This study on the performance of Peoples Insurance Company Limited as a general insurance company in Bangladesh was carried out as an internship project supported by the internship program as part of the requirement of completing the Masters of Business Administration (MBA) from AhsanullahUniversity of Science & Technology facilitated by the head office of Peoples Insurance Company Limited. The internship program was conducted over the course of three months from January 1, 2013 through March31, 2013, and included working full-time as an intern under the department of Finance & Accounts at the head office of PICL as well as meetings and in-depth interviews with the top management of PICL, Dhaka, Bangladesh.

Objectives of the Study

Purpose tells the reason of the report. Before going to the organization I set my objectives that guided me until I finished the report. It always kept me focused to be on right track. The objectives are to know the Performance of People Insurance Company Ltd. as a General Insurance Company in Bangladesh and build an overall understanding on the financial performance of People Insurance company Ltd.

Insurance industry is one of the growing sectors in Bangladesh . Peoples Insurance Company is to be amongst the leading insurance companies of the country with the clear perception of upholding the principles of corporate governance and making Peoples a profitable and growth oriented insurance company while creating insurance awareness and culture. To ensure the smooth operation of the concerned insurance companies, the regulatory bodies try to pass and implement new acts & regulations. There are 62 insurance companies in our country & there have been passed several acts to regulate those companies properly. Peoples Insurance Company Limited is a private insurance company in Bangladesh that serves with a variety of services to its valued customers. Due to the limitation of my report my scope was limited to PICL and the insurance act 2011 for the Non-life Insurance Companies.

Methodology

This report is primarily based on my experiences from the day to day official work under the department of finance & accounts at the head office of Peoples Insurance Company Limited. As my research method, I have used qualitative data collected through meetings & interviews with the top management of PICL and some secondary information from the annual reports (2008, 2009, 2010&2011) of the company & web information from the related companies and regulatory authorities. I have used both primary and secondary data in this report. The data were collected by different ways:

Primary Data

Primary Data were collected though both formal and informal discussions mainly with my supervisor and senior manager of the company. Besides, I took participation in in-depth group discussion and meeting which have given me the opportunity to take very relevant information regarding the particular topic of my report.

Secondary Data

Secondary data have been collected from Annual Report, published articles on Insurance industries, journals, brochures, and IDRA & PICL‘s official web sites In this report majority of the data collection works was done on a secondary data basis.In the analysis part of the report, I have tried to focus on the points that came out through the in-depth discussions, meetings & interviews with the respective personnel. And I have also tried to find out the prospects of the PICL as well as the other insurance companies in the same industry.

Limitations

The preparation of this report was not an easy task. I had to face some problems & limitations during the preparation of this report despite the fact that I have tried my best to prepare this project successfully.

The limitations were:

- The Insurance Act 2011 along with rules & regulations including the previous acts for the insurance industry and most of the other supporting documents are written and published in Bangla. Translating the entire act and relevant information from Bangla to English was quite difficult.

- Confidential information that no organizations inclined to share due to their business interest was another limitation.

- Data from different sources were quite inconsistent which created some problems in making the report & compelled me to verify the data diligently.

- The data collection was full of complexities because relevant data sources were hard to find out.

- There were so many obstacles because the company is not willing to disclose their offerings and flexibilities towards general people.

- Due to lack of practical experience, some errors might be occurred during the study. In spite of the maximum efforts was taken to avoid the mistake.

Insurance

Meaning & Definition of Insurance:

It is a contract in which one party known as the insured also known as assured, insures with another party (person or organization), known as the insurer, assures or underwrites his property or life, or the life of another person in whom he has a pecuniary interest, or property in which he is interested, or against some risk or liability, by paying a sum of money as the premium. Under the contract, the insurer agrees to indemnify the insured against a loss which may accrue to the other on the happening of some event.

According to encyclopediaedia, Insurance is

“A contract (policy) in which an individual or entity receives financial protection or reimbursement against losses from an insurance company. The company pools clients’ risks to make payments more affordable for the insured.”

At present, insurance is being used widely and becoming more and more popular both in personal life and in the business sector as a significant risk management tool which is primarily used to hedge against the risk of a contingent, uncertain loss. Insurance contract provides financial protection to the insured by the insurer against a loss arising out of happening of an uncertain event. The insured can avail this protection by paying premium to any insurance company with whom the contract has been made. Insurance works on the basic principle and concept of risk-sharing. When a company insures an individual entity (the insured), there legal requirements to share the risks associated with the insured by the insurer, breaking of which contract creates legal bindings. A great advantage of insurance is that it spreads the risk of a few people over a large group of people exposed to risk of similar type and the re-insurance system makes the total risk at zero level in the long run. On the one hand, insurance can increase fraud; on the other it can help societies and individuals in preparing catastrophes and in mitigating the effects of catastrophes on households, business operations and societies.

Features of Insurance

Insurance has various effects on society through the way that it changes who bears the cost of losses and damage of the insured according to the insurance contract. The distinguished common features of any insurance are as follows:

Shifting or transferring risk of loss or damage of any life, asset, or property from one party to another party.

- Sharing of losses by members of the group/company

- One party undertakes the loss incurred on the insured property or asset of the other party.

- The risk is shared/ accepted by the insurer for a consideration of money from the insured called as Premium (No risk to be assumed unless premium is received in advance).

- It is assured to the insured by the insurer that the amount will be paid on happening of the specified act or event. E.g. Death, Fire, Burglary, Accident, Any peril in Sea etc.

Parties of Insurance Contract

As insurance business has insurance contract, there are mainly two parties in the contract

- Insurer : ( The person who undertakes the risk under the contract)

- Insured: ( The person to whom the undertaking is given)

The Insurer can be any of the following mentioned below:

- An individual

- Unincorporated body of individuals,

- Body corporate ( established by the Companies Act)

- An Association of partnership firm Registered,

- Any other agency permitted under any other Law in Bangladesh

In order to lower the huge amount of insurance risk, insurance companies intend to re-insure their contract with any other (mostly larger) local of foreign insurance companies.

Prominent Features of Insurance Law of Bangladesh

The history of Bangladesh is a history of endless struggle. Since the independence of Bangladesh, its citizens have been fighting for the improvement of their standard of living as well as economic condition. But most of the time various accidental incidents and disasters hamper the smooth continuation of the journey. Over the last 40 years, many helping hand especially insurance companies are trying to share their risk associated with various tasks, assets, operations, and even of their life. The Insurance business has been introduced & developed in proportion to the development of the economic growth in Bangladesh. There are 62 insurance companies in the country, including two state-owned enterprises, the Jiwan Bima Corporation (JBC) for life insurance, and the Sadharan Bima Corporation (SBC) for general insurance. Nevertheless, BD remains behind its neighbors, both in terms of premium income and penetration. Only 1.5 percent of the population has life insurance coverage in Bangladesh, as compared to 4.5percent in Pakistan and 7.5percent in India (as of 2010).

Regulatory Framework in BD

Every industry needs to be regulated and maintained properly to ensure the conflict free operation in any country. In this regard, Parliament of Bangladesh, on 03 March 2010, passed two insurance laws in a bid to further strengthen the regulatory framework and make the industry operationally vibrant. The new laws, came in to effect on 18 March 2010, are Insurance Act 2010 and IDRA 2010. Major Insurance Acts

- The Insurance Act, 1938

- Insurance Rules of 1958

- Bangladesh Insurance (Nationalization) Order 1972.

- The Insurance Corporations Act, 1973

- Insurance (Amendment) Ordinances of 1984

- The Insurance Act, 2010

History of Insurance & Insurance Laws in Bangladesh

Insurance business is not new in Bangladesh. Almost a century back, during the British rule in India, some insurance companies started insurance business transaction, both life and general, in this region (former Bangal or Indian Subcontinent). This business gained momentum in East Pakistan during 1947-1971, when 49 insurance companies transacted both life and general insurance schemes. The insurance sector was originally regulated by the Insurance Act, 1938 and after the Independence in 1971; the industry was governed by the Insurance Act 1973. In 2010 a new Insurance Act has been passed to modernize the sector.

Period:

Insurance is not a new term in this territory of Bangladesh. Right after the great division in 1947, the industry had got its momentum and 49 insurance companies started to conduct their business during the Pakistan period (1947-1971). These companies doing insurance business were of various origins like British, Australian, Indian, West Pakistan and local. At that time, ten insurance companies had their head offices in East Pakistan, 27 in West Pakistan, and rest elsewhere in the world. Most of these companies were Limited Liability Company. Some of these companies were specialized on dealing in a particular class or sector of business, while others were composite companies that dealt in more than one class of business. After the Independence of Bangladesh in 1971 through the war of liberation, the Government of Bangladesh nationalized insurance industry in 1972 by the Bangladesh Insurance (Nationalization) Order 1972.

After Nationalization:

By virtue of the nationalization order, all 49 insurance companies and organizations transacting insurance business in the country were placed in the sector under fie operations except postal life insurance and foreign life insurance companies. These operations were: the Jatiya Bima Corporation, Tista Bima Corporation, Karnafuli Bima Corporation, Rupsa Jibon Bima 31

Corporation and Surma Jibon Bima Corporation. The Jatiya Bima Corporation was an apex corporation only to supervise and control the activities of the other insurance corporations which were responsible for underwriting. Tista and Karnafuli Bima Corporation were for general insurance and Rupsa and Surma for life insuance. The specialist life insurance companies or for a life portion of a composite company joined the Rupsa and Surma corporations while specialist general insurance companies or the general portion of a composite company joined The Tista and Karnafuli corporations. The basic idea behind the formation of four underwriting corporations, two in each main branch of life and general, was to encourage competition even under a nationalized system. But the burden of administrative expenses incurred in maintaining two corporations in each front of life and general and an apex institution at the top outweighed the advantages of limited competition. As a result of the nationalization of the insurance industry, on 14 May 1973, a restructuring was made under the Insurance Corporations Act 1973. Following the Act, the government formed two corporations in place of five corporations: the Sadharan Bima Corporation for general business, and Jiban Bima Corporation for life business. The postal life insurance business and the life insurance business by foreign companies were still allowed to continue as before .In reality, however, only the American Life Insurance Company Limited continued to operate in the life sector 3 for both new business and servicing, while three other foreign life insurance continued to operate only for servicing their old policies issued during Pakistan days. Postal life maintained its business as before.

Period :

After1973, general insurance business became the sole responsibility of the Sadharan Bima Corporation. Life insurance business was carried out by the Jibon Bima Corporation, the American Life insurance Company, and the Postal Life Insurance Department until 1994, when a change was made in the structure arrangement to keep place with the new economic trend of liberalization. The insurance corporations Act1973 were amended in 1984 to allow insurance companies in the private sector to operate side by with Sadharan Bima Corporation and Jiban Bima Corporation.

Period :

The Insurance Corporations Amendment Act 1984 allowed floating of insurance companies, both life and general, in the private sector subject to certain restrictions regarding business operations and reinsurance. Under the new act, all general insurance business emanating from the public sector were reserved for the state owned Sadharan Bima Corporation, which could also underwrite insurance business emanating from the private sector. The Act of 1984 made it a requirement for the private sector insurance companies o obtain 100% reinsurance protection from the Sadharan Bima Corporation.This virtually turned Sadharan Bima Corporation into a reinsurance organization, in addition to its usual activities as direct insurer. Sadharan Bima Corporation itself had the right to reinsure its surplus elsewhere outside the country out after exhausting the retention capacity of the domestic market. Such restrictions aimed at preventing outflow of foreign exchange in the shape of reinsurance premium and developing are insurance market within Bangladesh. The restriction regarding business placement affected the interests of the private insurance companies in many ways. The restrictions were considered not congenial to the development of private sector business in insurance. Two strong arguments were put forward to articulate feelings: Since the public sector accounted for about 80% of the total premium volume of the country, there was little premium left for the insurance companies in the private sector to survive. In this context, adharan Bima Corporation should not have been allowed to compute with the private sector insurance companies for the meager premium (20%) emanating from the private sector; Being a competitor in the insurance market, Sadharan Bima Corporation was hardly acceptable as an agency to protect the interest of the private sector insurance companies and should not have retained the exclusive right to reinsure policies of these companies. The arrangement was in fact, against the principle of laissez faire. Private sector insurance companies demanded withdrawal of the above restrictions so that they could: Underwrite both public and private sector insurance business in competition with the Sadharan Bima Corporation, and The government modified the system through promulgation of the Insurance Corporation (Amendment) Act1990.The changes allowed private sector insurance companies to underwrite 50% of the insurance business emanating from the public sector and to place up to 50% of their reinsurance with any reinsure of their choice, at home or aboard, keeping the remaining for placement with the Sadharan Bima corporation.

Present :

Since then the Industry is growing steadily despite many back logs, several amendments were made in the Insurance Law since 1984. In 2010, a New Insurance Act passed by Parliament called Insurance Act, 2010 to replace the old Act of 1973. As soon as the new insurance act has been passed, the old one has become inactive and from now on the entire insurance industry will be regulated by the new Insurance Act 2010.

Major Regulatory Conflicts

Even though the different rules & regulations have been made to regulate the entire insurance industry smoothly, many situations and problems regarding the implementation process caused conflicts over time. The Conflicts

- There was a restriction regarding business placement under the Insurance Act 1938, which affected the interests of the private insurance companies in many ways in Bangladesh. Since the public sector accounted for about 80% of the total premium volume of the country, there was a little percentage of premiums left for the insurance companies in the private sector to survive.

- In such situation, the withdrawal of the restriction became essential. So, the private sector insurance companies demanded withdrawal of such restrictions so that they could:

(a) Underwrite both public and private sector insurance business in competition with the SBC .

(b) Effect reinsurance to the choice of reinsures.

Resolutions Solving the Conflicts

When there is any problem, there is the emergence of solutions. As the insurance industry faced significant problems regarding the restrictions on business placement, the regulatory bodies had to take necessary resolutions to face & handle the situation. In this regard, the following steps had been taken by the regulatory bodies:

- The Government modified the system through promulgation of the Insurance Corporations (Amendment) Act 1990.

- The changes through the Insurance Corporations (Amendment) Act 1990 allowed the private sector insurance companies to underwrite 50% of the insurance business emanating from the public sector and to place up to 50% of their reinsurance with any reinsures of their choice, at home or abroad, keeping the remaining for placement with the Shadharon Bima Corporation (SBC).

- Many other changes were introduced such as privatization policy, which paved the way for a number of insurers to emerge in the private sector.

- The overhaul also includes the establishment of an Insurance Regulatory Authority (IRA), which would be autonomous, and have the power to regulate the state-owned JBC and SBC as well as all private insurance companies on an equal footing under a uniform regulatory framework.

Reforms in Insurance Sector

In order to smooth the overall insurance business in Bangladesh, the concerned authority had always been alert. While there was any problem or conflicting situation arises, the authority doesn‘t sit idle; rather they try to solve it at their best.

- Considering the expansion of trade and commerce in the country and for reducing risk related problems in people‘s life, the new law titled Insurance Act 2010‘ has been enacted to update the provisions of Insurance Act, 1938‘.

- Insurance Development and Regulatory Authority Act 2010‘ has also been formulated with a view to synchronizing the functions of the existing Insurance Department with the spirit of newly enacted Insurance Act, 2010 to maintain proper control and supervision of the sector and protect the interests of policy holders and beneficiaries under the insurance policy.

Overview of the New Insurance Act 2010

Bangladesh‘s insurance industry is set to start a new journey with the passage of two new laws in the parliament recently. The House passed two insurance laws in a bid to further strengthen the regulatory framework and make the industry operationally vibrant. The new laws are Insurance Act 2010 and Insurance Development and Regulatory Authority Act 2010. The government has taken the pragmatic step to boost the insurance sector.

| Name | The Insurance Act, 2010 |

| Act Number | 13 of 2010 |

| Summary | This law is related to the matters of Insurance |

| Ministry | Ministry of Finance |

| Passing Date | March 03, 2010 |

| Date in Force | Thursday, 18 March, 2010 |

| Regulatory Authority | Insurance Development & Regulatory Authority (IDRA) |

Insurance Act 2010 and Insurance Development and Regulatory Authority Act 2010 were passed to better regulate the insurance industry and protect customers’ interests. And Insurance Bill 2010 said the bill was moved aiming at modernizing and updating the old Insurance Act and to trim down the risks of investment in trade and commerce and of course particularly in the insurance industry. The laws update Insurance Ordinance 2008 and Insurance Regulatory Authority Ordinance 2008 of the past caretaker government. Insurance Development and Regulatory Authority (IDRA) were passed by the Jatiya Sangshad in March, 2010. The newly established IDRA started functioning in January, 2011. There are about 50 rules and regulations to be framed under the Insurance Act, 2010. The IDRA have been working on the initial drafts prepared under an Asian Development Bank (ADB)-funded Technical Assistance (TA) project.

The Ordinance has some notable new stipulations:

The much talked about the Insurance Act 2010 and Insurance Development and Regulatory Authority Act 2010 were passed in the parliament on 3rd March, 2010. The new ordinance has some notable provisions as follows:

Setting up of a Policyholders’ Protection Fund:

In order to make the overall claim settlement procedure smooth and timely, the insurance companies have to set up a special fund named ―Policyholders‘ Protection Fund‖ as per the new requirements of the newly passed and being implemented Insurance Act 2010.

Greater capital requirements for insurers:

The new Insurance Act 2010 raised the paid-up capital of life and non-life insurance companies to make them financially sound. The minimum paid-up capital of a life insurance company will now rise to Tk 300 million from Tk 75 million and for nonlife the capital size will be Tk 400 million from Tk150 million under Basel-II. For Financial Institutions (FIs,) full implementation of Basel-II has been started in January 01, 2012 (Prudential Guidelines on Capital Adequacy and Market Discipline (CAMD) for Financial Institutions). Now, FIs in Bangladesh are required to maintain Tk. 1 billion or 10% of Total Risk Weighted Assets as capital, whichever is higher.

Creation of brokerage houses for insurance policies:

The new Insurance Act 2010 (section 33) said that brokerage houses (Banks, financial institutions or any middleman company/organization) should be created for insurance policies. Under the section 58(1), none can give money of commission to anybody except the certain agents or brokerage houses in order to launch or expand any insurance business in Bangladesh. The distribution of the commission must be as follows:

- 35% of the premium in the first year.

- 10% of the renewed premium in the second year.

- 5% of the renewed premium in the 3rd year and on after .

Mandatory solvency margins for insurers:

All authorized life assurance companies are closely regulated by the IRA. Regular internal and external audit activity and strict reporting requirements ensure that the companies comply with the regulator‘s safeguards; one of those safeguards is a solvency margin. The solvency margin is the comparison between what a company owns (its assets) and what it owes (it liabilities) and indicates the ratio of assets to debt. Therefore the solvency margin provides a good indicator of the financial stability of that company. The IRA/IDRA, as the regulator, monitors any falls in solvency below a certain percentage.

Each and every insurance company has to keep a mandatory solvency margin following a certain percentage (which has not yet been fixed) and by using a certain formula (which has not yet been established) according to section 43 (1) of the Insurance Act 2010.

Allowing foreign investment in the insurance sector:

The Insurance Act 2010 said the sector needs to be managed properly and be strengthened by reducing business risks, and local and international insurance laws need to be harmonized considering the socio-economic aspect of the country and protect the interest of policy-holders and other beneficiaries.

Reduction of the number of directors from 20 to 15:

The insurance act bars a director of an insurance company to become director of any other financial institution including banks. Under the Insurance Act 2010, the number of the directors cannot exceed 15, while it was 20 under the Insurance Act 1938.

Categorization of Insurance Business:

The section 5 (1) of the Insurance Act 2010 proposed that insurance company to be categorized as life‘ and non-life‘ instead of life‘ and general‘ and it have replaced the Insurance Act 1938. So, from now on the insurance companies in the entire insurance sector in Bangladesh will be categorized as life and non-life insurance companies under the new insurance act.

New Additions by the Act, 2010:

The newly passed Insurance Act 2010 has some notable new additions, which were absent in the previous Insurance Act of 1938. Therefore, the entire insurance industry is facing some new practice while implementing the new act in the insurance business. The new additions by the new act are as follows:

Creation of New Regulatory Authority:

Insurance Regulatory Authority (IRA) will be established for the Insurance sector. There are 62 insurance companies (see Appendix) operating in the country and they need to be regulated under comprehensive laws and guidelines and need to be supervised by a strong regulatory authority. The Insurance Act 2010 said the sector needs to be managed properly and be strengthened by reducing business risks, and local and international insurance laws need to be harmonized considering the socio-economic aspect of the country, and to protect the interest of policy holders and stakeholders of the insurance industry in Bangladesh. The New Insurance Act provides for the composition of such Authority, its terms & conditions. The IRA will have the power to:

- Making regulation for Insurance Industry and delegation of powers,

- Establishment of the Insurance Regulatory Fund,

- Establishment of Insurance Advisory Committee,

- Power to make any future rules or amendments, etc

The Insurance Development and Regulatory Authority Act 2010 said the authority will comprise a chairman and four members and they will look after the whole sector. The enactment of the law will abolish the department of insurance under the Finance Ministry of Bangladesh. Premium charged by the companies will be determined by a committee formed by the authorities and it will also investigate any irregularities of the companies, the act said. To create a vibrant insurance sector, the industry got its recognition from the government and a new Insurance Act2010 has been passed to replacing the old Insurance Act of 1973.

Legal Framework for Islami Insurance:

Islamic Insurance was already in Bangladesh but it was now bought under legal framework by this new Act 2010. Under the section 7 (1) of the Insurance Act 2010, no insurance company is allowed to do both Islami Insurance business and non-life insurance business together. If any company have both of this businesses, then according to section 7 (2) of the new act it has to give up one and can continue any of these two. And the decision has to be informed to the insurance authority within six month of forming the business authority. However, the claim of the previous policy holders shall be settled according to the previous Insurance act of 1938. During 1999 & onward many insurance companies have been given license to underwrite Islami insurance business without having proper law, rules and regulations to guide them. It is not proper to allow Islami insurance business without having legal backing and, therefore, this business has been brought under the ambit of new law.

Micro Insurance Business:

The new Insurance Act 2010 is making way for the Micro Insurance Business opportunities in the insurance sector of Bangladesh which has a great prospect for the small and medium enterprises as well as the growing businesses especially in the rural areas

- Micro insurance can be a great prospective area for the insurance business in our country especially in the rural areas. Most of the people of our country are unable to have costly and long term insurance policies since a great portion of the country‘s population is from lower & middle income class.

- Micro insurance can be provided to individual personnel or to small business owners against little insurance premiums and with easy terms and conditions. When they will afford to minimize their risks at a lower price, they will take that opportunity and they will become to get used to it. This can cover a huge portion of the society who can be a prospective target market for this business.

Changes Bought by the New Act

The Insurance Act has not only brought the new additions, but also has brought some eye-catching changes in some significant areas that existed in the previous insurance act. The changes brought by the Insurance act 2010 are described shortly below:

Capital Requirements:

An insurer transacting life insurance business would be required to have a minimum paid-up capital of Tk. 300 million while the minimum paid-up capital for non-life insurer would be Tk. 400 million.

Spread of Business in Rural Areas:

Provision has been made to induce insures to undertake such parentage of his business in the rural areas or in social sectors as maybe specified by the Authority, This provision would encourage savings among the people in the rural areas and social sectors on the one hand, and provide financial security to the insurer, on the other.

Reinsurance Abroad:

The present mandatory provision for reinsurance of general insurance with the state-owned Sadharan Bima Corporation (SBC) has been relaxed. An insurer may reinsure with any other insurer inside or outside Bangladesh.

Penalty :

Under the new insurance law, maximum penalty for any violation will be Tk. 10 lakh in fine while the minimum fine will be Tk. 50,000. If the violation continues, an additional fine of Tk. 5,000per day will be imposed.

Provision for Foreign Investment:

With a view to attracting foreign investment in the insurance sector in Bangladesh, foreign investors would be allowed to hold or subscribe to the share of an insurance company up to a prescribed maximum (the maximum limit has not yet been set).

The role of Insurance in Economic Development

The management of risk is a fundamental aspect of entrepreneurial activity. Entrepreneurs manage the risk of accidental loss by weighing the costs and benefits of each alternative. In a structured risk management process, this involves: (1) identifying the exposures to accidental loss;(2) evaluating alternative techniques for treating each loss exposure; (3) choosing the best alternative; and (4) monitoring the results to refine the choices. Those who do not apply a structured process still make decisions about risk, although sometimes by default rather than design. The scope of an economy’s insurance market affects both the range of available alternatives and the quality of information to support decisions. For example, a manufacturer might produce only for the local market, forgoing more lucrative opportunities in distant markets in order to avoid the risk of losing goods in shipment. Transport insurance can mitigate this loss exposure and enable the manufacturer to expand. Similarly, to avoid the risk of total loss from drought, commercial farmer may keep half of hissed in reserve. Crop insurance can protect against drought and permit all of the seed to be planted for a smaller premium than the cost of holding half in reserve. Thus public policies that encourage insurance operations improve the economy’s productivity by broadening the range of investments. Insurers also contribute specialized expertise in the identification and measurement of risk. This expertise enables them to accept carefully specified risks at lower prices than non-specialists. They also have an incentive to collect and analyze information about loss exposures, since the more precisely they measure the cost of risk, the more they can expand. As a result, the insurance market generates price signals to the entire economy, helping to allocate resources tom reproductive uses. Insurers also have an incentive to control losses, which is a significant social benefit. By offering discounts for seat belts, smoke detectors, or other measures that reduce the frequency or severity of losses, they lower their eventual claims costs, in the process saving lives and reducing injuries. On the investment side, due to the long term nature of their liabilities, sizeable reserves, and predictable premiums, life insurance providers can serve an important function as institutional investors providing capital to infrastructure and other long term investments as well as professional oversight to these investments. Of course, these benefits are fully realized only in markets where insurance providers invest substantial portion of their portfolios domestically. The net result of well functioning insurance markets should be better pricing of risk, greater efficiency in the overall allocation of capital and mix of economic activities, and higher productivity. Importantly, these unique functions of insurance should be complementary to banking and financial sector deepening more broadly. For instance, insurance facilitates credit transactions such as the purchase of homes and cars and business operations, while depending in turn on well functioning payment systems and robust investment opportunities.

Insurance Companies in Bangladesh:

According to Bangladesh Bank, there are 60 private & 2 public insurance companies in Bangladesh

| LIST OF THE INSURANCE COMPANIES IN PUBLIC SECTOR | |

| Sl. No. | Name of the Insurance Company |

| 01. | Sadharan Bima Corporation(Gen. Ins) |

| 02. | Jiban Bima Corporation (Life Ins.) (Source : IDRA) |

LIST OF THE LIFE INSURANCE COMPANIES:

| Sl. No. | Name of the Insurance Company |

| 01. | American Life Insurance Company (Foreign Company) |

| 02. | Baira Life Insurance Company Ltd. |

| 03. | Delta Life Insurance Company Ltd. |

| 04. | Farest Islami Life Insurance Co. Ltd. |

| 05. | Golden Life Insurance Ltd. |

| 06. | Homeland Life Insurance Company Ltd. |

| 07. | Meghna Life Insurance Company Ltd. |

| 08. | National Life Insurance Company Ltd. |

| 09. | Padma Islami Life Insurance Company Ltd. |

| 10. | Popular Life Insurance Company Ltd. |

| 11. | Pragati Life Insurance Ltd. |

| 12. | Prime Islami Life Insurance Company Ltd. |

| 13. | Progressive Life Insurance Company Ltd. |

| 14. | Rupali Life Insurance Company Ltd. |

| 15. | Sandhani Life Insurance Company Ltd. |

| 16. | Sunflower Life Insurance Company Ltd. |

| 17. | Sunlife Insurance Company Ltd. |

LIST OF THE NON-LIFE INSURANCE COMPANIES:

| Sl. No | Name of the Company |

| 01. | Agrani Insurance Company Ltd. |

| 02. | Asia Insurance Ltd. |

| 03. | Asia Pacific Gen Insurance Co. Ltd. |

| 04. | Bangladesh Co-operatives Ins. Ltd. |

| 05. | Bangladesh General Insurance Co. Ltd. |

| 06. | Bangladesh National Insurance Co.Ltd. |

| 07. | Central Insurance Company Ltd. |

| 08. | City Gen. Insurance Company Ltd. |

| 09. | Continental Insurance Ltd. |

| 10. | Crystal Insurance Company Ltd. |

| 11. | Desh Gen. Insurance Company Ltd. |

| 12. | Eastern Insurance Company Ltd. |

| 13. | Eastland Insurance Company Ltd. |

| 14. | Express Insurance Ltd. |

| 15. | Federal Insurance Company Ltd. |

| 16. | Global Insurance Ltd. |

| 17. | Green Delta Insurance Co. Ltd. |

| 18. | Islami Commercial Insurance Co. Ltd. |

| 19. | Islami Insurance Bangladesh Ltd. |

| 20. | Janata Insurance Company Ltd. |

| 21. | Karnaphuli Insurance Company Ltd. |

| 22. | Meghna Insurance Company Ltd. |

| 23. | Mercantile Insurance Company Ltd. |

| 24. | Nitol Insurance Company Ltd. |

| 25. | Northern Gen.Insurance Company Ltd. |

| 26. | Peoples Insurance Company Ltd. |

| 27. | Phonix Insurance Company Ltd. |

| 28. | Pioneer Insurance Company Ltd. |

| 29. | Pragati Insurance Ltd. |

| 30. | Pramount Insurance Company Ltd. |

| 31. | Prime Insurance Company Ltd. |

| 32. | Provati Insurance Company Ltd. |

| 33. | Purabi Gen Insurance Company Ltd. |

| 34. | Reliance Insurance Ltd. |

| 35. | Republic Insurance Company Ltd. |

| 36. | Rupali Insurance Company Ltd. |

| 37. | Sonar Bangla Insurance Company Ltd. |

| 38. | South Asia Insurance Company Ltd. |

| 39. | Standard Insurance Ltd. |

| 40. | Takaful Islami Insurance Ltd. |

| 41. | Dhaka Insurance Ltd. |

| 42. | Union Insurance Company Ltd. |

| 43. | United Insurance Company Ltd. |

Peoples Insurance Company Limited

Peoples Insurance Company Limited is the second private insurance company and it is a reliable insurance company in the insurance landscape in Bangladesh. The company was founded in 1985 in order to provide non-life insurance services in the country. Customers’ satisfaction is the company‘s main concern. Peoples Insurance Company always tries to value its customer, and provides the entire needed safeguard to them. The company helps its customers to get them set soon again and to march with time.

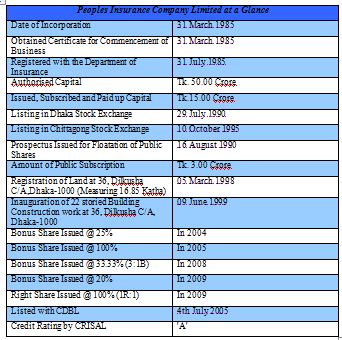

Since its inception, the company is providing a variety of services to its customers. Peoples Insurance Company Limited had been proud to stand beside its’ valued customer and the stakeholders when they are in any risk caused by disaster or accident. In order to operate business through 34 branches throughout the country, the company has created a great opportunity of employment for a large number of people; a notable number of which is female. Through its business responsibility and also through its corporate social responsibility (CSR), the company is always a friend of its valued customer. The summarized information about the Peoples Insurance Company Limited is shown in the table below:

Vision, Mission and Future Plan of PICL

Vision of Peoples Insurance Company Limited :

The mission of the company is to reach at zenith point of providing quality service and hence achieving highest corporate goal and customer satisfaction. The slogan of PICL is “manush manusher Janna”

Mission of Peoples Insurance Company Limited:

The dignity and well being of all people (especially the business houses and their interests) are ensured through insurance protection services in order to produce value for the shareholders all the way through customer, employee and general people satisfaction.

Future Plans:

The Company has undertaken various realistic future plans which include the following plans to be implemented—

- To computerize the entire operation system within the shortest possible time

- To impart extensive training for the employees at home and abroad. Field force (100%) has to be properly groomed up.

- To expand Company’s operations to all commercially important places of the country gradually.

- To introduce new products depending on the demand of the market.

- To observing March as the “Client Service Month” in every year.

- To follow “Service First than Business “by expeditious and judicious settlement of claim

Due to the increased price of various products used in any office or business, the Peoples Insurance Company Limited along with other insurance companies existing in the insurance sector of Bangladesh are having a great load of continuously increasing management expenses as well as other expenses. However, there has not been made any change in the maximum percentage of management expenses since 1938 under the new Insurance Act 2011, the company cannot show the actual management expenses if it exceeds the certain percentage.

Services of Peoples Insurance Company Limited

Since its inception, PICL is serving a variety of services to its valued customers. Currently, the company has 24 types of non-life insurance services through its 34 branches located in 23 districts throughout the country. The names of the services offered & provided by PICL are given below:

As per the MBA degree completion requirement of AUSTBusinessSchool, AUSTUniversity, I had been appointed in the three-month internship program under the Department of Finance and Accounts at the head office of Peoples Insurance Company Limited, Bangladesh. During the internship-training program I have worked in different significant programs undertaken by the Finance & Accounts department of the company. Fortunately, I had the advantage of working in the very friendly atmosphere in the Head office of PICL. Here I had the chance to learn a great deal.

The Finance & Accounts Department:

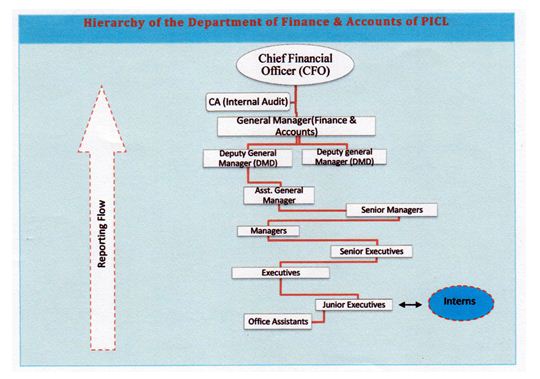

The department of Finance & Accounts (F&A) is responsible for all matters relating to Finance and Accounting functions of the Peoples Insurance Company Limited. To enable it perform its statutory responsibility, the department is structured into 5 different sections as shown in the figure 3.1. All these divisions however reports administratively to the CFO through the DGM & GM of the respective department. As an intern, I had work with the junior executives luckily under the supervision of the CFO shown in the graph below:

Hierarchy of the Department of Finance & Accounts of PICL

Responsibilities in Finance & Accounts Department:

The finance & accounts department of PICL takes responsibility for organizing the financial and accounting affairs including the preparation and presentation of appropriate accounts, and the provision of financial information for managers & stakeholders. It is the one of the most important departments of the head office of Peoples Insurance Company Limited. One can have a complete view of the functions and monthly expenses of the company from the finance & accounts department. The functions the department include managing, controlling and recording the inflow and outflow of cash from the daily basis to monthly and annual basis. It is very difficult job to record all the expenditure of the company which increases the importance of account department in the company. The basic functions of the department of finance & accounts are as follows:

- Planning & establishing budget

- Posting (Underwriting, journals etc.)

- Billing and keeping proper record

- Petty cash management

- Bank reconciliation

- Maintain cash book & bank book

- Preparation of financial statements

- Analysis of financial statements

- Tax & VAT calculation

- Preparation & submission of organization contributed tax return of the employees to NBR

- Conducting internal audit through the internal control unit

- Financial reporting to the management & to the stakeholders when necessary

- Maintaining payroll

- Maintaining liaison with the banks & other financial organizations etc.

Responsibilities assigned on me:

The profitability of a company can be judged through the analysis of its accounts record. Major work of account is done in company head office located at Dilkusha, Motijheel, Dhaka. One can have a complete picture of the different activities and expenses by sitting in ―the department of Finance & Accounts. From this perspective it was a knowledgeable experience for me to work in this department as an intern throughout the three-month internship period. On the very first day my on-site supervisor, Mr. Sib Sankar Saha, FLMI(I), FCA, who is designated as the Chief Financial Officer (CFO) gave me an overall view of the various functions performed by the department. During the internship period, I learnt a lot not only about the ―Accounts‖ but also various other activities of the Insurance company. Besides, Mr. Sib Sankar Saha, the GM, DGM, & the Sr. executives of the concerned department were very helpful and co-operative over the three-month internship period. I learnt about various functions of the department of Finance & Accounts. With the help of my supervisor, I was able to manage internal control tools and other related financial documents of the head office. He along with the other respected personnel of the department were helpful enough to take out time from their busy schedule to teach me how to maintain records relating to bank book, cash book. The main work of accounts is done in the company‘s head office. The manager, Mr. A.S.M. Abdul Awal (Saleh) supervised me about different activities of the department of finance and accounts. He was responsible for ―Managing Bank Reconciliation & Variance Analysis‖ which is a tough job and I helped him along with the Jr. Executives in doing this task during the period of my internship. Working in this department was a very knowledgeable journey for me.

During the training period, I was able to get a complete idea of the working of an insurance company. It was a very knowledgeable experience. In the following pages I have explained the performing various tasks that I have done during the period of internship period. Major Responsibilities:

- Internal audit for internal control

- Financial reporting

- Preparation of Bank reconciliation and necessary adjustment

- Training to the newly recruited Jr. executives

Now, I would like to give a short overview of the responsibilities that I have performed and my significant learning that I have learnt from my internship at the head office Peoples Insurance Company Limited under the department of Finance & Accounts.

1.Internal audit for internal control :

During the internship period, I took participation in internal audit which is a significant tool of internal control and is one of the most important functions of the department of finance & accounts.

Internal control:

Internal Control is the process designed to mitigate risks to the business and ensure that the business operates efficiently and effectively. ISA and BSA – 315 – “Understanding the Entity and its Environment and Assessing the Risk of Material Misstatement” defines the internal control –

“Internal Control is the process designed and implemented to address identified business risks that threaten the achievement of the entity’s objectives”

Materiality:

As part of internal audit, I had to calculate materiality. Materiality relates to the level of error that affects the decisions of users of the financial statements. IAS and BSA – 320 – defines

“Materiality is the auditors’ judgment about the size of misstatements in the financial statements”

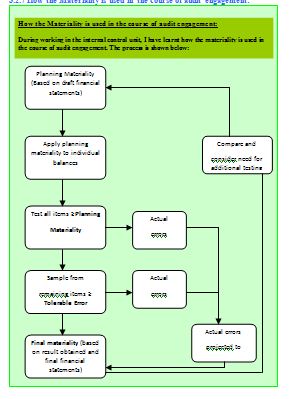

How the Materiality is used in the course of audit engagement:

Calculation of Materiality

Materiality depends on the size of the errors in the context if its omissions or misstatements. I came to know that materiality assessment helps the auditors to decide –

How many and what items to examine?

Whether to use sampling techniques?

What level of error is likely to lead an auditor to stay the financial statements do not give a true and fair view?

There are different methods used by different audit firms in calculating materiality. But among them, the following are an example used by the Peoples Insurance Company Limited.

Materiality for Planning Purposes

It is 5% of profit before tax or .5% of total assets or total revenue.

Significant Misstatement Threshold

It is 75% of Materiality for Planning Purposes.

Audit Difference Posting Threshold

It is 3% – 5% of Significant Misstatement Threshold.

Example

Revenue BDT. 13,089,394 Profit before tax BDT. 1,403,444 Total assets BDT. 4,305,538 Based on this information, calculation is conducted using the above given percentage for calculating the Materiality for Planning Purposes (MPP), Significant Misstatement Threshold (SMT) and Audit Difference Posting Threshold (ADPT). In the above cases, materiality can be individually or in aggregated in the class of transactions or account balances in the financial statements

I have learnt that there are two approaches to calculate materiality

- Income Statements approach; and

- Balance Sheet approach.

Financial reporting

I have audited the accompanying financial statements of Peoples Insurance Company Limited, which comprise the statement of financial position as at December 31, 2010, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year ended, and a summary of significant accounting policies and other explanatory information.

My Responsibility and Learning while Reporting

My responsibility was to express an opinion on these financial statements based on the financial analysis & internal audit. I conducted the audit in accordance with International Standards on Auditing (ISA). Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor‘s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity‘s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity‘s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

Maintaining Professional Ethics

During auditing, I have learnt that professional ethics is as important as conducting a proper audit in the purpose of ensuring proper internal control in South Asia Insurance Company Limited. Professional ethics concerns the moral issues that arise because of the specialist knowledge that professional attain and how the use of this knowledge should be govern when providing a service to the public can be considered a moral issue and is termed professional ethics. It agreed that Professionals are capable of making judgments, applying their skills; reaching informed decisions in situations that general public cannot, because they have not received the relevant training. I have learned that as an auditor, I am required to comply with the following fundamental principles – Integrity, Objectivity, Professional Competence and Due Care, Confidentiality, and Professional Behavior.

Preparation of Bank reconciliation

I have prepared a number of bank reconciliation of 02 branches of Peoples Insurance Company Limited as well as of the head office for the month of November-December, 2012 & January-February, 2013. I have learned that mainly 4 things are considered for preparing bank reconciliation:

- Cheque issued but not yet presented in the bank.

- Amount Deposited and shown in bank statement but not shown in bank book.

- Cheque issued but not yet accounted for

- Amount Deposited and shown in bank book but not shown in bank statement.

The first two amounts along with bank interests are added with the closing balance of the bank book kept by the organization, and the next two are deducted from it along with the bank charges. Thus the bank reconciliation is prepared, the balance of which is just same as the closing balance of the certain bank statement. (Please see Appendix#6.5 for the format of Bank Reconciliation used by PICL) .

Provided training to the newly recruited Jr. Executive

Before leaving the organization, I had to train up the newly recruited Jr. Executives under the department of finance & accounts about what I had learnt so that they can perform their tasks effectively in my absence.

Other responsibilities:

The other tasks that I have done in the internship period at PICL include the following:

- Posting of transaction (MR), underwriting, and money collection using accounting software ORACLE 2012.

- Preparing & posting vouchers, and Keeping file & Documentation etc.

CSR Activities of PICL

Peoples Insurance Company Ltd. has been participating in Corporate Social Responsibility (CSR) continuously since its inception in various ways. As for instance, the company has developed a unique culture to help distressed peoples, environment, heritage, sports, education, employment and much more. A few of the corporate social responsibilities are as follows:

- After the natural disasters, PICL participates in various types of the activities for the reconstruction of the damaged infra-structures. Moreover, when the calamity is over, we try to take care of those who have lost their lives and their valued properties.

- The company always in favor of protecting our tradition and heritage. For example, our company always sponsors not only the sports which are our own, for example, Kabadi, Bali Khela, Lathi Khela etc. but also our non-traditional sports like football and cricket.

- The company created a significant number of employment opportunities for the unemployment human resources since its inception. The effort for job creation will continue in future too.

- The company has a plan to provide scholarships for the needy brilliant students who want to make a career in the fields of technology and digital sciences.

- PICL has a plan to help the sick-aged people so that they do not consider themselves as a burden of our society.

Finally, the company focuses on the welfare of the employees so that they can have the necessary skills and opportunities to face the challenges.

Business & Statistical Information since 2002

(Figures in Million Taka)

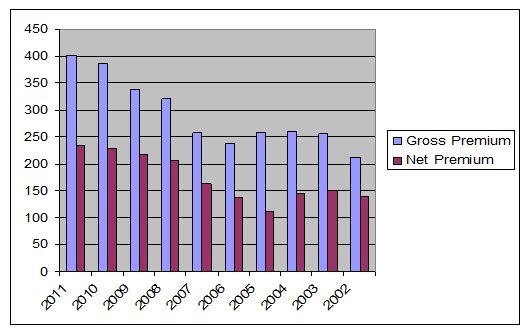

While observing the financial performance of the Peoples Insurance Company Limited, it has been found that the company has faced different situation over years and that is why the financial performance has some notable changes over the time period since 2002-20111.

In 2002, PICL had a gross premium of 212.55 million BDT which has been increased progressively over years and became 400.10 million BDT in 2011. At the same time, net premium of the company also has been increased from 2002 to 2011, but in 2005 & 2006, the organization made relatively lower net premium compared to the other years.

The annual reports (2008, 2009, 2010&2011) of Peoples Insurance Company show that the amounts of gross and net claim of the company since the year of 2002 to 2010 were fluctuated notably over the years.

Gross Claim & Net Claim of PICL

| Year | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 |

| Gross Claim | 73.50 | 72.47 | 79.4 | 50.06 | 38.18 | 423.24 | 55.33 | 104.29 | 49.8 | 23.62 |

| Net Claim | 49.62 | 22.32 | 44.61 | 30.37 | 23.35 | 120.38 | 24.5 | 37.49 | 29.49 | 22.11 |

The company faced different gross & net claims in different years due to the different situation (disasters/accidents/risks) of the policyholders. In 2006, both the amount of gross claim & net claim was significantly higher the previous and later years due to the greater number of policyholder‘s claim in that year. The graphical presentation of the finding is shown below:

Underwriting Profit (Loss) & Investment & Other Income

According to the annual reports (2008, 2009, 2010 & 2011) of Peoples Insurance Company, the amounts of underwriting profit/ (loss) and the investment & other income since the year of 2002 to 2011 were as follows:

Due to the greater amount of gross and net claim PICL had faced significantly higher amount of underwriting loss in 2006 and for the same reasons the amount of investment and other income of the company is comparatively lower than the later years.

Major Findings

To analyze an organization’s performance it is needed to apply the SWOT analysis. SWOT analysis is a strategic planning method used to evaluate the Strengths ,Weakness/Limitation opportunities and Threats involved in a project or in business venture .It specifying the objective of the business venture and identifying the internal and external factors that are favorable and unfavorable to achieve that objective.

SWOT analysis consist of four components-

- Strength

- Weakness

- Opportunity

- Threat

- Corporate identity of the Peoples Insurance company is the most positive and renowned Insurance company in Bangladesh.

- Peoples Insurance company Limited is second Private Insurance company which giving their service since 1985.

- From this report we found the company’s’ overview, its service ,vision, mission &future plans.

- We get Insurance laws and regulatory system, and regulatory conflicts in the insurance industry in Bangladesh along with the emergence of establishing and passing the new insurance act.

- In 2002, PICL had a gross premium of 212.55 million BDT which has been increased progressively over years and became 400.10 million BDT in 2011.

- . At the same time, net premium of the company also has been increased from 2002 to 2011, but in 2005 & 2006, the organization made relatively lower net premium compared to the other years.

- The company faced different gross & net claims in different years due to the different situation (disasters/accidents/risks) of the policyholders.

- In 2006, both the amount of gross claim & net claim was significantly higher the previous and later years due to the greater number of policyholder‘s claim in that year.

- Due to the greater amount of gross and net claim PICL had faced significantly higher amount of underwriting loss in 2006 and for the same reasons the amount of investment and other income of the company is comparatively lower than the later years.

- Peoples Insurance Company‘s Earnings per Share over the years since 2002 were quite satisfactory according to the stakeholders.

- Even though the company had negative EPS in 2002 due to the net loss causing by a greater claim settlement for the Jamuna Group.

While working on the internship report, the following findings also have been identified:

Strong regulatory system

Through passing the new Insurance Act 2011 and Insurance Development and Regulatory Authority Act 2011 to better regulate the insurance industry and protect customers’ interests, a strong regulatory system for the insurance industry has been developed. Therefore, the insurance industry is supposed to be modernized under the new and strong regulatory system and authorities.

Introduction of Agency System

The Agency system for the business development of the insurance business is a new addition under the Insurance Act 2011. So, the implementation is not that easy. Maintaining the ―Agent Account‖ is a new and complicated task for the PICL as well as the other insurance companies in Bangladesh which has caused increased pressure of work load. To some extent, it is causing higher expenses also. However, the loss due to corruption has been decreased due to the proper Agency System. Now, it‘s up to the company to conduct the cost-benefit analysis.

Percentage of Agency Commission Expenses Decreased

Under the new Insurance Act 2012, no non-life insurance company is allowed to expend more than 15% sales commission to the agents or brokers. Due to this, the agents are becoming de motivated, and as a result the PICL is losing their marketing as well as business. Sometimes, they could offer more commission in order to complete strongly with their business competitors as well as to spread business in some certain areas in Bangladesh where insurance business is not popular at all and seen negatively.

Some notable Restrictions

According to the section 74(1&2), no person who is the agent or appoints agent, brokerage house or directly involved in it, and surveyor or auditor can be the director of any life or non-life insurance company. If such happens to anyone then his/her license or certificate as agent, broker, or auditor will be void as per section 74(3) and that person will be working only as the director of the certain company.

Lack of guidelines & difference in legal opinion due to time gap

When a new law is passed to replace the old one, the system of the old law is automatically cancelled. In this condition, when the new insurance act of 2010 was passed to replace the previous one, the previous act of 1938 was automatically cancelled & inactive. The insurance Act 2011 only says what to be done by the insurance industry, but it doesn‘t set the information about how to do and in what amount/percentage. Actually, these things are properly given in the various Rules & Regulations supporting the Insurance Act. At this point, many supporting rules and regulations have not yet been set and established. Therefore, the whole insurance industry is suffering from lack of guidelines & different legal opinion.

Delayed Circulars

Many necessary circulars separately for the life and non-life insurance companies has not yet been developed and published by the Insurance Development and Regulatory Authority which is causing specific troubles to the concerned insurance companies.

Lack of some necessary changes

According to section 3 (1) (ii) of the insurance amendment 2012, the given percentage of the management expenses in different stages of the total gross premium is just same as the percentage in 1938. Throughout the last 73 years since 1938 to 2012, it is very natural the management expense has been increased, but the maximum percentage limit is constant which is not practical

Provision for Re-Insurance

SBC has long been the sole reinsures in Bangladesh and the private insurance companies of the country were statutorily compelled to place 100% of their reinsurance business with SBC. In 1990 the government amended the relevant provisions of the insurance Act allowing 50% of all reinsurance of general insurance business to be placed forcibly with SBC and the rest to private reinsurance companies .About 70% of premium income from general insurance business in Bangladesh is retained locally and the rest 30% goes to reinsures abroad.

Recommendations

I want to remind both the insurance regulatory authorities and the insurance business authorities concerned about the poor state of the entire insurance sector in Bangladesh, which is to be abolished following the enactment of the Insurance Development and Regulatory Authority Act 2010. While working on the report I have developed some recommendations and suggestions both for the insurance authorities and for the insurance companies in Bangladesh specifying the Peoples Insurance Company Limited.

Recommendations to the Regulatory Authority:

After analyzing the findings of my report I would like to place the following recommendations to the insurance authority of Bangladesh-

- The new Insurance Act 2010 introduced many essential features that were missing in the previous Insurance Act of 1938 but the implementation process were too slow, the independent Insurance Regulatory Body (IRA) is not yet fully functional. It was not yet properly established and many of features are yet to be implemented. So, the Finance Ministry should focus on the problems regarding it and should take pragmatic steps to solve those problems as soon as possible, because this is already too late and we don‘t want to be more lagged behind.

- To bring a real change and in the Insurance Business Sector in Bangladesh, the proposed changes brought by the Insurance Act 2010 should be implemented prudently and as soon as possible. In this purpose, the concerned authorities need to be stronger and more active as well as accountable enough.

- All the insurance companies in the insurance industry need to be responsive equally and very actively. So, the concerned insurance authority should focus on spreading necessary awareness among the insurance companies as well. To make it possible, regular seminars, meetings with the business authorities and proper auditing may be conducted.

- The percentage of management expenses should be at least double to cope up with the current price hike. In order to ensure maintaining proper expenditure accounts by the insurance companies, the regulatory authority should taken this issue into consideration with due importance.

- The total power that has been given to the regulatory authority to deal with the different opinions over insurance claims should be reconsidered.

- Transparency and accountability should be ensured in each and every step to ensure the full implementation of the new Insurance Act 2010 in the insurance sector in Bangladesh. For this, every single person associated with the implementation have to be honest and conscious. In this regard, everyone should come forward to make the associated procedure smoother.

- As one of the basic requirements for the insurance industry to have sustained growth is to enhance training facilities, BangladeshInsuranceAcademy is providing training facilities and professional education to those engaged in insurance business in the country. The syllabus, curriculum and training programs of the academy (BIA) should be modified and updated to meet the modern needs of the insurance industry and to ensure the proper implementation of the Insurance Act 2010.

- To establish the act reliable to the stakeholders and to make its implementation process bendy, the regulatory authority should keep the Insurance Act 2010 as flexible as possible, so that any essential amendment can be made and imposed in order to adjust with the rapid growing and changing situation when necessary.

Recommendations to Peoples Insurance Company Limited

When there is an emergence to cope up with the time, obviously something need to be changed. With the changes and additions brought by the Insurance Act 2011, there a lot more changes and modifications have to be brought in the individual insurance companies. So, even it is true that there are some problems created due to the implementation of the new act at Peoples Insurance Company Limited, the company should focus more on the prospects and the pragmatic solutions of the problems. Therefore, I also have come out with some recommendations to the company which is as follows:

- PICL should provide extensive training to its employees especially to the business development & marketing executives in order to make them able to cope up with the changes brought by the Insurance Act 2011. Through proper training to the employees and agents the company should practice and ensure marketing through the use of promotional tools such as advertising, sales promotion, public relation and publicity, personal selling and direct marketing.

- The company should raise awareness among all the employees and staffs about the implementation of the new law to make the implementation process much smoother. In order to do so, regular weekly/monthly meetings and seminars can be arranged after the office hours.

- As one of the most important tasks, client awareness needs to be increased in the insurance sector in Bangladesh. In this purpose, PICL should take the necessary steps through its large sales and business development force to ensure a level of awareness among their clients throughout the country.

- Even though it is quite difficult, the company should try its best to reduce the management expenses as well as commission expenses to cope up with the rules regarding these issues under the new Insurance Act 2011. In this regard, each & every employee should work as cost saver. At the end it will certainly be beneficial for them.

- The company should consider the rules and regulations for the non-life insurance companies in Bangladesh under the Insurance Act 2011 before and during setting any future plan regarding operation and expansion of its business, so that there doesn‘t arise any conflicting situation. It will make their way of business operations much smoother as well as easier and less problematic.

- Transparency and accountability should be ensured in each and every step in the implementation of the new Insurance Act 2011 in the entire departments of PICL. To ensure a transparent environment in the company, the employees along with the management and authorities should come forward with their best flexibility.

- The company should plan to take the opportunity of micro insurance business and Islamic Insurance business as their service diversification tool by providing responsive services and establish efficient departments to perform such task. This will allow them to expand their business among a large number of populations of Bangladesh, which will also help them to distinguish themselves from their competitors. For business expansion, PICL can introduce Islamic Insurance where they can capture a large portion of the population since the majority people of the country are Muslim.

Concluding Remarks

To conclude, I would like to mention that the whole internship period was a significantly knowledgeable journey for me which allowed me to learn and improve my skills and I hope the significant experience will allow and help me to build a better career in future. I think Insurance Industry is playing a significant role in the economic improvement of Bangladesh through its risk sharing operations which motivate investment in many important businesses. The government has now embarked on a reform program me in the insurance sector to promote a vibrant insurance sector in our country. As a first step towards achieving the objective, the Insurance Act, 2011 in replacement of the previous Insurance Act, 1938, and the Insurance Development and Regulatory Authority Act, 2011 also has been passed for establishing a stronger insurance sector in Bangladesh. I am upbeat that the new laws will help the entire insurance industry of Bangladesh to face the challenges of the time and thus bring dynamism in this sector. While I am genuinely joyous, I also would like to say that the proper implementation of the new act is extremely important. As the Insurance Act 2011 is for the insurance industry, the concerned authority should consider the interests of the insurance companies of Bangladesh as well as the stakeholders ‘interests. Strict transparency and discipline need to be there where around 3.0 million people are involved. In this regard I support the stand of the Bangladesh Insurance Association that has stressed the need for formation of the Insurance Development and Regulatory Authority and formulate necessary rules and regulations to make the new laws effective and purposeful.

In the era of globalization, domestic market should be well organized while the legal framework should be effective to address the changed circumstances in the business and socio-economic entities. In order to meet the challenges caused by changes, the Insurance Ordinance 2011 should be kept as flexible as practicable so that any change in the operational procedure, accounting, actuarial standard that would be needed in future inline without change in the international and domestic environment could be made without further amendment to the Ordinance. The new Insurance Act 2011 promised to bring the positive changes and I am looking forward for the beginning of a Globally Competitive Modern Insurance Sector in Bangladesh.