Being an animal lover, it’s difficult for me to resist falling in love with that lovely puppy on the cover slide when I see a well-designed pitch deck. Call me ridiculously prejudiced, but I believe that first impressions matter, therefore I chose this deck in part so that I would have a reason to spend some time admiring adorable creatures.

The presentation deck that will be dissected today is the one that tele-veterinarian Dutch used to raise its $20 million Series A, which Aisha covered earlier this year. Here are the specifics on how to submit your own pitch deck deconstruction if you enjoy them and would like to!

Love these three things. As of slide 17, this deck was intended to raise $15 million, however as we previously said, the firm ultimately raised $20 million. It’s simple to understand why; the deck outlines a compelling narrative for why the business is essential and highlights a sizable potential in a massive sector that is begging for disruption. There’s a lot to appreciate about this; fantastic visual narrative, excellent traction stats, and the ideal collection of images.

Dutch makes a strong argument for the benefits of telehealth for our canine pals throughout the pitch deck. Unfortunately, many individuals don’t get proper pet health insurance, which results in unexpected costs for the eye-wateringly costly and highly location-based veterinarian treatment that owners send their furry friends to when they need aid. Additionally, pet owners may worry about whether their animals are simply having a bad day or require medical treatment because animals may be hard to read.

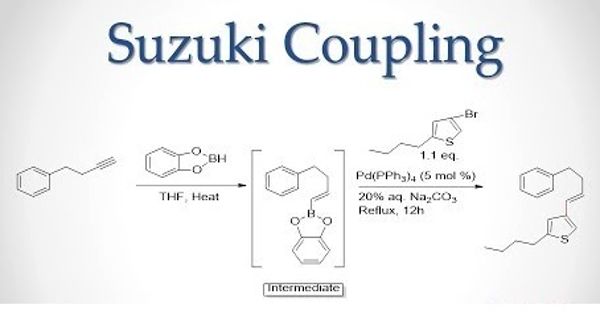

The firm makes a beautiful comparison between human and animal health care in Slide 6 (above), which is particularly effective in a world where not everyone has strong visibility into how animal health is handled. HIPAA is referenced here, but I haven’t heard the pitch, so I’m not sure why (though I guess it’s to emphasize that pet care won’t encounter the same privacy and regulatory challenges that a human-centered solution would).

I’m also not clear why the business compares medications for humans and animals, but as a narrative device overall, this presentation is brilliant: Explain the distinctions between something that practically every American has experienced and an emotional connection with and the counterpart.

Given that there are 200 million dogs in the U.S. and that all of them require some type of medical care, I don’t think Dutch would get much opposition if it decided to establish a venture-scale business. It’s beautiful to exclude any reference of foreign expansion because it may be redundant to brag about the company’s domestic market’s seemingly limitless growth.

A venture capital partner will almost likely lean forward when looking at this PowerPoint with small dollar signs in their eyes. Pet insurance, specialty pet food, and its own private-label animal pharmacy are some of the extremely potent market expansions that it plays to, and they may all help this business continue to expand for some time to come. The fact that the business has a strategy for sustainable expansion is a great touch. It will always be tempting to be seduced by fresh prospects in markets like this. The firm instills trust that it understands how to expand in a more predictable way, without getting sidetracked by every squirrel that crosses its path, by having a clear and targeted road map.