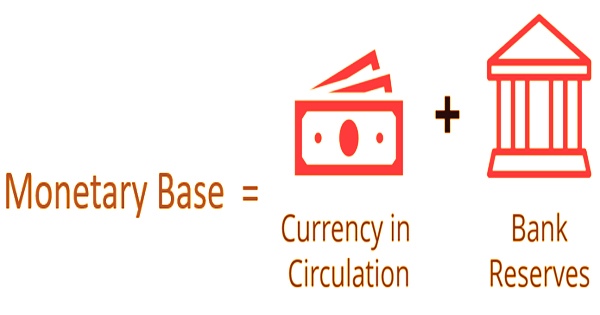

The monetary base (also known as base money, money base, high-powered money, reserve money, outside money, central bank money, or narrow money in the United Kingdom) is the total quantity of cash in circulation in the economy; it is made up of two parts: currency in circulation and bank reserves. A country’s monetary base can be expanded by issuing more money to the general people. This is common practice with newly issued money. Bank reserves are cash deposits held by financial institutions in central bank accounts.

The government can create currency by purchasing assets on the open market or investing in enterprises. A country’s monetary base can be reduced by selling assets on the open market. The monetary base ought not to be mistaken for the cash supply, which comprises of the all-out money flowing in general society in addition to specific sorts of non-bank stores with business banks. This proportion of the cash supply isn’t regularly referred to since it bars different types of non-cash that are pervasive in an advanced economy.

The most liquid assets in an economy are cash and cash deposits, which are represented by the two components above. The monetary basis, in general, is a measure of the amount of cash money in circulation in the economy. Inflation lowers the value of the currency when the monetary base is increased. Decreases in the monetary base raise the currency’s value, resulting in deflation.

Otherwise called M0, the monetary base of an economy incorporates the entirety of the actual paper and coin cash available for use, in addition to bank holds held by the national bank. These foundations change the financial base through open market tasks: the purchasing and selling of government securities. The monetary base, unlike the money supply, does not contain non-cash assets like demand deposits, time deposits, or checks. Because of the money multiplier effect of the fractional reserve banking system, the monetary base is frequently referred to as “high-powered money” (HPM).

During the time of gold as cash, gold coins contained the monetary base. The creation of cash was essentially in the possession of the private area. The State stamped it or printed the declarations utilized in exchange to address it, while private undertaking mined the mineral and received the rewards of doing as such. Although the overall amount produced was not under state control, the relative rarity of gold helped to keep its exchange value stable for the most part. By levying taxes and levies on the public, the State was able to get a portion of the basic money.

The monetary base is now generated by the Federal Reserve in the form of inconvertible notes and bank credits that may be exchanged for notes on demand. When the United States stopped using gold as a domestic currency in 1933, all restrictions on the creation of base money were effectively lifted. The State currently has limitless going through influence in base cash, and fundamentally holds an imposing business model on its issue. At the point when the Federal Reserve makes new assets to buy bonds from business banks, the banks see an increment in their saved property, which makes the financial base grow.

A central bank may often sway banking behavior by adjusting interest rates and imposing reserve requirements (how much money banks must keep on hand instead of loaning out to borrowers). Open market activities impact interest rates, particularly on federal funds (ultra-short-term loans between banks). A private endeavor with adequate monetary capital might acquire a contract that grants it to acknowledge stores of base cash from the general population and to give advances as credit convertible to put together cash with respect to request. These stores, usually known as banks, should hold adequate base cash, called saves, for that reason.

The monetary basis, which is not to be confused with the money supply, consists only of cash and cash deposits, such as banknotes, coins, cash held by commercial banks, and cash kept in bank reserves. The monetary basis is also known as M0, money base, or basic money in various situations. The monetary basis (MB or M0) is a lesser-known monetary aggregate that varies from the money supply but is nonetheless highly important. Various kinds of monetary policy can be used by central banks to expand or shrink the monetary base.

For some national banks, the monetary base is expanded through the acquisition of government securities, otherwise called open market activities. By buying bonds from business banks, the national bank can supplant the illiquid bonds with a money store in the bank’s save account. M1 is a limited measure of the money supply that counts demand deposits, traveler’s checks, and other checkable deposits in addition to actual cash and reserves.

M2 is a money supply estimate that takes into account all parts of M1 as well as “near money,” which includes savings accounts, money market securities, mutual funds, and other time deposits. The reserve requirements, which dictate how much cash banks must hold in their reserve accounts, can also be increased by central banks. Market interest rates will fall as a result of boosting the cash supply. The majority of money in circulation today is in the form of individual bank credits.

Anyway, when one pays by drawing on his financial balance if the check is saved in another bank, the payer’s bank should move an equivalent measure of stores to the payee’s bank. Along these lines, changing the financial base is another instrument that national banks use to adjust loan costs. Central banks may ensure that a continuous supply of currency is always available for use by employing monetary policy to sustain the monetary base. When the Reserve Bank fails to fulfill the banking system’s reserve requirements, banks that are low on reserves bid up the interest rate, control over the quantity of Base Money in the economy is lost.

The long-term survival of base money is contingent on the government enforcing tax collection and intervening to keep price inflation at a manageable level. The Reserve Banks’ open market activities, which involve the buying and selling of different financial instruments, most often Government debt (bonds), are used to sustain the number of reserves in the banking system. The government may keep some influence over the monetary base in many nations by purchasing and selling government bonds on the open market.

Information Sources: