Major principle of this assignment is to analysis Problems and Prospects of Bangladesh Capital Market. Here mainly analysis of present share market Problem and the way of reprieve also observe different conditions like Price manipulation, Delays in Settlement, I regulations in Dividends etc. The purpose is also to make recommendations for improving capital market condition and soundness of different services provided to the shareholders of stock exchange.

Introduction

Bangladeshi Share Market is in disaster condition now a day. Every day the prices and values of different shares are going to fall down. The potential investors in Dhaka Stock Exchange and Chittagong stock exchange are being depressed by the continuous price falling.

“But what are the problems behind it?”

We see, several months ago, Share market was spirited and all the share values were high. Suddenly, all the share prices are going to fall down.

The Bangladeshi Stock experts, investors and some other Technical Analyst are trying to find the possible monsters. The TA experts have found some reasons of this share market fall down. Syndicates are working behind this recent plunge. These syndicates have a huge investment in Stock Market and they take control of the price of the shares. They are united and buy a share simultaneously so a want is created in the whole market. So the prices of share become higher and general investors suffer with it.

Most of investors in share market is either newbie or have no analysis power. They are just trading on the basis of seeing what other peoples are trading. So without seeing a company’s saturation point; the invest money and lose money. And our Government has changed lots of rules of local stock market and applied lots of limited on Debt and other facilities. And this is another reason of this recent Bangladeshi share market plunge. like this many other reason behind for present alarming condition Bangladesh share market.

Methodology of the study:

For smooth and accurate study everyone have to follow some rules & regulation. The study impute were collected from two sources:

Primary sources

- Practical desk work

- Face to face conversation with the investor

- direct observations

- Face to face conversation with the client

Secondary sources

- Annual report of BPBL

- Files & Folders

- Daily diary (containing my activities of practical orientation in DSC) maintained by me,

- Various publications on DSC, Website

Contact methods:

To collect data for the report I use three types of contact method. I use personal , face to face contact method, internet method.

Here I am begin to start

What is stock?

Stock or Share is the smallest part of ownership of an asset/company/firm.

For example

you have a shop worth of Tk.10, 000/= Now if you divide the ownership of the shop in 100 parts then every part will be worth of 100tk. Now each of the part is called a share/stock. Now if you buy10 part/share from that 100part then you are partially an owner of the shop/firm/company.

How it can be traded?

if you want to transfer your part of ownership of the firm to other then you should sale the deed of ownership to someone else. In that case you have to maintain some papers. For example a sale deed will be signed and the deed will be registered in government registry office.

For example

In case of stock , when you buy stock/share of a certain company you will be given a share certificate. This certificate certifies that you own that much part of the company. And you haveto register your ownership certificate with company’s register. But due to some problems of paper certificates , such as:

Copied certificate,

Maintenance of huge paper certificatesetc ,

A new system of electronic stock is made. In this system your stock is preserved in an electronic system rather delivering you the paper shares. And you don’t need to register your ownership. The ownership is automatically transferred to you and preserved in an automatic system. This systemis called

Central Depository Bangladesh Limited (CDBL).

I will describe this CDBL system in details later.

What is stock exchange?

Stock exchange is a organized place or arrangement where the buyer and seller is brought together so they can buy sale their stocks/share.

For example

Dhaka Stock Exchange has electronic trading system called TESA and Chittagong Stock Exchange has an electronic trading system called VECTOR. These two system work as an arrangement to help buy/sale of listedsecurities

What is broker?

A broker is an intermediary who works as an media to bring together buyer and seller. And it takes commission form the buy/sales made. A broker must be listed member of any stock exchange (i.e. – DSE, CSE).

What is a listed company or unlisted company?

Companies or firms which are listed with stock exchanges are called listed public limited company. On the other hand firms/companies those are not listed with any of the stock exchange un-listed companies.

Can we buy stock/share of unlisted companies?

Definitely we can. But in that case you have to go the traditional method of buying or sellingprocess.

For example

at present if you want to buy share ofGrameen phone you have to go toTelinor who is the major 62% share owner of Grameen phone or to the Grameentelecome which is a subsidiary of Grameen bank who owns 38% of the Grameenphone shares and negotiate withthem so that they sale their shares to you. If they agree to sale any share/stock to you then youcan buy it and you have to go to register of joint stock companies and register your ownershipthere. But the whole system will work avoiding the stock exchange as still it is an unlistedcompany.

What is Securities and Exchange Commission (SEC)?

It is the regulatory body of Bangladesh capital market. For your information stock exchanges are called capital market as companies raise capital from here. SEC defines working process and rules and policies under which the stock exchanges will operate.

What is the face value (FV) of a stock?

This is the value assigned to a smallest part of ownership of a company.

For example

in case of the previous example I gave the Face Value of a share of that shop is 100tk.

What is the market value (MV) of a stock?

When someone sees a good business prospect of a company then he may be will to buy it other than the face value. It may be a higher price.

For example

at present SALAM still mill’s stock is trading around 190tk. So its market value (MV) is 190tk now.

What is market lot (ML)?

Every firm has millions of stock in the market. If every piece of stock is traded separately it will generate tedious clerical job and the system won’t support so many trades per day. Moreover the trading cost per trade will be intolerable. To face such problem stocks of different companies are traded in bunches. Then every bunch is traded in the market.

Every bunch is called a lot (market lot).

For example

you have to buy at least 50 stocks at a time in a bunch if you want to buy GQ ball pen’s stock. So the market lot (ML) gore GQ ball pen’s stock is 50.

What is earning Per Share (EPS)?

Earnings per share indicate how much profit is earned per share.

For example

if GQ ball pen is divided in 10 million stock and GQ ball pen makes a profit of 100million tk. then earning per share of GQ company is (100million tk / 10 million shares = 10tk.) 10tk. EPS is calculated through dividing the total profit buy total number of securities/stock.

What is Price Earnings Ratio (PER)?

It indicates that what is the price of a stock in relation to EPS. Say GQ ball pens price is now 140 tk. in the market and its EPS is 10tk. Then its price earnings ratio (PER) is (140tk/10tk) 14 times. It also indicates that if someone buy a GQ ball pen stock for 140tk today the company will earn the same amount of earning for that stock in 14years

What is dividend?

It’s the portion of profit given to the shareholders. Dividend is usually expressed in percentagebasis or per share basis.

For example

Now if GQ Company declares a 80% dividend to the shareholders it indicates that every shareholder will get 8tk per share. Dividend is calculated onFace Value not on the market value. The dividend declaration depends on the profit earned by the company, company’spayout ratio, investing policy etc.

What is Stock dividend?

In some cases company may earn some profit. But it may need some extra money for further growth of the company. In that case the company may retain the profit earned. It won’t declarecash dividend. Rather it will declare stock dividend. In that case an investor will get a few more stock of that company for free.

For example

if GQ declares a 80% stock dividend it means if youhold 100stock of GQ ball pen you will get 80stock for free. This is a very nice system forcompany growth. In this system company can retain its needed cash for further investment andstock holders also get some benefit.

What is Right issue?

In some cases business may need immediate money in the middle of the year or for any reason. May be it need some more cash for business growth. In that case the company can issue fresh share in the market. But according to regulation the existing shareholders have the priority to buy the shares. So when the company decides toissue new shares in the market at first it offers the shares to existing shareholders of the company. As existing shareholders get the shares according to their right it is called right issue. But if the existing shareholders decline to buy the new shares the company can issue the shares to general public as fresh IPO.

Dividend yield

Dividend yield is the return calculated on your buying price resulting from declared dividend. If ACI Company declares a 23% dividend and you buy ACI stock for 230tk. In that case you will receive 2.3tk as dividend (Face value of ACI stock is 10tk so 23% on 10tk. is 2.3tk). But as you bought the stock for 230tk your return is not 23% rather your return is 2.3/230=1% only. This is called dividend yield.

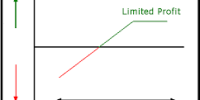

Circuit Breaker

This is an automated system introduced by both DSE and CSE. In this system a specific stock cannot increase or decrease more than a specific percentage point.

For example

Saypreviousday’s close price of Power Grid Company was 710tk. and the circuit breaker is 10%. It means Power Grid will not rise more than 10% today even it won’t fall more than 10% today. So in a single day its highest price can be 710+710*10%=781tk and the lowest price will be 639tk. This system is introduced to tackle unusual volatility in the stock market

LTP

Last Trade Price of a specific company in a day. The latest trade took place in this price.

Volume

Volume indicates how many stock of a specific company is traded in a single trading day.

High Price

This is the highest price of a stock in a single trading day.

Low Price

This is the lowest trade price in a single trading day.

Trade

It indicates how many transaction of a single stock took place in a day.

Weeks Range

It means that what was the highest and lowest price of a stock in last 52 weeks.

For example

iftoday (28/03/2008) ACI’s 52 weeks range shows 62-235 it means that ACI stock was traded lowest at 62 tk in last 52weeks and highest 235tk in last 52weeks. Usually it is updated every month on DSE website.

IPO

(Initial Public Offering) When any company offers their stock to general public for the first time it is called Initial Public Offering. A company can offer stock to the public again and again. Thoseare called Public Offering

Private Placement

When a company sells its shares to institutional or individual investors through private negotiation rather offering their shares to the public it is called private placement.

Technical Analysis

Technical analysis means analyzing a stock’s price trend based on its recent past trade pattern (investigating volume, price trend, high, low, close etc). People try to identify near-future-up- trend of any stock and invest in it so that when the price will go up he can make profit.

Fundamental Analysis

This sort of analysis is done based on the company fundamentals- (EPS, Dividend, NAV etc.) In this case peoples try to identify the true value of a stock rather the price trend. When someone identifies a stock is undervalued s/he consider that market will recognize the value shortly and the price will go up. And s/he invests in that particular stock in advance to reap profit from increased value when the market will recognize the value.

Comparative Valuation

I wrote on it earlier. Just read that. If you can’t find that post just type the topic- “Comparative Valuation” in the search box and search it. You’ll get it.

Intrinsic Value

this means that what is the true value of a stock. Fundamental analysts try to identify this value

About Sec

The Securities and Exchange Commission (SEC) was established on 8th June, 1993 under the Securities and Exchange Commission Act, 1993. The Chairman and Members of the Commission are appointed by the government and have overall responsibility to administer securities legislation. The Commission is a statutory body and attached to the Ministry of Finance.

Members perform the following functions:

- Serve as the members of the Commission and supervise its management.

●Provide policy direction to industry and staff and promulgate legally binding rules.

●Act as an administrative tribunal for decisions on the capital market.

Mission of the SEC:

- Protect the interests of securities investors .

●Develop and maintain fair, transparent and efficient securities markets.

●Ensure proper issuance of securities and compliance with securities laws.

Commissions’ main Functions

- Regulating the business of the Stock Exchanges or any other securitiesmarket.

- Registering and regulating the business of stock-brokers, sub-brokers, share transfer agents, merchant bankers and managers of issues, trustee of trust deeds, registrar of an issue, underwriters, portfolio managers, investment advisers and other intermediaries in the securities market

- Registering, monitoring and regulating of collective investment scheme including all forms of mutual funds.

- Monitoring and regulating all authorized self regulatory organizations in the securities market.

- Prohibiting fraudulent and unfair trade practices relating to securities trading in any securities market.

- Promoting investors’ education and providing training for intermediaries of the securities market.

- Prohibiting insider trading in securities .

- Regulating the substantial acquisition of shares and take-over of Companies .

- Undertaking investigation and inspection, inquiries and audit of any issuer or dealer of securities, the Stock Exchanges and intermediaries and any self regulatory organization in the securities market.

- Conducting research and publishing information

Dhaka Stock Exchange

____________________Background___________________________

Dhaka Stock Exchange (Generally known as DSE) is the main stock exchange of Bangladesh. It is located in Motijheel at the heart of the Dhaka city. It was incorporated in 1954.

Dhaka stock exchange is the first stock exchange of the country. As of 31 December 2007, the Dhaka Stock Exchange had 350 listed companies with a combined market capitalization of $26.1 billion.

History It first incorporated as East Pakistan Stock Exchange Association Ltd in 28 April 1954 and started formal trading in 1956. It was renamed as East Pakistan Stock Exchange Ltd in 23 June 1962. Again renamed as Dhaka Stock Exchange Ltd. in 13 May 1964.

After the liberation war in 1971 the trading was discontinued for five years. In 1976 trading restarted in Bangladesh. In 16 September 1986 DSE All Share Price Index was started.

The formula for calculating DSE all share price index was changed according toIFC in 1 November 1993. The automated trading was initiated in 10 August 1998. In 1 January 2001 DSE 20 Index was started. Central Depository System was initiated in 24 January 2004. As of November 16 2009, the benchmark index of the Dhaka Stock Exchange (DSE) crossed 4000 points for the first time, setting another new high at 4148 points.

The major functions are

- Listing of Companies.(As per Listing Regulations).

●Providing the screen based automated trading of listed Securities.

● Settlement of trading.(As per Settlement of Transaction Regulations)

● Gifting of share / granting approval to the transaction/transfer of share outside the trading system of the exchange (As per Listing Regulations 42)

● Market Administration & Control.

● Market surveillance.

●Publication of Monthly Review.

●Monitoring the activities of listed companies. (As per Listing Regulations).

● Investors grievance Cell (Disposal of complaint by laws 1997).

● Investors Protection Fund (As per investor protection fund Regulations 1999)

● Announcement of Price sensitive or other information about listed companies through online.

Management

The management and operation of Dhaka Stock Exchange is entrusted on a 25 members Board of Director. Among them 12 are elected from DSE members, another 12 are selected from different trade bodies and relevant organizations. The CEO is the 25th ex-officio member of the board. The following organizations are currently holding positions in DSE Board:

- Bangladesh Bank

- ICB

- President of Institute of Chartered Accountants of Bangladesh

- President of Federation of Bangladesh Chambers of Commerce and Industries

- President of Metropolitan Chambers of Commerce and Industries

- Professor of Finance Department of Dhaka University

- President of DCCI (Dhaka Chamber of Commerce andIndustry

Chittagong Stock Exchange

BACKGROUND

The Chittagong Stock Exchange (CSE) began its journey in 10th October of 1995 from Chittagong City through the cry-out trading system with the promise to create a state-of-the art bourse in the country. Founder members of the proposed Chittagong Stock Exchange approached the Bangladesh Government in January 1995 and obtained the permission of the Securities and Exchange Commission on February 12, 1995 for establishing the country’s second stock exchange. The Exchange comprised of twelve Board members, presided by Mr. Amir Khosru Mahmud Chowdhury (MP) and run by an independent secretariat from the very first day of its inception. CSE was formally opened by then Humble Prime Minister of Bangladesh on November 4, 1995.

MISSION

The Chittagong Stock Exchange believes that a dynamic, automated, transparent stock exchange is needed in Bangladesh. It works towards an effective, efficient and transparent market of international standard to serve and invest in Bangladesh in order to facilitate the competent entrepreneurs to raise capital and accelerate industrial growth for overall benefit of the economy and keep pace with the global advancements.

OBJECTIVES

- Develop a strong platform for entrepreneurs raising capital;

- Provide a fully automated trading system with most modern amenities to ensure: quick, easy, accurate transactions and easily accessible to all;

- Undertake any business relating to the Stock Exchange, such as a clearing house, securities depository center or similar activities;

- Develop a professional service culture through mandatory corporate membership;

- Provide an investment opportunity for small and large investors;

- Attract non-resident Bangladeshis to invest in Bangladesh stock market;

- Collect preserve and disseminate data and information on stock exchange;

- Develop a research cell for analyzing status of the market and economy.

The Potential of the Bangladesh Capital Market

The capital market is the engine of growth for an economy, and performs a critical role in acting as an intermediary between savers and companies seeking additional financing for business expansion.

Vibrant capital is likely to support a robust economy. While lending by commercial banks provides valuable initial support for corporate growth, a developed stock market is an important pre-requisite for moving into a more mature growth phase with more sophisticated conglomerates.

Today, with a $67 billion economy and per capita income of roughly $500,Bangladesh should really focus on improving governance and developing advanced market products,

Such as

Derivatives, swaps etc.Despite a challenging political environment and widespread poverty, Bangladesh has achieved significant milestones on the social development side. With growth reaching 7 percent in 2006,the economy has accelerated to an impressive level.

It is noteworthy that the leading global investment banks, Citi,Goldman Sachs, JP Morgan and Merrill Lynch have all identified Bangladesh as a key investment opportunity.

The Dhaka Stock Exchange Index is at a 10-year high, however, the capital market in Bangladesh is still underdeveloped, and its development is imperative for full realization of the country’s development potential. It is encouraging to see that the capital market of Bangladeshis growing, albeit at a slower pace than many would like, with market development still at a nascent stage

The market has seen a lot of developments since the inception of the Securities and Exchange Commission (SEC) in 1993. After the bubble burst of 1996, the capital market has attracted a lot moreattention, importance and awareness, that has led to the infrastructure we have in the market today.

Reasons behind the underdevelopment

Access to high quality and credible corporate information remains a major problem in the market. While a handful of institutional investors may enjoy certain benefits since they have an investment unit manned with qualified officers, nothing exists for retail investors.

And, in the absence of independent research houses, retail investors primarily focus on advice given by their brokers, which often consists of market rumors. This is not acceptable, and it often leads to enormous losses for small investors who are vital for a low-income and emerging market like Bangladesh.

Filtering of information among different types of investors may leave scope for manipulation; this assumption had been proved right in the 1996 market meltdown at the cost of many individuals and households. The market does not have an adequate number of fundamentally sound scrip.

Theauthorities should not force major corporations to come into the market, without creating an enabling environment. The focus should be on the privatization of state owned enterprises through public offerings in the bourses. The market has to reach such a stage of development that companies will take it as a serious alternative to bank financing.

The government has reduced the interest rates on savings instruments, however this particular market is still limited to the commercial banks, and individual investors do not have access to these instruments. These savings instruments are considered risk-free, and since they are not present in the capital market, the overall risk of investment for an investor remains very high.

A portfolio investor does not have the option of reducing his average portfolio risk by adding these risk-free opportunities. An estimate suggests that the ratio of institutional-to-retail investors is still low in Bangladesh, even relative to other emerging markets. Institutional investors bring long-term commitment and a greater focus on fundamentals and, hence, stability in the market.

The presence of institutional investors is also expected to ensure better valuation levels due to their specializedanalytical skills. While we do have public sector as well as private sector institutional investors in the economy, proprietary investment from these institutions is not significant — other than the

Investment Corporation of Bangladesh that was created in 1976 and currently manages several mutualfunds. Corporate governance of international standard is still lacking. Multinational corporation’sand institutions operating in Bangladesh often adhere to a very high international standard compliance regime.

Parent companies of most of these corporations and institutions have their scrip listed in developed markets. Unless the local market adheres to, and effectively enforces, a standard corporate governance system, there will not be a level-playing ground for international business houses vise-a-vise local operators.

An important aspect for capital market is reflection of fair value of scrip. This is not adequately present in the current scenario, and due to this reason the market is not receiving the attention of an important segment of investors, both foreign and local. Investors are perhaps depending more on speculative analysis, resulting in volatility in the market, as opposed to fundamental analysis, which could attract more stable long-term investors who are sure about their investment tenure and expectations.

1996 and now

The bull-run that took place in 1996 has left a number of positives for the market. Lot ofinvestment-friendly regulatory reforms have been implemented by the SEC. We now have stronger surveillance and improved rules relating to public issue, rights issue, acquisition, mergers and so on.

All these fundamental developments, which were well overdue, followed the1996 bull run. It was a learning experience for Bangladesh, and the desired level of changes was initiated by the market watchdog subsequently. Inthe secondary market, surveillance is more active and particular than before.

These developments, that are widely appreciated, are actually the fundamental requirements that are in place today resulting from the continuous efforts of the government and multilateral agencies. Trading has now become automated, led by the Chittagong Stock Exchange through the central depository.

In the present automated trading environment, bids/offers, depth, and required broker particulars are all recorded and can be retrieved for future reference. The Central Depository Bangladesh Limited (CDBL) was created in August 2000 to operate and maintain the Central Depository System (CDS) of Electronic Book Entry, recording and maintaining securities accounts and registering transfers of securities; changing the ownership without any physical movement or endorsement of certificates and execution of transfer instruments, as well as various other investor services including providing a platform for the secondary market trading of Treasury Bills and Government Bonds issued by the Bangladesh Bank.

The stock market surveillance mechanics in place at present has no resemblance to that of 1996.There are strict rules and guidelines, trading circuit breakers and international standard surveillance to protect investor rights and ensure fair play.

The disclosure requirements and its timing for both listed scrip and IPOs as devised by the SEC are now more reflective of international practices.

The SEC is also adopting new valuation methods that result in fairpricing of new issues. While there is still a lack of credible research organizations, a few firms like Asset and Investment Management Services of Bangladesh Ltd. (Aims) have come up, and they are investing in research and building up stock market related credentials

The recent surge in the stock market

The Dhaka Stock Exchange Index was at a 10-year high in the 2007 year end (up 66 percent),which made it Asia’s top performer after China. The steady investment atmosphere prevailing throughout 2007 is considered to be one of the main reasons behind this surge. Good return prospects, stable market growth, and uninterrupted trading as a result of political stability attracted foreign investors to local securities. In 2007, foreign investors bought shares worth$205.7 million, while the amount of selling was $78.6 million, according to a DSE statistic. According to the DSE, in 2007, net foreign or portfolio investment on the Dhaka Stock Exchange surged 8.3x to $129 million. The banking sector, followed by the power, pharmaceutical and cement sectors, received the most foreign investment.

The caretaker government has also attracted investors by pledging to sell state enterprises. The state-owned companies — Jamuna Oil Company Ltd. and Meghna Petroleum Ltd. — debuted in the bourses early this month. Some analysts think that the market had been undervalued before the surge, and the uphill trend, therefore, played the role of an upward correction of the market. The P/E ratio now stands at 20x as compared to 14.1x for emerging markets. It seems sustainable if the planned big IPOs of a few SOEs and the top telecom companies take place. More such large issues are required, which can emerge out of the energy, infrastructure and public sectors.

The Share Market Bubble?

JyotiRahman a famous columnist warns that there might be trouble afoot in our capital marketsAfter bringing uncomfortable memories of 1996 to many minds over the last few months, the bull run in Dhaka Stock Exchange (DSE) seems to be in abeyance, at least for now. At the time of writing, DSE had fallen by about 1 per cent since the end of February.

While there have been reports of angry reactions of retail investors expecting sharp price rises, a modest price correction is a preferable outcome than continuing froth in the market eventually ending in a more severe bust.

Of course, such a bust is still very much possible. We are by no means out of the woods yet. But with luck, we will have avoided a collapse. Either way, focus should now turn to factors that fuel these episodes, and what, if any, can policy do to avoid them.

Finanxial express Report

The government will make a further investigation into the recent share market scam as the report of the Ibrahim Khalid-led committee has been found to be based on assumptions rather than facts, Finance Minister AMA Muhith told the reporters Saturday.

The Finance Minister said this at his secretariat office while making officially the report of four-member probe committee public.

He said the government is officially releasing the probe committee report without any kind of editing. The probe committee was earlier formed January 26 under some specific terms of references (ToR) following a severe fall in the prices of the share prices in the stock market. The committee submitted its 284 pages report to the government on April 7.

MrMuhith said: “The report had been prepared, being based on some assumptions. Such a report is not sufficient to bring allegations against any foul game by share traders. We consider that it needs more detailed investigations.” He said it not desirable to go for any character assassination merely on assumptions. He also said: “The government does not want the genuine ‘culprits’ to evade the laws of the land.”

The Finance Minister said the government will form a task force to help translate different recommendations, made by the probe committee, into some real actions.

This task force will not only monitor and evaluate the recommendations of the probe report but also look after the restructuring process of the capital market, MrMuhith added.

“We’re expecting to announce the terms of reference and composition of the task force shortly,” he added. He said: “We do not believe the capital market regulator, Securities and Exchange Commission (SEC), had totally failed to tackle the situation.”He said there was a lack of coordination among all concerned agencies including Bangladesh Bank, the SEC and stock exchanges. He said: “We’ve to stop lack of coordination. For this, we’re taking institutional measures with the central bank, SEC and stock exchanges to help avert such a situation.”

The Finance Minister said the probe committee had recommended to investigate further into many more issues relating to share market scam, adding: “The government is also following their instructions.” MrMuhith said the Ibrahim Khaled-led committee identified criminal offences involving two aspects of things. “The government is following their recommendations as well,” he added.

“The government has already acted upon some of the recommendations made by the probe committee and measures in other areas are also under consideration,” MrMuhith told the reporters. He also said: “The country’s stock exchanges will be demutualised shortly in accordance with the recommendation of the probe committee.””We are making a roadmap for demutualization of the stock exchanges through consultations with all stakeholders,” he added. He said: “We’re expecting that the process of demutualization will begin in the next fiscal.”

Muhith, however, said the SEC should be restructured to bring confidence among the investors. “We’re working on it.”The Finance Minister said a massive campaign is necessary to raise the level of awareness among the investors. “This is a very risky area. Here both profits and losses can occur. For this, it needs right and prudent decisions,” he noted.

Famous newspaper editorial view about share market problem

The chief editor of Daily Independent, MahbubulAlam publish an report about the problem and prospects of capital marke.this is quoted below:

During the past 20 months the Bangladesh capital market has experienced a bubble – a rapid rise of share prices disconnected from underlying values, followed by a sharp fall in prices. It remains unclear if the decline in prices will continue or whether the market has stabilized. Knowledgeable students of the market are divided on this point. Many persons lost money from this bubble and public concern, as so often in Bangladesh, seeks someone to blame.

Of course everyone participating was greedy and trying to make money for themselves; some did and others did not. Those who did not are now very noisy and are seeking somehow to get their money back. The belief that this was the result of manipulation arose in everyone’s mind; naturally a committee was appointed to review what happened and all expected that the result would be to point the finger of blame at someone. There is now an official report prepared, whose contents are still considered confidential by the Government which has, so far, been reluctant to release the report

However many outsourced newspaper accounts of the report are busy telling us what the report contains. If we take these popular accounts are reflecting the report then we have to say that the comments and alleged contents of the report reflect a quaint, charming but completely wrong understanding of what the primary share market is about; and further have not grasped the macroeconomic forces which led to the bubble.

The Commission membership would not really consider the macro-economic forces at work. By skipping these or at least not giving them much attention the real issue has been left behind. Instead the report seeks to find people to blame. No doubt there is some security fraud but to see this as the cause of the bubble is to believe that man rather than God created the universe.

Accusations of fraud abound, as the press and civil society like to be quick to accuse, but usually such charges are presented without facts or even without an understanding of the matter at hand. Security fraud is widespread throughout the world and takes many forms. In particular there are three major abuses.

In the primary market

the issuance of new shares through documentation that contains misstatements of fact with respect to past accounts or false claims of existing assets. However, asset valuation is complicated and most balance sheets do not convey the real position of the firm. Questions of revaluation to actual market values and assets which are difficult to value plague the valuation of equity assets.

In the secondary

market insider trading when individuals with knowledge not known to the public that is likely to affect the share prices, is used to buy or sell shares before the information becomes public.

Also in the secondary

market there is often misrepresentation of the prospects of a share leading investors to take risks that they may not actually want to take. For the most part the participants in the secondary market are supposed to know the risks they face.

What caused the bubble? An asset bubble occurs when the price at which the asset is being traded bears no relationship to the value of the asset. The value of the asset relates the expected earnings of the asset to the prevailing market interest rate.

Putting aside the complexity of taxes and inflation imagine that someone offers you an asset which will give you one million taka in one year. You could put your money into a fixed deposit and earn say 10%; if you place Tk 909090 in the bank at the 10% you would get one million taka. Hence you would not pay more than that for the asset you have been offered. Of course you are concerned about the risk so you would pay less if you thought that there was some risk in whether you received the million taka. Share prices are valued in exactly this way; what is the return in dividends that I can expect, what are the risks associated with the dividends and what is the alternative use [interest rate] that I can earn.

Assume that you paid Tk 700,000 for the asset. For reasons that you do not understand the asset starts to be traded at Tk 800,000 then one million, then one million five hundred thousand. You think you should buy more of this since the price is rising. You forget the underlying real value of the asset is only Tk 700,000. This asset is experiencing a bubble, its price has disconnected from the underlying value. Eventually this price will stop rising and will fall sharply towards the real value. Once it stops rising everyone wants to sell their shares since it no longer worth holding. That is why the price will go down so rapidly.

The share market bubble is one of two bubbles that hit the Bangladesh economy in the last year; the other is the increase in land prices. As we shall see these are not completely independent.

Rapid increases in share markets usually arise from a sharp increase in demand for shares. This is what happened in Bangladesh.

What was the source of this sudden increase in demand for shares?

Once Bangladesh Bank capped lending rates the following happened: Deposit rates would not be increased as lending rates could not increase to offset the higher cost of funds. The inflation rate was increasing so the real return to depositors was falling. This led depositors to shift their money into the share market. Talk to middleclass persons with deposits of Tk 20-60 lakh and you will hear the same story. “I was not making enough from the interest so I was looking for a higher return. In parallel Government lowered the effective returns on national saving certificates resulting in reduced purchases of these instruments. More money headed for investment in the land and capital markets. The demand for shares raised the prices, at first slowly but then more and more rapidly. Bangladesh Bank persisted in allowing acceleration of the growth of the money supply. In effect this was pouring petrol on the fire. All of this was done in the name of rapid economic growth and increasing investment. This really did not come – what came were two bubbles.

Once the share market bubble got started participants were no longer interested in the long run but hoped to make 100% return in a only few months. Greed took over as it always does. The index rose from to 2500 in June 2009 to almost 9000 in November 2010, an 18 months period; this was an increase of 135% per annum. Many shares did even better. This was too good to miss so more and more people bought stocks. All such bubbles eventually collapse and fall rapidly. There is no mystery in such performance. There is no conspiracy here.

In such an environment of high, unsustainable prices many persons sold shares near the peak. Those who did, made money. Those who held on out of greed to make more found themselves losers. There are accusations of deliberately driving up a share price to lead others to buy it and then sell out. This ramping up a share price may be illegal but it is a difficult thing to demonstrate that there was a violation of the law. What is for sure is that one cannot ramp the whole market. The share price increase arose from feeding more and more resources into the share market as alternative deposit and saving certificates were increasingly unattractive.

This is the same problem as the sub-prime housing bubble in the USA. The Federal Reserve fed the market with a lot of low cost money. Many persons borrowed this money to buy housing as they thought that the housing prices were going up much faster than the interest rate. This worked for several years and then collapsed. In the course of this there was a lot of fraud of selling houses without revealing the real costs to the buyer; but these illegal or immoral activities were not the cause of the bubble. Ultimately it was the central bank’s keeping interest rates very low.

Share valuation: The press is full of stories of wild overvaluation of shares and selling at unfair prices in the primary market. Share valuation is not simple. Certainly an ongoing company’s balance sheet or a one quarter profit result is no basis for blind valuation of what a share is worth. While there is a vast literature arguing about how to value stocks one can keep this simple.

You buy a share and receive dividends of either cash or additional shares. You can sell those shares for cash if you want or hold on to then hoping they gain in price. You may receive rights issues which require you to buy the shares which you can sell if you want after you have bought them at a price below the market price. You may also sell the original share you purchased and make money from the price increase. You buy a share because the profit expectations of these dividends and capital gains are acceptable to you. It is the future dividends that matter. The past is interesting only as prologue to future profits.

Here are some things that can happen to stock values:

GMG Airlines

Receives landing slots in Saudi Arabia. These landing slots are of considerable valueas they open up the potential for earning large profits. The share value of GMG should increase sharply with acquisition of these landing slots. Unless the slots can be sold it is not so easy to put the enhanced value of the company in the balance sheet. Nevertheless the shares are more valuable.

The land boom

■has increased the value of land owned by a listed company. This may immediately increase4 the value of the shares of such a company. It is a completely legitimate action to revalue the land assets and raise the net worth of the company. After all it is more valuable. The company may sell the land. If it is renting to others then it may raise the rents for new agreements etc. But the company is certainly more valuable.

When a recession

The lesson is that stock valuation is much more complex than it appears at first sight. The press discussions surrounding the share market bubble are consequently rather quaint. Valuation of a stock requires understanding of the entire business environment facing the enterprise. Efforts to equate share price with the book value on the balance sheet will discourage business from going to the capital market. The SEC in Bangladesh indeed went through a period of forcing new issues to be priced at the book value. With these rules no thriving company would go public; indeed until the SEC changed this approach new issues were not coming to market.

What lessons can be drawn

If one wants to have a share market one cannot control interest rates. The 13% cap on lending rates brought disaster.

Inflation rates of 8-10% are devastating to a modern economy. High inflation helped drive investors to the share market. This means broad money growth should generally be limited to not more than 12-13% per annum. Bangladesh Bank faces great difficulty in getting the inflation rate down, but so far it has failed to achieve its stated goals. An expansionary monetary policy often leads to stock market booms and busts.

Share valuation is not the business of the SEC. It should set principles and then stay away. The press should refrain from looking silly by holding forth on share valuation.

The SEC should have a steady hand, increase and improve the quality of its senior staff and work harder and faster. Of course it should be independent of the Ministry of Finance. It should be free to set its staffing levels, sets its compensation subject to parliamentary approval, and have a source of revenue independent of the budget. [e.g. a small transaction tax].

The SEC should be an independent regulatory agency reporting to Parliament not the Ministry of Finance. The Executive should appoint the members of the Board and perhaps recommend legislation but no more.

After the last stock market bubble in 1996 the SEC asked for such freedom and was refused permission by the government. The SEC has never been able to get up to the regulatory tasks as the government did not allow it to do so Conspiracies:

If one goes around looking for conspiracy every time something happens you will be doomed to misunderstand what is going on. No doubt there were instances of security fraud committed during the bubble. But to see the bubble as arising from such actions is ridiculous. Those who committed security fraud should be brought to trial and if the facts support the accusation they should be found guilty andappropriately punished

Stock market a casino: Prof Sobhan.

Dhaka, Feb 13: Chairman of the Centre for Policy Dialogue (CPD), Prof RehmanSobhan, has branded the stock market as a “casino” even as Bangladesh Bank governor Dr AtiurRahman feels the capital market needed to be guarded from indiscipline at any cost. “This is a casino in the name of capital market. …It is a market of gamblers and ordinary people are not going there,” added Sobhan while chairing a dialogue on “growth, inflation and monetary policy; challenges for Bangladesh in FY (Financial Year) 2010-11,” organised by CPD in the city.

He urged the authorities concerned to turn them (gamblers) into credible investors by efficient financial management. Criticising the first half-yearly monetary policy of FY 2010-11, he questioned,

“Is that an efficiently functioning capital market when crores and croresof resources die there?”

He said low interest rate of returns against savings had prompted many depositors to look for maximum profit at the capital market. Former Bangladesh Bank (BB) governor Salehuddin Ahmed said sudden increase in CRR (Cash Reserve Ratio) had signalled that there was a crisis looming. He added the capital market was crunched because of greed and unscrupulous activities in the absence of appropriate policy back up by the central bank.

“I think that (CRR) was not done appropriately which resulted in a huge downturn impact for the capital market,” said Ahmed.

Prof Abu Ahmed of Department of Economics of Dhaka University has supplemented that the central bank had tightened everything with regards to the capital market in last July (2010) but failed to understand the fact that the capital market is going to be crunched soon.

On the other hand, Bangladesh Bank governor Dr AtiurRahman said a probe committee is reviewing the unprecedented topsy-turvy in the stock market and that action will be taken against those found responsible for this.

The government is waiting for the report. The central bank is now in a strategic position to adopt some long-term policy guidelines for better management of the capital market, he added. “We will ensure its protection at any cost as we have strengthened the strategic position to control the financial sector firmly,” Rahman said while answering questions at the same event.

The central bank will work with other regulatory bodies in charting a safe course for our financial sector in consultation with stakeholder forums, he added. “Following a recent slump in the stock market, we did our best, along with other authorities concerned, in helping stabilize the market,” he pointed out.

Such short term stabilizing interventions after a crisis precipitates will, however, do little in averting repetition of such situations in future unless the root cause of over valuation, such as chronic shortage of new capital issues to meet growing demands of intending investors, was addressed, said Rahman. He said the government was fully aware of this problem and has responded positively. Rahman added that Bangladesh Bank’s (BB) monetary policy was not only focused on controlling inflation, but also on growth and structural changes. Monetary policy is a blunt tool in addressing more volatile food or fuel price inflation, he said.“It cannot alone rein in on inflation unless complemented by other policy interventions,” he added.

The country’s economy is now on the threshold of a higher growth path as envisioned in the country’s medium and perspective plans for 6.7 per cent GDP growth in FY11, and above 7 per cent in FY12, he said.

“For the economy to grow at a faster pace without major hiccups or instabilities, we need to ensure that activities in the real and financial sectors proceed in sync and not discordantly,” added Rahman.The central bank is trying to activate the bond market soon to collect money for large infrastructure projects in the country, he said.

The bank is already in discussion with the Asian Development Bank to develop a formal structure in this regard. Advisor to the caretaker government, Dr AB MirzaAzizul Islam, has identified some weaknesses in the economy which need to be taken care of with proper measures. Executive director of Policy Research Institute, Ahsan Mansur, said the country’s economy might invite a bigger bubble in private sector’s credit growth which already crossed 27% in FY 2010. “There should be a limit in credit growth at 18% for a country like Bangladesh,” he added.

Executive director of CPD Dr MustafizurRahman has presented a keynote paper titled “Emerging Challenges for Bangladesh Economy in second half of FY 2010-11. The central bank’s senior consultant and advisor to the governor, Allah Malik Kazemi, deputy governor Ziaul Hassan Siddiqui and former special advisor to ILO Rizwanul Islam also spoke on the occasion.

Major influence of Grameenphone share in bd share market

Faruq A Siddiqi (a famous columnist of financial express)writes about bad influence ofGrameen Phone share. here is given below

BANGLADESH’S stock market has witnessed impressive growth since 2007. Listing of Grameen Phone was a major recent event. It was expected that listing of GP would be a catalyst for other companies to follow. That is yet to happen. It appears that progress of new listing rather has slowed down. It has to get out of current stagnation and move towards further expansion. A large number of new investors from across the country are entering the market. Institutional investors are active in the market.

Asset management companies are growing and their activities are visible. A number of proposals for new mutual funds are awaiting approval. These developments need to be seen positively. Policies regarding different methods of listing, IPO pricing, approval of new mutual funds and other market related matters should be made keeping long term market interest in view.

It is desirable that short term policy interventions just to address a temporary market crisis are avoided. In a small but rapidly developing stock market, there will be problems like market manipulation, over pricing of stock, panic created by vested interest, price distortion, and regulatory shortcomings and so on.

In any stock market, there will bullish and bearish trends. Regulatory policies should be framed with long term vision. In recent months, some policy decisions are being taken to address current problems at the cost of long term market interest. These policy changes include fixation of minimum size of new public issue, imposing restriction on private placements, disqualifying private sector companies under direct listing and discouraging new mutual funds.

Many of the stocks are overpriced and this is a serious risk factor for the inexperienced investors. Entry of new companies in the market can help reduce gap between demand and supply and help bring stability in the market. New companies need to be encouraged to come to the bourse through market friendly policy.

But recent policy interventions do not seem to be moving towards that end. The state-owned companies are not coming forward for listing despite repeated assurances given by the authorities. Immediate entry of at least two or three large companies could be extremely helpful for a balanced growth of the market.

Currently, Grameen Phone alone accounts for a large portion of the market capitalization. As a result, normal movement of its price affects the index substantially and entire market is influenced by it. Entry of a few more large companies could balance the market. In this backdrop the proposal on entry of Janata Bank with its big capital was a welcome move.

Perhaps, proposed premium was excessive and the balance sheet called for a close examination. But these are problems that could be settled. However, it now seems that the proposal has been shelved for the time being. This has been done in spite of regulatory requirement of listing for all banks and financial institutions.

BTCL with its huge asset is another public sector company that could make immense contribution to supply side of the market. But the way things are moving, it may take months or even years for that to happen. Recently, we have been hearing about Bangladesh Biman’s plan of raising fund from capital market. This is a losing company with huge accumulated debt. It may be difficult for the company to raise fund from the market unless it starts with a clean balance sheet.

It has to be admitted that it is not the responsibility of the government to ensure listing of the state-owned companies for expansion of the market. This alone cannot be the solution either. But the government and the SEC do have a responsibility to promote environment in which private sector companies feel encouraged to raise fund from capital market. Private sector companies are generally reluctant to be listed for variety of reasons.

Therefore, it will be difficult to bring them to the stock markets without liberal policy packages. Recent trend appears to be just in the opposite direction. By imposing different conditions and limitations, the intending companies are actually being discouraged.

On 11 March, 2010 SEC imposed certain conditions through a notification restricting further the scope of public issue. Henceforth, minimum paid up capital (existing + proposed) required for public issue will be Taka 400 million. It means that a smaller company that does not need that much of capital will not be able to raise fund from the capital market. The notification also provides that public offer at IPO up to paid up capital of Taka 750 million will be minimum 40% of the said capital and no private placement will be allowed. For companies with paid up capital between Taka 750 million and 1500 million, public offer at IPO has to be at least 25% of the said capital or Taka 300 million whichever is higher. There will be no private placement. Where paid up capital exceeds Taka 1500 million, IPO size has to be minimum 15% or Taka 400 million whichever is higher. It appears from the notification that for this category of companies there is no restriction on private placement.

Determination of IPO size by the SEC seems to be unwarranted. It should be for the concerned company to decide how much additional fund it needs to raise for running the business.

How can the SEC determine requirement of the company?

Direct listing is another area of current interest. Private sector companies have been disqualified under this scheme. This has resulted in an uneven playing field between public and private sector companies which is difficult to justify in principle. This is a valid criticism that direct listing does not help a company. Their beneficiaries are the share holders who offload the shares and make extraprofit from an overheated market. But private sector companies were coming to the market under this provision and that was helping supply side in the market. In the past, public sector companies derived the same benefit from an overpriced market.

Therefore allowing only the government to take advantage of the overpriced market can hardly be justified. It is true that pricing mechanism under direct listing needs to be revisited. Current practice of price discovery under book building is not justified under direct listing Institutional investors are taking advantage of indicative price and getting allotment at the cut off price while the small investors are obliged to buy the same normally at a much higher price after trading starts.

If this policy is to be continued, small investors should also get the shares at the cut off price through lottery as in the case of IPO allotment under book building scheme. Under no circumstances, institutional investors should be allowed to get allotment at a price lower than the price at which smaller investors will be able to buy subsequently.

In the interest of improving supply of shares in the market, direct listing could also be allowed for the private sector companies with some modifications. There should be an improved price discovery mechanism so that general investors get the shares at an acceptable price and manipulations are controlled. Provisions can be made to ensure investment of the generated fund in the prescribed priority sectors.

■At present, new companies cannot mobilize fund from capital market. Only companies with proven track record are allowed to make public offer. There is only one green field company now. However, direct listing method offers an opportunity where the entrepreneurs may invest the sale proceeds of their shares of a company in another new company.

There can be many other ways of effective utilization of funds generated under direct listing method. But disqualifying private sector companies altogether will only slow down the process of new enlisting and deprive the market of new supply.

Growth of mutual fund in Bangladesh has been slow. Only recently there has been a rush for new funds. Many banks and financial institutions are in the queue with proposals for their funds. Mutual fund is often a misunderstood subject in Bangladesh. Many investors do not understand the difference between mutual fund shares and other company shares. Mutual fund share is not the share of a company. It is a fund under a trust. Investment in mutual fund is ideal for investors who do not want to take risk because the fund is managed professionally and the collective investment is diversified. The price of a closed-end fund share is normally determined by the value of the investment in the fund.

Therefore, the market price of a fund share is often close to the per share NAV. However, in Bangladesh that may not always be the case. It is seen that market price of a mutual fund share can at times be much higher than their NAV justify.

Mutual fund share price can also fluctuate heavily and be subject to wild speculation. As a result the safe investment tool often becomes a risky area. In recent times, price of a share of a new fund has been a few times higher on the very first day of trading defying the basic characteristic of mutual fund. So the rush for getting private placement in the proposed mutual funds is understandable

The concern of the regulator is also a normal response. However, negative attitude in respect of mutual fund should be avoided. Compared to our neighboring countries, mutual fund size in Bangladesh is very low. New mutual fund increases both demand and supply. In the interest of professional investment and balanced market growth, new mutual funds must be encouraged.

It is true that massive influx of new funds at a time is not desirable in such a small market. SEC policy of allowing these funds in phases seems to be rational. But impediments should not be created in their normal growth and development of mutual fund should be encouraged. More institutional and professional investment is likely to stabilize the market and help reduce rumor based investment. However, private placement policy and allotment criteria may perhaps be reviewed.

The expanding stock market needs a strong and efficient regulator to steer its growth. The Securities and Exchange Commission will have to be more efficient and professional. It simply can not run with the present manpower. It needs more professionals, more training at home and abroad and more logistic support.

But it is just not possible to attract the right kind of professionals with the current pay structure. Housing and other facilities are shockingly absent. The Commission deserves more attention of the government for its capacity building. The authority of the Commission seems to have eroded in recent times. While the Commission has to work within overall government policy, frequent intervention is not desirable. Public image of the Commission must not be undermined.

Similarly, the stock exchanges will have to improve their professional management and practice principles of corporate governance. It is desirable that Board of Directors or any of the exchange members do not interfere with professional management of the exchange and leave day to day management to the Chief Executive Officer. This may not always be the case now.

Bangladesh’s stock market is poised for rapid development. For this the SEC, DSE , CSE and all market players should work together with the support of the government. Market confidence is sure to erode if conflicting signals are received from different authorities. At the same time investors will have to understand that in any stock market there are ups and downs and they can not blame others whenever stock prices slide down. Fortunately, investors are getting matured gradually and hopefully we may not have to see shouting and slogan in front of the exchanges any longer.

Effect of market index bd share market

Bangladesh’s stock market performance, measured in terms of the stock price index, has been one of the best globally for a number of years. Its upward surge defied global and regional market developments. When almost all markets across the globe collapsed during the global economic crisis, DGEN was perhaps one of the very few which defied the global trend and maintained its upward progression fueled by local developments/conditions.

When it started its upward trend in 2007, the market was certainly undervalued, and there were fundamental economic reasons for it to go up. At that time the average Price/Earning (P/E) ratio was in single digit and the market capitalization was less than 10 per cent of gross domestic product (GDP). The sustained upward surge, however, went beyond what could be justified by economic fundamentals by early 2010.

Since mid-2010, as the index crossed the 5000 mark, the market has clearly been driven by speculative forces. During the last two-month period leading up to the peak, the index increased by more than 2000 points before crossing the 8900 level on December 5. To put it in proper perspective, the index level was at about 1500 until this recent surge started in 2007. Daily market turnover increased 30 fold about Tk. 1.0 billion to Tk. 33 billion over the three-year period. Clearly, economic fundamentals cannot support this level of valuation gain and turnover, and the market is bound to correct itself once it runs out of steam.

The recent drop in the stock market index needs to be evaluated in this context. Even after a more than 2500 point decline, the index is still well above its mid-2010 levels. The corrections and volatility in the price index that we have experienced in recent days is nothing uncommon, and fully in line with what has been observed in many other important, and much larger stock markets across the globe. For the market to start consolidating, it needs to shed itself of speculative elements, and that can only happen once market valuations come back to their fundamental levels.

Global experience indicates that once stock markets get into a bubble phase, there is very little that regulators or policy makers can do to stabilize it. This has been seen in major markets in the US (NASDAQ in particular) and Japan, and in emerging markets like China and the Gulf Co-operation Council (GCC) countries in recent years. A broad and deep market in the US did not prevent the NASDAQ index from crossing the 5,000 level and crashing back to the 1,600 level in a matter of weeks. The experience of Japan is even more pathetic, with the Nikkei crossing the 33,000 level in 1991, and following the crash, is currently flirting with the level of 10,000 after almost 20 years. More recently we have seen the Shanghai stock index crossing the 7,000 level, crashing down to well below 3000 after the correction. We saw an even worse development in Bangladesh in 1996 when the index dropped from 3,600 to below 800.

The authorities should not panic due to the overdue correction observed in Bangladesh market in recent weeks. Their main concern should continue to be ensuring macroeconomic stability and sustaining real economic activity and employment generation. The stock market collapse would not necessarily hurt Bangladesh’s growth and employment prospects if the process is well managed. The recent tumble in the index should be seen as the inevitable outcome of irrational exuberance on the part of market participants. What worries me is not the correction, but the panic created by both in the streets and at the level of policy makers. What the retail investors are doing in the street is certainly not going to change the course of the market. It only shows how illiterate the Bangladeshi retail investors are as a class. Time and again, informed analysts and policy makers have warned against the state of market overvaluation. We can have sympathy for them, but there is very little the government can do to save those investors who are driven by greed and speculation, and ignore professional advice. Certainly the market is not for these types of investors, and the sooner they realize their mistakes and get out of the market, the better it will be for the market itself and for themselves. When we see people in every office have the stock market tickers on, and people leaving their productive jobs and becoming day-traders, we know there is something fundamentally wrong with what was happening. The stock markets should be the domain for long-term investors and market oriented professionals. Retail investors should invest in the market through instruments like mutual funds which are managed by professionals.

As regards policy makers, their objective should be to help ensure a softer landing, and let the market find its fundamental valuation level. It is bothersome to observe the administrative interventions undertaken a few weeks back when the index fell to 7200 level to engineer artificially a massive 16% rebound in the index in one day. As reported in the press, Bangladesh Bank directly intervened through Investment Corporation of Bangladesh (ICB). The Securities and Exchange Commission (SEC) and other authorities might have also pressured state owned commercial banks (Shonali, Rupali, etc.) and other financial institutions to get into the market and provide an artificial support. Such a policy never works when the market is misaligned, as we observed last week. Public money may have only bailed out some smart/lucky investors but weakened the financial institutions further.

To put it into perspective, countries like Saudi Arabia, Kuwait, the UAE, and China, with enormous amounts of financial resources could have bought the entire stock market several times if they wanted to do so. But those authorities did not try it because such interventions create morale hazards, and if continued would tantamount to nationalizing a large segment of the economy. Certainly, Bangladesh, with its meager resources and with the size of its stock market at 45-50% of its GDP, cannot afford to get into such misadventure.

This is not the time to panic and bring about short sighted regulatory changes. The experience of the last few weeks clearly indicates that whatever sensible move the SEC and Bangladesh Bank may consider would act against them and trigger a negative development for which the regulators will be blamed. This is a perfect example where you intend to do good things, you will be blamed, and if you don’t do anything, you will still be blamed (for inaction). The policy makers and regulators would, however, need to prepare themselves for two initiatives:

- Assess

the impact of a major stock market correction on the domestic economy and determine what kind of policy response the government may have to undertake to mitigate the dampening effect on the real economy through various transmission channels; and

- The SEC

and other policymakers should prepare a comprehensive set of reform measures which can be initiated once the market settles down at the proper level. Nothing major should be done now, when the market is in a correction mode.

The market will find its floor when stock prices would become attractive for the institutional investors, who are probably waiting in the side lines with lots of cash and other liquid assets for future investment at attractive prices. The critical issue is should we call the prices attractive at the average price/earnings (P/E) ratio of 23? This reported P/E ratio of 23 should also be taken with a grain of salt since much of the record profit gains recorded by the financial institutions would certainly disappear in 2011 and the adjusted or prospective P/E ratio will be much higher than the reported level. It is normally believed that an average P/E ratio of 12-15 would be attractive for long-term investors. Thus it would be irrational to expect institutional investors to jump into the market and provide a floor for the index at the current level.

It would be a serious mistake to force or pressure the financial institutions to enter the stock market prematurely. Bad assets (in terms of valuation) to be accumulated by these institutions in this process would only weaken their balance sheet and may lead to collapse of weak financial institutions, thereby transmitting the impact of the stock market collapse to the real economy on a bigger scale. As a matter of fact, Bangladesh Bank may have to be ready to inject liquidity to the financial system in the event some banks are hit seriously by their direct and indirect exposures to the stock market. The emergence of liquidity crisis in the financial system in recent weeks may be an early manifestation of that

Recent situation and new problem of share market

The free-fall in share prices continued till Wednesday as the policy measures taken so far have failed to bring back the confidence of the investors, who eventually staged violent demonstration in the capital’s Motijheel and Dilkusha areas after a trade suspension for the third time in a week.

The trading at Dhaka and Chittagong stock exchanges will, however, resume at 11:00 am today and would continue as per normal schedule.

Authorities concerned deferred Wednesday’s trading by two hours to 1:00 pm as they were expecting market-stimulating decisions from a morning meeting of the top economic policymakers at the residence of Finance Minister AMA Muhith.

A follow up meeting at the Securities and Exchange Commission (SEC) yielded only a “circuit breaker” on the main indices for the first time in the history of the country’s stock market.

The circuit breaker is to restrict the benchmark indices of both Dhaka and Chittagong stock exchanges not to fall beyond 225 points in a day from the closing mark of the previous day or to rise above 225 points from the level it was on the day before. The circuit breaker would remain effective until further order.

Following the trade halt at 1:40 pm on Tuesday, the day’s trading at the bourses resumed with a positive note but lost ground immediately, dipping below the circuit breaker within one hour 26 minutes and faced trade halt automatically at the DSE. The CSE suspended trading at 2:32 pm following the DSE shutdown.

The DSE general index fell 227 points or 3.17 percent to end at 6,913 on Wednesday as 230 out of the total 240 issues traded incurred losses, with only seven issues registering gains and three remaining unchanged. The day’s total turnover stood lowest ever level at Tk 5.37 billion.

Asia has an inflation problem

Asia has an inflation problem. The sooner it comes to grips with its problem, the better. Unfortunately, the appropriate sense of urgency is missing. Willingness to tackle inflation is impeded by Asia’s heavy reliance on exports and external demand. Fearful of a relapse of end-market demand in a still-shaky post-crisis world, Asian policymakers have been reluctant to take an aggressive stand for price stability. That needs to change – before it’s too late.

Excluding Japan, which remains mired in seemingly chronic deflation, Asian inflation rose to 5.3% in the 12 months ending in November 2010, up markedly from the 3.5% rate a year earlier. Trends in the region’s two giants are especially worrisome, with inflation having pierced the 5% threshold in China and running in excess of 8% in India. Price growth is worrisome in Indonesia (7%), Singapore (3.8%), Korea (3.5%), and Thailand (3%) as well.

Yes, sharply rising food prices are an important factor in boosting headline inflation in Asia. But this is hardly a trivial development for low-income families in the developing world, where the share of foodstuffs in household budgets – 46% in India and 33% in China – is 2-3 times the ratio in developed countries.

At the same time, there has been a notable deterioration in underlying “core” inflation, which strips out food and energy prices. Annual core inflation for Asia (excluding Japan) was running at a 4% rate in late 2010 – up about one percentage point from late 2009.

A key lesson from the Great Inflation of the 1970s is that central banks can’t afford a false sense of comfort from any dichotomy between headline and core inflation. Spillover effects are inevitable, and once a corrosive increase in inflationary expectations sets in, it becomes all the more painful to unwind. The good news for Asia is that most of the region’s monetary authorities are, in fact, tightening policy. The bad news is that they have been generally slow to act. Financial markets appear to be expecting a good deal more Asian monetary tightening – at least that’s the message that can be drawn from sharply appreciating

Asian currencies, which seem to be responding to prospective moves in policy interest rates.

Relative to the US dollar, an equal-weighted basket of 10 major Asian currencies (excluding Japan) has retraced the crisis-related distortions of 2008-2009 and has now returned to pre-crisis highs.

Export-led economies, of course, can’t take currency appreciation lightly – it undermines competitiveness and risks eroding the country’s share of the global market. It also invites destabilizing hot-money capital inflows. Given the tenuous post-crisis climate, with uncertain demand prospects in the major markets of the developed world, Asia finds itself in a classic policy trap, dragging its feet on monetary tightening while risking the negative impact of stronger currencies.

There is only one way out for Asia: a significant increase in real, or inflation-adjusted, policy interest rates. Benchmark policy rates are currently below headline inflation in India, South Korea, Hong Kong, Singapore, Thailand, and Indonesia. They are only slightly positive in China, Taiwan, and Malaysia.

The lessons of earlier battles against inflation are clear on one fundamental point: inflationary pressures cannot be contained by negative, or slightly positive, real short-term interest rates. The only effective anti-inflation strategy entails aggressive monetary tightening that takes policy rates into the restrictive zone.

The longer this is deferred, the more wrenching the ultimate policy adjustment – a its consequences for growth and employment – will be. With inflation – both headline and core – now on an accelerating path, Asian central banks can’t afford to slip further behind the curve.Asia has far too many important items on its strategic agenda to remain caught in a policy trap. This is especially true of China, whose government is focused on the pro-consumption rebalancing imperatives of its soon-to-be-enacted 12th Five-Year Plan.

So far, the Chinese leadership has adopted a measured approach to inflation. Its efforts focus mainly on increasing banks’ mandatory reserve ratios while introducing administrative measures to deal with food price pressures, approving a couple of token interest-rate hikes, and managing a modest upward adjustment in the currency.

While the jury is out on whether there has really been such a seamless transition of global economic leadership, Asia must face up to the critical challenges that may come with this new role. Inflation, if not addressed now, could seriously compromise the region’s ability to meet those challenges.

The writer, a member of the faculty of Yale University, is Non-Executive Chairman of Morgan Stanley Asia and author of The Next Asia.

Asian markets sink on modest US economic growth

- BANGKOK: Modest economic growth in the U.S. and mixed corporate earnings dampened stock market sentiment in Asia on Friday.