When a company changes its prices, it incurs menu costs, which are a sort of transaction cost. The term comes from the expense of restaurants printing new menus, but economists apply it to the costs of changing nominal prices in general. Menu costs are one of the microeconomic clarifications offered by New Keynesian business analysts for macroeconomic value tenacity, which may prompt the disappointment of the economy to acclimate to changing macroeconomic conditions. Updating computer systems, re-tagging goods, and paying consultants to establish new pricing strategies, as well as the cost of printing menus, are all possible menu expenditures.

Each time a firm raises or reduces the costs it charges; it faces a significant expense. All the more by and large, the menu cost can be considered as coming about because of expenses of data, choice and execution bringing about limited reasonableness. Due to this cost, enterprises do not always modify their pricing in response to changes in supply and demand, resulting in nominal rigidity. Price stickiness occurs when an economy’s prices do not respond to macroeconomic changes, which can lead to a recession.

For the most part, the impact on the firm of little changes in cost (by changes in supply or potentially request, or, in all likelihood in view of slight changes in financial arrangement) is generally minor contrasted with the expenses of telling people in general of this new data. All costs incurred by a firm to update the prices it offers to its clients are referred to as menu costs. A restaurant that needs to physically print new menus in order to adjust the prices of its items is a classic example. In an economy with excessive inflation half or more menu costs are a difficult issue, since firms need to continue to change its costs much of the time.

The most important conclusion from menu prices is that they are fixed. To put it another way, enterprises are unwilling to change their pricing until there is enough of a difference between their present price and the equilibrium market price to justify paying the menu cost. Organizations are for the most part reluctant to change their costs each time the market interest balance shifts due to the menu costs. At the point when costs continue as before, regardless of an adjustment of the inventory request balance.

A restaurant, for example, should not modify its prices unless the increase in sales is sufficient to cover the expense of printing new menus. In practice, however, determining the equilibrium market pricing or accounting for all menu expenses can be challenging, making it impossible for businesses and consumers to behave precisely in this manner.

Sheshinski and Weiss (1977) introduced the concept of a lump-sum cost (menu cost) to changing the price in their work on the influence of inflation on the frequency of price changes. They contended that in an inflationary climate the costs firms charge won’t rise consistently, however in rehashed, discrete leaps that happen when the normal expansion in income legitimizes causing the fixed expense of changing the cost. Lost deals is additionally something an organization needs to consider in its menu cost. Customers may be hesitant to buy at a specific price if the price changes. New Keynesian economists later included the idea of using it as a general theory of nominal price rigidity into their explanations for price-stickiness and its function in propagating macroeconomic swings.

The most direct of them was Gregory Mankiw’s 1985 study, in which he suggested that even tiny menu costs might result in enough price rigidity to have a significant macroeconomic impact. In most cases, a business will not change its prices until there is a large-enough disparity between the current price and the equilibrium market price. George Akerlof and Janet Yellen put forward the idea that due to bounded rationality firms will not want to change their price unless the benefit is more than a small amount.

Because of this constrained rationality, nominal prices and wages become inert, causing production to fluctuate at constant nominal prices and wages. In theory, a corporation should only contemplate modifying its prices if the cost of the menu is less than the additional income predicted as a result of the change. Gregory Mankiw used the menu-cost concept and applied it to the welfare impacts of output variations caused by sticky prices. Michael Parkin proposed the idea as well. Olivier Blanchard and Nobuhiro Kiyotaki extended the menu cost concept to labor and pricing.

At the point when menu costs are high in an industry, value changes will ordinarily be inconsistent and for the most part possibly happen when the net revenue starts to dissolve to a point where keeping away from the menu costs is costing the business more as far as lost income. Trying to figure out when a price adjustment outweighs the menu costs is difficult, and most of it is based on calculated guesswork. In some businesses, menu costs may be minimal, but there is often enough friction and expense at scale to impact the business choice to reprice or not.

Economists have long been debating whether menu costs are large enough to cause business cycles. The new Keynesian explanation of price stickiness relied on introducing imperfect competition with price (and wage) setting agents. This sparked a change in macroeconomic theory away from perfect competition with price takers and toward imperfectly competitive equilibria with price and wage setters (mostly adopting monopolistic competition). In a 1997 study, researchers looked at store-level data from five multi-store supermarket chains to directly quantify menu expenses.

The examination found that menu costs per store arrived at the midpoint of in excess of 35% of net revenues. This implies that the productivity of things expected to drop over 35% to legitimize refreshing the last cost of the things. Huw Dixon and Claus Hansen demonstrated that even if menu costs only applied to a tiny portion of the economy, they would have an impact on the rest of the economy, causing pricing to become less responsive to changes in demand. The results of a study titled “The Magnitude of Menu Costs: Direct Evidence from Large U. S. Supermarket Chains” were published in the Quarterly Journal of Economics by David Levy et al (1991). They proved that menu expenses are significant enough to trigger business cycles.

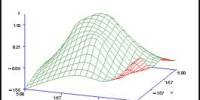

Menu costs fluctuate broadly by locale and industry. This can be because of neighborhood guidelines, which may require a different sticker price on everything, accordingly expanding menu costs. On the other hand, there might be generally couple of providers on fixed agreements that set out times of value change. Consider a hypothetical firm operating in a hypothetical economy, with a concave graph illustrating the link between the price of its good and the firm’s profit. The profit maximization point is always at the very top of the curve.

Information Sources: