPUA NEW GUINEA | 5,295.52 |

| PHILIPPINES | 17,739.32 |

| PAKISTAN | 49,247.60 |

| POLAND | 4,135.13 |

| PORTUGAL | 131,995.88 |

| PARAGUAY | 471,157.71 |

| QATAR | 500.37 |

| ROMANIA | 362,177.20 |

| RUSSIAN FEDERATION | 1,956,427.62 |

| SAUDI ARABIA | 895,400.95 |

| SWEDEN | 2,026,357.19 |

| SINGAPORE | 101,008.02 |

| SLOVENIA | 1,342,276.47 |

| SLOVAKIA | 513,583.33 |

| SENEGAL | 212,271.55 |

| EL SALVADOR | 21,929.28 |

| SWAZILAND | 54,102.27 |

| THAILAND | 27,650.03 |

| TUNISIA | 60,602.14 |

| TURKEY | 290,853.05 |

| TAIWAN, PROVINCE OF CHINA | 712,849.97 |

| Not Defined | 4,319,214.50 |

| UNITED STATES | 22,197,875.78 |

| URUGUAY | 7,541.15 |

| VENEZUELA, BOLIVARIAN REPUBLIC OF | 60,489.35 |

| VIET NAM | 1,665.95 |

| !!! Not Defined | 114,409.68 |

| SOUTH AFRICA | 845,691.90 |

| ZAMBIA | 148,104.45 |

Sources: Export Promotion Bureau (Bangladesh)

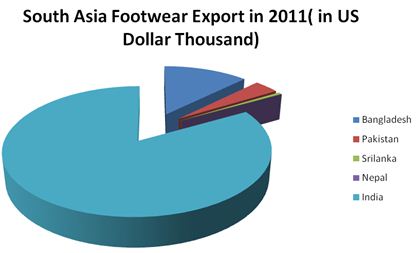

South Asian Footwear Export in 2011(in US Dollar Thousand)

In the footwear export, Bangladesh is the 31st position in the world but second in the South Asia. The chart given in the below:

Footwear export of Bangladesh

From international trade statistics we have find that Footwear export increased of year 2011 than the year 2010 is 42.33%. So, we can say that it is raising sector of our country’s growing economy. The Footwear sector plays a significant role in the economy of Bangladesh in terms of its contribution to export and domestic market.

Local Footwear market size of Bangladesh and share of imported and locally manufactured items

Footwear Marketing in Bangladesh

Marketing is the vital aspects for the Bangladeshi footwear. Production of footwear in Bangladesh being primarily for export purpose. All the efforts being made by the manufacturers are presented in the foregoing analysis. Of course, there are few units which rely on domestic market. They are also contacted and their views have been complied. As regards to domestic marketing of footwear, it is being done by nearly one fourth of total Footwear. However, it does not mean that these units solely rely on domestic market. Good number of units in Dhaka undertakes domestic sales. Such local sales units are very less in other Divisions. The domestic supply orders for the units are largely through direct contacts as well as from the corporate business groups for complimentary.

Category of marketing of Footwear:

Of the prominent categories, In Bangladesh context, there are various kinds of footwear are available in here like-

- Leather shoes.

- Synthetic shoes.

- Leather sandals.

- Synthetic sandals.

- Sports shoes.

- Canvas & PVC shoes.

- Slippers and Chappals.

- Army boots.

- Ladies boots.

- Jute sandals/chappals.

However, it was observed during the field survey, that more than hundred types of items are being made from leather for export purpose, with ever expanding uses. This category of industry is highly vulnerable for non-leather substitutes and supplements. Functionally leather and non-leather items perform the same job. Leather items are preferred for their natural feel, elegance and of course long life. The local sales affected, need not necessarily be always to the Bangladeshi customers. It is observed that foreign tourists’ effect purchases from Bangladeshi

Stores during their visit to Bangladesh. The situation in Dhaka is slightly different. Domestic marketing is remarkable high in the case of other Divisions units

The demand side of market

A difficult market in terms of fierce competition, sophistication of styles and fashions, trends in disposable income no less than the consideration of climate/season, environment and ecology play a critical role in generating the extent and pattern of demand. The demand is influenced by this different consideration; as cold weather leads to an increasing demand and consumption, new environmental concerns do also have a bearing; for example, have become important features in the mind of the consumers. Fashion trend is closely related with the market demand. Demand side of the market mainly depends on

- Weather and season

- Culture and heritage

- Adaptation of fashion

- Cost of the product

- Availability in the market side

- Market trend and general tendency

- Fashion trend etc.

Domestic market of Bangladesh

Bangladesh with its 80% population in village has no niche domestic market for high priced products made of leather due to low purchasing power of mass population and weak economic structure. Generally the target prospect for footwear is for middle echelons to upper echelons people in local market.

Footwear is the best selling item compared in local market. Neither the culture, nor economics or the climate, promotes the usage of footwear in large quantities in the country. Causes of the backwardness of leather goods sector development for local market

- Economical ability of the local people

- Lack of cost effective project.

- Costly raw materials in comparison to synthetic material.

- Tendency of buying foreign product

- Tendency of the industry as being export oriented.

- Lack of market research

- Lack of season based survey for demand

- Local fashion trends integration inability

- Lack of customer based marketing

Local market survey for footwear

Total people involvement: 20000-22000 (Approx)

Total Production: 5-5.5 million (including all) pairs.

Total Production in Bangladeshi currency: 12.5 million (taka)

To know the market trend I have done a survey in different market place including the shopping centre to foot path among the men and women. Primarily I have selected 20 men and 20 women to get the information about local Market demand which are given below:

Classification of Bangladeshi customer according to their ability

- Upper Class Customer

- Middle Class Customer

- General Category

Table: Customer Based survey of leather goods in Bangladesh

| Types of customer | Types of products | Origin of products | Value range in taka |

| Upper Class Shoe | Gents | Foreign | Above 1500 |

| Standard | — | Local & Foreign | 500-2000 |

| General category | — | Local | Below 300 |

| Upper Class Ladies sandal | Ladies sandal | Foreign | Above 800 |

| Standard | — | Local & Foreign | 400-1200

|

| General category | — | Local | 100-400 |

Source: Field survey

Production of footwear items in Bangladesh: A feasibility analysis

Environmental feasibility:

Export oriented footwear industries could be termed as highly value added sub-sector in the Leather Field. Bangladesh has fine quality cattle hides and top quality goat skins along with valuable buffalo leather and has one of the cheapest labors in the world. We only need to overcome of the weakness of the industry and can make footwear industry as most prospective sector.

Lowest labor cost:

Bangladesh is a small country in respect of area but it is the 10th largest country in the world in respect of population. Thousands of people in this sector have been skilled and semi skilled.

Cost competitiveness of products is the essence of international market that in turn depends upon the supply of raw materials manufacturing know how and conversion cost. The footwear industry in particular is highly labor intensive and the production cost is greatly depending on labor wage.

The established producers of these newly industrialized countries being affected recently by high rise in labor wages and export limitation in Europe have been looking for expanding or relocating their production base to low cost china, Indonesia, Thailand, India, Pakistan, Bangladesh and Vietnam.

The labor cost in advanced countries accounts for 40-45% of the total production cost whereas, it is less than 5% in developing countries, which is still the lowest in Bangladesh.

Table:

| Serial no. | Country | US $/Hour |

| 1 | Japan | 24.00 |

| 2 | Italy | 14.00 |

| 3 | South Korea/Taiwan | 6.00 |

| 4 | Brazil | 1.50 |

| 5 | Mexico | 0.80 |

| 6 | Indonesia | 0.45 |

| 7 | China/Vietnam | 0.30 |

| 8 | Bangladesh | 0.20 |

Source: Werner International Survey, 1993.

A Comparative Study of wages in Bangladeshi Footwear Industry:

| Name of the factory | Total Salary | BDT. 805,400.00 |

| AIMCO Footwear Ltd. | Manpower | 207 |

| Salary/Person | BDT. 3890.821256 | |

| Days | 30 | |

| Per day salary | 129.6940419 | |

| hours | 8 | |

| Per hours salary | BDT. 16.21175523 | |

| Price of dollar | BDT. 80 | |

| Wages | US $ 0.20264694 | |

| RIMEX Footwear Ltd. | Total Salary | BDT. 1205,400.00 |

| Manpower | 280 | |

| Salary/Person | BDT. 4305 | |

| Days | 30 | |

| Per day salary | 143.5 | |

| hours | 8 | |

| Per hours salary | BDT. 17.97 | |

| Price of dollar | BDT. 80 | |

| Wages | US $ 0.2242 | |

| H. N. shoes Ltd. | Total Salary | BDT. 1050300.00 |

| Manpower | 250 | |

| Salary/Person | BDT. 4201.2 | |

| Days | 30 | |

| Per day salary | 140.04 | |

| hours | 8 | |

| Per hours salary | BDT. 17.505 | |

| Price of dollar | BDT. 80 | |

| Wages | US $ 0.2188 |

Calculation of average wages:

US$ (0.20264694 + 0.2242 + 0.2188)

Average wages = ————————————————-

3

= US$ 0.2152

Better quality of product:

For export issue quality product is uncompromised factor to compete the world market. Maintaining international standard for any product is playing vital role for existence of the product. Bangladesh has enough ability to produce international standard product. Bangladeshi people have both technical and theoretical ability to produce international standard product

GSP facility:

Bangladesh enjoys duty exemption under the GSP – generalized System of preference from most the importing countries of the develop world.

Government Incentive:

Leather goods especially footwear and bags are already enjoying a 15 percent cash incentive for export and 2.5 percentage points increase in cash assistance will raise it to 17.5 percent.

Financial feasibility:

Availability of raw materials:

It is one of the best opportunities for Bangladesh to export footwear. The raw Hide and skin is collected from dead animals. At the time of Eid-ul-Azha a lot of raw materials are being produced by offering “Kurbani”s a part of Ibadah of the Muslin citizen. Everyday a huge number of cows, buffalos and goats are used to meet the demand of meat of the people. Primary process by mixing salt to curing the raw material is completed at the vendor level. Expertise has been developed in the root level to preserve the leather and leather goods. Leather is the main material of footwear

Availability of leather (total number)

| Origin | Total number (million piece)

| Number of leather (million piece)

| Leather (million Sq.ft) |

| Cow/buffalo/cattle | 24.31 | 5.31 | 116.00 |

| Goat/Sheep | 32.70 | 19.70 | 64.00 |

Source: Bureau of statistics, ITC, FAO

Projection of Production, Export earning and Employment generation by the year 2015 AD

| Sector | No of Unit | Production | Total Domestic uses | Available for export | Employent | Export Earning (m US$) | Production | Total |

| Tannery

| 250 | 300 msft | 45 | 128 | 3200 | 256 | 24500 | 28000 |

| Footwear | 450 | 47 msft | — | 47 | 3500 | 235 | 91600 | 94000 |

| Total | 700 | 347 msft | 45 | 275 | 6700 | 491 | 116100 | 122000 |

Source: BSCIC-2005

Cost- effectiveness and profitability:

Comparative study for costing of a business shoe between Bangladesh and China

Costing for business shoes in Bangladesh (AIMCO Footwear):

| COMPONENTS | AMONUNT | Description | PRICE | UNIT | COST/PRS (BDT.) |

| Upper 1 | 2.35 sft | Cow Polish Leather | 200 | 470 | |

| Upper2 | |||||

| Upper3 | |||||

| Lining 1 | 2.60 sft | Cow | 90 | 234 | |

| Lining 2 | |||||

| Lining 3 | |||||

| Toe cap | 0.56 sft | 60 | 33.6 | ||

| Heel grip | 0.67 sft | 40 | 26.80 | ||

| Back counter | 0.70 sft | 40 | 28 | ||

| Welt | .30 sft | 90 | 27 | ||

| Zipper | |||||

| Ribit | |||||

| Eyelet | 12 pcs | 1 | 12 | ||

| Ring | |||||

| Buckle 1 | 2 pcs | 10 | 20 | ||

| Buckle2 | |||||

| Insole | .87 sft | 15 | 13 | ||

| Texon | .57 sft | 10 | 5.7 | ||

| Bata shank | 2 pcs | 2 | 4 | ||

| Footbed Cover | |||||

| Outsole | Nrb hand made | 200 | 200 | ||

| Outsole Top | |||||

| Heel | TPR | ||||

| Heel Top | |||||

| Midsole | |||||

| Socks | .87 | 60 | 52.20 | ||

| Socks EVA | .80 | 10 | 8 | ||

| Lace | 2 pcs | 5 | 10 | ||

| Balcro | |||||

| Mocca Thread | |||||

| Insole stitch | |||||

| Insole+ Outsole color | |||||

| AUXILARY | |||||

| TOTAL MATERIAL COST | 1144.3 | ||||

| PROVISION FOR REJECTION | |||||

| OVERHEADS | 180 | ||||

| TOTAL COST | 1324.30 | ||||

| MARGIN (15%) | 198.645 | ||||

| FINAL TOTAL COST IN TAKA | 1522.945 | ||||

| FINAL COST IN US$ @ BDT. 80.00 | 19.03 | ||||

| OFFER PRICE IN US$ | 19.00 | ||||

| PRICE CONFIRMED BY BUYER | 19.00 | ||||

Costing for business shoes in China:

| COMPONENTS | AMONUNT | UNIT | PRICE | UNIT | COST/PRS |

| Upper 1 | 2.35 sft | Cow Polish Leather | 250 | 587.50 | |

| Upper2 | |||||

| Upper3 | |||||

| Lining 1 | 2.60 sft | Cow | 100 | 260 | |

| Lining 2 | |||||

| Lining 3 | |||||

| Toe cap | 0.56 sft | 60 | 33.6 | ||

| Heel grip | 0.67 sft | 40 | 26.80 | ||

| Back counter | 0.70 sft | 40 | 28 | ||

| Welt | .30 sft | 90 | 27 | ||

| Zipper | |||||

| Ribit | |||||

| Eyelet | 12 pcs | 1 | 12 | ||

| Ring | |||||

| Buckle 1 | 2 pcs | 10 | 20 | ||

| Buckle2 | |||||

| Insole | .87 sft | 15 | 13 | ||

| Texon | .57 sft | 10 | 5.7 | ||

| Bata shank | 2 pcs | 2 | 4 | ||

| Footbed Cover | |||||

| Outsole | Nrb hand made | 200 | 200 | ||

| Outsole Top | |||||

| Heel | TPR | ||||

| Heel Top | |||||

| Midsole | |||||

| Socks | .87 | 60 | 52.20 | ||

| Socks EVA | .80 | 10 | 8 | ||

| Lace | 2 pcs | 5 | 10 | ||

| Balcro | |||||

| Mocca Thread | |||||

| Insole stitch | |||||

| Insole+ Outsole color | |||||

| Elastic | |||||

| Shank | |||||

| Label | |||||

| AUXILARY | |||||

| TOTAL MATERIAL COST | 1287.8 | ||||

| PROVISION FOR REJECTION | |||||

| OVERHEADS | 300 | ||||

| TOTAL COST | 1587.80 | ||||

| MARGIN (15%) | 238.17 | ||||

| FINAL TOTAL COST IN TAKA | 1825.97 | ||||

| FINAL COST IN US$ | 22.82 | ||||

| OFFER PRICE IN US$ | 22.50 | ||||

| PRICE CONFIRMED BY BUYER | 22.50 | ||||

China is currently failing to produce high quality shoes at competitive prices due to the WTO anti-dumping rules. So, orders from Germany, Italy, France, Japan and Canada are shifting to Bangladesh.

Data interpretation:

From the above two countries costing we find that there is change the price in upper leather and lining and also have the change in factory overhead.

Hence we get the cost effectiveness like the below:

US $ (22.50 – 19.00)

Hence, the cost effectiveness = ————————————

US $ 19.00

= 18.42%

Here, we keep the margin fixed. But it may be changed.

Barriers and Challenges

Like RMG or Jute industries, Footwear is not so long history of reputation in world market for Bangladesh perspective. This is due to lack of technology, skilled manpower, good processing plants, and communication. Following barriers and challenges are to faces footwear industries to grownup:

- Technologies

- Skilled manpower

- Global market reputation

- Branding

- Political instability

- Power and utilities

Technologies: Technology is the first and foremost important thing to build world standard footwear processing plant. Now a day there is a number of technologies to process the footwear like Auto CAD, Automatic machines etc.. So we should adopt the new technologies to build our processing plants. We could communicate with European and North American countries for modern technologies.

Skilled Manpower: Skilled manpower is other important parameters for manufacturing of footwear. Educated, hardworking, creative and innovative minded young generations are the good sources of skilled manpower. They should trained first about the footwear technologies. In our country, there is only one leather technology college. To compete globally we should build more leather technologies related institutes in our country to make our people skilled in leather technology.

Global market reputation: There are some countries in the world that have global market reputation for footwear. Italy, France, Germany, USA, Japan and some other European countries have the global reputation for their footwear. They achieved this global reputation for their modern technology, processing plants and product related skilled man powers. So to get global reputation, we should take proper private and govt. initiatives in the field of leather technology.

Branding: Branding is the most important aspect to get the global market reputation in footwear sector. Nike, Rebook, Hushpuppy and some other is world famous reputation in footwear. So we should take proper steps to develop world famous brand by ensuring attractive design, price and quality.

Political instability: To ensure said factors, political stability is must. Without political stability no one can ensure those factors to develop our footwear industries. Our current political situation is not friendly for developing our footwear industries. So our national leaders should show the good behave for better stability of our country to encourage for investing foreign invest in our footwear sectors. Foreign investors are only investing when they found political stability in our country.

Power and Utilities: Power and utilities are the first requirement to grow any industries. Like other industries, footwear industry also needs the power and utilities facilities for processing, manufacturing of footwear. So our govt. should take necessary steps to provide the power and utilizes for footwear industry.

Possible impact of footwear items production in Bangladesh: a SWOT analysis:

STRENGTH

- Good potential of quality raw materials for maximum added value.

- Integrated production chain from raw materials to tanneries and footwear available.

- Law costs of production labor available (partly offset by low productivity due to lack of skills).

- Established international trading practice

- Existence of a few successful companies as path leaders,

- Geographic position for the future markets.

- The footwear industry got stimulus from the Progress in finished leather production.

- Customers from countries applying GSPs have been attracted by Bangladesh.

- Bonded warehouse facilities are available.

- No import duty on capital machinery for export oriented industry.

- Export of Bangladesh Footwear merchandise to Japan is 100% duty-free.

WEAKNESSES

- Information for product line, product mix and export marketing is inadequate.

- Skilled designers and facilities for product design and development are unavailable.

- Backward linkages between leather products (footwear and leather goods) industry and tanneries is still not a prevailing culture.

- No institutional support is available for the industry (such as FDDI in India).

- Trained or experienced workers to operate key machinery (lasting, sewing) are quite insufficient.

- High rate of interest on term loan and working capital, and pattern for loans are distorting prices.

- Footwear accessories (such as tapes, trims, buckles, linings, shoe-last etc.) are not locally available.

- Lack of quality control systems; reliance on foreign certification with penalized lead-time.

- Limited product development and market orientation.

- Over-reliance on visiting buyers.

- Complicated rules and regulations in customs department, which affect lead-time and acquisition of inputs.

- Partnership Marketing program has been a greatly felt needs.

OPPORTUNITIES

- Gradual progress in the finishing process of leather.

- Local production of sandals and slippers is in high demand in Mid-East and Southern Africa.

- Cash incentive (15% on FOB) for leather footwear has been introduced and likely to be at a higher rate.

- No import duties on raw hides or wet-blue hides for export-oriented leather industries.

- Proximity to future markets (South-East Asia)

- UNCTAD has been working with advocacy to EU to permit more time for LDCS.

THREATS

- Almost no output of sole/insole leather developed in local tanning industry.

- Leather footwear consumption is considerably replaced by casual footwear made of synthetic materials.

- No organized industrial unit for sole production natural rubber based, TPR, NU or EVA.

- EU’s stringent condition on SPS, certification etc, etc (it needs time to be ready for compliance.

- EU’s stringent condition on SPS, certification etc. (It needs time to be ready for compliance)

Recommendations:

A lot of constraints and drawbacks lying behind the Footwear industrial and business sector. To make the business unique and successful everybody should come forward to work united for the betterment of the sector. The following could be the immediate and urgent:

Arrangement for quality raw materials: Bangladesh has an abundant supply of raw hides and skins. It is the main raw materials for leather and footwear which earn foreign exchange. Therefore quality improvement for raw hides and skins is to be ensured by taking proper handling and caring measures of the raw stock.

Well trained workforce in management: The work force engaged in management should have been given a modern method of management training. The total quality management TQM they should have to be learn and implement in the related units, it is must for ISO certification.

Marketing toward global aspect: This sector is of 100% export oriented. We need to increase our export. So, Market exploration is needed. With this aim a group of marketing people is needed to give and intensive and competitive marketing management training. An orientation of global marketing should have been emphasized. Promotional support for market expansion may require from EPB and other agencies or through a coordinated, externally funded project.

Technology and human resource development: Well trained and skill manpower could be the only resource of a sector by which it reaches its optimum target. We know for technology and human resource development, Bangladesh College of Leather Technology has undertaken a new academic program under Dhaka University. This should be encouraged. And other agencies like GTZ, BFLLFEA, and ITC have also trying to flourish training and prototype centers. This should also be encouraged and make more participatory.

Footwear Board: A strong and independent Footwear Board should be formed immediately by which the footwear policy is to be furnished for footwear sector as well as to act as parent public body for the welfare of this sector.

Conclusion:

From my comparative study for cost-effectiveness of business shoe between two countries Bangladesh and China, I find that cost-effectiveness 18.42% in Bangladesh than China.

And also from international trade statistics we have find that Footwear export of Bangladesh increased of year 2011 than the year 2010 is 42.33%. This is happening due to availability of high quality leather, lowest labor cost and low overhead compare to other develop countries in the world.

So, we can say that it is raising sector of our country’s growing economy. The Footwear sector plays a significant role in the economy of Bangladesh in terms of its contribution to export and domestic market.

Finally it could be said that no efforts, no attempts would be enough for footwear sector to reach the highway of international free trade economy until and unless the management, the marketing and the technology of this sector as well as the public bodies make them positively work to walk for.