Introduction

Due to globalization and expansion of international Business, finance plays the major roles for the economic development. The development of a modern economy would not have been possible without the use of money. A fundamental characteristic of money is that it is like a collective commodity. There is a parallel relationship between the money and banking. Bank is an important and essential financial institution for the necessity of the use of money and the protection of the money.

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs conceived an idea of floating a commercial Bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, IFIC Bank Ltd. was set up at the instance of the Government in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial institutions abroad. The Government held 49 per cent shares and the rest 51 per cent were held by the sponsors and general public. In 1983 when the Government allowed banks in the private sector, IFIC was converted into a full-fledged commercial bank. The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy etc.

Background of the Study:

IFIC Bank Limited is one of the leading private commercial bank having a spread network of 96 branches across Bangladesh and plans to open few more branches to cover the important commercial areas in Dhaka, Chittagong, Sylhet and other areas in 2011. It performs all the modern banking activities to satisfy its clients. This study attempts to analyze the general banking activities of IFIC Bank Ltd. Through the internship program, close observation was made on different banking activities of IFIC Bank Ltd.

Objectives of the study:

Specific Objectives:

There are several types of objectives are involved in this report. These objectives are given below:

- To present a historical background of the organization, that is, the historical background of the IFIC Bank Limited.

- To gain the overall idea and know about the financial condition of the bank.

- Identify the different types of marketing activities of IFIC Bank Ltd.

- To provide a brief overview of IFIC Bank Ltd and the day to day functions offered by the bank

- Identify the major strengths of IFIC Bank Ltd.

- Identify the major weaknesses of the IFIC Bank Ltd

Scope of the Study

IFIC Bank Limited is one of the leading Banks in Bangladesh. The scope of the study is limited to the Malibagh Branch only. The report covers the organizational structure, background, functions and the performance of the Bank.

Methodology and Sources of Data:

Methodology:

In the organization much information has been collected from different published articles; journals, previous and recent annual report of IFIC Bank Ltd, and also based on the experience that I gathered during the period of internship. Within this period I visited two departments namely General Banking (GB) department and Marketing departments.

Sources of Data:

All the information in this report have been collected both from the primary sources and as well as the secondary sources.

Primary Source:

Personal experience gained by visiting, different desks and face to face communication with employees of the IFIC Bank Ltd.

Secondary Source: Secondary sources of data includes

- Annual reports of IFIC Bank Ltd.

- Data collected from internal report.

- Bank records.

- Journals of the Bank

- Different books, training papers, manuals etc. related to the topic

- Official Website of the Bank.

Scope and Limitation Scope:

IFIC Bank provides a wide range of credit facilities to its customers but the report limits to only the corporate credit facilities. Credit related to foreign exchange transactions (L/C, etc.) were excluded. Consumer Credit or retail credit facilities have also been excluded from the scope of this report. Various types of credit provided to the staffs of IFIC Bank Ltd has also been ignored, as they are special types of credit provided as a motivating tool for the employees with special terms and conditions.

Limitations:

I had to face some limitations at the time of preparing this report. The present study was not out of limitations. But as an intern it was a great opportunity for me to know the banking activities of Bangladesh especially IFIC Bank. Some constraints are as follows:

- First, one of the major limitations is the shortage of internship period. Since three month is not enough to know everything of a Bank, so this report does not contain all the area of IFIC Bank Ltd.

- Second, as an internee it was not possible for me to collect all the necessary secret information.

- Third, every organization has their own secrecy that is not revealed to others. While collecting data they did not disclose much information for the sake of organizational confidentiality.

- Fourth, non-availability of the most recent statistical data.

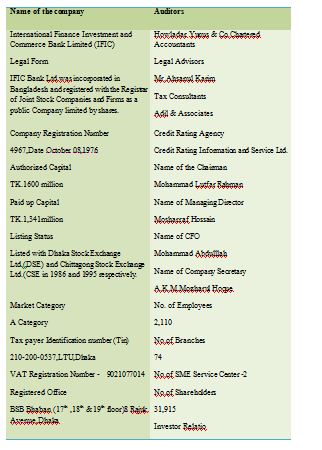

An Overview of IFIC Bank

Bank can be the major contributory part behind this development. A bank is a financial institution licensed by a government. Its primary activities include borrowing and lending money. Many other financial activities were allowed over time. Bank lending is important for the economy in the sense that it can simultaneously finance all of the sub-sectors of financial arena, which comprises agricultural, commercial and industrial activities of a nation. In the present economic policy achieving the high economic growth is the basic principle, so in order to achieve the objective the banking sector plays an important role. IFIC BANK LTD. is one of the largest leading banks In Bangladesh. It also operates in Nepal, Pakistan & Oman quite well. It offers lots of products and services.

Historical Background of IFIC Bank Ltd.

International Finance Investment and Commerce Bank Limited “IFIC Bank” came in to existence in 1976 as a joint venture between the Government of Bangladesh and sponsors in the private sector with the objective of working as a finance company within the country and setting up joint venture banks/financial Institutions abroad. IFIC was incorporated as a public limited company with an authorized capital of Tk. 20 core and paid up capital of Tk.10 core. IFIC commenced its operation on February 28, 1977 with a Subscribed capital of Tk.5 core, contributed by leading private sector entrepreneurs in the country. The Government held 49 percent shares and the rest 51 percent were held by the sponsors and general public.

Annual report as on 1983. the ownership of non Govt. sector is included

1. Mr. Jahurul Islam, Chairman.

2. Salman F. Rahman, Vice-Chairman.

3. A.M. Aga Usuf.

4. Syed. Mohsen Ali.

5. Mr. Ahmadul Kabir. Owner of “Dainic Shangbad”.

Milestones in the development of IFIC Bank Ltd.

- 1976- Established as an Investment & Finance Company under arrangement of joint venture with the govt. of Bangladesh.

- 1982- Obtained permission from the Govt. to operate as a commercial bank. Set up a its first overseas joint venture (Bank of Maldives Limited) in the Republic of Maldives (IFIC’s share in Bank of Maldives Limited was subsequently sold to Maldives Govt. in 1992)

- 1983- Commenced operation as a full-fledged commercial bank in Bangladesh.

- 1985- Set up a joint venture Exchange Company in the Sultanate of Oman, titled Oman Bangladesh Exchange Company (subsequently renamed as Oman International Exchange, LLC).

- 1987- Set up its first overseas branch in Pakistan at Karachi.

- 1993- Set up its second overseas branch in Pakistan at Lahore.

- 1994- Set up its first joint venture in Nepal for banking operation, titled Nepal Bangladesh Bank Ltd.

- 1999- Set up its second joint venture in Nepal for lease financing, titled Nepal Bangladesh Finance & leasing Co. Ltd. (which was merged with NBBL in 2008)

- Overseas Branches in Pakistan amalgamated with NDLC, to establish a joint venture bank: NDLC-IFIC Bank Ltd. subsequently renamed as NIB Bank Ltd.

- 2005-Acquired MISYS solution for real time on-line banking application. Core Risk Management implemented.

- 2006-Corporate Branding introduced. Visa Principal and Plus (Issuer and Require) Program Participant Membership obtained.

- 2009-Observing 25th Anniversary of Customer Satisfaction.

- 2010-64 Branches offering Real Time On-line banking facility.

- 2011-This year is a very significant year for the national and international economy.

Joint Ventures in Abroad

- Bank of Maldives Limited

- NIB Bank Ltd. Pakistan:

- Nepal Bangladesh Bank Ltd. (NB Bank)

- NepalBangladesh Finance & Leasing Limited (NB Finance):

- Oman International Exchange LLC (OIE)

Missions & Vision of IFIC Bank Limited

The mission of IFIC Bank Ltd. is to provide service to clients with the help of a skilled and dedicated workforce whose creative talents, innovative action and competitive edge make our position unique in giving quality service to all institutions and individuals that we care for.

Mission

IFIC Bank’s Mission is to provide service to their clients with the help of a skilled and dedicated workforce whose creative talents, innovative actions and competitive edge make their position unique in giving quality service to all institutions and individuals that they care for.

IFIC Bank Limited is designed to provide commercial and investment banking services to all types of customers ranging from small entrepreneurs to big business firms.

Besides the bank aims to provide different customer friendly deposit and loan products in the field of personal banking to fulfill the banking needs of individual customers.

On delivery of quality service in all areas of banking activities with the aim to add increased value to shareholders’ investment and offer highest possible benefits to their customers.

Vision

To be the best Private Commercial Bank in Bangladesh in terms of efficiency, capital adequacy, asset quality, sound management and profitability having strong liquidity.

Objectives of the Bank

The objectives of the bank are to promote joint participation of Government and private sponsors to establish joint venture banks, financial companies, branches and affiliates abroad to satisfy their customers.

It conveys its objective via their motto: “You’re Satisfaction First”

To establish, maintain, carry on, transact, undertake and conduct all types of banking, financial, investment and trust-business in Bangladesh and abroad.

To form, establish and organize any bank, company, institution or organization, singly and/or in joint-collaboration for partnership with any individual, company, financial institution, bank, organization, or any Government and/or Government agency for- the purpose of carrying on banking, financial, investment and trust business and/or any other business as provided hereafter.

To carry on any business relating to Wage Earner’s Scheme as may be allowed by Bangladesh Bank from time to time including maintaining of Foreign Currency Accounts and any other matter related thereto. To contract or negotiate all kinds of loan, and or assistance, private or public, from any source, local or foreign, and to take all such steps as may be required to complete such deals.

To take part in the formation, management, supervision or control of the business or operations of any company or undertaking and for that purpose to render technical, managerial and administrative services and act as administrator, manager and secretary.

To purchase, or otherwise acquire, undertake, the whole or any part of or any interest in the business, goodwill, property, contract, agreement, right, private assets and liabilities of any other company, bank, corporation, partnership, body person or persons carrying on, or having ceased to carry on, any business which the company is authorized to carry on, upon such terms and may be deemed expedient.

To encourage, sponsor and facilitate participation of private capital in financial, industrial or commercial investments, shares and securities and in particular by providing finance in the form of long, medium or short term loans or share participation by way of subscription to the promoter shares or underwriting support or bridge finance loans and/or by any manner.

Strategies

IFIC Bank Ltd. mainly follows top down approach to take necessary decisions for the company. Basically they follow the centralize strategy where the Head Office of the Bank control and monitor all the activities of its branches. In case of marketing strategy they basically depend on ‘word of mouth’ as they are already well reputed for its long-term service in the banking industry.

Products and Services of IFIC bank Ltd

IFIC Bank Ltd. offers various products and services. The bank has highly qualified professional staffs that have the capacity to manage and meet all the requirements of the bank. Every account is assigned to an account manager who personally takes care of it and is available for discussion and inquiries, whether on writes, telephones or calls. Let’s gives the diagram of product and service.

Branch Network:

The bank covers by its activities all the important tracing and commercial centers of the country. As on January 31, 2009 it has 70 branches within Bangladesh. But now it has 91 branches.

Branch Distribution of IFIC Bank Ltd in Different Districts in Bangladesh

All the important branches are equipped with computers in addition to the modern facilities, logistics and professionally competent workforce.

Current Board of Directors:

Mr. Salman F Rahman————————————-Honourable Chairman

Mr. Mohammad Lutfar Rahman————————-Honourable Director

Mr. Aminur Rahman————————————– Honourable Director

Mr. Syed Anisul Huq————————————–Honourable Director

Mr. Mohammed Nayem Syed—————————-Honourable Director

Mr. Anwaruzzaman Chowdhury————————-Honourable Director

Mr. Monirul Islam—————————————–Honourable Director

Mr. Mahmudul Huq Bhuiyan—————————-Honourable Director

Mr. Arastoo Khan—————————————–.Honourable Director

Mr. Syed Monjurul Islam———————————Honourable Director

Mr. Mohammad Ali Khan. ——————————Honourable Director

Management Hierarchy

Management Hierarchy are given below

| Managing Director |

| Senior Executive Vice President |

| Executive Vice Presidents |

| Senior Vice President |

| First Vice President |

| Vice Presidents |

| Senior Assistant Vice President |

| First Assistant Vice President |

| Assistant Vice President |

| Senior Staff Officers |

| Senior Officers |

| Officer Grade- 1 |

| Officers Grade- 2 |

| Junior Officers |

General Banking Section

- Issuing of power of attorney to the officers of the Branches.

- Maintaining general correspondence with Bangladesh Bank and other Banks etc.

Head Office Accounts

- Income, Expenditure Posting:

- Cash Section.

- Bill Section.

- Salary wages of the employees.

- Maintenance of employee provident fund.

Consolidation of Branch’s Accounts

All branches periodically (especially monthly) send their income & expenditure i.e., profit and loss accounts and head office made the consolidated statement of income and expenditure of IFIC Bank Limited. Here Branch statements are reviewed and prepares financial statements and submits to Bangladesh Bank.

Credit Division

- The main function of this division is managing IFIC Bank’s credit portfolio. Major functions are the followings:

- Receiving proposal

- Appraising the proposals

- Getting approval from the head office credit committee.

- Communication with the customer and sanctioning the credit.

- Monitoring and follow-up of the credit facilities

- Setting prices for credits and making it effective.

- Prepares required statements as made mandatory by the Bangladesh Bank.

International Division

The objective of this division is to assist the management to make international dealing decisions and guide Branches to implement the decisions made. Its functional areas are follows

- Maintaining correspondence relationship.

- Monitoring foreign trade & exchange dealings.

- Maintaining accounts and reconciliation;

- Authorizing of signature and test key;

- Monitoring Foreign Exchange returns &statement;

- Sending updated exchange rates to concerned branches.

Marketing Division

Marketing division is responsible for making the stakeholders concerned about the different products of IFIC Bank Limited. The marketing department is always in persuasion for attracting different customers to take their facilities.

Human Resource Division HRD performs all kinds of administrative and personnel related matters.

The broad functions of this division are as follows:-

- Selection & recruitment of new personnel

- Placement of manpower

- Dealing with transfer, promotion and leave of personnel

- Training & development

- Termination and retrenchment of employees

- Keeping records of every employee of the Bank

- Maintenance of employee welfare fund

- Arranges workshop for employees & executives;

Audit Division

Audit division works as internal monitoring and inspection division of the company. The officers of this division randomly go to different Branches and examine the necessary documents regarding each single account. If there is any discrepancy, they inform the authority concerned to take care of that/those discrepancy. They help the Bank to comply with the rules and regulations imposed by the Bangladesh Bank. They inform the Bangladesh Bank about the current position of the rules and regulations followed by the Bank.

Credit Card Division

IFIC Bank is a member Q-Cash VISA DEBIT/CREDIT card. The Q-cash card is more just than an ATM card. It can be used as a combination of debit and credit facility. Customers can withdrawal their money not only from IFIC’s booth but also they can withdrawal money from those bank’s booth who are also member of Q-Cash.

Merchant Banking and Investment Division

This division concentrates its operation in the area of under writing of Initial Public Offer (IPO) and advance against shares. This division deals with the shares of the company. They also look after the securities portfolio owned by the company. The company has a large amount of investment in shares and securities of different corporation as well as government treasury bills and prize bond.

Board and Company Secretary Division

- The main functions of this division are as follows:

- Conducting meeting of the Board of Directors;

- Dealing with Company Act;

Product and Services

Besides traditional Banking services, IFIC Bank Limited has added a wide range of products/services in its service portfolio. Various products & services offered by IFIC Bank Ltd. include:

Operational Activities

Operational activities of IFIC

Credit risk:

Credit risk is an investor’s risk of loss arising from a borrower who does not make payments as promised. Such an event is called a default. Another term for credit risk is default risk.

Investor losses include lost principal and interest, decreased cash flow, and increased collection costs, which arise in a number of circumstances:

- A consumer does not make a payment due on a mortgage loan, credit card, line of credit, or other loan

- A business does not make a payment due on a mortgage, credit card, line of credit, or other loan

- A business or consumer does not pay a trade invoice when due

- A business does not pay an employee’s earned wages when due

- A business or government bond issuer does not make a payment on a coupon or principal payment when due

- An insolvent insurance company does not pay a policy obligation

- An insolvent bank won’t return funds to a depositor

- A government grants bankruptcy protection to an insolvent consumer or business

Credit Operations and Description:

The Bank is committed to provide high quality financial services/products to contribute to the growth of the country through stimulating trade and commerce, accelerating the pace of industrialization, boosting up export, creating employment opportunity for the youth, poverty alleviation, raising standard of living of limited income group and overall sustainable socio-economic development of the country. In achieving the aforesaid objectives of the Bank, Credit Operation of the Bank is of paramount importance as the greatest share of total revenue of the Bank is generated from it, maximum risk is centered in it and even the very existence of Bank depends on prudent management of its credit portfolio. The failure of a commercial Bank is usually associated with the problem in credit portfolio. As such, credit portfolio not only features dominant in the assets structure of the Bank, it is critically importance to the success of the Bank also.

Types of Loans and Advances:

On a broad basis IFIC Bank Limited offers two types of advances –

1) Unsecured Advance;

2) Secured Advance;

Unsecured Advances:

Unsecured advances are granted to a constituent, which is not backed by any security.

Features:

An unsecured facility is allowed in exceptional circumstances, only for a short period, with definite repayment arrangement, subject to restrictions imposed by Bangladesh Bank or any other competent authority to a customer based on his personal credit worthiness, standing and reliability. A definite arrangement for repayment, whether by installments or otherwise, must, as a rule, is ensured.

Secured Advances:

Secured advances are granted to a constituent that is guaranteed by tangible securities subject to margin restrictions. Secured advances given by the Credit Department are classified as follows:

LOAN (GENERAL):

- Loans are a type of advance allowed to a constituent for a specific purpose and for a definite period.

- Types of Applicants: Individual, firms, industries;

- Time Duration: Short term- Up to 12 months; Medium term- More than 12 and up to 36 months; Long term- More than 36 months;

- Mode of Distribution: The total loan amount is disbursed at a time or in trances within a specific time.

- Mode of Repayment: The principal and interest are repayable by installment on agreed terms.

HOUSE BUILDING LOAN:

Loans allowed for construction of house (residential or commercial) fall under this type of advance

- Types of Applicants: Individuals, firms and bank staffs;

- Loan Size: Maximum 75 lac.

- Loan Period: Maximum 15 years.

Mode of Disbursement: The amount of loan disbursed in three equal installments as under

Mode of Repayment: The loan amount and interest are repayable through equal specific numbers monthly installments after the completion of house.

LEASE FINANCING:

Lease financing is one of the most convenient sources of acquiring capital machinery and equipment whereby a client is given the opportunity to have an exclusive right to use an asset usually for an agreed period of time against payment of rent.

Type of Applicants: Manufacturing concerns.

Time Duration: Maximum for five years.

Mode of payment: Payment is made directly to the seller of the machines.

Mode of Repayment: At a specific rent, which is inclusive of the repayment of principal as well as interest for adjustment of the loan.

Other Features:

a) Non equity payment is required by the client.

b) Exempted from the tax for the lease-financing period.

CONSUMER CREDIT SCHEME:

IFIC Bank Limited plays a pioneer role in providing necessary finance to the fixed income group for buying items that are necessary for raising the quality of living through the Consumer Credit Scheme. Through this special scheme IFIC Bank Ltd. offer Necessity, Convenience and Comfort.

Types of Applicants: Reputed Government and Private Service holders.

Time Duration: Specific period as per agreed terms and conditions.

Mode of Payment: Payment is made directly to the seller of the goods after obtaining a portion of equity from the borrower and personal guarantee.

Mode of Repayment; The loan amount and interest are repayable through equal specific numbers monthly installments after the purchases of goods.

CREDIT CARD:

A Credit Card is an instrument assuring the Merchant (by the Acquirer) for the payment made by the Cardholder against goods, services or withdrawing Cash from Bank/Institution or Automated Teller Machine (ATM).

IFIC Bank Limited is a member of VISA and thus issuing VISA Card in Bangladesh. IFIC Bank is offering following types of VISA Card:

- Gold VISA Card- International;

- Gold VISA Card-Local;

- VISA Standard (Silver) Card-International;

- VISA Standard (Silver) Card-Local;

All Credit Cards are issued by IFIC Bank Card Division in Head Office. Branches just dispatch the application to Card Division and deliver the issued card to its customers. It also collects the Card Bill on behalf of Card Division.

SMALL AND MEDIUM ENTERPISE CREDIT SCHEME (SME):

IFIC Bank Limited is offering a unique credit scheme only for the Small and Medium Enterprise (SME).

Objectives:

The main objective of the Small and Medium Enterprise Credit Scheme is to provide credit in flexible terms and conditions for the development of small and medium enterprises in the region easily accessible by the branches of IFIC Bank Limited.

The second objective of this scheme is to create opportunity for employment and economic growth through providing facilities to develop the small and medium enterprise sector of the country.

Eligibility for Application: The entrepreneur of the Small and Medium Enterprise must have following qualities to avail the credit facility under the scheme:

- Literate;

- Minimum two years of management experiences of the business;

- Age limit between 25-50 years;

- Owner of a Small or Medium Enterprise;

- The project must be financially viable and socially desirable;

- Nature of Loan:

- Working Capital;

- Capital Machinery;

Wide Loan Coverage:

- The scheme provides coverage for small enterprises up to Tk. 2, 50,000 and for medium enterprises up to Tk. 75, 00,000.

- Time Duration:

- One Year for the continuous loan;

- Maximum five years for the term loan;

Mode of Repayment:

Continuous Loan- The client as per his requirement can withdraw the total loan limit time to time subject to certain conditions.

Term Loan- The client can withdraw the total loan amount at a time.

Security:

Personal Guarantee from two persons acceptable to the Bank.

Any other acceptable securities available to the borrower.

The borrower has to maintain a Savings A/C with a compulsory deposit of 5% of outstanding loan amount per month for building up his own fund.

WOMEN Entrepreneur’s Loan (Protyasha):

Any business purpose loan for small and medium sized business, owned by women entrepreneurs.

Eligibility: Woman Entrepreneurs having two years experience in the same line of business. Monthly cash flow to support proposed loan installment

Nature of the Loan: Term Loan

Loan size: Minimum Tk 50000 and Maximum tk 3 lac

Repayment: Monthly repayment facility

Security: No collateral security

Loan Period:

- Maximum 18 (Eighteen) months for loan amount of Tk. 50,000

- Maximum 24 (Twenty four) months for loan up to Tk.1.00 lac.

- Maximum 36 (Thirty six) months for loan up to Tk.3.00 lac.

- Interest Rate: 15.00% p.a. with quarterly rest or as revised from time to time.

Transport Loan

- To purchase of Road/Water transport for commercial use individual, business enterprises (other than public limited company) engaged in transport business at least two years experience are eligible for transport loan.

- Interest Rate: 14.75% to 15.50% p.a. with quarterly rest or as revised from time to time

- Loan processing fees: 1.00% on loan amount maximum tk. 10000

- Service Charge: .50% on loan amount

- Penal Interest: Additional 2.00% p.a. on the overdue amount, if any

Non Funded Facility

Non funded credit facility to a customer refers to a bank’s commitment to a third party on behalf of the customer. The commitment itself constitutes facility but does not involve cash outflow from the bank. The bank’s commitment essentially states that in the event of occurrence or non-occurrence of a particular event, within a particular date, due to a particular reason or reasons, a specific sum of money shall be paid by the bank to the third party upon claim in a particular manner. The non funded facilities are:

Letter Of Credit:

A Letter of Credit is a commitment (undertaking) by the Bank to pay an agreed sum to the seller of goods on behalf of the buyer (client) under precisely defined condition. This is a non funded facility provided to the client for import of goods from abroad or in some cases to procure them locally.

The letter of credit gives the seller or exporter:

Credit security by eliminating the credit risk in the sale and shipments of goods;

Credit facilities by financing the sale when the goods are in transit;

Exchange security by assuring him that the required amount is available to him under credit from the time he receives the buyer’s order and the time of shipment and presentation of shipping documents.

Once the Bank receives the L/C documents as per specified terms and condition of the L/C, the amount is transferred to the Bills under Letter of Credit (BLC) Account. As per commitment Bank pay the seller of goods through Bank and settles the outstanding BLC amount from the client before handling over the L/C documents to him.

Bank Guarantee:

Bank Guarantee is a contractual relationship between the account (customer) and the beneficiary. The account party requests to the Bank to issue guarantees on their behalf to the beneficiary-committing to make an unconditional payment of certain amount of money to the beneficiary, if the customer (on whose behalf it is given) becomes liable, or creates any loss or damage to the beneficiary. It is a contingent liability for the bank.

The Issuance Procedures for Bank Guarantee:

The party looking for Bank Guarantee at first applies to the Bank in a prescribed form. In the Application, the following information should exist:

- Beneficiary (name & address)

- Amount;

- Expiry (with claim period);

- Delivery Date;

- Information relating to a guarantee issued under a documentary credit (in case of a foreign guarantee);

- Special conditions;

- Bid/Tender Bond

- Performance Bond

- Advance Payment Guarantee against Foreign Bank Counter Guarantee

Credit Appraisal System

It is very important for the proper functioning of the credit facilities is that they are guided through a definite and structured guiding system. Every project has to be evaluated before funding. The credit worthiness and performance of the clients should also be evaluated before approval of the credit proposal. All these are done using the Credit Appraisal system. The performance of the bank is highly influenced by the presence and effective utilization of a sound and appropriate credit appraisal system.

Credit Appraisal System of IFIC Bank Ltd.

The credit appraisal is the process of identifying and evaluating the risks in any lending proposal. The steps of credit appraisal system of IFIC Bank Limited are as follows:

- Quantitative factors are the firm’s financial performance.

- Qualitative factors are the factors regarding the firm’s management, industry position, customer/supplier relation, customer’s account performance.

The credit officer also seeks information from the ‘Credit Information Bureau’ of Bangladesh bank through the Head Office about the applicant’s relationship with other banks and financial institutions that is whether he has any credit facility with any other financial institution and if he has than how is the performance of those credit facilities. In assessing any credit application the credit officer follows some distinct steps. Those are:

- Evaluating the past performance of the applicant.

- Assessing the risk of failure by identifying factors in the applicant’s present condition and past performance.

- Forecasting the future condition of the applicant and evaluating the probability of successfully adjusting the loan.

- Setting terms and conditions for the loan.

Based on the analysis the credit officer prepares the proposal and with the approval of the branch credit committee, sends it to the head office for the approval of the head office credit division and the executive committee of the board. If the proposal is approved then the credit officer contacts with the applicant and prepares the documentation for loan and makes disbursement.

Bank do not approve any lending having an overall risk as “marginal” and “poor” without proper justifications except for renewal of existing facilities under compelling circumstances or for other reason such as salvage, which would also contain covenants for future improvement of the position . All credit applications rated “poor” require the approval of the board regardless of purpose, tenor or amount.

Performance of IFIC Bank in Loans and Advances:

IFIC Bank Ltd provides different types of credit facilities. Credit facilities have steady growth over the last three years. Loan general and Cash Credit, on the other hand House building, Lease finance, and hire purchase all are increasing over the years.So the Performance of Different Types of Loans is given below:

Efficiency Evaluation

Efficiency & Evaluation of IFIC Bank Ltd.

To survive competitively in the market any business whether it is production or service oriented should make their product and services more diversified. Responding to the market demand IFIC Bank has a complete array of Commercial Corporate and Personal banking service covering all segments of society. Now Commercial Banks are emphasizing on consumer loan due to minimize the risk of default. That is why the report is prepared on Operational Efficiency of Credit Management of IFIC Bank.

This report has been conducted to find out the possibility of establishing the position of IFIC Bank in terms of products. In this report the total credit portfolio of IFIC Bank has been shown that indicated a positive growth trend in the credit amount disbursed. Again in terms of interest income, credit is also accounting an increasing trend. One of the crucial parts of the report is that, IFIC Bank Retail Unit has been compared with other bank’s Credit, in some aspects to understand the current position in the market. From the comparison with banks, some problems and prospects are found in IFIC Bank Credit.

IFIC is offering diversified product portfolio and lowest rates and charges which are their strength to proceed further in the business. Again, IFIC Bank has a few problems regarding target clients segments and promotional activities that should be rectified. The credit disbursement procedure is also described in this report. There are many opportunities for IFIC Bank to develop and enter in credit market with a massive amount of investment as this is one of the ways for risk diversification. In recent banking business modern countries are focusing more and more on credit to shuffle their past ideas about investing in corporate credit. Though there is a tough competition in this sector, but to achieve a leading position IFIC bank should consider more its credit business on loan.

Financial Performance of 2010 & 2011

Deposits

The bank mobilized a total deposit of Tk . 73,042.23 million as of December 31,2011 as against Tk. 54,660.41 million as of December 31,2010 indicating an increase of 34% over the previous year. The competitive interest rates , deposit mobilization effort and customers confidence on the bank contributed to the significant growth in deposit during the year.

Loans & Advances

The total Loans & Advances of the bank stood at Tk . 65,428.35 million as of December 31,2011 as against Tk. 48,826.26 million as of December 31,2011 ,marking an increase of 34% over the previous year.

The loans & advances portfolio of the bank mainly consists of trade financing , Projects Loans for new Projects and BMRE projects , Working capital SME and Lease Financing . Besides the bank is financing individual borrowers under Consumers Financing Scheme . the Bank is gradually increasing its involvement in Agriculture Sector as per direction of the Bangladesh Bank.

Operating Profit

IFIC Bank generated profit of Tk. 2,877.90 million in 2011 before provisions as against Tk. 3,844.08 million in 2010 showing a negative growth of about 25% Mentionable here that in 2010 there was extraordinary income of Tk. 1,090 million from recovery of written –of loans.

Income

The interested by 45.65% which was Tk. 6,798.01 million in 2011 and Tk. 4,667.28 million in 2010 due to increase in loans and advances . During the year both income from investment and commission , exchange gain & broken increased as compared to the previous year . the income from capital stood at Tk. 129.07 million during 2011 against Tk. 227.66 million in 2010

Expenses

The total expenses of the bank for 2011 stood at Tk. 7,572.66 million Tk . 5,103.45 million in 2010. The interest paid to the depositors and borrowings represented Tk. 4,654.63 million which was 61.47% of the total expenses. The total operating expenses of the bank was Tk. 2,918/.03 million in 2011 in comparison to that of tk. 2,528.92 million in 2010

Capital & Reserve

The authorized capital of IFIC Bank was Tk. 5,350.00 million and the paid – up capital stood at Tk. 2,768.38 million as on December 31,2011. A break – up of the capital & reserve inclusive os statutory reserve for the fulfillment of provision under Bank Company Act , 1991 is fulfilled below

| Nature of Capital & Reserve | Taka in million |

| ü Paid – up capital | 2,768.38 |

| ü Statutory Reserve | 2,554.52 |

| ü Other Reserve | 171.75 |

| ü Retained Surplus | 1,190.52 |

| Total capital & reserve | 6,685.17 |

Source : Annual Report of IFIC Bank Ltd .2011

Findings and Analysis

Findings

Problems Regarding Credit Management

Proper Credit Management is the most important function of any bank. But for some reasons the credit management system faces some problems, which hamper the proper functioning of the systems. Some reasons behind dysfunctional credit management are:

Pressure

Undue Pressure on the part of different concerns for sanctioning of credit in favor of some project which is not viable makes it hard for the credit management system to functioning properly. Recently this type of pressure has been reduced by some rules imposed by the Bangladesh Bank.

Habitual Factors

Because of the past poor record of loan recovery by the banking sector as a whole developed this impression among the people that bank loans do not need to be repaid. And thus some even try to provide inadequate security against advances with the motive to default.

Delays in Loan Sanction

Lengthy process of loan sanction or delay in loan sanction is a common problem of credit management. Because of the lengthy approval process of the advances the delay happens.

Higher Rate of Interest for Credit

Higher rate of interest is a factor in credit management. Some times the rate is so high that the return from the investment is not adequate enough to repay the loan. And hence default occurs.

Lack of Supervision and Monitoring

Lack of management policy, LAN, lack of updated software, no rewards for recovery of CL, lack of new package, inadequate manpower, heavy works load on each officer or executive or carelessness of responsible officers are the reasons for lack of supervision and monitoring.

Changes in Policies

Due to changes in the export, import, foreign exchange policy as well as monetary and fiscal policy long-term financing suffer a lot. In many cases project loan lost their viability, Bank does not offer interest subsidy for such affected project.

Irregularity in Providing Loan

Usually Banks are responsible to provide loan to those who are eligible for the loan. But in reality, small investors do not get the loan easily.

Inadequate Data

For a successful credit appraisal data regarding the market and industry as well as the projects to be funded is required. But there is no available database regarding the market and various industrial sectors in Bangladesh.

SWOT Analysis of IFIC Bank Ltd.

The overall evaluation of bank’s strength, weakness, opportunity and threat is called SWOT.

- S = Strength

- W =Weakness

- O =Opportunity

- T =Thereat

SWOT is internal and external factor of the bank. Internal factors are controllable and external factor are not controllable. Internal factors are management related that is controllable by the bank. The impact of SWOT may negative or positive on the bank. Favorable impact of SWOT can create organizational progress and unfavorable SWOT creates lot of organizational problem.

Strengths:

The attribute with which customers were highly satisfied but gave less importance was tagged as the strength areas of the bank. Some attributes that give IFIC Bank Ltd. a better standing in the competition. These are:

- Large number of customers

- Location of the branches

- Professionalism of the employees

- Rates on savings

Weakness:

Some weaknesses of the bank were pointed out in the survey, which had low satisfaction scores and were somewhat less important to customers. But in order to improve overall satisfaction these attributes should be considered. Slow decision making due to large hierarchy Solution searching tendency of employees Location of the ATM’s Willingness to help

Opportunities:

Opportunities are the ones that hold bright prospects for IFIC Bank Ltd. identifying that where it should build its strength. These opportunities are

- Reliability of the statement

- Fees and service charges

- Location of the branch

- Savings service

Threats:

Threats are ones that represent danger for the bank in its future growth and are responsible for the downgrading of customer satisfaction. Some of the threats are:

- Location of the ATM’s

- Technology of bank

- phone banking service

- neatness of employees

- Friendliness of employees

This ratio indicates how profitable a company is by comparing its net income to its average shareholders’ equity. The return on equity ratio measures how much the shareholders earned for their investment in the company. The higher the ratio percentage, the more efficient management is in utilizing its equity base and the better return is to investors. IFIC Bank is more efficient management is in utilizing its equity base and the better return is to investors. But return on equity of Prime bank is not good.

Recommendation and Conclusion

Recommendations:

In order to make the service more efficient and hence increase the performance of the overall facilities, IFIC Bank Limited should consider the following:

- Introduce full on line banking in between all its branches so that the customers will be attracted to the bank.

- The practice of delegation of power should be exercised in the root level.

- Diversification of products is required. IFIC Bank is in the traditional line of business.

- Provide continuous training programs for the employees, so that their skills are developed and they become more efficient and effective.

- Concentrate more on the marketing of the existing products, so that people become well aware of them.

- In a competitive financial market, their products & services need to focused more on customers’ needs then simply offering what the customers are offering.

- Maximum number of the loan is provided in the short-term industrial loans.

- Improvements of salary and compensation are much needed to motivate the employees and change the tendencies of job switch.

- Improve and maintain a consistent relationship with customers, especially at retailing

- Even though IFIC is running online business very successfully they should open more ATM booths to meet customer needs and to meet the competitions

Conclusion:

From the learning and experience point of view the report says that it was really enjoy full internship period in IFIC Bank Ltd. From the very first day, the reporter was confident that this 3 (three) months internship program will definitely help the reporter to realize his further carrier in the job market. It is limited only to the study. For the criticality of the data series pattern, it is hard to get a clear picture of the Credit policy of IFIC Bank ltd. Though hard, it is tried to describe with some of the most available tools used to forecast time series data. As we know that in Bangladesh there is trend of floating foreign exchange rate, that’s why banks like IFIC Bank Ltd worked very hard to come up with the foreign exchange market.

Another most important thing is that, every bank has a vision to strive for excellence. IFIC Bank Ltd from the very beginning showed its determination to do well through providing good customer services. As the day will progress people will seek better service from the better bank. In the category of better bank IFIC Bank Ltd has proven to be great name.