Premium is a prize, bonus, or award given as an inducement, as to purchase products, enter competitions initiated by business interests, etc. It has multiple meanings in finance, with the first being the total cost to buy an option. A premium is also the difference between the price paid for a fixed-income security and the security’s face amount at issue. In an insurance contract, the risk is transferred from the insured to the insurer. For taking this risk, the insurer charges an amount called the premium.

In insurance, it is the amount paid or to be paid by the policyholder for coverage under the contract, usually in periodic installments. If denotes the money periodically paid by the insured to the insurance company in respect of- a policy whereby the latter agrees to cover the former against certain kinds of goods or other insurable objects. It is also the specified amount of payment required periodically by an insurer to provide coverage under a given insurance plan for a defined period of time.

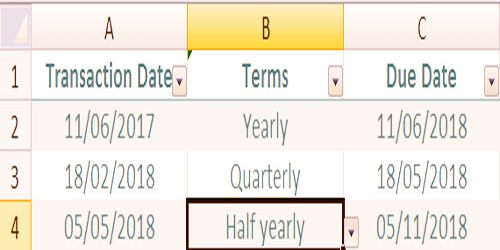

The term is also used to signify something which is above the nominal or fixed price. The premium is a function of a number of variables like age, type of employment, medical conditions, etc. The actuaries are entrusted with the responsibility of ascertaining the correct premium of an insured. The premium paying frequency can be different. It can be paid in monthly, quarterly, semiannually, annually, or in a single premium. In economics, it is the excess value of one form of money over another of the same nominal value.

Types

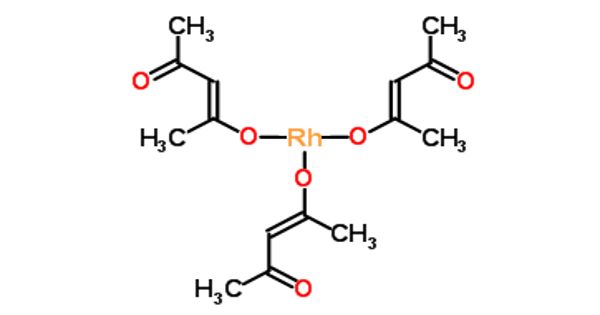

- Option Premium – The buyer of an option has the right but not the obligation to buy (call) or sell (put) the underlying instrument at a given strike price for a given period of time.

- Bond Price Premium – The concept of a bond price premium is directly related to the principle that the price of a bond is inversely related to interest rates; if a fixed-income security is purchased at a premium.

- Insurance Premium – Premiums are paid for many types of insurance, including health insurance, homeowners, and rental insurance. The premium for insurance includes the compensates the insurer for bearing the risk of a payout should an event occur that triggers coverage. The most common types of coverage are auto, health, and homeowners insurance.